What is social pension

Today, pensions in the Russian Federation for older people are of several types:

- Insurance. Received by persons who have reached retirement age and have appropriate insurance experience.

- State. Paid to military personnel, WWII participants, liquidators of radiation accidents and man-made disasters, and municipal employees.

- Social. Intended for unemployed disabled people and people who do not have enough insurance coverage.

Each of them is divided into subtypes depending on the conditions necessary to obtain it. A social pension is a fixed monetary allowance allocated from the federal budget to people who, due to psychophysical development, illness, current life situation, have not worked at all or their existing work experience does not give them the opportunity to receive another type of pension.

Difference from insurance

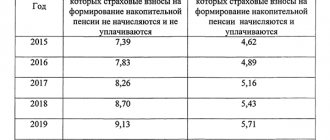

In order to understand how social pension differs from insurance, it is necessary to identify the conditions under which the latter is allocated. Social benefits for old age in 2020 are assigned if at least one of the circumstances is not met. The main one is reaching the age limit. It is 60 for men and 55 for women, although sometimes people can retire earlier (this issue is regulated by separate regulations). Additionally, you need to have a certain pension coefficient:

- 2017 – 11,4;

- 2018 – 13,8;

- 2019 – 15.2 and. etc. in increments of 2.4 until the reading reaches 30 by 2025.

Another condition that must be met is the presence of a certain length of employment, provided that all this time deductions have been made from the worker’s salary to the Pension Fund. For 2020 this figure is 8 years, and for 2018 it will be set at 9 years. Then it will continue to increase:

- 2019 – 10;

- 2020 – 11;

- 2021 – 12;

- 2022 – 13;

- 2023 – 14;

- from 2024 – 15.

The social pension is financed from the federal budget, while the insurance pension is financed from the budget formed by the Pension Fund of the Russian Federation, which is formed from:

- insurance premiums;

- deductions from the unified social tax;

- federal budget funds;

- funds received through capitalization, etc.

Who receives a social pension in Russia

State allowance is calculated based on several criteria and is based on:

- Upon reaching the age limit and lacking insurance coverage or pension coefficients.

- Disabled people of groups 1, 2, 3 and people with disabilities since childhood who have reached adulthood but have never been employed or worked unofficially (without making contributions to the Pension Fund). The time and reason for incapacity for work do not matter. The category must be determined based on the results of a medical and social examination.

- For disabled children. This category includes minors with congenital or acquired disabilities.

- Due to the loss of a breadwinner. If, after the death of a person, his family has minor children or other disabled dependents, they can apply for pension benefits. The age of children is limited to 18 years, but if they are students or full-time students of educational institutions, the age limit is set at 23 years.

- Indigenous residents of small peoples of the Far North and other areas included in this list.

Legal regulation

The legislation of the Russian Federation in the field of calculating pension payments and monitoring the implementation of pension provision is represented by a large number of regulations adopted at both the federal and regional levels. Among the main ones it is worth mentioning:

- The Constitution of the Russian Federation, which states that every citizen has the right to social security in old age and the conditions for the payment of pension benefits.

- Law No. 166-FZ. We are talking about state pension provision; it is used to guide the calculation of allowances.

- Law No. 111-FZ. Here are the conditions for participation in the funded pension.

- Law No. 167-FZ. Reflects the rules of insurance, the financial and legal sphere of providing for citizens.

- Law No. 173-FZ. The conditions necessary to receive old-age social benefits and the procedure for making accruals are considered.

What additional payments are possible?

The additional payment to the basic amount of the social pension depends on several factors:

- the total cost of living in the country and separately in the region;

- place of residence of the pensioner and duration;

- total amount of material support.

According to Bill No. 178-FZ “On Social Assistance”, if the amount of the social pension is below the established subsistence level, then the person has the right to an additional payment.

According to the innovations, in 2020 the Russian government approved the average subsistence level of 8,726 rubles. Consequently, the social pension will also increase, its amount will reach approximately this level.

These changes will apply to approximately 11 million citizens of the Russian Federation. This will make people feel more financially confident.

Conditions for assigning social pensions in 2020

To calculate and receive old-age social benefits in 2018, it is necessary that a person meets certain criteria. The main factor is that a citizen, in addition to social benefits, should not have additional income to his own budget, otherwise the right to payments is lost. Additionally, the citizen’s place of residence and his age are taken into account.

