What is a pension supplement?

The first time they started talking about surcharges was back in 2010. The government decided to support pensioners who worked during the Soviet period. To receive a payment, you must meet a number of conditions. Before submitting documents to the Pension Fund, you must carefully study all the requirements. Let's talk about this.

Important!

Additional payment is due to everyone who worked at least one day in the period before January 1, 2002.

Categories of citizens who have received the following types of pension benefits can count on payment:

- according to the age;

- for loss of a breadwinner;

- on disability.

There will be no increase if the person receives a social or state pension.

In order to receive an additional payment, you do not need to go to the Pension Fund and write an application. Everything is carried out automatically; specialists of the Pension Fund of the Russian Federation check who is entitled to additional benefits. payments according to its database, which stores information about all recipients of various types of pensions. The pensioner may not even know that he is already receiving such an allowance.

Important!

If you have doubts about the calculation of your pension, it is better to contact the Pension Fund and check the accruals.

Who can receive a recalculation of pension benefits

In the current realities, Russians can still claim a recalculation. This happens quite rarely, but it still happens. Most often, the reason for assigning a reason for recalculation is to obtain additional information about previously unaccounted for:

- work experience;

- salary indicators.

In the case of wages, we are talking about obtaining official evidence that the wages were higher than the consultant at the Pension Fund calculated. The document may come from the archive after a repeated request or become a consequence of a court decision, so there are indeed chances for an increase in the amount of payments after recalculation.

Another option for increasing the existing accrual amount outside the plan is to get on the list of those pensioners whose pension was initially calculated incorrectly. This opportunity arose after an expert team of auditors published the results of an audit of the pension system. In some cases, two SNILS were opened for one person at once, and then the pension was calculated only according to one of them. In other situations, two or even more citizens, on the contrary, had only one number. After repeated monitoring, Russians affected by such errors will be paid according to a new principle.

Legislative regulation of the issue of assigning additional payments to pensions

In the following sequence, changes occurred in legislation directly related to the issue of increasing the pension benefits of citizens who worked during Soviet times:

- Article 30 of Federal Law No. 173 of December 17, 2001 - a law was adopted that sets out the formula for calculating the amount of pension capital.

- Art. 30.1. Federal Law No. 173 of 01/01/2010 - additional information was introduced into the mentioned legislative act. A term such as valorization was introduced.

- In 2020, information on the assessment of “Soviet experience” was updated and amendments were introduced into the calculations.

Who can count on receiving insurance payments under the new law?

The following categories of citizens can apply for an insurance pension for whom all three of the following statements are true:

- There is a work book and a pension certificate.

- He has accumulated insurance experience of more than 15 years.

- Earned 30 pension points (the official name is IPC - individual pension coefficients, popularly called points).

The number of points directly depends on the length of service and the amount of contributions to compulsory pension insurance that were deposited into the citizen’s personalized account of his employers (if the citizen was an individual entrepreneur, then he made the deductions “for himself” throughout the entire period of business activity). More details about the accrual in the following table:

| Year | Conditions of insurance period | Minimum number of pension points | Maximum score per year | |

| To form the insurance part of the pension | To form the funded and insurance part of the pension | |||

| 2015 | 6 | 6,6 | 7,39 | 4,62 |

| 2016 | 7 | 9 | 7,83 | 4,89 |

| 2017 | 8 | 11,4 | 8,26 | 5,16 |

| 2018 | 9 | 13,8 | 8,7 | 5,43 |

| 2019 | 10 | 16,2 | 9,13 | 5,71 |

| 2020 | 11 | 18,6 | 9,57 | 5,98 |

| 2021 | 12 | 21 | 10 | 6,25 |

| 2022 | 13 | 23,4 | 10 | 6,25 |

| 2023 | 14 | 25,8 | 10 | 6,25 |

| 2024 | 15 | 28,2 | 10 | 6,25 |

| 2025 | 15 | 30 | 10 | 6,25 |

How long do you need to work?

Previously, a man could retire if he had worked for more than 25 years, and a woman – 20 years. According to the new Federal Law No. 173 “On Labor Pensions of the Russian Federation,” a person will be able to retire with a minimum insurance period of 5 years.

Attention! Those citizens who do not have the minimum insurance period at the time of retirement will not receive a labor pension.

In the current situation, even if you have a huge work experience, there is no guarantee of the possibility of obtaining bonuses, because everything depends on the number of months in which insurance premiums were paid. To receive additional payment, the following conditions must be met: the required amount of work experience and its compliance with insurance contributions.

For example, if a woman has actually worked for 30 years, but only 28 are noted in her work book, then she has no right to apply for an increase in the bonus. In this case, the amount of time worked does not correspond to the number of months in which insurance contributions to the Pension Fund were made.

