Non-state pension funds have been operating in Russia for almost 20 years. With their help, citizens can increase their savings and receive increased old-age benefits based on their age. One of the leaders in this area is Lukoil Garant, which offers several co-financing programs.

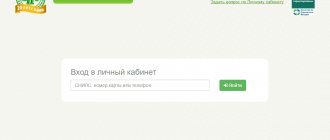

In August 2020, three non-state pension funds merged with NPF Otkritie. Now all clients of Lukoil Garant and other reorganized non-state funds are serviced in a single online service. Below are detailed instructions for users.

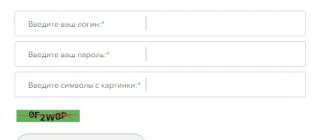

Registration in the personal account of the non-state Pension Fund Lukoil Garant

After signing an agreement with Lukoil Garant, the client automatically receives access to his personal account. In order to enter it, you will need to log in, that is, confirm the information specified in the paper document. The procedure itself takes about two minutes. The only thing you need to prepare in advance is a passport of a citizen of the Russian Federation or SNILS.

Register

Registration of individuals

Most recently, Lukoil Garant merged with Otkritie, so all previously registered clients undergo the procedure of authorizing their personal account on the NPF Otkritie portal.

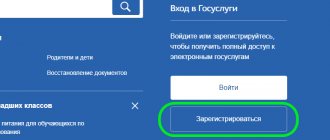

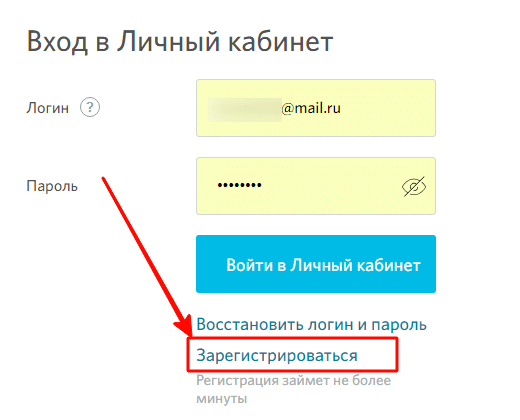

When you visit the page, a form immediately opens, where you need to click on the Register link.

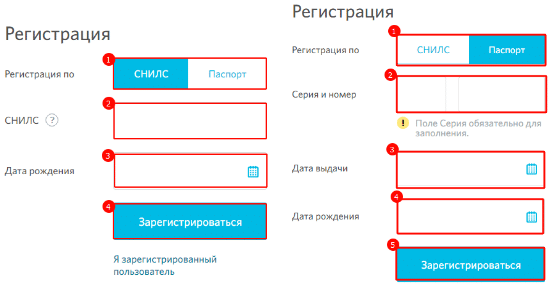

At the next stage of creating a personal account, you need to select a document with which the client will be verified in the Lukoil Garant database:

- SNILS.

- Passport of a citizen of the Russian Federation.

The input of information depends on this choice. In addition to information about the document, you must indicate your date of birth.

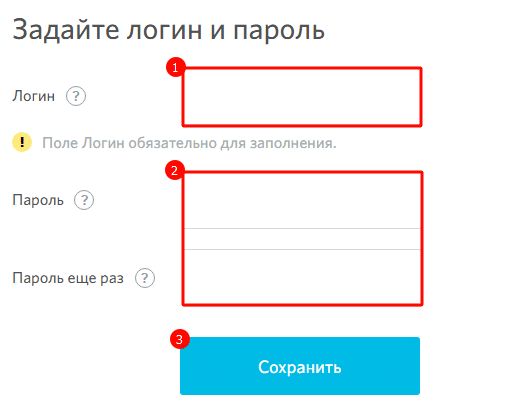

The next step will require you to come up with a login to further log into your personal account. It must contain from 5 to 30 characters of the Latin alphabet and numbers. It is allowed to use an email address. Below, enter the user-created password twice.

