According to the letter of the law, persons who have reached retirement age but continue to carry out professional activities and who have a dependent who is a minor child may qualify for a pension supplement. The additional payment to the pension for a minor child to a working pensioner will be determined individually in each case. It can be calculated in the form of:

- a specified percentage applied to the basic pension rate;

- pension points.

We’ll tell you exactly how to get the bonus you’re looking for, where to go, and what to expect in the following material.

Additional payment to the pension for a minor child for a working pensioner

How to apply for a supplement to the pension for children

As you know, pensioners are a category of citizens who, in general, have a greater number of benefits than other residents of our country. The thing is that pensions rarely provide them with a really decent standard of living, and they cannot work at the same pace. Therefore, Russian state policy involves various types of support for the desired category of persons.

In particular, in this case we are talking about a pension supplement for minor children. It is needed by pensioners who, for example, were able to have a child shortly before reaching retirement age, and at the time of filing an application for recalculation of payments from the state, he is still a minor, that is, a dependent requiring:

- full provision of his existing needs;

- constant assistance from parents, who are the only source of funds necessary for his existence.

In this case, the dependent must have:

- biological connection with a pensioner;

- other legalized family relationship with the person applying for an increased pension.

Thus, we can conclude that the supplement to the pension for children is due only to those pensioners who fully support their own children, providing them with:

- housing;

- food;

- clothes;

- education and other needs;

It should be understood that in addition to minor children, dependents may also be the offspring of pensioners who:

- are disabled for any reason;

- may be adults, but are studying at higher educational institutions or other organizations.

The required pension supplement is established at the following two state levels:

- federal;

- local.

This means that the budget for the payment of pensions and their amount will be formed not only through government regulations, but also taking into account the capabilities of each specific subject of the Russian Federation.

The amount of pension that will be added to each pensioner will be determined according to the number of dependents living with him

Supplement to pension payments at the local and federal levels

Let's look at one very important issue: which payments are allocated from the federal budget and which from the regional budgets. Let's look at the information we are interested in in the table below.

Table 1. To whom are pension payments allocated from the federal and regional budgets intended?

| Federal budget | Regional budget |

Thus, the funds that go to pensioners from the federal budget of our state are aimed directly at supporting children who:

| As for the money allocated by the regions, it must be said that in each municipality the authorities are developing specialized programs to support pensioners. In the required case, persons of retirement age who are:

|

Conditions for granting the allowance

The presented type of pension supplement for persons of retirement age who have assumed the responsibility to provide for dependents who are related to them is carried out only if the following conditions are met:

- Persons receiving pension payments who are not employed elsewhere receive additional payment without the need to provide evidence of their entitlement, in the case where the children are minors.

- If we are talking about receiving an allowance for children who are adults, but are unable to work independently, it will be necessary to submit documents for consideration to the Pension Fund that will prove the required condition of these dependents.

- To apply for a supplement for children studying at higher educational institutions and who are adults, you must provide a certificate from the educational institution.

Certificate of training

Procedure for applying for an allowance

Today, receiving the payment we are interested in is possible, provided that it is carried out in accordance with certain rules. We present a list of stages that you will need to go through to get the desired bonus.

- Writing an application and submitting it, complete with documents confirming your eligibility, to the Pension Fund of our country.

- Receipt by the desired government agency of the papers you submitted and consideration of the application.

- Representatives of the Pension Fund of the Russian Federation make a decision and notify the pensioner about it.

The period for reviewing documents on your application will be no more than 10 working days. After their expiration, and possibly earlier, you will receive official notification regarding the results of the review.

If your application is approved, your first pension increase will come to you as early as next month

You can submit your application for consideration not only directly to the Pension Fund specialists, but also through:

- state portal "State Services";

- Multifunctional Center.

However, in this case, you should understand that if you do not hand over the documents directly to the PF specialist, the waiting period increases to 30 days.

What is the recalculation of pensions for children born before 1990?

