Every person comes to a point in life when it’s time for him to think about rest.

Pension represents a certain stage in life when a person stops working and retires. To do this, a certain age limit is established at the state level, up to which the employee must work. The age may change; for this purpose, changes are being made to the pension reform.

State compensation for length of service is calculated depending on how long a person officially worked and in what industry. Experience can be ordinary or special. As for the second, additional allowances may be provided for it.

A person who is just starting his career often thinks about what benefits he can earn by working in his chosen industry.

What is preferential service?

Pension standards are defined in the following regulatory documents:

- Federal Law No. 173 “On labor pensions in the Russian Federation” dated December 17, 2001.

- PPRF N 516 “Rules for calculating periods of work giving the right to early assignment of an old-age labor pension...” dated 06/11/2002.

- Federal Law No. 400 “On Insurance Pensions” dated December 28, 2013.

This term refers to the worked period of work that allows one to retire before the maximum retirement age. In individual types of activities, a multiplying factor is used in the calculation. Thus, after working for a calendar year, a specialist receives additional days of service and retires before reaching the general age limit.

Preferential conditions may be provided for several reasons:

- For harmful or difficult working conditions (according to the list of dangerous and harmful professions). The basis is the characteristics of the work.

- For social characteristics (for example, due to health or family circumstances). The basis will be the characteristics of the employee.

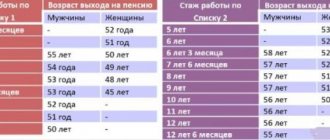

The lists of preferential professions were approved back in 1991 and include all types of employment under special working conditions. They are divided into:

- a list of professions with particularly difficult and particularly harmful conditions;

- list of professions with difficult and harmful conditions.

IMPORTANT! A separate list contains categories of citizens working and living in the territories of the Far North.

How is underground service considered for retirement?

Important

RF No. 516 of July 11, 2002. Having studied the above legislative acts, we can come to the conclusion that the insurance period, which gives the right to early retirement, includes periods such as temporary inability to work while receiving state social security benefits. This length of service does not include periods of unpaid leave (administrative or “at your own expense”), or educational leave. It also does not include the probationary period, downtime (due to the fault of the employer or the fault of the employee), the time during which the employee was not allowed to work due to such circumstances as:

- any type of intoxication;

- a medical report identifying the reasons for inadmissibility to perform work;

- failed knowledge test in the field of labor protection.

In addition to the above, there are other reasons why an employee may not be allowed to carry out activities.

To successfully implement a citizen’s right to early retirement due to work experience in hazardous conditions, it is necessary to understand who has the right to receive an early pension, what regulations regulate these issues, how harmful experience is calculated, what is included in it, etc. About Our article will tell you all about this. Harmful experience - concept and legal regulation Lists of professions associated with hazardous working conditions, No. 1 and 2 The procedure for determining harmful experience Harmful experience necessary for early retirement Confirmation of harmful experience Harmful experience - concept and legal regulation Under the stable expression “harmful experience” in the field Pension provision refers to the time spent performing labor functions in jobs and positions with hazardous working conditions. In accordance with Art.

By what rules is preferential service considered?

To obtain the right to early retirement, a person must work the number of years that he is entitled to by law. At the same time, his age at this moment does not matter.

Calculation rules:

- Determine which preferential category a particular profession belongs to.

- Correlate the type of activity with the size of the increasing coefficient. Depending on working conditions, one calendar year can be equal to 1 year 3 months of experience, 1 year 6 months, 1 year 9 months, two years.

- According to the entries in the work book, calculate the period during which work was carried out on preferential terms.

- Based on all calculations, preferential length of service is calculated.

The fact of carrying out labor activity must be documented in the labor document. If there is no entry in the book, you can contact the human resources department of the institution for a certificate.

IMPORTANT! In some cases, if it is impossible to document the fact that a person works in an organization (for example, during the liquidation of a company), the testimony of two or more witnesses is accepted. But the very nature of the activity is not confirmed by witnesses.

