The basis for filing an application with the Pension Fund of the Russian Federation is Articles 27, 27.1, 28 of the Law of the Russian Federation “On Labor Pensions”, which provide for cases and circumstances of assigning an early pension. Files in .DOC: Application form to the pension fund for early retirement. Sample application to the pension fund for early retirement.

State pension provision

The state pension allows disabled citizens to compensate for the lack of income with payments from the state budget. Types of state pension provision:

- social (appointed for disabled segments of the population, for example, citizens who have reached retirement age, disabled people, and so on);

- for length of service (required for civil servants who are exposed to harmful working conditions: military, police, psychiatrists, and so on);

- old age (for people who have reached retirement age: 55 years for women and 60 for men);

- in case of loss of a breadwinner (families of military personnel, astronauts, as well as persons who have experienced severe radiation exposure).

Social insurance

In the event of a certain insured event, the compulsory insurance system allows you to avoid loss of wages. This type of pension provision can only be used by insured persons (for example, in state-owned enterprises there is an obligation to insure employees). The compulsory insurance system pays benefits in the following cases:

- upon reaching retirement age (old age);

- after receiving a disability group;

- due to the loss of a breadwinner, and so on.

With the help of insurance, you can accumulate pension benefits, transfer them, receive bonuses to your social pension and much more. Social insurance even allows you to transfer money savings to the relatives of the deceased for burial.

Non-state pension provision

The non-state pension fund provides pensions to citizens who have entered into an insurance contract. Companies invest, assign and pay out funds accumulated by citizens. There are certain advantages to this:

- You can independently regulate the amount of payments;

- accumulated funds are inherited by relatives;

- at the same time you can receive a state pension;

- You can transfer your deposit to another fund at any time.

But there are also disadvantages:

- low investment income;

- payments can only be received upon reaching a certain insured event;

- profit received as a result of investment is subject to taxation;

- Failure to make payments on time will result in penalties.

A sample application to a non-state pension fund can be obtained by contacting one of these institutions. When drawing up an application, the future pensioner must indicate the amount of payments that he would like to receive as pension savings. Based on this, the amount of payments to the fund will be calculated.

Application for transfer of the funded part

First, a citizen needs to select a suitable non-state pension fund (NPF). You should take into account its rating and the volume of funds raised. The name of the fund is indicated in the application to the State Pension Fund about the funded part.

The second part of the application must be completed additionally in case of transfer from one pension to another. This can be done by a legal representative or other trusted representative of a minor or incompetent person.

After the necessary formalities, the citizen enters into an agreement with the NPF, which will begin to operate on January 1 of the next year. Funds are transferred no later than the end of March at the expense of the selected organization. From this moment on, responsibility for savings rests entirely with the NPF chosen by the pensioner.

An application for pension recalculation is an application to government agencies with a request to recalculate the assigned pension amount. You need to contact the Pension Fund for this. And if he wrongfully refuses, then he will go to court.

Statement

To get advice about a particular situation, it is enough to call the reception desk of the Pension Fund of Russia (PFR). But based on this appeal, it is impossible to make a definite decision regarding a specific person. You can apply for a pension only by contacting:

- to the public service at your place of residence, having received the appropriate sample application to the Pension Fund and filling it out;

- by registered mail to the territorial office (addresses are on the Pension Fund website);

- through the online reception (this is the simplest option, since applications are accepted both from citizens of the Russian Federation and from foreign citizens). Accordingly, there is no connection to a specific locality.

Where to contact

There are several ways to apply for a pension. This can be done in person or through a legal representative:

- When visiting the Pension Fund.

- Using the government services website.

- By sending documents by Russian Post with a notification letter.

- By turning to the services of the multifunctional center.

Apply for a pension through State Services

Having registered on the website gosuslugi.ru, you can use it to transfer the necessary information to the Pension Fund. A step-by-step algorithm that allows you to apply for a pension through State Services looks like this:

- The applicant will be required to log in to this Internet resource and enter his personal account.