Benefit recalculation is the process of making changes or additional data to a pensioner’s pension file, which results in an increase in cash payments on an ongoing basis. The current legislation of the Russian Federation defines a number of persons who have the right to recalculate pension payments due to reasons provided for by federal and regional regulations. Relatively recently, the law introduced the right to supplements for mothers who gave birth to 2 children (or more), and now a certain category of women has the opportunity to recalculate their benefits according to the “new” rules.

Regulation by law

Due to recent changes in the pension legislation of the Russian Federation, in the regulations that regulate labor relations, the concept of “individual coefficient” has appeared. Article 12 of Federal Law No. 400 indicates that the insurance period of one of the parents may take into account the time spent caring for a child. During this period, the woman is on maternity leave and the employer does not pay insurance premiums for her. In order to preserve pension rights for mothers, legislation takes such activities into account in the total length of service and assigns a certain number of individual coefficients (pension points).

It is also worth noting that this recalculation for women who have given birth to two or more sons and/or daughters in marriage does not differ from the recalculation procedure for single mothers. However, bonuses for women who gave birth to children before the specified period can be paid only if all the requirements and conditions defined by law are met.

What documents are needed to receive additional payment to the pension for children?

As we have already said, in order to receive a cash supplement, you need to collect a package of documents confirming your right to possess the funds you are looking for. We are talking about the following papers.

1. An application with a request to recalculate your pension, adding an increase for children to its amount.

2. Documents for dependents:

- passports;

- birth certificates.

3. The pensioner’s work book in the form of an original and a notarized copy.

Employment history

4. A certificate stating that other specialized additional payments do not receive:

- dependents;

- pensioner;

- spouse of a pensioner.

5. Provided that the pensioner is an individual entrepreneur, he must provide a certificate of registration of the individual entrepreneur with the tax service.

6. A paper confirming the fact that specific individuals are dependent on a pensioner - usually this is a certificate of joint residence of persons.

7. A certificate from the university, which will indicate:

- dependent's form of education;

- date of enrollment at the university;

- date of expected completion of training.

8. An extract from a person's pension account.

9. Provided that you have already applied for an allowance, you will have to renew it every year. In this case, each time you will need to submit for consideration to the Pension Fund:

- work book;

- a certificate indicating that the dependent and the pensioner are registered at the same address;

- documents for the student.

Procedure

The maximum increase for vacations is 6 years. This is 4 maternity leaves, and therefore, for the 5th maternity leave there will be no accounting of length of service.

The maximum increase for 4 children is 1909 rubles and 50 kopecks - despite the fact that the woman’s maternity leave was not taken into account in her work experience (she did not work).

If this condition is not met, then the premium will be less than the maximum:

- since during these periods the subject received a salary, and the period of work will be replaced by a period not related to PFR insurance;

- The period of working activity is reduced due to its transformation into a non-insurance period.

The size of the increases also depends on:

- age of the pensioner;

- pensioner's legal capacity;

- number of dependent persons;

- whether these persons have disabilities;

- territories - additional increases are provided at the regional and municipal levels.

You can apply for recalculation at any time - there is no statute of limitations or periods for filing an application. Recalculation is made from the 1st day of the following month after the month the application was submitted. There will be no recalculation for previous periods.

How is the pension increase for children calculated?

According to the current legislative acts in force in the field of calculating pension payments in favor of persons supporting a dependent, the current amount of allowances for the type of accrual we are interested in is:

- cannot be less than the current living wage in Russia;

- is subject to annual indexation, after which its size will be increased;

- subject to regulation by legislative acts in force in the required area in the territory of a specific region of the country;

- is calculated according to the specific category to which the pensioners applying for payment belong.

How is the pension increase for children calculated?

When calculating the amount due to a particular pensioner, Pension Fund employees take into account the following factors:

- the number of children dependent on the pensioner: minors, students, disabled people;

- current age of a person of retirement age;

- family place of residence;

- whether the pensioner has employment;

- belonging to the category of military personnel, athletes, etc.

Now let's look at the specific amounts discussed in this article.

Additional payment for mothers of many children

Pensioners who are mothers of many children have the right to:

- early payment of pension;

- obtaining pensioner status upon reaching 50 years of age, provided that the total length of service as a citizen is 15 years or more.

