Who has the right to early retirement if there is a disabled child in the family?

Firstly , if the family is complete and there is only one disabled child in it, then only one of the parents can apply for early retirement on this basis.

If one of the parents first applied for a pension on this basis, and then applied for another type of pension, then the second parent is given the right to retire early.

Secondly , if the family is complete and there are two or more disabled children in it, both parents are given this right.

Thirdly , if a child is raised in a single-parent family, then the parent who is raising him (single mother, single father, guardian) can take advantage of the benefit.

It doesn’t matter whether we are talking about biological parents or adoptive parents or guardians. Also, the retirement of a parent who raised a disabled child is possible even if the latter has already died at the time of application. In this situation, the parent or guardian may retire early if:

- The child's disability is confirmed by a certificate of completion of the medical examination.

- The length of work experience must be:

- at least 20 years – for men;

- at least 15 years – for women.

- The reduced retirement age threshold has been reached:

- 50 years – for women;

- 55 years old – for men.

- Care is provided until the child reaches 8 years of age or more.

During this eight-year period, the child should not stay in boarding schools, orphanages, or other institutions fully supported by the state or under the guardianship of other persons.

Legislatively, the right of parents of children with special needs to early retirement is enshrined in clause 1. Part 1. Article 32 of the Federal Law “On Insurance Pensions” dated December 28, 2013 N 400.

Please note that when applying for a pension, it does not matter in what period the child’s disability was established. It can be confirmed after 8 years (even after adulthood). Let’s say disability was established at the age of 21 with the status “disabled since childhood,” that is, the cause of the disease before the age of 18. There will be a right to an early date. There is also a basis when the child was temporarily disabled, for example, from the age of 3 to 4.5 years.

For guardians, the calculation of the retirement age occurs under different conditions.

The retirement age is reduced by 1 year for 1.5 years of guardianship.

| Guardianship period | Number of years by which the retirement age is reduced | Retirement age | |

| Male | Female | ||

| 1 g 6 months | 1 | 59 years old | 54 years old |

| 3 g | 2 | 58 years old | 53 years old |

| 4 g 6 months | 3 | 57 years old | 52 years old |

| 6 years | 4 | 56 years old | 51 years old |

| 7 years 6 months | 5 | 55 years | 50 years |

In this case, the fact of caring for a child under 8 years of age must be officially confirmed. That is, the guardian must take into account the time of fulfillment of his obligations when the child is from 0 to 8 years old .

For example, a guardian raised a disabled child from 10 to 14 years old. There will be no entitlement to pension benefits.

The period of guardianship that reduces the pension qualification must occur during the period when the child was disabled.

Let's imagine a situation: a guardian raised a child from 3 to 10 years old. The child was recognized as disabled from 9 to 13 years of age. A guardian can be registered for only one year (from 9 to 10).

Both the current and former guardian can claim the right to premature retirement, the main thing is that the above conditions are met.

For adoptive parents, the same calculation rules apply as for natural mothers and fathers, that is, a year is counted as a year.

In this case, the period of caring for a child with a disability is counted towards the length of service with an increased pension point (a coefficient of 1.8 is applied).

Information about terms. A disabled child , when in childhood, a disability is established in real time (temporarily or permanently).

Disabled since childhood - disability is established after the 18th birthday, but for reasons (diseases) that arose in childhood (before 18 years of age).

If there is not enough length of service

Women who have not worked for some time must provide certain documents to the Pension Fund.

This is necessary to account for the non-insurance period on a personal account. For each year of formal care for a minor with health problems, 1.8 points are awarded. The following documents are required to be submitted to the Pension Fund office:

- passport and SNILS;

- certificate of birth of an offspring;

- a certificate from a medical and social examination confirming the appointment of the group;

- confirmation that the pope did not take advantage of the preference;

- proof of education of a minor under 8 years of age.

Attention: women, based on the provided copies and certificates, are assigned a regular pension at the age of 55 in the absence of the required length of service of 15 years.

Additional Information

The disability group is assigned by the medical and social examination body for a certain period. The status does not have to be permanent. ITU develops recommendations for restoring body functions. After a certain time (a year or two), re-examination is carried out. Following recommendations may result in cancellation of the group. Attention: parents of a child whose group has been retained after 18 years of age can apply for preference. The law uses the term “disabled since childhood.” It means the extension of status after adulthood.

