Home / Labor Law / Payment and Benefits / Pension

Back

Published: 03/12/2020

Reading time: 5 min

3

4087

The procedure for calculating pensions remains unclear to many citizens. But based on the general requirements of the law, an old-age pension can only be applied for by those persons who have sufficient length of service to qualify for a pension and have enough pension points. Most often, applicants do not have enough points to apply for a pension, but they can be purchased in addition if desired.

- Why do you need to buy points? How legal is it?

- Formation of experience: how it happens

We'll tell you how to buy pension points and their cost.

Why do you need to buy points?

According to the current pension formation system, there are two models:

- Social compulsory insurance . In this case, pension insurance contributions are paid by the employer at his own expense.

- Voluntary insurance . In this case, contributions to pension insurance are paid by the insured persons themselves: entrepreneurs and voluntary insured persons.

As a result of participation in the insurance system, citizens develop their pension rights through the accumulation of length of service and the formation of points.

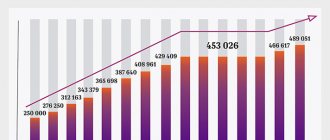

Every year, the Pension Fund raises the bar for the minimum requirements for points and length of service required to apply for a pension. If in 2020 a pension was assigned to those who had at least 8 years of experience and 11.4 pension points, then in 2018 this level increased to 9 years and 13.8 points.

To assign an old-age insurance pension in 2020, 11 years of insurance experience and 18.6 points are required. We must not forget about raising the retirement age and reaching the retirement age. In 2020, this is 55.5 years for women and 60.5 years for men. If citizens have 15 calendar years of work in the Far North, then the pension is assigned at 50.5 years for women and 55.5 years for men. In 2024, a pensioner will be required to have at least 28.2 points.

It is important to understand that if a citizen has accumulated the required number of points, but has not accumulated experience, then he is not entitled to a pension. For example, he has 7 years of experience and 30 points. In this case, you will have to continue to work and gain the necessary experience. Or vice versa - the citizen worked for 20 years, but received a gray salary and deductions for him were minimal. As a result, he only accumulated 15 points. In this case, the pension will not be assigned.

Citizens who are planning to retire in the near future should pay attention to the indicated values. If, according to calculations, any indicator turned out to be insufficient, then the appointment of an insurance pension should be postponed. As a result, a citizen will not be able to count on receiving a pension until he earns the minimum wage. If 5 years after a citizen reaches retirement age it is not possible to achieve the minimum, then he will be assigned a social pension .

The point system for calculating pensions is complex and incomprehensible to many Russians, and the regular increase in the threshold in the number of points for calculating pensions raises fears that many Russians will be left without a pension at all. Therefore, you can regularly come across calls for the abolition of points and a return to the previous model of calculating pensions based on length of service and earnings. But the point model continues to operate today, despite criticism.

How legal is this?

Buying a pension or pension points is absolutely legal and legal. According to the law, this procedure is called payment of voluntary contributions to a future pension . This possibility is based on the provisions of Art. 29 167-FZ of 2001 “On compulsory pension insurance in the Russian Federation.” Payment of contributions is carried out in accordance with Order of the Ministry of Labor of Russia No. 462n of 2020.

Current legislation allows citizens to independently pay contributions for themselves and other individuals in order to solve two problems: increase the insurance period and increase the number of pension points for calculating pensions.

How to legally buy experience in the Pension Fund

Acquiring pension experience (and, accordingly, points) is possible only if:

- the person has a length of service of 50% or more of the minimum required;

- the person is a participant in the insurance pension system of the Russian Federation and has SNILS;

- the citizen is ready to enter into voluntary legal relations with the Pension Fund.

If there are no problems with points 2 and 3, then a person may have difficulty with the length of service. For example, a mother of 4 children will not be able to acquire the necessary experience for retirement if she does not have a single entry in the Labor Code. After all, for 4 or more children, a maximum of 6 years of experience is awarded. And according to the requirements of 2025, the minimum experience is 15 years. Consequently, the woman will have to work officially for at least another 1.5 years.

Her score for all periods of child care will be only 24.3 points, and she will need 30. Consequently, she will have to work much longer than 1.5 years or look for a job with a very high salary (from 3.8 minimum wages per month). Or rely on the accrual of the IPC for all purchased years of experience, that is, get the necessary 5.7 IPC specifically for the purchased years. Then the salary for 1.5 years of work will not make much sense.

