Who can claim an old-age pension in 2020

An old-age pension is a regular monthly cash income paid to people who have reached retirement age.

Who will even be able to retire in 2020? Familiarize yourself with the periods for changing the retirement age, the list and sample documents, as well as the nuances of the employer’s interaction with the Pension Fund of the Russian Federation. When retirement age approaches, the employee decides whether to continue working or quit. To apply for a pension, citizens can independently apply to the Pension Fund of Russia (PFR). But many companies, in order not to distract employees from the production process, themselves begin to collect information about the length of service of the future retiree, prepare and check the necessary documents. Then they submit them to the relevant government agencies, observing the deadlines established for this procedure. This is usually done by the HR department and accounting department of the enterprise.

The new pension legislation sets out the conditions and requirements for citizens who are going to apply for pension benefits in 2020 and receive them in old age.

The conditions for old age pension in 2020 are as follows:

- The retirement age for a man should be 60.5 years, and for a woman - 55.5 years.

- Future pensioners must have 10 years of insurance coverage.

- The number of pension points, also known as the IPC indicator, should be equal to 16.2 points.

Let us recall the table of retirement periods prepared by the Pension Fund and posted on the official website of the Pension Fund.

A citizen can contact the Pension Fund at any of the above periods under the conditions that we have indicated. He will be able to submit an application earlier, but payments will begin to be made as soon as the citizen turns 60.5 or 55.5 years old.

Early retirement for health reasons and illnesses

- After visiting the employment center, you need to take a statement of desire to retire early (2 copies). It must be accompanied by a certificate confirming the time of issue. This document is sent to the Pension Fund within 7 working days.

- Such a statement will be valid for 1 month. The only exceptions are those who are temporarily disabled. In such a situation, a supporting certificate is additionally provided, which will extend the validity of the application.

- From the moment the application is submitted, the person will no longer receive unemployment benefits.

- After a month has passed after submitting all the documentation, the Pension Fund will assign a labor pension, to which a non-working person who previously received financial payments due to disability will be transferred.

Another category that has received from the state the right to retire earlier than required by age is the unemployed who cannot find suitable employment options for themselves.

But in this case, retirement is possible only if the corresponding application comes not from the potential pensioner himself, but from the employment service. Early retirement after layoffs A man will be able to retire at 58 even if the employee was fired from the enterprise due to staff reductions or in connection with the liquidation of the company. In this situation, all the conditions described below must be met:

- the employee was fired only for the reasons mentioned.

Possibility of early retirement due to illness?

Code. Employees are warned by the employer personally and against signature of the upcoming dismissal due to the liquidation of the organization, reduction in the number or staff of the organization’s employees, at least two months before the dismissal.

The employer, with the written consent of the employee, has the right to terminate the employment contract with him before the expiration of the period specified in part two of this article, paying him additional compensation in the amount of the employee’s average earnings, calculated in proportion to the time remaining before the expiration of the notice of dismissal. In case of threat of mass layoffs, the employer taking into account the opinion of the elected body of the primary trade union organization, takes the necessary measures provided for by this Code, other federal laws, collective agreement, and agreement.

Early retirement due to health reasons

You were sent to undergo an ITU commission (medical and social examination), based on the results of passing the commission, the ITU bureau issues a conclusion and you can be given a disability group, and, accordingly, a pension and all the required benefits.

Another option is that you can be sent to retirement early, within a year or a year and a half from the employment center. This happens if, say, you were laid off, you came and registered with the employment center on time, you have 1.5-2 years left until retirement , you will be registered, you will be registered, and 1-1.5 years before your scheduled retirement, you will be assigned a social pension, and when the retirement age comes, they will recalculate (the terms are approximate, I can’t say for sure about the employment center, but I know for sure that they leave early, but in a year or two I don’t know for sure, maybe even so, if you have 3 years left, you will be registered for a year, and then they will grant you a pension, i.e.

Pension for health reasons

Documents required for registration of early retirement If you wish to retire early upon reaching the age of 58, as well as if all the conditions mentioned above are met, you must contact the regional (local) branch of the Pension Fund and submit the following documents:

- a corresponding application filled out in accordance with Law 400-FZ;

- employment history;

- military ID;

- general passport;

- SNILS;

- a certificate for any period before 2002, which indicates the amount of average monthly earnings.

