Old-age pensioners who support a dependent family member are entitled to additional payments. The question may arise in every person’s mind whether a pensioner who is still working is entitled to any additional payment to the pension received for a dependent. Even in this case, the state will not leave a disabled person to support only one pensioner. The government provides a supplement to the pension benefit in the amount of 1/3 of the amount equal to the size of the fixed supplement to the pension.

Who is considered a dependent: 2020 list

The rules and regulations regarding payments for dependents are regulated by Federal Law No. 400.

According to the law, additional payments for dependents are calculated exclusively for those family members who are not assigned any other types of benefits. These may be the following categories of citizens:

- minor child;

- disabled since childhood;

- a person caring for a group I disabled person or an elderly family member;

- a student under 23 years of age studying full-time at a university.

In addition to these persons, pensioners and disabled people can be considered dependents, but the state is responsible for their maintenance. Thus, they are considered citizens dependent on the state.

Important! If a student is expelled from the university, he will no longer be considered a dependent.

Where to get it. Documents to be received

A similar document can be obtained from the Pension Fund. You can do this this way:

- Personally.

- Sent by mail.

- Through a representative.

You can get a certificate in the same ways.

The document is completed within 30 working days.

The fact of dependency can be established in court.

Documents to be received

To obtain a certificate, you must prove the presence of a dependent. The supporting documents will be:

- Personal documents (passport).

- Extracts from house books.

- Certificates from place of residence.

- Inspection report of residents living at the address. This is done if the breadwinner and dependent are registered in different places but live together. For such a document it is necessary to invite an employee of the Pension Fund.

- Certificates from the place of study.

- Medical documents: conclusion on assignment of disability group, medical certificates.

- Papers that will confirm the relationship.

- Documents that confirm expenses for food, training, maintenance.

You must certify that you live together and that your support is the dependent's only source of income.

If the breadwinner dies, the dependent may receive compensation for the loss of the breadwinner.

What categories of pensioners are entitled to receive additional payment?

There are a lot of benefit recipients in the Russian Federation, and not everyone is entitled to payments for dependents.

Additional amounts of money are due to the following categories of citizens:

- old age pensioner;

- former military man on a preferential pension;

- WWII veteran;

- disabled person supporting a minor child.

These are the requirements for people counting on additional payments to pensioners and other recipients of benefits for minor children in 2020.

Where you might need it. Filling Features

Help needed:

- To the Pension Fund to issue a certificate.

- In the Pension Fund for registration of a survivor's pension and early retirement.

- To the place of work of the breadwinner. The employer does not have the right to dismiss if such a document is available.

- To receive an inheritance (application for the right of inheritance).

- In other cases provided by law.

Documents for receiving an old-age pension:

Filling Features

The certificate of presence of a dependent must contain the following details:

- Corner stamp of the organization that issued the certificate.

- Document's name

- Last name, first name, patronymic of the recipient of the document.

- Residence address.

Pensioners who have dependents receive an increase of 900 rubles.

- Last name, first name, patronymic of a dependent citizen.

- Grounds for issuance.

- Where is the document submitted?

- Position, surname, initials, signature of the employee who issued the certificate.

- Date of issue.

- Wet printing.

Filling example

Application to establish the fact of being a dependent

Form for certificate of presence of a dependent

Results, the document confirming the presence of a dependent will be a certificate. It will not be so easy to obtain it, so you should collect all the necessary documents for proof in advance.

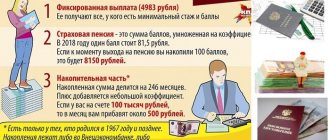

Current payment amounts

Even a professional lawyer will not be able to immediately say what is more in our laws: types of additional payments or categories of beneficiaries. Accordingly, it is unlikely that recipients of social benefits themselves can independently calculate the amount of the required additional payment. However, all these amounts are clearly stated in the laws.

| Category/amount | Whole fixed payment | For one dependent | For two | For three |

| Pensioner up to 80 years old | 5334,19 | 1778,06 | 3556,12 | 5334,18 |

| Pensioner over 80 years old | 10668,37 | 3556,12 | 7112,25 | 10668,37 |

| Group I disabled person | 10668,37 | 3556,12 | 7112,25 | 10668,37 |

| Disabled person of II, III groups | 5334,19 | 1778,06 | 3556,12 | 5334,18 |

Important! Payments for caring for a child with a first degree disability amount to 5,500 rubles.

How to register dependence on a wife’s child from her first marriage?

Dear Alina! In accordance with Art. 90 of the Family Code of the Russian Federation, parents are obliged to support their minor children. The procedure and form for providing maintenance to minor children are determined by the parents independently. Parents have the right to enter into an agreement on the maintenance of their minor children (agreement on the payment of alimony) in accordance with Chapter 16 of this Code. 2. If parents do not provide maintenance to their minor children, funds for the maintenance of minor children (alimony) are collected from the parents in court. In the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents monthly in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other income of the parents. The size of these shares may be reduced or increased by the court, taking into account the financial or family status of the parties and other noteworthy circumstances. (Article 81 of the RF IC) In the absence of an agreement between the parents on the payment of alimony for minor children and in cases where the parent obligated to pay alimony has irregular, variable earnings and (or) other income, or if this parent receives earnings and (or) other income in whole or in part in kind or in foreign currency, or if he has no earnings and (or) other income, as well as in other cases, if the collection of alimony in proportion to the earnings and (or) other income of the parent is impossible, difficult or significantly violates the interests of one of the parties, the court has the right to determine the amount of alimony to be collected monthly, in a fixed sum of money or simultaneously in shares (in accordance with Article 81 of this Code) and in a fixed sum of money. 2. The amount of a fixed sum of money is determined by the court based on the maximum possible preservation of the child’s previous level of support, taking into account the financial and marital status of the parties and other noteworthy circumstances. 3. If there are children with each of the parents, the amount of alimony from one of the parents in favor of the other, less wealthy one, is determined in a fixed amount of money, collected monthly and determined by the court in accordance with paragraph 2 of this article. Article 89 of the Family Code of the Russian Federation. Determination of shares when dividing the common property of spouses 1. When dividing the common property of spouses and determining shares in this property, the shares of the spouses are recognized as equal, unless otherwise provided by an agreement between the spouses. The court has the right to deviate from the beginning of equality of shares of spouses in their common property based on the interests of minor children and (or) based on the noteworthy interests of one of the spouses, in particular, in cases where the other spouse did not receive income for unjustified reasons or spent the common property of the spouses to the detriment of the interests of the family. (Article 33-39 of the RF IC). Detailed consultation, drafting documents, conducting a case in court - for a fee T 9152171802 My fate. practice. The site's lawyers do not call you first!

