Many pensioners are accustomed to receiving their pension without leaving home. The postman brings it. But you can receive it yourself at the post office or apply for a Sberbank card and receive transfers to it. It is difficult for older people to understand the working mechanism of modern systems and devices, so it is easier for them to receive their money in the traditional way. But recently the number of pensioners wishing to transfer their pension to a Sberbank card has been growing. For these purposes, the savings bank allows older people to obtain a Mir card for free to receive funds from the Pension Fund of the Russian Federation.

Who can transfer a pension to Sberbank and what documents are needed?

Sberbank has a large network of branches, which makes it possible for many residents of the country to receive a pension using plastic money. In principle, any pensioner can transfer a pension to a Sberbank card.

To receive a pension on a Sberbank card, you must provide employees of the financial institution with the following documents:

- Passport;

- Pension certificate and SNILS;

- A document confirming registration in the locality where the pensioner will receive money.

There is no need to provide additional documents.

Obtaining a Sberbank pension card - the first stage

Before transferring your pension to a Sberbank card, you must open a MIR pension card for this institution. To do this, you need to fill out an online application or come to a bank branch with your passport and pension ID to fill out the application on the spot.

To apply for a Sberbank pension card online, follow the instructions:

- Go to the bank's website;

- Select “Cards” in the top menu, then “Debit cards”;

- Now from the proposed list, select “Pension card”;

- Click “Apply” and fill out the form;

When an account is opened at the bank, a written application is filled out to transfer the pension to Sberbank. To do this, you need to visit a bank branch and have your passport and SNILS with you.

Registration of pension transfer - second stage

To transfer a pension to a Sberbank card, you will need to take some steps:

- Visit a bank branch with a package of documents;

- Conclude an agreement with the bank;

- If you wish, connect to Internet banking;

- Visit the territorial department of the pension fund.

If the pensioner has previously received money for the savings book, it must be provided with the application. Usually the application is considered no more than 10-14 days.

After this period, the citizen receives plastic. The manager must print out the card details with which the pensioner will go to the Pension Fund to process the transfer of the pension to a bank card.

Typically, the bank’s requirements indicate personal presence when filling out an application, but other conditions are provided for older people. You can send a trusted person in your place who will carry out the entire procedure. In order for such a person to have the right to manipulate the card, a power of attorney is issued to him.

Filing an application

Any retiring citizen can independently choose the most suitable delivery method for himself. You can do this using one of the 2 proposed options:

1 design option

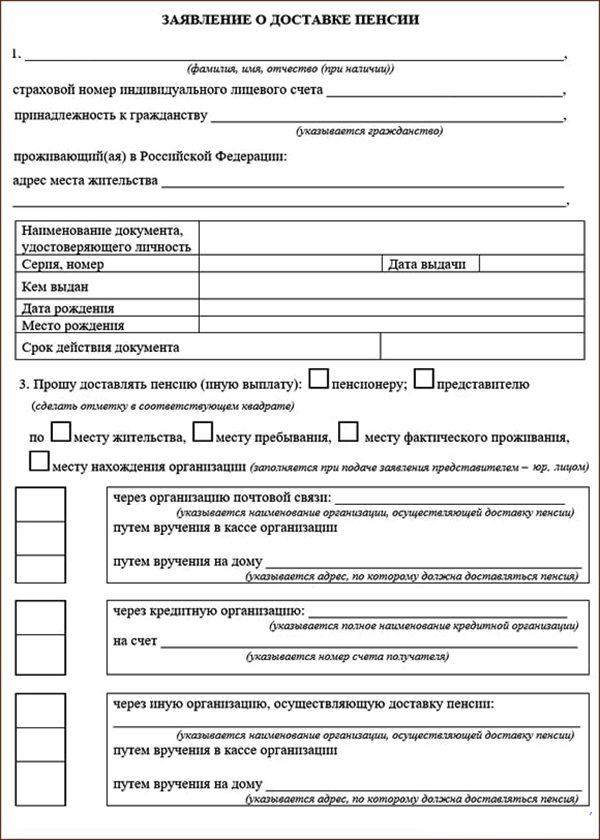

Write an application directly to one of the territorial departments of the Pension Fund. The form can be printed on the PFR website (https://www.pfrf.ru/grazdanam/pensionres/dostavka/), obtained from a specialist at the PFR branch, or click here to download the form, and here you can fill it out. The document indicates the applicant's full name, his SNILS, citizenship, residence and registration address, passport information, contact information (telephone or e-mail). If it is not the pensioner himself who submits the application, but his representative, then the details of this authorized person are entered into it. The date and signature must be affixed.