The amount of additional payments for mothers with many children is determined according to:

- region of residence of the family;

- the current demographic situation in a specific subject of the Russian Federation.

Supplement to pension for a child born in the USSR before 1990

Starting from 2020, women pensioners have the right to receive an additional payment to their pension for the birth of children before 1990, provided that they reached retirement age before the year the law on this pension payment was adopted.

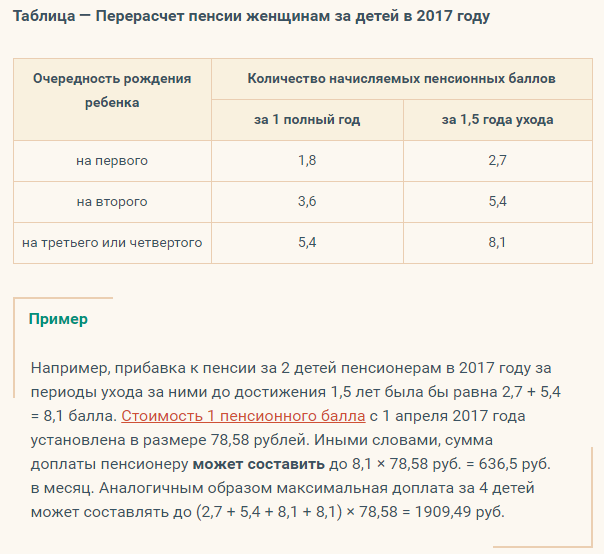

In the image below you can see the number of points that will be awarded to female pensioners in this category.

How many points are awarded to pensioners of the required category?

Read more detailed information about this surcharge in a special article.

Video - Supplement to pension for children born before 1990

Additional payment per student

So, for example, when calculating an additional payment for a dependent student, the amount of payment will also be determined by many additional circumstances. If a person provides support for a full-time student, then the amount of the fixed allowance for one child will be 1 thousand 607 rubles and 7 kopecks. Accordingly, in order to calculate the allowance for two dependent students, it is necessary to multiply the specified fixed amount by half.

A pension supplement can be received for a dependent student

Additional payment for a minor

In addition, various circumstances affecting payments will also be taken into account when determining the amount of payment for minor children.

Provided that the pensioner is not disabled and does not have the right to receive other types of social category payments, or to receive any benefits other than pension insurance, he may qualify for payments in the following amounts.

1.

Provided that a person of retirement age is not yet 80 years old, he/she applies for the following benefits:

- 3 thousand 416 Russian rubles per child;

- 4 thousand 270 rubles for two children;

- 5 thousand 124 rubles for three.

2. Citizens whose age has reached or exceeded 80 years have the right to receive support from the state for a dependent in the amount of:

- 5 thousand 978 rubles per child;

- 6 thousand 832 rubles for two;

- 7 thousand 686 rubles for three children.

Additional payment for disabled people and residents of certain areas

Pensioners who are disabled and receive an appropriate benefit, or live in the Far North, or in other regions, under conditions equivalent to it, receive bonuses in amounts varying:

- from 4 thousand 4 rubles 26 kopecks;

- up to 21 thousand 623 rubles.

You can see the payout amounts in more detail in the image below.

Allowances due to pensioners of a certain category

What additional payment for children is due for a military pensioner?

Military pensioners receive a pension for their length of service, which is calculated in accordance with the relevant legislative acts. They are also expected to receive additional pension payments, which, however, can only be received if dependent persons do not receive:

- other insurance category security;

- other provision for the pension category.

What kind of child benefit can a military pensioner receive?

The amount of the required payment for military pensioners is determined according to the percentage relative to the pension already accrued to him. It can be:

- 32% of the pension for one dependent;

- for two people the percentage rises to 64 units;

- for three dependents, 100% of the pension amount is subject to addition.

In one of the special articles, we will look at what pension supplements pensioners are entitled to for serving in the Soviet army.

Calculator for calculating military pension with dependents

Go to calculations

Supplement for working pensioners for children

For working pensioners, the amount of payment is also determined separately. So, provided that they support minors, they are entitled to a payment, the amount of which will correspond to 1/3 of the old-age payment due to them per child.

