Disabled people are among the most vulnerable citizens. It so happened that even the difference in age does not affect the situation in any way. A person becomes completely dependent on the help of third parties, as a result of which he receives support from the state in the form of social benefits. More than 8% of people with disabilities live in the country, and this percentage is increasing every year.

Disability pension: general issues

To assign it, it is necessary that the person has a disability group established by the commission. The basis for making the payment is that the disabled person cannot earn sufficient income to ensure an appropriate minimum standard of living. With the help of this pension, the state is trying to bring the living standards of the socially vulnerable population closer to general indicators.

Disability is established both from the birth of a person and throughout his life. The commission can assign disability groups from 1 to 3.

The legislation also distinguishes such a concept as a disabled child. If a person has the greatest degree of health loss, then he is assigned the first group, with smaller sizes - the second and third.

The main regulations governing the procedure for establishing disability and paying pensions for disabled people are Law No. 181-FZ and Law No. 166-FZ.

To whom is it assigned?

Legislative acts establish that payment of disability benefits is due to:

- Citizens for whom the commission has established disability groups 1,2,3. At the same time, if the loss of health is complete, then group 1 is assigned. If the second health group is assigned, it means that the individual has restrictions due to health conditions and the creation of special working conditions is required for work. If citizens cannot carry out their activities in their previous profession, they are assigned light work and the third group.

- An individual who has been assigned the status of “disabled child.”

- Uhf;

- A citizen who has a recorded loss of ability to work and belongs to the category of WWII veteran.

- An individual who has a loss of ability to work and belongs to the category of Leningrad siege survivors.

- A citizen who has a recorded disability and is an astronaut.

- An individual who has suffered a loss of health and is a military personnel.

- In case of disability of an individual who has survived radiation and man-made disasters.

Types of disability pension payments

The disability pension granted to people has the following types:

State

Pension benefits are assigned in accordance with the norms of state acts to certain categories:

- Persons who are WWII veterans.

- Persons related to military personnel and astronauts.

- Persons who have the status of “Besieged Leningrad”.

- Persons who suffered as a result of radiation and man-made disasters.

Attention!

Moreover, the amount of pension benefits directly depends on the place where the illness, injury or injury occurred, which resulted in loss of health and ability to work. The size of such a disability pension can be from one to three times the amount of social pensions. Also, some categories of state pension recipients are given the opportunity to receive several types of pensions at once.

Insurance

This pension is established for individuals who have worked at least one day and have lost their ability to work. It is often also called labor.

It is assigned based on the amount of deductions made for this person from employers and additional payments, which are established by law, up to a certain level. This amount is fixed and is established throughout Russia for each disability group.

If a disabled person lives in a territory classified as the Far North. Then regional coefficients are applied to this payment. The amount of such payment is affected by the presence of dependents of the person.

Social

A pension of this type is assigned to persons who have been assigned a disability group, but who do not have a single day of work experience. Such a pension can be paid to disabled people of groups 1-3. Practice shows that disabled people of group 1 often receive such support.

This type of disability pension can be taken by persons with disabilities whose insurance pension results in less than their social pension.

You also need to know that persons with disabilities are entitled to a number of benefits. If a given person renounces part and all of the NSU, then he is paid another EDV.

The amount of such payment is established depending on the refusal package of services and the disability group assigned by ITU. It is important to understand that the EDV refers to regional payments, and in the territory of different subjects of the federation its size may vary.

How to apply for a disability pension:

To apply for a disability pension, you will need to follow the established procedure.

List of documents

To receive a disability pension from the Pension Fund, you need to submit the following documents:

- Applications for a pension in the prescribed form.

- SNILS.

- The applicant's passport, or birth certificate of a minor, or residence permit for foreign citizens.

- VTEK certificate, which establishes the disability group.

- Original and copy of work book to confirm work experience.

- Other documents required for granting a disability pension. For example, a certificate of the Second World War, a military astronaut.

- Power of attorney for a representative if the application is submitted through another person.

Important! Representatives of the Pension Fund of the Russian Federation may also ask you to provide other documents - a certificate of family composition, a 2NDFL certificate, a certificate of the presence of dependents, etc. However, there must be a reasonable basis for this request.

Conditions for receiving a pension

The main condition for granting a disability pension is the establishment of a disability group. Any disability group gives the right to a pension. To confirm disability, a conclusion from a body such as the State Bureau of Medical and Social Expertise will be required.

This examination should be carried out periodically. For example, once a year. In order to receive a disability pension on time, you must undergo this health check.

For a citizen, just designating a disability is not enough. It is necessary to prepare a package of documents and submit them for payment of the pension.

In addition, a citizen who is going to receive a disability pension must be registered in the Pension Fund system (have a valid SNILS).

It is very important to have work experience when applying for a pension. In this case, even one day of work will be important. If a disabled person has not worked a day, he can only count on receiving the social part of the pension.

Terms of consideration

After submitting the application, its consideration takes up to 10 days.

But it must be remembered that the date of acceptance of the package of documents for consideration will be considered the date on which the last required form was submitted. If the documents were not submitted in full at once, the review period will be counted from the date on which the last required form was provided.

If, based on the results of the consideration, a decision is made to assign a disability payment to a citizen, then it will be established from the day he is recognized as disabled.

Important! It will be necessary to contact the government agency within 1 year from the date the group was established. If this deadline is not met, the pension will be assigned from the moment the documents are submitted.

