Who pays pensions in Russia

All transactions with payments to citizens who have reached retirement age are carried out by the Russian Pension Fund. It accrues, recalculates and pays monthly established amounts to all pensioners. But you can apply for benefits at the Pension Fund or Multifunctional Center (MFC).

In addition, a citizen can independently choose the authority that will deliver money to him monthly.

There are several options:

- Russian Post (at home or via cash desk);

- bank (via cash register or card);

- organization delivering the pension (the list is provided by the Pension Fund).

To choose or change the delivery method, you must contact the Pension Fund of Russia consultant directly or submit an application in your personal account on the “Unified Portal of State and Municipal Services” (https://www.gosuslugi.ru/).

Description of the insurance pension

An insurance pension is a monthly cash payment to participants in the compulsory pension insurance system in the event of incapacity for work due to old age or disability. The formation of an insurance pension occurs through insurance premiums that employers pay during the working periods of their employees.

The amount of contributions for compulsory pension insurance is 22%. Of this, 6% is a solidarity tariff intended to finance a fixed payment. And 16% of 22% is an individual tariff.

Depending on the citizen’s choice of pension provision option in the compulsory pension insurance system, 16% of individual tariff contributions either go entirely to the formation of an insurance pension, or 6% of them go to the formation of a funded pension, and 10% - to the formation of an insurance pension.

How is the old-age pension calculated in the Russian Federation in 2020?

The pension reform that was carried out in Russia proposed a new method of calculation. Previously, this was done by Pension Fund specialists, and the person did not have access to information on his accruals, but was waiting for the final result. Currently, old-age benefits include three indicators:

fixed rate + insurance pension + funded pension.

You can find out the level of insurance payment using the established unified formula:

SP = IPK x SIPC + FV, where

- IPC – the sum of pension points that were accrued at the time of registration of the pension;

- SIPC - the cost of one pension point, changes annually (2020 - 93 rubles);

- FV is a fixed payment that will be subject to annual indexation (2020 – 5686.25 rubles).

The majority of Russian citizens receive insurance (83%) and government (8%) old-age benefits.

The funded system is currently frozen until 2022, so it is not taken into account when calculating new pensions.

All employer contributions in the amount of 22% are redirected to the insurance pension fund, regardless of the wishes of the employees.

The cost of living included in the budget of each region will be the minimum pension

Amount of fixed payment to the insurance pension in 2020

Pensioners can receive a fixed payment in addition to their basic accruals. The amount of accrual is determined for different categories, defined in Article 16 of Federal Law of the Russian Federation No. 400 of December 28, 2013. It is worth noting that after recent changes in the laws of Russia, the basic and fixed part have become indistinguishable from each other and are synonymous.

Insurance part of pension in 2020 latest news:

The exact indexation percentage will become known at the end of January 2017, after the publication of official data from Rosstat. The projected inflation rate currently stands at 5.8%. This figure, if confirmed, will be the lowest since 1992. It may change up or down.

The calculations presented in the article are based on the projected level of the inflation indicator.

After receiving official data on statistics in Russia, the cost of living will be recalculated. The indexation of payments for military pensioners, survivors' and disability pensions will depend on this value. For many pensioners, this income is the only one, so the state treats social benefits taken responsibly. obligations.

The basic amount of the insurance part of the old-age labor pension in 2017

The basic amount of the insurance pension is distributed among citizens who have retired due to old age. You can count on it only if you have 15 years of work experience. This payment cannot be received if the total length of service is less than the amount established by law. This is the basic condition for receiving it. According to preliminary calculations, the amount of the insurance pension will be 4,823 rubles.

On the procedure for applying for an old-age pension in the Russian Federation in 2017

The latest changes do not imply any changes in the procedure for processing payments required by Russian law. To register, you must personally contact the Pension Fund. Specialists will review the documents and explain the entire registration procedure. This payment is calculated for the current month. There are no refunds for the period preceding the application. Now this procedure also applies to child benefits from 2020.