At the same time, according to the law, working pensioners cannot receive payments for more than three children.

You may be interested in information on how to get additional leave for a working pensioner. In the material presented we will tell you how to write an application for a well-deserved rest.

Cash bonuses for pensioners of the Ministry of Internal Affairs

At the Federal level, payments are also determined for another separate category of pensioners - persons who served in the Ministry of Internal Affairs.

The amount of payment for representatives of this category will be 32% of the pension already accrued to them for one minor child, or adult child studying full-time at a university. Accordingly, for two children this percentage will be equal to 64 units, for three – 100%.

Please note: even if there are two pensioners in the family, and both of them belong to the Ministry of Internal Affairs of our country, only one of them can qualify for the additional payment.

Who can apply for recalculation

The category of persons whose pensions are affected by the changes that came into force in 2020 are women who took parental leave before 2020.

Important! It does not matter in what year the child (or children, if there were several leaves) was born - before 1990 or after.

Information is actively disseminated among the population that an increase is provided specifically for women whose children were born before 1990.

In reality, these rumors are not groundless - in the Soviet Union there was a different system for calculating length of service and pensions. When recalculating, pensioners whose maternity leave was not counted toward their length of service before 1990 can count on a profitable increase, while for later children the benefit is insignificant or even goes into the negative.

The work experience available during the Soviet period for these categories can be converted into pension points, which significantly affect the size of the pension after the adoption of a new reform with the division of benefits into insurance and funded parts.

And women who gave birth after the collapse of the USSR worked under different Russian laws, and their length of service was taken into account differently, which makes the recalculation not so positive for them.

Submitting an application is effective in the following cases:

- for pensioners who were not employed during this period—the first year and a half after the birth of a child. If earlier this time was not counted towards the length of service at all, since the woman was unemployed, now she will receive points towards her pension for it;

- the woman had at least 2 maternity leaves and each for up to one and a half years;

- there was a multiple pregnancy and more than 1 child was born - as a result, she received longer maternity leave;

- minimum experience;

- there were low wages - identical to or slightly more than the subsistence minimum;

- A woman's pension before recalculation does not exceed the subsistence minimum.

The recalculation will reduce the pension for women who cared for only 1 child or had a high salary or long experience, incl. experience in the form of caring for a dependent.

Those citizens who have retired or are planning to retire early for long service, when recalculated, lose the right to early retirement for well-deserved retirement, so they are faced with a dilemma - to receive a recalculation or keep an early pension.

Types of pension benefits

It must be said that the additional accrual of funds to pensioners for the maintenance of children is initially subject to division into several main categories, according to the circumstances relevant to each pensioner. We will consider what categories we are talking about further in the text.

What are the pension benefits?

Supplement to insurance pension

The required type of additional payment, which potentially in the case under consideration becomes part of the insurance pension, is supposed to be paid only to those pensioners who do not receive other additional payments of the social category. In this case, the part of the pension that is paid as security will be subject to increase:

- on disability of a citizen;

- due to old age.

The right to receive a bonus in this case is relevant for pensioners:

- continuing to work;

- who have completed their careers.

However, for each of the listed categories, the amount by which the state payment received each month will be raised will vary.

Existing supplements to insurance pensions

Supplement to social pension

An additional payment to the pension in the required conditions will be provided to those pensioners who:

- receive early pension payments due to the fact that they are disabled;

- have work experience accumulated while working in the Far North and territories equivalent to it in terms of conditions.

These persons are entitled to a regional supplement for the maintenance of minors or disabled family members. In this case, the amount of payment will be determined under the influence of the following factors:

- conditions presented by regional programs of a specific constituent entity of the Russian Federation;

- when taking into account pension coefficients;

- according to the amount of funds received by the pensioner, defined as his income.

Additional payment for pensioners who are military or athletes

The current legislation of the Russian Federation implies that pensioners can receive a monthly supplement to the main part of the pension, provided that they:

- previously served in the military;

- have earned any sporting achievements, or have titles in this field.

