Who can recalculate a pension under the new law? Which people and under what conditions have the right to recalculate their pension?

How to recalculate your pension You need to submit an application to the Pension Fund and wait for its decision

How the pension for children is recalculated The recalculation is made for the period of caring for children from birth to 1.5 years.

What documents are needed To complete the recalculation, you need to prepare a package of documents

Registration of recalculation at the Pension Fund branch or at the MFC The easiest way to arrange recalculation of pensions at the Pension Fund branch or at the MFC

Registration of recalculation on the State Services website and by mail You can process recalculation remotely if you cannot visit a branch of the Pension Fund

How is the new pension calculated? The amount of the increase depends on the number of children and the time spent caring for them.

Is it worth recalculating your pension? Not in all situations it will be profitable to issue a recalculation

Questions and answers Answers to the most popular questions about pension recalculation

In 2013, Federal Law No. 400-FZ “On Insurance Pensions” was adopted. At the beginning of 2020, this law came into force. It changes the procedure for calculating the insurance part of the pension and adds new conditions to the existing ones. Now the size of the pension is now influenced by additional parameters.

One of them is now the number of children a retired woman has. More precisely, the periods of care for these children are taken into account. This is part of maternity leave from the birth of a child until he reaches a certain age. All this time his mother has not been working, and therefore this period was not taken into account in the length of service and, consequently, in the calculation of pension.

It was possible to calculate pensions according to the new rules and receive an additional increase at the expense of children after the adoption of the law, but the Pension Fund itself began to report this possibility only in the summer of 2020. Because of this, people have many questions about how to recalculate payments and what the increase will be. In this article, #AllLoansOnline will talk in detail about how pension recalculation works under the new law and how children are taken into account.

Who has the right to apply for pension recalculation?

Recalculation is the procedure for clarifying the amount of a previously assigned pension benefit in favor of a specific citizen, that is, the applicant. Not all Russians can apply for recalculation. Here are the conditions when you can recalculate pension payments:

- Only a pensioner can do this. That is, a citizen who has previously been assigned an amount of pension payments. Therefore, if you are not a pensioner, then you have no right to demand recalculation. First you will have to apply for the state pension itself, and only then demand a recalculation.

- The recipient does not agree with the assigned payment amount. Simple dissatisfaction with the size of government provision is clearly not enough. Documentary evidence will be required: the applicant will have to confirm to the Pension Fund the illegality of the calculation.

- Evidence and documents have been presented. For example, if the calculation of the pension does not take into account working periods, then the applicant must provide evidence. These may be employment contracts, work books, certificates and extracts and other documentation.

- Exceptional grounds for recalculation. All grounds for recalculation should be divided into general and exceptional. Under general conditions, the Pension Fund recalculates pensions without an application. For example, when indexing pension points. But exceptional grounds are a set of individual circumstances from the lives of citizens that directly affect the amount of pension payments.

The instructions on how to apply for pension recalculation are simple:

- Assemble the bases.

- Fill out an application.

- Collect additional documents.

- Contact the Pension Fund.

Recalculation of women for children in points

So, for example, in order not to lose the right to a preferential pension if the period of care is excluded from this period of service and not to lose the right to a pension, it is necessary to submit a certificate of the period of child care based on the employer’s documents (orders or time sheets). In this case, the pensioner’s length of benefit will remain the same, and periods of child care can be taken into account in points.

This is interesting: My Car Got into an Accident Now the Bailiffs Have a Duty to Tell Me What to Do

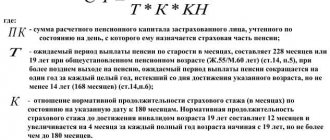

Accordingly, one and a half years of care for the first child will be taken into account in the amount of 2.7 b. , for 1.5 years of care, they will give 5.4 points for the second child, and 8.1 for the third, with a total number of points of 16.2. At the same time, we remember that 4.5 years of service will be taken away from these children’s service! And if for a given period the pensioner’s salary is taken into account to calculate the pension amount, then it cannot be applied and is excluded from the calculation of pension capital.

