Every citizen can send his funded pension not only to the state pension fund, but also to various non-state funds that offer higher profits and interesting terms of cooperation.

You can use this money only after reaching the age of a pensioner. The money is given in a lump sum or paid monthly for the rest of your life, and there is also the option of a term program where the money is paid over a specific period of time.

If citizens cooperate with a non-state pension fund for no more than 5 years, then funds are usually issued as a lump sum payment based on the investor’s application.

Rules for filing an application for a one-time payment of pension savings

A one-time payment of funds allows you to receive a large amount that has been accumulated over a long period of time when insurance premiums were transferred. Savings are formed for every officially working citizen.

Money can be transferred not only by the employer, but also by the direct employee , if he cares about his secure old age. You can receive money after reaching the age of a pensioner or when registering a disability group in which a person cannot continue to work.

Funds are paid based on an application drawn up by the direct depositor.

The text contains the following data:

- information about the applicant, provided by his full name, passport details, date and place of birth, citizenship, gender, registration address and SNILS number;

- citizen's contact phone number;

- information on the assignment of an old-age pension;

- the method of receiving money from the fund, for example, if it is planned to transfer it to a bank account, then its details are indicated;

- date of application;

- the exact number of the pension account on the basis of which the applicant is identified;

- depositor's signature.

Attention! If the investor died before applying for his savings, then the legal successors specified in the will or determined on the basis of legal requirements have access to these funds.

You can bring an application to the fund yourself or use the help of a representative. In the latter case, the authorized person must have a power of attorney certified by a notary.

Sample application for a one-time payment of the funded part of a pension:

What it is

The pension consists of three parts : basic, insurance and funded.

The first is a certain guaranteed minimum pension provision established by the state.

The second, insurance, is formed from employer contributions (so-called insurance premiums).

The third is formed as follows: part of the insurance premiums is transferred to the funded share. These funds are sent by the Pension Fund (hereinafter referred to as PF) at the choice of the future pensioner to the Management Company or, by default, to the management company that the fund itself will select.

The income received is credited to the client’s personal account. They form the indicated part. They are called pension savings funds (hereinafter SPN).

A person has the right to spend them gradually, in equal parts, or receive them at a time within the limits established by the state.

A one-time payment from the funded part of the pension, in this case, is the receipt by the pensioner at once of all the money that is stored in his PF account (meaning SPT) on the day on which it is assigned. Payment is non-cash, made by bank transfer to the specified details.

Carried out (for one person) no more than once every five years.

Find out from our material what deposits there are for pensioners at Sberbank, how favorable the conditions are and what the interest rates are.

You will find the types of bank deposits of Rosselkhozbank, the conditions for their placement and special programs for pensioners in our review.

Do you know what a deposit with the possibility of replenishment is? Let's talk about this concept in more detail in this article: .

Who receives the lump sum payment?

All savings are paid to citizens at a time only in certain situations, which include:

- the citizen registered a disability group before retirement, and therefore cannot continue working;

- a person requires financial support due to the loss of a breadwinner;

- the investor was unable to apply for a regular old-age pension because he did not have the required length of service and the number of points;

- the amount of financial support reaches no more than 5% of insurance payments, but a person must transfer funds to a pension account in the period from 2002 to 2004;

- persons who participated in the state program for co-financing pensions, which was carried out until 2014, receive a one-time payment;

- Citizens whose monthly payment is less than 5% of possible charges can count on this amount.

Important! In 2020, money for a funded pension is paid only once every 5 years, although previously it was paid out annually.

A one-time payment is offered to pensioners who are disabled. To do this, they must reach the age of a pensioner, and they must also have at least 5 years of experience. Funds are paid based on an application submitted to the branch of the Pension Fund or Non-State Pension Fund.

For whom is it available?

You can count on it:

.

- Citizens of Russia.

- Foreigners living in the country on equal rights with Russians.

- Persons with SPN, i.e. Born in 1967 and younger.

- Those who take part in co-financing (state program for investing pension savings in the economy).

- People whose SPN is 5 percent or less of the total.

- Those who do not have the right to work, but receive another, for example, due to disability.

Note that the main condition is the presence of an insurance share in the structure.

Where and how is it issued?

The rules for receiving a lump sum payment include:

- the application and other documentation are submitted exclusively to employees of the institution in which the savings were formed;

- You can contact state or non-state PFs;

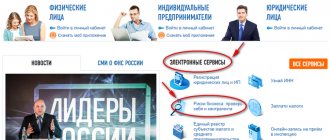

- the application is submitted directly when visiting the organization or by mail, and you can also use the help of MFC representatives;

- it is possible to submit an application through the State Services portal;

- In addition to a correctly drawn up application, other documentation is prepared, which includes the pensioner’s passport, as well as a certificate from the Pension Fund, which confirms the registration of an old-age pension;

- it is allowed to use the assistance of a representative who has a notarized power of attorney;

- Fund representatives may require additional documentation from the client confirming certain circumstances under which the payment is made.