In this case, in order to receive funds for children, it is also necessary that the specified categories of pensioners:

- received insurance pensions for long service;

- received insurance pension benefits for their length of service;

- kept minor children, adult students, or disabled people as dependents.

What payments are due to pensioners for children?

Citizens of the Russian Federation can receive security in connection with:

- disability;

- reaching retirement age;

- due to the loss of a breadwinner.

Only those who have been assigned disability or old age support payments can receive an increase in their pension for children.

Now, in addition to periods of work, its size is also affected by “non-insurance periods”. In particular, the provision of care for each child under 1.5 years of age by one of the parents.

Let's sum it up

What the amount of the pension supplement for children will be depends on which category of pensioners you belong to, as well as which dependents are supported by you. Read the article carefully and determine what documents you need to collect in order to receive the funds due by law, prepare them, and go to the Pension Fund.

Receiving the required bonus is your legal right

How and where to apply

You need to know that there is no automatic recount; the citizen’s personal initiative is required. To do this, you need to fill out an application indicating that you refuse the previous rules for calculating pensions and ask to apply new ones, according to the data provided. You can submit a request in several ways:

- Visit in person the PF service where your pension accruals were issued, and attach the required official papers.

- Go to the MFC and leave a request there, if this structure provides such services in your locality.

- If you have an account with the EPGU, then it is easy and simple to submit an application by sending it electronically. However, you will have to submit the documents yourself within a week after submitting your application.

- By mail, registered mail. This method requires printing out an official form, filling it out, and notarizing copies of all attached documents.

- Using the Android and IOS application “Electronic Services” from the Pension Fund.

An addition to the pension for children is made if the parent confirms her identity, certifies the birth of her offspring and confirms that they were cared for for up to one and a half years. After filling out the official supplement application form, you will need to submit the following documents:

- passport or other identity document;

- SNILS;

- papers indicating the birth of children (birth certificates or registry office certificates);

- documentary information that the child has reached one and a half years old and has been properly cared for - his passport, certificate, and other documents.

Submission deadlines

There are no time frames or restrictions on submitting information for recalculation, however, the sooner you submit the application, the faster - if a successful combination of circumstances - the premium will be accrued. This explains the excitement that has gripped pensioners who want to quickly receive the coveted additional payment. However, in order to avoid standing in queues, the management of the Pension Fund recommends waiting a little, and calmly, in comfortable conditions, carry out the required recalculation, without wasting time and nerves.

Directly in front of the applicant, the employee makes preliminary calculations, on the basis of which an opinion is made as to whether the recalculation will be profitable or not. If the pension amount becomes smaller, then recalculation will not be made, everything will remain as it is. If calculations show that you can qualify for an additional payment, then the documents are reviewed for 5 working days, after which an official decision on the additional payment is made. The deposited money will be added to the next monthly payments.

After all the necessary documents have been collected and the decision on the advisability of recalculation has been made, you should submit a corresponding application to the Pension Fund of the Russian Federation.

Note! According to the current legislation, which came into force at the beginning of 2020, missed months for which the required additional payment to the pension for children was not made due to the fact that the pensioner did not consider it necessary to recalculate on time or did not know that such an opportunity had arisen are not paid there will be!

There are no deadlines for submitting applications, but if you understand that the increase in your pension will be significant, it is better not to delay its registration:

- if the recalculation was not in your favor, do not worry, the pension will not be reduced, everything will just remain as it is;

- if, on your application, a positive decision is made and it is established that pension payments are subject to increase, the increase will be taken into account only from the next month after its appointment.

Are they saved?

northern pensions when moving to the middle zone

?

How to apply for an old-age pension in 2020? Find out here.

Increasing pensions for people with children

Recalculation of pensions for pensioners with 2 or more children is based on the number of accumulated points.

Federal Law No. 400 of 2013 stipulates how much IPC they will receive for the period while they were caring for children.

They are presented:

- for 1–1.8 points;

- when 2 appears - 3.6;

- for the third and subsequent ones – 5.4.

If a citizen retires early, she is not advised to apply for a recount. In this situation, the result of the operation will be a reduction in the amount of the benefit.

How much will the pension supplement be at the time of recalculation?

