The state provides support to citizens who want to take a decent vacation. Everyday work will soon disappear into oblivion and the former employee will receive modest payments instead of wages. To do this, you need to apply for an old-age pension. To complete this operation, the pension fund requires the birth certificate of the child (children), and sometimes the CoP of the pensioner candidate himself. It’s good if parents maintain a relationship and live in the same city as their son or daughter. But what if they live far away and it’s impossible to just pick up the certificate? We will try to cover this problem as deeply as possible and find a way out of the current situation. Let's get started.

Documents for the pension fund

To apply for a pension and recalculate it, Pension Fund employees require a standard package of documents from applicants:

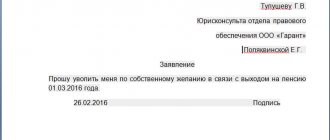

- Application for a pension

- Civil passport and other papers containing information about the citizenship, place of residence and age of the future pensioner;

- SNILS (plastic card);

- Documents on work experience;

- Information on the average monthly salary for a period of 60 consecutive months (until January 1, 2002);

- Bank details for transfer of designated funds;

- Other documents to confirm the circumstances related to the calculation of the pension.

The last point contains a huge pile of papers that are needed to receive and recalculate a pension, including a birth certificate for both yours and your children.

What documents are needed when applying for a pension?

The list of documents required for assignment or recalculation of a pension differs depending on the type of security. In addition to the application drawn up in the prescribed form, as a rule, the following is submitted:

- passport for all adult citizens of Russia (over 14 years old);

- residence permit (for stateless persons and foreigners);

- SNILS;

- documents confirming the existence of insurance experience (for example, a work book, extracts from orders);

- certificate of average monthly salary for 60 consecutive months until 01/01/2001;

- extract from the medical and social examination report (for disabled people);

- documents on the death of the breadwinner (for the loss of the sole breadwinner);

- confirmation of relationship with the deceased breadwinner (for the loss of a breadwinner);

- documentary evidence of belonging to the small peoples of the North (social peoples of the North).

- What to do if pension savings are transferred without your knowledge

- What deadly diseases are indicated by tinnitus?

- Banks warned about the danger of writing off alimony to pay off debts

Why does the Pension Fund need a certificate?

To answer this question, it is necessary to decipher what lies beneath the additional circumstances. It seems that a person has worked all his life for the good of his Motherland, but he was burdened with bureaucratic excesses, creating obstacles to a peaceful retirement. In fact, everything is logical and quite simple; a birth certificate is needed for:

- Confirmation of relationship with the child;

- Reconciling information from the CoR with other documents, checking the correct spelling of the applicant’s name and information;

- To recalculate the basic part of the pension if children are dependent (up to 18 years, in case of full-time study up to 23);

- When recalculating the insurance portion relative to the time of caring for a child up to 1.5 or 3 years (while on maternity leave);

- If the pension is issued early (the son or daughter is disabled);

- The applicant is a mother of many children.

As you can see, the list of reasons why pension service employees may require a birth certificate is quite impressive. But what to do if there is no access to the metric, and people are separated by hundreds and sometimes thousands of kilometers?

Why does the Pension Fund require children's birth certificates?

Question to the expert: “Why does the Pension Fund need a birth certificate for children when applying for a pension and does it need it at all?!”

When applying for a pension, we present to the social security service for verification, among others:

- passport;

- SNILS;

- work book;

- certificates – archival, from the employment service; on wages for the period of work determined by the law on calculating pensions;

- other documents that can certify family status and field of activity (military, business, etc.).

The Federal Law on Pensions (Article 18, Part 3, Law No. 173) talks about the obligation of those applying to submit the required documents to the social security officer.

A birth certificate (CoB) of a candidate for pensioner may be needed, for example, if the name, patronymic or surname is incorrectly spelled in any document, a possible typo, or an incorrect (uncertified) correction.

The following documents may be required by the social security service:

- about disabled family members;

- about the presence of dependents;

- about changing the surname, name, patronymic;

- on establishing disability.

A future pensioner may have children under 14 years of age.

The documents confirming their age will be the CoP or adoption document. Clause 29 of the List of Documents indicates the need to submit a document on marriage, change of name, divorce, and a copy from the registry office.

The same documents are required (including CoP) to confirm the relationship of family members (clause 37), as well as full-time education of children over eighteen years of age in various institutions of the educational system (of course, with the availability of their certificates).

A future pensioner will not need a SoR when registering (except for the cases specified above), but in the sad case of applying for a pension for the loss of a breadwinner, they are, of course, necessary (consultation on this issue will definitely be provided at the Pension Fund office).

Social Security employees will require the presentation of the children's SoR:

- In connection with the recalculation of the pension (its basic part) for a dependent family member (son or daughter under 18; maybe older, but studying full-time - until 23).

- To determine the size of the insurance portion (this means caring for a child up to one and a half or three years old - at different times when pension laws were in effect).

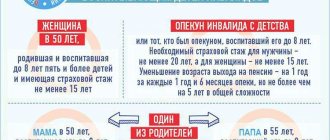

- In case of early retirement (the child has been disabled since childhood).