For registration, a pensioner will need the following package of documents:

- Certificate of family composition;

- Citizen's passport;

- An extract from the financial and personal account and other documents confirming the pensioner’s residence at the specified address;

- A work record book, but in addition to it, other documents may be needed, such as an employment contract, certificates from the archives of organizations;

- If a citizen works, it is necessary to provide a certificate of average monthly income from the employer;

- If a last name change was made, the citizen must submit documents from the registry office;

- Certificate stating that the citizen is or is not disabled;

- Military ID.

After submitting the necessary documents, payment will be made. If you have to wait for the necessary certificates, during this period the pensioner will receive a payment without taking into account points from the specified employer. When you provide a certificate to the pension fund, you will be recalculated, but there will be no compensation for the months of waiting. This payment procedure is not subject to dispute.

Disability insurance pension

This type of state support depends on the specific disability group assigned to the disabled person. Each presupposes the presence of serious physiological dysfunctions, the appearance of which radically affects the life of a pensioner and the ability to carry out work. The status of a disabled person is confirmed by special medical commissions.

- Group 1 includes disabled people who have lost the ability to work and self-care. A person’s illness does not make it possible to lead a full life. The amount of pension payments to disabled people of group 1 in 2017 will differ depending on the region of residence. Its base value will be 9117.86 rubles.

- Group 2 includes disabled people with significant health damage. At the same time, they retain the possibility of independent care, but there is no opportunity to work (due to the negative impact of work on their general health). The amount of pension payments to disabled people of group 2 in 2017 may also differ depending on the region of residence. In this case, the basic payment amount will be 4,558.93 rubles.

- Group 3 includes disabled people who have significant limitations that prevent them from working. They do not have the opportunity to work in their main profession. If the ability to work remains, but it is not possible to work with the same qualifications, due to the need to re-equip the workplace. The size of pension payments to disabled people of group 3 in 2020 will vary greatly, depending on the region of residence. The basic amount of such a pension will be 2,279.47 rubles.

In 2020, indexation will be carried out in the usual format, according to the annual indexation schedule. In addition, a payment has been established for dependent children. Its amount is about one and a half thousand rubles per child. No one-time payments for disabled people are planned in 2020. Citizens will receive payments from the Pension Fund on a monthly basis, as happened in previous months.

Who is entitled to such a pension?

The Pension Fund is obliged to pay monthly benefits to people who have reached a certain age. In 2020, men who are 65 years old and women who are 60 years old will be able to retire. There are categories of citizens who have the opportunity to retire earlier. This usually applies to military personnel, medical workers and employees of hazardous enterprises.

Additionally, a person must have a certain amount of work experience. The main thing is to remember that when calculating your pension, only those years in which contributions to the pension fund were made will be taken into account.

Citizens who have worked most of their lives without registration will have to fill the gap and retire later. In 2015, the minimum work experience was 6 years, but the government prepared and approved a program for its annual increase. In 2020, people with at least 11 years of experience will be able to retire. And by 2025, the minimum value will reach 30 years.

The third criterion, which gives the right to retire, is a certain number of individual pension points. These are conventional units that represent each year a citizen works, and depend on the level of official income. In 2020, the pension coefficient will be 18.6 points, and by 2025 it will reach 30.

Citizens who have worked most of their lives without registration will have to fill the gap and retire later

When was the recalculation of pension benefits for working pensioners carried out?

Adjustments to pensions for working pensioners were carried out in August 2020. This recalculation was of an undeclared and individual nature. The size of the adjustment depended on the volume of money supply of employer contributions to the Pension Fund of the Russian Federation in 2020 for a specific employee, expressed in pension points.