What are the periods of service?

To receive benefits in the pension sector, the following periods are taken into account:

- annual basic and paid vacations;

- sick leave and periods of temporary disability, including sick leave for pregnancy and childbirth;

- time for advanced training, retraining in accordance with the student agreement;

- if a pregnant woman is transferred from a hazardous occupation to a job without unfavorable conditions, then the period of work in the new place is also considered preferential;

- if a pregnant woman is indicated to be transferred to a safe place, and management is not able to immediately provide her with new working conditions, then the waiting period is also included in the length of service;

- The probationary period during employment is counted into the grace period, regardless of whether the candidate passed it or not.

IMPORTANT! The main condition for obtaining a preferential pension is the fact that during the period of service tax contributions were made to the Pension Fund of the Russian Federation.

What periods are not taken into account?

The calculation does not include the following time periods:

- when an employee was removed from duty due to intoxication;

- when the employee has not undergone training and certification in labor protection;

- if the person has not passed a mandatory medical examination;

- if, after passing a medical examination, the employee was not allowed to work for medical reasons;

- when a person did not perform labor activity at the request of authorities and officials;

- hours of downtime (due to the fault of management or the employee himself).

IMPORTANT! Preferential length of service includes forced paid absenteeism in case of illegal dismissal, as well as in case of transfer to another job and subsequent reinstatement in the same place.

General rules for calculating preferential length of service

Calculation rules for all categories of beneficiaries:

- the employee performed his work full time, or at a reduced rate, if this is in accordance with the employment contract;

- citizens applying for a pension must be registered in the pension insurance system;

- Shift service, which allows you to receive early retirement, includes work at the site, rest time between shifts, travel time from the collection point to the place of production and back;

- If an employee has reached the retirement age limit and has not yet accumulated the benefit period, then he has the opportunity to complete the missing number of years.

IMPORTANT! If the professional activity was carried out part-time, but full-time, due to a decrease in production, then the actual time worked is included in the length of service.

What is included in harmful experience?

What is harmful experience? This concept is actively used in the pension funds of the Russian Federation in order to provide the future pensioner with a decent pension for the fact that he has worked for many years in dangerous or harmful conditions that threaten his health, as well as to allow him to retire early. Males have the right to early retirement and additional payments if they have worked in those industries indicated in the first list for 10 years or more, and their total work experience is at least 20 years. Female persons who have worked in industries included in the first list can retire early if their special work experience is 7.5 years and their total work experience is 15 years.

In addition, it is worth noting that early retirement due to harmful work experience is permitted for males no earlier than 50 years of age, and for females no earlier than 45 years of age.

Who has the right to retire on preferential terms?

List of professions and activities that give the right to receive a preferential pension:

- work in hot shops;

- in hazardous production, with negative factors;

- underground and mining works;

- work in difficult physical conditions;

- expeditionary work;

- forestry activities;

- locomotive crews;

- temporarily or permanently working in the Far North;

- liquidators of the consequences of a radiation disaster;

- civil aviation pilots;

- miners and mines;

- metallurgists;

- members of the crew on ships;

- drivers of city vehicles;

- female machinists;

- employees of the Ministry of Emergency Situations;

- military personnel;

- teachers;

- medical workers;

- employees of institutions executing criminal penalties in the form of imprisonment.

People eligible for early exit based on social indicators:

- women raising 5 or more children, the youngest of whom should be no more than eight years old at the time of the mother’s retirement;

- one of the parents raising a disabled child;

- a person who has received a disability due to the performance of official duties.

The increasing coefficient, as well as the number of years for preferential length of service, differs for different types of professional activity. In addition to early retirement, beneficiaries are entitled to additional social benefits.

Disability pension

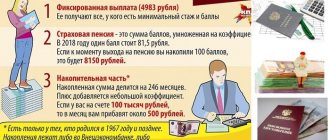

The new legislative act introduced an increase in length of service annually, that is, by 2024, this minimum length of service should be 15 years. In the Russian Federation, in accordance with the norms of legal acts, pension benefits are awarded if the following criteria are met simultaneously:

- reaching the required age for retirement;

- having a sufficient number of years of insurance experience;

- availability of the required number of personal pension points.

