Recently, citizens of the Russian Federation have the opportunity to independently manage the funded part of their pension. This allowed non-state pension insurance organizations to become more active and begin concluding agreements on transferring savings to their accounts. Unfortunately, most of these agreements are concluded fraudulently.

How to cancel an agreement with a non-state pension fund if the owner of the funds decides to transfer them to another organization? In fact, this is much easier to do than it might seem at first glance, but there are some exceptions.

For example, Sberbank, which often imposes the signing of an agreement on transfer to their fund, and denies the possibility of exiting it without any losses. Is it possible to terminate an agreement with Sberbank NPF?

Download for viewing and printing:

Federal Law of December 28, 2013 N 424-FZ, as amended. dated 05/23/2016 “On funded pensions”

Federal Law “On Non-State Pension Funds” dated 05/07/1998 N 75-FZ

Reasons and procedure for terminating an agreement with a non-state pension fund

As a rule, the decision on the need to terminate a relationship with a non-state pension fund is made due to the specifics of the agreement itself. For example, this document may contain a list of situations in which all agreements between the parties are canceled.

Other reasons include:

- The profit of the organization, since the financial benefit that the client receives depends on this indicator. This is an important indicator that you should focus on when choosing an organization to store and increase your savings. For example, funds left in the state pension fund practically do not increase, since the level of profitability of this institution is lower than the inflation rate.

- Reliability of the organization. Most small companies are closing or reorganizing. Therefore, when choosing a non-state fund to preserve and increase their pension savings, the client should focus not on advertising promises, but on the organization’s position in the reliability rating.

Step-by-step instruction

First of all, the account holder must carefully study the agreement, the other party of which is the NPF.

If this document does not contain special conditions for terminating the relationship, then to transfer funds to another organization, it will be enough to notify the NPF of your desire. According to Russian legislation, changing NPFs is possible no more than once a year.

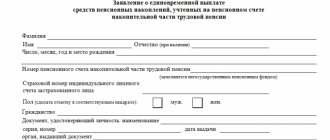

To terminate relations with a previously selected fund, the client must write a corresponding statement, which reflects information about what the NPF needs to do with the accumulated amount in the applicant’s account.

There can be two scenarios:

- Transfer of money to another NPF.

- Transfer of accumulated funds to your bank account.

Depending on the option chosen, the application indicates the fund data or bank account details so that the NPF has the opportunity to transfer accumulated funds and the income received as a result of such investment. Refunds are made within 3 months from the date of receipt of the documents, regardless of the exact stage of termination of the contractual relationship.

All costs of transferring money are borne by the depositor. When withdrawing funds to an account, the applicant must be prepared for the fact that he will additionally have to pay personal income tax.

Required documents

To terminate the agreement, the investor must provide the secretary with the following package of documents:

- Passport or other document proving the identity of the applicant.

- SNILS.

- An order from another non-state fund to transfer funds from an account.

In addition, the investor will need to fill out a form indicating his personal and contact information. Drawing up a new contract with the selected organization is possible only after completing this document.

The agreement to terminate the contract is drawn up in 2 copies, one of which remains in the hands of the applicant.

NPF future how to exit the fund

T.log('Set user id "'+g[0].__ym.user_id+'"'):T.log((c?"User p":"P")+"arams. Counter "+a+". Params: ",g[0]);J.sendParams(g[0],h,k,z.url?

After the pension reform, many chose one of the non-state pension funds. But what to do if you made the wrong choice on how to leave the NPF? You should not think that if you switched to a fund that for some reason did not suit you, then you will remain in it forever.

The most important thing about NPF future (welfare)

On the organization's website in the user account. To do this, you need to log in to the site and go to your account. After that, select the “Pension Savings” tab. Here you can request information about your current savings.

Profitability is the main component necessary for choosing a suitable pension fund in which it is recommended to invest your money. Since the more the organization earns, the higher the participant’s pension level will be in the future.

So when choosing a fund, always check detailed profitability statistics over several years of the organization’s existence.

It would also be useful to find out how many contracts with individuals. and legal individuals are discussed by the fund. There is also a direct correlation here - the more there are, the more stable and mass-oriented the fund will be.

Pension contributions paid during your work experience affect the amount of your pension. And in order not to be left broke, you should choose the right non-state pension funds, and their number is already approaching three hundred.