Russian citizenship

All citizens of the Russian Federation have the right to receive old-age social benefits in 2020 if their insurance coverage is less than 9 years. If a person permanently resides in Russia, but is a citizen of another state, he has the right to apply for payments to the Pension Fund. According to the law, he must have a residence permit in hand, which will certify that the period of residence on the territory of the Russian Federation is at least 15 years - this is the main condition for foreigners to receive social benefits, in addition to the lack of experience.

Age criteria

Depending on the type of pension that a citizen is applying for, he must be a certain number of years old. To receive labor pension benefits, a woman must be 55 years old, and a man must be 60 years old, but for the purpose of old-age social benefits, the age range is large and, according to the law, increases by 5 years at once:

- up to the 65th birthday for the stronger sex;

- up to 60 – for the fair half.

Many citizens of the country are interested in whether there are any benefits or conditions for early receipt of a social old-age pension in 2018. The only exceptions are representatives of the small peoples of the North and Siberia:

- Aleuts;

- Nenets;

- Chukchi;

- Evenks;

- Itelmens.

Peculiarities of accrual for the peoples of the Far North

Back in 1999, a separate document No. 82-FZ was adopted, which established the right of representatives of certain nationalities to receive old-age social benefits. The law establishes the age at which indigenous peoples have the right to receive benefits from the state. The document was adopted with the aim of state support and protection of citizens leading a nomadic lifestyle, subsistence farming and engaged in folk crafts. The social old-age pension in 2020, as before, will be assigned:

- for men when they reach 55 years of age;

- women over 50 years old.

What social payments are due to different categories of citizens for 2020?

Until April 2020, persons with disabilities of the first category received a monthly allowance, the amount of which was equal to 10,068 rubles, but after indexation, the amount increased to 10,360 rubles. This group includes those subjects who have completely lost their legal capacity due to illness or injury. These people need regular care.

However, it is worth considering that the benefit does not apply to those citizens who have caused irreparable harm to their health while under the influence of alcohol or drugs, as well as those persons who were injured while committing illegal acts.

People with disabilities of the second category, after indexing, receive 5,180 rubles monthly. This group includes subjects who cannot earn their own living, but are able to take care of themselves.

People with disabilities of the third category can claim 4,403 rubles per month. This group includes those segments of the population who have lost the ability to work in their specialty or to work fully, but can still provide for themselves by joining an organization whose requirements allow them to continue working in a simplified mode.

Persons with disabilities have received benefits since childhood, the amount of which depends on the category of disability. The allowance for disabled children or disabled children of the first category for 2018 is 12,439 rubles, and for subjects of the second category of disability - 10,369 rubles.

Citizens who have reached retirement age can count on a payment of 5,180 rubles. The same amount of salary is due to foreigners or stateless persons if they have been living in Russia for fifteen years or more.

Minors or full-time students who have lost their breadwinner receive a monthly allowance, the amount of which depends on whether they have lost one parent or both:

- If both parents died, then the amount of payments will be 10,369 rubles per month;

- If one parent died, then 5180 rubles monthly.

If we look at indexing this year, it did not produce tangible changes for any category. However, perhaps things will change for the better next year.

#Indexation #Pension reform #Pension reform 2018 #Pension bonuses #Pension #Pension 2020 #Pension in Russia #Pension for disabled people #Old age pension #Pension amount #Social pension

Read us first - add the site to your favorite sources.