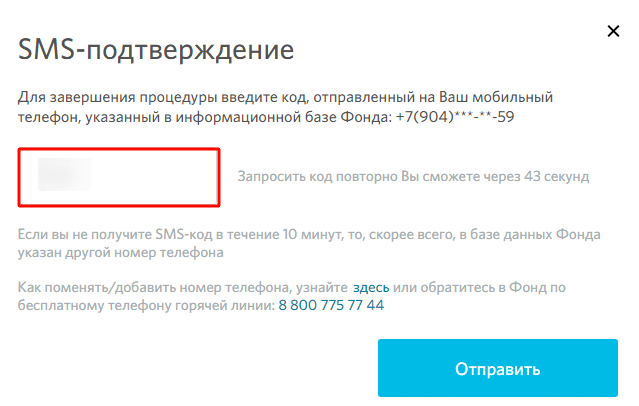

A telephone number is specified in the agreement with Lukoil Garant, so an SMS code is sent to it, which is another step in maintaining the security of personal data in your personal account. It will need to be duplicated in the line that opens.

Attention! If the phone number has changed, you need to call the call center at 8-800-775-77-44. Be prepared to recite information from your identification documents .

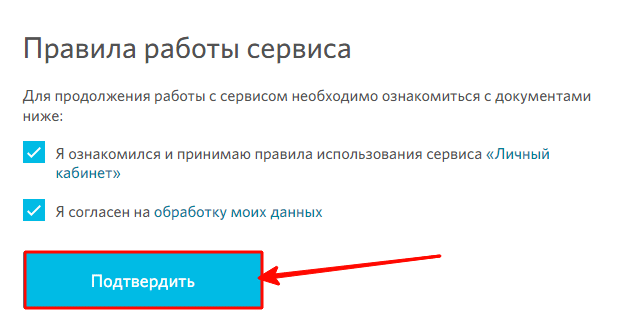

Read the rules of the service and consent to the processing of personal information and only then give your approval for the creation of a personal account by clicking on the Confirm button.

At this point, the client’s registration with Lukoil Garant ends and a personal account opens, where you can not only familiarize yourself with the funded part of your pension, but also use the portal tools for calculating or interacting with the funded pension fund.

How to open a deposit in NPF Garant

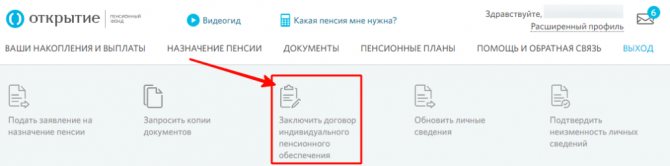

After a citizen signs an agreement and transfers to Lukoil Garant, he can also independently formulate his future social benefits by age. This can be done through contribution programs to Lukoil Garant. In your personal account in the top menu, go to the contract conclusion section.

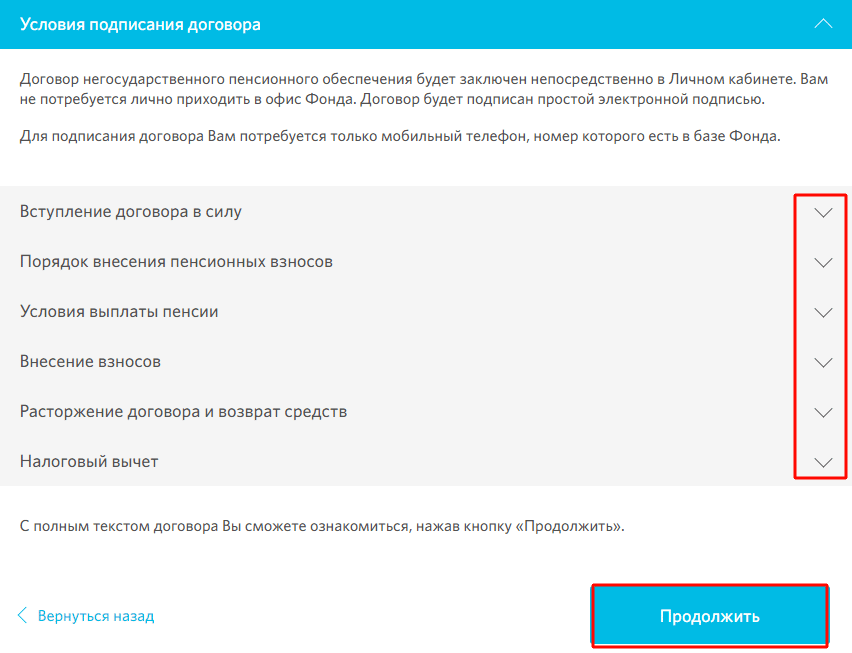

The conditions for signing a document drawn up through your personal account will open, where you must read all its points in order to have a general idea of the program. To expand information, click on the document section arrow on the right.

