The retirement age, established in the USSR in 1932, is still in effect in Russia to this day. However, in May 2020, a bill was passed aimed at increasing the retirement age of civil servants and came into force in January 2020. With the entry into force of the new law, certain categories of persons received the right to receive an early pension, taking into account compliance with the requirements for the amount of special experience of the person, his type of activity and other circumstances.

What are the conditions for retirement in 2020? What are the requirements for retirement age? Under what conditions is early retirement possible? Is the retirement age expected to increase? We will try to answer these questions in this article.

Old age insurance pension

An insurance pension is a regular cash payment that is formed from insurance premiums accrued by the employer during the official work of its employees and a fixed payment financed by the state. There are 3 types of insurance pension:

- old age (a person has reached the legally accepted retirement age of 60 years for men and 55 years for women);

- for disability (the citizen received/confirmed disability);

- in case of loss of a breadwinner (due to the death of one or more breadwinners in the family).

The conditions for accessing each type of pension are different. The main conditions for assigning old-age pension payments in 2020 are:

- compliance with the age giving the right to a pension (55/60 years);

- having the required number of points (11.4);

- availability of the required insurance experience (8 years).

The length of the insurance period depends on the year in which the person applies for pension payments. Every year its value increases by a year until it reaches 15 years. Thus, applicants in 2020 must have 9 years of experience, after 2024 - 15. If this is not available, the person is assigned social benefits.

Amendments to the Federal Law “On Amendments to Certain Legislative Acts of the Russian Federation Regarding Increasing the Retirement Age for Certain Categories of Citizens” dated January 1, 2015 No. 143-FZ oblige all applicants to have an IPC (individual pension coefficient), which in turn grows by 2 annually .4 units and by 2024 will reach 30 points. The value of the IPC is influenced by the presence of official employment, the amount of all contributions made by the employer to the Pension Fund, and the duration of the working period. Thus, the IPC has a direct impact on the amount of pension payments.

Important! Until January 1, 2020, the pension was called a labor pension, consisted of an insurance and funded part and was regulated by the Federal Law “On Labor Pensions” dated December 17, 2001 No. 173-FZ. In 2020, in connection with the entry into force of the Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, the labor pension was eliminated, and its parts became full-fledged types of pensions

Registration of old-age pension payments is carried out on an application basis - this means that a citizen must contact the Pension Fund of Russia office with a written application, as well as a package of necessary documents, in order to receive the monthly payments due to him. They are not assigned to insured persons automatically.

Pension payments may be increased due to a certain coefficient, which is applied if the applicant applied later than he could in accordance with the current law. Annual indexation or possible recalculation of the assigned amount can also lead to an increase in pension.

More detailed information about the old-age insurance pension can be found in the article “Old-age insurance pension”.

The size of the pension point and its calculation

To calculate the maintenance amount, pension points are used.

They are otherwise called annual pension coefficients. To calculate them, a series of numbers are taken:

- the amount of insurance contributions to the Pension Fund from the person’s annual income;

- the maximum amount of insurance premiums, which is established annually by the Government;

- 10, this additional factor is introduced for convenience of calculations.

The first indicator is divided by the second, and the quotient is multiplied by 10.

When a pension is calculated, the points received by the employee based on the results of his work are summed up, and based on these figures, an individual pension coefficient is derived.

Important: the longer a citizen worked, and the higher his salary, the larger the individual coefficient will be.

After February 1, 2020, the cost of one pension point rose to 74.27 rubles.

The exact indexation percentage for 2020 has not yet been published. To determine the minimum pension amount in 2020 and calculate the value of the pension point, you can use formulas.

- According to the forecast of the Ministry of Finance, the inflation rate will be 5.8%.

- Based on this, the indexation coefficient will take the form 1.058.

- Next, it is not difficult to determine the approximate cost of one pension point: 74.27 * 1.058 = 78.58 rubles.

