Pension systems work better only in those countries that do not experience demographic problems. But there are fewer and fewer of them. States are trying to provide a decent old age for their population in different ways: some cope with the task better, others worse. This is how things stand with pensions on the Green Continent - in Australia.

Who is entitled to pension payments?

Anyone for whom emigration to Australia has long been a reality, who has lived and worked in this country for ten years or more, is considered sufficiently Australian to qualify for a pension from a certain age. True, this “certain age” may come as a surprise to yesterday’s Russians - people here retire a little later than here. Women - from 64 years old, men - from 65. It is believed that up to this age a person is quite capable of working. Which, given the quality of life and medicine in the country, is completely justified.

Requirements for receiving a pension

In addition to age requirements, a citizen must also meet residency requirements, namely:

- Be a resident of Australia and be physically present in the country on the day of application

- Live in Australia for at least 10 years

- And have at least 1 period of continuous residence in the country for 5 years.

There are exceptions to this rule if the applicant is a refugee or receiving widow's benefits.

Income Requirements

To receive a state pension, a future pensioner also needs to prove that he receives insufficient income. In other words, if a citizen at retirement age earns sufficient income, he is not entitled to receive an old-age pension. For 2019, this income per person is $2,024.40.

No need to work

You only need to be Australian to receive the State Pension. It doesn't matter if you're a purebred or a migrant. Only resident status for 10 years

, it is he who gives the right to pension payments in old age.

The state pension is a guaranteed income.

But it’s not the only one: besides it, there are private pension funds and various investment programs that make it possible to increase the size of monthly payments.

High pensions and the resort climate of the coast make Australia attractive to expats

Who gets the bonus?

Almost every elderly person is entitled to a supplement. This part of the retirement benefit is called GIS. This supplement is available to Canadians whose 12-month income is below the income limit.

Return to contents

Benefit amount and receipt

The size of the bonus depends on the pensioner’s salary level, as well as on whether he is in a legal marital relationship.

In order to confirm your income, you need to submit a tax return once/12 months, but strictly before April 30.

Instructions for persons applying for additional assistance are as follows:

- If a citizen applying for a bonus is going to enter into or dissolve a marriage relationship, he needs to fill out a special form. form. The application form can be downloaded from the official Service Canada website.

- If the spouses do not live together, then the person claiming the supplement has the right to receive benefits as a single pensioner. To do this, he also undertakes to contact the relevant authority with a completed application.

A pensioner receiving a basic benefit + supplement has about $1,500/30 days on hand.

The minimum amount for a married couple will be $1090/30 days for each person.

The amount of the supplement for a pensioner who has any additional income is reduced depending on the 30-day profit.

If a senior's annual income is $17,400, they do not receive the supplement. For a married couple, this figure is 23 thousand dollars.

Find out more about taxes in Canada here.

Return to contents

Help from British Columbia

Persons residing in British Columbia and receiving Old Age Security + GIS are eligible to receive additional assistance from the government.

Those people who are 65 years of age or older and have lived in Canada for at least 10 years are eligible to receive an Old Age Pension benefit.

The supplement to already paid contributions is calculated “automatically”. If the senior decides to leave British Columbia, the additional benefit is paid for 6 months.

The amount of additional assistance is indicated on the sign.

| Family status | Amount of additional benefit |

| Single/widower | $50/30 days. |

| Married couple | $60.3/30 days. |

| Applicant's spouse | $49.8/30 days. |

Return to contents

Additional type of assistance

Older Canadians are also eligible to receive the Allowance. This is a special type of financial assistance, the main task of which is to protect citizens from poverty.

The right to receive the Allowance is available to the legal and civil life partners of pensioners, as well as their widows or widowers aged 60-64 years.

The main requirement for receiving this benefit is that you have lived in Canada for at least one decade after turning 18 years of age.

This takes into account Canada's mutual agreements with other states. The income of such persons should be classified as “low”.

The Allowance is paid 1 time/30 days. This benefit, unlike OAS, is not subject to tax. Another goal of the Allowance is to help people overcome the age gap between 60 and 65 years.

Persons over 65 years of age who are immigrants and have not had ten years of residence in Canada are also eligible to receive cash assistance from the government. This category of citizens is paid Social Assistance. In everyday life, this type of benefit is called “welfare”.