It will not be possible to accurately calculate the supplement to the benefit of a mother with 3 children. Data from the pensioner's file is needed. The final amount is called by Pension Fund employees, who take into account all the features.

If a citizen has 2 children and a small output, she can expect an additional amount close to the maximum.

The monetary value of the premium depends on the value of the point. This figure changes every year. In 2020, the IPC costs 93 rubles.

If a citizen has 2 children, then the calculation is carried out as follows: 93 * 5.4 = 502.2 rubles. A person can count on this amount.

Accrual conditions

To accrue additional payments to the pension, a working pensioner must meet the conditions established by law. These include:

- the person must have the right to receive pension benefits or receive it;

- the pensioner must have an official place of work;

- The pensioner must be dependent on minor children, or disabled people, or adult children studying full-time.

- the citizen must submit all the necessary documents and submit an application to process the payment.

These are the basic conditions under which any Russian citizen has the right to apply for this additional payment.

The excitement around the recalculation of pensions caused mass appeals from citizens to Pension Fund branches throughout the country, including in Karelia. Pensioners are demanding that their pensions be recalculated in accordance with the federal law “On Insurance Pensions,” adopted several years ago. The reason was a video that appeared on the Internet, telling about the multi-thousand sums that pensioners could supposedly receive. The head of the Karelian branch of the Pension Fund, Nikolai Levin, has already made a statement that these expectations are in vain - the increase is not that big, and most pensioners will not receive it at all, or rather, they themselves will refuse the recalculation, because now the size of their pensions is much larger.

Pension Fund specialists explain how to get an increase in your pension and whether it’s worth applying for it at all.

Who is eligible for an increase?

Women who have one or more children (including adults born in Soviet times before the 1990s or later) and who retired into old age pension before January 1, 2020, can receive an increase by counting so-called “non-insurance” pension points as pension points. periods” in which they cared for each child until he reached the age of 1.5 years.

Until 2020, these periods were taken into account only in the woman’s work experience and did not affect the amount of the established pension.

For mothers who have taken their well-deserved retirement starting in 2020, both of these options (count the time spent caring for children as work or calculate it with points as a “non-insurance period”) have already been calculated by Pension Fund employees at the time of granting a pension, and most a profitable method according to the new law has already been assigned to them for payment.

Therefore, it makes no sense for such pensioners to apply to the Pension Fund for recalculation of payments taking into account childcare time.

In what cases will recalculation provide an increase in pension?

If during these periods the woman had breaks in work - in other words, if she was not employed at all at the time of the birth of the child and until he was one and a half years old (for example, if the addition to the family coincided with the woman’s studies at a college, technical school or university).

If a woman has 2 or more children - in other words, the more children were born, the more points can be awarded for them and the more significant the addition to the already assigned pension can be (however, according to the law, points can be awarded for no more than 4 children).

If, when assigning a pension, the pensioner’s taken into account salary in the period before 2002, which included caring for a child under 1.5 years of age, did not exceed the national average salary or did not exceed it by more than 20% (the maximum taken into account earnings ratio in force before January 1, 2002 year, the law “On State Pensions in the Russian Federation” was set at 1.2). In other words, if a woman at the time of the birth of a child had a low salary at her place of employment.

As a rule, due to all the above circumstances, a woman’s pension in most cases before January 1, 2020 was assigned a low amount (in practice, this is usually no more than the subsistence level of a pensioner - in most regions it is 10-11 thousand rubles as of 2020 ).

If such circumstances occur, and the pensioner has several adult children, then recalculating her pension may be beneficial to her.

If a woman has all the grounds for revising the amount of her pension, but the results of the recalculation still turn out to be “minus”, then the Pension Fund employees will make a decision to refuse, and the amount of payments will not change downwards.

Who is not entitled to recalculation according to the law?

In addition, it is necessary to keep in mind that there are certain categories of pensioners for whom such a recalculation is not allowed at all according to the law.

These include recipients of early pensions who, at the time of its appointment, have not reached the general retirement age and are no longer working (that is, do not belong to the category of working pensioners) - in this case, as a result of replacing work experience with pension points, they may lose the right to early retirement from -for a shortening of preferential length of service (this is, in particular, true for medical workers, teachers and other preferential categories).

