Retirement age for those born in 1963

According to current legislation, women retire at the age of 55, and men at the age of 60.

In accordance with the bill of the Government of the Russian Federation, adopted by the State Duma in the 1st reading and changes proposed by the President of the Russian Federation, the retirement age will increase from 2019. Women born in 1963 have time to retire at age 55. Men of the same year of birth, in accordance with the new law, will work until the age of 65.

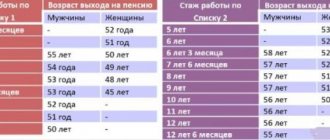

The exception at the moment is for citizens who are entitled to a pension for long service. Once men in this category who were born in 1963 have accumulated 25 years of service, they will be able to apply for payment. Cash support of this type is provided to federal government employees, military personnel, astronauts, and flight test personnel.

Conditions for assigning a pension

Requirements for future recipients of old-age benefits change annually. The right to a pension for men and women born in 1963 arises under the following conditions:

| Conditions for assigning a pension | Women | Men |

| Year of retirement | 2018 | 2028 |

| Retirement age | 55 | 65 |

| Minimum insurance period | 9 | 15 |

| Minimum amount of individual pension coefficient (IPC) | 13,8 | 30 |

Application of internal rate of return

Using the calculator, you can easily calculate the retirement date of any citizen. The calculator is especially important for people of pre-retirement age, since it is their retirement that will be regulated according to a special grid, based on the gradual implementation of the provisions of the pension reform.

Various types of pension calculators are very common on the Internet, which is explained by the increased interest of citizens in the issues of calculating pensions. However, it should be remembered that there is no calculator that could even approximately reliably calculate the size of your future pension payments. This is due to many reasons, the main one of which is the extreme opacity of the system for calculating pension savings practiced by the Pension Fund.

Calculation procedure and formula

The pension for those born before 1967 includes 3 periods: until 2002, from 2002 to 2014, and from 2020. Each period has its own formula for calculating the amount of savings from wages and IPC. The total pension amount (VP) is calculated as follows:

- VP=PB * TsPB *PK1 + FS *PK2, where:

- PB – points accumulated over a specific period.

- TsPB – cost of 1 point at the time of calculation.

- PC1 and PC2 are increasing bonus coefficients for retirement at a later period;

- FS - a fixed amount, currently equal to 4982.90 rubles.

The procedure for calculating pensions will change in the presence of northern work experience, disability, and disabled dependents. A bonus factor will be applied. It is set individually for each individual. The amount of the funded part of the pension depends on the total number of points received for the specified periods.

- How can a pensioner get a free trip to a sanatorium?

- How is sick leave paid?

- What medications are eligible for a tax deduction in 2020?

Pension calculator

These results of calculating the insurance pension are purely conditional and should not be perceived by you as the real amount of your future pension. To make the results easier to understand, all calculations are performed under constant conditions of 2020. For calculation purposes, it is assumed that the entire period of formation of your future pension rights took place in 2020 and you were “assigned” an insurance pension in 2020, taking into account the life plans you personally indicated, and also on the condition that you will “receive” all the years of your working life the salary you specified.

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment, taking into account all the generated pension rights and benefits provided for by pension legislation on the date of assignment of the pension. For example, for disabled people of group I, citizens who have reached the age of 80, citizens who worked or lived in the Far North and equivalent areas, citizens who have worked for at least 30 calendar years in agriculture, who do not carry out work and (or) other working activity and living in rural areas, the insurance pension will be assigned in an increased amount due to the increased size of the fixed payment.

This is interesting: Free Dental Repair Services According to Compulsory Medical Insurance List 2020

The insurance part of the pension for those born in 1963

This payment is formed on the basis of contributions (DC) made by employers for the entire period of the citizen’s labor activity. Pensions for those born before 1967 will be calculated using this formula:

- SSP=SO/228, where:

- SSP is the insurance part of the pension.

- SO – the total amount of insurance contributions for the entire length of service on the day of retirement.