How to confirm the fact of leaving?

To confirm that you are caring for a disabled child, you must provide the Pension Fund with:

- An extract from the ITU examination report confirming the child’s disability status.

- Birth certificate, child's passport.

- An extract from the house register (certificate of family composition), confirming the fact that the child and the person caring for him live together. It can be obtained from the local administration, the MFC, the management company or the HOA, and can be issued through the State Services website or through the website of the territorial MFC.

- Certificate of place of residence , which can be obtained from the MFC, the nearest unit of the Main Department of Migration Affairs of the Ministry of Internal Affairs, the management company of a residential building, a homeowners association or housing department.

The decision on whether care was provided or not is made by the district pension commission. In addition, before this, representatives of social protection authorities often pay visits to the applicant’s neighbors to personally verify that the child was not only registered with a parent, but was actually raised by him.

Sometimes the fact of upbringing has to be proven in court. Then the court decision is submitted to the pension authorities.

How to register - algorithm of actions

The sequence of registering early retirement is prescribed in the Federal Law under number 400. In this case, the algorithm of actions depends on what reason for leaving is used by the citizen. If we are talking about a child with a disability, you will have to go to the Pension Fund, where the necessary procedures are carried out. If the mother or father was laid off two years before retirement, they should contact the Employment Center. Below we will consider only the first option, concerning children with disabilities.

The order of registration is as follows:

- Parents take their child to undergo an examination (medical and social examination). This is required in order to confirm the baby’s disability. For further processing, an extract from the act is required. It is this that is used to further obtain a certificate, which is required by the Pension Fund of the Russian Federation to confirm the right to early retirement.

- Collecting the necessary package of papers (except for the certificate). At this stage it is worth collecting: the child’s birth certificate, the SNILS number of the applicant for early care, a passport and an application (drawn up according to the approved sample). All papers, except the application, must be copied and notarized.

- Filling out an application. Before filling out this paper, you need to collect the package of documents noted above, and then bring them to the Pension Fund of the region of residence. The application is filled out at the Pension Fund, because it is there that the forms are issued, and the necessary samples will be in front of your eyes. Basic design rules apply here - no errors, legibility of handwriting, no edits and full compliance with the information provided.

- Transfer of application and package of papers. In the process of submitting documentation to an employee of the Pension Fund of the Russian Federation, a citizen receives information about the amount of the pension due, as well as the approximate timing of its enrollment. At this stage, you need to choose the option of transferring funds - to a bank account or in cash.

- Waiting for pension payments. All paperwork is completed within 30 days (sometimes earlier), and the first pension transfers occur from the beginning of the month when the application was submitted. For example, if a person brought the entire package of documentation on April 15, he will receive payments starting on April 1.

Where and how to apply for early retirement?

The right to early retirement for parents of children with childhood disabilities can be used by contacting the pension authority at the place of registration (registration).

There are several ways to contact us:

- personally;

- in your personal account on the Pension Fund website (a mandatory condition is registration on the State Services website);

- by mail;

- through a trusted person.

In the latter case, along with other documents, you will need to provide a notarized power of attorney to the Pension Fund.

Employees of the pension department individually decide to grant such a right or not, based on an assessment of the documents provided and the candidate’s compliance with the requirements listed above.

If the Pension Fund refuses to provide a benefit, you can obtain it through the court by filing a statement of claim. Only in this case, to substantiate your claims, you will have to attach written correspondence with the Pension Fund. Your statements and written responses from officials to them are attached to the claim.

Appointment procedure

The pension is assigned at the Pension Fund branch at the place of registration. The woman herself must initiate the appointment procedure by submitting an appropriate application. You must apply before you become eligible (that is, before you reach age 50).

The application deadline is 10 days from your 50th birthday. Therefore, the procedure should not be postponed. If you delay it, difficulties will arise with registration, and it will be very difficult to receive a preferential pension.

The appointment procedure has several features:

- The day the right to a pension is registered is determined by the day the application is submitted. Even if the registration took several days, the main day is considered to be the day when the application was accepted.

- The pension is assigned from the month when the application was accepted. The date is not important. If a person visited the Pension Fund on September 30, then pension accruals are calculated from September 1. If it arrived already on October 1, accruals begin on October 1.