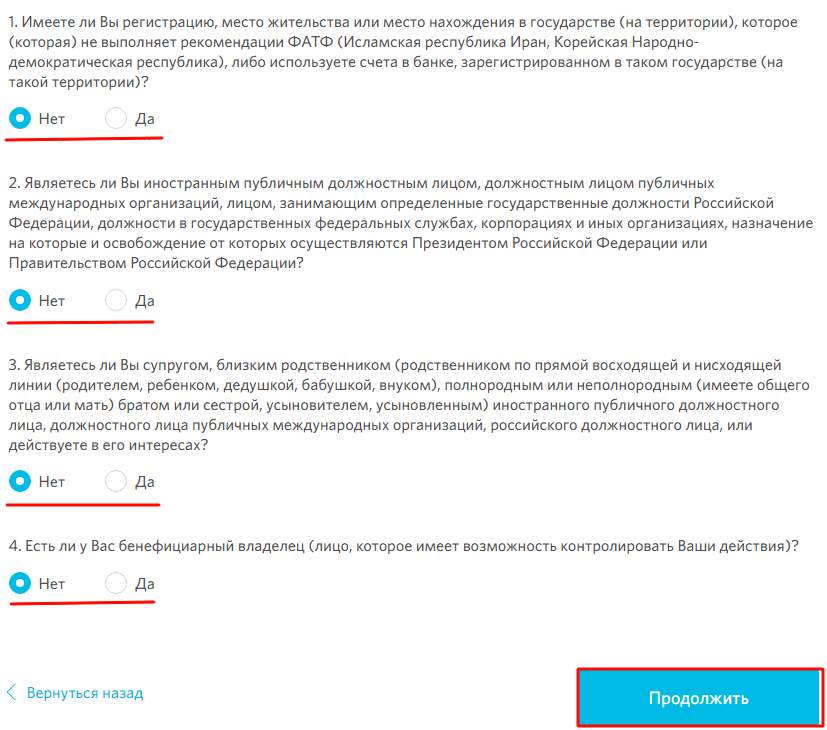

At the next stage, you need to answer yes or no to four important questions that affect the preparation of papers.

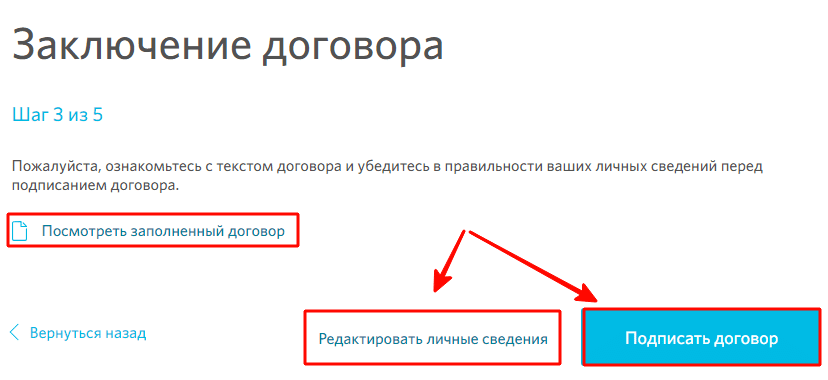

Be sure to read the text of the electronic form and check that your personal information and identification documents are written correctly. The information is generated from contract data, which is connected to your personal account automatically. If necessary, you can edit the information on the account holder in Lukoil Garant. If everything is correct, then proceed to the next step.