- 228 – expected number of months of upcoming payments.

What determines the total value of the IPC?

The number of accumulated points is influenced by the duration of work, the average monthly salary, and the period during which the work experience was accumulated. Instead of fractional coefficients, multipliers that increase the amount of accumulated capital are used for calculations. Features of calculating the individual pension coefficient (IPC) for each period:

| Calculation period | Criteria influencing the value of the IPC | Calculation features |

| Until 2002 |

| The Pension Fund (PFR) does not have complete information about the work of citizens according to SNILS before 2001, so the amount of income is often underestimated, as are indicators of length of service. Often even a work record book is not accepted as evidence, so you need to obtain archival certificates. The IPC for the specified period is not calculated separately. Calculate the amount of accumulated capital taking into account valorization using the formula:

|

| From 2002 to 2014 | Depends on the capital formed during the specified period. | The Pension Fund of Russia can calculate the IPC for this period independently at the request of a citizen. Calculations are performed using the formula:

|

| From 2020 | The calculation is performed using the formula:

| |

| Other periods |

| Fixed points:

|

Step-by-step calculation algorithm

The amount of payments is determined taking into account all periods of a citizen’s work. Algorithm for calculating cash pension provision:

- Determining the amount of capital before 2001. The calculation of pensions for those born in 1963 begins with determining the total amount of accumulated funds during work under the USSR and after its collapse at the time of the first reform.

- Calculation of the amount of pension savings from 2002 to 2004.

- Calculation of the number of pension points from 2020

- Summation of the total number of accumulated points. Calculation of the pension amount in accordance with the current cost of the IPC.

Determination of the amount of estimated pension capital until 2001

It is easier to understand the features of calculations using an example. Let's consider the procedure for calculating a pension for Nadezhda, born in 1963, who submits documents for old-age payments at the end of 2020. She has been working since May 1, 1982. Stages of calculating a pension:

- Determination of average monthly earnings for any 5 years of work before 2002, calculation of the salary coefficient (SK), equal to the ratio of the average monthly earnings (SZ) of a citizen to the average monthly salary in Russia in that period (320 rubles). Nadezhda’s income was 485 rubles. ZK is equal to 1.51 (485/320).

- Determine the average salary from 2002 to 2004. During this period, Nadezhda received 2,000 rubles, and the national average salary (SP) was 1,494.5 rubles. The salary coefficient is 1.33. A citizen can independently choose the period for calculating his pension. For some, the period from 2002 to 2004 is more profitable. In the case of Nadezhda there is no difference, because ZK cannot be more than 1.2.

- Calculation of the experience coefficient (SC). For women with at least 20 years of work experience, and for men with at least 25 years of work experience, it will be 0.55. The coefficient increases for each year of work above the norm by 0.1. Its limit value is 0.75. In the example, Nadezhda’s work experience is 20 years.

- Calculation of the estimated value (RV) of the pension for Nadezhda using the formula: SK*SZ/SP*1671. It is equal to 1102.86 (0.55 * 1.2 * 1671) rubles.

- Calculation of settlement capital (RPC). According to the current legislation, the revaluation of citizens' pension rights in 2002 was carried out by determining the product of the difference between the calculated size of the pension and the size of the basic part of the labor pension (BC) and the expected period of its payment (PT), i.e. (RV-warhead)*PT. The warhead as of January 1, 2002 was equal to 450 rubles. PT according to the law is 228 months. As a result, the RPC is equal to 148852.08 rubles ((1102.86-450) * 228).

- Indexation of capital due to inflation as of December 31, 2014. In 2003, the value of the coefficient for calculation was 1.307, and in 2014 – 1.083. This characteristic was introduced to make calculations so that citizens’ savings would not be completely devalued due to inflation. The total index value for the entire period is 5.6148. The RPC amount will be multiplied by the final coefficient. Formula: 148852.08 * 5.6148 = 835774.66 rubles.

