From January 1, 2020, rural pensioners began to receive a new type of pension supplement - in the form of an increase in the fixed pension payment by 25% for the completed rural service. It should be noted that such an increase was already provided for by law, but due to the difficult economic situation in the country, this norm was suspended from 01/01/2017. Only in October 2020, the pension reform law No. 350-FZ restored the effect of the article providing for a 25% increase in pensions for work in rural areas from January 1, 2019.

Thus, non-working pensioners living in villages and having more than 30 years of experience in agriculture can count on additional material support

. They are provided with a 25% supplement to the fixed payment of an old-age or disability insurance pension.

It is worth noting that the 25% increase is not due to all rural residents, but only to non-working old-age or disability pensioners who live in rural areas and have worked in agriculture for at least 30 years in the prescribed list of professions and continue to live in rural areas in pension period.

This supplement does not apply to the entire pension, but only to the fixed payment. For most pensioners, the fixed payment in 2019 will be 5,334 rubles. 19 kopecks, respectively, the amount of the premium is 1,333 rubles. 55 kopecks When calculating length of service in agriculture, along with periods of work, the following are taken into account: periods of receiving compulsory social insurance benefits during periods of temporary disability, as well as periods of annual basic and additional paid leave; the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than 6 years in total.

By law, a pensioner is obliged to notify the Pension Fund of Russia of a change in place of residence or the occurrence of other circumstances entailing a change in the amount of the pension no later than the next working day.

How to get a pension supplement for working in agriculture for more than 30 years

According to Part 5 of Art. 10 of Law No. 350-FZ, recalculation of the amount of payments and assignment of the corresponding allowance will be made automatically. That is, a pensioner does not need to submit an application if the Pension Fund has information about the required work experience in agriculture, as well as information that the citizen continues to live in a rural area.

A prerequisite is living in a rural locality. Rural settlements are villages, hamlets, crossings and settlements that are part of rural districts. Urban-type settlements and workers' settlements do not belong to rural settlements.

The recalculation to the Pension Fund was completed by September 1, 2020, while paying funds for the period from the beginning of 2020 until the recalculation was carried out to the pensioner.

If the necessary documents are not available in the Pension Fund, then the pensioner will need to independently contact the Pension Fund with an application to recalculate the amount of payments, providing all supporting documents.

If a citizen applies to the Pension Fund of Russia with an application for recalculation before December 31, 2019, then the bonus will be assigned to him from January 1, 2020.

If a pensioner submits an application to the Pension Fund after December 31, 2020, then the additional payment will be assigned from the 1st day of the month following the application (for example, if he applies in January 2020, then it will be assigned from 02/01/2020, etc. ).

As the Pension Fund emphasizes, non-working pensioners and living in rural areas are the main conditions necessary to receive an increase. When starting a job or moving to the city, the payment of increase for rural experience will be stopped.

How to calculate pensions for rural pensioners?

To assign an insurance pension to agricultural workers, a number of criteria must be met:

- obtaining the right to early retirement;

- availability of insurance experience;

- the presence of a minimum number of pension points (in 2020 – 16.2 points).

To assign a pension, a citizen can provide documents in one of the most convenient ways:

- contact the territorial branch of the Russian Pension Fund;

- contact the MFC;

- use the “Personal Account of a Citizen” on the Pension Fund website.

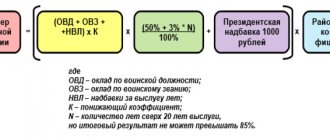

PV = SP PV (PV x N)

PV - pension payment

https://www.youtube.com/watch?v=upload

SP - insurance pension

N – supplement for rural pensioners (25%)

The Government of the Russian Federation in its Resolution No. 36 dated January 19, 2017 “On approval of the indexation coefficient from February 1, 2020 for the amount of a fixed payment to an insurance pension” determined the amount of a fixed payment to an old-age insurance pension from 01.02.2017 to 4982, 90 rubles.

If a citizen cannot influence the size of the fixed payment, then the size of the insurance pension depends entirely on the pensioner personally and consists of:

- individual number of pension points;

- pension point value.

SP = KPB x SPB

SPB - pension point value

The number of pension points depends on:

- the number of accrued and paid insurance premiums to the Pension Fund of the Russian Federation;

- work experience.

Example No. 2. Calculation of the amount of pension for an agricultural worker.

Matveeva M.M. She worked for 32 years on a collective farm, lives in a village and decided to retire. The number of pension points is 32.

The amount of the insurance pension will be 32*87.24=2791.68

The size of the pension payment will be 2791.68 6667.74 (6667.74*0.25) = 11126.36 rubles.

Professions for which a 25% bonus is given

for pensions for agricultural workers, the Decree of the Government of the Russian Federation approved lists of jobs, industries, professions, positions and specialties, in accordance with which an increased fixed payment is established for villagers. The adopted list includes more than 500 professions, positions and specialties of employees of agricultural enterprises, collective farms, state farms, and private farms. For example: agronomists, millers, collective farm members, veterinarians, livestock specialists, etc. In addition to ordinary workers, the list includes managers: directors of state farms, chairmen of collective farms, managers, foremen. The Ministry of Labor of Russia, on the recommendation of the Ministry of Agriculture of the Russian Federation and in agreement with the Pension Fund, may establish the identity of works, industries, professions, positions, specialties provided for by the approved list, if any agricultural work, industries, professions, positions and specialties had other names.