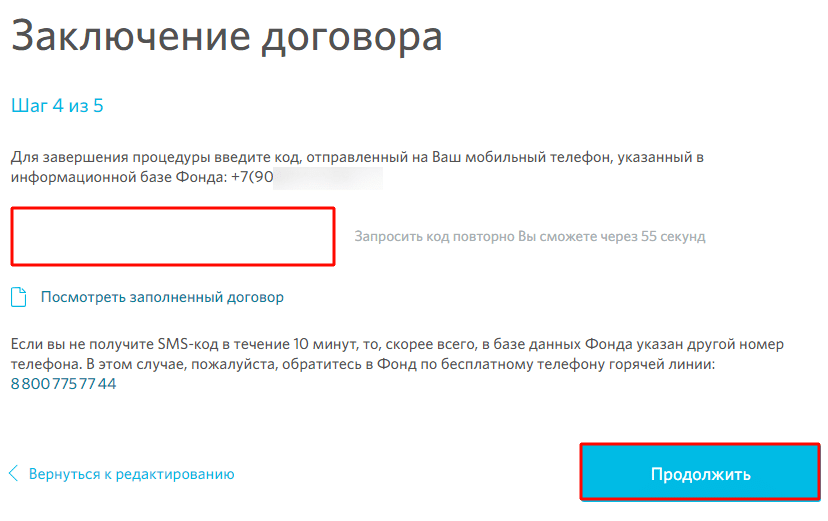

The document is signed online. The user receives a four-digit confirmation code on their mobile phone.

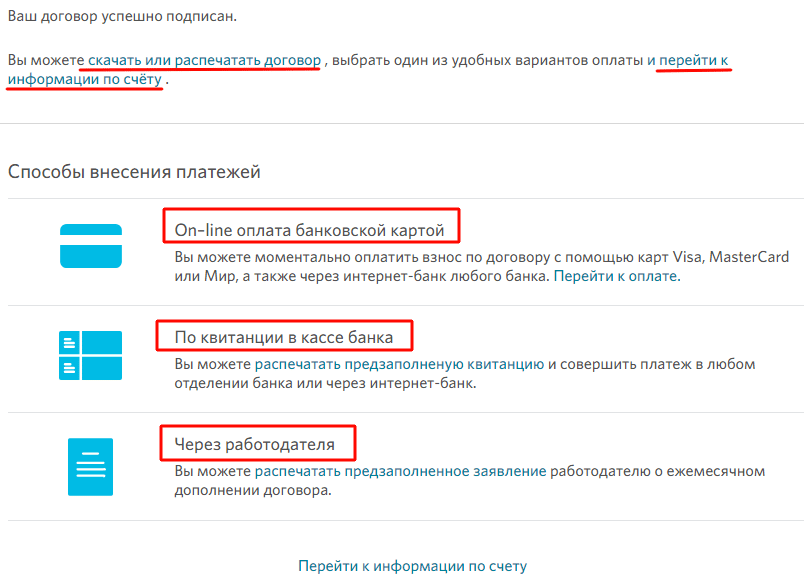

At the final step of forming an agreement through your personal account, the system will offer three payment options:

- Remotely through account services at NPF Lukoil Garant.

- By printing a receipt for a money transfer through a bank office.

- Prepare a statement for the employer.

There are no limits or deadlines for payment, so it is allowed to make it at different frequencies. In the future, information on this agreement can be obtained in your personal account, where on the main page you need to select your savings and deposits in the top menu. Here the client can make payments and print receipts.

Types of pension deposits

The Government of the Russian Federation has developed several programs that can use Savings Pension Funds to generate future social payments to their clients. And citizens, thus, have the opportunity to increase the size of future funded old-age payments. In the non-state PF Lukoil Garant you can use the following programs, which are easily connected through your personal account:

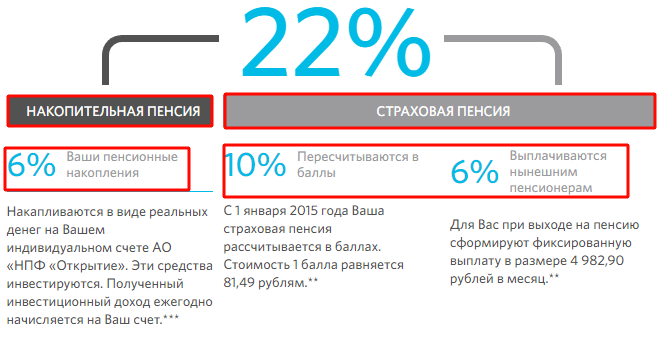

In Russia, starting from 2020, the pension has two parts: funded and insurance. The state pension fund receives 22% from each official salary, six of which go to a savings account in Lukoil Garant, subject to an agreement with the company, and 10% is subject to conversion into points (the amount is indexed annually), and the remaining 6% goes to payments to pensioners .