You can change your non-state pension fund once a year. There are no penalties for this, but you should be aware that you will receive interest for less than a full year, i.e.

only for those months that you were a member of the fund in the current year.

In order to receive a loan for a pensioner, the standard requirements are for Citizenship of the Russian Federation and registration in the city where the bank branch is located or adjacent territories. There are preferential lending programs for pensioners. For example, in Sberbank. One of its conditions is the transfer of the pension to a current account opened with Sberbank.

You should not think that if you switched to a fund that for some reason did not suit you, then you will remain in it forever. Not at all - you are not limited in your movements, and if you find a better offer with greater reliability and profitability, you have the right to change your NPF.

In addition to the statement of his intention to transfer to the Pension Fund of the Russian Federation, the insured person will need to submit additional documents: a passport and a certificate of compulsory pension insurance (SNILS).

But the termination process has a huge number of rules and pitfalls. Failure to comply with these will make it impossible to return your money.

NPF future: how to exit the fund and withdraw money

Before terminating cooperation with an organization, you must carefully study the concluded agreement. If the contract does not contain clauses with special conditions for termination, cooperation can be terminated by regular notification.

After the Pension Fund of the Russian Federation, as a result of satisfying the request of the insured person, makes a positive decision on the transfer of savings from the NPF to the Pension Fund and changes are made to the unified register of insured persons, the agreement with the Non-State Pension Fund terminates:

- At the same time, the NPF, on the basis of a notification received from the Pension Fund of the Russian Federation, must transfer the pension savings of the insured citizen to the state pension fund. Funds must be transferred from the NPF to the Pension Fund no later than March 31 of the year following the year in which the application for transfer was submitted.

- The Pension Fund, in turn, must transfer the savings received from the NPF to the Management Company within the month following the month in which they were received by it.

In order to still leave the NPF and transfer savings to the state pension fund, you need to:

- Decide on the choice of the Management company that will invest the funds received, and select the investment portfolio that it offers. The list of management companies with which the Pension Fund has entered into a trust management agreement for pension savings can be found on the official website of the Pension Fund.

- Submit to the Russian Pension Fund an application for transfer (early transfer) from the NPF to the Pension Fund of the Russian Federation.

NPF attracts citizens with its open policy, competent investment strategy and high interest rates. “Private companies” significantly exceed their state-owned counterparts in terms of profitability. When choosing, people most often take into account personal preferences, including reviews from loved ones, information from official statistics and current ratings.

How to exit NPF Welfare and get money 2019

The most obvious difference between pension programs is the right of inheritance, which occurs under NPO, regardless of any conditions.

How to withdraw money from the non-state pension fund Blagosostoyanie? There is Federal Law No. 360-FZ, issued back in 2011.

As a result, all contributions are transferred only to the insurance pension. The moratorium has been extended into 2020 and will also remain in effect in 2020 and 2020. As a result, only the voluntary component remains for the formation of pension savings.

The number of participants who receive additional pensions exceeds 354 thousand. The fund's pension reserves amount to 346 billion rubles.

The same opportunity remains for citizens who have recently started working, and for whom no more than 5 years have passed since the start of deductions of insurance premiums.

NPF Blagosostoyanie is one of the most reliable players on the market. But the need to terminate the contract may arise even when collaborating with such a company. How to withdraw money from the non-state pension fund Blagosostoy?

You should take the time to carefully study the rules of the organization, which clearly and in detail cover all aspects from the procedure for collecting and investing money to the pension payments themselves.

After submitting the application, within three months the funds must be transferred to the specified account.

However, there is a possibility that the investor will not be satisfied with the increase in pension received, and then he will need to withdraw from the non-state pension fund.

Have you returned your pension back from this fund to the one you were in before? Mine also somehow ended up with them.

And my colleagues and I were horrified to discover on the State Services website that our NPF is “Future”. We didn’t sign any contract with them!!!

If a citizen works at an enterprise and wants to leave the NPF, then it is necessary to contact representatives of the personnel service. According to the general rules, in such circumstances, a citizen breaks the obligations associated with the corporate pension system, the function of which is performed by the NPF. Therefore, the following rules must be observed:

- We write a special statement where we talk about our intention to terminate the contract and receive part of the funds.

- We provide the bank details where the funds will be transferred.

- Based on information from the employer, the operation is carried out.

Hence the numerous attempts to change NPFs that offer unfavorable investment policies or other undesirable conditions. First of all, you need to stop panicking. Funds transferred to the NPF account illegally or forcibly can be returned!