Application for pension delivery

2 design option

It is proposed to submit an application through the State Services portal. If you are using it for the first time, you must go through authorization. To do this, you need to enter some personal data:

- passport;

- SNILS;

- TIN.

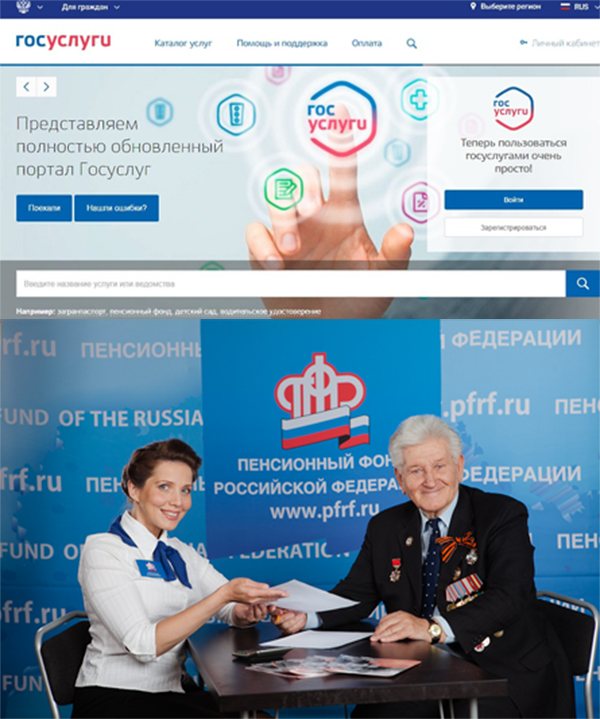

Documents for authorization on the public service portal

Next, a check is carried out, which can take from 15 minutes to 3 days, after which the account is assigned a standard status. But to submit such an application, additional confirmation will be required. You can do this:

- using the services of Sberbank Online, Post Bank or Tinkoff Internet Bank;

- using Russian Post and receiving a special code;

- if there is an electronic signature;

- visiting the Pension Fund branch.

After filling out the electronic application on the State Services website, a notification will be generated within one day indicating the allotted time for providing documents and the address where they should be brought. Typically, a submitted application is considered valid only for 5 working days. A visit to the Pension Fund is required to confirm the electronic application.

After authorization on the State Services website, you should visit the Pension Fund of the Russian Federation to confirm the electronic application