Who is eligible to purchase

Citizens who:

- They work outside the Russian Federation (hence, no contributions are made to the Pension Fund for them) and would like to form a pension in Russia.

- Citizens who permanently or temporarily reside on Russian territory and are not subject to the requirement for compulsory pension insurance. These are, for example, the self-employed.

- An individual paying contributions to the Pension Fund for another person for whom the employer does not pay.

What are “pension points” and how to earn them

Pension points are individual pension coefficients, which are calculated based on the interest paid by the employer to the Pension Fund to the employee’s personal account. Pension points are awarded at the end of each calendar year.

Provided that the monthly salary corresponds to 1 minimum wage, you can earn 1 point per year. If the payment for a month of work is 2 minimum wages, accordingly, you can earn 2 pension points.

The number of your accumulated points can be viewed in your personal account on the official website of the Pension Fund.

How much is a pension sold for?

In paragraph 5 of Art. 29 167-FZ establishes the minimum and maximum amounts of insurance contributions to the Pension Fund of the Russian Federation, which are paid by individuals who voluntarily entered into legal relations under compulsory pension insurance (OPI).

The minimum amount of insurance premiums from 2020 is determined according to new rules, which made it more profitable for Russians and allowed them to buy a pension cheaper. The minimum contribution value is now calculated as:

- Minimum wage * insurance premium rate * 12.

Whereas back in 2020, the minimum wage multiplied by 2 was included in the calculations. As a result, the minimum value of contributions in 2020 was 59,211.36 rubles, and in 2020 – 29,779.2 rubles. The tariff for contributions was also revised: instead of 26%, it was 22%. Legislators agreed to such a reduction after realizing that no one was taking advantage of the offer to buy pension experience.

In 2020, the minimum contribution amount will be (12,130 * 22% * 12) = 32,023.2 rubles. or 2,668.6 rubles monthly.

Minimum contributions directly depend on the minimum wage: as the minimum wage increases, so do contributions.

The maximum amount of contributions is determined by eight times the minimum wage. For example, in 2020 - 236,845.44 rubles, in 2020 - 206,720 rubles.

Formation of experience: how it happens

Let's say a citizen decided to enter into legal relations with the Pension Fund voluntarily and decided to register as a voluntary payer of contributions. He registered in June and paid dues until the end of December. During this time, he accumulated 7 months of pension experience.

In order to “buy” a year of experience, you need to make a minimum contribution to the OPS. It is quite common that a person lacks a couple of months to receive a pension. But he still has to make the minimum payment to OPS for the year. You cannot pay less, but you can pay more.

But you can enter into legal relations with the Pension Fund under compulsory pension insurance in October: then the amount of contributions payable will be recalculated based on the incomplete period. For three months, the payer will have to pay 8,005.8 rubles (2,668.6 rubles for each month).

There is a legal restriction: it is not allowed to buy the entire pension experience . You can purchase no more than half of the required required experience. For example, in 2020 you can buy no more than 5.5 years.

Cost of one point

To understand how many points will be accumulated for contributions made to the Pension Fund, you must adhere to the following formula:

- contribution amount * 16% / 22% / maximum contribution amount for pension formation * 10.

This formula requires some explanation:

- 22% – this is the tariff for insurance contributions to the Pension Fund, which is currently in effect in the Russian Federation;

- 16% – this is the individual part of the tariff of insurance contributions for pension insurance (this value is determined as 22% - 6% - going to finance a fixed additional payment to the insurance pension);

- The maximum amount of contributions to the Pension Fund , which is sent at an individual rate in 2020, is 206,720 rubles. (calculation is carried out as follows: 1,292,000 – the maximum base for calculating pension contributions * 16%);

- The maximum number of pension points is 10 . This is exactly how many points can be generated in a year with maximum payments from the employer (more precisely, 9.57 points during the transition period in 2020, from 2021 - you can earn 10 points).

For example, a citizen contributed an amount of 50,000 rubles for 2020. His point accumulations were:

- 50,000 * 16% / 22% / 206,720 * 9.57 = 1.68 points.