- To apply for disability benefits for a child, you must have an appropriate certificate of disability. To do this, you need to undergo a medical and social examination, based on the results of which a report will be drawn up. An extract from this act is a certificate of disability.

When should I contact the Pension Fund for early retirement?

According to the Rules established by Order of the Ministry of Labor and Social Protection of the Russian Federation dated November 17, 2014 N 884n, you must contact the Pension Fund 10 days before the right to early exit arises, that is:

- for women - 10 days before turning 50 years old;

- for men - 10 days before turning 55 years of age.

However, the optimal time to apply can be considered six months to a year before the expected early retirement.

Pension Fund employees will tell you exactly what documents you will need to bring specifically in your case. You will have enough time to prepare them. It may be necessary to confirm periods of work even during Soviet times, which may cause certain difficulties.

If, before the grounds for early retirement arise, the applicant does not contact the pension authorities within the specified time frame, he will not be deprived of his right. You can exercise your right later (at any time).

Example . Kalinina S.E. applied for an early pension at age 51, rather than at age 50, in March 2020. Her pension began to accrue in April 2020 from the age of 51. She will not receive any compensation for the lost year, which is why she should contact the Pension Fund in a timely manner.

Registration deadlines

Taking leave early due to the disability of one or more children requires registration, and this procedure takes a lot of time. On average, it takes about 30 days to visit all authorities and collect the required package of papers. Parents will have to undergo a medical and social examination, wait for a doctor’s conclusion, receive extracts, and then make copies of the documentation, having it certified by a notary.

As for the last stage - applying to the Pension Fund of the Russian Federation, the period for consideration of the application by a citizen of the Russian Federation is not determined. As a rule, this process takes no more than a month. This is due to the fact that payments are calculated from the month of application. The application must be submitted before the expected early retirement age is reached. The deadline for submitting the application is the tenth day from the date of birth. But do not delay - it is better to start the registration process in advance, 2-3 months before turning 50 and 55 years old, respectively.

From the moment the papers are transferred to the Pension Fund of the Russian Federation, there is no need to spend money. All costs are borne by the mentioned body, after which the costs of the Pension Fund are reimbursed from the State Fund.

But at the stage of collecting papers, some expenses are still possible - for obtaining a certificate of disability (if there was none), as well as notary services for certifying copies of documentation.

Required documents

In order not to come to the Pension Fund several times, carefully study the list of documents for obtaining an early pension for the parents of a disabled child:

- Passport.

- Employment history.

- Insurance certificate of state pension insurance.

- Certificate of average monthly earnings of a citizen for any 60 consecutive months during his working life until 01/01/2002 (average monthly earnings for 2000–2001 are confirmed by an extract from an individual personal account in the compulsory pension insurance system, which is at the disposal of the Pension Fund of Russia).

- Marriage certificate (if you changed your last name).

- Child's birth certificate.

- An act of the guardianship authority establishing guardianship and appointing a guardian (for guardians).

- MSEC certificate confirming disability.

- A document confirming the fact of caring for a child under 8 years of age.

- Statement.

Prepare copies signed by the notary, but be sure to take the originals with you when you go to the Pension Fund department. They are also needed.

If something is missing the first time, the documents can be submitted within three months from the date of application, but no later than this period.

Minimum pension

The minimum pension on the territory of Russia can be considered the value of the living wage for a pensioner, which is established in each specific region.

According to the law, if the amount of accrued pension benefits is less than the specified value, then an additional payment is made up to the “minimum wage”.

Required documents

The law establishes the following documents that must be prepared to receive an early pension:

- Parent's passport;

- A copy of the birth certificate;

- A document from the ITU that establishes the child’s disability;

- Certificate of family composition;

- A certificate confirming the fact that the child lives together with his parents;

- A copy of the marriage certificate;

- Employment history;

- Certificate of salary;

- A certificate stating that the applicant does not receive any other types of pension payments.

Pensions for the mother of a disabled child: are they entitled to the father?

Most often you can find information on the Internet about the early retirement of the mother of a disabled person, so there may be a misconception that only women are entitled to such a benefit.

