In what cases and who needs

To apply for benefits, an elderly citizen must bring a package of documents to the Pension Fund. It includes a work book, passport and SNILS. At the same time, the work book is the main document certifying periods of work before 2002. After 2002, labor data is contained in the Pension Fund of Russia - in the personalized accounting system (SPA). To confirm earnings before 2002, two methods are used to calculate the average monthly salary:

- The average monthly income for 2000-2001 is taken. At this time, the Pension Fund of the Russian Federation already had an STC in force, so no additional documents need to be provided in this case;

- if the employee’s income in 2000-2001 was very modest or the person did not work at all at that time, a salary certificate for pension may be required for any 5 consecutive years in the period before 01/01/2002. This will help increase your retirement benefits.

Let us say right away that the need to provide a certificate was due to the requirements of the Ministry of Labor Resolution No. 16, Pension Fund of the Russian Federation No. 19pa dated February 27, 2002, but currently this document has lost its force (see Order of the Ministry of Labor No. 1027n, Pension Fund of the Russian Federation No. 494p dated December 11, 2014) . However, the Pension Fund pretends that it doesn’t seem to know about this and continues to demand that this information be provided. You can complain and go to court... but this is extra time, it’s easier to do what they demand.

Earnings for calculating a pension. Is a certificate of earnings for 5 years required to assign a pension?

The Pension Fund requires information about earnings only before 2002 (if any). The fact is that since 2002, the size of the salary is not directly involved in calculating the pension, since it is determined on the basis of the contributions that the employer made for each employee. The employer submits quarterly reports on these contributions and the amount received for each employee is displayed on his personal account.

We recommend reading: Certificate of absence of registered persons

Compilation rules

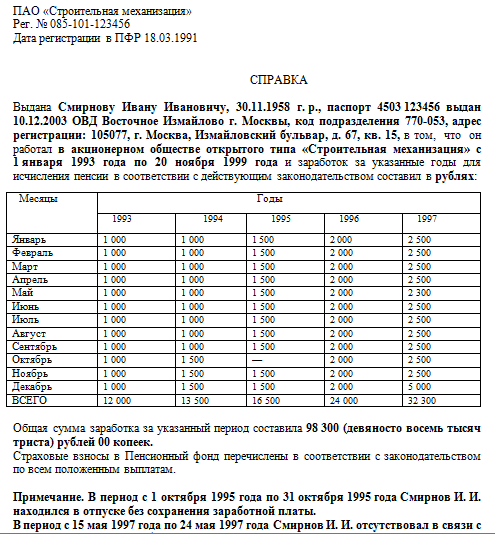

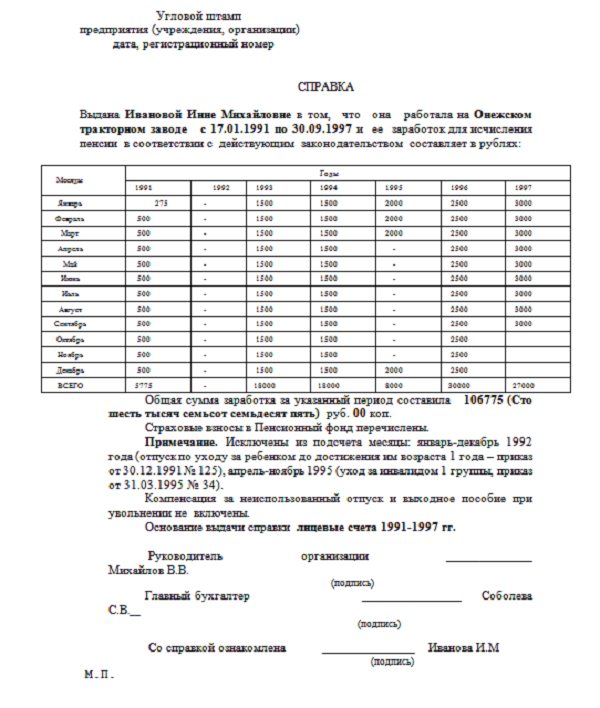

The document is drawn up in any form. It should contain:

- corner stamp, date of issue and document number;

- FULL NAME. and the applicant's date of birth;

- work periods and organization;

- salary indicated monthly, reflecting the total amounts by year;

- an indication of the currency in which the accruals took place;

- amounts are reflected as accrued, and not actually paid (due to the deduction of taxes).