Persons dismissed due to the liquidation of an enterprise or staff reduction and who cannot find a new job also provide a recommendation from the employment service. Let us remember that this is the main reason for early retirement under such conditions.

When is early pension granted for health reasons?

Important

How to calculate the amount of early pension payments If a citizen retires early, the amount of payments is calculated on general terms.

It depends on factors such as the average monthly salary (it is indicated in the relevant certificate), as well as on the length of service at the time of registration of documents.

In addition, early pension, just like regular pension, is subject to all recalculations and indexations initiated by the state.

pensionexpert.ru

How to retire early for health reasons? — Pravoved.RU Is it possible to retire at 53 due to health reasons? The doctor says that I hope you are not working? I have diabetes, my nervous system is all shaken. I lose consciousness very often, so they don’t keep me anywhere at work. Who needs sick people? I have a sick thyroid gland, I don’t sleep at all, chronic fatigue.

Is it possible to retire early due to health reasons?

It is very important to fill out all the papers correctly and correctly, check for the presence of seals and signatures. Citizen's rights The question of how to retire early is regulated by many Russian federal laws.

What rights does a citizen who plans to retire early have? A citizen is able to demand from his employer all the necessary documentation necessary for transfer to the employment center or the Pension Fund of the Russian Federation.

Attention

Moreover, the employer of the enterprise must confirm the preferential length of service of the employee. If the employer for some reason does not do this, then such a task is assigned to the relevant government body. As soon as the employee receives a pension insurance certificate, all information about his “movements” will be taken into account by the Russian Pension Fund.

Source: https://24-advokat.ru/dosrochnaya-pensiya-po-sostoyaniyu-zdorovya-kakim-boleznyam/

We arrange a pension for an employee

Employee actions

Registration of a pension: where to start? This is the main question that concerns future retirees. The answer is simple: from collecting the necessary package of documents for transfer to the Pension Fund.

