Home / Labor Law / Payment and Benefits / Pension

Back

Published: 03/02/2020

Reading time: 3 min

6

4605

Pension legislation remains quite confusing and incomprehensible for many citizens: changes regularly appear in the procedure for calculating pension savings, which introduces additional confusion. One of the innovations, the essence of which remains unclear to many citizens, is valorization. What kind of increase is this, who is entitled to it, and what is the calculation procedure?

- What is valorization and who does it apply to?

- Calculation procedure

- How to apply

- Conclusion

Defining the valorization process for pensioners

The valorization process begins with the recalculation of citizens' pension savings by at least 10% , plus 1% for each year of service until 1991. Working citizens with experience before 2002 who have not reached retirement age participate in the valorization process, but there will be an increase in pension not that noticeable.

Valorization of pensions

Non-working pensioners whose pensions and social benefits are less than the minimum established in the country will receive additional payments. The pension amount is calculated individually and depends on the region, age and length of service. Valorization amounts are multiplied by indexation coefficients, which depend on the time the pension was assigned.

Valorization of pensions

In the past, a citizen's pension depended on contributions earned over the past few years and work experience. If the salary was low before retirement, the citizen received funds taking into account the last five working years, when the salary was higher.

Valorization affects everyone who was officially employed before the start of the pension reform. The program is based on the official employment of each citizen - the longer a citizen worked, the higher the coefficient and the higher the increase.

What is valorization and who does it apply to?

Valorization is regulated by Art. 30 – 30.3 Federal Law “On Labor Pensions”. The relevant legal provisions were introduced into the law in 2009 and acquired legal force in 2010.

The term valorization was borrowed by the Pension Fund from other areas of activity. Thus, in the economic sphere it is used to understand the revaluation of securities. In matters related to pension provision, valorization is understood as a mechanism for the growth of pension savings.

Valorization should be distinguished from indexing. They have different purposes. Indexation aims to prevent the depreciation of pension savings, valorization is a change in the amount of payments for citizens whose rights were infringed upon during the pension reform.

Valorization applies to citizens whose work experience occurred before 2002. This recalculation is aimed at overcoming the unfair situation when, after the pension reform of 2002, people with work experience before this year could not count on a decent pension.

Thus, until 2002, when determining the size of a future pension, only the concept of length of service and its duration was used. The 2002 reform implied the abandonment of payments based on length of service in favor of the insurance model of the pension system. From that moment on, the size of the pension began to depend not only on length of service, but also on the amount of contributions to the Pension Fund and the amount of insurance contributions.

Since 2002, employers have been required to transfer pension contributions for employees to their personal account in the amount of 22% of their salary . This means that the higher the amount of contributions, the greater the pension a citizen is entitled to. In this case, only taxable income can be taken into account to calculate the amount of contributions. From 2002 to 2014, contributions were calculated in actual amounts and then converted into points.

Since insurance contributions for employees were not paid until 2002, it was necessary to make a conversion (average earnings or length of service were taken into account), but all this significantly reduced the size of the pension that citizens would have been entitled to before the 2002 changes. This is what determined the need for valorization of pension savings.

An increase in the size of the pension through an increase or valorization of the pension rights of citizens that they received before January 2002 has been carried out by the Pension Fund since 2010. Valorization refers to the procedure for increasing the pension rights of citizens that were acquired before January 2002. It will affect not only current pensioners, but also citizens with work experience before 2002 and who have not reached retirement age at the time of valorization.

According to the Pension Fund, valorization will affect up to 36.5 million Russians who will apply for a pension.

Why was there a need for valorization?

After the pension reform, the contributions of persons who became pensioners before 2002 and those who received pensions later were practically equal and did not cause problems. Over time, the gap has become much larger: people who have taken out a pension these days, in addition to accumulated contributions, receive insurance premiums. The employer is required to transfer these contributions to the citizen’s account.

Valorization of pensions

The length of service was the same, but citizens who retired in 2002 or later received more than citizens who worked before 1991 because in the past, pensions were calculated using a special indicator based on data on the average salary throughout the country.

While it is not necessary to provide paperwork for every year of work, it may increase your pension contributions.

In order for pension calculations to be carried out fairly, it was decided to index the pension contributions of persons who worked before 2002 , even if they have not yet reached retirement age. Those who do not have documents on employment between 1991 and 2001 must prove the presence of at least some work experience before 2002.