The following are excluded from earnings:

- compensation for unused vacation;

- child care allowance.

In the note you need to indicate the months of accrual and the amount of certificates of incapacity for work, periods of vacation at your own expense.

Below it is written that for all accruals, deductions were made to the Pension Fund of the Russian Federation at established rates. The basis for issuing the form (personal accounts, pay slips) is also included.

The document is certified by the signature of the chief accountant, the head of the enterprise and a seal.

Carefully study the sample salary certificate for calculating a pension and the rules for filling it out. Judicial practice shows that it is the employer who will be punished for errors made in this form. Thus, the Arbitration Court of the Central District issued a Resolution dated June 11, 2019 in case No. A83-4304/2018, in which it agreed with the decision of the Pension Fund of Russia to recover about 150 thousand rubles from the company for the fact that an error was made in the certificate. From the case materials it follows that the employee asked the employer for a certificate from the Pension Fund for the purpose of assigning an old-age pension. The employer provided the certificate, but incorrectly indicated the amount of the employee’s salary in the period from January 1986 to February 1992. Fund employees calculated the pension taking into account these data, but then they doubted it and carried out a check. It turned out that due to an error, the pensioner was paid more than he should have been paid for 32 months. The total amount of the overpayment was 144,742.82 rubles. This money was not demanded from the pensioner, but was collected from the company, since it was the employer who was considered guilty. The arbitration court agreed with this decision. In addition to the overpayment, the organization had to pay a state fee in the amount of over 5 thousand rubles. As a result, an error in the salary certificate cost the employer almost 150 thousand rubles.

What is this document and why is it needed?

Including for the registration of preferential pensions (for length of service and for harmful working conditions).

In this case, all types of activities are taken into account when deductions were made from income to the Pension Fund:

Other publications: Calculation of payment in case of an accident under compulsory motor insurance

If you want to find out how to solve your particular problem in 2020, please contact us through the online consultant form or call :

- Moscow: +7(499)350-6630.

- St. Petersburg: +7(812)309-3667.

- under an employment contract;

- from an individual entrepreneur or an individual;

- under an agency agreement;

- under a contract.

In essence, a certificate is official information about a particular event, certified according to the rules of document flow . Its main task is to prove at what time and where a person worked. If a preferential pension is issued, for example, due to harmful working conditions, the certificate will confirm that the profession (or position) in which the citizen worked actually gives the right to early retirement.

What documents must be submitted to the Pension Fund to apply for a pension?

To receive a pension, a citizen must collect a package of documents and submit them to the Pension Fund at the place of residence. In paragraph 6 of Art. 21 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ states that the list of documents required to establish a pension is determined by the Government of the Russian Federation. Turning to the order of the Ministry of Labor dated January 19, 2016 No. 14n, we find in paragraph 17 a list of documents that a citizen must submit to the Pension Fund:

- application for a pension;

- document proving the identity, age and citizenship of the person applying for a pension (passport);

- documents confirming periods of work and other periods included in the insurance period (work book, labor and civil contracts, personal accounts and salary statements);

- other documents to confirm special circumstances.

The salary certificate we mentioned to the Pension Fund is not listed in the list of documents. However, it is mentioned in the no longer valid Resolution of the Ministry of Labor dated February 27, 2002 No. 16. Nevertheless, the Pension Fund continues to require a salary certificate, and it appears in the list of documents required for registration of a pension posted on the Pension Fund website. Therefore, despite doubts about the legality of the requirement to submit a salary certificate, we will analyze what information needs to be included in it and where to get it.

