- home

- Reference

- Insurance pension

The level of financial well-being of domestic pensioners leaves much to be desired. This is also why the state has legislatively provided for additional tools for citizens to accumulate their future monthly income.

One of them was voluntary insurance in the pension system of the Russian Federation. Let's consider what it is, how it differs from insurance, which is the responsibility of citizens and their employers, and how it is implemented in practice.

What is voluntary pension insurance

The concept of voluntary pension insurance is not disclosed by current legislation. Only in some regulatory documents (for example, the Tax Code) does the term non-state pension provision (hereinafter also referred to as NPO) appear, which in practice is a synonymous concept.

In simple words, it means entering into a voluntary contractual relationship with a non-state pension fund to form an additional pension to the state pension. After concluding such an agreement, the citizen or his employer has an obligation to make payments within a certain period of time in the amount established by the agreement.

All funds transferred voluntarily will form an additional pension in the future . Also, the specified finances can be moved from one management organization to another or received by the citizen or his heirs.

In addition to NPFs, voluntary pension insurance programs are also offered by insurance companies. In this case, an insurance contract is concluded, and the insured person or policyholder makes periodic payments towards a future pension.

Important! Non-state pensions are not regulated by separate legislation, and the procedure for its formation is determined by the internal rules of the NPF.

At the same time, the activities of the fund within the framework of voluntary insurance should not contradict the law.

How much does a self-employed person pay into the pension fund at will?

Airat Farrakhov said that all self-employed people will contribute 4% to the Pension Fund, like individuals. The company is obliged to give 2% more. This allows the employee to exit the shadow market and create his own trading segment. However, when it comes to insurance experience, you need to remember that people have never paid anything for their work.

The question becomes, how much do self-employed people pay contributions to the pension fund so that they can maintain their insurance period at the same time? The taxman spoke about this: in 2019, a self-employed person must pay 29,354 rubles in order to be credited for an insurance year with an income of less than 300 thousand rubles. If it is more (based on conscience), then +1% of the amount above the threshold.

Otherwise, the lack of insurance experience will not allow you to receive a pension on an equal basis with others, despite payments to the Pension Fund in the amount of 4-6%.

Difference between voluntary and mandatory

The main differences between these two types of insurance lie in their very names. Mandatory implies the obligation of a citizen or his employer to make contributions to the Pension Fund for the future state benefit of an elderly citizen. The decision on voluntary insurance is made by the person himself or his employer; the state leaves the possibility of using this instrument at the discretion of these individuals themselves.

Within the framework of an NGO, a person entering into a contractual relationship with a foundation has the opportunity, at his own discretion, to determine:

- amount of payments;

- the duration of their transfer;

- frequency of application;

- formation scheme (inheritance rules, payment start period, etc.).

NPO rules are established by management companies independently, but must comply with the Standard Insurance Rules approved by the Central Bank. The specified rules of NPFs are registered with the Bank of Russia, and if changes are made to them, they are also subject to registration.

The role of the state in the formation of NGOs is to establish general legislative norms and regulate the activities of NPFs. The authorities do not directly participate in the formation of non-state pensions, since it is only additional to compulsory insurance.

Attention! Do not confuse NGOs with the voluntary transfer of additional insurance contributions within the framework of compulsory pension insurance. The latter is strictly regulated by the state, administered by the Pension Fund of the Russian Federation, and a separate legislative act was adopted as part of co-financing.

How are contributions made and when?

Volunteers and law-abiding citizens were explained how to pay into the pension fund of the self-employed . Deputy Head of the Federal Tax Service of the Russian Federation Daniil Egorov said that more than 30 Russian banks are already ready to join the “My Tax” platform to process payments from individuals. By 2020, the special regime will be launched in all regions of the country, and everyone will be able to top up their balance with the required amount within a year after opening an account.

It is noted that the continuous insurance period consists of working periods and those in which the citizen was self-employed or unemployed. Accordingly, anyone who has lost their job and does not want to interrupt their insurance and work experience can independently pay for themselves to the Pension Fund (as unemployed), retaining the right to use sick leave, medical care, child benefits and other benefits.

