Pedagogical activity is classified as hard work, therefore retired teachers have the right to social assistance, through which the state tries to compensate for the costs of vital resources that invariably accompany teaching work.

Particular attention is paid to teachers working in rural areas, where, as a rule, young specialists go without enthusiasm.

There are traditionally not enough teachers in rural schools, and the state is trying to motivate graduates of pedagogical universities with various kinds of benefits, which can be compensation, allowances, subsidies and other social support measures.

Who retires earlier than others?

The right to stop working early and receive a pension has been granted to a large number of citizens of the country. These include mothers with many children, welders, and miners. In short, more than 21 categories, not counting workers in the Far North, equivalent regions, and many other “beneficiaries”.

Lists of jobs that require early retirement are given in 400-FZ “On Insurance Pensions” and some other laws. The Lists approved by the USSR Cabinet of Ministers in 1991 are also in effect. But applying for a pension based on preferential service or on other grounds is unified and will not be very difficult. Let's look at this process in more detail.

Preferential pension for teachers based on length of service in 2020

- Annual paid holidays.

- The time during which the teacher was incapacitated.

- Working hours that were equated to a full working day (must be confirmed by the volume of insurance premiums).

- Time of receipt of pedagogical education (the teacher, before entering the university and after receiving a diploma, worked in the field of education in a preferential position).

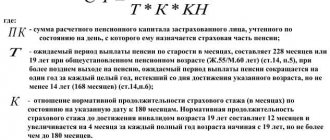

Pension payments are calculated on an individual basis, but in any case the pension amount will not be less than 40% of the teacher’s average monthly income. To calculate, you can use the following formula:

How to prepare

The key to timely assignment of a pension, taking into account all pension rights, is detailed preparation. Basically you will need:

- consultation with a lawyer who will tell the citizen about his rights and help him decide on the set of documents relevant in his case;

- collection of necessary documents that confirm the development of experience;

- requests to archival organizations and the Federal Tax Service, if any internship documents or information on salary before 2002 are missing;

- collection of documents that determine the exclusive right to early retirement - relevant only to certain categories of “beneficiaries” (mothers of large families, “Northerners”, etc.);

- registration with the Pension Fund for advance registration of a pension.

All necessary activities should be started at least 2 years before the expected retirement date. At the same time, you should register with the Pension Fund for advance preparation no later than 6 months before the actual date of assignment of pension benefits.

Contacting the Pension Fund

Registration of a preferential pension according to the list involves the use of all rights of a citizen, including early application to the Fund. Registration of a pension in advance greatly simplifies the end of work (or simply the assignment of pension benefits). 1-2 years before retirement, consultation with the Fund is requested. During the consultation, the collected documents are submitted, and the date of retirement is also indicated.

Pension Fund specialists formulate a pension case, or rather its project. In the future, it will significantly simplify retirement, and in addition, some certificates will not have to be taken out again, because they will already be in the fund.

Preferential pension for teachers based on length of service

- directors;

- deputy head responsible for the implementation of the educational process;

- head of academic department;

- teachers of various levels;

- kindergarten teachers of all levels;

- school teachers, pedagogues and methodologists with combined teaching positions;

- masters of vocational schools teaching industrial training;

- specialist organizers of extracurricular activities;

- teachers who are also psychologists;

- speech therapists, teachers acting as speech therapists;

- teachers of music schools, physical education, social educators, teachers conducting coaching activities;

- teachers working in additional educational programs;

- individual specialists.

Be sure to check the entries in your work book with the positions and institutions indicated in the lists. If there are discrepancies in the current period, the HR department can make corrections. If inaccuracies arose in an earlier period, then all arising conflicts are resolved by going to court.

What documents will be required?

Basically, a citizen must provide the following basic documents:

- identification;

- SNILS (this is a green card issued by the Pension Fund of Russia in Russia to all insured persons, including children);

- documents on length of service (work book) and salary for any 60 months before 2002;

- Certificate of change of name (if changed);

- Certificate of marriage, divorce (if this happened);

- Military ID (for citizens liable for military service);

- Birth certificates of children (if any);

- Confirmation of caring for a disabled person or a citizen over 80 years of age (if available).

But what documents are needed to apply for a preferential pension is one of the frequent questions that lawyers hear during consultations. Many “beneficiaries” believe that they need to confirm their rights in some special way.

In fact, information about the right to early retirement is almost always taken from experience documents, which include:

- work book – the main “working” document;

- employment contracts, contracts, civil contracts, especially fixed-term ones;

- copies of orders on employment and dismissal, job transfers;

- route sheets, pay sheets and other internal personnel, accounting and other documents of the enterprise where the citizen worked.

But in some cases, “special” documents will be required. This is the conclusion of a special commission recognizing working conditions as harmful (for example, for drivers). A certificate from the employer may be required, which substantiates the impossibility of using less harmful production. In some cases, certificates from the municipality may be required (for example, in the case of “Severyan”).

