Concern for the safety and increase of pension savings has become a headache for the majority of Russians of working age. There is nothing surprising here: the state smoothly shifts the responsibility for a dignified old age onto the shoulders of citizens. To cope with this burden, you need to take care in advance of a “safety cushion”, from which you can live after the end of active work. And one of the options for this cushion is investing in non-state pension funds, for example, Sotsium, which is now actively attracting new clients.

Information about the fund

Current information about JSC NPF Sotsium can be found on leading information sites, for example here, or on the portal of the Bank of Russia. The main thing a potential investor needs to know is whether the organization is currently operating. If the company you are interested in is in the process of reorganization or liquidation, these resources will post the relevant data.

The following is currently known about the Socium Foundation:

- INN – 7714324003;

- OGRN – 1147799013559;

- authorized capital – 150 million rubles;

- NPF license 320/2 dated April 26, 2004;

- sole shareholder - PJSC Ingosstrakh;

- The head of the company is Shishkina Ekaterina Sergeevna.

Information regarding the organizational structure, available pension programs, the procedure for joining and leaving the fund is presented on the official website. The resource interface is user-friendly: it is intuitive and convenient even for inexperienced users.

In the upper right corner of the main page of the site there is a contact telephone number (8(800)775-72-35), where you can ask the duty operator all your questions. To view the list of branches and representative offices, follow the link.

Customer support through the account of NPF Sotsium

Users of their personal account have three options for contacting the support service:

- Online consultation . At the bottom of the company page there is an “Online Consultation” button. By clicking on it, you will need to enter personal data, indicate the subject of the appeal, and so on. After sending a request, a support specialist will independently contact the user and provide all the information of interest.

- Hotline by phone 8-(800)-77-572-35.

Reliability rating

The history of the Sotsium pension fund began in 1994, when it was still called NPF GAZ. In 2002, to increase the potential of the NPF and consolidate resources, three more non-state funds were added to it. In 2014, in accordance with changed legal requirements, the organization was corporatized.

In 2020, the RAEX Rating company (“Expert RA”) assigned the updated NPF a ruAA- (stable) rating, which is still in effect. Clients of the fund can hope that it will work stably in the coming years and provide good growth in the pension savings of investors.

The reliability of the fund can be judged by other indicators:

- current assets of NPF – 23.8 billion rubles;

- liabilities as of June 30, 2019 – 74 million rubles;

- number of clients – 380 thousand people.

NPF ranks 10th in terms of the volume of pension savings and the number of insured persons, which indicates its stable position in the market.

Statistics of NPF Sotsium: rating of reliability and profitability

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 24321616.13

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 2064102.05

- Total number of participants (people): 130601

- Participants receiving a pension (persons): 30938

- Total amount of pensions paid under NPO (thousand rubles): 130717.38

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 21772360.73

- Number of insured persons (people): 307693

- Participants receiving a pension under compulsory pension insurance (persons): 5510

- Amount of pension payments under compulsory pension insurance (thousand rubles): 79463.59

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 8.31%

- Return on investment of pension savings (OPS): 9.26%

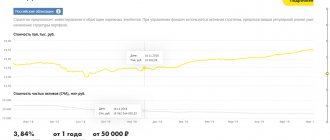

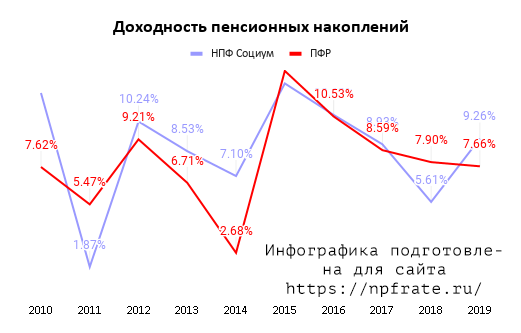

Profitability chart

Data on the profitability of NPF Sotsium in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund of Russia (VEB):

Yield comparison table

| Year | NPF Society | Pension Fund |

| 2010 | 11.88% | 7.62% |

| 2011 | 1.87% | 5.47% |

| 2012 | 10.24% | 9.21% |

| 2013 | 8.53% | 6.71% |

| 2014 | 7.1% | 2.68% |

| 2015 | 12.43% | 13.15% |

| 2016 | 10.62% | 10.53% |

| 2017 | 8.93% | 8.59% |

| 2018 | 5.61% | 7.90% |

| 2019 | 9.26% | 7.66% |

Fund return

Any investor in a non-state pension fund is interested in increasing his savings: otherwise, why transfer money to it? However, today not all non-state pension funds provide clients with the desired level of profitability.

The non-state pension fund “Socium” is among the “average” in this indicator. Over three years, he increased clients' savings by 13%. This year the situation has improved a little, but 29th place in the ranking based on the results of 9 months of 2020 cannot be called successful. Over the past period, the yield was only 7.81%, which practically coincides with the result of the state NPF Vnesheconombank.