The size of the fixed payment will also change proportionally. We multiply the value of 4,558.93 by a coefficient of 1.058 and get 4,823.35 rubles - the minimum pension in 2020.

back to menu ↑

Early retirement

A pension assigned by the Pension Fund of Russia in connection with certain circumstances before the applicant reaches the generally accepted retirement age is called early. The requirements for insured citizens who wish to receive insurance payments ahead of schedule are described in detail in Articles 30, 31 and 32 of the Federal Law “On Insurance Pensions”.

Workers in certain professions, people belonging to certain social groups, as well as citizens who lost their jobs as a result of layoffs while approaching retirement age can apply for early payment. The more difficult the working conditions, the sooner a person is given the opportunity to retire. The categories of persons entitled to these payments include:

- workers of underground structures, persons whose work took place in hazardous conditions or in hot workshops;

- mothers of many children with 5 or more children;

- visually impaired;

- railway workers;

- persons who were involved in operating heavy equipment;

- citizens with rare genetic diseases;

- geological prospectors and search engines;

- employees of sea and river vessels;

- employees of the Ministry of Emergency Situations;

- father or mother of a disabled child;

- guardians of disabled children;

- unemployed men (from 57 years old) and women (from 53 years old) who lost their existing jobs for certain reasons;

- people who have become disabled as a result of military service;

- civil servants, teachers, doctors and others.

To apply for an early pension, the applicant must have with him original documents confirming the special experience specified in the application. In addition, you must have a passport, SNILS, and work book with you. Early pension payments are accrued from the date of application to the Pension Fund branch, subject to receipt of the right to it.

Important! Early pension payments will be suspended if the person is officially employed again.

Residents and workers of the Far North

Persons employed in the regions of the Far North, as well as places that are officially equated to these territories, can receive pension payments ahead of schedule. In addition, the pension can be indexed and increased in connection with living or working in these territories. Early retirement of workers in the Far North is possible thanks to additional calculations made by employers to the Pension Fund of the Russian Federation throughout the entire period of the employee’s work.

Men are granted pensions from the age of 55, women from 50. To retire, persons working in an area that is officially equated with the regions of the Far North must have 20 years of insurance experience. The retirement age of a person working in the Far North decreases annually by 4 months from the moment his insurance coverage reaches 7.5 years. Moreover, a year of work in areas equated to the territory of the Far North is comparable to 9 months of work in the Far North.

Dependence of length of service in these territories on the age at which an insurance pension is assigned

The retirement age directly depends on the number of years worked in the Far North or areas equivalent to it. The dependence of the length of service obtained in these territories on the age at which the insurance pension is assigned is reflected in the comparative table.

| Experience in the Far North (men) (in years) | Age of appointment of pension payments (year and month) | Experience in the Far North (women) (in years) | Age of appointment of pension payments (year and month) |

| 15 l. | 55 l. | 15 l. | 50 l. |

| 14 l. | 55 l. 4m. | 14 l. | 50 l. 4 m. |

| 13 l. | 55 l. 8 m. | 13 l. | 50 l. 8 m. |

| 10 l. | 56 l. 8 m. | 10 l. | 51 g. 8 m. |

| 9 l. | 57 l. | 9 l. | 52 years old |

| 8 l. | 57 l. 4 m. | 8 l. | 52 g. 4 m. |

| 7.5 l. | 57 l. 8 m. | 7.5 l. | 52 g. 8 m. |

Dependence of length of service on the area in which the citizen worked

In order not to lose years of insurance experience, years of work in places equated to the Far North and in the Far North are equalized or equalized. Thus, it is possible to derive the total amount of insurance experience of one person. To calculate your total length of service, you can use this table.

| Experience in the Far North | Experience in the Far North |

| 1 year | 9 m. |

| 2 years | 1 year 6 m. |

| 3 years | 2 years 3 months |

| 4 years | 3 years |

| 5 l. | 3 years 9 months |

| 10 l. | 7 l. 6 m. |

| 20 l. | 15 l. |

Example: Citizen K. worked for 11 years in Severodvinsk (KS) and 2 years in Petrazavodsk (which is included in the list of territories equated to the territories of the KS). 2 years must be equated to the length of service that could have been in the Far North itself. To do this, 2 is multiplied by 9 m, resulting in 1 year and 6 months. The two lengths of experience are added together and the result is 12 years and 6 months of experience. Accordingly, citizen K. is assigned a pension of 50 years and 10 months

Men who have been hunting and fishing for 25 years, and women for 20 years in the Far North, have the right to retire at the ages of 50 and 45 years. In this case, the amount of total insurance experience does not matter.