Goals and functions of voluntary insurance

The main goal of voluntary pension insurance is to generate additional income after a citizen stops working due to age. An NGO allows you to have an additional source of monthly income along with government support. Also, this tool allows you to provide a citizen with a more decent financial condition in old age.

One of the functions of NGOs can also be investment of funds, i.e. their investment with the aim of making a profit. Thus, some NGO programs imply not only the possibility of transferring funds accumulated in this way to other funds, but also receiving them for further personal disposal. With the right choice of fund, its investors have the opportunity to accumulate a certain amount, as well as increase it in the case of financially competent activities of the NPF.

This type of insurance also makes it possible for citizens who work in harmful or dangerous jobs to retire before the deadline established by law. Early NPO allows citizens to receive a guaranteed monthly income before becoming eligible for payments from the state, while ceasing their work activities.

Another function is the provision of additional social guarantees to employees by the employer. Thus, a collective agreement between an organization and its employees may provide for the employer’s obligation to additionally insure employees within the framework of NPO. Thus, the employer can interest citizens in entering into labor relations with him, and the employee can receive additional guarantees.

Pension without experience

As you know, the size of the pension directly depends on the amount of insurance premiums paid. But for now, let’s skip this size issue and talk about the right to a pension as such.

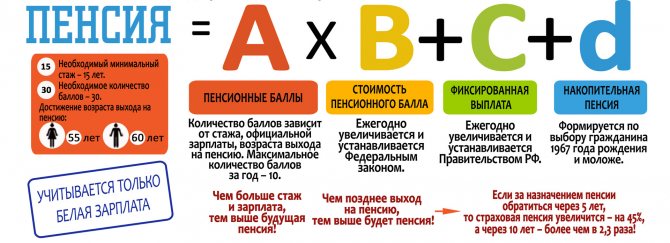

The fact is that the right to an insurance pension does not automatically occur upon reaching retirement age. It depends on two more criteria - length of service and points. To qualify for an insurance pension, you will need to have at least 15 years of experience and at least 30 accumulated points, the number of which, in turn, depends on the amount of contributions paid.

Let’s say a man has been self-employed all his life or has worked under an employment contract for a short time, but by the age of 65 years of experience or points he has less than the norm. What kind of pension can he expect? Only for social.

At the same time, you can apply for a social pension only 5 years after reaching the generally established retirement age. That is, for men, the right to such a pension will begin at 70 years old, for women - at 65 years old.

The size of the social pension is set by the state. Now it is 5283.84 rubles per month.

Subjects of voluntary insurance

Within the framework of the NGO agreement, several categories of persons enter into relations, i.e. subjects of these legal relations:

- A non-state pension fund is an organization that provides the service in question by accepting contributions, investing them in various projects and areas, and paying non-state pensions to current pensioners or other persons entitled to this in accordance with the terms of the contract.

- Depositors are persons who make regular payments towards the formation of an NGO. These persons can be citizens themselves, as well as their employers. The category of the latter does not matter; both organizations and individual entrepreneurs who carry out their activities without forming a legal entity can act in this capacity. These persons always act as the second party to the NGO agreement.

- Participants are those citizens in whose interests contributions are made within the NGO, i.e. in fact, future recipients of non-state pension payments. If a citizen makes contributions on his own behalf and in his own interests, he will simultaneously be both a participant and a contributor.

Management companies that directly invest accumulated funds can act as independent subjects of legal relations under NGOs.

Insurance without employment registration

Any type of activity must be registered, then the provision of services or sale of goods will take place within the legal framework. Paying insurance premiums without registering with the tax authorities is a risky and temporary step, since in this way you are advertising your illegal activities.

After receiving the information, the tax inspector will be forced to conduct a check on the consistency of income; if entrepreneurial activity is confirmed, you will face fines.

Subtleties of the DS agreement

The content of the agreement of the type of DS in question is established by each fund independently, taking into account the norms of the law. The form of such a document can always be viewed on the official website of a particular NPF before its conclusion or a visit to the company’s office.

At the same time, the standard form of this document is planned to be approved in the near future by the Directive of the Central Bank; its draft is currently being reviewed and discussed.