Add a comment

{"commentics_url":"\/\/express-novosti.ru\/comments\/","page_id":383489,"enabled_country":false,"enabled_state":false,"state_id":0,"enabled_upload": false,"maximum_upload_amount":3,"maximum_upload_size":5,"maximum_upload_total":5,"securimage":true,"securimage_url":"\/\/express-novosti.ru\/comments\/3rdparty\/securimage\ /securimage_show.php?namespace=cmtx_383489″,”lang_error_file_num”:”\u041c\u0430\u043a\u0441\u0438\u043c\u0443\u043c %d \u0444\u0430\u0439\u043b\u043e\u 0432\u043c\u043e\ u0436\u0435\u0442 \u0431\u044b\u0442\u044c \u0437\u0430\u0433\u0440\u0443\u0436\u0435\u043d\u043e.","lang_error_file_size":"\u041f\u043e \u0436\u0430\u043b\ u0443\u0439\u0441\u0442\u0430, \u0437\u0430\u0433\u0440\u0443\u0437\u0438\u0442\u0435 \u0444\u0430\u0439\u043b \u0440\u0430\ u0437\u043c\u0435\u0440\u043e \u043c \u043d\u0435 \u0431\u043e\u043b\u0435\u0435 %d MB.","lang_error_file_total":"\u041e\u0431\u0449\u0438\u0439 \u0440\u0430\u0437\u043 c\u0435\u0440\ u0432\u0441\u0435\u0445 \u0444\u0430\u0439\u043b\u043e\u0432 \u0434\u043e\u043b\u0436\u0435\u043d \u0431\u044b\u0442\u044c \ u043d\u0435\u0431\u043e\u043b\ u0435\u0435 %d MB.","lang_error_file_type":"\u041c\u043e\u0436\u043d\u043e \u0437\u0430\u0433\u0440\u0443\u0436\u0430\u0442\u044c \u0442\u0 43e\u043b\u044c ""lang_text_loading":" u0437\u043a\u0430 ..","lang_placeholder_state":"\u0420\u0435\u0433\u0438\u043e\u043d","lang_text_country_first":"\u0421\u043d\u0430\u0447\u0430\u043b\u0430 \u0432\u044b\u04 31\u0435 \u0440\u0438\u0442\u0435 \u0441\u0442\u0440\u0430\u043d\u0443″,”lang_button_submit”:”\u0414\u043e\u0431\u0430\u0432\u0438\u0442\u04 4c","lang_button_preview":" \u041f\u0440\u0435\u0434\u0432\u0430\u0440\u0438\u0442\u0435\u043b\u044c\u043d\u044b\u0439 \u043f\u0440\u043e\u0441\u043c\u 043e\u0442\u0440″,”lang_button_remove ":"\u0423\u0434\u0430\u043b\u0438\u0442\u044c","lang_button_processing":"\u041f\u043e\u0434\u043e\u0436\u0434\u0438\u0442\u0435..."}

Registration procedure

Old age social pension in 2020 is issued subject to a certain algorithm of actions:

- At the initial stage, it is necessary to collect a certain package of documents and draw up an application for the desire to receive old-age social benefits.

- Appear at the government structure specified by law to submit the entire package of papers.

- Wait for the application to be reviewed and a decision made. The law allows 10 days for this, after which the future recipient of the allowance must be given an answer.

- The Pension Fund will calculate the payment depending on the region of residence.

- Receive the first cash payment, and this should happen no later than the next month after the month of submitting documents. For example, if the application was written in August, then the first social pension should be paid in September.

Where and how to contact

In 2020, social pension will be accrued to a person, provided that he himself is the initiator. If the documents are not submitted, representatives of the Pension Fund, and its employees directly involved in the calculation of pensions, will not accrue payments, since they have no basis for this. To register, you must contact one of the organizations:

- Multifunctional Center;

- territorial branch of the Pension Fund of Russia.

You can do this in several ways:

- On one's own. To do this, you need to prepare documents, write an application and visit a branch of the MFC or Pension Fund. The institution’s specialist is obliged to accept the documents and put a date and his own signature on the application, which will mean that the papers have been accepted for consideration.

- Via postal service. To do this, you need to send a registered letter with a description of the attachment. Upon receipt, the employee who accepted the documents will date and sign the return receipt.

- Through a legal representative. The procedure can be carried out if you have a notarized power of attorney. When filling out the application, you must write in the appropriate box “through the applicant” and indicate the details of the representative.

- Using the Internet. Anyone can register on the official website of the Russian Pension Fund, and then submit an application through their personal account to receive old-age benefits in 2020.

Rules for writing an application

An application for receiving a social old-age pension in 2020 can be filled out through your personal account on the website of the Russian Pension Fund or by hand by downloading the form on the portal itself. Data must be entered legibly and correctly, without allowing corrections. If the application is submitted by a stateless person or a foreign citizen, some information will need to be entered in the national language of the applicant.