After signing an agreement with Lukoil Garant, the client gradually forms a savings part with each salary. Its size directly depends on the salary.

Attention! According to the decree of the Government of the Russian Federation, in the period from 2014 to 2020, all insurance contributions sent from the employer are used to form the insurance part.

- A co-financing program approved in 2008. Its participants are considered to be clients of the NPF Lukoil Garant who joined it before the end of 2014 and made the first contribution before the end of 2020. Its essence is to double the amount contributed by the client of the non-state PF. For example, you credited 5 thousand rubles to your account, then at the end of the year the state will add another 5,000 rubles to it. Thus, the funded part increases by 10 thousand rubles.

- Co-financing program (56 Federal Law dated April 30, 2008). According to it, everyone at any time has the opportunity to conclude an agreement with their NPF and join the Voluntary Co-financing program. The deposit amount is not limited. But at the same time, the state does not double the invested funds.

- The Non-State Savings Program is in many ways similar to the financial products of banks. A citizen voluntarily and periodically contributes a certain amount to this program. It increases due to the investment income of NPF Lukoil Garant. It is worth noting here that the earlier you start forming a deposit, the larger the amount will accumulate on it. Unlike previous programs, the Non-State Pension can be withdrawn in full after five years, and by decision of the Government of the Russian Federation, the client has the right to take advantage of a tax refund on contributions in the amount of 13% per annum. Here you need to take into account the fact that when filing a declaration, a citizen must have an official salary, that is, contributions to the budget that he decided to return. Another advantage of the program is that the accumulated funds can be inherited in the event of the early death of the owner of the deposit. All this is stated in the contract, which can be drawn up through your personal account.

Functions and capabilities of the personal account of NPF Garant

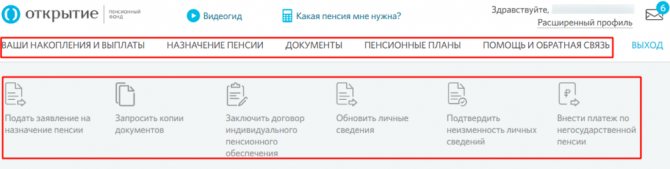

The functionality of your personal account allows you to fully control the savings of your future pension, as well as:

- enter into contracts;

- make payments online;

- get acquainted with regulatory documents;

- update personal information;

- create requests;

- apply for a pension;

- contact Lukoil Garant specialists for help.

The personal account interface is intuitive and therefore accessible to all categories of citizens. Its sections are located in the top menu.

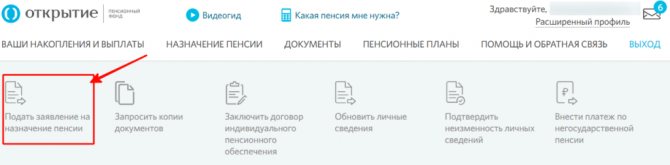

Application for a pension

When retiring due to age, a citizen who has entered into an agreement with NPF Lukoil Garant must submit an application for social benefits. This can also be used by citizens who have signed a Non-State Pension Agreement and whose term has passed for more than five years. The fastest and most convenient way is to create a request through your personal account.

From the menu, select the Submit Application section.

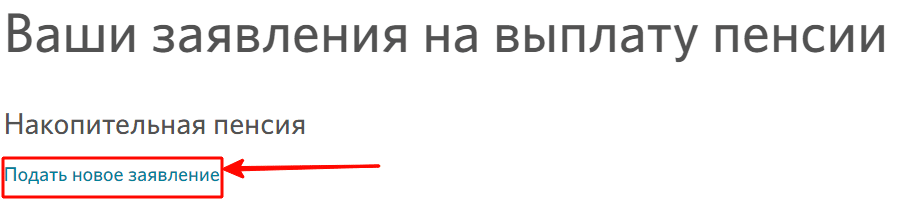

In the form that opens, click on the Submit a new application link.

