In 2012, the Russian Pension Fund sent out so-called “chain letters” to the population for the last time, from which citizens received information about the status of their ILS. From these notices you could find out which fund you belong to: state or non-state. Now the curious person will have to find out for himself where his pension savings are, fortunately, there are several options:

- in a pension fund;

- on the state portal;

- at the employer;

- in banks - “partners” of the Pension Fund.

If the insured person’s ILS funds are in a fund that does not suit him, then they can be transferred to another once a year, but no later than December 31. Transfer from the Pension Fund to a non-state pension fund is carried out by submitting an application to one of the institutions:

- in non-state pension funds - only in case of conclusion/termination of an agreement;

- in UPFR (management);

- at the MFC.

Who is a member of the State Pension Fund?

Citizens who have not signed agreements on transferring pensions to a non-state institution can rest assured that their savings are in the Pension Fund. You can always go to the personal account of the pension fund and find out the status of your pension.

When the pension reform began, there were cases when representatives of the Pension Fund of Russia visited apartments and asked to conclude agreements with them. As it turns out later, Foundation employees do not go around and force anyone to sign papers. People who signed the agreements transferred their savings to non-governmental organizations. In their case, there is no need to fear that the funds will be lost or burned. In the event of bankruptcy of a frequent institution dealing with pensions, the entire base and savings are automatically transferred to the Pension Fund.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

If a non-state fund changes its name, transfers will also not be affected. The only question that remains is, what is the new name of the non-state pension fund? There are several ways to find out this information.

Calculation of future pension

For any person, even a young one, the question of what kind of pension he will have in old age is a pressing question. To calculate a future pension, a citizen can use a special calculator located on the Pension Fund website.

Factors influencing the issue of future pension:

- The total work experience of a citizen.

- The amount of the employee’s salary, based on which the policyholder paid insurance premiums.

- The age of the citizen applying for a pension.

Pension calculation formula: Insurance pension = pension points * cost of one point (the year the pension was assigned is taken into account) + fixed payments.

Why do you need to check your deductions?

Control over an account in the Pension Fund makes it possible to verify the integrity of the employer. If an employment contract is concluded with the employee, the company owner is required to transfer 22 percent to the employee’s pension account. In the event of a violation being detected, an individual can prove that he is right and that the employer is guilty thanks to a notice of pension.

Non-state Funds may abandon their activities and declare themselves bankrupt. In this case, the individual is not notified about this. The citizen himself checks and controls his future pension.

How is a pension formed?

The total amount of pension payments that a citizen is entitled to after reaching a certain age or completing the length of service is formed from several parts:

- Insurance. Represents all cash payments that were transferred to the Pension Fund of the Russian Federation by the citizen’s employers. Also, the size of the insurance portion is affected by the number of years during which the Russian worked for the benefit of the state. In addition, the insurance pension is periodically subject to indexation in accordance with Orders of the President of the Russian Federation or innovations in pension legislation.

- Cumulative. It is the same pension, or rather, only a part of it, which a citizen can manage at his own discretion. It is no secret that all those years until a person still receives a pension benefit, his funds are under the management of the Pension Fund of the Russian Federation. If you wish, you can independently invest the funded part of your pension to receive increased income or transfer it under the management of non-state pension funds (NPF). The transfer of the accumulative part into management can be carried out as many times as desired.

If the future pensioner is officially employed, then funds are transferred to his personal account every month, indexation occurs, interest is added, etc.

Personal visit to the Pension Fund of Russia using SNILS number and passport

You must show up at the State Fund branch at your place of registration with your passport and SNILS number. In order not to waste time, it is best to make an appointment in advance through government services.

Arriving on the appointed day, the employee uses the SNILS number to request an application for the issuance of the document. After 10 days, the visitor will again have to appear on the threshold of the Pension Fund. The employee provides information about transfers for the entire length of service. The document will also contain the name of the organization in which the savings are stored. The service is provided free of charge. The method is inconvenient because the Pension Fund will have to visit the Pension Fund twice and wait more than a week for a response.

In order not to come to the Pension Fund a second time, you can make a request (again in writing) to provide the document by mail.