Recipients of state pensions set at a fixed amount (including for living in territories affected by the Chernobyl nuclear power plant accident).

Recipients of a survivor's insurance pension (situations where the insured person himself has died or gone missing, and the pensioner is a dependent disabled family member, the fact of caring for children does not in any way affect the pension points of the deceased person, from which the amount of the payment was calculated ).

How much can a pension increase amount to?

The amount of additional payment to the pension for children born depends on a large number of individual factors. Even if two pensioners of the same age have the same number of children, in each specific case the amount of the increase will be different, since the place of work, length of service, salary and the moment of birth of children is determined individually for everyone.

Such a recalculation will definitely benefit women who did not work (for example, received education) at the time of birth and during the first 1.5 years of the child’s life. In this case, they simply add a new, previously unaccounted period for which pension points will be assigned.

If the period of child care falls during the mother’s employment, then it can be credited to her only in one of two forms, the most beneficial in each specific case (either in the form of length of service and the salary received during this period, or according to the new rules - insurance points). In this case, not the least role will be played by the amount of earnings a woman received during the “non-insurance period”, as well as how much her work experience will be reduced as a result of such a replacement.

According to Art. 12 of the Law “On Insurance Pensions”, the insurance period from January 1, 2020, along with periods of work, includes the periods of one of the parents caring for each child until he reaches 1.5 years, but no more than 6 years in total (i.e. no more than than 6 years / 1.5 years = 4 children).

At the same time, according to clause 12 of Art. 15 of the same law, for periods of child care up to one and a half years from 2020, the following number of pension points can be accrued (see table below and example of calculation).

However, in practice, the amount of the increase during recalculation in most cases turns out to be much less. The fact is that if a woman worked during the indicated periods, as a result of such a replacement, the amount of the already assigned pension will be reduced in proportion to the amount of earnings received during this period.

In this regard, for example, for the first child, the result of the recalculation may turn out to be negative, since the least number of pension points is provided for it, and such a replacement will not be economically profitable (especially if the mother worked in a good position and received high salary).

In other words, sometimes periods of work provide a higher increase in pension than 1.5 years of child care, so replacing these periods when recalculating the pension may turn out to have a “minus sign” and lead to a decrease in the size of the pension.

According to the territorial bodies of the Pension Fund of the Russian Federation, according to statistics, only in 20-30% of cases of the total number of requests a woman can receive an additional payment when recalculating a pension for children, while the average increase is in the range of 100-200 rubles (although in some cases you can get more an impressive amount, so it’s advisable to try).

Who does not benefit from recalculation?

In practice, an addition to the pension for children in 2020 will not be possible in the following cases

If a woman retired starting from January 1, 2020 (i.e. in 2015-2017) - in this case, the most profitable option has already been calculated and selected automatically when assigning pension benefits, since all the necessary documents are already available employees of the Pension Fund.

If a woman has only one child (pension points for the first child are minimal and the increase for them is usually completely “eaten up” by the reduction in length of service and earnings attributable to it).

If the woman’s pension was initially calculated based on the maximum earnings taken into account before 2002 (maximum 20% more than the national average - the maximum taken into account earnings ratio was then set at 1.2).

What documents are needed to recalculate mothers' pensions?

Recalculation of the amount of the insurance pension in connection with an increase in the amount of pension points (the value of the individual pension coefficient - IPC) for periods before January 1, 2020 is carried out in accordance with clause 2 of Art. 18 of the law of December 28, 2013 No. 400-FZ. It is carried out in a declarative manner - i.e. the pensioner will need to send to the Pension Fund an application for recalculation of the pension amount (the application form was approved by Order of the Ministry of Labor dated January 19, 2020 No. 14n), which, in accordance with clause 2 of Art. 23 of the same law is submitted with the simultaneous provision of documents necessary for such recalculation.