The Federal Law “On Insurance Pensions” provides for 3 types of insurance payments for pensioners:

- according to the age;

- with disabilities of different groups;

- upon the loss of a breadwinner, if there is confirmation of the fact of being dependent on the official breadwinner.

Length of service for retirement in Russia under the new law Let's consider why length of service is needed, how it is calculated for men and women, and how long it is needed for retirement.

Features of calculating the insurance period if a person works in hazardous production

When calculating early pension, the following periods are taken into account:

- Leave to which an employee is entitled under labor law.

- Labor activity at the enterprise.

- Work during a probationary period (experience is accrued even if the person was not accepted as an employee of the company).

An occupational disease can cause a person to be transferred to a new place. A change in working conditions in such circumstances is not grounds for interrupting the benefit period. What do specialists pay attention in order to assign early retirement

Often, the employer transfers the employee to another site. The reason for personnel changes may be production needs. If the duration of work in a new place does not exceed 1 month, then the preferential length of service continues to accrue.

When determining length of service, specialists take into account periods of maternity leave. Work does not stop even when a woman takes maternity leave. A completely different situation arises if a woman quits her job before giving birth. Unemployed mothers receive benefits from social security agencies. In this case, preferential length of service is not accrued.

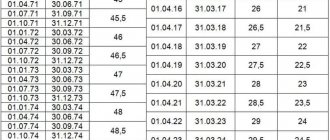

Table of how men who have 42 years of experience will retire

Starting from January 1, 2020, the time for exercising pension rights for men with extensive insurance coverage can be determined using the following table:

| Year of birth | Generally established retirement age, years | Age with at least 42 years of experience, years | Year of early retirement |

| 1959 | 60,5 | 60 | 2019 |

| 1960 | 61,5 | 60 | 2020 |

| 1961 | 63 | 61 | 2022 |

| 1962 | 64 | 62 | 2024 |

| 1963 | 65 | 63 | 2025 |

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

What is included in the insurance period from 2020 upon early retirement.

Good day.

From January 1, 2020, a new basis for early retirement in old age is in force in Russia - having a long work history. According to the new law, in order to receive an early pension, you will need 42 years of service for men and 37 years for women. If a citizen has worked for this number of years, he will have the right to become a pensioner 2 years earlier than retirement age. The decision to introduce such a benefit was made during the discussion of the bill on raising the retirement age. Initially, the amount of length of service giving the right to early retirement in old age was 45 and 40 years for men and women. These standards were lowered for 3 years by the decision of V. Putin, who made his own amendments to this law. Law No. 350-FZ, containing such changes, was signed by the President on October 3, 2018.

Due to the fact that the retirement age is gradually increasing from 2020, the right to take advantage of this benefit will be provided to everyone differently.

When the retirement age is set at its final value (60 and 65), the final parameters for early retirement with long service will be fixed. It will be possible to become a pensioner as early as 58/63 - these conditions will apply starting in 2023.

Experience for early retirement in Russia under the new law

Since 2020, citizens with a long work history are granted the right to early retirement. This change in pension legislation was provided for as part of the new pension reform of 2020 and enshrined in Part 1.2 of Art. 8 of Law No. 400-FZ of December 28, 2013. To become an old-age pensioner early, you need to have at least 37 years of insurance experience for women and 42 for men.

According to the new law, the right to early retirement based on length of service is granted with a number of restrictions:

The new benefit does not imply that after working for a set number of years (37 or 42), a person will be able to immediately retire into old age pension. For citizens who have worked for such a long period of time, the retirement age will only be reduced by 24 months relative to generally established values.

The retirement age, determined taking into account such a benefit, cannot be lower than 55 years for women and 60 for men (that is, lower than the values under the old legislation). It is for this reason that in the first years of the reform, not all citizens will be able to fully take advantage of this preferential condition.