The information that must be provided in the application includes:

- the name and address of the specific PFR branch where the applicant is applying;

- last name, first name, patronymic of the person according to the passport;

- passport details;

- registration address (registration);

- address of actual place of residence or stay;

- SNILS number;

- contact details of the applicant;

- presence/absence of dependents;

- information about work activity, if the person was officially registered;

- if the application is submitted by the applicant, indicate his personal data;

- list of documents attached to the application.

What documents need to be provided

Since the old-age social pension in 2020 is paid from the federal budget, a basis will be required for its calculation. The documents that will be required from the applicant include:

- an application drawn up in the form and signed by the applicant;

- pensioner's ID;

- an identification document of a citizen - his passport, regardless of citizenship;

- for foreigners and stateless persons, it is necessary to provide papers indicating their legal presence on the territory of the Russian Federation, for example, a residence permit;

- confirmation of a person’s belonging to the peoples of the Far North;

- power of attorney to perform actions on behalf of a person of retirement age;

- documents evidencing work experience.

An elderly person or his legal representative can submit the collected papers only upon the onset of the right to receive old-age social benefits - reaching the age specified by law. The specialist may request other documents, but he can only demand those that the pensioner can independently request from public or private organizations.

Economic crisis and pension payments

With the onset of a crisis situation in the country, the pension system has become more vulnerable. Officials decided to reduce costs in the social sphere. This action on the part of the authorities contributed to a decrease in the income of citizens of retirement age. And the decline in the economic level, as well as the process of devaluation of the ruble, became the reasons for the acceleration of the inflation process. The country's budget does not provide the ability to index payments to citizens of retirement age. Today, the government is again increasing pensions on the basis of current legislation.

The budget of the Russian Pension Fund is experiencing great difficulties, the amount of which amounts to approximately 200 billion rubles. It is believed that this trend will continue in the future, the reason for this is the negative influence of the demographic factor. With an increase in the number of pensioners, the pension fund budget will experience some financial deficit.

To restore the balance of pension payments, certain reforms are required. 2020 will show what size of social payments to pensioners will be determined.

The size of the social pension in 2020

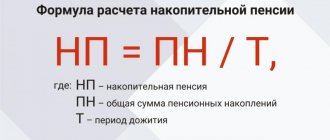

If you compare labor and social pensions, you can understand that they are calculated in completely different ways. The insurance benefit is designed to compensate for lost income upon reaching the age limit. For this reason, the size of the pensioner’s salary that he received before entering retirement must be taken into account. To calculate the old-age social pension in 2020, this will not be required, because it can be paid even to those who have not worked a single day and have not been registered with the employment service.

Such a payment is essentially a state benefit of the minimum amount, which is paid to a certain category of people. The size of the social pension is a fixed value, which is established by law, and the cost of living budget is taken as the basis. The last increase in social pension benefits was made on April 1, 2020 and the social pension was indexed to 8,742 rubles. The next increase is scheduled for April 1, after which the social pension in 2020 will be 9,045 rubles.

Increasing coefficients

Unlike recipients of insurance pensions, applicants for social benefits in old age are not subject to any increasing or decreasing coefficients, since social pensions are fixed assistance from the state budget to certain individuals. Another thing is that for each category of persons who are entitled to receive a social old-age pension in 2020, separate minimum values are established. So, for example, the allowance of a disabled child will be greater than that of an old man who has not earned enough to earn an insurance pension.

The difference in the amounts of payments for pensioners by age is fixed due to the different level of the subsistence level budget, which is established for the country as a whole and in each region separately. For this reason, residents of the Far North receive more than pensioners, for example, of the Astrakhan region. If a person changes his permanent place of residence, then subsequent payments to him are calculated based on the region where he decided to settle.

Additional payments up to the cost of living

As noted, the cost of living is established at the federal and regional levels. In 2018, the average basic cost of living for a pensioner in the country was 8,540 rubles, while for 2020 this figure is planned at 8,726 rubles. According to the law, the social old-age pension in 2020, which is payable to a person, should not be less than the subsistence level in the region.

Social benefits can be paid from the regional or federal budget. If the pension in the region is less than the average Russian subsistence level, the federal budget makes up for this difference. Supplements are paid from the regional treasury only in some regions. This applies to the city of Moscow and those regions where the cost of living is higher than in the country (Chukotka, Yamalo-Nenets Autonomous Okrug, Sakhalin Region, etc.)