WHAT IS IMPORTANT TO KNOW ABOUT THE NEW PENSIONS BILL

Paragraph 1 part 1 art. 40 of the Law of Ukraine “On Pension Insurance” establishes that for calculating pensions, wages (income) for the entire period of insurance coverage starting from July 1, 2000 are taken into account. At the request of the pensioner and subject to confirmation of the salary certificate with primary documents in the period before January 1, 2016 or if the insurance period starting from July 1, 2000 is less than 60 months, for calculating the pension, wages (income) for any 60 consecutive calendar months of insurance coverage until July 1, 2000, regardless of breaks.

Where can I get a salary certificate?

A salary certificate can be issued by the accounting department of the enterprise where the citizen worked in the years selected for calculating the pension. It is better to apply for a certificate of average monthly earnings by submitting a written application drawn up in free form. Art. 62 of the Labor Code of the Russian Federation obliges the employer to issue a certificate within 3 days from the date of the employee’s application. This article of the Labor Code does not specify whether this norm applies only to current employees or to former ones too. However, based on the situation (and Rostrud agrees with this position), we can conclude that former employees have the same rights as current employees to receive information directly related to their work.

The employer has the right to determine the form of the certificate independently, taking into account the necessary information that must be included in such a certificate. A new salary certificate form can be found here.

If the enterprise where the citizen worked in past years does not currently exist, you can find the legal successors of the old organization. If any are not found or are missing, you will have to contact the archive at the former location of the company where the documents are stored.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

Regarding the “certificate of average monthly earnings for 60 consecutive months.” (for pension calculation)

I contacted the organization where I worked in the 90s for this certificate. I received a certificate, but it shows the salary amounts, broken down by month, only for 1993-1996. And for 1997-1998, in the lines and columns about my salary, there are dashes. That is, the impression from this certificate (and not from the work book) is as if I did not receive a salary at all.

As this organization explained to me, all information, starting from 01/01/1997, was submitted to the relevant government authorized institutions in electronic form.

In this regard, questions:

- does such a certificate contradict the regulatory documents of the Pension Fund of Russia, where in the section “What documents to submit” it is said - “a certificate of average monthly earnings for 60 consecutive months before January 1, 2002 during labor activity. "?

— will the branch of the Russian Pension Fund accept such a certificate from me?

— how can I check the correctness of pension calculation if I myself do not know how much was actually accrued to me?

Client clarification

Dear Sergey and Harutyun. Thanks for answers. But they are not entirely relevant to my questions.

There is a sample form for such a certificate:

— what should it be called, what must be indicated in it, etc.?

13 January 2020, 11:20

What does a salary certificate look like?

The salary certificate does not have an approved form, so it is filled out in free form, but must contain the following mandatory information:

- name and details of the organization where the citizen worked;

- personal data (full name, date of birth) of the citizen;

- work period;

- monthly salary;

- name of the currency in which the accruals were made;

- the total amount of earnings received for the entire period specified in the certificate;

- an indication that contributions to the Pension Fund from the amounts paid have been transferred;

- separately in the note - the periods of being on sick leave and on administrative leave;

- the document on the basis of which this certificate was issued (this could be pay slips or personal accounts of employees);

- signature of the head and seal of the organization.

Monthly earnings are indicated in compliance with the following rules:

- it includes all types of payments as part of the performance of labor duties: vacation pay, sick leave, bonuses, payments for overtime work, work on weekends, part-time work, and so on;

- it does not include compensation for unused vacation, upon dismissal, and child care benefits;

- if desired, you can replace incomplete months of work in connection with its beginning or end, periods of parental leave, caring for a disabled person of the 1st group with months preceding or after the specified period.

A sample of the completed certificate can be downloaded here.

***

The certificate is submitted to the Pension Fund for pension calculation. It must be compiled for 5 consecutive years of work until 2000, where the citizen’s earnings will be listed monthly. You can obtain a certificate at the enterprise where the employee was registered in the specified years, or in the archive if the company was liquidated.

***

You will also be interested in reading the materials that we wrote specifically for our Zen channel.

