If the deceased’s pension exceeded the spouse’s similar provision, she has the right to apply for a survivor’s pension. At the same time, she will have to give up her own benefits, since receiving two types of pensions is not provided for by law.

It should be taken into account that payments under the SPC (in case of loss of a breadwinner) do not amount to 100% of the deceased’s pension. Their size depends on the amount of insurance premiums paid by the deceased during work, that is, on length of service and salary. If the widow’s own pension is higher than the expected benefit under the SPC, there is naturally no point in switching to it.

Can a wife receive her husband's pension after his death?

In many countries around the world, it is common practice for the pension funds of a deceased husband to be paid to his wife. In our country there is no such law, so it is impossible to receive the full pension of the deceased spouse. But there is a possibility for a widow to receive sums of money in connection with the loss of a breadwinner.

It’s worth noting right away that you cannot receive two pensions: your own and your late husband’s. According to paragraph 1 of Article 4 of Law No. 173, Russian citizens can fully receive only one pension of their choice. Therefore, it is advisable to apply for a survivor's pension only when the spouse had it much more than the widow.

Only the Pension Fund of the Russian Federation can tell you the exact amount of the survivor's pension, since the state has not established the exact amount, and many factors are taken into account when calculating.

For example, the size of the pension depends on the following points:

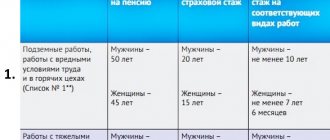

- whether the deceased was a military man or belonged to another category of beneficiaries;

- wages;

- how many years of work experience did you have;

- whether the wife was completely dependent on her husband.

ATTENTION.

Only a woman who had no income at the time of her death can receive a survivor's pension. For example, she is a pensioner or has a disability.

How to calculate the amount a widow can receive

The concept of “transition to the husband’s pension” is also fundamentally incorrect in this regard, in that it mistakenly means that the widow will be able to receive her husband’s payments in full. Actually this is not true. The payments due to the widow will be less than what her deceased husband received.

It should be noted that the amount of payments to the spouse will depend on many factors, such as:

- the size of the husband’s salary and his insurance period, since the size of the pension depends on these factors;

- number of dependents other than wife;

- whether the spouse was one of the military personnel or other persons entitled to state pension provision.

In practice, transferring to the husband's pension can only be justified if the deceased spouse's pension was really large. If the amount of his pension provision did not differ much from the payments due to his wife, then it may turn out that the pension after the transition will be even less.

Thus, the calculation of the amount that a widow can claim largely depends on individual factors. In this regard, it is recommended to contact employees of the state pension fund for additional clarification.

Separately , it should be noted that the wife can receive her husband's funded pension . This is only possible if the citizen participated in its formation, but died before he reached retirement age.

In this case, pension savings become part of the inheritance estate. If there is no will, then, in accordance with the provisions of the Civil Code of the Russian Federation, heirs of the first priority will be able to claim them, including, in addition to the spouse, the children and parents of the testator, between whom they will be divided in equal shares.

How to transfer to my husband's pension after his death

Submitting an application to the Pension Fund is the main action for a woman who wants to transfer to her husband’s pension. Moreover, this must be done no later than six months from the date of the death of the spouse. If the established period has expired, then the issue can be resolved in court.

Before changing your own pension to a survivor's pension, it is recommended to calculate the new pension provision in order to understand the feasibility of the transition. The full calculation formula is specified in Art. 16 Federal Law No. 173. To calculate the figure, the husband's total pension money is divided by 228 months and fixed payments are added. On average, the amount obtained does not exceed 30% of the money that was accrued to the deceased. Accruals of old age pensions and in connection with receipt of disability are taken into account. The coefficients used in the calculations are very complex, so fund employees should not try to make a preliminary calculation.

An application for calculation of compensation can be sent to:

— directly to the Pension Fund of the Russian Federation;

— use the services of the MFC;

— by registered mail to the address of the Pension Fund of the Russian Federation;

-in your personal account on the Pension Fund portal.

How to calculate the amount of insurance pension according to the SPC

The insurance pension for the loss of a breadwinner is assigned not only to the spouse, but to all disabled members of his family. Its value is determined by the formula (Part 3 of Article 15 of Federal Law No. 400 of December 28, 2013):

P = K × C , where P is the amount of survivor benefits; K - individual pension coefficient of the deceased spouse; C - the price of one coefficient at the time of calculating the survivor's benefit.

If the deceased husband received a pension or disability benefit

Disabled family members of a deceased pensioner have the right to choose a calculation method different from that specified in Part 3 of Art. 15 (Part 6, Article 15):

P = K: H × C , where P is the amount of the survivor's benefit; K is the personal coefficient of the deceased person. N — the number of family members entitled to payments; C is the monetary expression of the individual coefficient.