The summary table shows pension indexations and recalculations in 2020:

| Pensioner status | Change date | Name of adjustment | Quantitative measure of change |

| idle | January | one-time payment | 5000 rub. |

| February | indexing | 5,4 % | |

| April | indexing | 0,38 % | |

| working | January | one-time payment | 5000 rubles |

| August | recalculation |

|

An example of recalculating an insurance pension for a working pensioner. Citizen Ignatov retired in May 2015, but continued to work. On the individual pension account gr. Ignatov by July 2020 had accumulated 2.5 points according to insurance premiums from his salary during this time. This citizen forms only an insurance pension (he did not apply for the formation of a funded component in any NPF), therefore his accrued 2.5 points will be valid for recalculation (with the existing limit of 3 points). If gr. Ignatov formed not only insurance payments, but also accumulative ones, then only 1.875 points out of the accumulated 2.5 could be used for recalculation.

The pension provision accrued to Ignatov in 2020 was calculated taking into account the cost of the PC that existed at that time, i.e. 71.41 rubles. The coefficient has not changed since the pension was calculated, as the citizen continued to work. Therefore, the cash increase in August 2020 will be calculated based on the same coefficient: 2.5 points x 71.41 rubles. = 178.53 rub.

The amount of the old-age pension and the latest changes in 2020

The state annually announces the indexation of payments to citizens who have completed their working career. In 2020, the increase will occur again, which will cover the impact of last year's inflation.

Social pension

The recalculation of payments was carried out on April 1, 2020 by 6.1%, so the increase on average amounted to 566 rubles. According to statements by the Russian Pension Fund, the average pension will be 9,853 rubles. This amount is usually received by citizens who lack work experience or individual pension points.

Insurance pension

The increase in payments was carried out on January 1 by a total of 6.6%. On average, the increase was about 1 thousand rubles. Currently, the average pension that non-working citizens are entitled to is 16.4 thousand rubles.

Labor pension

According to a statement by the Pension Fund of the Russian Federation, since 2020, the state has introduced a new procedure for calculating pensions and the formulation of pension rights of citizens. In accordance with the introduced changes, the term “labor pension” is removed from the legislation and replaced by “insurance pension”.

Let us remind you that the average value of this benefit is 16.4 thousand rubles.

What will change?

Since mid-2020, 3 events have occurred that will have different impacts on the future of Russian pensions.

Amendments to the Constitution

The main change is related to amendments to the Constitution proposed by Vladimir Putin in January 2020. There is a clause on mandatory indexation of pensions.

First of all, it will affect working pensioners. For them, pensions have not been indexed since 2020, that is, for 5 years.

Co-chair of the working group on preparing amendments to the Constitution, Talia Khabrieva, stated that after the adoption of the amendment, pensions will begin to be automatically indexed for working pensioners. But she added that this provision could be adjusted by federal law.

After this, a dispute began between the lawyers. Some believe that the amendment only talks about mandatory indexing; but it is not noted for whom it is. Others say the new Constitution would at least force a new federal law on who is covered by indexation provisions. How this will end is still unknown.

New pension system

In September 2020, a new bill appeared on the website “Regulation gov.ru”, the creation of which was initiated by the Ministry of Finance. It involves the creation of a project called “Guaranteed Pension Product”.

Its essence is as follows. Currently, citizens rely on the government's long-term savings system. In it, the organizational role is played by the state, which automatically takes part of the citizens’ income to form a pension. Future retirees play only a passive role in this process.

The new law will develop the system of non-state pension provision. In it, citizens will play a more active role, voluntarily giving up their earnings to ensure a comfortable old age. The state will provide incentive support to the process. The document did not clearly state what this support consisted of.

At the same time, non-state savings will not affect state savings in any way. Vladimir Putin also stated this at a press conference in December 2020. He compared the “Guaranteed Pension Product” project with investments and clarified that government incentives will consist of protecting citizens’ assets from the vicissitudes of the market.

The text of the bill already exists, but it has not yet been considered by the commission and the Government. This may be due to the change of prime minister and cabinet of ministers and the need to spend energy on reorganization. There is a possibility that the bill will not be developed. But there is no reliable information yet.

Regular informing of citizens

The state intends to increase the activity of the population in the formation of pensions. To achieve this, a number of measures are being introduced.

From 2021, the Russian Pension Fund will begin informing citizens about the size of their future pension. It is expected that a letter with the following data will be sent to their personal account on the State Services portal:

- The amount of the accumulated amount.