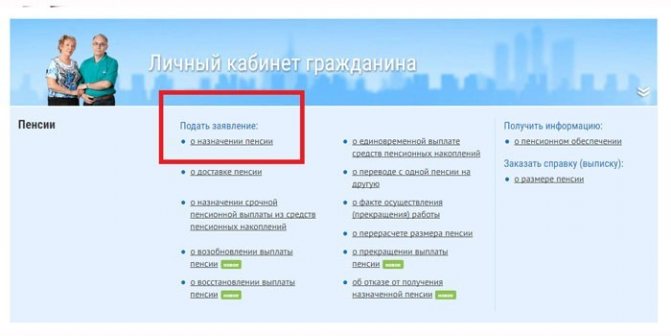

- In the catalog of available .

- Click on the button to set pension payments.

- A new page will open. On it you need to find the link “Pension assignment” and click on it. If necessary, you can first study the information from the section “Information about pension provision”.

- On the page that opens, you need to mark the “Electronic service” section, then click the “Receive” button. An application form opens.

- The required information is entered into the proposed form (date of completion, citizenship of the applicant, passport details, etc.). In the “Information on the assignment of a pension” section, the type of security that the applicant is applying for is indicated. Next, indicate the address of the territorial division of the Pension Fund of Russia, where the applicant is applying, check the box indicating the obligation to inform this structure about changes affecting the amount of payments, and press the send button.

- A notification appears in your personal account that the application has been sent to the Pension Fund. It will be reviewed within 10 days. The applicant needs to know that submitting an electronic application does not eliminate the need to present the original documents to the Pension Fund for verification.

Personal visit to the Pension Fund office

In this case, the applicant is required to:

- Fill out the application form and prepare a package of documents.

- Contact the territorial branch of the Pension Fund of the Russian Federation at the place of registration. The specialist will check the correctness of filling out the application and the completeness of the documents. This is an advantage of such a registration procedure - if an error is detected, a lack of some kind of certificate or other shortcomings, the applicant will immediately receive information about this and will be able to quickly correct the situation (rather than wait for consideration, as would be the case when submitting an application online).

- Wait for the submitted application to be reviewed. The deadline for this case is the same as for filing via the Internet – 10 days.

Registration of a pension at the MFC

In this case, the submission algorithm is similar to a personal application to the Pension Fund. The applicant needs:

- Prepare a package of documents and an application.

- Come with them to the MFC and submit them through a pension specialist, checking on the spot that they are filled out correctly and complete.

- Wait for the results of the review. The time interval is the same as for other cases - 10 days.

- Severyanka pear jam

- 10 ways to remove wrinkles between eyebrows

- Kefir diet

Sample application to the Pension Fund

The official application form can be obtained either at the Pension Fund branch or downloaded on the Internet (for example, on the Pension Fund website). If you have any difficulties completing your application, you can consult with a fund employee at the online reception or at your place of residence. It is worth noting that applications drawn up in free form will not be accepted, so you must take seriously the filling out of the application.

How to find out what was calculated for my pension at the Pension Fund

According to various sources, namely, on the portal of the organization for pension contributions, it is possible to approximately calculate the amount of subsequent contributions. It is better to check the exact value directly through the Pension Fund branch.

Long before benefits are calculated, it is necessary to obtain documentation called an “extract from the personal account of the insured person” by sending a PRF document. Using this extract, you can find out and check whether everything was calculated correctly. You can also find other documentation through the portal that explains the rules for calculating the length of insurance for pension payments.

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

How to make an application?

You can contact the Russian Pension Fund to resolve the following issues:

- assignment of pensions;

- recalculation of deposits and pension amounts;

- transfer of funds that have been accumulated;

- appointment of DEMO;

- conducting an absentee examination;

- pension payment.