Grounds for recalculating pensions

General grounds - the recount is carried out without a request.

Exceptional - a recount will be carried out only at the request of a citizen

|

|

To recalculate, it is not necessary to fulfill all the conditions at once. A pensioner has the right to submit an application even without compelling reasons. The Pension Fund will accept the application, check it and report the result.

Who is entitled to an additional payment for children born before 1990: how to calculate, what documents are needed

If the non-insurance period lasted 1.5 years, 2.7 points will be awarded, i.e. 0.15 points for each month. The price of each point in 2020 is 81.49 rubles. Therefore, a woman who takes care of one child for one and a half years will receive a pension supplement in the amount of 220,023 rubles. For comparison, in 2020 only 212.17 rubles would have been added to payments.

It is also unprofitable to contact the Pension Fund to request non-insurance payments for the birth of children if the pension amount is calculated on the basis of a high salary. In this case, the coefficient will significantly reduce existing premiums. The same applies to women who receive a preferential pension. Recalculation may cancel existing privileges, for example, you may lose the right to receive an early pension.

Principles for recalculating pension payments

The actions of representatives of the Pension Fund of the Russian Federation during the recount are carried out in strict accordance with the established regulations (Resolution of the Board of the Pension Fund of the Russian Federation No. 16p dated January 23, 2019). The algorithm of actions has a number of features. Let us note the key principles of recalculation:

- The basis for recalculating a pension is a written request from a citizen. The appeal is drawn up in person or through an authorized representative.

- You can submit the form in person by making an appointment at the Pension Fund. Or through the MFC, if there is no territorial branch of the Pension Fund in your locality. It is also possible to send an appeal by mail or via the Internet. For example, using the State Services website or your personal account on the website of the Pension Fund of the Russian Federation.

- When submitting your application, you will receive a notification that your documents have been accepted. The notification is issued in person or sent by letter or email. This form confirms the fact of the application.

- Recalculation is made only from the 1st day of the month following the month in which the citizen’s official application was received. Recalculation rules differ for working and non-working pensioners.

Documents confirming the grounds for recalculation must be attached to the application. If such documents are not provided with the application, Pension Fund employees will request them separately. In this case, the recalculation process may take an unlimited amount of time.

Who can count on additional payment

It is worth noting the fact that the year of birth in the process of considering the number of children will not have any important meaning, that is, both children born after the collapse of the USSR and before this event are taken into account equally.

The erroneous opinion that the additional payment today is provided exclusively for those children who were born before 1990 or 1991 has arisen due to the fact that the updated procedure, which appeared in 2020, in accordance with which pension pensions are currently accounted for rights, provides for quite significant increases for pensioners with adult children. At the same time, they themselves mostly have work experience obtained during the USSR, which today is not so strongly reflected in the amount of the pension and in this case will be taken into account by civil servants on more favorable terms for citizens.

This innovation does not at all indicate that when a woman gave birth to a child after the collapse of the Soviet Union, she immediately loses the right to arrange such a recalculation for herself. It’s just that in the vast majority of cases, for such pensioners, carrying out this recalculation is unprofitable for one reason or another.

We should not forget that the period of time during which each child was cared for does not in itself provide for an immediate increase in subsequently provided pension payments, since periods of work, which are often taken into account when assigning such accruals, provide citizens with an order of magnitude more tangible contribution to the amount of pensions compared to their replacement by a year and a half allocated for childcare. In practice, there are a huge number of special situations in which the profitability or disadvantage of carrying out such recalculations is envisaged.

| Cases when recalculation is appropriate | Cases when recalculation is not appropriate |

|

|

Those citizens who have more than two children, and also had a small salary or not the longest work experience can count on receiving an additional increase in pension payments through such a procedure.

At the same time, it is highly discouraged to carry out such recalculations for those pensioners to whom the corresponding payments were accrued on preferential terms.

In particular, persons receiving early pension payments, that is, who have not reached the required age, due to the replacement of the working period with the specified benefits, completely deprive themselves of preferential service, which is why they may, in principle, be deprived of the right to receive an early pension.