In addition, the calculation of the length of service giving the right to receive a pension on preferential terms differs from the calculation of the insurance period. Not all periods will be included in it, for example, military service, maternity leave, and so on will be excluded.

What is included in the preferential period

When calculating the length of service that gives the right to early receipt of a pension, there is a limitation provided for in Part 9 of Art. 13 of Law No. 400-FZ. According to this provision of the law, not all periods that are traditionally included in the insurance period are included in the benefit period. Only the following will be taken into account when calculating:

periods of official work on the territory of the Russian Federation, during which the employer pays insurance contributions to the Pension Fund;

paid vacations (annual basic and additional);

periods when an employee is on sick leave when he receives temporary disability benefits).

Let us remind you that in addition to the above, other socially significant periods are additionally included in the insurance period:

period of receiving unemployment benefits;

military or other service equivalent to it (for example, service in the army);

child care until the age of one and a half years (in total - no more than 6);

care for disabled persons (senior citizens over 80, disabled people of group 1 or disabled children) and so on.

They were recorded if, immediately before or immediately after them, a person officially worked and made contributions to the Pension Fund for his pension insurance.

All of the above periods of time will not be counted towards the preferential length of service, which gives the right to early receipt of a pension. That is, in fact, the preferential period will be less than the insurance period due to the exclusion of a number of important periods. Therefore, only those citizens who began working at a fairly early age will be able to take advantage of this basis for early old-age pension.

Early retirement with 37 and 42 years of service (table)

Having completed 37 years of service for women and 42 years for men gives them the right to reduce the retirement age by 24 months. According to the new law, the retirement age for Russians has been increased to 65 and 60, which means that you can become a pensioner early at 63 and 58 years old (24 months earlier).

During the transition period (2019-2023), when the retirement age will gradually change, the retirement age will be different. Best regards, Alexander Vasiliev.

How to calculate underground service for pension

He did not acquire northern rights, since this requires 15 years; Truck drivers for ore hauling also retire early after only completing 15 years of service. In such cases, the summation of preferential length of service is allowed, but according to special rules. The principle is observed: a period of work with the same conditions or providing greater benefits can be added to work that gives the right to exit under less favorable conditions. So, for example, according to List No. 2 the reduction is 5 years, and according to List No. 1 - 10 years. To obtain the right to benefits under the 2nd list, periods under the 1st list are included in the special length of service; the opposite option is not allowed.

42 years of service for men for early retirement: what does it include?

The beginning of 2020 marked the start of pension reform, which will gradually increase the retirement age. This will affect almost every Russian, excluding those who have the conditions for preferential calculation of pension rights.

The government also provided for the opportunity for workers with extensive work experience to retire earlier - two years before the generally established age. The required length of service for early retirement for men must be at least 42 years. Let's consider this issue in more detail.

Is military service included in the 42 years of service?

Note that to calculate the insurance period, a limited number of periods are taken into account - only those for which insurance premiums were transferred to the Pension Fund (see above). The question arises, why military service is not included in the 42 years of insurance coverage in 2019?

The main basis for early retirement when the bill was adopted was the presence of extensive work experience. Thus, the Russian government wants to soften the adopted standards for retirement for those citizens who began their career early and have a long career in their work record. Therefore, military service and other military activities equivalent to it cannot be credited to a citizen when establishing 42 years for early retirement, as well as other periods listed above.