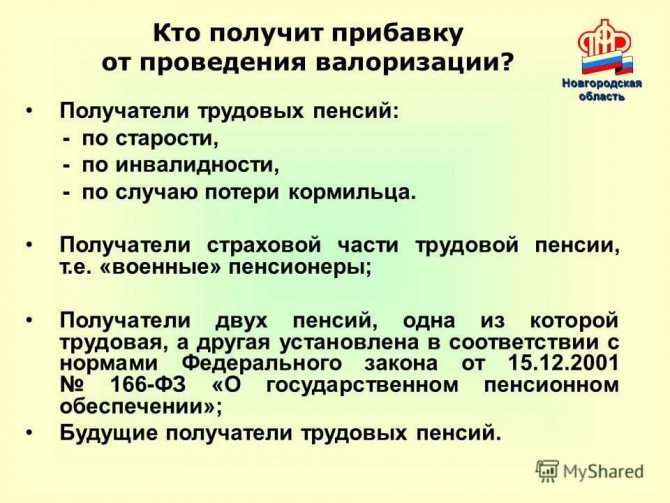

Who will receive an increase from valorization

The average amount of pension increase for older citizens is 1,100 rubles, for younger ones – 700 rubles, depending on length of service.

When was pension valorization carried out?

In 2010, pensions were valorized.

Initially, citizens’ pensions were much lower due to the peculiarities of their calculation. In 2002, the calculation system itself changed, and payments for different age groups began to vary greatly.

In January 2010, pension payments were valorized for citizens who worked for any period of time before 2002.

Today, when assigning a pension to citizens with work experience before 2002, its size is established taking into account valorization.

Differences between valorization, indexation and recalculation

All three concepts mean an increase in the amount of pension payments, but the conditions, regulation and method of receipt are very different.

Valorization

The size of the increase in pension depends on the length of service earned before 1991. The point of valorization is to equalize the pensions of people who worked in the USSR. Affects citizens employed before the start of the pension reform in 2002. The process occurs automatically; citizen participation is not required.

Recalculation of pensions taking into account valorization

Indexing

Indexation is carried out automatically for pensioners to increase purchasing power during inflation. Indexation depends on price increases ; the government independently determines the coefficient. Pensions of federal civil servants and astronauts are indexed as monetary remuneration increases.

Recalculation

If circumstances affecting pension payments change, recalculation occurs. If the pension authority has all the documents confirming the citizen’s rights to a pension, the recalculation will occur automatically . According to Article No. 142 of the Federal Law, recalculation occurs on August 1. Additional paperwork is required if:

- the pensioner has reached 80 years of age;

- a higher disability group has been established;

- the number of dependents has increased;

- The pension authority mistakenly did not take into account the pensioner’s length of service.

The concept of “valorization”

The term “valorization” has a fairly broad application. It is usually used in the economic sphere and involves a revaluation of the value of any goods. This can be various kinds of goods, currency, government securities, bonds. Actually, the term itself comes from the French language, where valoir means “to overestimate”, “to appreciate”, which most accurately characterizes this process in practice.

In matters related to pension provision, valorization should be understood as a revaluation of the corresponding rights of citizens. That is, in essence, this means a mechanism and accompanying measures aimed at increasing the size of pensions or other cash payments.

Many non-specialists who are even familiar with the term in question may understand valorization as recalculation or indexation. However, these are completely different procedures in their legal nature and economic consequences. Let's take a closer look.

Recalculation

This term should be understood as a change in the amount of payments when previously unaccounted for circumstances arise. For example, if, when assigning a pension, any periods were not taken into account, which the pensioner was subsequently able to document, then a recalculation may be made on this basis.

Attention! The recalculation can be carried out either upward or downward, reducing the amount of pension provision. It depends on the specific circumstances.

Valorization is not a special case of recalculation; on the contrary, it is one of the reasons for its implementation.

Indexing

Indexation involves a periodic increase in the amount of payments, which, as a rule, is associated with the size of current or projected inflation. For example, in 2020, insurance pensions in the Russian Federation were indexed by 7.05%. This is almost twice as fast as official data on rising prices for services and goods in the country. This procedure has nothing to do with valorization.

Basic rules and valorization rights

The main rule of valorization is automatic recalculation based on the citizen’s official work experience before 2002 The pension authority has information on the amount of pension contributions as of January 1, 2020.

