Should you trust the funds of NPF Lukoil-Garant?

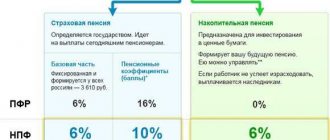

The funded part of a pension is money that a citizen has transferred throughout his entire working life to a state or non-state pension fund in order to form a future salary on which he can live after leaving work for a well-deserved rest. By transferring funds, a citizen takes care of his future, since after reaching a certain age threshold, he will not need to live only on the insurance part of this material support, which is formed by making insurance contributions from his employing organization.

Illegal transfer to NPF

Illegal transfer to a non-state pension fund without the consent of the owner is a serious violation of the law. There are several actions to help keep your savings safe and sound:

- You cannot show your documents to strangers.

- Under no circumstances should you enter into agreements with suspicious agents of unfamiliar funds.

- You can contact the Pension Fund with a request to leave your savings unchanged for the next year. If there is such a statement, the savings will not be transferred under any circumstances.

How to receive the funded part of your pension

Payments of the funded part of the pension are made on the basis of the client’s personal application and supporting documents attached to it. A list of them is available on the “Customer Support” tab of the website.

The necessary papers are submitted in person to the NPF office or sent by registered mail with acknowledgment of receipt. In the latter case, they must be notarized. Along with the application, consent to the processing of personal data is sent in the form of the fund and an individual client questionnaire (it does not require certification).

How scammers deceive

There are cases when agents go around apartments and conclude contracts fraudulently. By introducing themselves as an employee of a pension fund, they gain the trust of a person who thinks that they are representatives of a state fund. After all, in fact, you can’t undermine here: the NPF is also a pension fund, but a non-state one.

Must remember! Fraudsters only need your personal data to conclude a new contract. By gaining access to them and forging signatures, unscrupulous agents give the contracts to the pension fund. The investor will learn about this only after 2 - 3 months.

Answers from a fund representative with our explanations

In response to your requests dated June 14, 2018, NPF FUTURE JSC (hereinafter referred to as the Fund) informs that the result of investing pension savings under compulsory pension insurance agreements is determined by the Fund annually at the end of the financial year and is reflected in clients’ pension accounts no later than the end of the 1st quarter of the year following the reporting one, the end date of the previous financial year.

Our translation

This means that the funds reflected in the client’s account as of 01/01/2018 in the amount of 128,920 rubles do not take into account investment income/loss received in 2020. Income/loss received for 2017 (for any previous year) is reflected during the 1st quarter of 2018 (that is, in the 2nd quarter of the following year). The date the client applied for an extract is June 14, 2020. The funds reflected in the client’s account as of June 14, 2020 include an investment loss for 2020, that is, a negative result from the placement of pension savings (the fund did not earn anything for the client and even went into a loss), so they are less than the amount reflected as of January 1, 2018, and amount to 125,000 rubles.

Petr Petrovich, at the moment there is an agreement between you and the Foundation No. ХХХ-ХХХ-ХХХ ХХ dated 09/30/2016. In accordance with Art. 36.4 of the Federal Law of 05/07/1998 No. 75-FZ “On Non-State Pension Funds”, the contract on compulsory pension insurance comes into force from the day the pension savings transferred by the previous insurer are credited to the account of the new insurer. According to the agreement concluded between you and the Fund in 2016, pension savings funds were received by the Fund on March 27, 2017, at which time the agreement entered into legal force.

Our translation

According to the law, the agreement comes into force not from the moment of its conclusion, but from the moment pension savings are received into the fund.

We would like to inform you that in 2020, several non-state pension funds were merged with NPF FUTURE - NPF StalFond, NPF Uralsib and NPF Our Future. In connection with this reorganization of the Fund, the profitability accrued to the account of a particular client depends on the profitability of the fund in which he was serviced before joining the NPF FUTURE, and varies up to 11.56%. We also inform you that the result of investing pension savings in 2017 is -3.98%. The market situation, which provoked negative investment results, is force majeure; we expect that it will level out in the near future. In accordance with current legislation, investment results can be both positive and negative, however, the legislation provides for a guaranteed replenishment of pension contributions, which prevents them from decreasing below the amount established by law. The decrease in profitability is primarily due to the reorganization of FC Otkritie Bank, in whose securities pension savings were invested. In addition, the price of VTB Bank shares decreased significantly, which also affected the profitability of those funds that invested in its shares.

Our translation

The result of investing pension savings can be viewed on the Central Bank website in the section.

The investment result of NPF "Future" for 2020 is 4.08% (return on placement of pension savings funds)

For 2020: -2.01% (Profitability of investing pension savings minus remuneration to management companies, a specialized depository and a fund)

Indicators for 2020 and 2020 are calculated according to different principles, but, in general, the picture is clear.

Most likely, this means a joint investment result for all merged funds.

It should be noted that based on the results of the 1st quarter of 2020, the investment result was positive. At the time of writing our article, there were no similar data for the 1st half of 2020 on the Central Bank website, the reason is unknown. And according to the resource, the fund received a loss of 6.01%.

We would like to inform you that in 2020, several non-state pension funds were merged with NPF FUTURE - NPF StalFond, NPF Uralsib and NPF Our Future. In connection with this reorganization of the Fund, the profitability accrued to the account of a particular client depends on the profitability of the fund in which he was serviced before joining the NPF FUTURE, and varies up to 11.56%. We also inform you that the result of investing pension savings in 2017 is -3.98%. The market situation, which provoked negative investment results, is force majeure; we expect that it will level out in the near future. In accordance with current legislation, investment results can be both positive and negative, however, the legislation provides for a guaranteed replenishment of pension contributions, which prevents them from decreasing below the amount established by law. The decrease in profitability is primarily due to the reorganization of FC Otkritie Bank, in whose securities pension savings were invested. In addition, the price of VTB Bank shares decreased significantly, which also affected the profitability of those funds that invested in its shares.