Features of recalculation of old-age labor pension

The Pension Fund reviews pension accruals from the 1st day of each month. Therefore, you need to apply there after a reduction in pension payments has occurred. For working pensioners, there are some legal grounds for recalculation, and for non-working pensioners, there are others. This must be taken into account when sending an application for pension recalculation to non-working pensioners.

It should be remembered that any requirement to increase pension payments must be accompanied by a package of documents providing a legal basis for recalculating the old-age pension. Otherwise, he will not be accepted. By law, all paperwork for increasing pension payments must be provided by the pensioner himself.

Package of documents attached to the application for recalculation:

Such documents include:

- employment history;

- extracts from the archives of former employers on the amount of wages;

- information about awards during the work period.

If employees of the local Pension Fund refuse to accept papers and confirmations, then you should write a statement of claim for recalculation of the pension. A sample statement of claim is always provided at the court secretariat.

How to write an application for an increase in pension for children born before 1990

This form is not new, because there are other grounds for recalculating pensions, in addition to the new decree for women who gave birth to children before 1990; these grounds are indicated in the application; when filling out, you need to tick what is needed.

At home, you do not need to write an application for recalculation (not an increase, but a recalculation) of the pension due to the presence of children born before 1990. An application form in the prescribed form will be given to you by the Pension Fund upon your application. In this case, you yourself will have to fill out the minimum column in this application; the pension fund employees will help you. You will be required to sign and indicate the date of application. Notification of the result of consideration of your application will be sent to you by the method you have chosen: by Russian post, to your email, or you will come to the pension fund yourself and receive a notification.

How is recalculation done?

To carry out the recalculation, the pensioner will need:

- collect documentation that confirms the need for recalculation;

- make an application;

- submit an application and attached documents to the Pension Fund branch or MFC.

After submitting the documentation, you should expect a decision. If the applicant has submitted an incomplete list of documents, recalculation will be denied. There is no recalculation, as a result of which the amount of the assigned pension will be reduced.

The following documentation is required:

- identification document of the applicant;

- employment history;

- certificate of pension amount at the time of application;

- death certificate of the breadwinner;

- documents confirming a change in disability group;

- children's birth certificates.

Step-by-step guide to drawing up an application to the Pension Fund

- The applicant's full name must be written at the beginning of the document;

- After the header indicate the number of the pension certificate and the time of assignment of old-age maintenance;

- Then you should indicate the amount of current payments, which the applicant is not ready to agree with. Explain with reason the reason for the insufficient accrual of money: the lack of labor documents for a certain period, which also needs to be clarified. It is also necessary to explain why it was not possible to obtain extracts for the period of work that was omitted from the record;

- Indicate the chronological period for receiving missing extracts from the archives confirming the amount of salary for which the pension is calculated;

- Write the salary amount for a period not previously confirmed by archival statements;

- Indicate what position the applicant held during this period, what organization he worked for and what his earnings were;

- At the end of the application, state a request to recalculate the total amount of wages from the previously unaccounted for period of work.

Submitting a document to the Pension Fund

It is necessary to prepare documents in advance (passport, pension certificate, SNILS), and then visit the nearest branch of the Pension Fund of the Russian Federation with them. The application should be submitted to the Pension Fund organization in which the amount of this payment was assigned.

If a pensioner, due to poor health or other reasons, cannot visit the Pension Fund in person, he can send an application and documents by mail. Copies of these documents must be notarized. Otherwise, they will not have legal force.

You can also use the official website of the Pension Fund. To do this, the pensioner needs to visit the resource and find the “Appeals from Citizens” menu item. Next, you need to follow the system prompts and select the regional branch of the fund where the application is sent, formulate the subject of the request and carry out other necessary actions.

You must attach scanned (photographed) documents to your application, the list of which is listed just above. Then you need to choose the option of receiving a response: in the form of an official letter to the pensioner’s residential address or by sending a message to his email.

Application procedure through State Services

It is possible to submit an application electronically through the State Services portal, which helps applicants save time.