No, the statute of limitations for resolving issues has not expired, my advice to you is to order a 2-NDFL certificate for 2013 from both your place of work and the NPF. If they withheld tax, they are obliged to provide you with such certificates. After which you immediately write to me and we will specifically understand the numbers, okay?

It is worth deciding in advance which organization in this area a citizen is willing to trust. NPF Welfare is one of the most reliable players on the market. But the need to terminate the contract may arise even when collaborating with such a company.

The application must be submitted by December 31st. The funds will be transferred to the Pension Fund by March 31 of the next year, and to another non-state fund - from January 1. If your fund has lost its license, your savings will automatically be transferred to the Pension Fund. You do not need to write an application for this.

At any time, you can terminate the contract with the fund and choose the company that will manage your money. We recommend choosing those companies that are included in the reliability and profitability rating.

Have a question about choosing a microloan, secured loan or other financial product? Our consultants will provide quick and qualified assistance using a method of communication convenient for you.

How to exit a non-state pension fund

A person who has spent money on voluntary pension insurance or on non-state pension provision can receive (subclause 4, clause 1, article 219 of the Tax Code of the Russian Federation). This right is only and only for income (except for dividends), which is subject to personal income tax at the rate 13 percent (p.

If you transferred your pension to a non-state pension fund, then you have the right to transfer your savings to another fund, including the Pension Fund. To do this, you need to contact the NPF branch and write an application. The funds will be transferred to another fund starting next year.

It is noted that very often you will be told that you can receive your pension savings portion in cash. Many people rejoice after such promises.

If the funded portion is assigned to a pensioner for payment indefinitely, then the funds are not issued even to legal successors.

How to transfer the funded part of a pension from a non-state pension fund back to a pension fund?

At the moment, JSC NPF “Future” is the second largest in terms of savings in Russia. In this article we will look at basic information about the above organization.

My wife and I also ended up in this mess; we didn’t sign anything, I don’t understand how. Changing a fund through government services is not easy, you need to email. signature (it seems to last for a year and costs money), so you need to drag yourself to the Pension Fund in your free time (apparently you will still have to).

How to get out of a pension fund

This is the only way to withdraw savings. What’s remarkable is that you can, in principle, withdraw your money in the form of cash. Only this option often turns out to be irrelevant.

The law allows for a situation where a so-called urgent payment is issued. The duration of receipt is chosen by the citizen, depending on the following characteristics:

- Accumulation amount.

- Amount of monthly payments.

Together with the labor component of the pension, the insurance can be paid indefinitely. The specific amount in this case depends on the decision made by the Government of the Russian Federation.

Pension co-financing programs: differences

Pension co-financing is part of compulsory insurance for pensioners, present and future.

Thanks to this program, citizens themselves can influence the amount of future pension contributions.

- By transferring savings from state pension funds to non-state ones. This helps to increase investment returns.

- Participation in government co-financing programs.

Joining a non-state pension fund allows citizens to independently shape their future pension provision. By law, any member of this organization can terminate the contract, taking with him the so-called redemption amount.

The following rules must be taken into account.

- When using the state co-financing program, 1 thousand from the state is added to every thousand rubles paid by a citizen.

- But the state can pay citizens no more than 12 thousand per year.

- When participating in independent funds, the size of investments can be changed, but you should not count on additional payments.

Thanks to this program, citizens themselves can influence the amount of future pension contributions.

- By transferring savings from state pension funds to non-state ones. This helps to increase investment returns.

- Participation in government co-financing programs.

Possible client losses upon termination

When terminating a contractual relationship with a non-state pension fund, the client will have to incur some losses. In particular:

- The investor will be able to count on receiving only part of the profit from the investment, since the funds are transferred for an incomplete financial year.

- An individual is subject to a tax of 13 percent of the income received for investing pension savings. If the applicant decides that the redemption amount is transferred to the account of another non-state fund, then such taxes will not be levied.

- All costs associated with transferring funds to a bank account or other pension fund are paid by the investor.

How to get out of a pension fund with future wealth

The most obvious difference between pension programs is the right of inheritance, which occurs under NPO, regardless of any conditions.

Important Pension co-financing programs: differences Pension co-financing is part of compulsory insurance for pensioners, present and future.

Thanks to this program, citizens themselves can influence the amount of future pension contributions.

- Participation in government co-financing programs.