Calculation of pension coefficient

The personal coefficient is calculated according to the formula:

K = (Ks + Kn) × U , where K is the individual coefficient at the time the benefit was assigned; Kc - coefficient for the time before January 1, 2020; Kn - coefficient for the period from January 1, 2020 until the moment of benefit accrual; Y is the coefficient increase index.

Calculation of Ks

The coefficient for previous years is calculated as follows:

Ks = T: Ts + S: R: H , where Ks is the personal coefficient for the years before January 1, 2020; T is the amount of the insurance part of the breadwinner's pension; C - the price of one coefficient as of January 1, 2020, amounting to 64 rubles. 10 k. C - the sum of the coefficients calculated for annual periods before January 1, 2020; P is an index for determining the amount of insurance payments for the breadwinner. In the case of old-age benefits, it is equal to 1. If it concerns disability payments, the required insurance period is in months. (depending on age) should be divided by 180 months. N - the number of relatives of the deceased entitled to payments.

Calculation of Kn

The coefficient for years after January 1, 2020 is calculated as follows:

Kn = (S + D) : R : H , where Kn is the personal coefficient for the time elapsed after January 1, 2020; C is the sum of coefficients calculated for time intervals from January 1, 2015; D is a set of annual coefficients for other intervals; P is an indicator for determining the size of pension payments. For those appointed for old age, it corresponds to 1. If payments were made due to disability, it is necessary to divide the duration of the insurance period (established depending on age) by 180 months. H - the number of applicants for benefits.

Determination of the coefficient increase indicator

The increase index is not taken into account if the deceased received another benefit or lifelong maintenance. It is calculated by the number of months that have passed since retirement age.

What documents are needed to apply for a husband’s pension for himself after his death in 2020

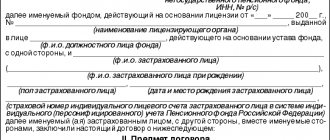

When applying for a survivor's pension, the widow is obliged to write an application to the Pension Fund at her place of residence and attach the required documents from the list to it:

— identity document (civil passport);

— SNILS and INN;

- document on the death of the husband;

- a certificate confirming the fact of marriage;

— documents by which you can determine the insurance period. This may be: work book, certificates, military ID and other documents about the work of the deceased;

— a document on the average earnings of the breadwinner for 60 months;

In addition, in some cases additional documents may be requested:

— confirming that a disabled person is dependent on a deceased man;

— about the loss of a source of livelihood.

Transition methods

If a woman really understands that it is more profitable for her to use a PC pension than to receive her own payment, then she can use the following methods:

- a new pension can be transferred from the first day after the death of the husband if you apply for it within 12 months from the date of death, but there must be evidence that the woman was a dependent of the deceased;

- if there is no evidence that the woman was a dependent, for example, she worked, so her income was approximately equal to the earnings of her spouse, then you can submit an application to the Pension Fund for transfer due to the loss of a source of income, but for this you will have to quit your job.

Confirming your dependency is quite simple. To do this, you must have official documents proving that the deceased person's income was higher than the applicant's earnings.

When calculating a personal pension, all the income of the deceased is taken into account, since he could receive not only a regular old-age benefit, but even a disability payment if he had any group registered.

Collection of documents

Before applying for an appropriate pension, the widow must collect the necessary papers, including:

- passport or other document identifying the applicant;

- a certificate confirming the death of the spouse or a corresponding court decision;

- marriage certificate;

- a document confirming that the woman is a pensioner;

- TIN;

- SNILS (if available);

- work book of the deceased breadwinner.

In addition, depending on the circumstances, other documents may be required, such as: military ID, birth certificates of children, certificate of family composition, and so on.

Where to contact

To assign security, a citizen must contact the pension fund at her place of residence. In addition, it is possible to submit documents through multifunctional centers, which is much more convenient for applicants.

If the deceased spouse was a military pensioner or received a pension from the department where he served, equivalent to military service, then his wife must contact the appropriate authorities to assign support.

It should be noted that a pension upon the death of the breadwinner must be applied for within 6 months. after this date.

If the six-month period is missed, the Pension Fund will refuse to grant a pension. In this case, it will be necessary to go to court. At the same time, during the hearing, the plaintiff will have to present arguments and evidence in favor of the valid reasons why the deadline was missed.

Contributory pension after the death of a husband

According to Article 38 of Federal Law No. 111 of June 24, 2002, the funded part is an inheritance left by the husband. These savings are located in the accounts of a pension fund: non-state or state.

ATTENTION.

After a woman inherits these funds, they are issued once in the entire amount, but only in the amount due to her according to the rules of inheritance.