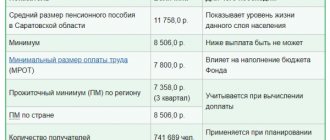

How to calculate the regional supplement for disabled people of group 3

FSD is paid to pensioners from the federal budget. But regional authorities may, at their discretion, assign additional subsidies and benefits to citizens with the third group of disabilities. A pensioner can obtain an exact list of entitlement benefits from the local social security office.

A disabled person has the right to apply for regional allowances if his income is less than the minimum subsistence level established in the region. The amount of the additional payment is calculated simply - from the PMP you need to subtract the sum of all the pensioner’s income. If the result is positive, you should contact social security with a statement.

Disability pension amount

What factors influence the amount of payments?

The amount of pension paid due to disability may be influenced by the following factors:

- Established disability group;

- Disability was established in childhood or acquired during life;

- Availability of dependents;

- Availability of insurance experience;

- Is the disabled person included in any special category - accident liquidator, astronaut, etc.;

- Services from the NSO are received in kind or monetized;

- A disabled person works or lives in normal territory, or in the Far North with the current regional coefficient.

Social pension amount

What is important here is only the disability group and at what time in life it was acquired. Citizens belonging to the same category receive the same allowance. But additional payments may also be established at the regional level.

The social pension assigned for disability in 2020 from April 1 is:

- For children with disabilities - 12,681.09 rubles;

- Disabled people of group 1 whose disability has been established since childhood - 12,681.09 rubles;

- Disabled people of group 1 under general conditions - 10,567.73 rubles;

- Disabled people of the 2nd group whose disability has been established since childhood - 10,567.73 rubles;

- Disabled people of group 2 on general terms - 5283.84 rubles;

- Disabled people of the 3rd group whose disability has been established since childhood - 4491.30 rubles;

- Disabled people of group 3 on general terms - 4491.30 rubles.

If a regional coefficient is used in the region, then the pension is also recalculated to its value.

State pension amount

The state pension is established as an additional payment to the current social pension.

If the cause of disability is a military injury:

- For a disabled person of group 1 - surcharge of 300%;

- For a disabled person of group 2 - surcharge of 250%;

- For a disabled person of group 3 - additional payment of 175%;

What do monthly fixed payments depend on?

Now we propose to consider what amount of additional payment to the pension is expected in 2020 for a disabled person of group 3. At the state level, fixed additional payments have been established for people with disabilities of group 3. This amount consists of a set of benefits that a citizen has the right to choose independently. This list includes:

- the ability to receive free prescription medications (or purchase them at 50% of the market price);

- benefit of free use of city and railway public transport;

- the opportunity to receive a free certificate for sanatorium treatment;

- there is no need to pay taxes (or pay a reduced amount);

- the opportunity to receive the full amount within established limits.

What will be the increase in pensions for disabled people in 2019?

According to the law, the increase in pensions for disabled people in 2020 is carried out in several stages, which affects all layers of pensioners:

- From January 1, the insurance pension and fixed payment were indexed to 5,334.19 rubles. In addition, the disability pension has increased by 25% for those who have worked for at least 30 years in agriculture, do not work anywhere while receiving a pension, and live in rural areas. This increase will only apply to those who are unemployed;

- Since February 1, the EDV and NKU have changed by 3.4%.

- From April 1, social and state pensions were indexed by 2%.

- From August 1, pensions for working pensioners will be raised. It is expected that the increase will occur by no more than 3 pension points, so the maximum increase will be 244.47 rubles.

Features of indexation of payments to disabled people in 2019:

Indexation of insurance pensions

From 01/01/2019, the insurance part of the pension was indexed. Despite the statement that they would increase it by 1000 rubles, this turned out to be an average figure. In fact, the indexation rate was 7.05%.

Important! Therefore, from January 1, the minimum insurance portion is charged in the amount of 5334.19 rubles.

Fixed payment

The fixed payment is indexed from January 1, 2019. The basic indicator is now 5334.19 rubles.

For disabled people of each group, the indicator is indexed by a certain coefficient:

- Disabled people of group 1 (coefficient 2) - 10,668.38 rubles;

- Disabled people of group 2 (coefficient 1) - 5334.19 rubles;

- Disabled people of group 3 (coefficient 0.5) - 2667.09 rubles.

Indexation of social pensions

The indexation of social pensions in 2020 was carried out on April 1. It was expected that it would change by 2.4%, but in fact they increased only by 2%.

Basic pension rates are now:

- For children with disabilities - 12,681.09 rubles;

- Disabled people of group 1 whose disability has been established since childhood - 12,681.09 rubles;

- Disabled people of group 1 under general conditions - 10,567.73 rubles;

- Disabled people of the 2nd group whose disability has been established since childhood - 10,567.73 rubles;

- Disabled people of group 2 on general terms - 5283.84 rubles;

- Disabled people of the 3rd group whose disability has been established since childhood - 4491.30 rubles;

- Disabled people of group 3 on general terms - 4491.30 rubles;

If a region has a regional coefficient, the payment will also be increased by it.

A set of social services for disabled people of group 3

Along with monetary assistance, disabled people of the third group are entitled to a certain set of social services. The law includes among them:

- compensation for the cost of medications;

- discounts on trips to a sanatorium (from 25 to 100 percent);

- free travel to the health resort;

- compensation for travel on suburban transport.

A citizen can, at his choice, receive the listed services in kind or in cash equivalent. In the latter case, he will be given an additional payment to his monthly pension benefit in the amount of 1,048.97 rubles.

The specified NSO cash equivalent is current as of October 2020.