So, what you should pay special attention to in the DS agreement:

- Selected pension scheme. Each NPF offers different schemes for the formation and payment of non-state pensions in terms of the procedure for making contributions, receipt of savings amounts by the participant or his legal successor, and the time of appointment of the NPF. In the text of the agreement, as a rule, only the number of such a scheme is indicated, but its decoding is given in the Rules of a particular fund.

- Grounds for the emergence of the right to receive monthly payments within the framework of NGOs.

- Rules for making contributions (their size, frequency, length of time for making contributions).

- Period of validity of the contract.

The treaty in question concerns a very important area, and therefore is subject to careful study in its entirety. This applies not only to the stated points, but also to all other sections, be it the rights and obligations of the parties, their responsibilities, the subtleties of succession, etc.

Tax holidays for a number of self-employed categories

The legislation establishes tax holidays for tutors, nannies and similar categories of self-employed persons. Citizens in 2017-2020 do not pay contributions and other contributions to the budget. In paragraph 3 of Art. 422 of the Tax Code of the Russian Federation establishes benefits in the form of exemption from contributions.

Self-employed persons must report the conduct of business activities in any of the 3 types defined by law. To obtain exemption from paying taxes and contributions, a person must notify the territorial office of the Federal Tax Service about the conduct of activities, after which they can legally provide services.

A self-employed citizen, after the expiration of the tax holiday, starting from 2020, must decide to register an individual entrepreneur, choosing a taxation method that is convenient for him, or refuse to further conduct business. In the near future, the issue of opening a separate register for self-employed persons is not being considered.

Auditor T.V. Lubnevskaya

Legislators are considering the option of registering self-employed persons without registering as an individual entrepreneur. Starting from 2020, it is planned to regulate the procedure for paying taxes and contributions of self-employed citizens by patent with reduced tax rates.

Self-employed persons who are not registered as individual entrepreneurs will pay contributions in the event of acquiring a patent. The purchase price, set by the regions, will include contributions for pension and health insurance. The acquisition of a patent is carried out voluntarily, for a period of 1 month to 1 year. The cost of a patent is calculated in proportion to the period.

DS programs at NPFs

In addition to compulsory insurance, each NPF offers NGO programs. Moreover, one can also take part in such a program according to various schemes approved by the internal rules of the fund. Each of them has a different list. GAZFOND, for example, offers 7 possible participation schemes; NPF Transneft already has 10 such schemes.

In each case, they are subject to individual study depending on the specific situation, the goals of investors and participants.

The differences between these schemes lie in the following criteria:

- duration of pension payments;

- the time of the participant’s right to receive a monthly income within the framework of the NGO;

- level of employer and employee participation in the program;

- the amount of contributions, duration and frequency of their payment.

A complete list of programs and schemes of a particular fund must be given in its pension rules, approved by the Board of Directors. Any citizen should be given free access to familiarize themselves with them.

In conclusion, we note that voluntary insurance within the framework of NGOs allows citizens to independently create an additional source of income in old age. DS serves not only to increase the future income of the pensioner, but can be considered as an investment or an additional guarantee to the employee on the part of the employer. When concluding an agreement, it is necessary to responsibly choose a scheme for the formation and payment of NGOs.

Responsibility for non-payment of contributions

Self-employed citizens who have not registered with the register do not bear responsibility or liability for paying insurance premiums. Individual entrepreneurs, heads of peasant farms and other registered persons must pay fixed insurance premiums for the entire period that the data is in the register. Lawyers, notaries and other persons conducting private practice are responsible for the period of their tax registration.

Individual entrepreneurs acting as employers are required to pay contributions accrued on employee benefits. Payment is made for each type of contribution. Reports on accrued and paid contributions are submitted to the Federal Tax Service. If the deadlines for payment of employee contributions are violated, while the amount in the reporting is understated, sanctions are imposed on individual entrepreneurs.

In case of violation of tax legislation, expressed in non-payment or incomplete payment of contributions as a result of inaction, penalties are imposed:

- In the amount of 20% of the amount of arrears.

- 40% if intent to violate the law is revealed.

- Penalties accrued for each day of delay in payment of contributions in the amount of 1/300 of the refinancing rate, starting from 31 days - 1/150 of the refinancing rate.