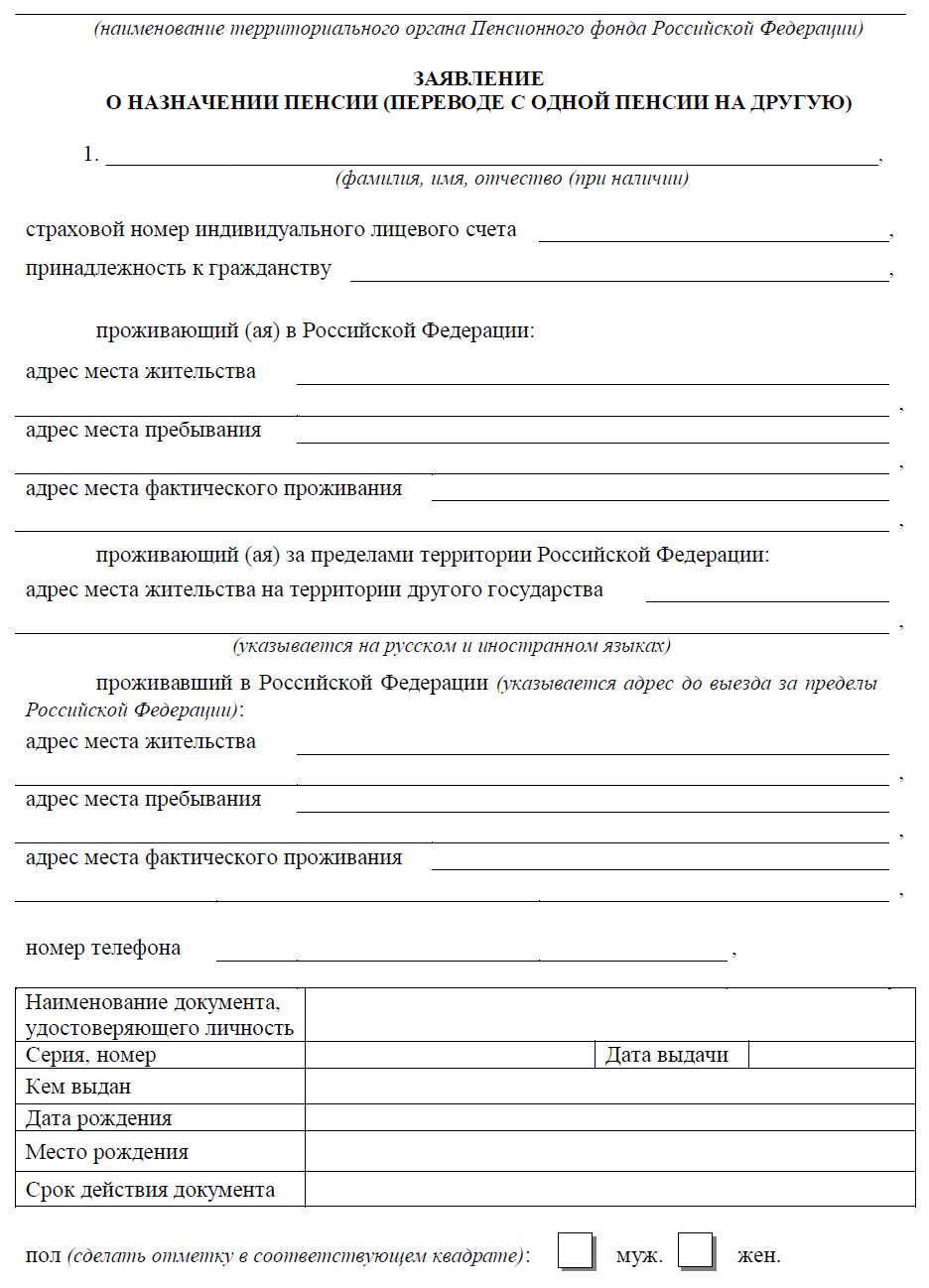

The employee himself must contact the Pension Fund with a corresponding application. The application must be accompanied by documents according to the list approved by Order of the Ministry of Labor of Russia dated November 28, 2014 No. 958n.

Main list of documents:

- statement (at the end of the article);

- passport (for citizens of the Russian Federation) or residence permit (for foreign citizens and stateless persons);

- certificate of compulsory pension insurance (SNILS);

- work book or documents confirming the duration of the insurance period. For example, papers issued by an employer upon dismissal from a job may be accepted as confirmation of insurance coverage, provided that they do not contain the basis for their issuance;

- certificate of average monthly earnings for 60 consecutive months up to 01/01/2002 during employment. Employers must provide information on average monthly earnings for 2000–2001;

- a document confirming the period of military service (copy of pages 1, 3 and 8 of the military ID);

- Bank account details for transferring payments.

Documents must be submitted to the Pension Fund of the Russian Federation at the place of residence (Clause 1, Article 18 of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation”). You can also attach documents on the basis of which gratitude and incentives were announced, and others necessary to confirm additional circumstances.