Social Assistance is a type of financial assistance for citizens who have immigrated to Canada

Eligibility for this benefit is limited to the obligation of legally resident relatives of immigrants who act as sponsors. You can only receive Social Assistance after a 10-year sponsorship period. The exception is cases when the sponsors themselves “sit down” on the “welfare”.

Return to contents

Old age pension

The retirement age in Australia is: - for women: 64 years - for men: 65 years. Not only age is considered a condition for paying a pension, but there are also additional conditions related to the financial difficulties of an Australian resident.

Retirement age in Australia

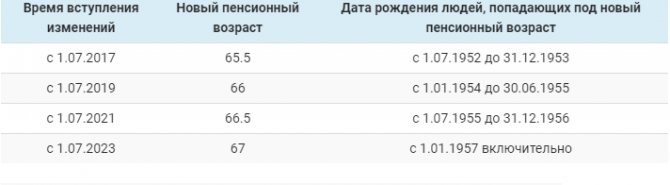

However, this idea was abandoned in 2017. Nevertheless, a law was passed according to which the age limit for retirement will be raised to 67 years by mid-2023. The provisions of this regulation apply only to people born after July 1952.

More detailed information is presented in the table:

But in Australia there are also opponents of such half-measures. They said that the decision to abandon retirement at age 70 would cost the state budget AUD 5 billion.

In the third quarter of 2020, life expectancy on the Green Continent is 84 years. According to forecasts, every fifth resident of the country will be over 65 years of age by 2045, which will lead to a manifold increase in the volume of pension payments.

State pension amount

The amount of government pensions in Canada is low relative to average per capita income. The 100% pension entitled to persons who have lived in the country for 40 years was $563 per month in 2020.

The Canadian government encourages its citizens to go beyond just paying mandatory fees. Investment funds offer numerous retirement plans for Canadian citizens. Payments made to them are not subject to additional tax.

The amount of pension payments is reviewed every three months taking into account inflation.

Features of the Australian pension system

There are a number of certain purely Australian aspects of receiving a pension that you need to know if you are going to receive a pension in this country.

So, there is a rule in the Australian pension system that means that the more income a person has, the less his state pension will be.

It is important to know! In Australia, private pensions are also included in the income list.

Thus, a married couple can expect to receive a full pension if their joint income is less than 230 Australian dollars, and a single pensioner will receive full pension payments with an income of less than 130 Australian dollars.

Attention! A pensioner risks depriving himself of government benefits while having additional income.

That is why in Australia, people of retirement age try to regulate their income and keep it below the threshold set by the state.

If we talk about the most profitable type of accumulation of pension funds, then today private pension funds , which the state responsibly controls, are in demand. Payers will have access to the money upon reaching retirement age.

Pension in Australia - how much do they pay?

The average payment for a single citizen after retirement is $500 monthly. An elderly couple is entitled to an average amount of $900. The pension is subject to changes from year to year due to fluctuations in the economy and changes in the external political environment.

The size of payments is reduced when owning large private property, up to the deprivation of a pension. If, according to the authorities, a citizen owns real estate for a large amount, then he is able to live on personal savings and does not need support from the state.

For this reason, wealthy Australian citizens are trying to reduce their average income to the normal level, as they value special preferential opportunities for pensioners on the continent. In this case, after reaching retirement age, they receive minimum payments and retain benefits.

Be sure to read it! Where to go if you are not paid your unpaid wages: what to do, how to force the employer to pay the debt upon dismissal?

About the amount of pension payments

Let’s start our conversation about what kind of pension is in Australia by indicating the minimum numbers:

- a single person receives approximately 500 AUD per month;

- the minimum total pension per elderly married couple is 900 AUD.

As for the maximum payments, a single pensioner receives 1,590 AUD per month, and an elderly married person receives 1,200 AUD.

You also need to know what the average pension in Australia is in 2019:

- a single pensioner receives 18,070 AUD per year;

- each spouse of an elderly couple – 13,624 AUD.

When a pensioner continues to work, the size of his salary is taken into account when calculating the pension. If it exceeds AUD 43,000 per year, the pension is not calculated at all.

By the way, if you convert into Russian currency, then the figures in rubles will turn out to be realistic for the Russian labor market: 1,875,690 rubles per year or 156,307 rubles per month. This is the guaranteed salary of a highly qualified programmer in Moscow.