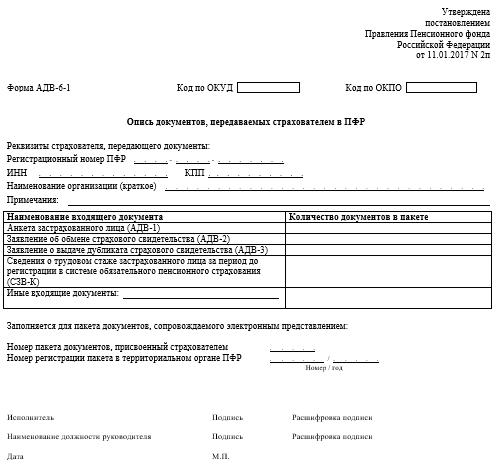

Thus, most sample applications to the pension fund are uniform in their design. The following table and example will help you correctly draw up an official appeal.

| Statement header | Name of the institution to which the application is made. |

| Statement | Full name of the applicant, passport details, TIN, SNILS number, information about dependents who are in the care of the applicant and family composition, residential address and contact telephone number. |

| The reason for petition | Here information about work activity, a request for the establishment of pension provision is indicated, indicating specific regulations (the applicant should indicate what kind of pension the applicant is counting on). |

| Application | A list of all papers that the applicant attaches to the application (copies of passport, SNILS, work book, income certificate). |

| Date and signature | The date of submission of the application is indicated, and along with it the applicant signs the document, deciphering the signature |

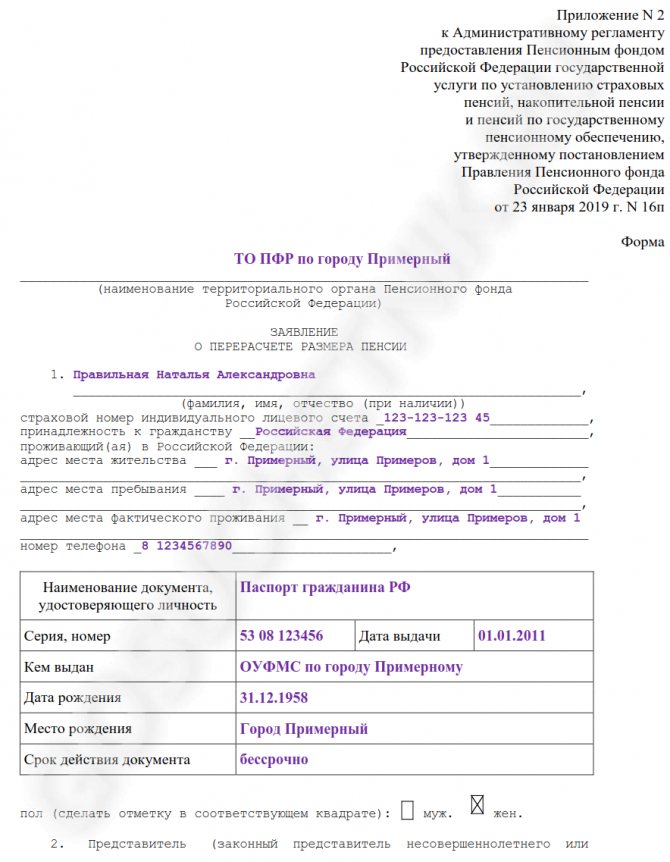

How to write an application for pension recalculation: sample, submission

To increase the assigned pension benefit, the pensioner must write an application for recalculation of the pension.

What to do if you disagree with the pension calculation? Is it possible to obtain a document from the Pension Fund containing details of their pension calculation? What is the procedure in case of claims against their calculation? 03 October 2020, 13:09, question No. 1395473 Pavel,

The applicant must be a pensioner, otherwise his application will not be considered. Before this, he must already write an application with a request to assign old-age pension payments and receive it. Important! An application for recalculation of the pension amount is written only when you have already received a pension one or more times, the amount of which did not satisfy the pensioner.

If a person receiving a pension does not agree with the amount of payments assigned for old age, he can apply to the Pension Fund for recalculation only if he has important grounds for increasing such payments. He must write, contacting the Pension Fund with a request to re-calculate it.