After submitting all the papers, representatives of the fund review the application and inform the citizen about the decision made. To do this, a written notification is sent by mail.

If a positive decision is made, a lump sum payment is transferred within 60 days to the account specified in the application. If this information is missing in the application, then the money can be received through post offices or a bank cash desk.

Reference! Citizens can apply for a new lump sum payment only after 5 years.

Is it possible for disabled people to receive funds in the form of one-time compensation?

The categories of persons who are entitled to a one-time payment of a funded pension include:

- citizens with I, II, III disability groups;

- citizens who have lost their breadwinner.

If a person worked before losing his ability to work, then his personal account contains savings that were transferred by the employer. In addition, he could independently deposit money into his account. In this case, a mandatory condition is that the citizen reaches the age when the state social old-age benefit is calculated in the absence of the length of service required to pay the insurance pension (less than 5 years).

As you can see, reaching retirement age is a prerequisite for receiving a funded pension in any case. Only persons who reach this age ahead of schedule have the right to receive savings early (for example, those working in difficult or unhealthy conditions, residents of the Far North and others).

Unfortunately, this rule does not apply to working pensioners. If you continue to work, a one-time payment of funds from your savings account is not possible.

Funds from the Pension Fund of the Russian Federation are used to pay

· state pensions (by age, for length of service, in case of loss of a breadwinner);

· disability pensions for military personnel; compensation for pensioners;

· material assistance to the elderly and disabled;

· benefits: for children aged 1.5 to 6 years, single mothers;

· for children infected with the immunodeficiency virus;

· victims of the accident at the Chernobyl nuclear power plant and other payments.

The Pension Fund of the Russian Federation also finances various programs for social support of disabled people, pensioners, and children, and makes one-time cash payments.

Payments of state pensions and benefits occupy the largest share in the total expenditures of the Pension Fund of the Russian Federation.

The pension system is a technological chain consisting of a number of links - from assignment to payment of pensions. This is a regional branch of the pension fund - a bank - the department of social protection of the population of a constituent entity of the Russian Federation - a district (city) social protection authority - a post office (Sberbank) - a pensioner. The appointment of pensions is carried out by the social protection bodies of citizens, and the financing of pension payments is entrusted to the bodies of the Pension Fund of the Russian Federation.

However, one of the fundamental problems of the modern Russian pension system is associated with the low ratio of people of working age to pensioners. This value determines the financial stability of the entire pension system, built on the distribution principle. Forecasts for the growth of the number of pensioners in Russia, as well as the low level of security for pensioners at the present moment, have determined the need for pension reform.

33. Almost all participants in medical, medical and industrial activities are, to one degree or another, involved in market relations and are represented on the market for goods and services. Commercial organizations and entrepreneurs are directly connected to the market, selling the results of their activities on it and acquiring the necessary resources. But state-owned medical organizations, and even government agencies, are not exempt from participating in the market for medical goods and services, just like health care providers. If a government order to medical organizations or an order for the provision of medical insurance services is provided on a competitive basis, using bidding, then there are market relations here too. Individual consumers of medical goods and services directly participate in market relations, choosing a manufacturer, seller and paying for purchased benefits. But consumers of goods and services paid from budgetary funds, extra-budgetary funds, and insurance funds also indirectly participate in the market for a medical product, being its consumer.

1. About some deterioration in the health of the population recently: a quarter of the population records their health as unsatisfactory; men assess their health with more optimism than women; the older the person, the worse the self-assessment of health; the higher the level of education, the higher the self-assessment of health status; Entrepreneurs and businessmen rate their health the highest, and pensioners rate it the lowest; among those who assess their health according to subjective feelings as good, a large percentage belongs to the unemployed; among residents, the largest number of those who rate their health as good and the smallest number of those who rate their health as unsatisfactory are residents of rural areas; Only 10% of parents find their children in good health.

2. Despite the fact that the frequency of requests for medical care in public medical institutions is decreasing, it remains quite high and depends, first of all, on the health status of the population. This can be explained, in particular, by the loss of confidence in the medical services of government institutions.

3. Women are much more likely than men to seek help from medical institutions; the frequency of visiting a doctor increases in proportion to age, especially sharply after 50 years; persons with higher education prefer to see a doctor once or twice a year, persons with secondary and specialized secondary education visit medical institutions somewhat less often, almost a third of them - less than once a year; with incomplete secondary and primary education - monthly or once every six months; place of residence influences the frequency of visits, but the dependence here is not related to the size of the locality and the number of medical institutions available in it, as one might assume at first glance; by social status, pensioners are in first place in terms of frequency and regularity of visits to medical institutions, public sector workers are in second, engineers and office workers are in third, blue-collar workers are in fourth, unemployed are in fifth, and entrepreneurs and businessmen are in sixth; persons who have an insurance policy visit medical institutions much more often than those who do not have one; the number of parents turning to a doctor for help for their children is two-thirds of the total number of parents with minor children.