An Australian resident, upon retirement, can count on the following pension supplements:

- Remote Area Allowance (allowance for remote regions). These funds are intended to compensate residents of remote regions for higher communication and transport costs. The size of a two-week benefit of this type: for a single pensioner – equal to 18.2 AUD;

- for each spouse in a couple – 15.6 AUD.

- by widowhood;

Amount of additional payments:

- a single pensioner is entitled to 60.2 AUD every 2 weeks;

- for a married couple in total – 90.8 AUD.

Currently, the minimum component of the supplement is transferred to the pensioner’s bank account not once every 2 weeks, but quarterly.

Types of contributions to pension funds

Tax deductions in pence. Fund of Canada are made for all officially employed citizens. The tax rate has a fixed rate and has been equal to 4.96% of the monthly salary since 2013. The same percentage is charged monthly to employers if they are not included in the “self-employed” group, since for employers in this category the interest rate is 9.92%.

Tax deductions in pence. The fund is levied only on those financial sources that fall within the range of the state-established minimum ($3,500 per year) and maximum ($53,500 per year), the amount of which can be indexed each year.

There are 2 types of pension payments in Canada:

- OAS is a universal pension that is awarded to people who have reached the age of sixty-five, regardless of their monthly income. The only condition for receiving such a pension is that the citizen has resided in Canada for at least 10 years.

- SPP are pension payments that are accrued from the age of 60, provided that the citizen has made contributions to the pension fund every month throughout his life without delay.

If a person lives in Canadian territory for most of his life, that is, more than 20 years, then pension payments are accrued to him even if he subsequently resides in another state.

If a person who has lived in Canada for less than 20 years retires and leaves the country for a period of more than 6 months, then the pension is temporarily suspended until the citizen returns to his “homeland.”

general information

Pension contributions are strictly mandatory for all employed persons. The percentage of income is fixed. Since 2003, its size has been 4.96%.

The same figure is relevant for the employer. If the taxpayer belongs to the “self-employed” category, the rate for him is doubled.

Pension contributions are levied on income falling within the interval between the fixed minimum and maximum. Parameters may change annually.

Return to contents

Main types of pension contributions

You can learn more about pensions in Canada from the video below.

There are 2 types of state. pensions in Canada. Information about them is presented in the plate.

| Type of pension contributions | Description |

| OAS | Main state a pension that is paid to all persons who have reached the age of sixty-five and have lived in Canadian territory for more than a decade. |

| SRR | This type of pension contribution is paid to Canadian citizens starting at age 60. The main condition is to make contributions to the SRR every 30 days. |

If a person has lived in Canada for more than 2 decades, then pension contributions are paid to him even when he leaves the country.

Payments to a person who has not lived in Canada for 2 decades and left the country for 6 months or more are temporarily suspended. They resume when the person returns to Canada.

A person who has reached the age of 65 and intends to leave the country for more than 6 months is obliged to notify the employees of the relevant service about this fact.

What pension is in Bulgaria and Greece can be found on our website.

Return to contents

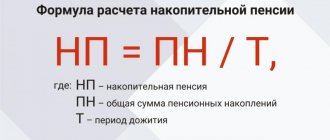

How is the calculation carried out?

The pension contribution for Canadian citizens today is $1,066/30 days. Indexation is carried out annually, in the first ten days of January. In this case, the inflation rate must be taken into account.

You can retire to a well-deserved retirement strictly before your seventieth birthday. The calculated pension for every 30 days that were underpaid or overworked before the sixty-fifth birthday changes up or down. The size of possible changes is 0.5%.

Over the entire period, pension contributions can be increased or decreased by up to 31%.

Find out everything about pensions in Canada from the video below.

Return to contents

How much do Canadian retirees earn?

The amount of contributions that retirees receive in Canada depends on many factors.