- Conditions and procedure for acquiring rights to it.

- Payout calculation parameters.

Not all citizens will receive such a letter. Initially, it is intended to be limited to those who have reached the age of 45 years. Also, those who already receive at least one type of pension will not receive the newsletter. The letter is planned to be sent every 3 years.

So far this seems like a minor change. But behind it lies the clear intention of the authorities to shift responsibility to citizens.

Amount of old age pension by region

The size of the monthly state subsidy after completion of work directly depends on the region of residence. Therefore, residents of the capital and cities located, for example, in the north of Russia, will receive different benefits.

In the Moscow region

After the next indexation, carried out at the beginning of the calendar year, residents of the region can count on payments in the amount of 9908 rubles. The corresponding resolution was recorded in the Law of the Moscow Region No. 173/2019-OZ “On establishing the cost of living for a pensioner in the Moscow Region for 2020.”

In St. Petersburg

Having calculated the inflation rate, the local government decided to increase payments to people, setting the minimum value at 9,514 rubles. This resolution was confirmed by the Law of St. Petersburg No. 614-132 “On the budget of St. Petersburg for 2020.”

In the Rostov region

At the end of 2020, the regional law of the Rostov region No. 256-ZS “On the regional budget for 2020 and for the planning period 2021 and 2022” was adopted. According to the resolution, local residents will receive a pension in the amount of 8,736 rubles throughout 2020.

In Samara

This year, citizens of the region will receive monthly payments in connection with the end of their labor activity in the amount of 8,690 rubles. This decision is spelled out in the law of the Samara region No. 88-GD “On establishing the cost of living for a pensioner in the Samara region for 2020.”

To Tolyatti

The City Duma met on December 11, 2019 and adopted the budget for the next calendar year. In Resolution No. 427 “On the budget of the Togliatti urban district for 2020 and the planning period 2021 and 2022.” The amount of payment to pensioners is indicated as 8,690 rubles.

What is the insurance part of the pension?

But first, let's find out what an insurance pension means and what its average size is now. After reforming the system, pension payments were divided into insurance and savings parts. Despite active social advertising in the media, the influx of funds into the savings accounts of future retirees has increased slightly. In 2020, due to the worsening economic situation in Russia, it was decided to suspend the formation of this type of accumulation. This increased the level of distrust of citizens in the pension system.

The savings account is formed by the future pensioner by transferring additional funds to the pension account. This includes:

- Voluntary contributions from employers paying for the work of a pensioner;

- Income received from the use of pensioner funds in non-state Pension Funds;

- Maternity capital (at the disposal of the certificate holder);

- State contributions under the co-financing program.

The insurance part of the pension is a payment guaranteed to pensioners, established for work. It is paid based on mandatory contributions to the pension fund. It directly depends on the pensioner’s work experience. From 2020, indexation is carried out in individual insurance coefficients. This payment is basic in the Russian pension system. This was announced in the latest news about changes to the pension system.

For persons who have reached retirement age, a point calculation system is used as a supplement to the insurance portion. The number of points directly depends on the length of service. In connection with recent changes in laws in Russia, an incentive coefficient has appeared for late application to the Pension Fund. A pensioner can increase future income if he decides to continue working and forego the required pension payments.

Another type of insurance pension is paid by the state if, due to circumstances, a citizen loses income. In this case, the state replaces the official employer for him. Or is an official employer, as is the case with the military and other employees of law enforcement agencies.

It is applicable to the following persons:

- With limited abilities (disabled people of groups 1, 2 and 3);

- Those who have lost a breadwinner (one or two);

- For length of service (military and other employees of law enforcement agencies).

For persons receiving old-age pensions, compensation will be made twice, in accordance with the actual inflation rate for the period 2016. This indicator of overall inflation is calculated according to the value officially calculated by Rosstat. In some regions of the Russian Federation it may differ significantly from the average level. If the pensioner works, indexation will not be carried out until 2020, in accordance with the latest laws of Russia.