Menu

Important

It should contain the following information:

- main state registration number (OGRN);

- taxpayer identification number (TIN);

- full details of the enterprise;

- address;

- Contact phone numbers;

- surname, name, patronymic of the employee;

- the document is certified by the seal of the organization.

Nuances: information is provided only for one calendar year.

The manager and chief accountant are required to sign the document. The certificate is valid for up to 30 days. What kind of document is this? What does it look like? Form There is no single clear form for drawing up a salary certificate. It is drawn up in any form by employees of the HR department.

The salary certificate was introduced in order to find out about the real income of citizens. The document is drawn up on special forms where information about earnings is entered.

A certificate is issued by an organization (state-owned enterprise, institution, individual entrepreneur, etc.) to confirm the person’s place of work, position, length of service and salary. This document will be needed for registration:

- maternity leave;

- pensions;

- visas for traveling abroad;

- subsidies;

- bank loan;

- unemployed status (Employment Center);

- documents to court and other institutions.

Each organization has a prescribed document form, but a free one is also allowed.

What does the law say? According to the new legislation, an employee does not have to wait or ask to receive a document.

Where can I get information about income for calculating pension payments?

Old-age pension for men begins at the age of 60 years, for women - 55 years. But some professions (preferential ones) imply retirement at an earlier age.

A certificate of the employee’s average salary for the purpose of an old-age pension is requested from the organization’s accounting department.

As a rule, an employee of pre-retirement age only asks for a certificate orally. This practice is used in small companies; in large enterprises, a corresponding application is also drawn up.

Each enterprise can develop the salary certificate form for the Pension Fund independently; it is also possible to fill it out using an existing document taken from another organization as a basis.

The completed certificate is signed by the head of the human resources department, chief accountant, and head of the enterprise.

If the organization has been liquidated, it is necessary to send a written request to the archive department that accepted the papers of the deregistered company, and issue an extract from the salary documents.

The form of the certificate for the Pension Fund is known to the archive workers; they help collect the necessary documents for assigning a pension.

It is not always possible for an archive employee to draw up a certificate in the approved form, but he has the right to fill out the document himself according to the information he has.

Additionally, on our website you can download samples of earnings certificates:

- for subsidies;

- for unemployment benefits from the employment center;

- for social security benefits.

Validity period for pension fund certificates

What is the validity period of a certificate from the Pension Fund (PFR) for the liquidation of an LLC?

I’m going to submit form 16001 to 15ku one of these days, and a certificate from the Pension Fund dated November 23, 2009, i.e. We took it a month and a half ago. It so happened that the liquidator went abroad and returned only now, so we could not certify Form 16001, and we took a certificate from the Pension Fund in advance.

Is this certificate valid now? Will they accept her in 15th grade? The Pension Fund told us that the certificate is valid for 10 days, but they did not refer to the law.

Where should the salary form be submitted?

Order No. 884n of the Ministry of Labor and Social Development (dated November 17, 2014) states that citizens, in order to apply for a pension, send their applications to the territorial bodies of the Pension Fund located at their place of registration.

Persons whose registration and place of actual residence are different can submit a set of documents for calculating a pension at their place of residence.

Convicted citizens submit the form to the Pension Fund through the administration of the correctional colony at their location.

The deadline for applying to the Pension Fund for accrual of an old-age pension is not limited by law.

For what period is it compiled for assigning and calculating a pension?

The pension legislation currently in force allows 2 methods of calculating the average monthly salary to determine the size of the future pension:

- based on personalized accounting information, average monthly earnings in 2000-2001 are taken into account;

- in accordance with the submitted salary certificate for 5 consecutive years of work.

As practice shows, with a permanent place of work, it is more profitable for a citizen to take the salary received in the period 1976-1986 for calculation.