The abundance of information regarding mothers of disabled children is due to the fact that it is primarily they who provide child care and benefit from this benefit. There are not so many single fathers, and if we talk about two-parent families in which there is a disabled child, then in them, too, according to statistics, it is usually the mother who takes out early retirement.

However, according to the law, any of the parents, that is, including the father, can take advantage of the benefit.

Parents who have a child with a childhood disability.

Parents who have a child with a childhood disability.

One of the parents has the right to early retirement (who is decided by the family council). If a mother goes, she must have at least 15 years of insurance coverage and be 50 years old. If the father, then he must be 55 years old and have at least 20 years of insurance experience.

A prerequisite for early retirement is:

- 1) the child has the “DISABLED CHILDHOOD” category;

- 2) a disabled child must live to be 8 years old.

For example, by the time parents reach retirement age, their disabled child has died at the age of 8 years and above, then the parents retain the right to early retirement subject to the conditions of having an insurance period of 15 and 20 years and reaching the ages of 50 and 55 years.

If a child’s disability arose at the age of 10-11 and persisted until the age of 18 and beyond, the parents do not lose the right to early retirement due to the fact that the disability occurred after 8 years. The condition of Article 32 400-FZ “until they reach the age of 8 years” has not been violated

If the child was disabled from 3 to 7 years old, then the parents retain the right to early retirement, subject to the conditions of having an insurance period of 15 and 20 years and reaching the ages of 50 and 55 years.

According to the Rules for recognizing a person as a disabled person, approved by Decree of the Government of the Russian Federation of February 20, 2006 N 95, the category “disabled child” is established for children from birth until they reach the age of 18. However, a child can be recognized as disabled from childhood and at a later age, for example at 20 years old, and this does not deprive his mother or father, who raised this child until the age of 8 (later recognized as disabled since childhood), from the opportunity to receive an old-age pension early .

If a woman has not worked anywhere while caring for a disabled child, then for these years she is accrued insurance experience, which by the time she retires early, accumulates in the amount of 15 years or more.

Can parents of disabled children lose their right to early retirement?

A pension for a woman with a disabled child, as well as for a man who is a father, is awarded only if there are grounds for it. If there are none, it is denied. They don’t even accept documents for registration when:

- the applicant did not raise a child under 8 years of age for any reason;

- the applicant was deprived of parental rights until the pension was issued;

- the other parent took advantage of the benefit;

- the insurance period is below the established threshold;

- the age at which you can take early leave has not yet reached.

In these cases, the right is lost, and the Pension Fund immediately refuses to issue such a labor benefit.

But if the mother or father was deprived of parental rights after the pension was awarded (that is, at the time of its registration they met all the criteria), then the right to further receive a pension is not lost. They continue to receive it further.

Persons entitled to claim early retirement.

Persons entitled to claim early retirement.

So, as already mentioned, not only the blood parents of a disabled child, but also guardians have the right to retire early. The main condition in the latter case is recording the fact of guardianship in the manner prescribed by law. The gender of the guardian is not significant.

It was stated above that this preference can be used only by one of the parents if there is one disabled child, and by both parents if there are two or more disabled children. Also an important condition is the presence of work experience of at least 15 years for a woman or 20 years for a man.

However, when receiving this preference, there are also differences in the case when the recipient is a parent or guardian. Let's look at it more clearly.

| No. | Recipient of preference | Conditions for receiving preference |

| 1. | Blood parents | If one of the blood parents applies for early retirement, then the period for which you can retire early will always be five years. |

| 2. | Guardians | The following rule applies to guardians of a disabled child: for every 18 months of guardianship, one year is deducted from the retirement period. However, the maximum number of years for which you can retire early is five. This means that in order to receive the maximum five years, the guardian must have raised the disabled child from the age of seven and a half years. |

Legal aspect

Basic regulations on the assignment and payment of citizens' pensions apply to this situation.

This is primarily Federal Law No. 166 of December 15, 2001. The responsibilities of the parents of a disabled child are provided for by the norms of the Family Code in Article 81. According to this norm, the care and supervision of such a child requires increased attention.

The right of care for the parents of a disabled child is provided for by the rules set forth in Article 28 of Federal Law No. 173, adopted in December 2013 by Federal Law No. 400, namely, Chapter 6 defines the rules for the early exit of parents of disabled children.