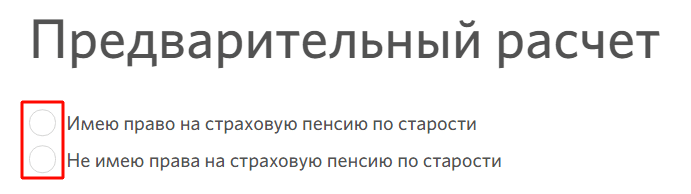

The next step is to select the appropriate option:

- by old age;

- ahead of schedule (for persons who have entered into an agreement for non-state financing).

Upon completion, the program performs calculations and displays information. Then the document is signed and sent for consideration to NPF Lukoil Garant.

Pay the fee in your personal account

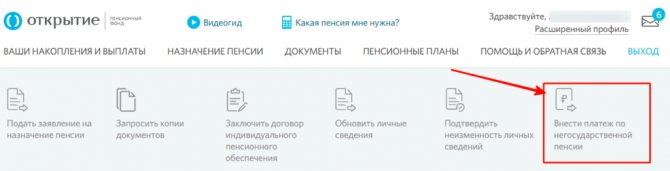

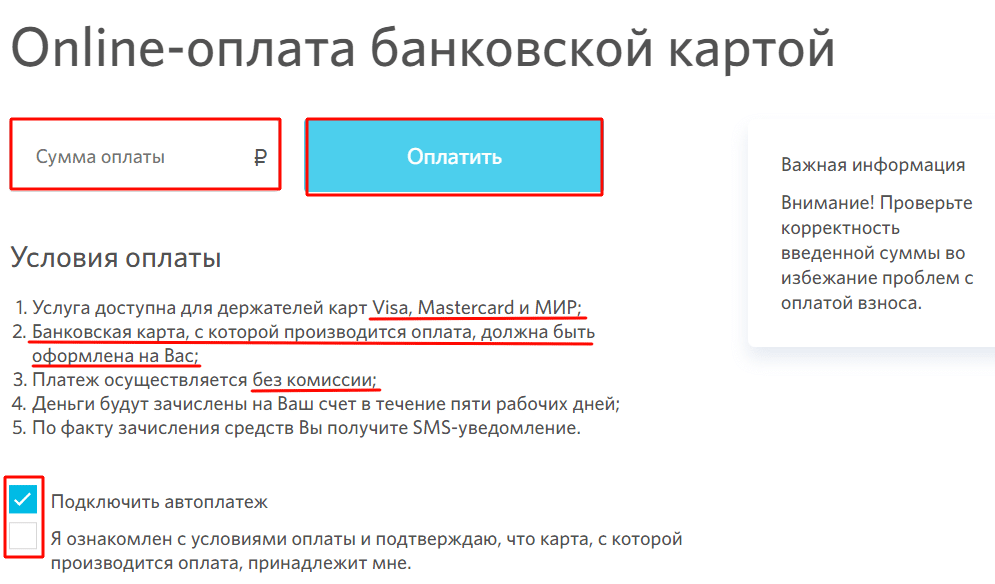

Citizens who have entered into an agreement to participate in the Non-State Pension program can make contributions to their investment account through their personal account. To do this, in the top menu you need to select the Make payment according to IR section.