What do you think about this?, write comments, ask questions...

Regulatory acts

Federal legislation practically does not regulate the procedure for calculating additional payments for working in rural areas, including the amount. For this reason, the accruals in question take place on the basis of:

- legislation of the region within which a particular worker works. For example, such accruals are established by the Regulations on the remuneration of hired employees of budgetary institutions, which are on the balance sheet of the Ministry of Physical Education, Sports and Tourism of the Republic of Udmurtia (in accordance with Resolution of the Republican Government No. 454 of September 2013);

- industry departmental regulatory documentation. In this case, an allowance for work in rural areas can be approved in a specific individual field of activity. For example, Order No. 700 of the Ministry of Emergency Situations of Russia “On the remuneration system...” of December 2020.

Please note: the premium in question in rural areas can be established at a specific enterprise by local regulations.

Today, insofar as it does not contradict the norms of federal legislation, the Resolution of the Supreme Court of the RSFSR on measures to improve the situation of women, families, maternal and child health within settlements No. 298/3-1 of November 1990 continues to be relevant.

It is this regulatory document that determines the possibility of receiving material additional accruals for women whose employment conditions provide for the possibility of dividing the working day into 2 parts with a break of more than 2 hours.

What fees does a farmer have to pay?

For members of the peasant community and attracted workers, the peasant farm transfers two types of payments to the solidarity budget:

- according to the OPS system;

- for compulsory health insurance (CHI).

Each type of payment is calculated and transferred to the budget separately.

Attention: the basis for calculating transfer amounts is the minimum wage established by the Government of the Russian Federation annually.

The order of listing is quite flexible:

- The manager (accountant) carries out the calculations independently.

- The due amount has the right to transfer to the solidarity budget:

- in parts;

- single payment;

- according to a convenient schedule.

Important: the deadline for transferring money to the Pension Fund has only one limitation: by December 31, the current year’s debt must be fully repaid.

The procedure for calculating payment amounts in 2020

The amount of annual payments is calculated on the basis of the minimum wage established for the current period. In this case, the following rates are applied for calculations:

- according to OPS - 26%;

- for compulsory medical insurance - 5.1%.

The amount for the annual transfer consists of a contribution for each member of the farm, including the manager himself. It should be borne in mind that each person’s contribution is calculated per month.

Thus, the formula for transfers to the joint budget of the public pension organization is as follows:

- EVF = minimum wage x 12 months. x 26% x CU, where:

- EVF - annual contribution to the pension provision of community members;

- 26% — tariff rate;

- KU - the number of members of the farm (including the farmer).

By analogy, transfers to compulsory medical insurance for the year are calculated using the following formula:

EVFoms = minimum wage x 5.1% x 12 months. x KU, where:

- EVFoms - the amount of the annual transfer for health insurance;

- 5.1% — tariff rate;

- KU - number of participants in peasant farms.

Important: there are no special conditions related to the amount of income for farmers.

Tariff rates will not increase under any circumstances. Example

Citizen Ivanov is registered as the head of a peasant farm, which includes 15 peasants.

For 2020, he will have to pay the following insurance amounts:

- OPS:

- 7500 rub. x 26% x 12 months. x 16 people = 374,400 rub.;

- Compulsory medical insurance:

- 7500 rub. x 5.1% x 12 months. x 16 people = 73,440 rub.

Attention: lack of income does not exempt the farmer from transferring the specified payment to the Pension Fund budget.

How can a peasant save for his old age?

The problem of people engaged in business in agriculture is the minimum accruals when an insured event occurs. As of 2020, most peasants cannot qualify for an old-age pension at all.

The fact is that at one time these citizens did not make transfers to the solidarity budget, therefore, they did not earn pension points. Thus, statistical authorities provide the following data:

- in 1990-96, 5% of peasants made deposits;

- in 1997 - 20.6%;

- in 1998 - 20.6%;

- in 2001 - 14%.

For the rest, these periods are not taken into account in the insurance period.

Thus, the only hope for farmers and farm members is social benefits. And its value is minimal (RUB 4,959). And they appoint it five years later than the insurance one. There is only one way out - to save on your own.

Funded pension

People born after 1967 received the right to choose a pension rate:

- invest part of the contribution into savings;

- or transfer everything to the insurance account.

In this case, the savings investments are entrusted to the financial institution:

- non-state pension fund (NPF);

- management company (MC).

The selected organization is engaged in investing deposits, due to which they should increase. In addition, investments in old age can be replenished:

- voluntary contributions;

- maternal capital.

Important: in 2020, there is still a moratorium on savings. This means a ban on transferring part of the obligatory payment under compulsory pension insurance to a non-state pension fund or management company.