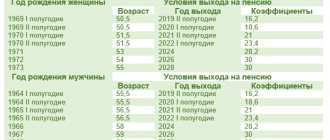

Therefore, parents can retire early, women at the age of 50, men at the age of 55. Taking into account the pension reform, this age will gradually increase. So for women in 2020 it will be 50.5 years, for men – 55.5 years.

If there is one child in the family, then this right applies only to one parent. The decision about who will exercise this right is made independently by the family.

If there is more than one child in a family with disabilities, then each parent is entitled to early exit.

To obtain the right, such people must have accumulated a certain amount of work experience.

Amount of preferential pension

The size is determined by analogy with the algorithm for calculating the usual old-age insurance pension (not preferential) and depends on:

- the total amount of insurance premiums received by the Pension Fund of the Russian Federation for the insured person;

- the amount of pension rights acquired before January 1, 2002.

That is, essentially the size will depend on:

- the employee’s salaries in the past (the higher the salary, the higher the pension subsequently);

- duration of insurance period;

- age of application for an insurance pension;

- number of pension points.

Early pensions for the unemployed are subject to all indexation of the insurance pension.

Peculiarities of retirement due to health reasons among military personnel and employees of the Ministry of Internal Affairs

Unlike ordinary citizens, in relation to this category, a separate law establishes the right to a pension for long service upon dismissal for health reasons.

Such payments are made subject to the following conditions:

- on the day of dismissal the citizen was already 45 years old;

- the person has a total working life of 25 years;

- the duration of service in the armed forces or the Ministry of Internal Affairs is at least 12.5 years;

- there is a conclusion from a military medical commission that the citizen cannot continue to serve.

This law also provides for a pension for health reasons if it is received during the period of service.

Are parents of disabled people entitled to only one pension?

Currently, pensioners in the Russian Federation receive two types of pensions:

- insurance benefits received by able-bodied persons;

- social benefits received by disabled persons.

Above we discussed the conditions for assigning an insurance pension, which able-bodied parents with a certain length of service can receive on preferential terms.

Only parents who do not have a single day of insurance coverage can receive a social pension. Also, this type is received by disabled people and incompetent persons due to the loss of a breadwinner, but we do not even consider these categories, since they cannot, by law, be representatives of a disabled child.

That is, in fact, there is only one pension, the official recipient of which is the parent. But our help to families with a disabled child or childhood disability does not end here.

They also receive support not only in the form of pensions, but also in the form of social benefits, namely:

- to the parent or guardian of a disabled child (under 18 years of age) or a disabled person from childhood of group I (over 18 years of age) - in the amount of 5,500 rubles ;

- other persons – 1200 rub .

Parents of groups 2 and 3 disabled since childhood do not receive such care benefits.

In addition, the child himself, due to his disability, receives a social pension and EDV, and since the parents are legal representatives, in fact they are the ones who receive these payments.

| Social payment | Disabled children | Disabled since childhood | ||

| 1 group | 2nd group | 3 group | ||

| Monthly cash payment (MAP) | 2701,62 | 3782,94 | 2701,62 | 2162,67 |

| NSO (in monetary equivalent) | 1121.42 rub. | 1121.42 rub. | 1121.42 rub. | 1121.42 rub. |

| Social pension | 12432,44 | 12432,44 | 10360,52 | 4403,24 |

*in the bottom line in brackets the maximum amount of EDV is indicated, subject to refusal to use NSO in kind

Payments are indexed several times a year. As a rule, their size increases after this.

Procedure and rules for registering disability due to health

The procedure is divided into several stages. If the patient is bedridden, to register the disability you will need a notarized power of attorney for the representative. Registration procedure:

- A citizen undergoes a medical examination in a hospital.

- Registration with the ITU Bureau. The pensioner fills out an application and attaches documents along with copies. The originals are registered, verified, and then returned to the applicant.

- Setting a date for passing the ITU. The examination can be carried out in a month or six months. The date of completion depends on how busy the bureau commission is.

- Passing the ITU . On the appointed day, the citizen comes to the bureau. Bedridden patients undergo MSA at home or in the hospital (with preliminary hospitalization for a couple of days).

- Obtaining examination results.