For an example of calculating additional payments from the federal budget, we can consider the following situation. A pensioner receives 7,650 rubles in allowance and lives in the Bryansk region, where the cost of living budget for a pensioner in 2020 is 8,095 rubles, which is lower than the Russian average (8,540 rubles). He is entitled to an additional payment from the federal budget of 445 rudders (8095–7650=445).

An example of an additional payment from the regional budget looks similar, with the only difference that the payment is accrued not from the federal, but from the regional budget. The pensioner receives 11,700 rubles and lives in the Magadan region. The subsistence budget for 2020 for elderly people here is set at 15,450 rubles, which is more than the Russian average (8,540 rubles). He is entitled to an additional payment of 3,750 rubles (15,450–11,700 = 3,750).

The minimum social pension in 2020 depends on the cost of living of pensioners in the region. The table below shows some of them:

| Subject name | 2016 | 2017 | 2018 |

| Overall for the Russian Federation | |||

| Russian Federation | 8 803 | 8 540 | 8 726 |

| Central Federal District | |||

| Moscow | 11 428 | 11 561 | 11 816 |

| Moscow region | 8 950 | 9 161 | 9 527 |

| Bryansk region | 6 648 | 8 095 | 8 441 |

| Northwestern Federal District | |||

| Saint Petersburg | – | 8 540 | 8 726 |

| Arhangelsk region | 11 173 | 10 816 | 10 285 |

| Novgorod region | 8 437 | 8 483 | 8 886 |

| North Caucasus Federal District | |||

| The Republic of Dagestan | 7 900 | 8 374 | 8 680 |

| Kabardino-Balkarian Republic | 8 095 | 8 500 | 8 726 |

| Stavropol region | 7 524 | 7 975 | 8 135 |

| Southern Federal District | |||

| Republic of Adygea | 8 138 | 8 138 | 8 138 |

| Krasnodar region | 8 418 | 8 478 | 8 537 |

| Rostov region | 8 488 | 8 488 | 8 488 |

| Volga Federal District | |||

| Republic of Bashkortostan | 7 842 | 8 015 | 8 320 |

| Republic of Tatarstan | 7 526 | 8 232 | 8 232 |

| Perm region | 7 731 | 8 473 | 8 537 |

| Ural Federal District | |||

| Tyumen region | 8 530 | 8 540 | 8 726 |

| Chelyabinsk region | 8 499 | 8 523 | 8 586 |

| Yamalo-Nenets Autonomous Okrug | 13 425 | 13 425 | 13 425 |

| Siberian Federal District | |||

| Krasnoyarsk region | 8 411 | 8 540 | 8 726 |

| Irkutsk region | 8 801 | 8 536 | 8 723 |

| Kemerovo region | 8 059 | 8 208 | 8 347 |

| Far Eastern Federal District | |||

| Primorsky Krai | 8 744 | 8 967 | 9 151 |

| Khabarovsk region | 10 895 | 10 895 | 10 895 |

| Magadan Region | 14 770 | 15 460 | 15 460 |

Latest changes to the old-age social pension

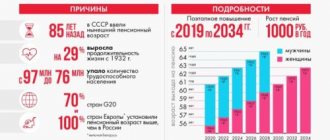

With the increase in the retirement age from next year in Russia, the age for receiving a social old-age pension will correspondingly increase. The five-year difference between the standard retirement age and the retirement age for those who do not have sufficient service and pension points will remain during the transition period.

As a result, it is planned to increase the retirement age for recipients of social old-age pensions to the following values:

- 70 years - for men (to be reached in 2028),

- 65 years for women (to be reached by 2034).