- By transferring savings from state pension funds to non-state ones. This helps to increase investment returns.

Joining a non-state pension fund allows citizens to independently shape their future pension provision. By law, any member of this organization can terminate the contract, taking with him the so-called redemption amount.

Now you will have to try hard to get your money back.

Cash Many believe that resolving this issue will not be difficult. It is enough to simply terminate the contract with the organization. On the one hand, this is true.

But the termination process has a huge number of rules and pitfalls. Failure to comply with these will make it impossible to return your money.

It is noted that very often you will be told that you can receive your pension savings portion in cash. Many people rejoice after such promises.

Has there already been a change this year? Then there is nothing to hope for. You will be denied both termination of the contract and transfer of the funded part of the pension.

And on legal grounds, you shouldn’t be surprised. I don’t see money Are you interested in the organization “Welfare” (non-state pension fund)?

How to withdraw money from there under certain circumstances?

It all depends on what kind of case is being considered. No one will let you pick up the transferred funds just like that, in the form of cash or bank transfer. This is impossible and prohibited by law.

You can write an application to transfer the funded part of your pension to another fund.

This is the only way to withdraw savings. What’s remarkable is that you can, in principle, withdraw your money in the form of cash. Only this option often turns out to be irrelevant.

Why? Because you will be able to complete this business only after retirement. In fact, it's just a hoax. This is how they lure gullible and naive clients.

Remember one important point if you decide to open a future pension account.

You can deposit funds into the non-state pension fund "Blagosostoyanie", but you will not see them in the form of cash. At least until you retire. At the moment, the legislation of the Russian Federation does not provide for payment of pension savings in advance, and even in cash.

How to exit NPF

According to the general rules, in such circumstances, a citizen breaks the obligations associated with the corporate pension system, the function of which is performed by the NPF. Therefore, the following rules must be observed:

- We write a special statement where we talk about our intention to terminate the contract and receive part of the funds.

- We provide the bank details where the funds will be transferred.

- Based on information from the employer, the operation is carried out.

It is better to receive detailed advice in advance when contacting HR staff.

In total, there are two areas that have become the main ones for the company’s activities:

- Individual offers for people who do not work for Russian Railways.

- Pension programs designed specifically for Russian Railways employees.

The bottom line is that the employer and employee of the company participate in equal shares in the formation of savings. The terms of a specific contract depend on which service option the client chooses.

According to standard schemes, several solutions are proposed:

- The ability to choose inheritance: it is either absent or applies to personal or state savings.

- Contribution amount: minimum, maximum, optimal.

- Limitation on the number of heirs. Or the absence of such conditions.

A non-state pension is paid in the following circumstances:

- Upon dismissal from Russian Railways.

- With participation in the program for at least 5 years.

- Reaching the generally established retirement age.

Any citizen, not only Russian Railways employees, can be a party to such agreements. Personal savings are involved in the formation of a pension.

The frequency of payment of contributions along with their amounts is determined by the citizen himself.

The main thing is that the first payment is at least 10 thousand rubles. Subsequent contributions can be made for any amount.

In this case, an open-ended contract is concluded. The participant can terminate it at any time when the following conditions are met:

- More than a year has passed since the conclusion. Then the entire amount of investment is returned, as well as the income received on its basis.

- If less than 12 months from the date of conclusion, then the investment will be returned along with income at a guaranteed rate of up to 4 percent.

No more than two months must pass from the date of early termination before the money is returned.

Most opinions on this organization remain positive. Among the main advantages, citizens note:

- Excellent level of profitability.

- Fund stability.

- High ranking positions.

Separately, they note the high level of service, even for specific branches located in small towns. There is only one drawback - forced entry into this fund for those who work for Russian Railways.

Non-state pension But everyone has the opportunity to choose individual terms of service. Deposit amounts and profitability depend on gender, as well as age at the time of conclusion of the agreements.

Automatic termination of the contract

An agreement with a non-state pension fund may provide for a number of situations in which the validity of this document is terminated automatically. These may be cases of failure by a citizen to fulfill any of his obligations, for example, not visiting a branch of a non-state pension fund to renew the agreement for the next year.

In this case, the contract ceases to be valid automatically. There is no need to specifically contact the fund to draw up an application to cancel the agreement or refuse to extend the relationship. All accumulated funds are transferred to the account specified in the documents.

