Funds that are state property, in no way available for withdrawal and not included in any other budgets, aimed at one goal - pension provision for Russian citizens. This is the definition of the Pension Fund budget. It is calculated for each year by the Pension Fund of Russia board with the obligatory account of the balance of income and expenses.

Such a budget is formed from insurance pension contributions of the civilian population, money from the federal budget, and profits from the placement of free finances by the state. At its core, in the Russian Federation the budget of the Pension Fund is consolidated. In other words, it combines all local and regional funds.

How is it formed?

The budget of the Pension Fund of the Russian Federation is formed in accordance with the legislative act - clause 1 of Art. 17 Federal Law No. 197 “On compulsory pension insurance”. In particular, it is said here that it consists of the following components:

- State budget funds.

- Insurance contributions paid by employers.

- Penalties and other monetary sanctions levied on the population.

- Profit from investing temporarily free cash from OPS.

- Reserve funds aimed at paying the funded part of the pension.

- Accumulated funds that are intended to pay urgent pensions to insured persons.

- Other sources of replenishment permitted according to the legislation of the Russian Federation.

Who shapes it?

The budget of the Pension Fund of the Russian Federation is formed mainly by payers-insurers. They send a contribution (in cash and in kind) in favor of their own employees who are entitled to state pension provision.

Such payers are the following persons:

- Organizations (legal entities) represented both in Russia and in other countries (branches of companies).

- Foreign enterprises and their branches, divisions located on the territory of the Russian Federation.

- IP.

- Citizens working for themselves, engaged in arts, crafts, art and other types of individual activities.

- Farmers running their own farms.

- Officially employed citizens (under an employment contract).

Insurance pension contributions are thus accrued for all types of remuneration of a citizen. These include remuneration under civil law contracts - copyright and contract.

Classification of income by period

The amounts of insurance contributions to the Pension Fund budget in the period from 2010 to 2017 are reflected in the table below:

| Year | Budget (trillion rubles) |

| 2010 | 1,9 |

| 2011 | 2,8 |

| 2012 | 3,0 |

| 2013 | 3,46 |

| 2014 | 3,69 |

| 2015 | 3,86 |

| 2016 | 4,13 |

| 2017 | 4,42 |

In this statistical calculation, one can note the extremely low collection of insurance premiums in 2010 (only 41% of the total budget). The thing is that until 2010 inclusive, the old rate of insurance contributions from employers was in force, set at 20%. The funds collected in this way were clearly not enough, which resulted in a budget deficit of the Pension Fund of Russia (the excess of expenses over income) of almost 1.3 trillion rubles. Because of this, the mentioned tariff was raised to 26% in 2011.

The volumes of budget funds in the period from 2010 to 2020 are presented in the table below:

| Year | Budget (trillion rubles) |

| 2010 | 2,64 |

| 2011 | 2,4 |

| 2012 | 2,8 |

| 2013 | 2,84 |

| 2014 | 2,41 |

| 2015 | 3,1 |

| 2016 | 3,33 |

| 2017 | 3,34 |

There is no linear growth in income, as in the table above, since the size of budget subsidies in each period depended entirely on the general state of the economy in the state. If it was possible to find funds to increase pensions, then they were valorized (revalued) and indexed, and the amount of contributions to the Pension Fund budget increased accordingly. Otherwise, the amount of injections remained at the same level (as in 2013 and 2017) or decreased altogether (2011, 2014).

The volumes of independent savings of citizens in the period from 2010 to 2016 are presented in the table:

| Year | Budget (trillion rubles) |

| 2010 | 60* |

| 2011 | 50* |

| 2012 | 90* |

| 2013 | 90* |

| 2014 | 60* |

| 2015 | 167,3 |

| 2016 | 131,2 |

Data for 2010-2014 are marked with an asterisk, as they are the result of an approximate calculation (in official annual reports for these periods, only direct voluntary contributions from citizens are indicated, without taking into account funds transferred by management companies, the Central Bank, NPFs, etc.). In general, such unstable dynamics and the small volume (only 1.7%) of the income item under consideration can be explained quite simply - Russian citizens do not have any serious trust in third-party organizations involved in the formation of funded pensions, so no one is in a hurry to transfer their savings there. The serious increase in contributions in 2020 is largely due to pension reform, and, as you can see, by 2016 citizens’ interest in such companies had fallen again.