Rating for Russia

Many people have doubts. And for a reason. After all, NPF Sotsium is a pension fund that is far from leading positions in the ranking of the best companies in Russia providing pension insurance services.

This organization is in the TOP-40 NPFs in the country. The approximate position of “Socium” is 36-38th place. Too far from leadership. Therefore, many potential investors begin to doubt further cooperation. As a rule, the further a corporation is from the leading places in the rating of Russian non-state pension funds, the lower the trust in it. And the higher the likelihood of a sudden license revocation.

How to join

To become a fund contributor, you must enter into a pension service agreement with the fund. To do this you will need:

- Contact the NPF in person or remotely: submit an online application through the website or request a call back.

- Choose a suitable pension scheme with the help of a consultant or on your own.

- Collect the necessary documents, the forms of which are available for download at this link.

- Sign a pension service agreement with the NPF.

If you plan to transfer the funded part of your pension to NPF Sotsium, you must contact the Pension Fund of the Russian Federation with an application for the transfer of funds. Fund managers will organize a visit to the territorial office of the Pension Fund of the Russian Federation at a time convenient for you.

Personal account of NPF Social Development - registration and login

The service is available to fund clients via the link https://npfsr.ru/login/. Unregistered users can complete the registration procedure on the appropriate page. To do this you will need personal data:

- FULL NAME;

- E-mail address;

- SNILS;

- password.

You can confirm your registration in the system by following the link in the letter that will be sent to your email.

Thanks to the service, clients of NPF Social Development JSC always have the opportunity to monitor their own savings and see information about the growth of funds due to the fund’s investment policy. Here you can change the password for logging into the system and adjust your personal data.

How to receive payments

Since July 2012, NPF Sotsium began accepting applications for lump-sum payment of pensions to citizens who have reached retirement age or received similar pension grounds. The following types of payments are made from savings:

- one-time;

- fixed-term pension;

- monthly (cumulative part);

- payment to heirs (successors).

NPF Socium considers applications for a one-time payment only if there are supporting documents:

- general passport;

- SNILS;

- a certificate from the Pension Fund confirming receipt of one of the types of pensions (if there are grounds provided for by law).

The application must indicate a contact telephone number for communication and prompt resolution of any issues that may arise. Documents can be submitted to the fund in person or sent by registered mail. In this case, they must be certified by a notary or consul (if the Russian is outside the country).

The procedure for submitting documents to NPF Sotsium

How to get your savings from NPF Sotsium is a question that many new clients of the company have to face. The operation is simple; you need to have an application and documents that can be sent by mail to the company’s address or visit the center in person (it is also recommended to use the personal account service).

The package of required documents looks like this:

- passport;

- application in the form of the institution (a sample can be found in the department or requested electronically);

- insurance type certificate of compulsory pension accrual;

- certificate from the Pension Fund of the Russian Federation at the place of residence of the pensioner.

The personal account of NPF Socium helps you answer additional questions. You can also call the number provided and get detailed information. Thus, answering the question of how to get your savings, we can say that the operation is simple, just select one of the options for submitting documents and write an application.

When sending by mail, you should use the nearest address of the NPF Socium branch. Otherwise, you will have to wait longer for a response. It is recommended to contact the institution’s staff in advance and clarify the amount of time that will be spent on implementing the procedure. Employees can also help calculate profitability based on the information provided by the client. You can also get information in your personal account.

How to terminate a contract

The interaction between non-state pension funds and investors is not always successful. Sometimes clients who have not seen an increase in their pension savings become disillusioned with the fund and decide to transfer the funds to another non-state company. In this case, it is useful to remember that changing NPFs more often than once every five years entails a loss of investment income.

If the decision to terminate the contract has become irrevocable, you should proceed as follows:

- notify the Socium Foundation of your decision with a corresponding statement;

- inform the Pension Fund about the change of policyholder;

- provide NPF “Socium” with details for transferring pension savings to another policyholder.

Any questions that arise can be resolved by calling the hotline or stating your problem using the feedback form on the official website.

Contact Information

The head office of the joint-stock company is located in Lipetsk, st. Frunze, 6A. Contact number. Reception hours for citizens: from Monday to Thursday from 9.00 to 18.00 (break from one to two o'clock), on Friday - from 9.00 to 13.00.

A hotline 8-800-200-01-48 has been opened for clients and interested citizens (Lipetsk residents can use the following number 23-38-33). Calling the specified number is free.

Customer Reviews

There is practically no mention on the Internet that the fund took any illegal actions to increase the number of investors or deceived its clients. Citizens write very reservedly about the work of NPF Sotsium. Customer reviews mainly concern the peculiarities of interaction with the company’s specialists, the speed of processing applications to join and leave the fund, and the low return on investment.

Based on the restrained comments of the authors, it becomes clear that the NPF operates within the legal framework and respects the interests of clients. Overall, it is suitable for cautious investors who expect long-term investment returns to grow.