Rules for valorization of pensions

If a citizen worked unofficially, but can confirm this with other documents, he must send them to the pension authority for review.

Citizens officially employed in the Far North receive an increased valorization coefficient. It ranges from 1.4 to 1.9%, varies from region to region and leads to higher pension payments.

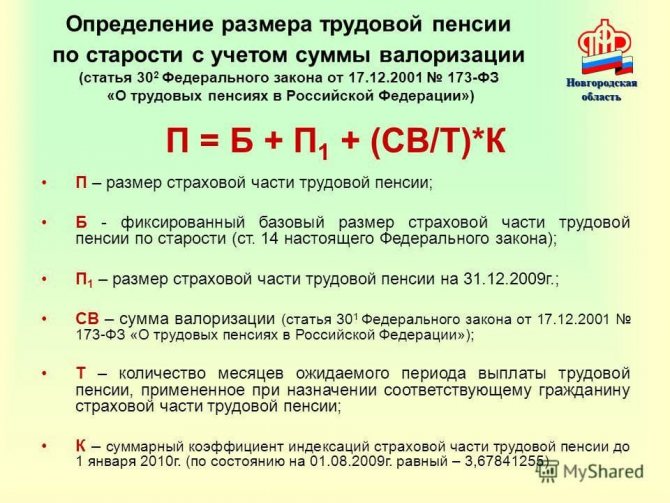

Calculation formula

The payment amount can be calculated using the formula.

As with any economic activity, valorization involves its own formulas for calculating bonuses and payments. With their help, knowing some basic values, you can easily calculate the increase to your pension.

Amount = Pension Capital x 0.1 + (0.01 x OTC)

- OTS – length of service until 1991 (number of full years)

Pension Capital = (Pension Amount – Basic Part) x T

- T – time of payment of old-age pension benefits.

Basic terms of valorization

Calculating valorization is not difficult if you understand the basic terms:

- The work experience coefficient means the period of official employment until 2002. If the work experience is 25 years, the coefficient is 0.55. For 1 year, 1% is accrued, but not more than 75%. Interest rates are reduced if the work experience is less than 25 years.

- Conversion - recalculation of length of service into cash equivalent for citizens working before 2002.

- Pension rights - data on wages and insurance accruals that determine the insurance part of payments.

- Estimated capital is the amount of pension contributions for 2002. All officially employed citizens who have received a pension certificate have an estimated capital. When a citizen begins to receive a pension, the capital becomes the insurance part of the payments.

Calculation of pensions taking into account valorization

Calculation procedure

The amount of valorization will be determined by employees of the Pension Fund on an individual basis. For calculations, it is taken into account that the estimated pension capital for each person as of 2002 increases by 10%, and also by an additional 1% for each full year of service worked before 1991. 10% is a fixed amount of valorization, and additional interest is accrued only for Soviet experience .

The recalculation of pensions taking into account valorization from January 2010 will affect all recipients of labor pensions: old age, disability, survivors, if they worked before 2002.

For example, a citizen applied for a pension with 45 years of work experience. 10 years of them occurred before 2002, another 19 during Soviet times. The overall percentage increase in pension experience will be 29% (10% for service before 2002 and 19% for Soviet service).

Taking into account the above values, each pension recipient can calculate the amount of valorization as a percentage.

To calculate the amount of valorization, the following formula is used:

- amount after valorization = (Calculated capital * valorization percentage * indexation volume after 2002) / period for receiving payments / 100.

Estimated capital is the amount of pension contributions as of 2002.

The experience coefficient is the total length of service in the pre-reform period, which is 0.55 for an experience of 25 years.

When carrying out valorization, the Pension Fund takes into account periods of work, year of birth, year of start of payments, additional allowances and coefficients (for example, for northern experience).

For example, a man applies for a pension in 2020. It started operating in 1976 and its valorization percentage will be 25%. The estimated capital is calculated as 200 thousand rubles. The indexation coefficient was 10.9, the payment period was 228 months.

The calculation will look like this:

- (200000 * 25 * 10.9) / 228 / 100 = 2390.35 rub.

This is exactly what the increase in pension will be as part of valorization.

Who will retire in 2020

How to calculate the amount of pension payments

The Pension Fund will independently calculate the amount of your pension upon reaching retirement age. It’s easy to find out this amount; just count two main numbers:

- how many years worked before 1991;

- how many years worked from 1991 to 2002?