What benefits are available to retired teachers?

Social support for retired teachers provides preferential conditions for retirement, compensation for expenses related to paying for utilities, etc.

For utilities

Retired teachers living in rural areas have the opportunity to:

- do not pay for the use of central or autonomous heating if natural gas is used as fuel;

- pay for electricity at a reduced rate. The amount of assistance in this case is calculated by regional authorities based on electricity consumption standards per square meter of living space;

- buy, if necessary, solid fuel at preferential prices if the housing is not heated centrally.

It should be taken into account that each of the provided types of compensation is paid only after the full cost of the service has been repaid, i.e., according to the principle of repayment - first the teacher pays 100% of the tariff for the service, and after that the money spent is returned to him in full or partially.

Due to the low rates of gas and solid fuel due, the government is today considering the possibility of replacing these benefits with cash payments in the amount of 1,200 rubles.

Honored

You can receive the title “Honored Teacher” after 20 years of teaching if your personal contribution is recognized in:

- ensuring a high level of education;

- introducing methods that promote the full potential of students;

- training winners of school Olympiads;

- creation of scientific works and unique methodological developments.

Honored teachers are entitled to an additional salary increase. The amount of this type of assistance depends on the region of residence, but on average this figure is 18-20% of the salary.

In addition to additional payments to earnings, regional authorities can, on their own initiative, assign additional benefits to honored teachers living in their region.

By length of service

After working for 25 years in an educational institution, a teacher becomes entitled to a long-service pension. To count on pension payments in this case, the teacher must achieve an individual pension coefficient equal to 13.8 (as of 2020).

It should be remembered that if, after accrual of long-service pension payments, a teacher continues to work in education, he does not lose the right to these payments: the continuation of teaching activity in this case can only affect the indexation of payments.

The following periods are included in the preferential length of service:

- direct performance of official duties;

- being on sick leave;

- tariff and additional paid holidays;

- leave to care for a child (if such leave began before 06.10.1992).

Among the requirements for calculating a long-service pension is compliance with the norm of time spent at work. In 2020, this figure is a minimum of 6 hours per week and 240 hours per year. Vocational school teachers must work a minimum of 360 hours per year.

Rural school teachers and elementary school teachers are exempt from this requirement; when calculating a long-service pension, the number of hours worked for them is not counted.

At the time of certification

A retired teacher undergoes certification on a general basis, that is, he submits an application to the certification commission, which must make a decision on assigning a qualification category within 30 days.

This category is valid for 5 years, after which it must be confirmed. If a teacher of retirement age has notified management of his intention to retire after the end of the academic year, he continues to be paid a salary in accordance with his qualification category throughout this time.

If there are no documents about experience

If there are no documents on special or general experience before 2002, information can be obtained from the employer in the personnel and accounting department. If the company has already closed, but it has a legal successor, the corresponding certificate will be issued by the accountant and personnel officer of the new company. If there is no legal successor, you will have to request information from the archive.

But situations often arise when the archive refuses to issue information because it does not have the appropriate documents. In such cases, citizens can either look for 2 witnesses who worked with them during the disputed period.

There is another way - to establish length of service in court. The fact is that the courts have the authority to request, among other things, classified information from the tax office and the Pension Fund of the Russian Federation. Consequently, if the company made tax deductions for the employee, then on their basis it will be possible to restore both the length of service and calculate the salary.

Where to contact

Registration of an early insurance pension in Russia is carried out exclusively at the Pension Fund of the Russian Federation. You can submit an application and a package of documents to the territorial Pension Fund Client Service at your place of residence or stay. If there is none, the application is made to the Pension Fund Office for the locality, district, region where the citizen lives or stays.

Alternatively, documents can be sent to the Fund either through the MFC or by mail. If a citizen applies for an early pension via the Internet (via State Services or the Pension Fund website), the application will be accepted electronically, but the documents will have to be submitted either by mail or in person to the Fund or the Multifunctional Center.

The period for consideration of the application is 10 days. The pension is paid from the day the citizen applies, but not before the right to a pension arises. Documents are submitted no earlier than 1 month before the appointment of pension benefits.

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question by calling the hotline number 8 (800) 555-40-36 or write it in the form below.

Assignment of preferential pensions to teachers

because you have no brains Live the way you want, not your mother, so you don’t regret later that you succumbed to her persuasion, that’s right, you’re not in the Stone Age, you don’t owe anyone Why are you living with your mother at 25? Live alone, your tired one will leave you in 10.

No. You don’t have any harmful position/work. you are not in the service, you did not work in the Far North region. Why on earth should you pay money at 50 years old? Do you want to receive an old-age pension at age 50? In accordance with paragraph 1 of paragraph 1 of the article.