Is it possible to leave early?

The legislation of the Russian Federation provides the grounds according to which a citizen can be assigned pension payments. This may include:

- disability for which a person has the right to apply for a certain type of pension;

- a special place of work, for example, the Far North (how is northern experience considered for a pension?);

- labor activity is carried out under hazardous industrial conditions;

- citizens who work in the mining industry (find out what special experience is and how much underground experience is required for retirement in Russia);

- persons who serve in the navy (find out whether military service is included in the length of service when calculating a pension here).

The following persons have the right to rely on early security:

- drivers of categories B and C, whose activities were limited to public transportation and other routes;

- medical workers;

- people of creative professions;

- judges, as well as people working in court;

- citizens who work as teachers and have worked for more than 20 years (the features of calculating teaching experience for retirement are described here);

- citizens who are involved in the mining industry.

Who is eligible for pension recalculation in 2020?

Pensions this year will be recalculated for the following categories of citizens:

- Persons who have reached retirement age in accordance with the new rules (this refers to the recent pension reform in Russia, as a result of which the retirement age of women and men was increased). They must submit an application to the Pension Fund for registration of a pension. If there are supporting documents “for Soviet” experience, then the “young pensioner” will be recalculated automatically.

- Already retired people who have found papers confirming their work experience from the time they worked in the USSR. The pensioner must submit an application to the nearest PFR branch at the place of registration. Employees will recalculate and the monthly pension will increase.

How to make additional payments for length of service to a pensioner in 2020

If a person has work experience that was obtained before 2002, he is entitled to a bonus of 10% of the received pension capital.

Plus, for each year of such experience, the Pension Fund will add another one percent.

Important!

Payments will be calculated based on the entire amount of pension capital. In this case, the size of the pension is not taken into account.

To understand everything, you need to try to make the calculations yourself. For example, let’s calculate the payment for 3 pensioners with different conditions for calculating pension payments.

Example 1. Calculation of additional payment for work experience during the Soviet period (several years of Soviet experience accumulated)

The initial data for calculating the amount of additional payment to the pension of a citizen with Soviet work experience are given below:

- pensioner experience – 36 years and 4 months;

- Moreover, 20 years is for the Soviet period of work until 1991;

- the amount of additional payment as an incentive for having Soviet experience during this time is 1% for each year of experience;

- adding another 10% additional payment to the pension for the very fact of having Soviet experience.

Let's calculate the total percentage of the bonus to the pension contribution:

20% (1% each for all 20 years of Soviet experience) + 10% (for having such experience) = 30%

A Pension Fund employee will calculate the amount of pension capital and calculate 30% of the amount received.

Example 2. Calculation of payment for a working period in Soviet times (there are several days of Soviet experience)

The citizen did not work for a single year during Soviet times. But there are still several days of Soviet experience, which was proven by archival certificates. The pensioner is entitled to 10% of the amount of the pension capital of the pension as an additional payment to the benefit. But she will not be accrued a percentage for each length of service worked during Soviet times (since not a single full year was worked during Soviet times). But if a citizen had worked for at least a year during the USSR, they would have added another percentage.

As a result, the pension capital will be checked, and 10% will be calculated from it. This will be the size of the bonus for work during Soviet times.

Example 3. Calculation of payment for working time in the USSR (a woman started working later than 2002)

Let’s say a woman belongs to the category of “young pensioners”. She began her career in 2002. She is not entitled to any additional payments, since she has no work experience during the Soviet era.

The nuances of receiving a pension bonus for Soviet experience were explained to Russians

Citizens of Russia whose work experience began during the years of the USSR will be able to count on additional accruals to their pensions, said Vitaly Polyakov, a lawyer at the Union of Moscow Lawyers.

Persons whose Soviet work experience was not previously taken into account will be able to apply to the Russian Pension Fund to recalculate their pension if they have documents confirming their work activity before 1991.

There are several ways to obtain lost documentation. For information about the period of work, you should contact the legal successor of the organization. The citizen will be helped by Russian archives, as well as the presence of two witnesses who are his former colleagues. The experience can also be restored through the court, the iReactor publication reports the words of the expert.

If it is difficult for a pensioner to search for documents on his own, he can turn to relatives or use the services of qualified specialists, Polyakov added.

When preparing the publication, the source tele4n.net was used

Good health to you!

What is pension capital?

Previously, a funded system was used when calculating pensions. Instead, in 2020, individual pension capital will be used.

It represents the contribution of each citizen individually to the personal account of the Pension Fund of the Russian Federation

. The Pension Fund opens an account into which the employee deposits 6% of his salary independently. These funds accumulate on the deposit of the future pensioner.

Disputes are still going on whether citizens will transfer money to the Pension Fund account voluntarily, or whether this will become a mandatory measure.