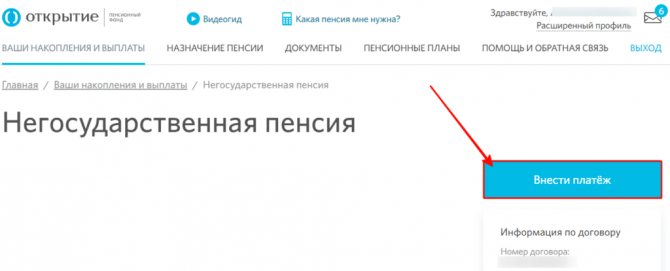

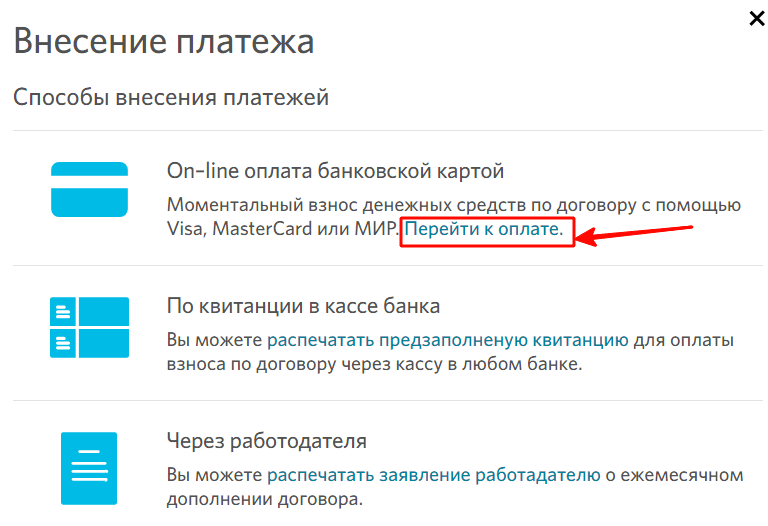

A page with comprehensive information on the agreement will open, where on the right you need to select Make a payment. After which an additional window for selecting a payment method will open:

- online using MIR card, Visa, MasterCard;

- print a receipt for transfer through the bank office;

- prepare a statement for the employer.

For remote payment, go to online money transfers.

In the next step, you need to indicate the amount of money to be written off from your card. Please check the boxes below.

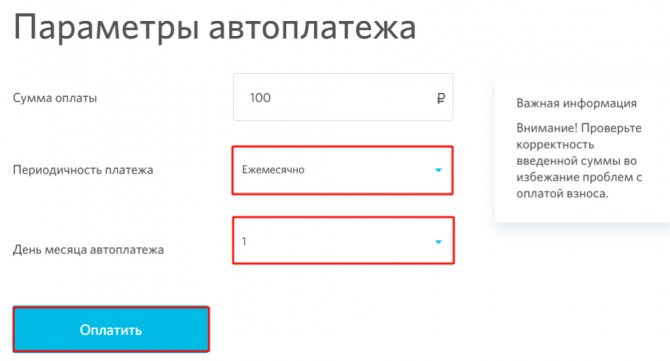

Set the frequency of crediting funds to the Non-State Pension account, as well as the date of debiting.

After you click Pay, you will be taken to a page where you need to provide your bank card details.

What did the reorganization give for clients of the RGS fund?

In 2020, the non-state fund Lukoil-Garant sent a notification to the pension authority that a reorganization procedure was underway. As a result of the merger of 3 funds, one was formed, which became known as Lukoil-Garant. Rosgosstrakh and Elektroenergetiki joined it.

For this reason, persons whose savings were stored in these organizations were given the opportunity to apply for an early transfer from one of these organizations to the country’s Pension Fund or to another company.

There was no need to write applications for the transfer of funds to the merged organization . This suggests that an automatic order was applied,

Hotline number of NPF Lukoil Garant

People often have questions about savings and pension payments. For information, you can contact the hotline specialists, which operate free of charge. In addition to general questions, they can provide assistance in navigating your personal account, completing documents, and provide advice on fund products.

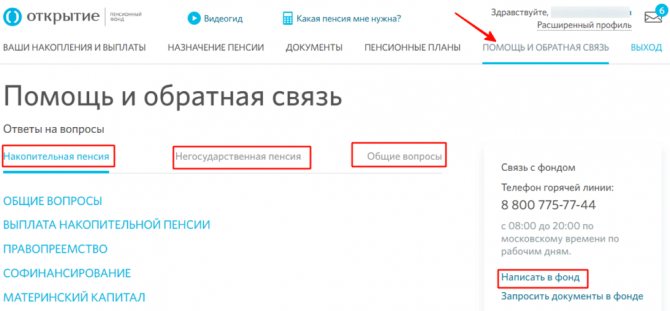

In your personal account there is a customer assistance section for NPF Lukoil Garant, located on the right in the top menu. On the page that opens there are three blocks in which specialists’ answers to frequently encountered problems are formed:

- Accumulation part.