Alternative ways to obtain information about the Pension Fund

There are other options to obtain information about your future pension savings. Let's look at them below:

- Submit an application to the territorial branch of the Pension Fund. You need to have your passport and SNILS with you. The notice will be ready in 10 days and can be received in person or by mail.

- Get information from the multifunctional center.

- Write an application to the accounting department at the place of official employment.

- Submit an application to partner banks (for example, Sberbank, Gazprombank, VTB 24, etc.) with which the Pension Fund has entered into a cooperation agreement. These organizations provide information to all citizens who apply, even those who are not bank clients.

Among the methods described above, you can choose the most convenient for yourself, all of them are available and free. The services of the State Services portal are the most popular; the advantages of this choice are obvious: you don’t have to go or travel anywhere, it’s enough to have the Internet at home and be a registered user.

Find out which Pension Fund we are a member of on the State Services website

Having a personal account on this portal, finding out the name of your PF will not be difficult. The user must have a standard or verified account. In the case of a simplified registration option, you will not be able to receive the service.

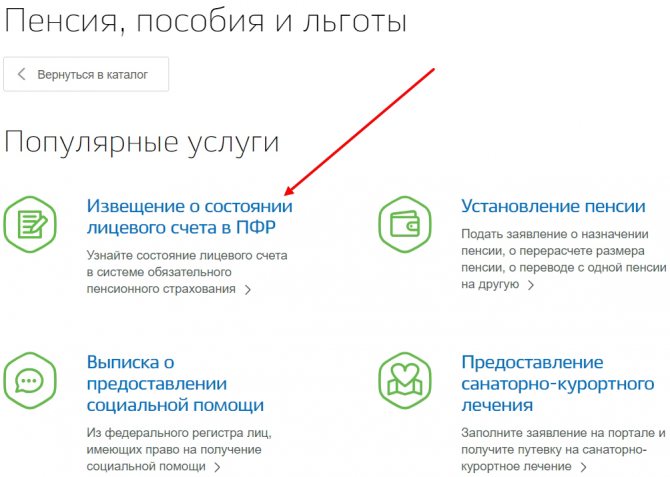

Those who have SNILS registered on the website will need to complete the following steps:

- log into your personal account in a way convenient for you;

- find the “Service Catalog” at the top and open it;

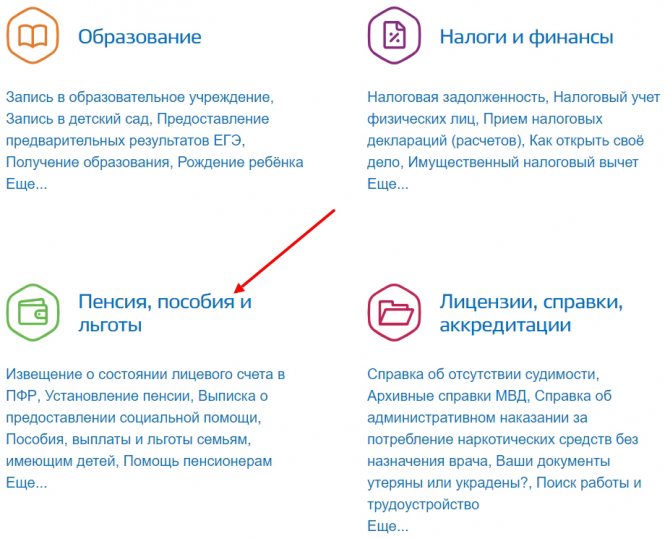

- find the category “Pension, benefits, benefits” in the general list;

- select the link “Notification of the status of a personal account in the Pension Fund of Russia”;

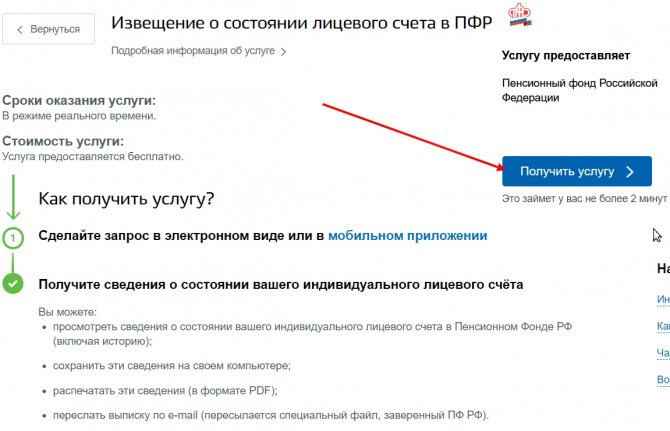

- Click “Get service”.