If the husband previously filled out an application in which he divided the amount of accumulated wealth among several heirs, then each receives his share. If such a statement was not written, then the wife receives the money as a matter of priority.

Only a woman whose deceased spouse can rely on the funded part of the security:

— transferred his own money to the Pension Fund account;

- was born after 1967 and automatically took part in the funded pension insurance program;

- at the time of death had not reached retirement age.

Procedure for wives who want to receive the funded part of their deceased husband’s pension:

— Find out the location of the individual account where the savings portion was transferred. It can be located in a state or non-state PF; — Fill out an application to the appropriate pension fund, where you register a request to receive your husband’s savings. A certain package of documents must be provided with the application. — Wait for the decision of the Pension Fund, which can be made within six months. — Receive funds once in full.

IMPORTANT.

You must apply for savings savings within the first six months from the date of death of the breadwinner. If this is not done within the specified period, the woman will have to prove her right to these funds through the court.

When applying to the Pension Fund to receive the deceased’s funded pension, a woman must bring the following documents from the list (originals and copies):

- general passport;

— a document confirming marriage;

— SNILS of the spouse;

— details for transferring funds;

If the application is submitted later than six months from the date of death of the spouse, then it is also necessary to provide a court decision that the period for applying to the PF service has been restored.

ATTENTION.

If the marriage was dissolved at the time of the husband’s death, then the ex-wife cannot claim to receive his funded security. The right of inheritance passes to other close relatives. For example, to children, parents, siblings.

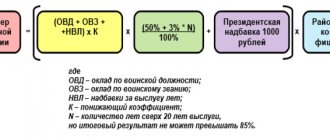

Military pension after the death of her husband

Based on Article 28 of Law No. 4468-1, as amended on December 20, 2017, “On pensions for military personnel,” the widow of a deceased military spouse is entitled to a pension in the following situations:

— The husband is listed as missing or has been in captivity for a long time.

— His death occurred after he was transferred to the reserve.

— While on duty, the husband received injuries that caused the death of the military man.

— Died while performing his duties.

The widow of a serviceman whose position meets one of the following conditions is entitled to receive a military pension:

— Was fully supported by her husband; — Disabled (with supporting documents attached); - Provides care for children under fourteen years of age.

REFERENCE.

If the husband was a military man, then the death benefit of the breadwinner is about 40% of the payments to the spouse.

In our country it is prohibited to receive several pensions at the same time, but there are exceptions for certain categories of citizens. For example, widows can claim two pensions:

— military personnel who died from injuries while on duty;

— astronauts who died;

— liquidators of the accident at the Chernobyl nuclear power plant.

These categories of wives have the right to receive both a survivor's pension and their own labor pension.

In order to apply for a military pension, you must contact the Commissariat by preparing documents: your own passport, the file of your deceased spouse, a serviceman’s ticket and an order.

After registration with the Commissariat, an application is written with a request to assign pension benefits to the deceased spouse. Attached are the following papers from the list:

- certificate confirming marriage;

- husband’s death certificate;

— an extract indicating the reason for the exclusion of the serviceman from the personnel;

— conclusion from the forensic medical examination;

— documents confirming benefits.

IMPORTANT.

Usually the military has many benefits. And when military personnel die, their wives have the right to retain the benefits they are entitled to.

For example, such benefits include:

— sanatorium treatment and travel at state expense;

— free services in special medical institutions;

— preferential terms for paying utility bills.

In order for the benefits to go to the widow, she needs to submit a written application to the military registration and enlistment office at her place of residence.

Can a wife receive the deceased spouse's pension instead of her own if she marries again?

There are situations when a woman receiving a survivor's pension marries again. In such cases, they do not have the right to deprive her of her pension. She can receive it until she chooses another type of pension. Thus, in a new marriage, you can receive a pension for your deceased husband.

REFERENCE.

If a woman wants to transfer to the pension of her deceased spouse after she has entered into a new marriage, then the transfer will be legally denied to her.

According to the law, it is possible to exchange your pension for the pension of your late husband, and this will mean assigning a pension due to the loss of a breadwinner. But this should only be done when the pension due to the deceased husband is several times greater than the wife’s pension. Also, do not forget about the opportunity to receive the funded portion of your deceased husband’s support.

Publication date 05/31/2019

Amount of pension for a spouse

The size of the pension in such a situation is calculated based on the insurance period, earnings and insurance contributions of the deceased spouse. However, the widowed husband or wife will still not receive a full pension: the fixed payment is set in an amount equal to 50% of the amount provided for the old-age pension.

Moreover, if the surviving spouse did receive a pension, then he will be paid the difference between the pension already paid and the new pension. Thus, the increased pension for the deceased depends on the number of pension points that were accrued to the deceased spouse when payments were assigned to him.