| Type of payment | Size | Nuances |

| Old Age Security | 25% of the amount that was earned by a person within 10 years. This amount is divided by 120. | This plan is relevant even if the pensioner has another source of taxable income. A full pension can only be received by those who have lived continuously in Canada for 4 decades since reaching the age of 18. A person who has lived in Canada for less than 4 decades is entitled to receive 1/40 of the full pension contributions. In some cases, when immigrants receive OAS, their length of residence in the United States is taken into account. |

| TheSPP | 25% of average annual income. The average pension size is calculated taking into account both the employee’s salary and length of service, as well as the amount of contributions to this program. | The program is based on mandatory contributions for all Canadian citizens who work in a company or own their own business. To receive such payments, you must fill out the special form in a timely manner. form. The largest pension contribution today is $738/30 days. |

| RRSP | 17% of the amount of income for the previous 12 months. The amount of annual contributions is constantly limited. | Duties on savings are levied only when a person begins to use them. The amount accumulated in this program can be used to purchase the first property in the country. Over the course of 15 years, it must be returned to the fund in equal shares. |

| GIS | The maximum amount is $484/30 days. | This is an additional pension. An application to receive it must be submitted annually. It is usually paid to single elderly people. |

Return to contents

Structure of the Australian pension system

The structure of the pension system, which is based on a complex of two types of pensions, is attractive for older people:

State

Financed from the state budget, paid to a citizen of the country or a person from another state who has reached 65 years of age. You do not have to work to receive an old-age pension.

The salary doesn't mean anything. But at the same time, the presence of income and real estate is taken into account. The purpose of such a pension is to ensure a normal standard of living for older Australians. To receive a state pension, it is necessary to fulfill the conditions that apply to native residents and emigrants from other countries, including from Russia:

- Be a citizen of the country and have resided on its territory for at least 10 years.

- For expats, be in Australia when you reach retirement age.

- The amount in the bank account should not exceed 50,000 AUD.

- If there is a land plot, its area should not be more than 2 hectares.

- The total value of all property should be assessed at a maximum of 160,000.

Failure to comply may result in the pension being reduced or denied altogether.

It is believed that if a family has the opportunity to purchase expensive real estate, then they can have income from its use.

Private pension (Superannuation)

Australians with a formal job can count on a private or funded pension.

By law, employers are required to contribute 9% of an employee's salary to a private pension fund, provided the employee is over 18 years of age and works more than 30 hours a week. By 2025, the government plans to increase the percentage of contributions to 12%.

The employee has the right to choose his own pension fund. There are a huge number of them in Australia, and they differ in the size of the entry fee and the percentage that is charged on service fees.

The fund can be changed at any time. This is very easy to do - you just need to call the newly selected pension fund or fill out a special form (Rellover Form) on its website.

After the employee decides on the fund, he can choose whether to leave the transferred funds for storage at a fixed percentage or invest. There are several options for investment - shares of Australian or foreign companies and real estate. If the investment was successful, the fund returns the interest and the pension grows. In this way, pension funds support the country's stock exchange.

Most funds provide clients with the opportunity to track their pension savings using an online account. There you can transfer money from one type of investment to another.

Money from the fund can be withdrawn upon reaching 60 years of age. The accumulated amount is not subject to tax. The pensioner himself decides what to do with them - buy a villa on the seashore or add to the state pension.

Other types of pensions and benefits

In Australia you can get a pension that is not age related. Parents can count on state help. The government redistributes the amounts collected from taxes, trying to help everyone who is raising a child.

A woman who divorces and is left with small children in her arms will not vegetate in poverty. The state will support her financially, paying about $16,500 per year. Mom is also entitled to the benefits that pensioners have. A small child is considered to be one who has not yet reached the age of 8.

In addition to money and benefits, single parents have the opportunity to obtain public housing. Although you will have to pay rent, it is minimal. This is very often used by divorced women to reduce their expenses.

The pension received for children is also calculated individually depending on the income the mother has. The minimum amount for the year is $5,179, and the maximum is $47,330.

Be sure to read it! Regional maternity capital in 2020, conditions for receiving and documents

Not only single parents can count on state help when raising children. A pension is provided for children and married couples if they have a small income. Getting this help is not so easy: a number of conditions and requirements have been developed that applicants for receiving benefits must fulfill.

Citizens who are unemployed and do not receive pensions can count on unemployment benefits. Even those who have not yet lived in the country for 10 years can count on it. Often those who have just arrived in the country or people who are not yet entitled to an old-age pension apply for it.

It is quite possible to live on unemployment benefits in Australia, as the amount is $250 per week.

There are many different types of assistance in Australia. The government cares about the citizens of its country.