A salary certificate for 5 years is not needed in cases where the employee’s monthly earnings in 2000-2001 are equal to:

- 2100 rub. — for regions where wages are multiplied by a regional coefficient of up to 1.5 (for example, 1.5 for the Udmurt Republic);

- 2600 rub. — for areas with an established coefficient in the range from 1.5 to 1.8 (Murmansk region);

- 2900 rub. — for areas with a coefficient over 1.8 (Yakutia).

Otherwise, an employee planning to retire must prepare in advance for the Pension Fund a certificate for 5 years of work with a higher salary, if there were any for a different period of work.

The earnings certificate submitted to the Pension Fund serves as one of the main documents from the entire necessary package for calculating a pension.

The amount of the accrued pension depends on the amount of income. Every citizen is very interested in providing this form.

Filling out for Pension Fund authorities

An employee’s earnings certificate for applying for a pension must include information on the salary amounts paid for each individual year.

Average values (for 3 or 6 months) are not taken into account when calculating pensions.

To accrue and calculate a pension, the Pension Fund accepts any official payment to an employee:

part-time wages, overtime, days off, with the exception of dismissal benefits or compensation for unused vacation, child care benefits.

The certificate for the Pension Fund is drawn up in any form; it must contain the following information:

- company stamp (corner) with the date of issue of the document and its number;

- FULL NAME. (in full) of the employee who applied;

- date of birth of the worker;

- period of work;

- monthly salary amount and calculation of annual income;

- Payroll currency (ruble).

The form in the Pension Fund must also contain information about the organization that issued it:

- full name of the legal entity (in accordance with the constituent documentation);

- address of registration of the enterprise with the tax authority;

- company telephone numbers, tax identification number.

It is necessary to take into account in the certificate the amount of wages actually paid to the employee, and not accrued.

As a note, you should note the periods of sick leave and unpaid leave, and also record the presence of a certificate of incapacity for work before and after the birth of the child.

At the bottom of the form, the fact of deductions of insurance contributions to the Pension Fund of the Russian Federation for all employee accruals at accepted tariffs, as well as the grounds for issuing a salary certificate (personal accounts, payroll statements) must be recorded.

The certificate is signed by the company's responsible persons and the company's seal is affixed.

to the Pension Fund of Russia

Download a free sample of filling out a certificate to the Pension Fund for the calculation and assignment of a pension –word.

Useful video

What documents are needed to calculate a pension and important points to pay attention to can be found in this video:

Useful topics:

- Methods for calculating depreciation in accounting

- Accrual and cash method

- Postings for accrual of dividends to the founder

- Production method of depreciation

- Accrual accounting

- Certificate of expenses

- 2 Personal income tax certificate

- Help 182n

Certificate of earnings for 5 years for pension calculation

Certificates submitted for calculating pensions are issued by the employer (employer), the archival body on the basis of documents on wages paid. In accordance with the All-Russian Classifier of Management Documentation OKO11-93 (Resolution of the State Standard of the Russian Federation dated December 30, 1993 No. 299), the documentation for accounting for labor and its payment is: for wages - payroll, payroll, payroll, personal account. There are no other documents for recording wages. Extracts from the staffing table regarding salary for a position cannot serve as documents confirming actual earnings.

What certificate should I use to confirm my work experience in order to be accepted into the Pension Fund?

In Art. 62 states that the basis for preparing a certificate to the Pension Fund about work experience according to the company’s internal sample is a written statement from the employee. The law does not provide a unified form for such a document. It can be prepared in any form, including the following information:

Why is a Pension Fund certificate required?

According to the provisions of Art. 62 of the Labor Code of the Russian Federation, the employer is obliged to provide the specialist with documents related to his work within three days from the receipt of the request. The papers are certified by an authorized person of the company and a seal. It is illegal to charge a fee for their production.

If an employee managed to work in another organization before returning to the enterprise, then the income received in another company should have been taken into account by it . For example, after working for three months, A.I. Ivanov quit and returned to Mechta LLC. For the three months he worked, the personnel officers of the Stroymat enterprise were supposed to make transfers.