For other citizens, indexation will be made based on the subsistence level established in the region. Today, the national average insurance pension is 4,800 rubles.

How to receive the insurance part of a pension

Citizens who have reached retirement age can count on receiving the insurance portion. A prerequisite for receiving it is the presence of voluntary contributions to the insurance share of savings. For example, under the state pension financing program. It is possible to use maternity capital funds to form the insurance part. If a citizen has retired, he is entitled only to monthly payments from the insurance portion of his savings. But subject to the necessary work experience. The insurance part is a guaranteed income for conscientious and long work. Receiving payments from the insurance part of the pension became possible after the introduction of a moratorium on the formation of a funded pension. Further changes in the system will be made based on the economic situation in Russia as a whole.

How to receive the insurance part of your pension in a lump sum:

- This can be done if the person is the legal successor of a deceased pensioner who made voluntary contributions to the formation of the funded part of the pension. There are age restrictions here. This payment cannot be received if the deceased pensioner was born before 1965. To do this, you must submit an application to the territorial department of the Pension Fund of Russia or the National Pension Fund of the Russian Federation.

- A one-time payment of savings can also be used by citizens whose savings portion is less than 5% of the insurance amount.

- Citizens who have lost their breadwinner or become disabled also have the right to count on payment, if they do not have the necessary length of service, to calculate an insurance pension.

In this case, they can contact the Pension Fund with a corresponding application, but not more than once every 5 years.

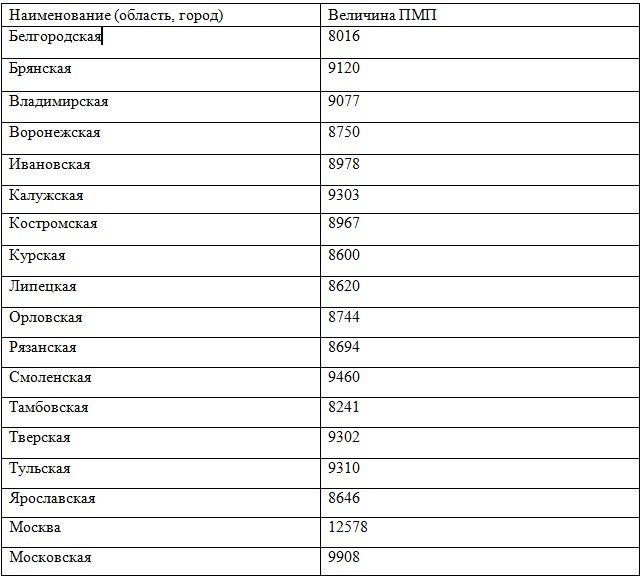

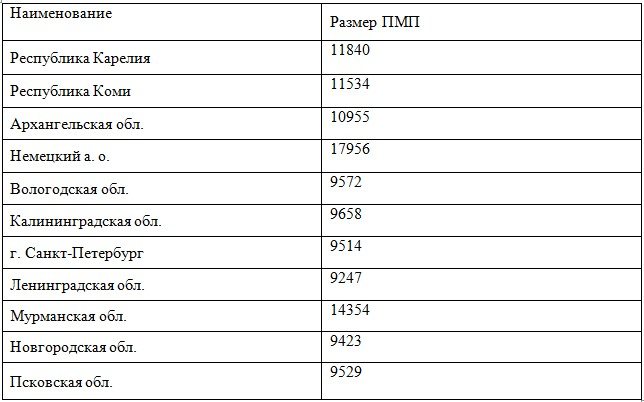

Minimum pension table by region of Russia 2020

In each region, pension payments are different, which is directly related to local budgets, climatic conditions and living standards. Minimum values are shown in tables, which are divided by county.