4. The majority of the population is not satisfied with the level of medical care. The greatest dissatisfaction of the population is caused by inattention on the part of medical staff, in second place is the organization of patient reception, in third place is the quality of medical care, and in fourth place is the qualifications of doctors. However, only a small part of the population makes complaints. A patient can complain about a doctor or a medical institution only if he has every opportunity not to contact him again. Most people do not always have this opportunity for objective and subjective reasons. Consequently, at present, compulsory medical insurance largely occupies the position of only an additional extra-budgetary source of financing, and the rights of the insured are not yet fully realized.

5. A small group of people with incomes significantly above the subsistence level apply to various paid medical institutions, and some of the patients do this by limiting their consumption of food and other essential goods. Thus, at present, paid medicine has exhausted the capabilities of the population and can have a future only with further economic growth. And since government funding for healthcare is not always carried out in an adequate volume, under these conditions the compulsory medical insurance system becomes no alternative.

6. Low wages for doctors, as well as the preservation of a single tariff schedule in market conditions, have led to the emergence of an illegal market for medical services with prices based on market conditions.

34.Market structure is the internal structure of individual market elements; a set of interrelated quantitative and qualitative relationships between individual elements of the market, characterizing its stable certainty and ensuring the functioning of the market system as a whole.

The market system as a whole is characterized by a rich and complex structure, which is characterized by using a variety of criteria that allow the market system to be divided.

Market structure is classified according to various criteria , the most important of which are the following.

1. By economic purpose - the market for goods and services, means of production, labor, investments, securities, financial.

2. By geographic location - local, regional, national and global.

3. According to the degree of restriction of competition - monopolistic, oligopolistic, free, mixed.

4. By industry - automobile, grain, etc.

5. By the nature of sales - wholesale and retail.

6. According to the specifics of the functioning of the market mechanism and the completeness of the implementation of its regulatory functions : undeveloped, free (perfect), regulated, deformed .

An undeveloped market is characterized by the fact that market relations in it are random; exchange of goods and services - commodity (barter); the functions of the market mechanism are reduced to differentiation of members of society and the creation of a system of incentives.

A free (perfect) market presupposes an unlimited number of participants in market relations and free competition between them; the ability to carry out any economic activity; absolute mobility of factors of production; unlimited freedom of movement of capital; each participant has complete information about the market; production of homogeneous goods; inability to influence the decisions of competitors using non-economic methods; inability to influence prices. In a free market, the market mechanism acts as the only regulator of economic and social processes.

In a regulated market, along with the market mechanism, regulatory functions are performed by the state. A regulated market is the result of the humanization of society. The state seeks to soften the blows of the market on the interests of individual members of society, but in such a way as to preserve the motivation for creativity, initiative work and risk in economic activity. At the same time, unjustified government intervention in market relations leads to their deformation.

A deformed market exists in a command-administrative economic system. The most important features of market deformation are: the absence of diverse forms of management based on different forms of ownership; natural distribution of factors of production; monopoly of the manufacturer and trader; imbalance of supply and demand; hidden inflation; the flourishing of the shadow economy, etc. Regulation of the economy in a deformed market is carried out by the state through centralized, directive planning.

The market can exist only when its individual parts perform all the necessary functions that ensure the process of social reproduction. Therefore, the functional structure necessarily presupposes the presence of its three main segments : the market for goods and services, the capital market and the labor market.

Each of these markets has its own specific structure. Thus, the market for goods and services is divided into many specialized markets (the market for shoes, food, travel services, etc.); capital market - the money capital market and the securities market; labor market - the market for skilled and unskilled labor, markets for individual specialties.

The modern market is impossible without developed infrastructure, i.e. auxiliary industries and organizations.

See also: Market subjectsMarket functions

Market infrastructure is a set of institutions, systems, institutions, services, enterprises that serve the market and ensure its normal functioning.

The market infrastructure performs the following functions:

· facilitates the purchase or sale of goods for market participants;

· increases the efficiency and efficiency of the work of market entities;

· organizes the formalization of market relations;

· facilitates economic and legal control.

It is customary to distinguish between the infrastructure of three markets : commodity, financial and labor markets.

The infrastructure of the commodity market is represented by commodity exchanges, wholesale and retail trade enterprises, auctions, fairs, and non-exchange intermediary firms.

The financial market infrastructure includes stock and currency exchanges, banks, insurance companies and funds.