- Non-state financing.

- General issues.

On the right side you can select the version of the written request to Lukoil Garant technical support. But before using this option, be sure to read the answers from experts. Perhaps the solution to your problem is there.

Customer support

The Lukoy-Garant personal account allows the investor to write a text message to a representative of a non-state pension fund, which may contain a question about the company’s activities or a complaint about the quality of the services provided. It is worth saying that online consultants have enough experience and authority to solve most problems that arise with clients, and the average wait time for a free technical support employee is no more than 1 minute. The user can also call the hotline or write an email to the company.

Reviews of NPF Lukoil Garant

Relatively recently, three large non-state PFs merged, including Lukoil Garant. Now his clients have automatically transferred to the newly created NPF Otkritie. Therefore, we will consider the responses that will allow us to more fully imagine the situation and get a general idea of the work of the fund.

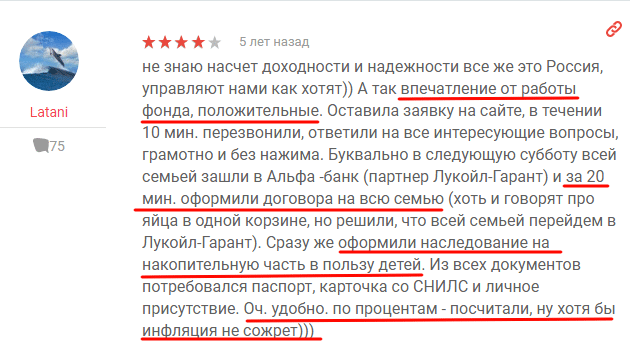

On the Internet you can find reviews about Lukoil Garant until August 2020, that is, until the fund is reorganized. One of the resources has quite a lot of positive feedback. A visitor under the nickname Latani talks about the efficiency of Lukoil Garant employees, who, after leaving a request on the website, called back within 10 minutes and provided detailed advice on pension savings. Thanks to this, the citizen decided to transfer the whole family to the fund, additionally registering the inheritance of funds for his children.

Another site visitor talks about the support service, which provides assistance to Lukoil Garant clients free of charge. The choice of this fund was made taking into account the stability of oil prices and the company’s reputation.

Another resource contains negative reviews about Lukoil Garant. For example, a woman is indignant that after a year and a half her savings portion was transferred to a third-party non-state pension fund, with a loss of interest. However, she claims that she did not sign any papers.

Situations like this happen quite often. They are connected with the fact that some employers forcibly transfer employees to their funds or, when drawing up a loan agreement, an application is signed with a non-state PF. Loss of investment may occur due to the fact that a full year has not passed during the transition, which is not counted according to the state calendar, but from March of the following year.

Another visitor came to Lukoil Garant by chance in 2008 and is a member to this day. He is satisfied with the stability of the company and the opportunity to actually accumulate a pension, since investment income exceeds inflation, which the state pension fund cannot provide. It also talks about the possibilities of your personal account, where information on all charges and transfers is available.

People often have various questions about the pension savings program, so we invite you to leave comments on the instructions and share your opinion. You can also leave questions that interest you, which our specialist will answer.

Fund rating

In order to assess the overall rating of NPF LG, you need to analyze the main characteristics of the fund, which will be discussed below:

- High reliability - despite the crisis of 2008 and 2014, the fund was able to maintain high reliability indicators after assessment by the rating agencies Expert RA and NRA (national rating agency).

- Positive customer reviews – you will rarely find negative reviews about the work of this company on the Internet, since NPF carefully prepares its staff for high-quality work with potential clients.

- NPF LG is among the 10 best NPFs in the country.

The volume of pension reserves is 18 million rubles.

- Stable level of profitability - for every 1000 rubles of savings, NPF LG provides double income - up to 2000 rubles. For more detailed profitability indicators, read the next section of this material.