How are pensions paid to rural pensioners?

| Method of delivery of pension payments | Advantages | Flaws |

| "Post office" | · payments are delivered to your home or post office; · funds are always delivered in cash and do not require the ability to use ATMs. | · dependence on the pension payment schedule (the need to be present at home or take into account the work schedule of the post office) |

| Bank | · funds are available at any time at an ATM; · there is no need to adjust to the pension payment schedule. | · Skill in using an ATM is required; · Skill in using non-cash payments is required; · dependence on the performance of the ATM and the availability of banknotes in the ATM. |

| Organization providing pension delivery services | · payments are delivered to the organization’s home or office; · funds are always delivered in cash and do not require the ability to use ATMs. | · dependence on the pension payment schedule (the need to be present at home or take into account the organization’s work schedule) |

After making a decision on the method of receiving pension payments, the pensioner is obliged to notify the Pension Fund in writing.

What types of pension benefits are available to peasants?

Farmers receive the same guarantees from the state as other people. They also relate to pension benefits upon the occurrence of one of the insured events:

- reaching the age limit for compulsory participation in labor activity:

- 55th anniversary for women;

- 60th birthday for men;

- preferential, specified in regulations;

- registration of disability

- loss of a breadwinner.

Managers and members of peasant farms receive benefits upon the occurrence of an insured event, determined by current laws. Namely:

- Insurance if available in 2020:

- 18.6 points;

- 11 years of work experience.

- Social, if you have not managed to accumulate enough of the above indicators.

- Cumulative, subject to the deduction of voluntary contributions to capital for old age.

Important: farmers are given the opportunity to independently take care of future maintenance from the Pension Fund budget.

They must decide how and how much to invest in their old age. These people receive the right to a pension due to old age or in another insured event, subject to contributions to the Pension Fund of Russia (PFR). But the difficulty lies in the fact that the size of pension benefits directly depends on the amount of a person’s contribution to the budget of the compulsory pension system. And for rural workers this amount is calculated based on the minimum wage (minimum wage), that is, it is very small.

Relations between peasant farms and the Pension Fund of Russia

Due to the peculiarities of the activities of farms, there are several ways for them to interact with the Pension Fund. The subtleties depend on the role of the leader or organizer of the peasant enterprise:

- If this person heads a team of like-minded people, then he is the insured. In this case, there is no need to specifically register with the Pension Fund. Information about an individual entrepreneur is sent to the government agency automatically. This happens within three days after the type of activity is fully registered in the Unified State Register of Individual Entrepreneurs (USRIP).

- If a farmer uses the services of hired workers, then he is an employer. His responsibilities include registration with the Pension Fund.

- Separately, the head of a peasant community can open his own pension account (optional).

Important: for ordinary members of peasant farms, money is transferred to the joint budget by their leader. That is, the head of the household is responsible for the right to receive state support by all members of the community (after the occurrence of an insured event).

How to register

The head of a farming community must submit an application to the fund in one case:

- when concluding an official labor agreement with another person for: performing any type of work (for example, transporting goods or selling products of peasant activities);

- provision of services (treatment of plants with chemicals, for example).

Important: the farmer is given a certain period for registration - 30 days (counted from the date on the agreement).

Registration is carried out on the basis of an application, to which copies of the following documents are attached:

- passports of the head of the household;

- registration certificates issued by the Unified State Register of Entrepreneurs or licenses;

- labor agreement with the employee (all, if there is more than one);

- document from the tax authority regarding registration.

Attention: for violation of the specified registration period, a fine is calculated based on the number of days of delay:

- up to 90 days - 5,000 rubles;

- over - 10 thousand rubles.

Pension Fund specialists process the application within three working days, subject to the provision of a complete package of documents.

Who in the village will receive a new increase

The 25% supplement is intended for certain groups of the population.

These include:

- pensioners receiving old-age insurance benefits;

- citizens to whom disability payments are transferred.

To apply for this allowance, you must meet the conditions. First of all, the presence of 30 years of experience in agriculture is taken into account. It is required that the position be reflected in the above list.

When calculating length of service, the time intervals when official employment took place are important. During these periods, the employer must pay insurance contributions to the Pension Fund.

It is also taken into account that at the time of registration of the increase, the citizen has retired and is not performing labor functions. In addition, he must not carry out other activities for which the payment of insurance premiums is provided. Another requirement is permanent residence in a rural area .

List of professions that give the right to a rural bonus

The list of positions of villagers who can qualify for an increase in payments is reflected in Government Decree No. 1440 of 2018. Preferences are provided to workers in 3 areas: crop production, fish farming and livestock farming.

These professions include:

- agronomists and agricultural technicians, agrochemists;

- machinists and drivers of agricultural equipment, combine operators;

- mechanics, mechanics, repairmen;

- persons performing management functions in peasant farms;

- state farm directors and chairmen;

- veterinary doctors, orderlies and technicians;

- livestock technicians, tractor drivers and machinists;

- livestock breeding masters, adjusters in cultivation workshops.

Also, an allowance is provided for other professions reflected in the specified list of the Government.