It is also necessary to understand that the recalculation of pensions for pensioners from January 1, 2020 in accordance with Art. 34 of the new law “On Insurance Pensions” was carried out on the basis of documents from the payment case. If any documents indicating that the woman was caring for children were not presented when applying for a pension, then they could not be taken into account automatically, and in order to take into account the period of child care in points, recalculation will need to be done on an application basis.

The application can be submitted in person to the Pension Fund client services, as well as through the MFC. In 2020, it is also possible to apply electronically through the “Personal Account” on the public services portal. Before this, it is advisable to make an appointment and get advice from employees of your Pension Fund branch, if possible, with preliminary calculations that will confirm the advisability of filing an application in your particular case.

It is recommended to make an appointment in advance (the service is provided on the official website of the Pension Fund of Russia without registration). However, in some regions the waiting list for appointments may be booked for several months in advance. Due to long queues regarding the recalculation of pensions at the Pension Fund branches, it is often recommended to submit completed applications remotely, including by sending notarized copies of the necessary documents by mail.

When applying for recalculation of pensions for children, women must provide the following documents.

Identification document of the applicant (passport of a citizen of the Russian Federation), SNILS.

Birth certificates of all children (if they are not in the pensioner’s payment file).

Documents indirectly confirming that children have reached the age of 1.5 years. If birth certificates are stamped with a stamp indicating that the child has been issued a passport, then it will be sufficient to submit only a certificate with such a stamp. If there is no such stamp on the certificate, then you can present any other official document issued to the child after reaching 1.5 years of age (for example, a school certificate of education, a notarized copy of the child’s passport, his marriage certificate, etc.).

In cases where a pensioner for some reason cannot present birth certificates for her children (for example, if the children have grown up and moved with their documents to another region or even left the country), then you can obtain a birth certificate from the civil registry office.

The law does not provide any restrictions on the timing of filing an application for recalculation (in other words, you can apply for recalculation of your pension at any time). It is considered no later than 5 working days, counted from the date of receipt of the application with a full set of necessary documents submitted on the applicant’s own initiative; from the date of receipt of the necessary documents by the Pension Fund through interdepartmental interaction channels.

If a positive decision is made, recalculation is made in the general manner from the 1st day of the month following the month of application.

Important!

If the periods of childcare coincide with the woman’s work, then the recalculation of the pension with the replacement of work for “non-insurance” periods can only be carried out by refusing the previously established pension, which may entail a significant change in the pension rights of the pensioner. In this case, it is necessary to approach this issue more responsibly, since after refusal it will be impossible to receive a pension on the same terms.

Based on materials from Pensiology.ru

When is recalculation made for women with 2 children?

The recalculation of pensions for citizens with 2 children consists in the fact that the established amount of payment is adjusted by changing output to a point system. Points accrued during the period while the woman was caring for the baby are taken into account.

This procedure is based on Federal Law No. 400 of 2013 “On Insurance Pensions” and Federal Law No. 173 of 2001 “On Labor Pensions in the Russian Federation”.

Please note: this additional payment cannot be considered as a separate type of benefit. Therefore, there is an increase in the previous amount of pensions.

The influence of the number of children on the procedure

The recalculation of pensions for children is based on the period during which the citizen cared for the baby. The short duration of this leave and the quantitative expression of minors must be taken into account.

Women with one child cannot count on a significant increase in benefits. It makes sense to contact the Pension Fund for this process when you have raised 2 or more children.

Maximum points are given to persons who cared for babies during the first 1.5 years. In addition, they look at when the citizen had other periods during which she did not receive income. What matters is the time the woman was not working.

The exact calculation is carried out by Pension Fund employees. A payout case is used.

Who is not eligible for recalculation on this basis?

Many citizens turn to the Pension Fund for the purpose of recalculating benefits. The increase in payments will occur only from the beginning of the month following the submission of the application. Retroactive recalculation will not be possible.

There is no need to write such a statement for those who retired after 2020. All necessary calculations for such citizens have already been made. In addition, those who receive state benefits and payments related to the loss of a breadwinner cannot use the recalculation.

Thus, in order to make a recalculation, the woman will need to submit an application to the Pension Fund. Before this, you need to consider whether the procedure will be beneficial for her or not.