How can a pensioner apply for additional payment for a dependent?

Registration of additional payment to the pension is carried out in accordance with the established procedure, by contacting the applicant to the Pension Fund of the Russian Federation at the place of registration.

Required documents

Before contacting the Pension Fund for additional payment, the pensioner should prepare the necessary documents. The basic package of documents includes:

- Identification. Citizens of the Russian Federation present to the Pension Fund a passport, foreign nationals and stateless persons - a document confirming their current registration.

- Statement. The document contains basic information about the applicant (full name, passport details, residential address, etc.), as well as the grounds giving the right to receive additional payment (presence of a minor child, living with a disabled spouse, etc.). The application can be drawn up in free form, but it is recommended to use the form posted on the Pension Fund website. You can also obtain a document form to fill out at the Pension Fund branch.

- Certificate of assignment of SNILS. Based on SNILS, a PFR specialist checks the fact that an age/disability insurance pension has been accrued to the applicant, and, therefore, confirms his right to receive an additional payment.

One of the main documents required to assign an additional payment is confirmation of the applicant’s right to such an additional payment. Since the circumstances under which a citizen applies to the Pension Fund may be different, the contents of the full package of papers depend on the specific conditions for processing the additional payment.

In different cases, the following documents can serve as confirmation of the presence of a dependent, and, accordingly, the pensioner’s right to additional payment:

- Birth certificate, adoption of a child, guardianship agreement, guardianship agreement, if the applicant applies for an additional payment for a child under 18 years of age.

- When submitting documents for additional payment for a disabled spouse - a marriage certificate, a certificate from the Pension Fund of the Russian Federation stating that the spouse has been assigned a pension below the minimum monthly wage.

- The applicant's birth certificate, as well as a certificate of the amount of pension accrued to the parent, are the grounds for assigning additional payment for dependent parents.

Procedure for applying for a pension supplement

Stage-1. Transfer of documents to the Pension Fund.

After preparing the required papers, the pensioner should contact the territorial Pension Fund at the place of registration. Documents can be submitted in person or through a representative, sent through a Russian Post office, or you can fill out an electronic application on the Pension Fund website.

Stage-2. Processing of documents in the Pension Fund of Russia.

Upon receipt of documents, PFP specialists accept them for verification for up to 10 working days. The date of acceptance of documents for work is determined on the basis of the application.

Stage-3. Notification of additional payment.

Upon expiration of the established period, the Pension Fund sends a notification to the pensioner:

- on the assignment of payments if all documents are completed correctly;

- about a request for revision of documents if some of the papers are filled out incorrectly or the documents are provided incompletely.

In the latter case, the pensioner is given a period of 3 months to finalize the papers and re-apply to the Pension Fund.

Payment period

The period for assigning additional payment depends on the specific situation:

- Additional payment to pensioners who support a spouse (parent) recognized as disabled due to old age is assigned for life.

- Citizens receiving additional payment for a disabled dependent have the right to payment until the relative's disability is removed.

- Additional payment for children is assigned until they turn 18 years old. This period can be extended provided that the child is studying full-time at a university, technical school, vocational school, or other educational institution (for 23 years old with supporting documents).

USEFUL INFORMATION: How to refuse alimony

A complete termination of payment of the previously assigned additional payment amount is possible if it is established that the applicant provided false and falsified information. The basis for canceling the payment is the corresponding court decision.

Benefits and allowances for pensioners with dependent minor children

My husband is disabled 2 grades and receives a pension of 13 thousand. I am disabled 3 grades. and I receive a pension of 8 thousand. We are both old-age pensioners.

Social guarantees and compensation provided for by this Federal Law and federal laws for military personnel and members of their families may be extended to other persons and members of their families by decrees of the President of the Russian Federation. Federal Law No. As for alimony from the natural father, it will stop when the child becomes an adult, that is, reaches the age of 18 years.

If it is impossible to provide the listed documents to confirm the fact that a family member is a dependent, this fact can be established through testimony (for example, other relatives, neighbors) or in court.

Procedure for receiving payment

The Pension Fund considers the citizen’s appeal within ten working days, if a decision is made in his favor, the increased payment begins from the next month. These deadlines must be taken into account when choosing the period for applying for an allowance. This application must be submitted annually, otherwise the pension will be reduced automatically.

Payments for the maintenance of a relative are not made separately; the pensioner can receive the accrued amount for a dependent with his own money. Nothing changes during the appointment process: the date of enrollment and methods of transferring benefits remain the same.