If you do not agree with this initiative, you can vote “FOR” the inclusion of 42 years of service for men in the army, using the link - roi.ru/49821/

However, during 2020, a transitional provision is in force, allowing men who have reached the age of 60 to retire not at 61, but six months earlier. The same rule will apply until the end of 2020, when it will be possible to apply for a pension not at 62 years old, but at 61 years and 6 months.

| Year of reaching age 60 (men) | Year of birth | The right to a pension arises | |

| aged | per year | ||

| 2019 | 1959 (1st half of the year) | 60 years 6 months | 2019 (II half of the year) |

| 1959 (2nd half of the year) | 60 years 6 months | 2020 (I half of the year) | |

| 2020 | 1960 (1st half of the year) | 61 years 6 months | 2021 (2nd half of the year) |

| 1960 (2nd half of the year) | 61 years 6 months | 2022(I half of the year) | |

This norm is enshrined in paragraph 3 of Article 10 of Law 350-FZ. Accordingly, during these periods, citizens will have the right to apply for a pension earlier than the age assumed in the draft law.

Which periods are now not taken into account?

These periods are related to:

- service in the army or non-departmental structures;

- caring for a child up to 1.5 years old, but in total no more than 6 years;

- temporary disability;

- caring for a disabled person of group 1 or a disabled child, a senior citizen over 80 years of age;

- receiving unemployment benefits;

- the period of settling in the process of moving to another region for the purpose of working.

Important: the period of full-time study is excluded due to the lack of contributions for the citizen to the Pension Fund.

Until 2025, the minimum level of work experience will increase by 1 year until it reaches 15 years, and pension points will increase by 2.4 until it reaches 30:

Depending on the category of experience

Length of service for pension

When counting this type, the following may be excluded:

- serving in the army if there was no work before or after it;

- a period of temporary disability can only be counted if there were payments from the social fund at that time;

- if the mother was not fired during the periods of child care, that is, she had a job, this time will not be taken into account, and the period of care will be more beneficial for the amount of the pension;

- periods of unemployment, public work and relocation must be confirmed by a certificate from the State Social Protection Service;

- periods of detention or care for disabled and elderly citizens must be confirmed by certificates from relevant institutions or guardians of the disabled person;

- For military wives serving on the territory of the country, certificates are needed not only from military units, but also from employment centers; stay abroad, both with a military husband and a diplomat, is confirmed by a certificate from the organization of his work.

Important: if there are no conditions specified by the standards, the periods will not be taken into account.

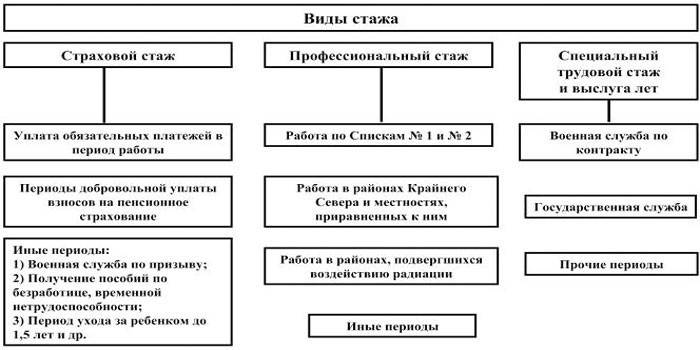

Main types of experience.

Experience for early retirement

Such length of service occurs when a citizen works in harmful and dangerous conditions. For them to be recorded there must be:

- entries in the work book about appointment to a position that falls under a similar category;

- the enterprise must have permits to conduct such activities;

- the employer must also make additional insurance contributions.

Experience for reduction by 2 years

This length of service is provided for citizens who have worked for over 37 years for women and 42 years for men. If you have the required number of years of work, you can retire 2 years earlier, but only at the age of 55/60.

Non-working periods can reduce the number of years if there were no contributions to the Pension Fund as a result of the lack of work activity before and after such periods.

To receive a rural allowance

Since the beginning of 2020, workers in rural areas have had their pensions indexed by 25%. To obtain it, you must have at least 30 years of experience in agriculture and not currently work. Not everyone has enough of the required years, so they began to contact the Pension Fund with a request to add the missing years as non-insurance periods.

In some cases, military service and child care have ceased to be included in the length of service since the beginning of 2020:

However, the condition for indexation is work in rural areas for 30 years. Therefore, such a period as military service is not taken into account.

You will learn how military service and general work experience compare in practice in the publication on our website.