To calculate valorization, there is a formula : the percentage of valorization (in the example it was 30%) multiplied by the amount of accumulated capital. Valorization will affect only those citizens whose pensions were accrued before 2002. The rest receive contributions in accordance with the new pension program.

Calculation of pension valorization

To begin with, take the average salary for 5 years, including the months when no work was carried out. This amount is divided by the average salary in the country and multiplied by the length of service. For all years of activity before 2002, a percentage is added. With work experience of 25 years or more, the coefficient increases.

According to the new program, the main part of the pension is calculated from the federal budget and is the insurance part. Previously, pension increases depended on the level of inflation and rising prices on the market. Since 2010, the amount of contributions depends on the income of the Pension Fund and the average salary in the country.

For example, if the length of service exceeds 25 years for a year, the basic part of the pension increases by 6%, after two years - by 12%. Citizens decide for themselves whether they want to retire later or not.

Valorization - revaluation of pension rights since 2010

Valorization is a revaluation of the monetary value of pension rights that were acquired by citizens before the 2002 pension reform.

Valorization was carried out in 2010 in relation to all insured persons who had experience before 01/01/2002. Simply put, valorization affected all current pensioners, as well as all Russians who worked in any period of time before 2002.

How was valorization carried out?

The Pension Fund database contains information on the amount of the estimated pension capital of citizens as of January 1, 2002. Almost everyone who has worked before 2002 has it, only the size differs. From January 1, 2010, this estimated pension capital was multiplied by 10%. In addition, the pension capital was additionally increased by 1% for each year of service completed before 1991. There are no maximum restrictions here. If your work experience before 1991 was 25 years, then in general your estimated pension capital as of January 1, 2002 will increase by 10% + 25% = 35%.

The procedure for valorization

Valorization since 01/01/2010 was carried out by the territorial bodies of the Pension Fund of the Russian Federation without requiring an application on the basis of documents available in the pension file.

If a pensioner (who was a pension recipient before 01/01/2010) submits additional documents before the end of 2010, the recalculation of the pension amount taking into account the valorization amount is carried out from 01/01/2010.

Why is valorization carried out?

Until 2002, pensions in the Russian Federation were calculated based on two factors - the length of total work experience and the average monthly earnings of a person retiring, which was formed in a certain period of time before retirement: either for the last 2 years or for any 5 years throughout your working life. Thus, pension rights in the old, pre-reform system were measured through length of service and through earnings. These two main characteristics determined the amount of the pension.

In 2002, a transition to a fundamentally new system took place. This is a model based on the fact that the size of the pension is determined not by length of service and earnings, but by the amount of insurance contributions that are transferred by the employer for the employee to his individual personal account. Accordingly, the greater your salary and insurance contributions from it, the greater the value of the so-called estimated pension capital. In turn, the estimated pension capital to obtain the pension amount is divided by the expected payment period*.

“When determining the size of the insurance part of the labor pension, starting from 01/01/2002, the expected period of payment of the old-age labor pension is set at 12 years (144 months) and increases annually by 6 months (from January 1 of the corresponding year) until reaching 16 years (192 months), and then increases annually by one year (from January 1 of the corresponding year) until the age of 19 years (228 months).”

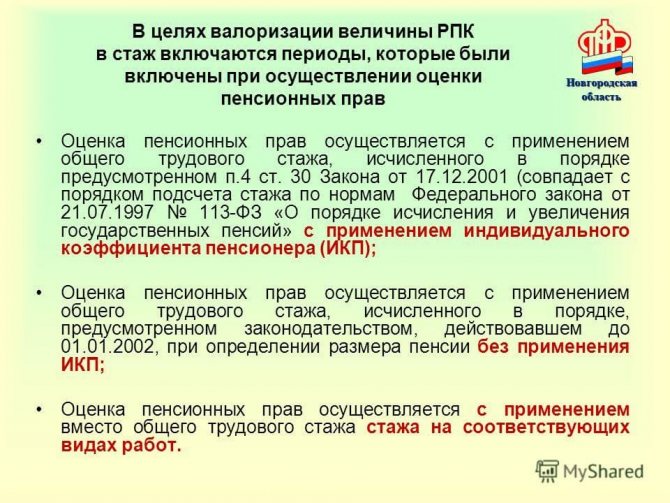

It is obvious that citizens whose pension rights are formed entirely on insurance principles, i.e. those who started working after 2002 have not yet reached retirement age. Meanwhile, after the pension reform of 2002, pensions according to the new rules are assigned to those citizens whose pension rights were already formed in the old system, i.e. measured by experience and earnings. Naturally, these rights had to be taken into account; they had to be combined with those insurance contributions that began to be individually taken into account for people and affect pension rights since 2002. In order to combine old and new rights, so that all this is included in the calculated pension capital, a conversion of pension rights was carried out in relation to all pensioners who retired before 2002, and those who started working before 2002.