Entrepreneurs who discover the arrears to the tax authorities and pay the amount simultaneously with the penalty calculated independently can avoid penalties.

Amount of pension contributions for the self-employed

The rules for interaction between the self-employed and the Pension Fund are defined in Art. 29 of the Law “On Compulsory Pension Insurance”. There are two directions in which contributions can go - the insurance and funded parts of the pension. Regarding insurance payments, the conditions are somewhat different for different categories of self-employed. And in terms of savings, they are the same for everyone.

Self-employed tax payments are in no way related to pension contributions . They do not decrease by the amount of expenses, as happens with individual entrepreneurs. And insurance premiums do not depend on the amount of income. That is, no one will control how much of the proceeds goes to future pensions.

Mandatory pension insurance

The calculation period for contributions to compulsory pension insurance is a calendar year. For this period, the maximum and minimum possible amounts are established, and credit is taken based on length of service and pension points. If a person applied to the fund not from the beginning of the year, a proportional calculation is made for the number of months and days remaining until December 31.

The exact amount of contributions remains at the discretion of the payers themselves. It can be round or with pennies, a multiple of the established minimum or not. Restrictions exist only on payments per year.

To understand the entire system, we can single out a conventional unit of account - about 30 thousand rubles. per year (or 2,500 per month), which approximately corresponds to the minimum contribution. For this, the insured receives 1 year of service and 1 pension point. And after retirement, he will have the right to minimum insurance payments. If you pay less, both indicators decrease proportionally. With a larger contribution amount, additional points are awarded, but the length of service does not increase. This unit is convenient to use for calculations, for example, how much is missing to calculate an insurance pension. This will make it easier to plan payments.

If Russians are ready to save for old age themselves, then these amounts are comparable to those with which the Pension Fund operates

Minimum and maximum contributions

There are two categories of self-employed, and the rules for them are different:

- Payers of professional income tax (PIT). They only have a maximum contribution limit. In fact, you can pay as much as your capabilities allow and common sense dictates.

- Nannies, tutors, nurses, house helpers who do not pay taxes. In this case, there is a minimum and maximum limit.

Maximum contribution rates are tied to the minimum wage approved at the federal level. That is, you will only be able to find out the exact figure for the current year. In 2020 it is 11,280 rubles.

The minimum amount of contributions is calculated as follows: minimum wage x insurance premium rate (22%) x 12 months. This is 29,779.2 rubles. in 2019. That is, approximately the amount that we took as a conventional unit. The maximum size is 8 times the minimum - RUB 238,233.6. for 2020.

Video: how a self-employed person can earn money for retirement - commentary from the Pension Fund of Russia

Funded pension

The savings system works as an investment that generates income. And all the risks and benefits are associated with this. The rules for the formation of a funded pension are described in laws 56-FZ of April 30, 2008 and 424-FZ of December 28, 2013.

Contributions to the funded part of the pension are not converted into points, but are calculated in monetary terms. To place funds, you can choose one of the funds or a management company, and then change your decision. Children and grandchildren will inherit the money if the payer himself did not have time to use it.

The Pension Fund offers self-employed people to make contributions on a voluntary basis and participate in the state co-financing program. There are no restrictions on the amount of contributions. But there is an essential condition: if an amount from 2,000 to 12,000 rubles is received in a year, it is doubled at the expense of the state. And their consultants are happy to talk about the rules of operation of non-state funds.

How does a future pension depend on the amount of contributions?

We can speak very conditionally about the return on pension contributions. A pension is a long-term project, and legislation changes frequently. And this is the main problem of calculations. Another difficulty is the many variables that depend on the decisions of the authorities and the state of the economy.

The insurance part of the pension is calculated using a special formula. What the payer himself can control here is the length of service and pension points (officially this is called the IPC - individual pension coefficient). To calculate, the total number of points must be multiplied by the cost of one point at the time of applying for a pension. The latest indicator is officially approved for each year. For now, the figures are available until 2024. Therefore, the amount received will be relevant if you retire in the near future. That is, you cannot calculate from contributions what your pension will be in 10 or 20 years. You can only understand the pattern - more or less than others.