What documents are needed

To undergo a medical examination you will need:

- passport;

- referral to ITU;

- survey results;

- patient's outpatient card received against signature;

- employment history;

- characteristics from the last place of work;

- act of injury at work or occupational disease (if health problems arose due to work).

Referral to ITU

The registration procedure begins with a visit to the attending physician. The specialist issues a referral for tests and prepares medical documents for medical examination. The research results are sent to the hospital commission. After its approval, the patient is given a referral for medical examination. The mailing list states:

- data on the patient’s health status;

- past illnesses (heart attack, stroke, cancer, etc.);

- test results;

- necessary rehabilitation equipment (stroller, hearing aid, etc.)

Medical and social commission for disability

The ITU date is determined by the citizen’s health. In case of temporary incapacity without the possibility of improving the patient’s condition, an examination is carried out after 4-5 months. If the prognosis is favorable, the ITU will be appointed 10 months after submitting the application. In case of a rapidly progressing disease, the examination is carried out within 1 month. The medical and social commission includes 3 doctors:

- Clinical pharmacologist.

- 2 medical specialists (profile depends on the nature of the disease or injury) with higher medical education.

The chairman of the commission is the head of a medical organization or one of his deputies with a higher medical education. The procedure for conducting the examination:

- Citizen survey. His physical condition is being assessed.

- Study of submitted documents.

- Analysis of social and everyday skills. The patient is asked questions and his behavior is assessed. An employed citizen submits a reference from his place of work to the ITU for examination. The document is needed to establish the degree of disability. The boss can indicate in the characterization deviations in behavior that appeared after receiving an injury or that the citizen has always had.

- Making a decision by voting.

Expert opinion on group assignment

The commission can assign or deny disability to a citizen. In both cases, a conclusion is issued. When a group is assigned, the patient is given a certificate of disability and an individual rehabilitation program (IPRA). The latest document states:

- rehabilitation means;

- drugs to restore health;

- types of sanatorium-resort treatment necessary for a disabled person.

- How the elderly are deceived on the Internet

- Can coronavirus spread through air conditioners?

- Angora cat - description and standard of breeds, colors and coat type, characteristics of behavior and education

Disability is established indefinitely or for a certain period. In the conclusion, indicate the time of passing the commission to confirm the status. When the document expires, the status is canceled. To restore it, you need to go through the ITU again. In case of lifelong disability, re-examination is not necessary. This is also indicated in the document. Standard frequency of re-examination:

- disabled people of group 1 every 2 years;

- disabled people of 2-3 groups annually.

Diseases for which permanent disability is recognized:

- oncology in the last stages;

- complete deafness and blindness;

- paired hip amputation;

- diabetes mellitus with many functional disorders;

- schizophrenia;

- epilepsy with severe mental disorders, etc.

Transfer from disability pension to old age pension

The transition to old-age social benefits occurs when the disabled person reaches the appropriate age. To receive an old-age pension, it is necessary to contact the Pension Fund of the Russian Federation, since this process occurs automatically, but it is necessary to correctly calculate the amount that an individual is entitled to. The more information provided about work experience, military service and participation in civilian activities, the greater the payment.

Monthly disability payments will be added to the amount of the insurance pension. They are fixed for each group of disabled people:

- Group I – 3540 rubles;

- Group II – 2527 rubles;

- Group III – 2022 rubles;

Payments to disabled children are equivalent to payments to disabled people of group II and amount to 2,678.31 rubles.

You must apply in advance - two to three months before retirement age. Documents you will definitely need are a passport or a residence permit for foreign citizens. Also, you need a certificate of pension insurance and official confirmation of work experience and socially significant periods (military service, maternity leave, and for some professions, also years of study).

If there is no work experience or the opportunity to provide proof of his years of work (when the citizen worked unofficially), then the pension will also be paid, but in a smaller amount without taking into account work experience.

Who can retire early

The following groups of people can retire early:

- persons whose profession is associated with risks and danger (these are nuclear energy workers, miners, military personnel, employees of the Federal Penitentiary Service, etc., the full list can be found in Resolution of the USSR Cabinet of Ministers of January 26, 1991 N 10);

- persons who live and work in unfavorable geographical conditions, such territories include the regions of the Far North and equivalent areas;

- people with a certain social status are mothers of many children, midgets, disproportionate dwarfs, disabled people and their guardians.