NPF "Electroenergetics" is a non-state pension fund founded in 1994. The main area of work is pension provision for employees of energy companies. After the reform, the NPF became open. Clients are organizations and individuals. According to the rating, Elektroenergetiki was in fifth place in terms of reliability. The fund also led in terms of profitability for investors.

The non-state pension fund developed pension programs. He also interacted with maternity capital and was a participant in the state pension co-financing program. All users were offered a personal account. Using the virtual service, it was possible to view the status of pension accruals or other useful information. At the moment, Elektroenergetiki is included in the Lukoil-Garant fund. In December 2020, NPF LUKOIL-GARANT was renamed NPF Otkritie. All clients are automatically transferred under the management of the new organization and can use the updated personal account.

- 1 Personal account features

- 2 NPF Electric Power Industry: login and registration of your personal account

- 3 Contacts

History of NPF Electric Power Industry

The non-state pension fund of the Electric Power Industry was initially established by a large number of private companies, mostly generating and supplying electrical energy. The fund had high returns and enjoyed the trust of the population.

But changing legislation and current realities have necessitated the consolidation of pre-existing funds and, as a consequence, a decrease in their number.

Reorganization

In 2020, NPF Electric Power Industry was reorganized by merging, together with NPF RGS, into NPF LUKOIL-GARANT, which was soon renamed NPF Otkritie. As a result of this reorganization, one of the largest funds in the country appeared, with a history of activity in this area dating back to 1994.

Pension fund profitability

Today, NPF Electric Power Industry cooperates with 600 organizations throughout the country. The institution has corporate programs created for each company. The composition of the personnel and financial capabilities are taken into account. The amount of the pension depends on the chosen program and frequency of contributions. So, if a woman has the right to maternity capital, it can be used to form an old-age payment. The application must be submitted in person during a visit to the organization.

| Year | Profitability of the Electric Power Industry Pension Fund |

| 2014 | 9,04% |

| 2015 | 8,46% |

| 2016 | 8,94% |

| 2017 | 4,3% |

Otkritie Foundation programs

NPF offers 2 programs for the formation of future pension payments:

- The funded part of the insurance pension (although currently no contributions are being made and the fate of this type of security remains unknown).

- Formation of a non-state pension, which depends on the amount of voluntary contributions of a citizen under a direct agreement between him and NPF Otkritie.

In essence, this is the full range of pension insurance programs that funds can offer under current legislation. Some NPFs have already moved to the formation of an individual pension plan , which, in essence, is just a non-state pension.

How to transfer funds to this NPF

The procedure for transferring funds to this fund is general. To do this, it is necessary to conclude an agreement for managing the funded part of the pension with NPF Otkritie at the fund’s office or representative office. Then notify the Pension Fund of the Russian Federation about the transfer of savings to this company by filling out the appropriate application and attaching the necessary documents: a copy of the agreement with NPF Otkritie, a copy of the identity card.

Attention! If the savings were managed by the previous company for less than 5 years, there is a risk of losing part of the funds, since the state does not guarantee their preservation in the event of negative returns. If at least 5 years have passed, then all savings, including investment income, will be transferred under the management of the Otkritie fund in full.

Last news

Our readers often ask why the fund does not currently participate in ratings.

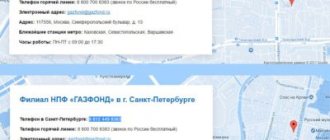

The previous contacts listed on the company's official website are not working at the moment. The answer is very simple: NPF Elektroenergetiki has been part of the NPF Lukoil-Garant fund since August 2020. This means that all the fund’s clients simply switched to a new company - while the insurance conditions for them remained the same. All that has changed is the name of the fund and its details.

Currently, NPF Lukoil-Garant has a new name - NPF Otkritie. Together with , other companies also transferred to the new fund, forming a large organization with representative offices throughout Russia. This organization has an impressive amount of savings, which guarantees an increase in customer savings.

We invite you to familiarize yourself with the main performance indicators of NPF Otkritie:

- The number of company clients is 7.9 million people.

- The accumulated return of the fund is 175.10%.

- Coverage of the domestic market is approximately 20% of the country's population.

- The company's own funds are 18.6 billion rubles.

- The fund's own property is 569 billion rubles.

- The yield last year was 8.22%.

Unfortunately, we cannot yet provide information on the company's profitability for 2020. It will be possible to find out the latest data at the end of this year, after the publication of official information.

To obtain information about your own savings in this company, contact one of the branches of NPF Otkritie. You can also familiarize yourself with the information you are interested in by logging into your Personal Account on the official portal of the fund. Free consultation is available to everyone via the company's hotline - to receive it, call the number 8 (800) 200-59-99.

Official website of the fund

Although the law does not oblige non-state funds to have official websites and provide depositors and insured persons with the opportunity to use personal accounts on it, the new time - the age of information technology - is forcing this to happen.

Due to the fact that the non-state pension fund of the Electric Power Industry was reorganized, clients can obtain information on the website of the Otkritie fund.

Personal Area

Like other non-state pension funds, Otkritie provides its clients with the opportunity to use a personal account on the company’s official website in order to be able not only to receive prompt and up-to-date information, but also to manage their savings.

In fact, a personal account is provided to each fund investor immediately after concluding an agreement on the formation of a funded pension or non-state voluntary provision. However, you will still have to go through formal registration to gain access to your personal account.