- Name of the organization;

- number of the employer registered with the Pension Fund of Russia;

- taxpayer number and reason code for registration (TIN and KPP);

- date of sending the information to the Pension Fund;

- the period for which information is provided;

- employee's insurance certificate number;

- surname, name, patronymic of the insured;

- the form is indicated (original - if it is submitted for the first time for this individual, corrective - if the information that was submitted earlier has changed, or canceling - cancellation of previously submitted information);

- funds credited and paid for the insurance part of the pension;

- the amount transferred and paid for the funded part of the pension(overpaid amounts are not indicated);

- length of service (including vacation, temporary disability);

- working conditions (full time, part time)

We recommend reading: Which Okof Smartphone iPhone

The procedure for contributions to the Pension Fund for employees (PFR) in 2020

The employer gives the former employee a work book. If an employee requires other documents, he can make a request in writing. In this case, copies of them (Article 62 of the Labor Code of the Russian Federation) are provided. The organization must submit the documents on the day the employee is dismissed or no later than three days following the filing of the application. Information about transfers may be useful in the future.

Before carrying out the reconciliation, the company should prepare the necessary documents. The first step is to send an official request to the Pension Fund for the issuance of a certificate reflecting the status of settlements with the fund as of the current date. This request can be sent either in writing or via the Internet. The fund will additionally need to obtain information about the status of settlements.

Pension savings in Kazakhstan

Let's look at what changes are currently in effect in pension savings payments. How are pension savings paid from the Unified Pension Fund in Kazakhstan now? How are pension savings issued in Kazakhstan? How to receive pension savings? Is it possible to withdraw all your pension savings at once upon retirement in Kazakhstan?

Another innovation concerns pension savings of Kazakhstanis. From January 2020, you can receive your pension savings from the Unified Accumulative Pension Fund (UPF) in Kazakhstan only once a month (until January 2020, payments were made according to the schedule chosen by the pension recipient: monthly, quarterly or annually), according to the coefficient table the current value of your pension savings, which you will find below.

Do I need a certificate from the institute to apply for a pension?

I'm starting to collect documents to apply for a pension. I want to collect as much information as possible before my first visit to the Pension Fund. Do I need to take a certificate from the institute where I studied if I did not graduate (incomplete higher education)? If so, where should I contact the dean’s office of the faculty where I studied, the university’s human resources department, or the university’s archives?

Other publications: Elimination of emergency dilapidated housing

And also - as I understand it, a certificate from the place of study is needed only so that the Pension Fund employees do not have a question whether I worked somewhere during this period or not?

PS My main job is not in my specialty.

Have a question for a lawyer?

This certificate is required only to receive a survivor's pension. You do not need to provide such a certificate to receive an old-age pension.

In accordance with the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions,” one of the conditions for assigning an insurance pension in the event of the loss of a breadwinner, establishing an increased fixed payment to the old-age insurance pension, for disability is that a person who has reached 18 years of age is on dependency (children under 18 years of age are considered dependent). A similar condition is contained in the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation”. These federal laws determine that disabled family members are considered dependent on the breadwinner if they were fully supported by him or received assistance from him, which was their constant and main source of livelihood. The need to confirm the fact that a person is a dependent, in order to establish a pension, is determined by subparagraph “h” of paragraph 7 and subparagraph “c” of paragraph 8 of the List of documents required for establishing an insurance pension, establishing and recalculating the amount of a fixed payment to an insurance pension, taking into account the increase in the fixed payments towards an insurance pension, the appointment of a funded pension, the establishment of a pension for state pension provision, approved by Order of the Ministry of Labor and Social Protection of the Russian Federation dated November 28, 2014 No. 958n. In order to establish an insurance pension in the event of the loss of a breadwinner, to establish an increased fixed payment to the insurance pension for old age, disability, persons who have reached the age of 18 and are studying full-time in educational institutions, a certificate from the place of study, indicating the date of completion of studies, is provided with one times when assigning a pension or establishing an increased fixed payment, educational institutions with whom Agreements on information interaction have been concluded. These payments are made until the age of 23, while continuing full-time studies.

