How to arrange this?

The non-profit organization Sberbank provides the service of transferring and managing pension savings. After the freeze in 2014, those citizens whose accumulated funds were registered can transfer them to non-state funds or leave them in the Pension Fund of Russia. If you transfer to a non-state pension fund, then the invested funds go into investment , and the profit is accrued against future funds.

To apply for this type of pension, a transfer is made from the Pension Fund or another NF, if the money is in their custody. Or it was necessary to make transfers at the beginning, when the pension was just being formed (before 2014).

Reference. Registration is carried out on the basis of an application for the transfer of funds, as well as the conclusion of an agreement taking into account the individual pension plan.

Transfer of pension savings

The following steps are followed when transferring money to a new non-state pension fund:

- The choice of the organization itself. It is best to obtain as much information as possible regarding current programs and their conditions.

- Fill out the transfer form. There are urgent and early types of procedures. They differ in the moments of transferring money from one organization to another.

- Contact the existing fund with an application to transfer savings to another market participant.

- Wait until the application is reviewed.

Attention! The procedure remains the same regardless of whether the citizen transfers from Sberbank NPF or vice versa.

Procedure

To make a transfer, you need to go through a number of procedures. Initially, we contact a Sberbank branch to fill out an application for transfer of a funded pension from the Pension Fund of the Russian Federation or another NF (depending on where the pension is currently located). You can contact us in the following ways:

- in person to a bank branch;

- through postal transfers;

- through the online service of Sberbank (you will need to register);

- by proxy, send a person to register.

Next, you will need to collect a package of documents (be sure to make photocopies) to conclude an agreement :

- passport of the insured person;

- SNILS;

- The bank account to which the transfer will be made is opened in Sberbank.

Attention! The next operation is the conclusion of an agreement to transfer funds to Sberbank.

Money is transferred for one visit or request. Applications can even be completed using an electronic signature.

Reviews from fund clients

Currently, the majority of Russian citizens are skeptical about the work of any non-state pension funds, including those created on the basis of the largest financial institution in the country. Some clients encounter difficulties already at the first stage, when they decide to transfer the funded part of their pension to Sberbank. Not every branch of a financial institution can find an employee who deals with this issue. In addition, registration takes place in two stages, which is very inconvenient. First, the client writes an application and submits the necessary documents to the NPF, after which an agreement is signed.

You might be interested in:

Individual pension plan “Target”

However, there are also a lot of grateful clients who decided to transfer the funded part of their pension to Sberbank. All receipts can be viewed through the Internet bank, and information about the work and profitability of the fund, as well as the programs it offers in 2020, is posted on the official website. You can also take part in co-financing your pension by transferring money to the NPF account directly from your card. In your Sberbank-online personal account, you can even activate the corresponding automatic payment.

Possible difficulties and pitfalls

Choosing a non-profit organization has both positive and negative aspects. It is important to pay attention to some factors when choosing:

- It is worth taking into account the fund’s experience - Sberbank has been serving its clients for more than twenty years, it has experience working with many categories of citizens. Their work involves a variety of monetary transactions and their turnover, as well as the management of pension savings.

- Pay attention to the customer base - quantity.

Sberbank has a wide customer base, reliable suppliers and partners, more than three million users. Important! Interest rates - investing is primarily about profit, so it is worth carefully studying the annual interest and deposit rates for your future pension. - Fund rating - for this there are various services and agencies for viewing the rating. The symbols A++ are used to indicate a very high level, A+ for a high level, and A for an average level. According to the rating, Sberbank is one of the leaders in its industry.

- Licensing for insurance activities - the company was one of the first to start working in the pension insurance system, which guarantees the reliability of deposits and stability of income.

Particular attention should be paid to the timing of transfers - this may affect the amount of money and lead to some losses. Such losses include money taken into account in excess of the “fireproof amount” fixed for workers (who began saving for a pension in 2011).

Transfers of pension funds to a Sberbank branch have the following pros and cons:

- reliability;

- high profitability;

- state guarantee on deposits;

- control over funds (how to view the funded part of a pension in Sberbank?);

- According to user reviews, there may be difficulties with receiving money, delays in payments for a couple of months and a slight decrease in profitability (when and how to receive the funded part of a pension from Sberbank?).