The assessment of the pension rights of insured persons as of 01/01/2002 is made based on the estimated amount of the old-age pension, determined in a manner similar to the procedure for calculating the amount of the labor pension according to the norms of the previously in force pension legislation, based on the earnings and length of service of the insured person, earned before the start of the reform. (until 01/01/2002).

In order to ensure an increase in pensions for older citizens, the state decided to reassess the monetary value of pension rights that were acquired by citizens before the launch of the pension reform.

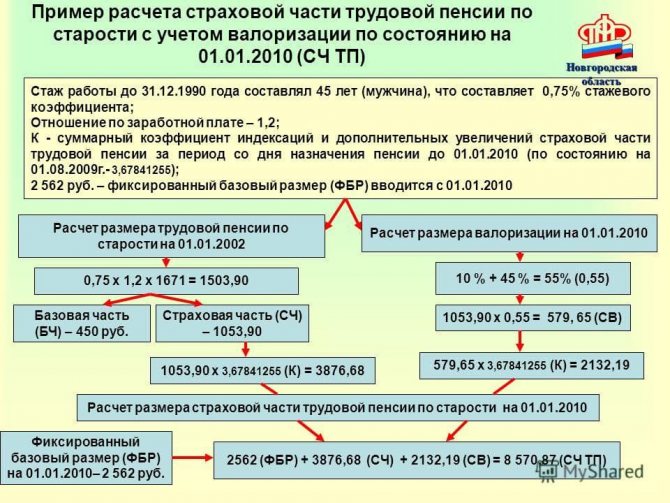

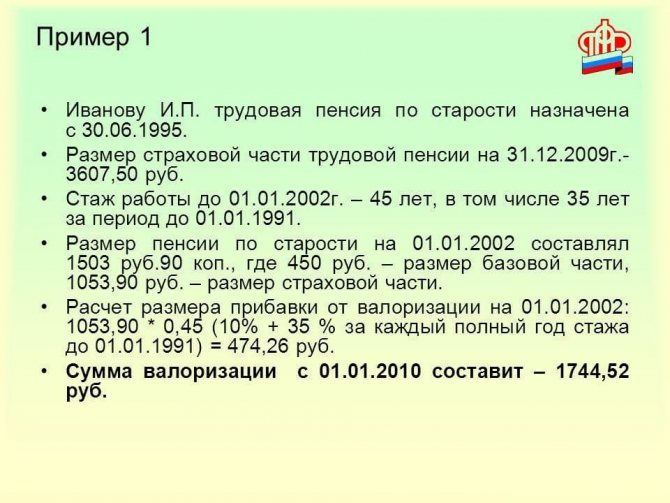

Examples of pension calculations taking into account valorization

1. A man who, as of January 1, 2002, has a total work experience of 42 years, including 40 years of “union” experience, has an average salary that exceeds the average salary in the country for the same period by 1.3. labor pension will increase by 1827.69 rubles.

Calculation conditions:

1. Year of birth - 1931

2. Year of initial pension assignment: 1991

3. Duration of insurance (general labor) experience - 42 years

including until 01/01/2002 - 42 years

including until 01/01/1991 - 40 years

4. Duration of insurance period after 01/01/2002 - 0 years

5. The ratio of the average monthly earnings of the insured person to the average monthly salary in the country is 1.3

taken into account during conversion - 1.2

6. The amount of the insurance part of the old-age labor pension as of December 31, 2009 is RUB 3,655.37.

7. The basic amount of old-age labor pension as of December 31, 2009 is 2562 rubles.

8. Calculation of the pension amount taking into account valorization:

The amount of the insurance part of the old-age labor pension as of 01/01/2010 (taking into account valorization):

5483.06 + 2562 = 8045.06 rubles, where 2562 is the fixed base amount of the insurance part of the old-age labor pension.