Actions of the personnel officer

1. Preparation of documents.

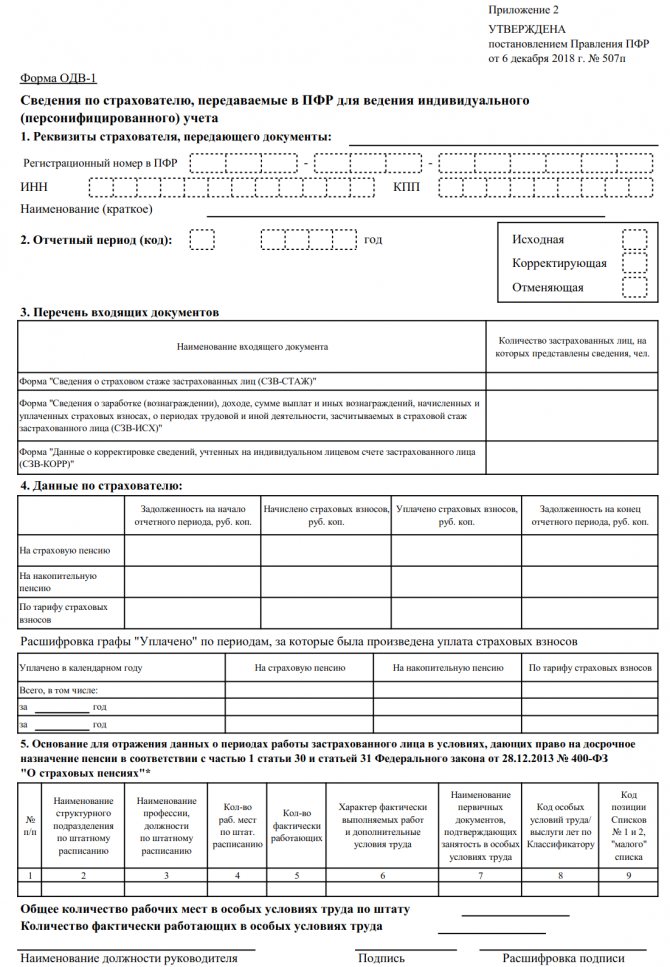

When preparing documents, the HR employee, within 10 days after the employee’s application, submits to the Pension Fund:

- information in the form SZV-STAZH (approved by Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p);

- EDV-1;

- ADV-6-1;

- explanatory note.

All forms must be completed for the period from the beginning of the year until the day of retirement age. The form indicates the type of “pension assignment”.

The insurance period is calculated by the state on the date of their completion. It includes not only the period of work at various enterprises, but also military service, caring for a child under three years of age, the time of receiving unemployment benefits, participation in paid public works, caring for a disabled person of group 1 or a person over 80 years of age. These periods are called non-insurance periods.

2. Checking and issuing a work book.

As a professional in his field, the personnel officer checks the work book for possible corrections and inaccuracies. If incorrect filling is detected, he helps the future pensioner collect relevant evidence confirming the length of service. It is necessary to ensure that all data in the documents corresponds to reality (full name, dates, numbers, etc.) in order to avoid further paperwork.

The personnel officer, upon a written application from the employee, is obliged to give him a work book for presentation to the Pension Fund of Russia, and then make sure that he returns the book back.

3. Checking information.

To verify the data provided to the Pension Fund, the employer requests an extract from the individual personal account.

4. Dismissal of a pensioner is only at his request.

If an employee wants to end his career and retire, he is fired from the day indicated in his application. He is not required to work the two weeks required upon dismissal. If an employee wishes to continue working, he cannot be fired. It is also impossible to renew an open-ended employment contract into a fixed-term one.

We present individual information

After submitting documents on the assignment of a pension, the employee must contact the employer with an application to provide personalized information on him in the form SZV-STAZH (approved by Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p). The employer is obliged to fill out the specified form, indicating the type of information “Pension assignment”, and within three calendar days submit it to the Pension Fund (Clause 2 of Article 11 of the Federal Law of 01.04.96 No. 27-FZ).

If the future pensioner has not written an application to submit the SZV-STAZH form, the employer is not required to fill it out. In this case, information about the length of service of this person will be received by the Pension Fund later, when the employer submits the annual form SZV-STAZH with the type of information “Initial”.

In addition, the employee can ask the employer to submit information about work experience before 2002. Such information is presented in the SZV-K form (approved by Resolution of the Pension Fund Board dated January 11, 2017 No. 2p). Sometimes this form is requested by the Pension Fund itself as part of collecting information on the total length of service of insured persons for the entire period of their work until January 2002 (“Insureds can now generate the SZV-K form for free in the “Kontur.Report PF” web service”). .

Who is entitled to early retirement?

The law provides for the right to receive a pension early. Under what conditions it is provided, read the following regulations:

- Labor Code of the Russian Federation;

- Resolution of the USSR Cabinet of Ministers of January 26, 1991 No. 10 “On approval of lists of production, work, professions, positions and indicators giving the right to preferential pension provision”;

- Law of the Russian Federation of February 19, 1993 No. 4520-I “On state guarantees and compensation for persons working and living in the Far North and equivalent areas”;

- Federal Law of December 28, 2013 No. 426-FZ “On special assessment of working conditions.”