What are interbudgetary transfers?

The budget of the Pension Fund of the Russian Federation is also characterized by such a phenomenon as interbudgetary transfers. What does this mean? This is monetary assistance to the budgets of the Pension Fund of the Russian Federation.

Such transfers are regulated by clause 2 of Art. 17 Federal Law No. 167 “On Compulsory Pension Insurance” (2001). Such assistance can be aimed at the following:

- Material support for increasing pension capital.

- Compensation for missing budget revenues of the Pension Insurance Fund.

- Covering the costs of paying insurance pensions in the event that the following periods are included in a citizen’s work experience: military service, caring for a young child, a disabled person, staying with a spouse at the place of his military service.

- For compulsory pension insurance - in cases of assignment of early pensions.

- To provide material support for the payment of social benefits for the funeral of the deceased who received an insurance pension during their lifetime.

Funds from the budget here will be calculated and distributed in the manner prescribed by Federal Law No. 18 “On Federal Budget Funds” (2005).

Financial system of compulsory pension insurance and payment of insurance premiums

1. Budget of the Pension Fund of the Russian Federation 2. Estimated pension capital 3. Accounting for insurance contributions 4. Insurance contribution tariff 5. Penalties 6. Insurance risk

Funds from the budget of the Pension Fund of the Russian Federation are federal property, are not included in other budgets and are not subject to withdrawal. The budget of the Pension Fund of the Russian Federation is drawn up by the insurer for the financial year, taking into account the mandatory balancing of its income and expenses.

When forming the budget of the Pension Fund of the Russian Federation for the next financial year, a working capital standard is established. It is approved annually upon the proposal of the government of the Russian Federation by federal laws in the manner determined by the BC.

Mandatory pension insurance funds are stored in accounts of the Pension Fund of the Russian Federation opened in institutions of the Central Bank of the Russian Federation, and in their absence - in accounts opened in credit institutions, the list of which is determined on a competitive basis by the Government of the Russian Federation.

The budget of the Pension Fund of the Russian Federation is formed through:

- insurance premiums;

- federal budget funds;

- amounts of penalties and other financial sanctions;

- income from the placement (investment) of temporarily free funds of compulsory pension insurance; voluntary contributions of individuals and organizations paid by them not as policyholders or insured persons;

- other sources not prohibited by Russian legislation.

Federal budget funds allocated for the payment of the basic part of labor pensions and state pensions established in accordance with the Law on Labor Pensions and State Pensions, including the organization of their delivery, reimbursement of insurance premiums for the period of caring for a child until he reaches the age of one and a half years and period of conscription military service in the amount provided for by federal law, as well as federal budget funds are included in the revenue and expenditure parts of the budget of the Pension Fund of the Russian Federation.

Funds from the budget of the Pension Fund of the Russian Federation have their intended purpose and are directed to:

- for payment in accordance with the legislation of the Russian Federation and international treaties of the Russian Federation of labor pensions and social benefits for the burial of deceased pensioners who were not working on the day of death;

- delivery of pensions paid from the budget of the Pension Fund of the Russian Federation;

- financial and logistical support for the current activities of the insurer (including the maintenance of its central and territorial bodies);

- other purposes provided for by Russian legislation on compulsory pension insurance.

To ensure the future financial stability of the compulsory pension insurance system in the event of a budget surplus of the Pension Fund of the Russian Federation, a reserve is created. The size of this reserve, as well as the procedure for its formation and expenditure, are determined by the federal law on the budget of the Pension Fund of the Russian Federation.

The estimated pension capital is formed from the total amount of insurance premiums and other revenues to finance the insurance part of the labor pension received for the insured person to the budget of the Pension Fund of the Russian Federation, based on individual (personalized) accounting data, confirmed by data from the federal treasury authorities of the Ministry of Finance of the Russian Federation.

