In 1994, the Non-State Pension Fund “Renaissance Life and Pensions” was established, which worked quite successfully in the field of non-state pensions. It became the brainchild of Renaissance Credit Bank.

The company had its own website where you could control the growth of your savings, monitor profitability, and ask specialists questions of interest. Alternatively, clients could contact the hotline to clarify unclear points.

Information about the fund

The fund offered many bonuses and was popular among Russians. Subsequently, a reorganization took place in this structure. As a result, the name changed to “Sun. Life. Pensions." This measure was taken to improve positions in the ranking.

The goal was to become one of the top five such organizations in Russia. To achieve this, certain changes were made to the strategy; it was planned to implement a number of innovative solutions that would attract the maximum number of customers.

Liquidation of non-state pension funds and its reasons

However, in August 2020, the license of this NPF was revoked by the Central Bank. The reason for this situation was the organization’s failure to fulfill its obligations. According to the regulator, clients were denied the transfer of funds to other structures of this kind at their request.

Important! Every Russian has the right to independently decide where to place the funded part of their pension. If for some reason you are not satisfied with the chosen NPF, a person can always terminate the agreement and transfer the money to another structure.

NPF Renaissance was also caught refusing payments. According to the Central Bank of the Russian Federation, the fund refused to issue about 3.4 billion rubles to clients.

By the way, the fund belonged to Anatoly Motylev, and he was the owner of several other structures working in the same area. There were seven of them in total.

By decision of the Central Bank, the license was revoked from each of them. NPF Renaissance tried to prove the illegality of the regulator’s decisions, however, these efforts were in vain. The fund insisted that the regulator did not give time to eliminate the identified deficiencies and submit the necessary documents.

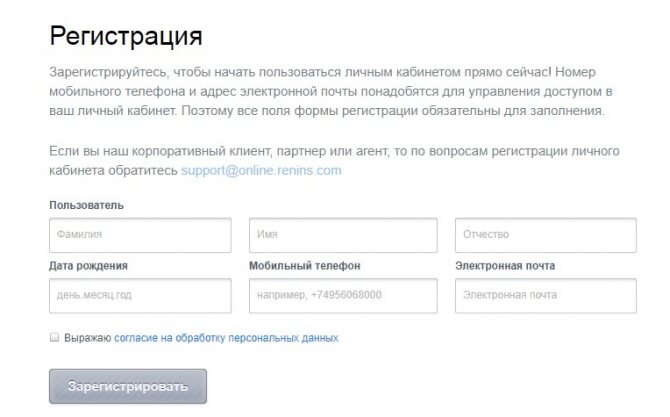

Registration

By signing an agreement with an insurance company, citizens have the right to a personal Renaissance insurance account. Technically this happens automatically. The contract itself provides for the indication of login and password positions. In fact, the cabinet contains all the information about the policyholder and data useful for the client:

- personal insurance tracking;

- editing information about yourself;

- clarification of everything related to policies, etc.

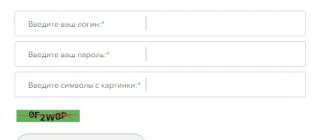

Registration is carried out by activating the button of the same name. In the window that opens, you need to fill in the fields with your passport data, full name, phone number, email address, password and its confirmation. Then, in a special field, repeat the alphanumeric image and check the box that allows the use of personal data. The account activation code will be sent to your phone. All that remains is to enter the number and code in the appropriate fields and enter your personal account.

Actions of investors

So, NPF Renaissance’s license has been revoked, what should I do? At least 800 thousand people have faced this question. A temporary administration was created to solve the problem and satisfy customer demands.

The result of her work should be the transfer of all money to clients, and the funds will be transferred to the Pension Fund. If there is a shortage of funds, they will be fully compensated to pensioners.

This means that citizens will receive the funded part of the pension contributed to the Renaissance Non-State Pension Fund and will be able to transfer it to another non-state structure or leave it in the Pension Fund.

Good to know! Citizens will be returned only those funds that they invested in this fund. You cannot count on a return on the income accumulated as a result of investing.

Meanwhile, many citizens considered these funds as an opportunity to ensure a decent standard of living in old age.

Fund performance before liquidation

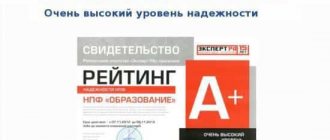

It should be noted that before the problems with the license, the fund was doing very well. The national rating agency did not evaluate it, but the ratings from RA Expert were high. The last time the reliability level of a non-state pension fund was rated as “A+” with a positive outlook was in 2013.