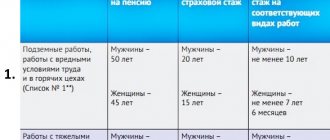

The conditions for assigning a preferential pension for them from 2020 still remain:

- Reaching the retirement age established separately for lists 1 and 2.

- Availability of full general insurance experience and the required number of pension points (IPC).

- Availability of the required preferential length of service.

The following categories of citizens can apply for early retirement:

- employees who have the necessary preferential length of service for working in difficult and dangerous working conditions;

- those who worked in the Far North or equivalent areas;

- teachers and medical workers with teaching (25 years) or medical (30 years) experience;

- mothers of many children who gave birth and raised five or more children up to the age of eight (they acquire the right to a pension at age 50);

- mothers (or fathers) who raised a disabled child from childhood (they have the right to retire five years earlier than the generally established age: women - at 50 years old, men - at 55 years old).

Law No. 350-FZ, which entered into force on January 1, 2019, which provides for an increase in the retirement age from 2020, changes the current system of early pensions in Russia. In particular, the new law provides for changes in the withdrawal deadlines for such preferential pensions as:

- by length of service - for teachers, health workers, creative professions;

- for residents of the Far North and equivalent territories.

For these categories of citizens, the period of working capacity will increase, starting from 01/01/2019. According to the new law, the requirements for special professional experience for these categories of workers will not change, but the deadline for processing pension payments for them will be delayed by 5 years relative to the year in which the required experience was acquired.

All changes will take place gradually, in several stages, providing for transitional provisions, during which the retirement period will gradually increase until it reaches the values provided by the bill.

It will be possible to issue pension payments to teachers and health workers in accordance with generally established requirements, that is, at 60 years old for women or 65 years old for men.

In addition to doctors and teachers, workers in creative activities (in theatrical and entertainment organizations) have the right to receive early pension payments. For them, the old law established requirements for special experience depending on the type of work - from 15 to 30 years. The new law provides for a similar increase in age for them to 55-60 years, respectively. The change for them will also occur in stages, with an annual increase of 1 year.

For citizens who, due to work in the Far North and equivalent areas, retire early, the law on pensions from 01/01/2019 also provides for a number of changes relating to increasing the period of working capacity.

It should be noted that the increase in the working period will not affect workers in the Far North and equivalent areas if they work in difficult or harmful conditions (for example, workers in ferrous and non-ferrous metallurgy, miners, railway workers, etc.). No changes are planned for them by the adopted law.

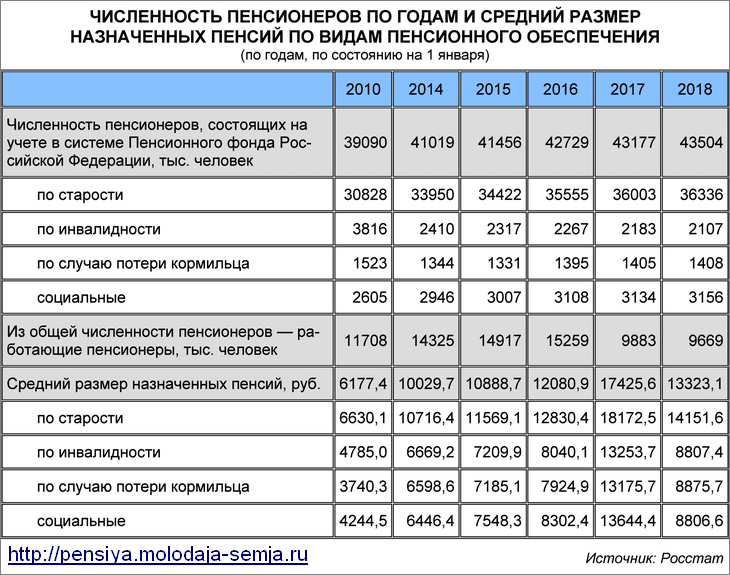

Retirement in the Russian Federation under the new law

The result of the changes being made is that the procedure for receiving old-age benefits becomes more complicated. The action is being carried out to reduce the number of pensioners in the Russian Federation. According to the pension fund, at the beginning of 2020 there were 43.5 million people in this category. 9.7 million continued to work. The average payment amount was 14,151.6 rubles. These are official data from Rosstat.