However, if a Pension Fund employee requests original documents on the basis of which a decision on recalculation will be made, you will need to visit a Pension Fund branch.

In this case, the procedure will be reduced in time, since the information will already be verified in advance; the Pension Fund employee will only verify it. Citizens also have the right to submit an electronic application in their personal account on the Pension Fund website.

First, the citizen will need to go through the standard registration procedure. You should select the item “Submission of an application for pension recalculation” and fill out the electronic form. All mandatory information must be entered (personal data of the citizen, name of the Pension Fund branch to which he belongs, etc.), because otherwise, the document will not be sent to the recipient.

From the proposed options, you need to select the reasons that will be the basis for the recalculation.

A citizen must upload the necessary documents to the State Services website that confirm the fact that he has the legal right to conduct a recalculation.

Recalculation of pension for children: who is eligible and how to apply

You can sign up in your personal account on the foundation’s website or through the “Make an Appointment” service, which does not require any additional registration or authorization. The application can also be submitted electronically if the pensioner is registered on the government services portal.

The longer the insurance period and the individual pension coefficient, the more money the pensioner will receive. To make it clear, the insurance period is those periods when a citizen worked and insurance premiums were paid for him.

10 Jun 2020 lawurist7 218

Share this post

- Related Posts

- What to do if a mother with many children is taken away from home because of debt

- Putin's Decree of December 27 On Changing the Term of 2020

- When will the pension increase occur in 2020?

- Will Maternity Capital be Renewed After 2020?

Submitting an application through the MFC

Not all citizens use the Internet freely, so submitting an electronic application is very difficult for them. At the same time, standing in line at the Pension Fund branch is also very inconvenient.

In this case, the best way to submit an application and attached documents is to contact the Multifunctional Center for the Provision of State and Municipal Services. There are a large number of branches; you can choose the one closest to your home or place of work.

MFC employees will assist the pensioner in drawing up an application and answer any questions that may arise.

The decision of the Pension Fund of Russia and the timing of recalculation

Check whether the application is completed correctly. Attach all necessary documentation and submit it to the Pension Fund for review. The period for consideration of the application is 5 working days from the date of receipt of documents. If you contact the MFC, the review period increases by 4-5 working days. This is due to the regulations for document flow between departments.

If the decision is positive, the pension will be recalculated:

Increasingly Decreasingly

| From the first day of the month following the month of circulation, regardless of the date of occurrence of the grounds for recalculation | From the first day of the month following the month in which the grounds for recalculation occurred. |

| Example: The statement was written on July 22. The grounds for the recount arose on April 10. | |

| The recount will take place on August 1. | The pension will be recalculated from May 1. |

Pension Fund employees have the right to request additional certificates and papers confirming the grounds for recalculating pension payments.

Recalculation of pensions through the court

To achieve an increase in pension in court, you need to file a statement of claim in court for recalculation of the pension. You need to carefully write such a document about recalculating the amount of your pension. Completed sample, application form

to recalculate your pension will help you avoid making mistakes. All columns of the form must be filled out as indicated in the sample, otherwise it will not be accepted for registration in the court office.

Any claim for recalculation of the pension amount must be supported by documents confirming the right of a person who has retired to receive a larger monthly old-age payment. Such documents will be an argument for the court, which will allow it to make a decision in favor of the plaintiff.

The plaintiff must provide as evidence:

- work book, which by law is the main document confirming the employment of every Russian citizen;

- archival extracts supplementing inaccuracies or gaps found in the work book;

- documentary evidence of awards and cash bonuses received by the pensioner during his work activity.

To increase the amount of payments, every pensioner who has every reason to do so must write an application for recalculation of the pension amount. A sample of such a document will help you do this properly. In addition to appeals to the Pension Fund or the court, documents are also required to confirm the plaintiff’s claims to increase his old-age pension.

You need to submit documents for recalculation of your old-age pension in the middle or end of the current month so that the pension fund can make the recalculation from the 1st day of the next month.