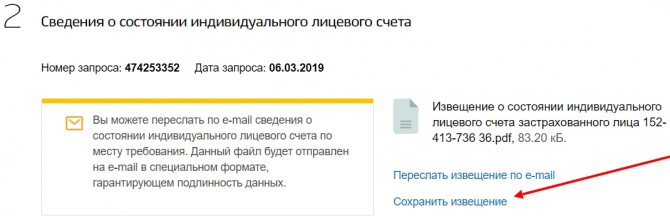

After completing the actions, a message with the attached file will appear in the notification feed. You can open it, print it, or send it by email. The pdf format is readable on all devices.

Self-check methods

Every citizen is able to independently check which organization he is registered with and where his pension contributions are stored. To do this, just contact any of the previously listed institutions and companies, where you should not be refused.

Recently, all government services have been transferred to electronic format, which significantly simplifies and increases the speed of completing procedures, processing documents and making appointments. A striking example of such an online resource is the government services portal; it is a convenient service that works with almost all municipal departments and authorities, including the Russian Pension Fund. Below we will consider the procedure for obtaining a certificate using all available methods and try to choose the most effective and simplest one to find out your pension fund.

Online on the Gosuslugi portal

The main advantage of this method is the high speed of data processing and information collection. To submit a request, you will need to have a mobile phone or personal computer with an active Internet access point.

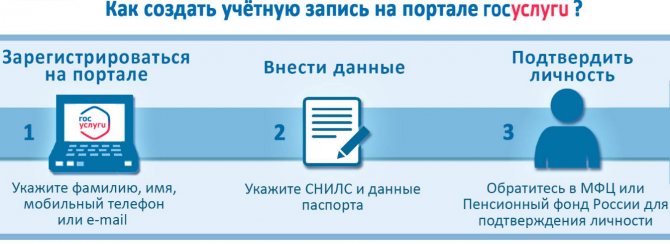

To receive the service, you will first need to register an account on the government services portal.

To do this, just fill out the authorization form, enter your first and last name, phone number and mailbox address. Receive a personal code to log in via SMS notification. Thus, you will only have a simplified account, which is limited in capabilities and functions.

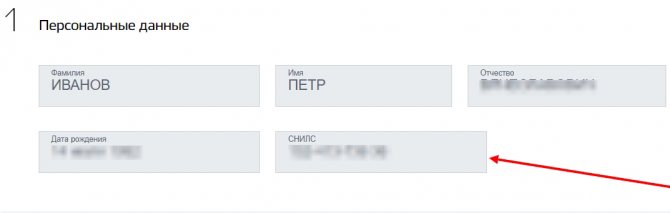

To confirm your profile, you need to specify the details from your passport and SNILS in your personal account settings. The pension fund will check the entered information within ten minutes. The last step is to visit any branch of the MFC.

From now on, you have access to all services on a single portal. Read more about the registration issue here.

You can find out which NPF I am a member of by using my SNILS number:

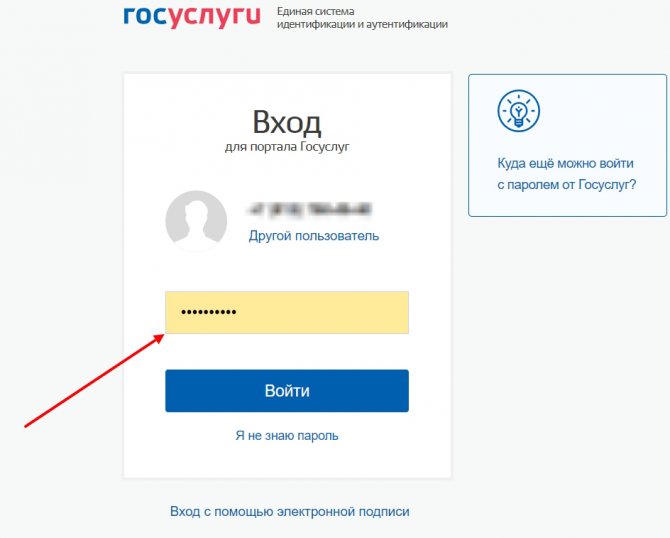

- Log in to your personal account on the portal, enter your security password and login name.

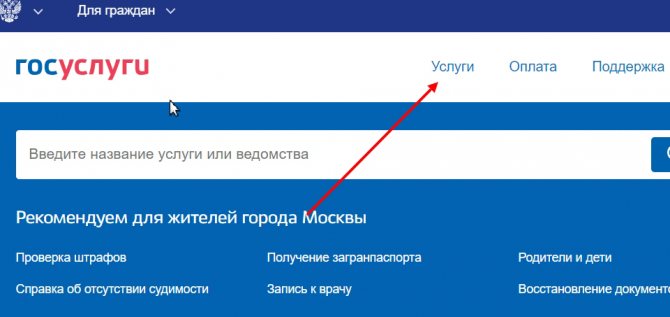

- Select the services tab, which is located on the top panel of the screen.

- In a new window, all available services will appear in front of you, divided into categories. We need a pension, benefits and benefits.

- After this, select the section of the notification about the status of your personal account in the Pension Fund. Don't worry or doubt the name of the function. As a result, you will receive a detailed statement of the amount of accruals for the entire period of registration, as well as the name of the fund in which you are a member.

- You will see a description of the service and a detailed procedure for receiving it. Click on the confirmation button.

- The next step is to fill out the form, enter your personal data and SNILS number, which is located on the front side of the green card. If you previously specified the details, the fields will be filled in automatically.

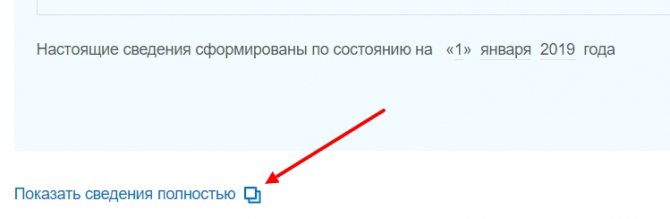

- At the bottom of the screen you will see information about the completed request, its registered number, the date of submission, as well as the dating of the prepared statistical data in the report.

- After this, you can save the result to your computer or mobile device for later viewing, or send it by mail to your email.

- To view statistics online, just click on the corresponding button on the bottom panel of the screen.

- A statistics file with detailed information will open in a new window. It will indicate the applicant’s personal data, exact work experience and the amount of deductions for the entire period of work from the official salary.

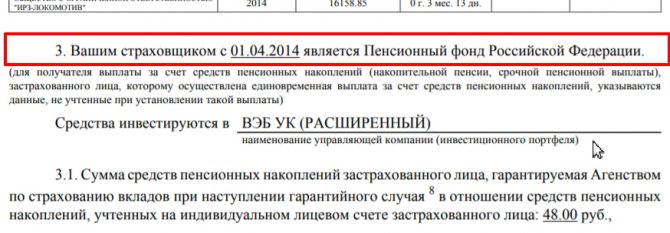

- Below you will see the name of the insurance company with which you are registered. Done. Try to remember the information.

Making a request through the government services portal is free and does not require an additional fee. As for the timing of the provision of statistics, you will receive the report instantly after writing your application online.