Accounting for insurance contributions included in the calculated pension capital is carried out in the manner determined by the Government of the Russian Federation, and its indexation is carried out in the manner established for indexation of the insurance part of the labor pension in accordance with the Law on Labor Pensions. The calculation period for payment of insurance premiums is understood as a calendar year, which consists of reporting periods (first quarter, half a year, nine months of the calendar year).

The policyholder pays advance payments monthly, and at the end of the reporting period, calculates the difference between the amount of insurance premiums calculated on the basis of the base for calculating insurance premiums, determined from the beginning of the billing period, including the current reporting period, and the amount of advance payments paid for the reporting period. The amount of insurance premiums is calculated and paid by policyholders separately for each part of the insurance premium and is determined as the corresponding percentage of the base for calculating insurance premiums.

On a monthly basis, policyholders calculate the amount of advance payments for insurance premiums based on the base for calculating insurance premiums, calculated from the beginning of the billing periods, and the insurance premium rate. The amount of advance payment for insurance premiums payable for the current month is determined taking into account previously paid amounts of advance payments.

Did not you find what you were looking for?

Teachers rush to help

Diploma

Tests

Coursework

Abstracts

Insurance premium rate - the amount of insurance premium per unit of measurement of the base for calculating insurance premiums.

At the end of the billing period, the policyholder submits to the insurer a calculation with a mark from the tax authority or with other documents confirming the fact that the calculation has been submitted to the tax authority. The amount of insurance contributions for compulsory pension insurance is considered received from the moment it is credited to the account of the relevant body of the Pension Fund of the Russian Federation.

Insured organizations, which include separate divisions, pay insurance premiums at their location, as well as at the location of each of the separate divisions through which these insurers pay benefits to individuals.

Control over the payment of insurance premiums for compulsory pension insurance is carried out by tax authorities in the manner determined by Russian legislation regulating the activities of tax authorities.

Collection of arrears of insurance premiums and penalties is carried out by the bodies of the Pension Fund of the Russian Federation in court.

Penalties are the amount of money that the policyholder must pay in the event of payment of the due amounts of insurance premiums later than the deadlines established by law.

Penalties ensure the fulfillment of the obligation to pay insurance premiums. They are accrued for each calendar day of delay in fulfilling the obligation to pay insurance premiums, starting from the day following the established day for payment of insurance premiums. Penalties are not charged on the amount of arrears that the policyholder could not repay due to the fact that, by decision of the tax authority or court, the policyholder's transactions with the bank were suspended or his property was seized.

Penalties for each day of delay are determined as a percentage of the unpaid amount of insurance premiums. The interest rate of penalties is taken equal to 1/3 0 0 of the refinancing rate of the Central Bank of the Russian Federation in force at that time. The amount of penalties is paid simultaneously with the payment of insurance premiums or after payment of such amounts in full.

The procedure and terms for paying insurance premiums in the form of a fixed payment. Policyholders pay the amounts of insurance premiums to the budget of the Pension Fund of the Russian Federation in the form of a fixed payment. Its size per month is set based on the cost of the insurance year, annually approved by the Government of the Russian Federation. The minimum amount of a fixed payment to finance the insurance and funded parts of a labor pension is set at 150 rubles. per month and is mandatory. At the same time, 100 rubles. is used to finance the insurance part of the labor pension, and 50 rubles. — to finance the funded part of the labor pension. The procedure and terms for calculating and paying fixed payments in amounts exceeding the minimum are determined by the Government of the Russian Federation.

Citizens of the Russian Federation working outside the territory of Russia have the right to voluntarily enter into legal relations under compulsory pension insurance and pay insurance contributions to the budget of the Pension Fund of the Russian Federation for themselves. Individuals have the right to voluntarily enter into legal relations under compulsory pension insurance and pay insurance premiums to the budget of the Pension Fund of the Russian Federation for another individual for whom insurance premiums are not paid by the policyholder.

The paid amounts of insurance premiums are taken into account when determining the right of citizens to receive compulsory insurance coverage on a general basis.