Although, if you want to use this paragraph (clause 4 of article 30 of the Federal Law on Labor Pensions).

The estimated size of the labor pension is determined (if the insured person is selected) using the following formula:

RP = ZR x SK, where: RP is the estimated size of the labor pension; ZR - the average monthly earnings of the insured person for 2000 - 2001 according to individual (personalized) records in the compulsory pension insurance system or for any 60 consecutive months of work on the basis of documents issued in the prescribed manner by the relevant employers or state (municipal) bodies. The average monthly earnings of the insured person are not confirmed by testimony; SK is the length of service coefficient, which for insured persons:

from among men with a total work experience of at least 25 years, and from among women with a total work experience of at least 20 years (with the exception of persons specified in paragraphs seven to ten of this paragraph), is 0.55 and increases by 0, 01 for each full year of total work experience in excess of the specified duration, but not more than 0.20;

Then, for the purpose of determining the estimated size of the labor pension of the insured persons in accordance with this paragraph, the total length of service is understood as the total duration of labor and other socially useful activities until January 1, 2002, which includes :

periods of preparation for professional activity - training in colleges, schools and courses for personnel training, advanced training and retraining, in educational institutions of secondary vocational and higher vocational education (in secondary specialized and higher educational institutions), stay in graduate school, doctoral studies, clinical residency;

You will need a diploma of incomplete higher education or an academic certificate.

You need to contact the university dean's office.

Periods of training are not included in the total length of service that gives the right to an insurance pension.

At the same time, a detailed list of documents required for submission to the pension fund authorities is established by the relevant administrative regulations, and is also explained directly by the pension fund authorities.

In accordance with the new pension legislation, one of the main factors determining the right to an insurance pension and its amount is: the citizen’s insurance length, the amount of wages and the age of applying for a pension. In turn, length of service is divided into insurance and general work experience.

The minimum length of service required to qualify for an old-age insurance pension (retirement age for men is 60 years, for women - 55 years) in 2020 is 7 years and increases annually by 1 year (by 2024 it will be 15 years ). If the length of service is less than 7 years, then citizens can apply to the Pension Fund for a social pension, with men aged 65 years and women 60 years old. The insurance period is the total duration of periods of work for which insurance contributions were accrued and paid to the Pension Fund, as well as non-insurance periods. Non-insurance periods include: - the period of military service, as well as other service equivalent to it, provided for by Federal Law No. 4468-1 of February 12, 1993; — the period of receiving compulsory social insurance benefits during the period of temporary disability; - the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total; - the period of care provided by an able-bodied citizen for a person who has reached 80 years of age, a disabled person of group I or a disabled child; - the period of receiving unemployment benefits, the period of participation in paid public works and the period of relocation and resettlement in the direction of the state employment service to another area for employment; - the period of residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work due to lack of employment opportunities, but not more than five years in total; - other periods in accordance with Art. 12 of Federal Law No. 400-FZ of December 28, 2013 (these non-insurance periods are counted in the insurance period if they were preceded and (or) followed by periods of work, regardless of their duration, during which insurance premiums were paid to the Pension Fund). Total length of service is the total duration of periods of work and other socially useful activities before 01/01/2002, which are taken into account when assessing rights as of 01/01/2002. The duration of work periods is calculated in calendar order according to their actual duration. The total length of service includes: - periods of work as a worker, employee (including for hire outside the Russian Federation), member of a collective farm or other cooperative organization; - periods of other work in which the employee, not being a worker or employee, was subject to compulsory pension insurance; - periods of work (service) in paramilitary security, special communications agencies or a mine rescue unit, regardless of its nature; — periods of individual labor activity, including in agriculture; - periods of creative activity of members of creative unions - writers, artists, composers, cinematographers, theater workers, as well as writers and artists who are not members of the relevant creative unions; - periods of temporary incapacity for work that began during the period of work, and stay on disability of groups I and II, received as a result of injury associated with production or an occupational disease; - periods of stay in places of detention beyond the period assigned during the review of the case; — periods of receiving unemployment benefits, participating in paid public works, moving in the direction of the employment service to another area for employment; - service in the Armed Forces of the Russian Federation and other military formations created in accordance with Russian legislation, the United Armed Forces of the CIS, the former USSR, internal affairs bodies of the Russian Federation, etc.