How to transfer the funded part of your pension to Sberbank

This non-profit organization has existed for more than 20 years. Few such companies have been operating for so long and have an impeccable reputation according to customer reviews. Extensive experience and stability of the institution are the undeniable advantages of this fund.

In case of closure of the NPF, the Deposit Insurance Agency returns clients' money

Sberbank proposes to transfer the funded part of the pension to a non-state pension fund as soon as possible in order to accumulate funds in the future and influence the formation of regular payments.

To transfer to this institution, you must:

- Come to the nearest branch of a financial institution;

- Present your Russian passport and SNILS card;

- Write a corresponding application;

- Give it to a Sberbank employee.

After a documented transfer to this fund, you will not be tormented by the question of how to transfer the funded part of your pension to Sberbank. 6% of deductions from the employee’s salary will be transferred to the account automatically and accumulated. In the future, it will be possible to significantly increase regular payments through savings, in contrast to citizens whose pension was formed only by insurance contributions.

How to further increase your future pension

Using the example of today's pensioners, we understand that we should not count on the state to provide us with a decent old age. Therefore, you need to think about how to save for your future pension yourself.

- Participation in the state system of co-financing of citizens.

A very interesting and profitable program, the essence of which is to annually make additional contributions to your personal account.

Current pensioners use it as a deposit with 100% return. It is designed for 5 years. After this period, the state doubles these savings. The amount of annual transfers must be at least 2,000 rubles. Amounts over 12,000 per year are not subject to increase. For example:

You joined the program in 2020 and started contributing 1,000 rubles per month. Over the course of 5 years, you have accumulated 60,000 rubles. In 2022, the state will increase this amount to 120,000 and you can receive it by writing an application at the branch of the Pension Fund of the Russian Federation. Those who work will not be able to take advantage of the contributions until retirement.

- Corporate programs for co-financing future pensions.

Some employers practice their co-financing programs similar to the state ones. At the end of the period, the funds can be withdrawn or used to form a future pension. The conditions for obtaining a guaranteed income, as a rule, are continuous work experience in the organization, which, of course, encourages employees for long-term cooperation.

- Non-state pension from NPF. The same thing, only all funds are transferred and stored in the NPF.

Terms and rates

Depositors of NPF Sberbank can choose one of 3 individual plans (TP) offered by the financial institution:

| No. | TP name | Down payment amount (RUB) | Amount of periodic contributions | Contribution schedule | Pension payment terms (years) |

| 1. | "Complex" | from 1,000.00 | from 500.00 | arbitrarily | from 5 |

| 2. | "Guaranteed" | regular contribution amount | determined by contract | determined by contract | from 10 |

| 3. | "Universal" | from 1,500.00 | from 500.00 | arbitrarily | from 5 |

If you withdraw the deferred amount urgently after 2 years, the depositor will receive the following:

- 100% of the principal amount;

- 50% of investment income.

The state provides the opportunity to obtain a tax deduction. Its size is equal to 13% of what was deposited into the account, but not more than RUB 15,600.00. during a year.

Sberbank also provides programs for non-state pension provision:

- "Our Heritage";

- “I am a mentor”;

- "Your future";

- "Big Start";

- "Parity".

The Security Council establishes age conditions for citizens to transfer to NPFs. This:

- for men, the year of birth is no later than 1953;

- for women, the year of birth is no later than 1957.

Anonymous transfer of money to a Sberbank card

Ways to find out how much money has accumulated in Sberbank NPF?

Sberbank offers several options to check your savings:

- remotely through the Sberbank Online service;

- through ATMs and bank offices;

- visiting a branch of NPF Sberbank;

- in the personal account (PA) of NPF SB;

Let's consider the listed methods in more detail.

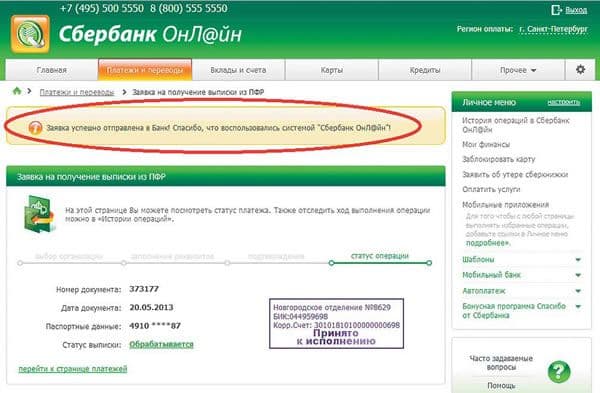

How to get information using Sberbank Online?