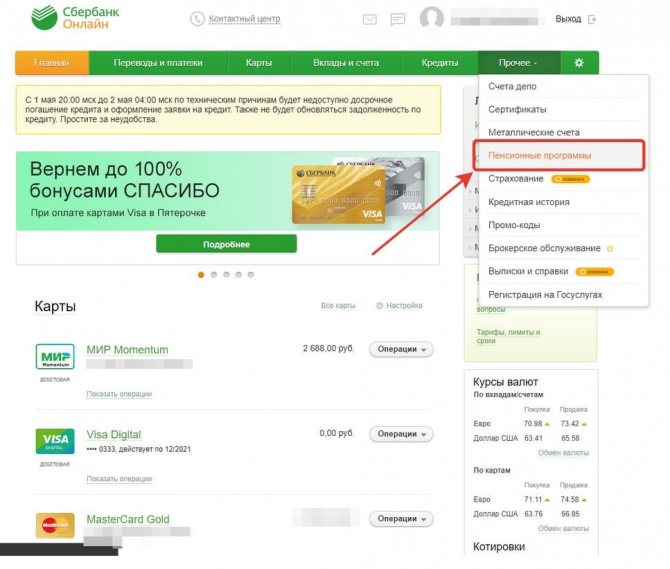

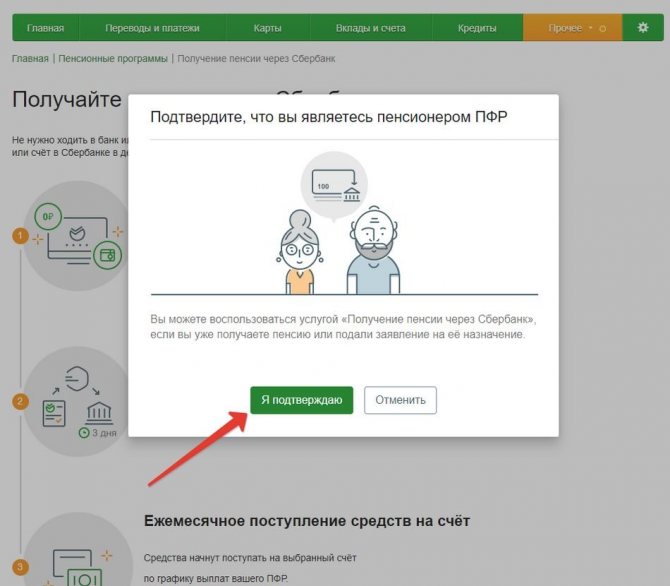

How to transfer a pension to a Sberbank card via Sberbank Online

You can transfer your pension to a Sberbank card in Sberbank Online if the citizen is already a Sberbank card holder. For this:

- Log in to your personal account and on the main page, select “Other” from the menu;

- Now you need to open the “Pension programs” section;

- Find “Receive a pension from Sberbank”;

- On the page that opens, click “Apply for a pension.”

To do this, you need an account on the State Services portal, where an electronic application is filled out.

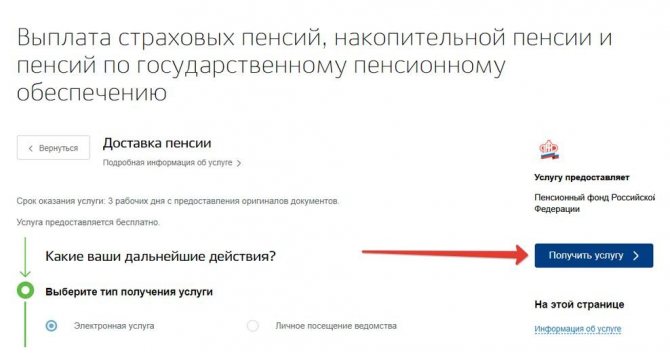

By registering on the website, you can fill out an application without leaving your home. Choose the Pension Delivery service. The application will require you to provide bank details.

Methods of obtaining

There are several ways to deliver pension money:

- The opportunity to receive monthly payments from the Pension Fund of the Russian Federation is provided not only to the pensioner himself, but also to his appointed representative.

- A retired person is not always able to go outside. Therefore, you can receive pension money at home. This service is provided to older people by the Russian Post, as well as some organizations with whom the Pension Fund signs an agreement for a similar service.

- A person who has retired can also arrange to receive his cash receipts from a credit institution with which the Pension Fund has an agreement. The list of banks can be found on the official website of the fund (https://www.pfrf.ru/branches/perm/info/~grazdanam/3280). The leader among them in terms of the number of pensioners attracted is Sberbank.

Ways to receive pension money

Which card can I transfer my pension to?

Before applying for a pension on a Sberbank card, it is important to understand what they are. Today the bank offers several products:

- Pension card MIR;

- MasterCard Active age.

When applying for a MIR card, there is no service fee, the card is issued free of charge, and 3.5% per annum is charged on the cash balance in the account.

The MIR pension card from Sberbank has a number of advantages in addition to the ability to receive a pension directly to your account without visiting a Post Office or other institutions. Pension card holder:

- receives 3.5% on the balance of funds on the card;

- can connect the Thank you program from Sberbank and accumulate points for purchases in stores, pharmacies, gas stations, cafes, etc. Then you can pay with points or exchange them for a discount with project partners;

- can register in Sberbank Online Internet banking and remotely manage the account: make transfers, pay for utilities, telephone, Internet, pay for a loan, etc.

And the main advantage is that the Sberbank MIR pension card is issued free of charge and the service is also free.

Active Age product has the same benefits, but also includes the added bonus of special course prices, themed sales and special travel prices.

How to issue a power of attorney

Then he should turn to a citizen in whom he has confidence. You will need to document the power of attorney, otherwise neither the cashier nor the postman will give money to the authorized person. The form of power of attorney is free if the organization issuing the pension does not provide forms. But there is data that must be present in such a document:

- Title of the document;

- date of issue of the power of attorney;

- passport details of the representative;

- for what purpose is the document drawn up (the purpose is to receive a pension).

What is the validity period of the power of attorney (valid for a year, unless a different period is specified). In Art. 186 of the Civil Code of the Russian Federation (clause 1) states that there must be a date on which the document becomes effective. Otherwise, such a power of attorney is considered void.