The labor market infrastructure includes labor exchanges, employment and retraining services, regulation of labor migration, etc.

Thus, the main elements of classical market infrastructure are: trading network, exchanges and banks .

Supply and demand (the essence of which will be discussed in the following topics) play a significant role in the functioning mechanism of a market economy, which is a way of interconnecting elements of the market structure, ensuring that they perform their functions. For example, the elements of a market structure are money, goods, credit, price, etc. The mechanism of functioning of a market economy must ensure that money, goods, credit, and so on perform their functions, and money must be a universal equivalent, a measure of value and a means of circulation. If, in addition to money, to purchase a product you also need a coupon or coupon, then money, in essence, no longer adequately performs the functions of a universal equivalent and is not full-fledged money. A product that, for example, is produced by an industrial enterprise and does not go to the market, but is directly exchanged for agricultural products for factory workers, is a full-fledged product, etc. A normally functioning mechanism of a market economy creates conditions for the laws of value, supply and demand, etc. With its help, three main problems of organizing an economy are solved: what, how and for whom to produce. The first problem: what to produce, what goods, in what quantities (produce, for example, more food and fewer machines or more sour cream and less milk)? The second problem: how to produce, using what equipment, technology (in particular, electricity can be obtained using thermal, nuclear, hydropower plants, etc.)? The third problem: for whom to produce, who will buy and consume the products (if, for example, baby strollers are produced, then you cannot count on older people buying them for themselves)? In a market economy, these problems are solved using the market mechanism, the most important components of which are supply and demand.

35. The transition to market relations has placed the issue of pricing in all areas of the national economy in one of the first places. When talking about the price of a product in the healthcare system, we mean the price of a medical service that is fully endowed with commercial properties.

Through the market mechanism, buyers and sellers interact to determine the price and quantity of goods produced. Consequently, demand, supply and price are the main elements of economic relations in the market.

The medical services market has the following characteristics:

— the number of sellers is limited, there is a restriction on entry into the market;

— heterogeneity of medical services, its individuality, uniqueness;

— imperfect awareness of buyers about the services market;

— impossibility or difficulty of comparing price and quality;

— the presence of a large number of public or private non-profit organizations;

— in most cases, the sale of goods requires a competent intermediary, who pays for a significant part of the medical service.

Thus, the medical services market for the most part can be classified in structure as a market of monopolistic competition and monopoly.

Budgetary healthcare is an example of a monopsony in the medical services market, when the level of prices at which medical services are purchased is determined not by the real costs of service providers, which no one considers, but by the solvency of the state and its ideas about the value of such a good as the health of citizens.

Thus, one can be convinced that the peculiarity of the Russian medical services market is that it is a strong fusion of monopoly and monopsony, when almost all medical workers and medical institutions are subordinate to the Ministry of Health. At the same time, the state, being a monopolist, also dictates clearly unfavorable conditions for financing the structures subordinate to it, without even ensuring that their real costs are covered.

The patient in such a system is alone and absolutely powerless.

Therefore, the goal of the health care reform is the gradual transformation of the Russian medical market, when sellers have greater market power (dictating their terms to the buyer, imposing goods (services) and prices on them), and then into a “buyer’s market,” when the central figure determining the position of medical services and their price will be the consumer-patient.

On the way to this, one of the primary tasks is to determine the legal and economic status of medical institutions and ensure their financing, based, at a minimum, on the real costs of producing medical services provided to the population. Financing at the level of real costs will ensure the financial sustainability of the country’s medical institutions, allowing them to move from solving problems of survival to problems of improving the quality of medical services.

When considering the market for medical services, it is necessary to pay attention to the factors that determine the supply and demand of medical services, the main one of which is price. In this case, prices can be divided into the following three groups:

Group 1 - high prices (first price) for a service reflect its uniqueness, technological patent protection, and lack of demand (demand market) at the initial stage;

Group 2 - low prices (breakthrough or penetration price) for the service, reflecting the simplicity of the technical and technological solution, low costs, high and stable demand, strong financial position of the company;

Group 3 - experimental prices (when there is no similar product on the market), reflect the novelty of the functional purpose, the lack of data on the emergence of a sales market and prices.

medical service marketing pricing

Having chosen a market, divided it into segments, and assessed the attractiveness of each, it is necessary to develop a marketing mix for the target segment - a set of controllable variable marketing factors, the combination of which the company uses in an effort to evoke the desired response from the target market.

Response options: make the company (products) known among a certain number of consumers; win the market share established by the marketing program; increase sales volume, etc.

Numerous opportunities for marketing influence on the market are combined in the marketing complex into 4 main elements (tools): product, price, sales, communications.

A product is a product of labor produced for sale. The goods in this area are services in the medical services market, which means that labor in this case provides services not as a thing, but as an activity.