The retirement age will be raised gradually, by an average of six months each year. For convenience, you can refer to the following table:

| How men will retire on social pensions in the next 10 years | ||

| Year of birth | Retirement age | Year of retirement |

| 1954 | 66 years old | 2020 |

| 1955 | 67 years old | 2022 |

| 1956 | 68 years old | 2024 |

| 1957 | 69 years old | 2026 |

| 1958 | 70 years old | 2028 |

| How women will retire on social pensions in the next 16 years | ||

| Year of birth | Retirement age | Year of retirement |

| 1959 | 61 years old | 2020 |

| 1960 | 62 years old | 2022 |

| 1961 | 63 years old | 2024 |

| 1962 | 64 years old | 2026 |

| 1963 | 65 years old | 2028 |

| 1964 | 66 years old | 2030 |

| 1965 | 67 years old | 2032 |

| 1966 | 68 years old | 2034 |

This table is preliminary, it is compiled on the basis of the draft reform proposed by the government on June 14, 2018.

Most likely, given the expected discontent among Russians, the government’s reform project deliberately contains more draconian measures than the state plans to implement in reality. If people's discontent turns out to be strong, the president will come out in their defense, but for now he is pretending that he has nothing to do with it. The reform will be slightly edited, and, most likely, the retirement age will not be raised as much as is being said now.

However, for now we need to rely on the above transition period schedule as the only official draft law for today.

As for the amount of the pension in future years, recipients of social pensions should, in principle, focus on the minimum payment in the amount of the subsistence level. It is clear that the state, which seeks to save money and therefore raises the retirement age, will not pamper them with larger payments, reports the Therussiantimes.com portal. But it will not pay less, since this is unprofitable for itself.

Indexation of social pensions in 2020

An increase in the social pension in 2020 is planned from April. The figure is adjusted annually and for this year will be 4.1%. This is an established practice that will help bring the average social pension in the country to 9,045 rubles. More specific figures will be known later and depend on the state of the country’s economy and budget capacity. According to official sources, people who have retired will not receive less than the minimum subsistence level established for a pensioner in 2020. They are planned to be paid extra from the budget, as was done previously.

Application for a social pension

The corresponding application must be submitted to the appropriate authority for registration of a social pension. The following points must be reflected in the appeal:

- Personal data of the person who needs state benefits;

- Provide accurate passport information;

- You should also note your contact details and address;

- Indicate your right to receive this security;

- The necessary evidence should be attached to the document;

- At the end of the document, a date and signature are placed.

In order to complete the document without errors, it is recommended to take the deed form from any branch of the fund or download it on our website.

Terms and procedure for payment

The first payment of money to a pensioner should take place in the month following the submission of documents. If representatives of the Pension Fund of Russia decided that not all documents were in order and gave it an additional period to resolve the problem, the countdown begins from the moment the papers are transferred (provided that the applicant invested in the agreed time). You can receive allowance in several ways, but you must choose one of them, which is indicated when filling out the application. A citizen can change the method at any time by writing a corresponding application.

Social old-age pension in 2020 can be transferred to:

- At the post office. You can receive money at the nearest territorial branch, or at home through the postman.

- Through the bank. There are two ways to do this. The first is to get a bank card and withdraw money as needed from an ATM, or pay using plastic non-cash for purchases and services. The second method is to receive money monthly through the cash desk of a selected banking institution. Money is credited to the pension account on the day it is received from the Pension Fund.

- Through a special organization that has an agreement with the Pension Fund.

The difference between a social old-age pension and an insurance pension

In 2018, not much is required to receive an old-age insurance pension in Russia. Those who reached retirement age this year (women born in 1963 and men born in 1958) must also have:

- minimum 9 years of insurance experience,

- minimum 13.8 pension points.

In addition to work experience, the insurance period also includes some other periods of a person’s life, including military service, being on maternity leave, etc.

A social old-age pension is received by those who have not reached the above minimum by a certain age in terms of length of service and the number of pension points earned.

It is worth keeping in mind that the retirement age for those receiving a social pension is five years higher than for everyone else. In 2018 this is:

- 60 years - for women,

- 65 years old - for men.

Since the citizen, by the time he reaches the generally accepted retirement age, has not contributed enough funds to the budget of the country's Pension Fund, the state agrees to begin paying him a pension only after five years. During this time, a person also has the opportunity to earn the required minimum length of service and pension points. If the minimum is reached within these five years, the citizen will have a basis for receiving an insurance pension.

Another nuance that you need to know about is that since the beginning of 2020, the rules for assigning social old-age pensions in Russia have changed slightly. Now foreign citizens and stateless persons can receive Russian social pensions only if they prove that they have lived in Russia for at least 15 years.