- Sample power of attorney to receive a pension

- Power of attorney form to receive a pension

Record of the person certifying the document.

The power of attorney is certified by the responsible representative of the educational institution, enterprise, medical institution, housing authority. A specially authorized person signs, which is confirmed by the seal of the manager. Certification of a power of attorney is free of charge. In special cases, a notary can certify a document, but this is a paid service. You can call a notary at home (for example, if the principal is a bedridden patient), but it is easier and cheaper to visit his office.

So now a senior citizen does not have to stand in line for half a day to receive a pension. Money can be delivered to your home or transferred to a card. The pensioner chooses the most convenient option for him to receive a pension. The main thing is not to make a mistake with the choice initially, so as not to have to re-register documents later.

Advantages and disadvantages of applying for a pension on a Sberbank card

Having decided to transfer a pension to a bank card, a pensioner must understand what advantages this method of receiving funds provides and whether it has any disadvantages.

Let's list the advantages:

- High degree of reliability. Sberbank is a large financial institution that reliably protects the money of its clients. The likelihood that the bank will go bankrupt is minimal;

- A large number of ATMs. Plastic holders can withdraw funds from a large number of ATMs;

- Modern technologies. Users have the opportunity to use Sberbank Online, where many transactions are carried out, and the account can also be managed remotely using the Mobile Bank service;

- Free release of plastic. In addition to the fact that you will not have to pay for issuing the card, interest will be charged on the remaining funds. The SMS notification service will be free for 2 months, then only 30 rubles will be charged per month.

There really aren't many downsides. For example, a pensioner may lose the PIN code of the card, or lose the card. But these problems are being solved. You can always reissue the card or block it if necessary.

All benefits of a pension card

The obvious advantages of any plastic products are:

- access to funds at any time without queues and connection to the organization’s operating hours;

- no need to constantly carry cash with you, since you can always carry out a cashless transaction;

- the ability to manage a bank account using modern and convenient services;

- receiving social benefits immediately after they are transferred to the bank.

What Sberbank offers

There are many local services that holders of social savings bank cards can use.

- Wide service network. Sberbank owns the largest share of the financial market in Russia, so it is always very easy for its clients to use the card in any region.

- Preferential terms for loan products and deposits.

- Bank card protection. “MIR” cards have a high degree of protection thanks to the built-in microprocessor.

- Mobile banking service. This service has long gone beyond the usual informing clients about all transactions carried out using the card. Using a mobile phone, you can pay for cellular communications, utilities, and transfer money between any Sberbank accounts.

- Auto payment. Automatically transfers funds when needed. Automatic replenishment can be set up to pay for cellular communications, utilities, repay loans, pay traffic fines. Any consultant will help with the settings, then everything will happen without your participation, provided there are funds in the account.

- Bonuses THANK YOU. You can accumulate points when servicing with a bank card. In the future, these same bonuses can be used to pay up to 99% of the purchase price.

- Internet service Sberbank Online. Allows you to control all bank accounts, make money transfers and payments, open deposits on more favorable terms, and repay loans.

- 24/7 free customer support service. If you have any questions, you can always contact the call center by phone, providing your personal information.

How to deposit money to a card

You can deposit funds either in cash or by bank transfer.

Cash deposits are possible in the following ways:

By passport through any bank branch

To top up, you can specify either the bank card number, which is written on its front side; or a twenty-digit bank account number received when opening the card (registered in a copy of the application or bank details, if they were issued to you), and the number of the Sberbank branch in which it is opened.

Via electronic service devices

A terminal or ATM with a cash acceptance function. To do this, you will need the card itself, which should be inserted into the card reader, and then enter the PIN code. After this, in the menu that opens, select “Top up your account”. Next, “Cash Transactions” and “Replenishment”. When the ATM asks you to deposit bills, place them one by one in the bill acceptor. After completing the operation, you need to click “Finish acceptance” (“Continue” or “Pay”), pick up the card and receive a receipt.

Non-cash deposits

Transferring money to a card non-cash is also very easy:

- Through ATMs and terminals you can transfer money both to your accounts and to the card accounts of other Sberbank clients. When transferring to someone else's card, you will need to fill in its number and transfer amount. To check, the first name, first letter of the middle name and last name of the owner will be displayed on the device monitor. To top up your account, you need to select the appropriate transaction, and then select non-cash transactions.