More detailed information on the appointment and registration of an early pension can be found in the article “Early pension”.

Russian pensioners continue to work after retirement

For pensioners themselves, the opportunity to work and receive a pension is a great help not only for their own needs, but also for helping their children and grandchildren. Therefore, having the opportunity to continue working, many try not to miss it. However, the worsening economic instability of our country leaves monthly payments to working pensioners in question.

Every year the burden on the pension fund grows ( the number of pensioners increases in relation to the number of young people of working age), and the material base to provide for all their needs is simply not enough. In order to resolve this issue, the State Duma of the Russian Federation decided to take a number of measures to reduce payments to working pensioners.

Retirement age of judges

From the beginning of 2020, the retirement age of judges will increase by 0.5 years annually. Accordingly, in 2025, pensions will be assigned to male judges at 64.5 years old, and to female judges at 62.5 years old. Not only will the retirement age increase, but also the maximum possible period of work in a position, as well as the amount of insurance coverage. Now this public position can remain with judges up to 65 years of age, and the length of service must be at least 25 years for early retirement.

If pension provision was assigned to a person before 01/01/2017, these changes will not affect his payments. The amount of payments assigned to a person before this date was carried out according to the old system of formation of rights; accordingly, a judge could work in his position for only 20 years and retire at the age of 60.

About the military

Military pensions are growing at the very least due to a special coefficient, which is increased annually so that by 2035 its size will be 100%.

It was planned to index old-age benefits for the military on February 1, 2020, but Vladimir Putin ordered this to be done “synchronously” with the increase in salaries for the military, that is, from January 1, while people should receive the money in their hands in December.

The good news will affect not only the military of the Russian army, but also police officers, as well as military personnel of the Russian Guard.

Retirement age of civil servants, including deputies

From January 1, 2017, officials can hold government positions only until they are 65 years old. Previously, the age was limited to 60 years. Heads of civil services will be able, if they wish, to extend their tenure in their positions by contacting a federal government agency or the appropriate official. The period of stay can be extended to 70 years; previously, such permission was issued personally by the President of the Russian Federation.

The length of service in a position was also increased; previously it was 15 years, after which an official could apply for a long-service pension. From the beginning of 2020, the length of service will increase by 0.5 years annually. Thus, officials retiring in 2020 will have to have 20 years of insurance experience.

About lump sum payment and indexation

Due to financial difficulties and budget shortages, the pension legislation of the Russian Federation in 2020 was adjusted: the indexation required by law was replaced with a one-time payment of 5,000 rubles. All citizens who retired at the end of 2016 received it.

In October, the government published a draft resolution that provides for the indexation of old-age benefits and a number of other payments on February 1, 2020 by 3.2% (the amount of expected inflation). The size of the premium will be clarified after Rosstat publishes official information on the 2017 consumer basket.

On a note! Earlier, the head of the Ministry of Labor, Maxim Topilin, promised that insurance pensions for unemployed people would be increased by 3.7%, while 200 billion rubles would be allocated from the budget for these purposes.