Central Federal District

Residents of the region in 2020 can count on the following payments:

Northwestern Federal District

Local authorities have designated the following pension level:

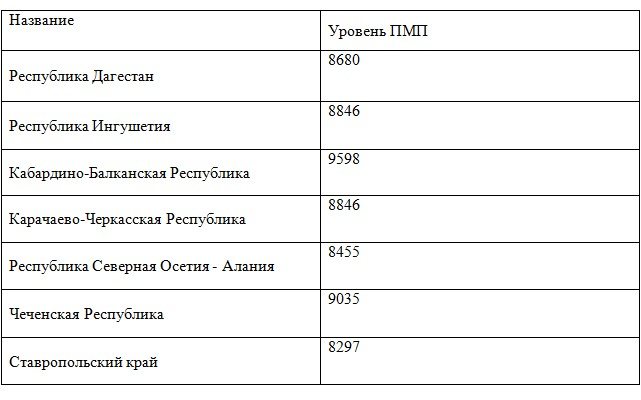

North Caucasus Federal District

According to the government decree and the increase in the minimum level of pensions, citizens will receive the following payments:

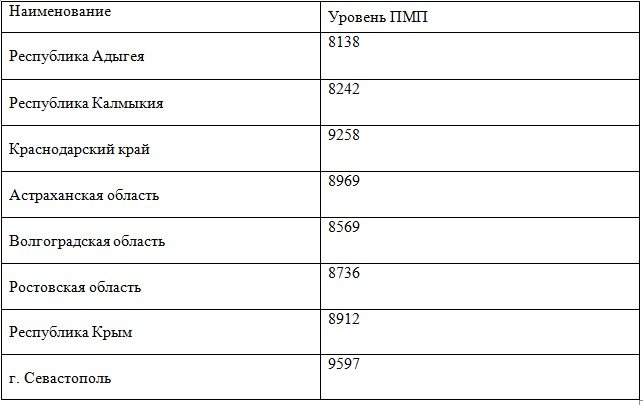

Southern Federal District

Residents of warm regions will receive the following subsidies:

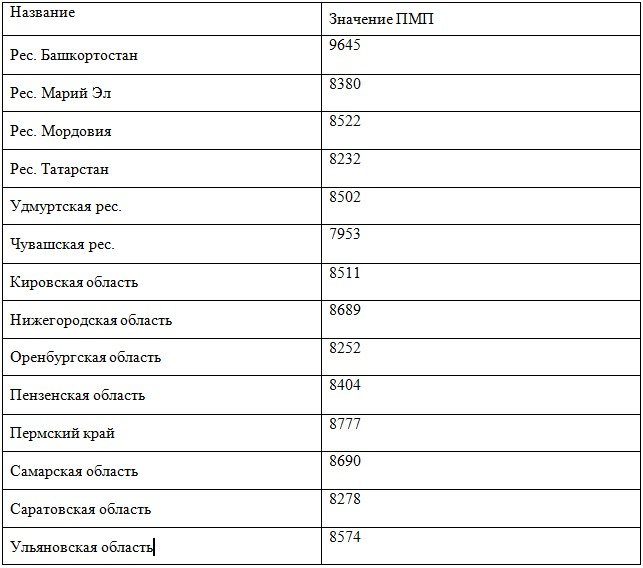

Volga Federal District

After the indexation carried out in January, the new pension level was:

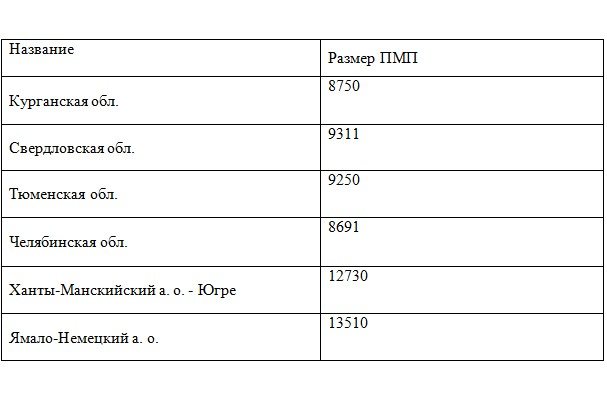

Ural federal district

According to the government decree, residents of the region will receive the following payments:

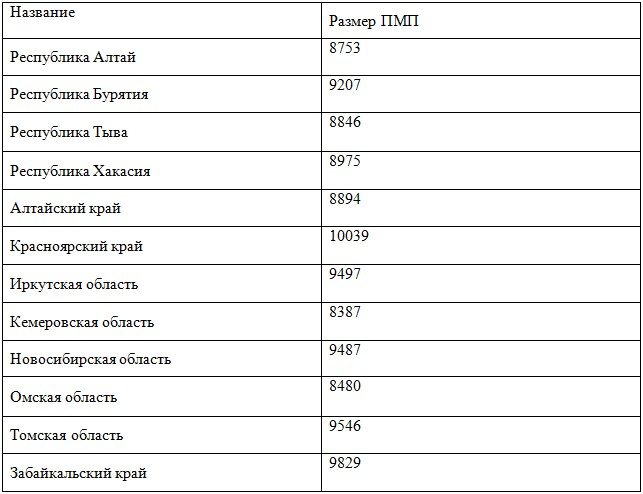

Siberian Federal District

Natives of the district will receive the following minimum pension in 2020:

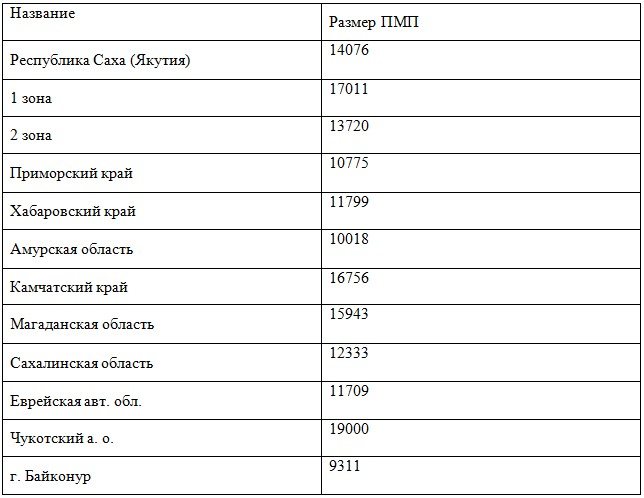

Far Eastern Federal District

Living in an area with a harsh climate, you can expect the following pensions:

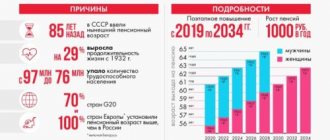

News regarding pension indexation

As a result of a violation of the indexation schedule that occurred in 2016, the amounts paid lost their original purchasing power.

The state of the budget at that time did not allow for recalculation in the prescribed manner.

This means that the amount of payments was not increased in accordance with the real inflation rate.

Indexation of old-age pensions in 2020 will be carried out in accordance with the established procedure.

This means that the amounts will be indexed in full and in accordance with the current inflation rate.

The need for such indexation was taken into account when drawing up the annual budget.

Important: the Pension Fund budget for 2020 is estimated at 8.6 trillion rubles.

However, not everyone will be affected by indexing. Payments to working pensioners will remain without any adjustments.

back to menu ↑

Amount and calculation of pension

Until 2020, the pension consisted of three parts: the federal basic amount, the insurance part of the pension and the funded part. Now the funded part has turned into a funded pension, and is regulated by a separate law.

The labor pension began to be called the insurance pension. Its size is determined as follows: Insurance Pension = number of points * cost of 1 point The cost of a pension point in 2020 is 78 rubles, 28 kopecks. It is approved annually by Government Decree. Points are calculated for each year separately, starting from 2020. And to qualify for a pension, you need to earn at least 30 of them.

Then, a fixed payment - an analogue of the former basic part - will be added to the received amount of the insurance pension, and as a result the total amount of the pension paid will be obtained. Thus: Pension = FV + SP = fixed payment + insurance pension.

The fixed payment is set in fixed amounts, the rules regarding it have not changed (more details here).

The fixed payment amount in 2020 is 4,805.11 rubles (after indexation on February 1, 2017). But the insurance part of the pension, which depends on length of service and salary, will be calculated in points.