Online on the Pension Fund of Russia resource

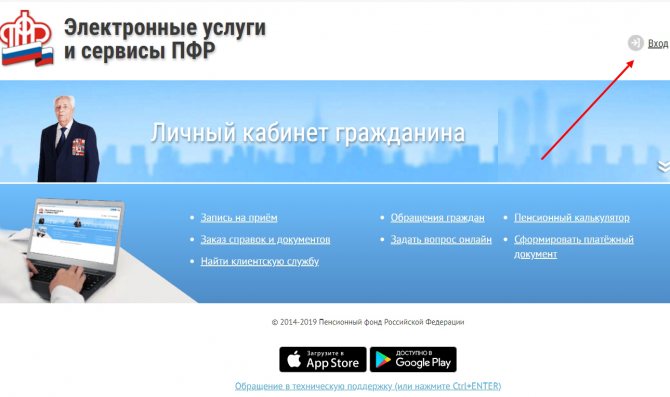

A similar operation is available on the official website of the Russian Pension Fund. All you have to do is submit an application and wait for the completed certificate. Follow the instructions:

- Find the main page of the Pension Fund on the Internet.

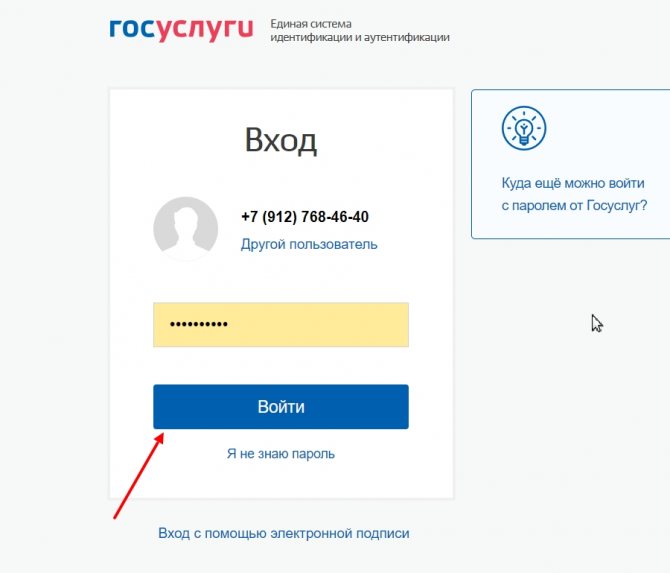

- Next, you will need to log in to the service; here you will again need an account from the government services portal.

- On the top bar of your desktop, find the login tab.

- Confirm initialization using the state src=»https://gosgo.ru/wp-content/uploads/2019/04/blobid1551866241702.jpg» class=»aligncenter» width=»968″ height=»400″[/img]

- Enter your password and login in the authorization window.

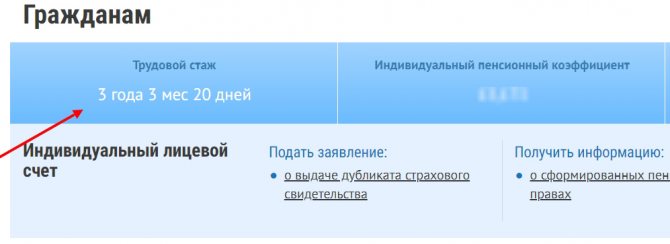

- After this, you will find yourself in your personal account, where detailed statistics about your work experience and the number of contributions to your insurance pension are displayed.

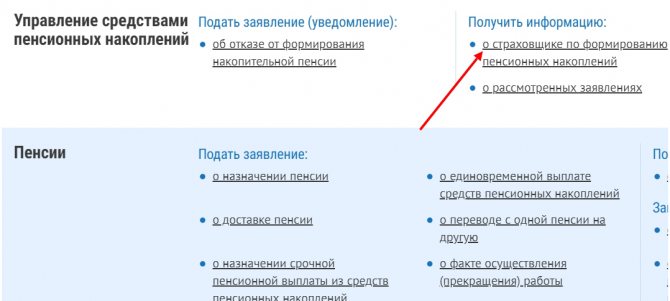

- Below you will see a section for obtaining information about the insurer, click on it.

- In a new window you will see information about your insurance src=»https://gosgo.ru/wp-content/uploads/2019/04/blobid1551866285221.jpg» class=»aligncenter» width=»1086″ height=»476″[/ img]

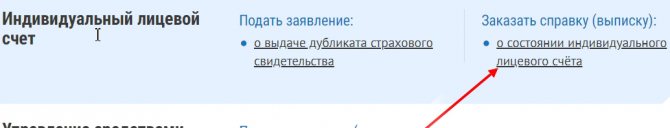

- More detailed statistics can be found in the tab on the status of your personal account.