Valorization coefficient as of 01/01/2010: 0.5 (0.1 + 0.4)

Calculation of RPK valorization:

9. Seniority coefficient as of 01/01/2002: 0.55+0.17 = 0.72

10. Estimated amount of labor pension:

0.72 x 1.2 x 1671 = 1443.74 rub.

11. PC as of 01/01/2002: (1443.74 - 450) x 144 = 143098.56 rubles.

12. Increase in pension due to valorization:

(143098.56*0.5*3.6784):144 = 1827.69 rubles, where

3.6784 - total indexation coefficient of the estimated pension capital until 01/01/2010.

2. A woman who, as of January 1, 2002, has a total work experience of 29 years, including 21 years of “union” experience, has an average salary that exceeds the average salary in the country for the same period by 1.27, the size labor pension will increase by 950.25 rubles.

Calculation conditions:

1. Year of birth - 1949

2. Initial assignment of pension in 2004

3. Duration of insurance (general labor) experience - 31 years

including until 01.01.2002 - 29 years

including until 01/01/1991 - 21 years

4. Length of work experience after 01/01/2002 - 2 years

5. The ratio of the average monthly earnings of the insured person to the average monthly salary in the country is 1.27

taken into account during conversion - 1.2

6. The amount of the insurance part of the old-age labor pension as of December 31, 2009, taking into account insurance contributions after January 1, 2002, is 3,313.07 rubles.

7. The basic amount of old-age labor pension as of December 31, 2009 is 2562 rubles.

8. Calculation of the pension amount taking into account valorization:

The amount of the insurance part of the old-age labor pension as of 01/01/2010 (including valorization)

4263.32 + 2562 = 6825.32 rubles, where 2562 is the fixed base amount of the insurance part of the old-age labor pension.

Valorization coefficient as of 01/01/2010: 0.31 (0.1 + 0.21)

Calculation of RPK valorization:

9. Seniority coefficient as of 01/01/2002: 0.55+0.09 = 0.64

10. Estimated amount of labor pension: 0.64 x 1.2 x 1671 = 1283.33 rubles.

11. PC as of 01/01/2002: (1283.33 - 450) x 156 = 129999.48 rubles.

12. Increase in pension due to valorization:

(129999.48 * 0.31 * 3.6784): 156 = 950.25 rubles, where 3.6784 is the total indexation coefficient of the estimated pension capital until 01/01/2010.

Basic concepts used in calculations

Conversion of pension rights was carried out in 2002 for all pensioners who retired before 2002 and those who started working before 2002. In order to transfer pension rights into capital, it was necessary to calculate the conditional amount of the pension corresponding to the amount of rights that the person acquired while working before 2002. That is, determine the estimated amount of the pension. How was he counted? The length of service coefficient is taken - this is the work experience that was developed before 2002, depending on its duration the percentage was determined. The percentage could be from 0.55 to 0.75.

For example, if, when assigning an old-age labor pension upon reaching the generally established retirement age, a man had 40 years of total work experience (before 01/01/2002), then his length of service coefficient is 0.55 (for 25 years of total total work experience) + 15 (for every year over 25 years). The length of service coefficient is multiplied by the ratio of the average monthly earnings of the insured person either for 2000-2001 according to personalized records, or for any 5 consecutive years throughout the entire working life to the average monthly salary in the country for the same period (not more than 1.2 is taken into account - for except in cases provided for by pension legislation). All this is multiplied by 1,671 rubles (the average monthly salary in the Russian Federation as of the third quarter of 2001). If, when determining the estimated amount of the old-age labor pension, the insured person has incomplete total work experience, then the amount of the estimated pension capital is determined based on the amount of the estimated pension capital with full total work experience, which is divided by the number of months of the full total work experience and multiplied by the number of months of actual total work experience.

The assessment of pension rights by converting them into estimated pension capital was carried out according to the formula:

PC = (RP-warhead) x T, where

PC - the amount of the estimated pension capital;

RP - the estimated size of the labor pension;

BC - the amount of the basic part of the labor pension as of January 1, 2002 (450 rubles per month);

T is the expected period for payment of an old-age labor pension, equal to the same period to be applied when establishing a labor pension.