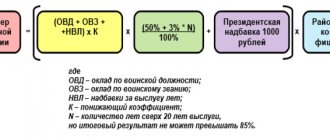

What payments are due to pensioners depending on their retirement?

Previously, the size of the pension payment depended mainly on salary, as well as the amount of contributions to the Pension Fund. The 2020 reform introduced the concept of insurance experience and IPK. In this regard, there was a need for recalculation.

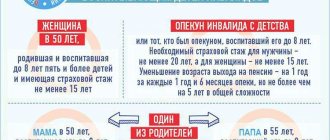

Benefits for women who have given birth to two children upon retirement before January 1, 2020

Women who have given birth to two or more children can apply to the Pension Fund for recalculation, regardless of when these children were born. The topic was widely discussed in the media that pension payments would be increased significantly, especially for pensioners who gave birth to children before the 1990s, that is, during Soviet times. However, these conversations have nothing to do with reality. The recalculation is carried out in the same way for those pensioners who gave birth before the 90s and for those who gave birth later. The measure that really matters is when they retired: before 2020 or later, not when their children were born.

What payments are due to pensioners with two children upon retirement after January 1, 2020?

For women who retired after January 1, 2020, the optimal periods were automatically selected from those that were available, since the reform had already been adopted by that time. The pension payment is calculated in the largest possible amount. Therefore, it makes no sense for them to apply for recalculation.

Recalculation of insurance pension without application

The amount of the insurance pension is recalculated without an application for working pensioners and for non-working pensioners through an increase in the individual pension coefficient (points).

For working pensioners, recalculation is made taking into account the insurance contributions that the employer accrued and paid for him to the Pension Fund of the Russian Federation, and which are not taken into account:

- when assigning an old-age insurance pension;

- when assigning an insurance pension in case of loss of a breadwinner;

- when assigning a disability insurance pension;

- when transferring from one type of insurance pension to an old-age insurance pension or a disability insurance pension;

- during the previous recalculation.

In these cases, the amount of the insurance pension is recalculated by the Pension Fund of the Russian Federation without an application from August 1 of each year.

The recalculation of the amount of the insurance pension in the event of the loss of a breadwinner is subject to adjustment once: in August of the year following the year in which this pension was assigned.

The legislation establishes maximum values of the IPC (not higher than 3 points), which are taken into account when recalculating the insurance pension without an application.

In addition, if, after the appointment of an insurance pension, the policyholder submits accounting information regarding periods of work that occurred before its appointment, which entail an increase in the IPC, the amount of the insurance pension is recalculated from the date of appointment of the specified pension without requiring an application.

A non-declaration recalculation of the amount of a fixed payment to an insurance pension is carried out in the following cases:

- the pensioner reaches the age of 80. Applies to old age insurance pension only. Reaching the age of 80 allows you to set the size of the fixed payment to the old-age insurance pension at an increased rate;

- changes in disability group. Applies to both old age insurance pension and disability insurance pension. At the same time, an increased fixed payment to the old-age insurance pension is provided for disabled people of group I.

The process of recalculating pensions for children with an example

All questions that relate to additional payments to pensions for a child or children have begun to gain particular popularity only recently. Probably not everyone knows that a similar opportunity existed earlier, in particular, since the Law “On Insurance Pensions” No. 400-FZ, which was adopted at the end of 2013, came into legal force.

The recalculation process, which involves an additional payment taking into account non-insurance time, is carried out only if there is an application from the person with the provision of all the necessary documents for recalculating the pension for children. To apply for an increase, a pensioner must go through several stages, namely:

Recalculation of pension savings

Citizens who continue to work after the appointment of a payment in the form of a funded pension or an urgent pension payment, or for whom, after the appointment of such payments, additional contributions for the formation of pension savings continue to be received within the framework of the State Co-financing of Pensions Program, recalculation is made on August 1 of each year without a declaration.

Recalculation is based on:

- results of investing a citizen’s pension savings;

- amounts of income that were not taken into account when assigning an immediate pension payment or payment of a funded pension or a previous adjustment.