The list of requirements for receiving old-age insurance benefits is fixed in Article 8 of Federal Law No. 400 of December 28, 2013. The norms enshrined in the law do not imply the addition of new conditions for receiving old-age benefits. Only those features that are currently in effect are adjusted.

Changes will affect:

- Number of pension points. Currently in the Russian Federation there is a minimum IPC. The value of the indicator will increase by 2.4 points annually. The transition phase is planned to be completed in 2025. As a result, the requirements for the indicator are fixed at 30 points.

- Retirement age. Previously, women and men could count on receiving old-age payments when they reached 55 and 60 years of age, respectively. From January 1, 2020, a transition phase will begin, during which this age will gradually increase. It will be brought to the level of 60 and 65 years in 2023.

- Seniority. Increases by one year annually. The final value will be reached in 2024 and will be 15 years.

- A new law proposed by the government and adopted by the State Duma in 2018 provides for an increase in the retirement age. The increase in experience and points occurs from 2020.

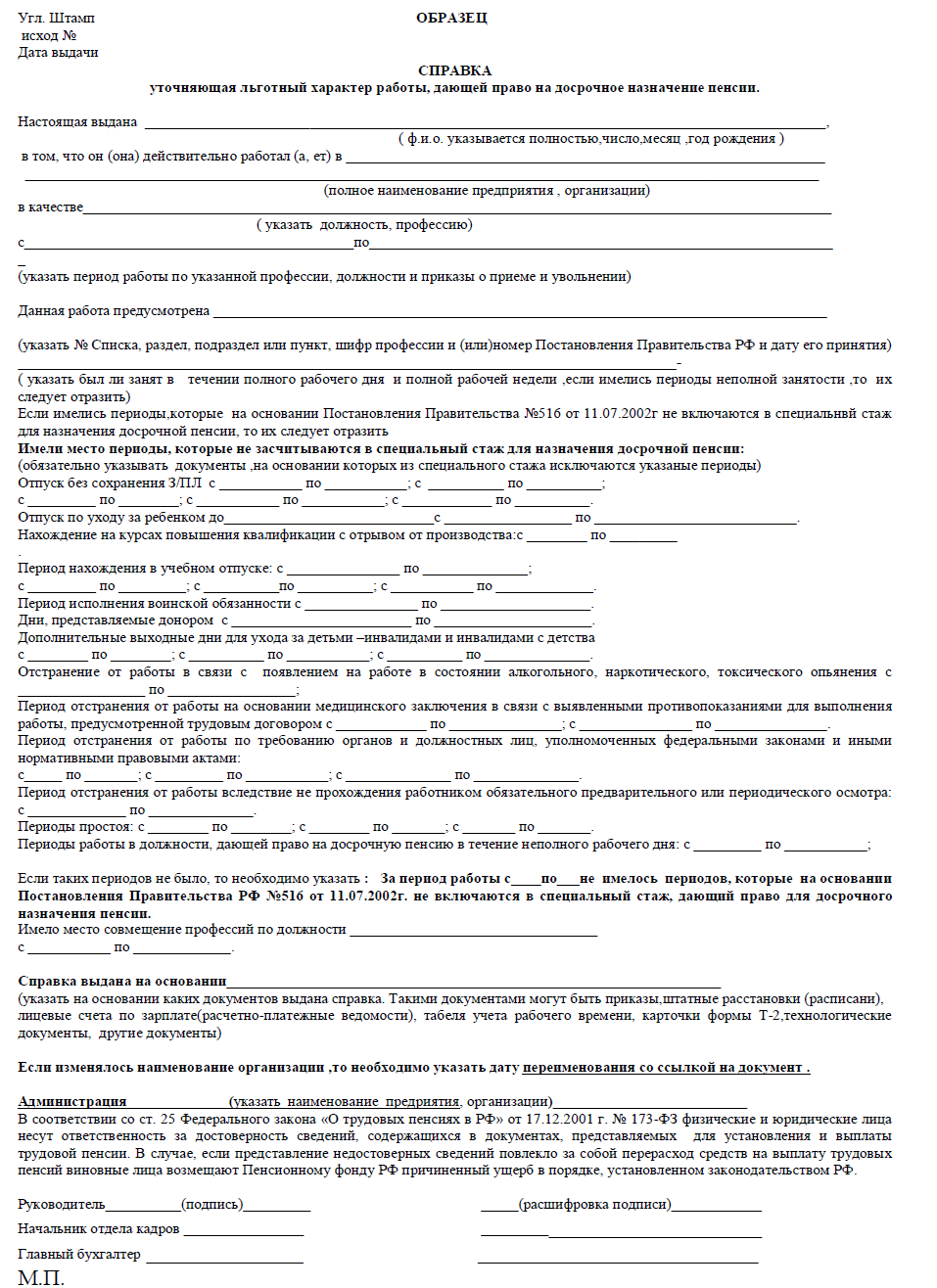

Registration of a preferential pension

In the case of a preferential pension, the HR department prepares documents to confirm the benefit. To do this, you must provide the following to the Pension Fund:

- reference (at the end of the article);

- constituent documents;

- certificate of entry into the Unified State Register of Real Estate;

- certificate of registration with the tax authority;

- information letter from statistical authorities with OKVED;

- license or certificate of admission to a certain type of work (SRO);

- staffing schedule;

- job descriptions or production instruction cards, etc.;

- copies of workplace certification documents, certification cards, state examination reports of working conditions;

- copies of local acts describing production technology;

- copies of documents on the availability of equipment;

- other documents confirming preferential length of service.

When contracting

You can retire earlier than the established period in a situation where the company has ceased operations and the employee has been fired on this basis. It is required that the following conditions be met: termination of employment is due to the presence of the above reasons. When dismissal is related to filing an application for dismissal at will or due to health conditions, early exit cannot be considered.