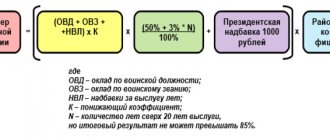

Pension capital is mentioned in Art. 30 Federal Law No. 173. The calculation used to be carried out according to a certain formula, which consists of the following indicators:

- coefficient for work experience;

- payment period;

- wage ratio.

The formula for calculations looks like this:

PC= ((SK*ZR/ZP*SZP)-450 rub.)*T, where

- PC is the size of the pension capital;

- SC – indicators for length of service;

- ZR – average monthly salary;

- SWP - the amount of the monthly salary approved by the Government of Russia. It was 1,671 rubles as of January 1, 2002;

- 450 rub. – the basis of the old-age labor pension, which was assigned on January 1, 2002;

- T is the expected payment period by age for the pension.

It is not possible to calculate the amount of pension capital on your own. For example, pensioners who worked during Soviet times have the same length of service, but their wages are different. As a result, the premium for work from 1971 to 1991 will not be the same.

Important!

To make an accurate calculation, you will need the help of a specialist from the Russian Pension Fund.

What influences the size of the payment?

When applying for a pension, its size is affected by the average salary for the last 3 calendar years. The insurance and work experience of each citizen is also taken into account.

Today the fixed amount will be 4558.93 rubles. In addition, for each year worked, the pensioner is accrued a coefficient. This is a percentage value that is determined from the average amount of insurance premiums.

It affects the overall size of the insurance part of pension payments. It is this part that can be increased for the category of people who have worked for more than 30-35 years. To do this, you need to multiply the total amount of contributions by additional coefficients.

Reference. The cost of 1 coefficient will be 74.27 rubles.

Since the minimum insurance period is 5 years, the accumulation of additional points encourages workers to continue working in order to increase their length of service to record levels.

The average additional payment upon retirement will be 1,250 rubles. If a citizen has not left his place of work, then the individual coefficient will be equal to 1. For every 12 months of work activity with 30 years of experience, this figure will increase by 0.1. Thus, the increase in pension insurance payments every 12 months will be approximately 500 rubles.

For medical workers

The procedure for calculating allowances for workers in the medical field is almost identical to that used when calculating payments for citizens of other categories of the Russian Federation. The amount of the amount is determined taking into account the quantity and quality of years worked, accumulated by the IPC.

What is valorization

Translated literally from French, it means “to approach or appreciate.” In Russia, this concept first appeared in 2002. The state has taken measures to increase pensions and social benefits. Starting from this period, pensioners who had Soviet experience had their pension capital recalculated.

Actions taken to improve the quality of life of older people. When calculating valorization, the average monthly income for a citizen’s entire working time is taken into account. This amount was increased by 10%. Therefore, the size of the bonus is different for all pensioners.

Who is entitled to an increase in benefits for Soviet experience?

Due to the fact that domestic legislation regarding pension provision for citizens changes regularly, it can be difficult for ordinary people to navigate the constant innovations. But no matter what scenarios the government comes up with, the basic basis for calculating pension benefits remains the amount of wages and accumulated work experience.

The requirement requires that the required length of service be earned before the changes came into force in 2002. If a citizen successfully fits into such a framework, he can apply for valorization, which automatically means the opportunity to add as much as 10% to his pension capital.

When accumulating length of service up to 1991, the pensioner is additionally charged 1% for each year.

It turns out that those individuals who managed to accumulate an impressive number of working years during the heyday of the USSR can now count on the opportunity to significantly increase their own level of income through an increased pension.

Another option for calculating additional pay for experience

Let's carry out calculations using the example of the future pensioner V.I. Grigoriev. The citizen retires in 2020. Initial data for calculation:

- work experience is 26 years;

- of which, until 1991, the future pensioner worked for 15 years;

- experience indicator – 0.55;

- wage ratio coefficient – 1.2.

Knowing these data, you can calculate the estimated pension amount:

0,55*1,2*1671= 1102,86

,

where 1671 is the average salary that was set for 2002.

Now you need to do the following:

1102,86 – 450 * 228 = 148 852.08

, Where

- 450 – pension base;

- 228 – the payment period expected by law and is 19 years;

- the result obtained is the calculated pension capital.

Important!

Estimated and individual pension capital are two different concepts.

We determine the insurance part of the pension for 2020:

RUB 148,852.08 / 228 * 5.6148 = 3,665.68 rub.

, Where

5.6148 is the coefficient of the product of all indicators from 2003 to 2014. The amount received is the insurance part of the pension.

Next, we do the following: 3,665.85 / 64.10 = 57.18, where 64.10

– this is the price of a point in 2020.