- If the woman is the mother of five or more children.

Lawyers discuss cases from practice when citizens, in order to increase old-age benefits, reveal the presence of children who have already died, hiding death certificates. This is another circumstance (whether tragic or comic - in any case outrageous) of the mandatory requirement to present a birth certificate for children.

Is it possible to provide a copy of the CoP?

If the child lives in another country or city and it is not possible to transfer the certificate, you can provide a copy of it. But a simple copy for registration is not suitable for a pension fund - it must be notarized. To do this, you should contact a notary with the original document. Notarization of documents from the registry office is inexpensive. The cost of this service ranges from 200 to 300 rubles. You can then send a certified copy by post, preferably by registered mail. Nobody forbids sending the original certificate, but there is a high probability of its loss. If it is lost, you will have to restore it, pay a state fee and overcome new rounds of bureaucratic hell. After all, as you know, children’s metrics are necessary for a citizen throughout his life.

How to verify your salary

As already mentioned, the Pension Fund of the Russian Federation does not have data on the activities of workers before 2002, but specialists are required to know the average earnings for this period. In 2001, the system was already in effect, so the option is this: the citizen simply agrees to take into account the average monthly earnings for 2000-2001 when calculating his pension.

However, it also happens that a citizen did not work during this period, or his income was insignificant. In this case, he has the right to request that earnings data be taken into account for any 5 consecutive years preceding 2002 (60 months). Confirmation, of course, must be documentary - a certificate from work.

We have listed all the main documents for assigning a pension. However, depending on the situation, the Pension Fund may require additional certificates. If there was a preferential period of service and the pension is granted early, it must also be confirmed. Please note that all forms must be filled out carefully and contain the required details: last name, first name, patronymic of the employee, clearly indicate the position, dates of periods of activity.

Where to apply for a pension

To apply for a pension, the child’s legal representatives must contact the territorial representative office of the Russian Pension Fund at their place of residence (registration, actual residence). The application is formalized by sending a corresponding application, which is accompanied by documents for obtaining a pension for a disabled child:

- Birth (adoption) certificate of the child for whom pension support will be established;

- ID card of a representative of a disabled child;

- conclusion of a medical and social examination (MSE), which confirms the child’s disability;

- SNILS of the applicant and representative.

Documents can be sent to the Foundation either in person or by mail. It is also possible to submit documents through the multifunctional center. The appeal is considered within 10 working days (that is, excluding weekends and holidays), based on the results either a pension is assigned or a reasoned refusal is issued.

The amount of the established pension is determined by law. In 2019, disabled children receive a pension in the amount of 12,432 rubles. From April 1, the pension for disabled children will rise by approximately 2% and will amount to 12,731 rubles. In addition, the parents (guardians) of the child will receive an appropriate additional payment, and the entire period of care will be included in the insurance period with the accrual of 1.8 pension points annually.

In most cases, children are not assigned an indefinite disability pension until the age of 18, but a fixed-term one. Upon expiration of the period, you will have to re-confirm your disability and apply for a pension. But in this case, as documents, you will only need passports, birth certificates, ITU acts and SNILS. The Pension Fund will not require any other documents.

Unlike a disability pension, maintenance due to the death (disappearance) of the breadwinner is established indefinitely until the child reaches 18 years of age, or 23 years of age if he or she is studying full-time at a secondary school or university.

Confirmation of “non-insurance periods”

The most likely version, which easily explains the need to provide a child’s birth certificate, is related to changes in pension legislation. The thing is that since 2020, the amount of pension payments has an important influence on the so-called non-insurance periods. These include:

- Compulsory military service.

- Living with spouses of officers or contract soldiers in regions of the country where there were no employment opportunities. This period cannot exceed five years.

Care for disabled people of group I, which is carried out by able-bodied persons.- Removal from work duties due to unfounded criminal prosecution (the period is counted only if there are documents confirming rehabilitation).

- Caring for an elderly person over 80 years of age.

- Service in the army, internal affairs bodies and other law enforcement agencies without acquiring for any reason the right to a pension according to length of service or disability.

- Documented care for a disabled child.

- Residence outside Russia of spouses of diplomats and other officials.

- Care by one of the spouses for children until they reach the age of 1.5 years (the period cannot exceed 6 years).

During these “non-insurance periods” additional points are awarded that affect the amount of the pension. Therefore, it is necessary to submit documents that are the basis for recalculating the amount of pension payments. This includes the child’s birth certificate.

Attention! As part of our website, you have a unique opportunity to receive free advice from a professional lawyer. All you need to do is write your question in the form below.

Payments for children due to pensioners

It is important to understand that we are not talking about any independent payments; pensioners can only receive an increase in their pension. As of January 2020, a law defining new rules for calculating pensions came into force. Now the length of service includes non-insurance periods, in particular, parental leave for up to one and a half years, in which one of the legal representatives (parents) was. Those pensioners who retired after January 1, 2020 do not need to provide their children’s birth certificates to the Pension Fund to recalculate their pension; the calculation was initially made in accordance with the new requirements.