Pension book of the insured person. It is issued to citizens in the manner determined by the Government of the Russian Federation and serves to reflect information about the status of a special part of the individual personal account of the insured person in the Pension Fund of the Russian Federation. The insured person independently replenishes the contents of the pension book by including in it annual statements on the status of the special part of his individual personal account, which come from the Pension Fund of the Russian Federation in the manner established by Russian legislation.

A written application from the policyholder or insured person on controversial issues arising in the field of compulsory pension insurance is considered by the insurer's body within one month from the date of receipt of the said application. The insurer's body informs the applicant in writing about the decision made within five working days after consideration of such an application. In the event of disagreement between the policyholder or the insured person with the decision adopted by the insurer's body, the dispute must be resolved by a higher body of the insurer or in court in the manner established by Russian legislation.

Compulsory pension insurance is a system of legal, economic and organizational measures created by the state aimed at compensating citizens for the earnings (payments, rewards in favor of the insured person) received by them before the establishment of compulsory insurance coverage.

Insurance risk is the loss of earnings (payments, rewards in favor of the insured person) or other income by the insured person due to the occurrence of an insured event.

Insured event - reaching retirement age, onset of disability, loss of a breadwinner.

Review and acceptance

The PFR budget is preliminarily approved by the highest Russian legislative bodies in the following order:

- The preliminary draft budget of the Pension Fund is sent for consideration by the State Duma.

- If deputies approve the project, it is adopted. The law “On the Pension Fund Budget for...” is published. year".

- The law is then considered by the Federation Council (the upper house of the Russian parliament). If he approves it, the Pension Fund budget will come into force.

It should be noted that such a law is an open document. This means that anyone can familiarize themselves with its text, calculations and provisions. It is posted on the official website of the State Duma and the Pension Fund of Russia.

In the case when the budget has already been adopted, but some important amendments need to be made to it, for example, due to changed economic circumstances, a draft with the necessary changes is sent to the State Duma. They are included in the approved budget according to the same procedure as presented above.

Fund income

Let's look at what constitutes the budget revenues of the Russian Pension Fund:

- Transfer by employers of insurance premiums for their employees and contractors. As statistics show, this is more than half of all contributions to the Pension Fund budget.

- Funds from the federal budget. They are directed towards specific goals. The first is increasing the amount of insurance pensions (through indexation and valorization), financing a group of preferential pensions (mostly early). The second is covering costs associated with providing social support to the population. These are funds for disability benefits, maternity capital, all kinds of additional payments to pensions, etc.

- Creation of pension savings by citizens independently. By making voluntary contributions, cooperation with management companies, non-state pension funds, through the Central Bank.

Revenues of the Pension Fund of the Russian Federation

An analysis of the composition and dynamics of budget revenues of the Pension Fund of the Russian Federation is presented in Table 1.

Table 1 – Composition and dynamics of budget revenues of the Pension Fund of the Russian Federation, billion rubles.

The total amount of budget revenues of the Pension Fund of the Russian Federation in 2020 compared to 2020 increased by 498.61 billion rubles, or by 7%, and in 2020 compared to 2020 by another 634.86 billion rubles, or by 8.33 %. The increase in budget revenues in 2016-2017 was mainly caused by an increase in receipts of insurance contributions for compulsory pension insurance, the value of which in monetary terms increased by 267.12 billion rubles in 2020, and by another 350.4 billion in 2020. rub.

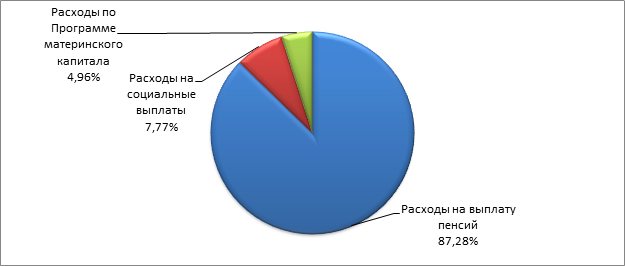

Figure 1 shows the structure of budget revenues of the Pension Fund of the Russian Federation in 2015-2017.

Structure of income of the Pension Fund of the Russian Federation for 2015-2017.