The application requires you to write reasoned disagreements and support them with documented extracts from the archive and work record book.

Old age pension

The benefit is assigned subject to the following conditions:

- The applicant has reached a certain age. Currently, this age is 55 years for women and 60 years for men. But by January 2020, a planned increase in the age will be carried out to 60 years for women and 65 years for men, respectively (6 months are added every year; accordingly, the age specified in the planned increase will be reached by 2025). Specialists in certain professions can retire early. The list of these employees is on the official website of the Pension Fund of the Russian Federation.

- Insurance experience of at least 15 years (currently it is 9 years, but every year it is planned to increase by one more).

- IPC - 13.9 points (by 2025 this figure will increase to 30 points, each year the number increases by 2.4 points).

A sample application to the Pension Fund for the assignment of an old-age pension can be found on the website of the Pension Fund of the Russian Federation.

Application for pension calculation

Hello! In 2003, he retired at the age of 50 as a participant in the liquidation of the accident at the Chernobyl nuclear power plant and continued to work.

A state old-age pension was assigned at 250% of the basic part, taking into account the regional coefficient of 1.5 in Khanty-Mansi Autonomous Okrug. Judging by the amount of the pension, it was clear that this pension was paid until 2009, and then transferred to old-age pension without my application. I wrote an application to the Pension Fund to provide me with a full calculation of my pension.

They did not give a full calculation, but they provided an explanatory note, which said that since 2004 I have been receiving a labor pension, the survival period was indicated as 156.

Questions: - did the Pension Fund act legally by initially establishing a state old-age pension for me with a regional coefficient of 1.5, if I worked in the oil and gas industry and a coefficient of 1.7 was applied to wages and at the same time, state employees, according to the resolution of the Khanty-Mansi Autonomous Okrug, received a pension taking into account the same coefficient

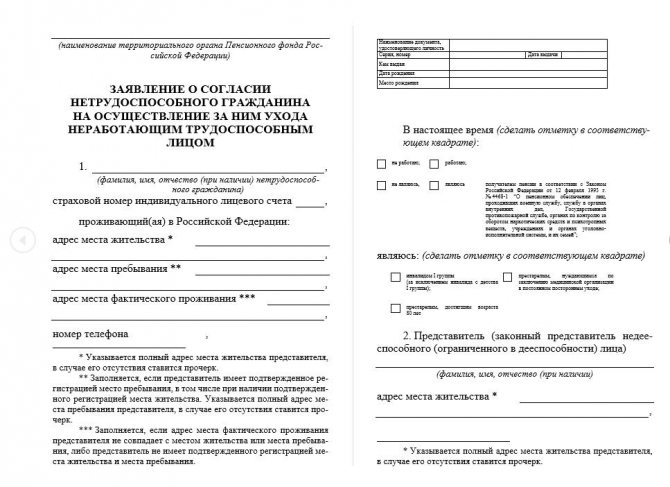

Care allowance

As a rule, someone helps people who cannot take care of themselves and manage their daily life. Usually these are close ones. For an able-bodied person caring for a sick person and not working because of this, the following types of payments are provided:

- Compensatory - is established for a person caring for a disabled person of group 1, a citizen aged 80 years, an elderly person who, according to the medical commission, is entitled to outside care, regardless of whether this citizen is a close relative or family member.

- Monthly - provided for non-working able-bodied citizens who are caring for a disabled child under the age of 18, a disabled person of group 1 since childhood.

Payments are made monthly. The amount of the benefit for compensation payment is 1,200 rubles, and for monthly payments - from 1,200 to 5,500, depending on the degree of relationship with a disabled child or a disabled person since childhood. To assign benefits, you need to submit applications to the Pension Fund for Caregivers (a sample application is presented above) only after receiving consent from the citizen who will be searched.

You will also need:

- a certificate from the employment center stating that the person intending to care for the sick does not receive unemployment benefits;

- a document confirming the authority of the legal representative;

- certificate from the place of study (if it is a child) and medical institution.