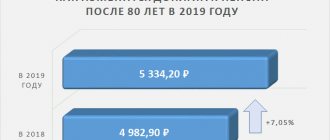

The cost of 1 coefficient in 2020 will be 29,761.9 rubles. For this amount, the pensioner will receive 93 rubles. per month or 1116 rub. in year.

He would have earned the maximum number of points (9.57) if he had deposited RUR 206,720.

Is there an alternative to purchasing?

Points are not always required to be purchased. Sometimes they can be obtained, for example, while on leave to care for an elderly person over 80 years old - 1.8 points; while on parental leave to care for a child up to 1.5 years old – 1.8; with a second child – 3.6; with the third – 5.4; when serving in the army - 1.8; if you marry a military man and go to a military town where there is no work - 1.8; when registering on the stock exchange and receiving unemployment benefits – 1.8.

Thus, a mother with many children can count on 16.2 points for being on maternity leave. Taking into account the cost of these points, you would need to pay 500 thousand rubles for them.

Who will retire in 2020

General requirements

To retire upon reaching the retirement age established in the state, you must work a certain number of years and earn the corresponding pension points. Starting from 2020, the length of service requirements will increase by one year each year. In 2019, at least 10 years of total insurance experience and 16.2 IPC in an account with the Russian Pension Fund are required. In 2025, you will need 15 years and 30 pension points.

Non-insurance periods also count towards length of service. This includes conscript military service, caring for children under 1.5 years of age, and caring for an elderly relative or disabled person. By including non-insurance periods in the insurance period, many people can still hope to achieve the minimum length of service and points.

But what if you don’t have enough experience? Recently, experience can be purchased. And we are not talking about forgery of documents or falsification of entries in the Work Book. The purchase of both experience and points is legalized by the government.

Procedure for paying voluntary contributions

To pay voluntary contributions, you must register with the Pension Fund at your place of residence. Registration is carried out on the day of application. You need to have your passport and SNILS with you.

During the application process, you can request from the pension fund employees a receipt for payment of contributions. It can also be generated on the Pension Fund website using the electronic service.

The payer needs to decide how he will pay: one-time, in several payments or monthly. All contributions are recorded on an individual personal account. Having paid contributions before December 31, it will be possible to receive a reflection of the amounts only after March 1 of the year following the reporting year.

Where to contact

To acquire experience and rights, you can only contact the Pension Fund Client Service at your place of residence, registration, or residence. A citizen must have an identity card and SNILS with him.

If experience and points are purchased for another person (for example, a husband buys experience for his wife or a son for his father), then the package of documents must additionally include SNILS and an identity card of the citizen for whom the contribution will be paid.

An application of the established form is filled out at the Fund's Client Service. Contributions can be paid in installments or in a lump sum, but no later than December 31 of the year for which the experience is acquired.

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question using the hotline number or write it in the form below

Legal regulation

The insurance period is the total working time that a citizen spent on work and other activities, making appropriate payments to the Pension Fund. To assign old-age benefits, these periods are summed up. The calculation is based on the insurance premiums made by the person.

The legislation that regulates relations related to old-age pensions is represented by the following regulatory documents:

- Constitution of the Russian Federation.

- Labor Code of the Russian Federation.

- Federal laws No. 400-FZ, No. 166-FZ, No. 173-FZ, No. 167-FZ.

- Decree of the Government of the Russian Federation “On approval of the Rules for calculating and confirming the insurance period...” (02.10.2014 No. 1015).

The main law is No. 400-FZ “On Insurance Pensions” (December 28, 2013). The list is not limited to these documents. There are federal and regional regulations and instructions that define the procedure for old-age pension payments, including preferential conditions in the territory of a particular subject of the Russian Federation.

- Viagra analogue

- A special inhaler has been developed for self-treatment of coronavirus

- What happens to a loan if a person goes to prison

The procedure for confirming insurance experience

Since 1996, compulsory pension insurance has had IPU - individual personalized accounting. It brings together all the information about the output and contributions of citizens. IPU and SNILS allow you to confirm insurance periods for calculating old-age pensions automatically. Their proof may be needed if the Pension Fund does not have enough information about the periods of a person’s employment. Then they are confirmed by documents provided by the employer. If the necessary papers are lost and cannot be restored, use the testimony of two or more persons.