As you can see, the structure of budget revenues of the Pension Fund of the Russian Federation in 2015-2017. has not undergone significant changes. The main part of the income of the Pension Fund of the Russian Federation, more than 54%, throughout the analyzed period was made up of receipts of insurance contributions for compulsory pension insurance. The share of revenues from the federal budget accounts for an average of 26 to 27% in the total structure of extra-budgetary fund income.

Fund expenses

As for the expenditure of the Pension Fund budget, it comes from state budget resources. Compensated in case of non-payment of insurance premiums by payers or budget deficit for the next financial year. It should be noted that for inappropriate distribution and expenditure of the Pension Fund's budget, liability is established under Russian legislation.

Budget expenditures of the domestic pension fund are realized on the basis of information about recipients, types of pensions established in the Russian Federation and the amounts of these payments.

As for the costs of paying insurance pensions, which are financed from insurance payments, this is carried out on the basis of Federal Law No. 400 “On Insurance Pensions” (2013).

Expenses of the Pension Fund of the Russian Federation

The main items of expenditure of the Pension Fund are:

— payment of insurance pensions;

- social payments;

— performing other functions of the Pension Fund and operations related to the transfer of pension savings (from fund accounts to the balance sheets of non-state pension funds, management companies, etc.);

— payment of state pensions;

— spending funds under the Maternity Capital Program.

Read also: Pension Fund of the Russian Federation: tasks, functions, structure

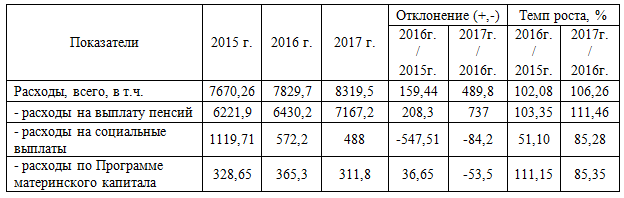

The composition and dynamics of budget expenditures of the Russian Pension Fund are presented in Table 2.

Table 2 – Composition and dynamics of budget expenditures of the Pension Fund of the Russian Federation, billion rubles.

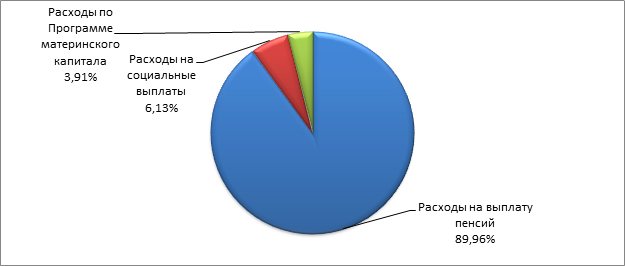

In 2020 and 2020, there was a decrease in spending on social benefits. At the same time, there is a positive trend in expenses related to the payment of pensions. The total amount of budget expenditures of the Pension Fund of the Russian Federation in 2020 compared to 2020 increased by 36.65 billion rubles, and in 2020 compared to 2020 decreased by 53.5 billion rubles. Figure 2 shows the structure of budget expenditures of the Russian Pension Fund in 2015-2017.

Structure of expenditures of the Pension Fund of the Russian Federation in 2015-2017.

Throughout the entire analyzed period, there has been an increase in the share of budget expenditures of the Russian Pension Fund for the payment of pensions from 81.12% in 2020 to 89.96% in 2020. At the same time, costs for social payments are significantly reduced from 14.6% in 2015 to 6.13% in 2020.

Payment of pensions

How is the budget of the Russian Pension Fund executed? In accordance with Art. 18 Federal Law No. 167 “On Compulsory Pension Insurance” (2001). Funds are directed to:

- Payment (according to Russian legislation and international agreements) of insurance coverage under compulsory insurance. Transfer of funds in an amount equal to the amount of pension savings of the insured citizen to the NPF chosen by him (to create a funded pension part).

- Delivery of pensions assigned from the Pension Fund budget.

- Financial content, technical, material support for the work of the insurer.

- Payment of guaranteed contributions (based on Federal Law No. 442, adopted in 2013).

- Other goals, according to Russian legislation, related to pension insurance.