Number of points for each child

Starting from 2020, the key indicator that affects the amount of funds paid is the total number of pension points or, as they are commonly called in the professional environment, the individual pension coefficient. This amount is established by authorized employees of the Pension Fund on the pensioner’s own account.

Special attention should be paid to the fact that today this parameter is displayed not in rubles, as was done previously, but in so-called relative units.

The formation of the total number of points accumulating on a citizen’s personal account is carried out through the use of two main tools. The first is the payment by the employer of the corresponding insurance premiums, which in 2020 are calculated as 22% of the standard amount of payment for the employee's length of service, of which 6% will be used to compile a fixed payment amount, while the remaining 16% is sent to the account in the form of accumulated points.

They can also be accrued due to the fact that the points take into account “non-insurance periods”, that is, when a person was engaged in some activity of social significance, but did not work, and therefore corresponding contributions were not accrued for him, so as in this case, the formation of pension rights will be carried out at the expense of the state.

Special attention should also be paid to the fact that today the leave granted to citizens to care for children is taken out until they reach the age of three, that is, only half of the period from which provided for by current legislation.

Over a similar period of time, regular benefits provided for child care have been paid, which many citizens note as an unfair approach, which has led to many disputes.

In the process of assigning pension payments, the total number of points that accumulated in the pensioner’s personal account throughout the entire period of his working activity, as well as for all non-insurance periods, must be multiplied by the cost of one coefficient provided for by the current Government. This is how the amount of the insurance pension is determined. It is worth noting that in 2020, each pension point will cost 81.49 rubles.

In accordance with the new norms of the law, along with the periods of work in the insurance record of each of the parents, the periods during which they cared for children until they reached the age of one and a half years will be taken into account, but in total this period of time should not be more than six years.

In accordance with the standards specified in Article 15 of the new law, the number of pension points calculated for a full calendar year of caring for a minor child may be different and depends, first of all, on the order of their birth. Thus, the maximum amount of points is provided for the third and fourth child.

The calculation itself looks like this:

| Child's turn | Points that are added for one and a half years of care | Maximum allowable amount of increase |

| First | 2.7 | 212.17 rubles |

| Second | 5.4 | 424.33 rubles |

| Third | 8.1 | 636.5 rubles |

| Fourth | 8.1 | 636.5 rubles |

| Total maximum | 24.3 | 1909.5 rubles |

The maximum permissible increase indicated in the table is provided only for those women who did not have any labor relations during childcare, and therefore this period of time was in no way taken into account in the process of assigning a pension.

Otherwise, the maximum indicated in the table will be reduced due to the fact that the wages taken into account according to the old rules are deducted from the calculations of pension payments, since during the recalculation process this period of time is replaced by a “non-insurance period”. In addition, the maximum is reduced due to the reduction in the duration of the pensioner’s work due to the recalculation.

In this regard, the correct calculation of the pension for all periods of time, as well as the exact amount of the bonus, will be determined exclusively by an authorized employee of the Pension Fund, who will use the payment file as the basis.

This procedure is carried out on an individual basis, and therefore the amount of the supplement for different citizens, even if they have the same number of children, may be different, since the procedure for forming pension rights is carried out separately for each person.

If, as a result of the action taken, it turns out that the amount of the increase is negative, carrying out such a replacement, accordingly, will turn out to be unprofitable for the pensioner, and therefore he will simply be refused.

Recalculation of insurance pension upon application

A declarative recalculation of the amount of a fixed payment to an insurance pension towards an increase is carried out in the following cases:

- changes in the number of disabled family members dependent on the pensioner. When disabled dependents appear, an increased fixed payment is established for the old-age and disability insurance pension (no more than three disabled dependents are taken into account);

- living in the Far North and equivalent areas. The fixed payment to the insurance pension for old age, disability or loss of a breadwinner is increased by the corresponding regional coefficient for the entire period of residence in the specified areas (localities);

- acquiring the necessary calendar work experience in the regions of the Far North and (or) equivalent areas or insurance experience. An increased fixed payment is established for the old-age or disability insurance pension;

- changes in the category of survivors' insurance pension recipients. For example, a child who receives a survivor's pension for one parent and subsequently loses the other parent is entitled to an increased fixed payment

The recalculation of the fixed payment amount will be made from the 1st day of the month following the month in which the application with all the documents necessary for such recalculation was accepted.