According to paragraph 3 of Article 30 of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation,” the estimated size of the labor pension is determined for men with a total work experience of at least 25 years, and for women with a total work experience of at least 20 years, according to the formula:

RP = SK x ZR/ZP x SZP, where

ZR - the average monthly earnings of the insured person for 2000 - 2001 according to individual (personalized) records in the compulsory pension insurance system or for any 60 consecutive months on the basis of documents issued in the prescribed manner by the relevant employers or state (municipal) bodies;

ZP - average monthly salary in the Russian Federation for the same period;

SWP - average monthly wage in the Russian Federation for the period from July 1 to September 30, 2001;

SC - length of service coefficient, which for insured persons is 0.55 and increases by 0.01 for each full year of total work experience in excess of the duration specified in this paragraph, but not more than by 0.20.

The ratio of the average monthly earnings of the insured person to the average monthly salary in the Russian Federation (ZR/ZP) is taken into account in an amount not exceeding 1.2.

The expected period of payment of the old-age labor pension is an indicator used to determine the insurance part of the labor pension. The expected payment period was determined to be 19 years, but this value will only apply starting from 2013, and before that, from 2002, starting from a period of 12 years, there is a smooth transition to 19 years, adding first six months, then per year until age 19.

SCH is the insurance part of the labor pension. The size of the insurance part of the old-age labor pension (AS) depends on the size of the estimated pension capital of the insured person, formed by converting pension rights acquired by the insured person before 01/01/2002 into the estimated pension capital, and by recording on the individual personal account of the insured person in system of compulsory pension insurance of insurance contributions to the Pension Fund for the insured person from 01.01.2002. The size of the insurance part of the old-age labor pension is determined taking into account the fixed basic size of the insurance part of the old-age labor pension.

Insurance length of service is the total duration of periods of work and (or) other activities taken into account when determining the right to a labor pension, during which insurance contributions were paid to the Pension Fund of the Russian Federation, as well as other periods counted as insurance length of service.

The size of the insurance part of the old-age labor pension is determined by the formula:

SCh = PC / T + B, where

SC - the insurance part of the old-age labor pension;

PC - the amount of the estimated pension capital of the insured person, taken into account as of the day from which the specified person is assigned the insurance part of the old-age labor pension;

T - the number of months of the expected period of payment of the old-age labor pension, used to calculate the insurance part of the specified pension. In 2011 it is 204 months;

B - fixed base amount of the insurance part of the old-age labor pension

FBI (Fixed basic amount) - from January 1, 2010, instead of the basic part of the labor pension, a fixed basic pension amount (the insurance part of the old-age labor pension) is introduced, as an integral part of the insurance part of the old-age labor pension, disability labor pension and accidental labor pension. loss of a breadwinner.

The fixed basic size of the labor pension (the insurance part of the old-age labor pension) is established in a fixed amount and is differentiated depending on the age of the insured person, the disability group and the presence of disabled family members dependent on him, and the category of recipients of the labor pension in the event of the loss of a breadwinner.

Conditions for undergoing valorization

No applications are required; the pension authority carries out all calculations automatically . Documents are needed only if some data has been lost or entered incorrectly; you can deliver the papers at any time.

If any documents are missing, the employer is required to provide copies. If the company no longer exists or it is impossible to contact them, the documents are located in the local archive. Such an archive should be in the city where the work took place. Very small cities and towns transfer documentation to the regional archive.

If the pension authority requires additional documents, they will send a written notice asking you to deliver the papers. If a citizen believes that providing additional documents will affect pension contributions, he needs to come to the Pension Fund and write an application.

An example of calculating a pension taking into account valorization

List of documents that may be needed during valorization:

- passport and copies of pages with information (registration, marriage information);

- amounts of wage payments with dates;

- insurance experience, officially confirmed by documents;

- average salary in Russia after 2002;

- date of retirement.

Insurance accruals for old age, loss of a breadwinner and disability, calculated taking into account the valorization coefficient, can be changed if:

- the citizen was able to prove earnings that were not taken into account in the initial calculation of pension payments;

- if the option for calculating deductions selected automatically differs from that chosen by the citizen.

A citizen can apply for recalculation to the pension authority after the grounds for recalculation arise. Changes in payments are indicated in letters from the Pension Fund of the Russian Federation, or you can go to the Pension Fund and get information at any time.

Who will be affected by pension valorization in 2020?

It is worth noting a very pleasant fact that the program will include absolutely all citizens who are retired and receive old-age payments. There are no restrictions or lists regarding increasing payments, which is a big plus.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The only important thing is that the more seniority and age you have, the greater the additional amount of accruals will be.