- Valorization of pension capital. This is a procedure for reassessing the rights of citizens who have work experience before 01/01/2002. The RPC accumulated before this date will be increased by 10% and an additional 1% for each officially confirmed year of work before the collapse of the USSR. Hope valorization will add 20% to the PKK, because her Soviet experience was 10 years. The total added amount is 167,154.93 rubles. The value of the RPC will be 1002929.59 rubles.

- Russian doctors are considering 2 options for the coronavirus epidemic

- How does the flu shot affect coronavirus disease?

- Cancellation of roaming in Russia

Calculation of pensions from 2002 to 2014

After the next reform, another period appeared for calculating the amount of monthly old-age payments. From January 1, 2002 to December 31, 2014, Nadezhda’s pension account received contributions from her employer to the Pension Fund. Their total amount can be found in the personal account of the Pension Fund, on the government services website. Due to inflation, they were subject to indexation annually. Pension calculation method:

- The insurance capital (IC) accumulated during the second period is subject to indexation. For Nadezhda it is 335,689.42 rubles. The general indexation coefficient used when calculating capital based on Soviet experience will not change, i.e. the formula will be as follows: 335689.42*5.6148=1884828.96 rubles.

- The total value of the RPC will be equal to 1002929.59 + 1884828.96 = 2887758.55 rubles.

- Calculation of the insurance part of the pension (SPP). It is equal to the ratio of the estimated capital (RPC) to the expected payment period (228 months), i.e. 2887758.55/228=12665.6 rub.

- Calculation of pension points. It is necessary to divide the SPP by the cost of one pension point as of 01/01/2015. Formula: 12665.6/64.1=197.5 points.

Accounting for pension points from 2020

According to the new legislation, insurance premiums held on a citizen’s individual personal account with the Pension Fund of the Russian Federation must be converted into IPC every reporting period. Pension points are calculated annually. The current formula for calculating the IPC looks like this:

- IPK=S/MZ*10, where:

- C – total amount of insurance premiums paid.

- MZ is the maximum contributory part of the salary.

To calculate the number of individual insurance companies from 2020 to 2020, you need to know the value of the maximum insurance premiums for the specified period. According to regulatory legislation, the size of the Ministry of Health will be as follows:

- 2015 – 115,200 rubles;

- 2016 – 127,360 rubles;

- 2017 – 140,160 rub.

In 2020, Nadezhda was credited with 57,850 rubles to her individual personal account. The calculation of points will be as follows: 57850/115200*10=5.022. In 2020, 62,800 rubles were transferred. or 4,931 IPK (62800/127360*10). In 2020, Nadezhda’s salary was increased and the amount of deductions amounted to 75,000. In total, over the annual period, she accumulated 5,351 points (75,000/140,160*10). The total amount of the IPC is 15,304 (5,022+4,931+5,351).

You need to use a calculator to add up the points for all periods, i.e. 15.304+197.5=212.804. Upon retirement, the final IPC is multiplied by the cost of 1 IPC as of 01/01/2018, and then a fixed payment is added (RUB 4,982.90). The formula will be as follows: 212.804*81.49+4982.90=22324.29 rubles. The calculation of the future pension can be considered complete.

Example of Calculating a Pension for a Woman Born in 1962

A woman born in 1963, upon retirement, must officially work for at least 9 years (confirmed by entries in the work book, pension contributions, etc.). If a woman did not officially work and does not have other periods counted in the insurance period (did not care for a child until he reached the age of one and a half years, or did not care for a disabled person of group I, a disabled child or a person who has reached the age of 80 years), she was not spouse of a military man, etc.) she is DENIED to receive a pension even when she reaches retirement age;

This is interesting: Large Families Benefits 2020 Chita

When choosing a salary period of work to provide a certificate of average monthly earnings, you must focus on the most profitable period. Marina’s average monthly earnings over 5 years were 280 rubles, and the average salary in the country for the same period was 320 rubles. This means that the KSZP is equal to 0.875, which does not reach the maximum coefficient of 1.2.