Parenting Payment

The allowance for single women with a small child in their arms is simply less than 500 a year, and this despite the fact that all sorts of benefits appear for almost any service in Australia, and most importantly, they are given the opportunity to rent public housing, the rent of which is simply meager. But all this is only until the child is 8 years old. Hence the conclusion that of course there should be more divorces (there is an opportunity to get social housing and tolerate a husband), but at the same time the criminal situation is reduced because a woman or a man can live peacefully apart from each other without throwing each other out of balance. To receive Child Care Benefit you must apply to Centrelink.

What does the state give to families who have no income and have a child? It gives approximately A$950 per month, but this child care benefit is paid until the child is 6 years old.

And here is the most common child care benefit, see here: Family Tax Benefit. This is especially true for immigrants, if you have children you need to contact the Family Assistance Office.

Benefits for pensioners

In addition to regular cash payments, pensioners in Australia are entitled to various benefits. The main ones are the issuance of special cards that make it possible to buy medicines and essential goods at significantly reduced prices. Preferential travel on all types of public transport and tax benefits for working and retired citizens.

Seniors in Australia are provided with large discounts throughout the country - in shops, cafes and restaurants, hotels and inns. The pensioner is also entitled to a free intercity ticket within the country once a year.

As for utilities, certain categories of pensioners are also provided with discounts - on electricity, telephone, etc. However, the size of the discount depends on the city. In various states of Australia, retired citizens are additionally provided with various allowances and surcharges.

Funded pension

The country has a non-state funded pension system, i.e. All working citizens are entitled to a private pension financed by individual contributions. The size of such contributions can reach 9%. The funded pension can be used by residents of the country who work at least 30 hours a week.

There are many superannuation funds in Australia, and the number continues to grow. The employee must independently choose the fund, and, if necessary, can change it. With the introduction of electronic systems, these procedures have been greatly simplified, and today any citizen can choose the fund that suits him via the Internet by filling out the required form on the pension fund website.

Having reached the age of 60, a working citizen has the right to withdraw the accumulated amount from the fund and use the funds received at his own discretion. The funded part of the pension can also be increased at the expense of the state if the citizen takes advantage of a number of special programs.

How is a pension issued to a foreigner?

Residents of the country, as well as immigrants, can receive a pension in Australia. The latter are subject to the following requirements:

- availability of a permanent visa;

- Duration of residence in the country is at least 10 years. The total time is taken into account, but the duration of one of the periods must be at least 5 years.

Issues related to the assignment of pensions, including for immigrants, are dealt with by the Centrelink agency, an analogue of the Russian Department of Social Protection.

To apply for a pension to this organization you must provide:

- A document capable of proving identity.

- Tax number. Those foreigners who do not have one need to take a special form from Centrelink, fill it out and send it to the tax office at their place of residence. In a few days the TFN tax number will be ready.

- A document confirming 10 years of residence in Australia. This can be done by a certificate from a local employer.

The pension will be issued if there are no comments on the submitted documents.

The state of pensions in Australia today

Today the average pension in Australia is $2,610. Like other countries around the world, Australia's population is noticeably aging.

It is expected that by 2030, 25% of the population will approach the retirement age limit and cross it.

That is why the state is trying to make the pension system as thoughtful as possible . This gives a positive result.

From 2020, the government plans to gradually increase the retirement age. To begin with, the retirement age will move from 65 years to 67 years, and then rise to 70 years.

Today, compared to 2020, there is a sharp decrease in the size of the state pension. The fact is that according to this item, income growth is not desirable. Experts predict that a gradual reduction in pension benefits from the state is inevitable in the future.

Today, Australia is one of the top 12 countries with policies that allow retirees to live comfortably . This is not surprising, because the government of this country strives to teach citizens to provide for themselves in old age, first by paying taxes responsibly.

Future retirees are offered several profitable ways to receive a pension . This allows each Australian citizen to determine for himself what type and amount of pension is acceptable to him.

Retirement age in Canada

The retirement age in Canada for women is 65 years. Taking earned leave may be slightly delayed, but not longer than 4 years 11 months, provided that the person legally has permanent residence within the country.

This privilege makes it possible to earn a substantial pension, the size of which will exceed the old-age pension by 31%. But not everyone benefits from using such a privilege, namely:

- People who have not lived in Canada for more than 20 years;

- Citizens leaving the country for more than 6 months, or living in the territory of another state.

It is important to understand that by voluntarily deferring a pension, a Canadian is deprived of the right to receive additional benefits.

The state retirement age in Canada for men is also 65 years. Men, like women, can leave earlier or later, subject to the established rules.