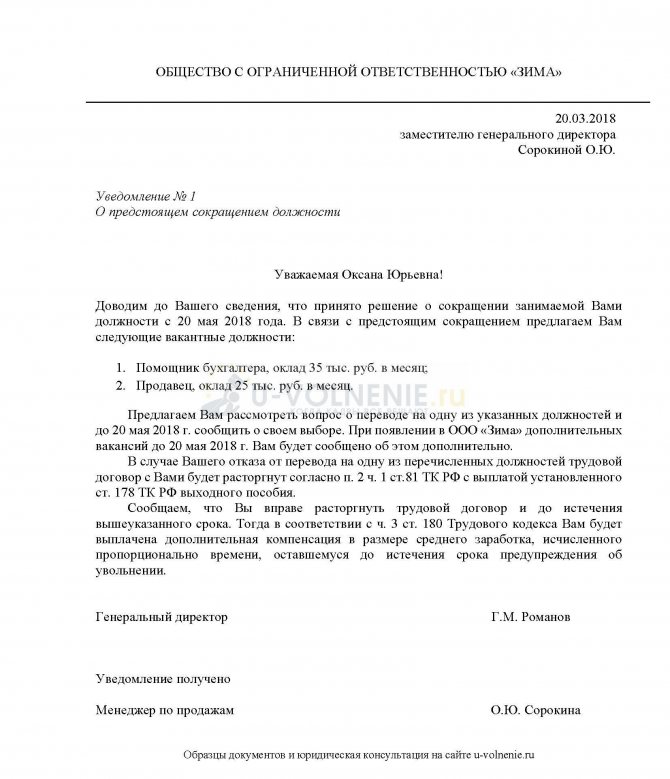

Sample notice of job reduction

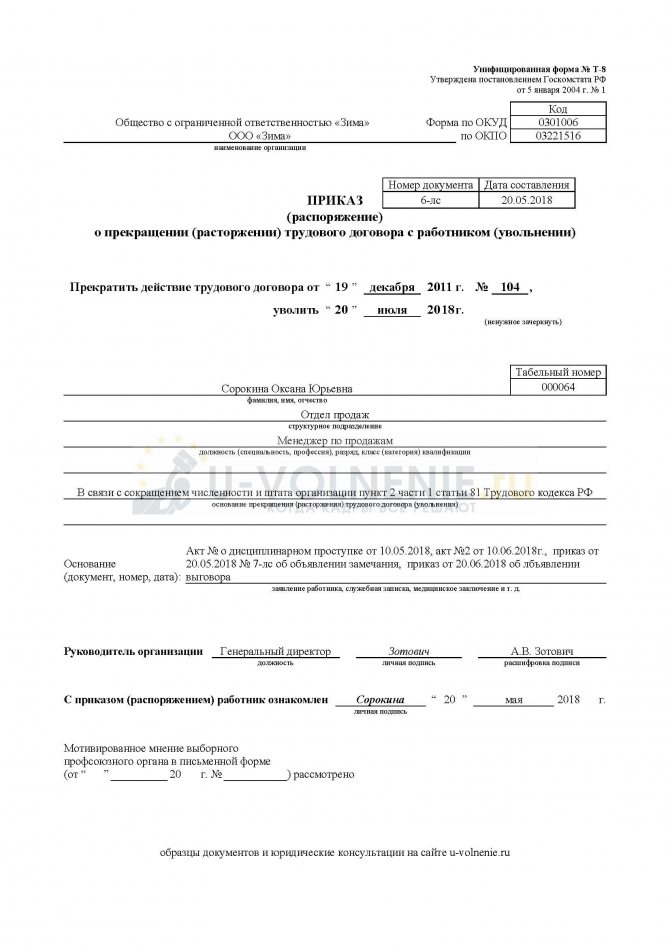

Sample letter of dismissal due to reduction

It is required that a person has the experience specified in legislative acts. For example, for males this figure is 25 years. Those who previously worked under special working conditions or territory are considered an exception.

In addition to the above, a person fired immediately after being laid off must contact the centers responsible for employment and register for unemployment. If the application deadline is missed, you cannot count on payments from the company during the first three months. There must be no suitable vacancies in the CZN to employ a person. Vacancies must meet the requirements of the person’s qualifications and existing education.

Read on the topic: What do you need to receive unemployment benefits when you are fired due to staff reduction?

Procedure for admission and consideration

The full package of documents is provided in person or through a legal representative (notarized power of attorney).

The time for consideration of an application by the Pension Fund should not exceed 10 working days. To assign payments from the date of retirement age, we recommend that the future pensioner contact the Pension Fund a week before his birthday.

If at the time of submitting the application not all necessary documents are attached, he will be given three months to collect the missing ones. In this case, the day of application will be considered the day the application was received.

How to increase your pension

To understand, you need to understand what pension payments consist of.

Let's divide the payments into three parts and see what they consist of and how to increase them.