Pension payments to persons affected by radiation and man-made disasters

Citizens injured in radiation or man-made disasters can receive one of three types of insurance pensions. Old-age payments are assigned to victims with a reduced retirement age. The age is reduced depending on the extent to which the citizen was injured and the nature of his injuries.

| Age of reduction of insurance period | Causes |

| 10 years | Liquidators of the Chernobyl accident from 1986 to 1987, evacuated citizens, disabled people as a result of this accident |

| 5 years | Liquidators of the Chernobyl disaster from 1988 to 1990; citizens with radiation or other diseases as a result of this event; Chernobyl NPP employees |

| 5 years +0.5 years for each year lived in the Chernobyl nuclear power plant zone | IDPs from the Chernobyl Nuclear Power Plant zone |

| 3 years + 0.5 year for each year lived in the Chernobyl nuclear power plant zone; 2 years + 1 year for 3 years; 1 year + 1 year for 4 years | Residents from the Chernobyl resettlement zone before their relocation |

| 0.5 years for each year | Workers of the Chernobyl resettlement zone living in other areas |

A mandatory requirement for those wishing to retire early due to participation in or residence in an area associated with the Chernobyl tragedy is the presence of 11.4 units of IPC in 2020. Veterans or participants in military conflicts also have the right to early payments; for this they will need 20 years of military service and 10 years of insurance experience in civilian life. The person must be at least 50 years old.

How will the cost of living change in 2020?

The cost of living directly affects the calculation of pensions. The size of the Federal social supplement depends on this limit.

Important: according to the budget bill, the cost of living for a pensioner will be 8,540 rubles. By region this figure is lower.

The federal social supplement allows you to increase the total amount to the established minimum subsistence level.

Based on the new bill, the payment is calculated for citizens who became pensioners in 2020.

back to menu ↑

Raising the retirement age

From 01/01/2017, the retirement age of government employees will be increased annually by six months to the extreme mark of 65 years. In addition, for the purpose of granting a long-service pension, the minimum insurance period for a position in government agencies will be increased annually by 6 months from 2020. By 2020 it will be 20 years.

In 2020, A. Kudrin, head of the Center for Strategic Research, put forward an initiative to increase the retirement age for all citizens to 63 years. However, Deputy Prime Minister Olga Golodets said that the decision on reform will be made in 2020 after the formation of a new government.

What is a fixed payment?

In essence, the fixed benefit is the basic component of the pension.

This is an amount guaranteed by the state to every citizen who has reached retirement age.

It has a fixed size, which is established by law.

Important: in 2020, the established payment is 4,558.93 rubles. Exact information about what the minimum pension will be in 2020 will only be available in mid-January.

The established payment is indexed twice a year:

- On February 1, indexation is focused on rising consumer prices;

- On April 1, the amount of revenues to the Pension Fund for the past period is taken as a basis (this indexation in the law is called possible, and its implementation is determined by the Government).

There are some categories of citizens who are legally provided for an increased fixed payment.

These include persons over 80 years of age, disabled people of the first group (accordingly, with benefits), who worked in the Far North, engaged in agriculture while living in rural areas.

back to menu ↑

How is the amount calculated?

The minimum old-age pension is now paid to those who have been officially employed for at least 5 years. If a person has not worked anywhere at all, he is entitled to social benefits.

When calculating length of service, the following are taken into account:

- Army service.

- Child care up to 1.5 years old.

- Caring for a disabled child.

- Caring for a person with disabilities.

- Caring for a person over 80 years of age.

An important point: these years will count toward the length of service if the person worked somewhere officially and paid contributions to the Pension Fund.

Pension amount

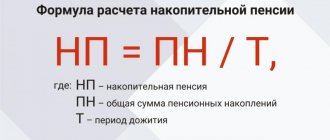

Currently, the pension amount is calculated using the formula:

RP = midrange + bass, where:

- RP - pension amount;

- SCh - insurance part;

- LF - accumulative part.

When calculating the average, the following is taken into account:

- The base rate and capital assigned at the time the benefit is awarded.

- Approximately how many years a person can live after retirement (that is, if you retire earlier, the amount will be less).

Employees of some important industries may retire earlier:

- aviation employees;

- firefighters;

- miners;

- port workers;

- some employees of the transport industry;

- workers who worked in hot shops (production premises in which the technological process took place with the release of large amounts of heat or various harmful impurities).