During its activity, the fund has achieved high indicators:

- Accumulated funds in the amount of 34 billion rubles;

- The total amount of funds from the founders amounted to 433.8 million rubles;

- Right before the license was revoked, he received two prestigious financial awards at once;

- Own property amounted to 28 billion rubles;

- The yield was 7.68%;

- The accumulated return by 2013 is 37.34%, the average for the year is 8.25%;

- The fund took 15th place in the consolidated rating of all Russian structures of this kind, which also indicates successful work;

- Official website of NPF “Renaissance. Life and Pensions” was quite functional.

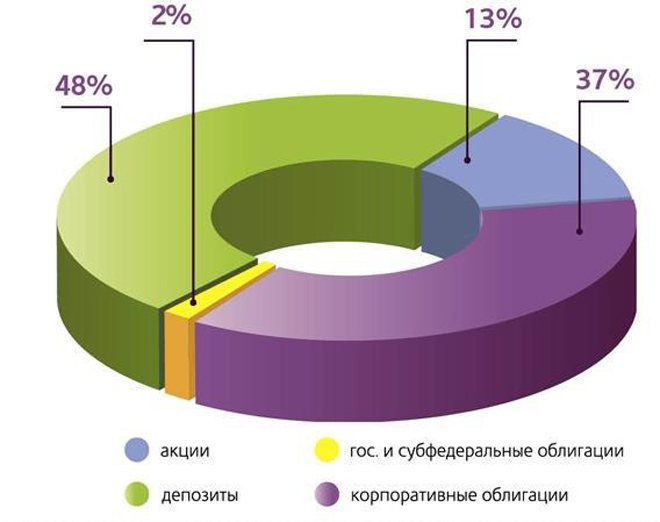

The fund invested in bank deposits, corporate and government bonds, and shares of leading companies operating in various fields.

Investments involved different degrees of risk, which indicates the implementation of a conservative investment policy.

The website featured a personal account that any client of the fund could use. Now this service is no longer available, but users who have a login and password can try to log in to it at https://lifecabinet.renlife.com/user/login.

Here, everyone could use a calculator to calculate the pension in this NPF and compare it with the indicators of other funds, including the Pension Fund.

News

The Renaissance Insurance Group and NPF "BLAGOSOSTOYANIE" with the participation of the Baring Vostok fund are combining their insurance assets to create a major high-tech player in the Russian insurance market.

The corresponding agreement was signed in Moscow on July 6, 2020 and will come into force after receiving the necessary regulatory approvals.

The united insurance group will include LLC "Renaissance Insurance Group", LLC "IC "Renaissance Life", JSC "INTOUCH INSURANCE", JSC "SK BLAGOSOSTOYANIE", JSC "SK BLAGOSOSTOYANIE OS", JSC NPF "BLAGOSOSTOYANIE EMNCY", JSC "UK" SPUTNIK - CAPITAL MANAGEMENT" and LLC "Meditsinskaya.

The purpose of the association is to develop business and achieve leadership positions by the united group in target market segments: direct insurance, endowment life insurance, bancassurance, auto insurance, health insurance. At the same time, the best technologies and practices of the merging companies will be used in the new structure; the full range of insurance products and high-tech, high-quality service in all distribution channels will become available to clients.

The parties to the transaction are: the international Sputnik Group, Management Company "TRANSFINGROUP", the pension reserve manager of NPF "BLAGOSOSTOYANIE" and the international institutional investor Baring Vostok Fund. The partners will receive shares in the combined company of 52.1%, 35.8% and 12.1%, respectively.

The capitalization of the combined group will exceed 27 billion rubles. The transaction will be the largest for the Russian insurance market with the participation of an international investor over the past 10 years. Sberbank CIB acted as a strategic consultant to Sputnik Group on organizing the transaction.

The managing partner of the merged company with a controlling stake will be the Sputnik Group, headed by Boris Jordan. The development strategy of the merged company will be approved by the established Board of Directors, which will include representatives of the three shareholders. Key decisions in the merged company will be made jointly by investors in accordance with best corporate governance practices.

“I am glad that our business will develop together with such successful investment partners. And now a fully capitalized and highly profitable player will appear in Russia. As a result of this merger, an insurance group will appear that will be able to offer its retail and corporate clients the widest range of insurance services and products, including medical services and a corporate pension product. This combination will provide significant business and profit growth. The consolidated premiums of the merged company will exceed 50 billion rubles this year,” says Boris Jordan, president of the Renaissance Insurance Group and owner of the Sputnik Group.