Information about the fund

It’s wise to start getting acquainted with NPF “SAFMAR” from its official website – www.npfsafmar.ru. The main page of the fund contains advertising information about the proposed pension programs, the advantages of investing in non-state pension funds, and the average level of return on investments over the last 3 years. And there is also a convenient online calculator that helps you make an approximate calculation of your future pension for various contributions and investment periods. There is also a hotline number for the NPF SAFMAR, where you can find out other information of interest to potential clients.

Official information regarding the Joint Stock Company Non-State Pension Fund "SAFMAR" can be found on the website of the Bank of Russia. From the data provided there it follows that the organization has a valid license to operate. The ultimate beneficiary of the company is Gutseriev S.M. and Tsikalyuk S.A.

The answer to the question of where JSC NPF SAFMAR is located can be found either on the website of the Central Bank of the Russian Federation (legal address) or on the portal of the fund itself on the “Contacts” tab. If you don’t have time to search for information on the Internet, just call the hotline and get the necessary information from a call center operator.

Transfer of pension savings to the Pension Fund of Russia

Despite the fact that the obligation to transfer their pension savings arose for every citizen of the Russian Federation back in 2015, some people are in no hurry to make such a decision.

It is customary to secretly call these people “silent people.” There is also a separate category of citizens who, having transferred their savings to a non-state pension fund, suddenly changed their minds and decided to return their funds to the Russian Pension Fund. In this case, the money in the account will be used to invest in government programs.

Important! To terminate an agreement with a non-state pension fund and transfer your funds back to the state fund, a citizen must submit a corresponding application before December 31 of the current year.

The completed application, as well as all accompanying documents, must be submitted to the territorial office of the Pension Fund. You can do this in several ways:

- In person or through your representative.

- By post.

- In the form of an electronic document on the State Services portal.

Review of received documents is carried out within 3 months. After this period, the money is transferred from the NPF account to the State Pension Fund.

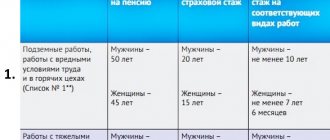

The procedure for forming a funded pension

The total amount of contributions paid by the employer for a citizen is 22%. They are distributed like this:

- 16% – individual tariff (personal account of the insured person).

- 6% - solidarity tariff (charges to finance the basic pension and social benefits: for funeral, for the birth of a stillchild, for maternity on the day of death, and others).

If a person refuses accumulative contributions, then all 16% will go to the formation of insurance coverage. Otherwise, the tariff is divided as follows:

- 6% - for accumulation;

- 10% - for insurance.

Main sources of savings provision:

- 6% of a person’s individual tariff are contributions paid by the employer to the Pension Fund.

- Maternity capital (only women direct funds).

- Voluntary additional employee contributions, including the State Co-financing Program for Pension Payments (you could become a participant in the project until December 31, 2014).

- Investments from management through NPF or Pension Fund.

Advantages and disadvantages

Such savings have their negative and positive sides. The main disadvantage is the lack of state indexation. The size of the latter depends on the performance of the non-state pension fund or management company. Forming pension savings has its advantages:

- Opportunity to receive all savings in the form of a lump sum payment.

- Money in the event of the death of its owner is inherited by his relatives.

- Quantiferon test

- Galette cookies - composition and calorie content, step-by-step recipes for cooking at home

- Who won't get a mortgage in 2020

How to cancel the contract?

If the agreement does not include any special conditions, then it will be enough to notify Sberbank NPF. Termination of the specified paper becomes available after writing the corresponding application at the bank branch and indicating the number of the Sberbank Non-State Pension Fund agreement.

Additionally, the person must not inform the fund in any way about the decision made. There is no need to comment further on your position.

The application for termination must contain not just a request to cancel the agreement, but also an indication of what to do with the accumulated amount. There are several options to solve the situation:

- It is possible to use the services of another fund. In this case, the application indicates the data of the new fund.

- The second option is to transfer funds to the Russian Pension Fund. In this case, you can enter into a Sberbank NPF agreement and then painlessly submit an application to the Pension Fund. The agreement will be terminated automatically.

We invite you to read: The agreement is about to be signed

An alternative to all funds is to transfer funds to a bank account. When choosing this method, in the application, indicate all the details of the account to which the money will be redirected. The agreement itself can be quickly canceled, but the funds are transferred within 90 days.

It is possible to break off a relationship very quickly. But before you do this, you need to familiarize yourself with some losses for the client.