Making an application: step-by-step instructions

According to the current regulations of the Pension Fund, citizens will have to draw up an application for recalculation of their pension in the established form. The form is enshrined in Appendix No. 2 to Resolution of the Board of the Pension Fund of the Russian Federation No. 16p.

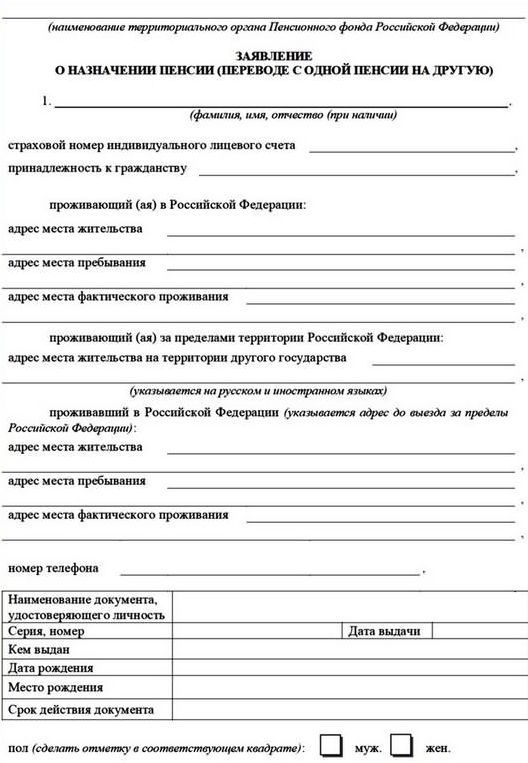

The form has a rather complex structure. Use step-by-step instructions:

Step 1. In the header of the document indicate the name of the territorial branch of the Pension Fund to which the application will be sent.

Step 2. Now fill out Information Block No. 1, indicating one by one:

- FULL NAME. the applicant;

- insurance number;

- citizenship;

- registration and residence addresses;

- phone number;

- We enter the passport data in a special plate;

- Determine the gender of the applicant - put a mark in the appropriate field.

Step 3. Information block No. 2 is filled out only if an authorized representative is involved in the registration. Fill in the appropriate fields about the attorney. Please provide the details of the power of attorney separately.

Step 4. In Information Block No. 3 of the application, indicate the type of pension that needs to be recalculated. Make marks opposite the reasons for the recount. It is allowed to make several marks at once. If the required reason is not available, then enter it in the appropriate “Other” field.

Step 5. In Information Block No. 4, we indicate information about the current status of the applicant. We note whether the citizen is currently working. Then we determine the number of dependents. If they are missing, then we write the word “no”.

Step 6. Get acquainted with the information from block No. 5.

Step 7. In block No. 6 you must indicate all the documents attached to the application.

Step 8. Information block No. 7 is intended to indicate the feedback form. The applicant independently determines the method convenient for him.

Step 9. In the last column, indicate the date of the application. Put your handwritten signature and indicate the transcript.

This is what a completed application for recalculation of pensions for working pensioners looks like:

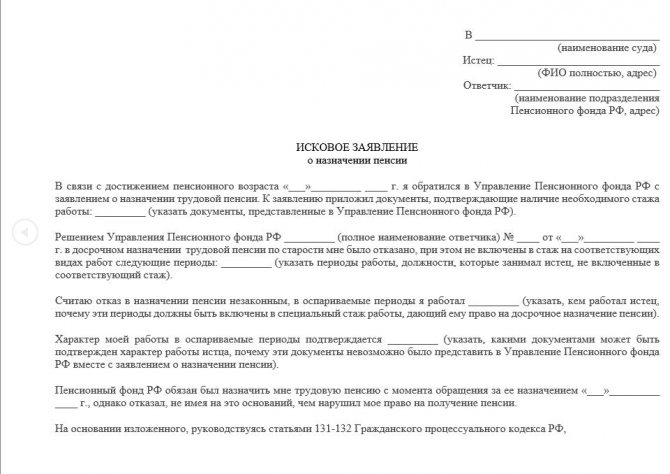

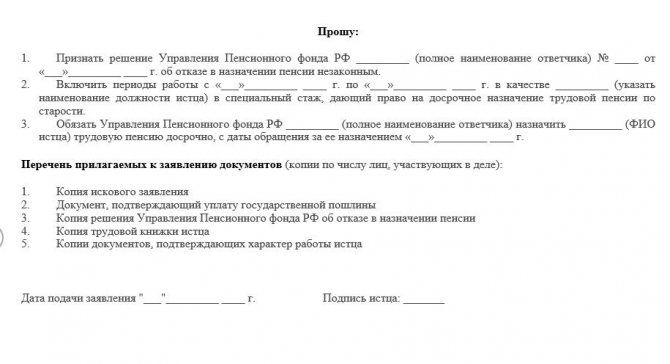

Sample statement of claim to the Pension Fund

If a citizen has been refused a pension, he has the right to challenge this decision by filing a claim with the court at his place of residence. Filing a statement of claim will cost the plaintiff 200 rubles in state duty.

The document must contain the following information:

- name of the branch of the Pension Fund of the Russian Federation that made the decision;

- plaintiff's details;

- details of the document recording the refusal;

- briefly about the essence of the violated rights;

- links to regulatory documents that confirm the PF is wrong;

- please consider the case based on the circumstances and recognize the decision of the Pension Fund of the Russian Federation as illegal.

Samples of statements of claim to the Pension Fund can be found on the website of the Pension Fund of the Russian Federation. But for your reference, examples of documents will also be attached here.

It is quite simple to draw up applications for a pension to the Pension Fund using the sample. It is necessary to comply with the mandatory points that were indicated in the article and try to comply with the attached examples. Having completed the correct request using the sample, the application to the Pension Fund can be sent by mail, completed at the Pension Fund branch, or sent an electronic copy.

More detailed information on the assignment of pensions can be found directly on the portal of the Pension Fund of the Russian Federation.

In what cases can you file a complaint against the Pension Fund?

Citizens can file a complaint with the Pension Fund in the following situations:

- failure to register an application or provide government services;

- refusal to accept documentation;

- denial of government services;

- refusal to forward any mistakes or typos in the provided documentation;

- demand for papers that are not provided for by regulatory and legal documents;

- requirement of payment for the transfer of free public services.

How to write a complaint against the Pension Fund

A complaint to the Foundation is written in any form. The application must be brief and discreet. The content depends on the specific moment, but necessarily contains the following information:

- name and address of the application authority;

- Full name, address, telephone number;

- nature of the complaint;

- requirements;

- list of documentation in the application;

- date and signature.

Where to file a complaint against the Pension Fund

You need to file a complaint with the management of the Fund Management: as a general rule, they respond to your appeal within a month. If there is no response, send a complaint to a higher branch of the Pension Fund of Russia, the prosecutor's office or the court.

Also, based on the current rules, individuals and policyholders are able to submit an appeal to the Pension Fund at each level of the Fund system:

- 2.46 thousand customer services of the organization;

- departments of pension institutions in the constituent entities of the Russian Federation;

- to the central executive body - the Moscow City Directorate.

Work with citizens' appeals is also carried out by:

- department for pension security of citizens who live outside the country;

- Department for handling appeals from people, insured citizens, institutions and policyholders.

The Pension Fund’s daily work with people’s requests also takes place via the telephone numbers of the Unified Federal Advisory Service.

Where to file a complaint against the Pension Fund electronically

It is possible to submit a complaint to the Pension Fund not only in person or by mail, but also electronically, through the Fund’s portal or the Unified portal of services from the state and municipality. The appeal is also considered in the general manner.

To the Pension Fund of the Russian Federation Address: ___________________________

From ____________________________ Address: ___________________________

I, _________________________ __________ born I am a recipient of an old-age pension.