Our translation

The result of investing pension savings can be viewed on the Central Bank website in the section.

The investment result of NPF "Future" for 2020 is 4.08% (return on placement of pension savings funds)

For 2020: -2.01% (Profitability of investing pension savings minus remuneration to management companies, a specialized depository and a fund)

Indicators for 2020 and 2020 are calculated according to different principles, but, in general, the picture is clear.

Most likely, this means a joint investment result for all merged funds.

It should be noted that based on the results of the 1st quarter of 2020, the investment result was positive. At the time of writing our article, there were no similar data for the 1st half of 2020 on the Central Bank website, the reason is unknown. And according to the resource, the fund received a loss of 6.01%.

In response to your request, the Joint Stock Company Non-State Pension Fund FUTURE (hereinafter referred to as the Fund) informs that at the end of 2020 the Fund received a negative financial result from investing pension savings. We inform you that in accordance with Art. 36.2. Federal Law No. 75-FZ dated 05/07/1998 “On Non-State Pension Funds”, the Fund’s responsibility is to annually determine the result of investing pension savings under contracts on compulsory pension insurance at the end of the financial year and reflect it on the pension accounts of the insured persons no later than the end of the 1st year. th quarter of the year following the reporting one, the end date of the previous financial year. In accordance with the above federal law (Article 3), the results of investing pension savings can be both positive and negative, however, in case the fund receives a negative financial result from the investment, Federal Law No. 422-FZ dated December 28, 2013 “On Guaranteeing the Rights of Insured Persons” in the compulsory pension insurance system of the Russian Federation, when forming and investing pension savings, establishing and making payments from pension savings” (Article 5), a guarantee replenishment by the Fund is provided in accordance with the requirements of the current legislation, preventing their reduction below the amount established by law. At the same time, the obligation to guarantee replenishment does not affect cases of decrease in accumulated investment income if it has not yet been “fixed” (“fixation” is carried out by the fund once every 5 calendar years in accordance with Article 36.2-1 of the Federal Law of 05/07/1998 No. 75-FZ). The Foundation is currently taking measures to correct the negative situation. We are conducting legal proceedings with Promsvyazbank PJSC and Trust Bank, a member of the FC Otkritie group, regarding compensation for losses incurred by the Fund. We hope that the decisions taken by the court will help the Fund compensate for losses in a shorter time. You can be confident in the safety of your pension savings in accordance with current legislation. The loss of contributions to a funded pension received from the employer is excluded - your pension savings are guaranteed at the state level in accordance with Federal Law No. 422-FZ dated December 28, 2013.

Our translation

Negative investment income (that is, in human terms, a loss) at the end of the year is a normal situation in recent years. The final investment result of the activities of the Non-State Pension Fund (NPF) is calculated based on the results of five years. If you receive a loss at the end of the five-year period, the law comes into force, on the basis of which you receive a guaranteed compensation for the investment loss; in simple words, what you had at the beginning of the five-year period will remain at the end of it. Therefore, you have earned nothing in five years.

Please note that it is beneficial to change the Fund after being in it for five years. If you do this earlier, then the investment income earned during this time will remain in the fund, and you will transfer only with your initial savings or losses (that is, with the amounts that were in your account on the first day of the five-year period).

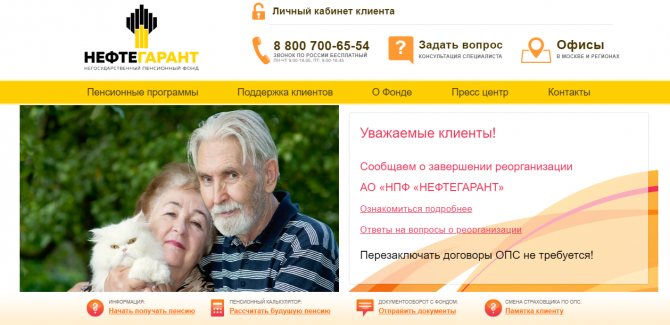

Official website of NPF "NEFTEGARANT"

If you are still tormented by doubts regarding the pension fund and whether to invest and whether to trust them with your money or not, you can read all the detailed information provided on the official website and learn a lot of interesting things about them. It should be noted that the most important criteria in the choice are two main characteristics - profitability and reliability rating.

Having learned the statistics of these two criteria, you can judge by it and determine what the percentage of risk and the percentage of future earnings are. We want to provide data on the specified pension fund so that you can familiarize yourself with it and draw conclusions regarding the Neftegarant fund.

Profitability

Profitability – the most important and responsible role in making a decision regarding a particular fund is played by this point. It provides information not only in percentage terms, but also provides information regarding what are your chances of profit if you invest in this fund. For example, 6.43%, which safely guarantees that your income, payments, and the funded part will be worthy.

Reliability rating

Reliability rating – A++. Another important point that is also not recommended to be ignored when making a decision. The reliability rating also provides a guarantee that the fund is economically stable and reliable, and that you can invest in it without fear for your investment.

Good to know. When making a final decision, you should make sure that the information provided to you is correct in order to avoid problems and misunderstandings with the company in the future.