Other publications: Order 137 of the Ministry of Agriculture

Periods of study in colleges, schools and courses for personnel training, advanced training and retraining, in educational institutions of secondary and higher vocational education, stay in graduate school, doctoral studies, clinical residency in the calculation of length of service when assigning a pension, in accordance with paragraph 3 of the Federal Law No. 173-FZ, are not included.

Since 2020, the pension rights of citizens for each working year are recorded in individual pension coefficients, or so-called pension points. When a pension is assigned, points are converted into rubles. For socially significant periods of life, which are included in the length of service as non-insurance periods, points are also awarded. It is important to note: the longer a citizen’s insurance experience before applying for a pension, the more pension rights he will have and the higher his pension will be.

What documents to submit

application for an old-age insurance pension; passport (for citizens of the Russian Federation) or residence permit (for foreign citizens and stateless persons); certificate of compulsory pension insurance (SNILS); documents confirming the duration of the insurance period; Documents confirming periods of work and other periods must contain the number and date of issue, last name, first name, patronymic of the citizen to whom the document is issued, the day, month and year of his birth, place of work, period of work, profession (position), grounds for their issuance ( orders, personal accounts, etc.). Documents issued by the employer upon dismissal from work may be accepted as confirmation of the insurance period even if they do not contain the basis for their issuance. certificate of average monthly earnings for 60 consecutive months before January 1, 2002 during employment. Information on average monthly earnings for 2000-2001, submitted by employers and available in the information systems of the Pension Fund of Russia, may be taken into account; other documents necessary to confirm additional circumstances.

More articles:

- Deprivation of parental rights of parents with limited parental rights Issues of compliance with laws on minors On November 14, 2017, the Supreme Court of the Russian Federation adopted a resolution of the Plenum “On the practice of courts applying legislation when resolving disputes related to the protection […]

- Who is assigned a pension under the state pension system WHAT YOU NEED TO KNOW ABOUT CHANGES IN THE PENSION SYSTEM Subscribe to news A letter to confirm your subscription has been sent to the e-mail you specified. In Russia there are four main types of pensions: – state […]

- Details of the parties to the contract, civil code Chapter 27. Concept and terms of the contract (Articles 420 - 431.2) Chapter 27. Concept and terms of the contract See Encyclopedia of decisions. Civil contract. General provisions See the diagram “Concept and terms of the agreement” © NPP LLC […]

- My husband has drawn up a will for my son. My husband has drawn up a will for our son. Will children from his first marriage be able to claim the property? Good afternoon. My legal spouse has an apartment purchased before our marriage and another apartment […]

- Are there any benefits for treatment? Benefits for sanatorium-resort treatment in 2020 Social activities aimed at supporting various categories of citizens include health measures. As part of the implementation of social policy, beneficiaries […]

- Petition to suspend the execution of a court decision of the Civil Code Petition to suspend the execution of a court decision of the Civil Code Samples of documents. Samples of agreements, contracts, orders, agreements. Next—> Sample statements. Samples of applications, appeals, claims, resumes. Next—> […]

Validity period for pension fund certificates

PFRF website of the Pension Fund personal account

Tax agents issue to individuals, upon their applications, certificates of income received by individuals and amounts of tax withheld in a form approved by the federal executive body authorized for control and supervision in the field of taxes and fees. Moreover, an employee who was fired earlier can also request a document. Salary certificate The salary certificate has a number of features, which are listed below.

It is extremely important that the information about the applicant is filled out correctly in the paper, without blots or errors. In view of this, the current legislation does not at all provide for the need to indicate the expiration date of the certificate.

When calculating monthly benefits, parental leave is excluded. The amounts earned during this time are included in the average earnings.