“Economies of scale are important in the insurance business, so the fund is interested in participating in a large diversified insurance group. We consider this trilateral partnership to be strategically correct: Renaissance Insurance is in the TOP 10, has an operationally profitable and one of the most attractive retail portfolios on the market, and also actively invests in technology; Baring Vostok is a major international investor. We believe that the economic potential of the combined business creates prospects for increasing dividend yield on the fund’s investments,” says Yuri Novozhilov, executive director of NPF “BLAGOSOSTOYANIE”.

“We see that investor interest in Russian business is being restored. And this deal with the participation of a large international fund and a Russian institutional partner confirms that the Russian financial market is open to local and international investors,” comments the head of Sberbank CIB, Igor Bulantsev, on the signed deal.

“Renaissance Insurance today is a transparent and well-managed business in an insurance industry that is undergoing fundamental changes that are improving the profitability and sustainability of the sector as a whole. We believe that the strong capitalization resulting from the transaction completed today, as well as Renaissance Insurance's leading position in some of the fastest growing segments of the sector, enhances the company's investment attractiveness,” said Michael Calvey, senior partner at Baring Vostok Capital Partners Group.

Renaissance Insurance Group was founded in 1997 by the Sputnik Investment Group. The company's authorized capital is 2.1 billion rubles. The volume of the signed prize of the Group (which includes Renaissance Life) at the end of 2020 amounted to 40.3 billion rubles. According to the Central Bank of the Russian Federation, the Group is among the top 10 insurance companies in Russia in terms of premiums collected.

NPF "BLAGOSOSTOYANIE" is one of the largest non-state pension funds in Russia. The fund is a leader in the non-state pension provision segment: the number of clients exceeds 1.2 million people, and over 346 thousand people already receive a non-state pension from the fund. Since 1999, NPF “BLAGOSOSTOYANIE” has been implementing a corporate system of non-state pension provision for enterprises and organizations in the railway transport sector.

Baring Vostok is one of the leading private equity companies operating in Russia and the CIS countries. Since 1994, Baring Vostok funds have invested more than $2.8 billion in 80 projects, including a number of successful companies in the financial services, oil and gas industries, telecommunications, media and consumer sectors.

Currently, the raised capital of the funds is $3.7 billion. Among the projects of the Baring Vostok funds: STS Media, Golden Telecom, Yandex, Ozon, Gallery Group, CFT, Enforta, ER-Telecom, 1C, Barren Energy, Volga Gas, Zhaikmunai, Novomet, Kaspi Bank, Vostochny Bank, Europlan, EMC and many others.

The investment advisor to the funds is Baring Vostok Capital Partners Group Limited (located in Guernsey), whose Moscow office employs a team of forty investment professionals.

The Baring brand unites private equity funds with a capital of over $18 billion. Baring Private Equity International is one of the world's largest networks in the private equity market in the CIS countries, Asia, India, Europe and Latin America.

Customer Reviews

At one time, reviews of the work of the NPF “Renaissance. Life and Pensions” were quite positive. Many clients noted the good service and convenience of their personal account. The level of NGOs that generated high income also played an important role.

People were also attracted by the simple procedure for signing a contract. To enter into an agreement for service in the fund, a passport and a pension certificate were enough. In addition, the NPF has organized an extensive branch network throughout the country. Residents of any region could personally contact specialists in the nearest city.

But there were also negative reviews. They concerned, for example, the execution of contracts without people’s knowledge, as well as discrepancies between information on the website and actual indicators. First of all, this related to profitability.

Authorization problems

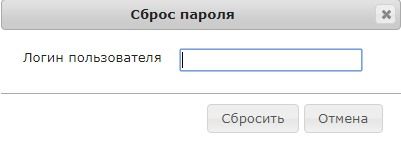

If, when logging into your account, the system notifies you that you are entering the password incorrectly, then you can use the access recovery system. For this:

1.Open the authorization window.

2.Click on the “Forgot password” button.

3.Enter your login.

4.Enter the confirmation code from the SMS message.

5.After that, create a new password.

If you experience the system error “ORA-20101: Contact with the received login was not found,” then first check that the parameters have been entered correctly. If the error appears again, contact support for help (the phone number is listed on the company’s website).