Who can apply for a review of their children's pension?

According to Law No. 400-FZ of December 28, 2013 “On insurance pensions in the Russian Federation,” mothers can receive an increase in pension for the time they spent caring for children. Since maternity leave excludes the possibility of working, women are entitled to compensation for this period. Information is actively spreading on the Internet that you can apply for recalculation only if the baby was born before 1990. In fact, this information is false.

In the package of laws on pension reforms there is no concept of “a child born before 1990”. Indexes can be assigned to any mother, even if she had children after the collapse of the USSR. The only mention in the legislation of 1991 is found in the concept of “pension valorization,” which provides for an increasing coefficient for people who have work experience during the Soviet Union. There will also be additional conditions for bonuses for women who give birth during this period.

Recalculation of insurance pension taking into account non-insurance periods

The periods of work during which insurance contributions to the Pension Fund are paid for a citizen are called insurance periods. Along with them, there are so-called non-insurance periods - when a citizen, as a rule, does not work and employers do not make contributions for him, but his pension rights to an insurance pension are formed.

Such periods, for example, include: care of one parent for a child until he reaches the age of one and a half years, care provided by an able-bodied person for a disabled person of group I, a disabled child or a person who has reached the age of 80, military service upon conscription. Like insurance periods, non-insurance periods are counted into the insurance period, and for them the state calculates pension coefficients.

From January 1, 2020, a pensioner who has “non-insurance” periods can at any time apply to the Pension Fund for recalculation of the amount of the insurance pension, attaching to it all the necessary documents confirming the right to include the corresponding “non-insurance” period in the insurance period.

Documents confirming the corresponding “non-insurance” periods are determined by law. For example, for the period of care of one of the parents for each child until he reaches the age of 1.5 years, documents are required certifying the birth of the child and his reaching the age of one and a half years. In addition, the citizen (one of the parents) applying for an insurance pension provides information about the second parent necessary to resolve the issue of including the period of child care in the insurance period.

The period of caring for a child is counted towards the parent's insurance period if the corresponding period of caring for this child is not included into the insurance period for the other parent when establishing his or her insurance pension.

If the Pension Fund has the necessary information at its disposal, the citizen is not required to submit documents. The application and the documents attached to it are considered by the Pension Fund of the Russian Federation, taking into account the choice for the applicant of the most profitable option for his pension provision.

The recalculation of the amount of the insurance pension towards an increase is carried out from the 1st day of the month following the month in which the pensioner’s application for recalculation of the amount of the insurance pension is accepted, with all the documents necessary for such recalculation attached to it.

If the recalculation of the amount of the insurance pension is unprofitable for the pensioner - it leads to a decrease in the amount of the old-age insurance pension received or the loss of the right to receive an early assigned insurance pension - the pensioner is informed that the recalculation is not made and the pension is paid in the same amount.

Non-insurance periods for which pension coefficients are calculated include:

- care of one of the parents for each child until he reaches the age of one and a half years, but no more than 6 years in total (coefficients are calculated for no more than 4 children);

- completion of military service upon conscription;

- care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80;

- residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive bodies, state bodies under federal executive bodies or as representatives of these bodies abroad , as well as to representative offices of state institutions of the Russian Federation (state agencies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than 5 years in total;

- temporary removal from office (work) in the manner established by the criminal procedural legislation of the Russian Federation of persons who were unreasonably brought to criminal liability and subsequently rehabilitated;

- military service, service in internal affairs bodies, the State Fire Service, bodies for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, other service or carrying out activities (work), during which they were not subject to mandatory pension insurance for those dismissed from the specified service (work) starting from January 1, 2002 and who have not acquired the right to a long-service pension, a disability pension or a monthly lifetime allowance, financed from the federal budget.