Also, I am registered with the tax authority as an individual entrepreneur. The entrepreneurial activity I carry out consists of renting out, under a rental agreement, part of an apartment that I own.

In accordance with the requirements of Tax legislation, I, as an individual entrepreneur (hereinafter referred to as an individual entrepreneur) who does not have employees, pay tax according to the patent tax system. Also, as an individual entrepreneur, I am obliged to pay contributions to the Pension Fund of the Russian Federation and to the compulsory medical insurance fund. Recently I received a letter from the Pension Fund of the Russian Federation demanding that I pay an insurance premium for compulsory pension insurance in the amount of _________ rubles. ___ kop.

and an insurance premium for compulsory medical insurance in the amount of _________ rubles. ___ kop.

Yes, in accordance with Art. 5 Federal Law dated July 24, 2009

No. 212 of the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation”, payers of insurance premiums are, among other things, individual entrepreneurs, lawyers, notaries engaged in private practice, and other persons engaged in private practice in accordance with the procedure established by the legislation of the Russian Federation (hereinafter referred to as payers of insurance premiums, not making payments and other remuneration to individuals), unless otherwise provided in the federal law on a specific type of compulsory social insurance.

Previously, I systematically paid contributions to the Pension Fund of the Russian Federation in a significantly smaller amount than indicated in the letter that came to me. After which, I, as a pensioner, received the appropriate recalculations and deductions. The demands presented to me by the Pension Fund at the present time have not been explained to me, and therefore I consider them illegal and unfounded.

Also, it was not explained to me whether the payments indicated in the letter were independent or in addition to the deductions I was already making.

The Constitution of the Russian Federation, enshrining freedom of labor, the right of everyone to freely choose their type of activity and profession, the right to freely use their abilities and property for entrepreneurial and other economic activities not prohibited by law (Articles 34, part 1 and 37, part 1), also guarantees everyone social security by age in case of illness, disability, loss of a breadwinner, for raising children and in other cases established by law (Article 39, part 1).

Also, please take into account that I am a pensioner and a recipient of a pension, and therefore, I consider it necessary to receive detailed explanations about the movements of the deductions I make. In addition, for citizens, including individual entrepreneurs, who, after the establishment of a labor pension for old age or disability, continue their labor (entrepreneurial) activities, it is possible to annually recalculate the insurance part of the labor pension, taking into account the insurance contributions received into their individual personal account (clause 3 of Article 17 Federal Law “On Labor Pensions in the Russian Federation”) and, thus, paying insurance premiums allows you to increase the amount of the pension you receive.

In accordance with Art. 22 Federal Law of December 15, 2001 No. 166-FZ “On state pension provision in the Russian Federation”, the assignment of a pension, recalculation of its size and transfer from one type of pension to another are made upon the application of a citizen.

So, in accordance with Art. 2 of the Federal Law of the Russian Federation of May 2, 2006 “On the procedure for considering appeals from citizens of the Russian Federation,” citizens have the right to apply personally, as well as send individual and collective appeals to state bodies, local governments and officials.

Based on the aforesaid and guided by Article. 2 Federal Law “On the procedure for considering appeals from citizens of the Russian Federation”

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

1. Recalculate my contributions to the Pension Fund of the Russian Federation as an individual entrepreneur - _________________; 2. Provide me with information about the procedure and amounts for recalculating the pension I receive;

Please notify me of the decision made on this application in writing at the above address.

" "_____________ G. ___________________________________________

Citizens turn to the Russian Pension Fund (PFR) on a variety of issues. But if for consultations in most cases it is enough to dial the fund’s telephone number, then in order to obtain a decision on any issue it is necessary to submit an application.

You can get advice from PFR specialists in several ways:

- Contact directly the Pension Fund office at your place of residence: you must write an application, which will be registered.

- Send your application by registered mail: the official website of the Pension Fund of Russia contains the addresses of territorial branches.

- Form an appeal through the online reception: both Russians and citizens living outside the country can count on help.