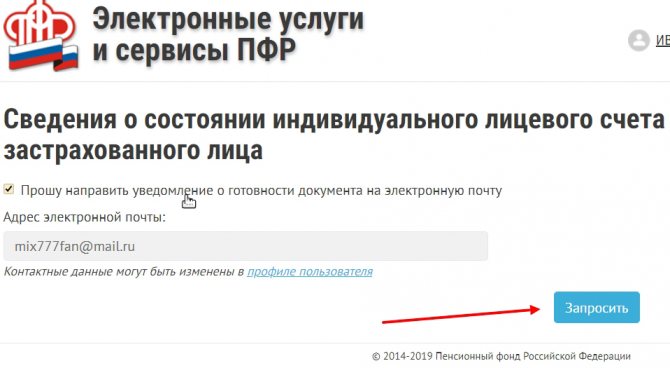

- After that, provide an email address where to send the completed report on my pension savings.

- Confirm your request.

- Later you will be able to view all written applications and requests in the requests section on the desktop of your personal account.

As soon as the statistics are prepared, a notification will be sent to the specified address.

At the place of work

As mentioned earlier, there is another way - contact your direct employer. Your management should know where deductions from the basic salary are made. To obtain the required information, simply contact the accounting department of your organization and ask for a detailed report.

It should be borne in mind that not all bosses have open access to data on the pension savings of their employees. Currently, many citizens receive black wages in an envelope; it is worth remembering that in this case no deductions will be made to your personal account. Demand official income from your management or look for another job.

Requesting pension data from the bank

Another method is implemented thanks to specialized financial organizations that cooperate with the Russian pension fund. These include state banks, among them VTB 24, Sberbank, Bank of Moscow, Gazprombank and UralSib. The listed institutions actively cooperate with the Pension Fund of the Russian Federation and must provide information to citizens upon request.

Please note that you do not have to be a client of the bank and use its services. All you need to do is visit any branch and write an application to provide information. They will require money from you for completing the procedure and may offer to transfer your savings portion to their fund.

Personal visit to the Pension Fund of the Russian Federation

If it is not possible to use electronic services and submit a request online, then you can follow the old and proven method. Find out where your nearest pension fund center is located and visit it in person. Contact a free consultant and ask for assistance. In this case, you must provide a package of documents consisting of a passport and SNILS, as well as write an application. After receiving the request, the department will consider it within ten days. You will be notified as soon as the statistics are prepared.

Via bank

To provide information about the types and amounts of pensions, you must go to the bank and sign a written permission to exchange information between the bank and the Pension Fund. If you already have such a document, you can view your pension savings and the name of the Fund in your personal bank account. A credit institution will not be able to provide information about pensions if it does not have an agreement with the Pension Fund. The list of banks with which the Pension Fund cooperates can be viewed on their website or follow the link https://www.pfrf.ru/branches/spb/news~2015/12/04/102779.

Selecting a method for providing information

If for some reason you do not know which NPF you are a member of, you can find out without any problems. Each of the above methods has its pros and cons. For example, not all Russians feel confident as Internet users.

This primarily concerns older citizens. It may be difficult for them to register on the relevant portal and obtain the required information.

As for obtaining data through an employer, this is a suitable option for people engaged in working activities.

If a person has already reached the retirement threshold and retired, he will have to go to his last place of work to visit the accounting department. It also happens that a pensioner does not live too close to his organization.

Most often, the most convenient option is a request to the Pension Fund. By the way, such applications are not subject to duty, information is provided free of charge.

Important! It is impossible to find out your NPF online using SNILS alone. The number can only be used in requests in conjunction with a passport.

It often happens that citizens have no idea where the employer is transferring their future pension. To see how things are going with pension savings and where they are, future pensioners will be interested in how to find out which pension fund they are in through State Services.

Many people were transferred to non-state pension funds and their transfers, designed to ensure a comfortable old age, are located unknown where.