From January 1, 2019, the amount of the fixed payment to the insurance pension is indexed by 7.05% and amounts to RUB 5,334.19. Such an increase is provided for in Part 8 of Art. 10 of Law No. 350-FZ of October 3, 2018, which came into force on January 1, 2019.

| Pension payments | Explanations | Size | Pension increase |

| Basic part | Paid from the budget. Paid to citizens if they have length of service. | As of 01/01/2019, the amount is 5334.19 rubles. per month. | The persons listed in Article 17 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” are entitled to an increase. |

| Insurance part | Determined from the amount of insurance premiums. These payments are made by the employer based on the official salary. | It is set individually depending on the value of the coefficients. Affects: age and experience. |

|

| Cumulative part | It is accumulated in the same way as the insurance part, but is increased by the income received when placing funds on the securities market. Citizens have the right to independently manage the funded portion. | Savings of citizens born in 1967 and subsequent years. |

|

DO WORKING PENSIONERS RECEIVE A PENSION?

Since 2016, a law has come into force which states that pensioners continue to receive an insurance pension even if they continue to work. The aspect is that planned indexations are not taken into account. Payments apply to people who are entitled to an insurance pension. Recipients of state pensions (including social pensions) are not entitled to them.

If a pensioner resumes working activity, his insurance payments are not reduced. After its termination, no documentary reporting is required. Since 2016, a simplified form of monthly reporting has been in force for employers, in which the fact of work of a pensioner is determined automatically by the fund.