It turns out that Grigoriev V.I. 57 points are added to the pension. In 2020, the cost of a point is 93 rubles. What we get as a result: 57.18*93= 5317.74

. A future pensioner will receive such an increase in pension for work during Soviet times.

Good afternoon, reader!

Information constantly appears on the Internet that pensioners will receive an increase for long service. Such information is not supported by facts and is therefore fake. The media on the Internet mislead citizens with such actions. It’s enough to go to the Pension Fund’s website and compare the data to understand where the lies and the truth are.

To protect against rumors and false information, there is a warning on the Pension Fund website. Its essence is that the current laws do not have standards defining additional payments for work experience over 30 years, except in a few cases. Among them:

- bonus for unaccounted length of service, which applies to pensioners who retired before 2020;

- recalculation of pensions for employed persons;

- an increase to 30 years of experience in agricultural conditions; persons of retirement age living in villages or villages can receive additional payment;

- additional payment for length of service if you have the title “Veteran of Labor”, but only at the regional level.

In other situations, the length of service does not particularly affect the amount of payments. Such data is already taken into account in the main pension calculations, although the role is indirect. First of all, the average salary of a person is taken into account, on the basis of which payments to the Pension Fund were made. The more the pensioner previously received, the higher the benefit amount. However, long experience can increase the chance of additional points, which will affect the amount of monthly income.

You can obtain detailed information on pension calculations from the Pension Fund of your region. Information from the Internet is best filtered, analyzed and compared with official sources.

How to calculate valorization in 2020

10% is added to the previously obtained result and 1% for each year of work during Soviet times. Let us take for calculation the data of citizen V.I. Grigoriev. What we get:

10% + 15% = 25%,

it turns out that in addition to the existing bonus, the pensioner will receive 25% of the amount of 148,852.08. So:

25% * 148,852.08 / 228 * 5.6418 = 920.82 rubles. – this will be the amount of valorization.

Next, let's make some more calculations:

- 920.82 / 64.10 = 14.35 points.

- 14.35 * 93 = 1334.55 is an additional payment due to valorization.

- 5317.74 + 1334.55 = 6652.29 – the total amount of additional payment to V.I. Grigoriev’s pension.

Important!

All calculations made are just for example, so that it is clear what we are talking about. You shouldn't do them yourself. All calculations must be performed by Pension Fund specialists.

What actions should be taken to valorize pension payments in 2020

Most often, nothing is required from pensioners; all recalculations are made automatically by employees of the Pension Fund. But, the pensioner’s work experience will be determined based on the documents that were previously submitted to the department at the place of registration.

Therefore, if any changes occur, the pensioner must submit new documents.

For example, previously he could not confirm the entire period of service during Soviet times. The initial experience was 13 years, and according to the new documents - 18 years. Accordingly, the size of the bonus for work during Soviet times will become larger.

What to do if your pension has not been recalculated

If a pensioner has not received a payment or believes that the calculation was made incorrectly, he must submit an application to the nearest Pension Fund branch. In it, the citizen must state his requirements and attach to the application all the necessary documents for correct calculation.

Pension Fund employees will recalculate or explain their previous actions.

Important!

The response from the fund must be in writing. You will need it in the event of initiation of legal proceedings regarding the assignment of a pension in a smaller amount.

Valorization for representatives of certain categories of the population

If a citizen, in addition to the insurance part of the pension, also receives a disability payment, then the Soviet experience will not be counted:

- military

- the period of service that preceded the receipt of disability benefits, and the length of service taken into account in the pension payment for length of service; - for cosmonauts

- the same conditions as for military personnel.

Pensioners whose work experience begins in 2002 will not receive valorization indicators.

Indexation of pensions within the framework of the supplement in comparison with inflation

Vladimir Putin has already announced that in 2021, pension payments for Russians will increase by 6.3%, which is an order of magnitude higher than the inflation plans for the country. Citizens were also glad that after the adoption of amendments to the Constitution, they had an officially established right to recalculate pension-type benefits.

In the Russian Federation, the reform is still ongoing, providing for a gradual increase in the pension threshold. The final mark will be different for men and women - 65 and 60 years old, respectively. The authorities explained that they were prompted to take such an unpopular step by the demographic situation.

Source

Common mistakes on the topic “Increase in pension for Soviet service from 1971 to 1991”

Error:

The pensioner did not timely submit certificates confirming his work experience in the USSR.

As a result of such an error, the pensioner is not assigned an additional payment to the pension benefit if there are grounds for receiving it.

Error:

The citizen submitted an application for calculation of valorization, and his work experience begins in 2002.

Valorization will not be carried out, because The pensioner is not entitled to additional payment. It is designed for people who have work experience from 1971 to 1991, at least a few months or even days.