Citizens to whom it was assigned before 2020 can also apply for a pension recalculation. When calculating pensions assigned according to the new pension formula since 2015, the law takes into account the most profitable option, so their recalculation, as a rule, is not necessary.

The recalculation of the amount of the insurance pension, taking into account non-insurance periods, occurs upon the application of the pensioner, which he must submit to the Pension Fund.

In addition to the application, you will also need:

- identification document (passport of a citizen of the Russian Federation, foreign passport of a citizen of the Russian Federation, service passport of a citizen of the Russian Federation, diplomatic passport of a citizen of the Russian Federation, etc.);

- documents confirming non-insurance periods counted in the insurance period if they are not in the pension recipient’s payment file (for example, to take into account the period of child care up to the age of 1.5 years - birth certificate, child’s passport).

When sending an application in the form of an electronic document using the “personal account” on the government services portal and the Pension Fund of Russia website, documents proving the citizen’s identity, age, and citizenship are not required.

The period for a citizen to submit the documents necessary to recalculate the amount of the pension should not exceed 5 working days from the date of submission of the relevant application.

If such documents are not submitted within the prescribed period, the application for recalculation of the pension amount submitted in the form of an electronic document will not be considered.

Non-insurance periods are primarily confirmed on the basis of individual (personalized) accounting information that the Pension Fund has at its disposal. If this information turns out to be incomplete or missing, non-insurance periods are confirmed by relevant documents.

The procedure for submitting an application for recalculation on the State Services portal

The request is processed within 5 working days. After the user submits the application, the site representative checks whether the data is filled out correctly and registers the application in the system. The following can submit a request to review pension points:

- citizens of the Russian Federation living in the country (does not apply to people who went abroad for permanent residence);

- foreigners who permanently reside in the Russian Federation;

- refugees and people without permanent citizenship, if they are permanently in Russia.

According to the law, a representative of public services does not have the right to refuse to review the number of pension points. Any request must be serviced, and then employees are required to provide a response based on the outcome of the request. For this service, the application is considered sufficient grounds. Based on the results of the review, the PFRF will provide an official response: refusal or approval and a final revision of pension points.

What documents may be required for recalculation?

In order for the government agency dealing with pension payments to consider the application, you must submit:

- original application for revision of pension supplements (the citizen receives a copy). The document is needed in electronic or paper format;

- original paper document confirming authority, certified by the employer (if the application is submitted on behalf of the company);

- passport of a citizen of the Russian Federation (original in paper form).

Attention! If the citizen does not submit all the necessary documents, the application will be rejected.

Possible responses of the Pension Fund of the Russian Federation to the application

If the person who applied to the Pension Fund with a request to redistribute pension points has done everything correctly, the government agency approves the application. The date from which payments under the new procedure will begin is indicated in the response. However, if the application form is filled out incorrectly, the applicant to the PFRF will be refused. The review will indicate:

- the date of the decision and its number indicated in the reporting of the Pension Fund;

- the full name of the body to which the citizen applied;

- information about the application;

- Full name of the person who submitted the request to the Fund;

- payment case number;

- account of the case in the Pension Fund of the Russian Federation;

- the type of pension for which the refusal was made;

- rejection reason;

- necessary steps to resubmit your application;

- information about the official who reviewed the application.

How are things going with recalculation for children in other departments (FSIN, Ministry of Internal Affairs, and others)

The conditions of pension payments described above are relevant for civilians who are not employees of specialized departments. If a person belongs to the Federal Penitentiary Service, the Ministry of Internal Affairs or other bodies, it is better to consult about the advisability of reviewing points in the Pension Fund. For example, the terms of the military child allowance may vary, so the application may not be beneficial.

Any mother has the right to pension supplements. They are already taken into account in modern legislation. It is beneficial to order a review of points if the woman retired before 2020 and all payments were calculated at Soviet rates. It does not matter when exactly the child was born: before 1990 or after. All citizens of the Russian Federation have the same rights to non-insurance payments.