- Using a mobile phone, if you have activated the Mobile Banking service. Transfers are available between your accounts, as well as to cards of other holders. Sending is carried out by dialing and sending an SMS to service number 900 indicating the amount, card number or mobile phone number of the recipient.

- When using the Internet service from Sberbank via a PC or mobile phone. Any intrabank and interbank transfers are possible.

- Through another organization - a bank, Russian Post, communication shops. To do this, you will need detailed bank details of your account: BIC, INN, current account. In the purpose of payment, it is necessary to indicate the bank card number, twenty-digit account number and the full name of the owner. The time of transfer through another organization should be checked with the sender.

- Through an online payment system service. The crediting time depends on the affiliation of debit and replenishment cards to a specific payment system.

For any methods of depositing funds, Sberbank makes the transfer no later than the next business day after the date of receipt.

Safe use of the card

The safety of plastic depends, to a greater extent, not on its technical features, but on the correct handling of it by the owner himself.

To protect the card from breakage and demagnetization, it is necessary to store it in a case or special compartments of wallets, and also keep it away from electromagnetic devices and fasteners. The electronic chip and magnetic stripe are very sensitive to damage.

Information security consists of preventing the disclosure of personal data to third parties, including the PIN code and data written on the front and back of the card. It is also prohibited to transfer the plastic card itself to third parties.

Precautions when receiving a pension

After receiving a pension, the pensioner needs to sign for the pension. The amount on the documents and the amount issued in hand must match.

When receiving a pension during the quarantine period, an elderly person should exercise caution:

- Sign documents with your own pen.

- Make sure the postman is wearing gloves and a mask.

- Wash your hands after receiving cash.

The postman may ask for a passport, but he has no right to copy or photograph it. He should not ask questions about the card details and existing savings.

Usually a pensioner knows the postman by sight. When visiting a suspicious stranger, you can call the post office to make sure that this is an employee of the Russian Post.

It is worth considering that pension providers cannot provide services for revising the size of the pension or increasing it. This is not within their competence. Pension Fund employees also do not make house calls, offering additional services.

FAQ

One of the most frequently asked questions concerns the security of contactless payment . — The popularity of payment products with contactless payment is additional confirmation of the security of this technology. In addition, the card is always in the hands of the owner, so it is impossible for fraudsters to gain access to the data. The system prevents from:

- double debiting;

- unauthorized withdrawal of money.

If, in case of loss of the card, the money is spent illegally, the bank will compensate the damage in full.

Many people are interested in whether the unique number will be retained if the card is reissued early due to its loss? — If a card is reissued before its expiration date, the holder will receive a new card with a new twelve-digit number, but the same account number.

How to quickly block a card? — Call the number that everyone knows — 900. If you have a mobile application, go to it:

- open the “Maps” section;

- select a card and click the “Block card” button.

How to refuse a card?

The holder of a pension card has the right to close a debit account on his own initiative. To do this, you need to visit any additional Sberbank office, not forgetting to take your general passport with you. Once at the bank branch:

- Receive an electronic queue coupon by selecting the “Bank Cards” section.

- Approach the operator's window after announcing the number indicated on the coupon.

- Show your passport and tell them you want to refuse the card.

- Fill out an application for closing a card account, indicating the method of obtaining the possible balance of funds:

- in cash after closing the card account at the bank’s cash desk;

- translation using the details provided.

- close existing debts for bank services, if any;

- disable services and facilities.

The card account will be closed 30 days after submitting the application. It is advisable to visit the bank again to:

- hand over the physical carrier of the account - a plastic card;

- obtain from the operator a special certificate indicating the absence of financial obligations on the part of the holder.

Is it possible to make a transfer in 2020?

To start working, you need to find an official place of work, reflected in the work book. In the process of paying wages to employees, there is a provision for contributions paid by the organization from the labor fund, another share is superimposed on the basic amount and is reflected in the form of tax deductions in the amount of 22%, where 16% relates to insurance and goes to pay people on pensions, and 6% is sent to the citizen’s personal account.

All pension contributions are transferred to a non-state pension fund, now any citizen can participate in the fate of 6%, choose a pension fund and in a similar way in the future increase the amount of the accrued pension.

When considering sending to Sberbank itself, such a request is not entirely correct. From the beginning of 2020, it is possible to transfer pension contributions to Sberbank NPF, since Sberbank JSC holds shares of this fund.