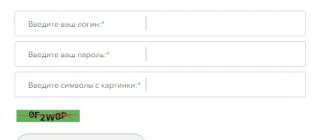

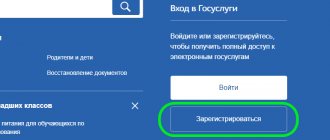

Registering an account on the site

To enter your personal account, it is not necessary to register; you can log in using your account on the government services portal in electronic form. This can be done if you have an account that has passed the verification procedure (confirming the identity of the owner). If there is none or the citizen simply does not want to use it, then you can go through the registration procedure, which will not take much time.

Registration of a personal account is carried out in several short steps:

- On the main page of the official website, select “Personal Account” in the upper right corner.

- On the login page at the very bottom, select “Register”.

- Select the registration method (using pension insurance certificate data or passport data).

- Enter the document data (SNILS or series, number and date of issue of the civil passport).

- Indicate your date of birth.

- The system will check the presence of the entered data in the system.

- Create and specify a username and password for your account for subsequent logins.

If you have a registered account, you can log in on the Personal Account page by entering your login and password. In this case, the login can be the insurance number of an individual personal account.

Online calculator

Another convenient service offered by the official website of NPF Otkritie is an online calculator that allows you to calculate the size of your future pension or, conversely, calculate an individual savings program based on the desired amount of your future pension.

The calculator itself is located on the main page of the site, you can find it by scrolling the page a little using vertical scrolling.

To calculate the total monthly amount you must indicate:

- citizen's gender;

- date of birth;

- the amount of wages or other income from which insurance premiums are paid, as of the current date for 1 calendar month (the amount is indicated before withholding personal income tax; more than 100 thousand rubles cannot be indicated, since the annual amount subject to contributions is limited 1,150 thousand rubles);

- the amount of the planned monthly contribution to the formation of a non-state pension (not to be confused with the funded part of the compulsory insurance pension);

- profitability of investing funds from pension reserves.

After specifying the requested information, the total amount of future pension provision will be displayed on the right side, and the amount of funded and non-state pensions will also be indicated separately.

Important! The calculator is for informational purposes only and allows for very rough calculations.

The NPF Otkrytie calculator takes into account average indicators, be it the level of profitability of 7.24%, the start of working life at the age of 18, or the period of “freezing” contributions to the funded pension until 2021 (although it is not known for certain whether it will extend in the future and not Will such fees be abolished altogether?

Registration process

It does not take much time to register a personal account for the Electric Power Fund. The investor can enter SNILS or passport data, or a pension certificate can be used. There is a separate tab for this. After entering the data. Including your date of birth, you should click the “Register” button.

Important! Write down your password and login to use your personal account in the future.

Any client of this NPF can register to gain access to the user’s account. By the way, all Russians born no earlier than 1967 can be served by the fund.

Reviews about NPF Elektroenergetiki

Initially, I used the services of NPF Elektroenergetika and was very pleased: a good level of profitability, an intuitive interface for my personal account, a transparent system for investing funds. Afterwards, he was automatically transferred to NPF Otkritie (with intermediate stages), and was struck by the negative level of profitability from managing pension reserves. I have decided not to switch for now, since the previous level of profitability, government participation and the number of investors inspire hope for a bright future.

Sergey, 37 years old

Of course, I cannot help but be upset by the fact that in 2020 the size of my savings did not increase due to the ineffectiveness, apparently, of its use. But I am a long-time investor in Garant-Lukoil, which is now called Otkritie, and I know that the average growth rate of pension savings is at least 7% per year, which is generally above average. Otherwise, I am satisfied with the fund’s activities, I trust it and plan to increase the amount of contributions to non-state pensions.

Natalya, 39 years old

I chose the Otkritie fund based on information on the Internet; its performance is one of the best among all other companies in this field. I registered a personal account, very convenient, comfortable feedback. So far there are no complaints, I will continue to look at the results of managing my savings.

Svyatoslav, 29 years old

general information

To satisfy the needs of all clients, NPF Elektroenergetiki steadily increases the level of service and also improves the technologies used.

Over the past few years, NPF "Electroenergetics" has been one of the leaders in terms of the volume of pension reserves and pension savings. The company also demonstrates consistently high performance in terms of the number of fund participants and insured persons. NPF partners are more than 600 enterprises from different industries - all of them have the opportunity to use a wide range of corporate pension programs. Numerous ratings confirm that the Electric Power Fund has the maximum level of reliability:

- The national rating agency assigned the company an AAA index, indicating the highest level of reliability.

- The Expert RA agency assigned the company an A++ index, indicating the highest quality of service and level of reliability.

Main indicators of the fund's economic investment policy:

- Since 2009, the average profitability rate has been 8%.

- For 2020, the return was 9.36%.

- The number of insured persons in the fund is over 1.2 million people.

- The yield received for all years of the fund’s activity is 152.73% per annum.

- The fund's own property has a volume of 144.1 billion rubles.

- At the end of the year, total pension assets exceed 138 billion rubles, pension savings of this amount amount to 92.8 billion, and reserves account for 45.3 billion rubles.

- In 2020, the amount of pension payments amounted to 5.3 billion rubles.

Perhaps the above figures will raise doubts among some potential clients of the fund - is it worth transferring the funded part of the pension to a non-state pension fund, paying the company a certain percentage for managing the account, because the proposed return will be lower than what can be received by default?

Our answer is that it is definitely worth doing if you are interested in the long term, and if you are a participant in current pension insurance programs. The income that it offers its clients exceeds the official inflation in Russia.