To use this method, you must be connected to Internet banking. Information about the status of your pension account can be obtained in the “Pension Fund” section.

Conditions for obtaining a loan secured by real estate at Alfa Bank

You need to submit an application. The algorithm is like this:

- In the menu of the above section, select “Other”.

- Click on the “Pension programs” tab.

- Click on the “Get Statement” command.

- Complete the process by clicking on the virtual “Submit” button.

When the status of the application changes, that is, an o appears next to the request, you can click on the button to view the extract from the Pension Fund.

At an ATM

You can use both a terminal and an ATM. You can use this method only if you have a Sberbank payment instrument. You should insert the plastic into the card reader and, by pressing PIN, go to the section to find the necessary information. The direction of action will be indicated by the interface of the selected device.

At the bank office

Information about the size of the savings portion at the time of application is required to be provided by Sberbank employees upon the client’s request.

By visiting one of the Sberbank offices, you can:

- get answers to questions from the operator;

- use one of the computers of a financial institution.

In the halls of large branches there are consultants who are ready to help clients.

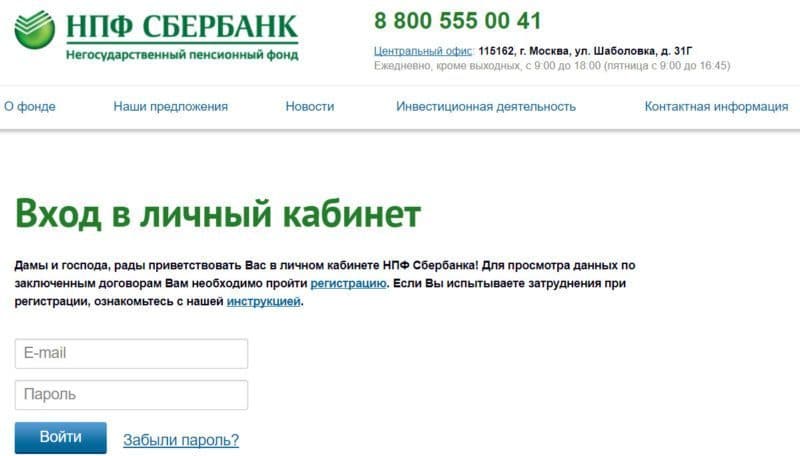

Through the personal account of NPF Sberbank

You can view the statement using the online resource of the Sberbank NPF division. To do this, you need to register on the website https://npfsberbanka.ru. The service’s personal account will display information about transfers to the holder’s account. The balance at the time of entering your personal account will also be visible.

At the office of NPF Sberbank

The algorithm of actions is the same as when visiting the Security Council office. You need to have a passport with you for personal identification. You should contact the employee and state your request.

A visit to Sberbank divisions is necessary when you need to obtain an official statement in writing with the signatures of responsible persons and seals of the enterprise.

Through State Services

Using the tools of the government services portal is another convenient way to find out the status of your pension account via the Internet. The algorithm of actions is as follows:

- Register on the portal, indicating the following information about yourself: full name, ID details, TIN and SNILS.

- You request an activation code, which will be sent to your mobile phone or email (as indicated in the request).

- After passing verification, fill out the form and enter your personal account.

- Click on the “Electronic Services” tab.

- Click on the “Pension Fund” subsection.

- You study the information about your account, which will appear on the monitor in a few seconds.

Expert opinion

Alexander Ivanovich

Financial expert

Important: in the future, to enter the portal you will only need to enter SNILS.

How to find out using SNILS?

Balance information is confidential. Only the account owner has the right to receive them. To do this, he can use one of 2 options:

- contact one of the Pension Fund offices in person;

- request an extract online.

How to connect Troika to a Sberbank card?

In the latter case, you need to use the electronic services of State Services or Pension Fund.

Find out by contract number

Knowing the contract number, you can obtain information using the algorithm described above. However, this is a difficult method. By using contract numbers, you can get what you want only in the PF system that manages the requester’s funds.