The pension consists of several parts, which are calculated differently

An important point is the right to receive an insurance pension. It occurs if a person has the minimum required experience and number of points. And here it is worth deciding whether it makes sense to apply for payments. It is possible that a person has not worked for a long time or has worked without official registration. Previously, there were no deductions, and for years of self-employment it was impossible to pay large contributions. If you don’t reach the minimum, it’s better to forget about deductions - the money will be lost. In another situation, it would be wiser to spend money on contributions in order to cross the minimum threshold.

It’s not so simple with savings either. For example, due to the crisis, it was decided to freeze funds in the Pension Fund, in other words, to transfer them to the insurance part. In fact, this is the collapse of the system. In such realities, it’s time to think about whether it’s worth the risk. After all, it’s your money, not your employer’s.

Table: indicators by year for calculating pensions

| Year of retirement | Minimum IPC amount to receive a pension | Minimum insurance period for retirement | Cost of IPC in rubles |

| 2019 | 16,2 | 10 years | 87,24 |

| 2020 | 18,6 | 11 years | 93 |

| 2021 | 21 | 12 years | 98,86 |

| 2022 | 23,4 | 13 years | 104,69 |

| 2023 | 25,8 | 14 years | 110,55 |

| 2024 | 28,2 | 15 years | 116,63 |

| 2025 and beyond | 30 | 15 years |

Examples of calculations

Let's calculate the minimum you need to pay to qualify for an insurance pension. If a self-employed person has not made contributions before and will not retire soon, he will need 15 years of experience and 30 pension points. To do this, you need to pay contributions for 30 years at the minimum rate or 15 at the double rate.

Let's consider a situation where a person previously worked under an employment contract and deductions came from the employer. And then I decided to go self-employed. Let’s say the salary was small, during employment, 10 years of experience and 10 points were accumulated. This is not enough for an insurance pension. Therefore, a person is faced with the task of “earning” five years of experience and accumulating 20 points. There are options here: pay contributions for 5 years at the minimum rate x 4 (approximately 120 thousand per year), 10 years at a double rate, or 20 years at the minimum. If the salary was high before, the starting conditions may be different - for example, 10 years of experience 30 points. Then the task is simplified - it’s 5 years of payments at the minimum rate. Everything else will go towards increasing benefits.

As a rule, employees have higher pensions than the self-employed. This happens because the average annual payment to the Pension Fund for an employee in the region is 92.8 thousand rubles, and for the self-employed population - 44 thousand rubles. in year. Hence the difference in pension amounts.

Elena Andrusenko, head of the department for organizing the assignment and payment of pensions, Branch of the Pension Fund of the Russian Federation in the Khabarovsk Territory

https://www.consultant-dv.ru/periodika/gazeta-vernoe-reshenie/vypusk-10–20–10–17/kak-samozanyatym-grazhdanam-zarabotat-dostoynuyu-pensiyu/

Now let’s determine the increase in pension from contributions for a specific year. For example, a person pays the maximum rate (RUB 238,233.6 in 2020), he will receive 8 points for this. Then everything will depend on when he retires. The additional payment in 2020 will be: 8 x 93 = 697.92 per month. In 2024 it will be 8 x 116.63 = 933 rubles.

Video: negative opinion about pensions for the self-employed

How to determine the optimal contribution amount

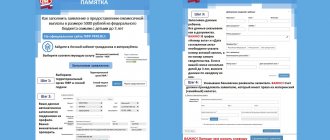

It would be wisest to seek advice from the Pension Fund. Before that, solve a few problems:

- Find out the current amount of pension capital. This information can be obtained in person at the fund at the place of registration or remotely by ordering a certificate of personal account status through your personal account or the State Services portal.

- Make an approximate calculation of your future pension using a calculator.

- Decide on your wishes for retirement - whether it will be the legal minimum, the optimal middle or the highest possible payments.

- Select the principle of pension formation (insurance, funded).

- Calculate the amount that can be allocated for contributions per year.

The answer will depend on the balance of priorities and capabilities. Knowing the initial data, the fund's employees will suggest possible options and help with advice. But the decision remains with the person himself.