Pension structure in the Russian Federation

A pension in Russia consists of two parts: insurance and funded. The insurance pension is part of the pension provided by the state through the Pension Fund. In order for the Pension Fund to pay it, employing enterprises contribute a certain percentage of the employee’s salary to the fund. This pension is indexed by the state for inflation. And if there is not enough money to pay it, the Pension Fund deficit is covered from the budget.

Previously, the insurance pension was assigned upon reaching retirement age - previously it was 60 years for men and 55 years for women. But in 2020, the Russian President signed a law gradually increasing the retirement age for men to 65 years, and for women to 60 years (Table 1).

Table 1 – Schedule for raising the retirement age in Russia

Retirement date

It should be noted that the original bill providing for a change in the working period of citizens contained a more stringent version of the reform - an increase of 1 year every year (without the right of early registration 6 months earlier in 2020 and 2020), as well as an increase in the retirement period for women for 8 years (i.e. from 55 to 63 years). But during the consideration of the project in the State Duma, an amendment was adopted that softened the proposed parameters (it was proposed by President V.V. Putin).

Read also: Development of pension provision in Russia

Today, not only the ordinary population of the country is opposed to raising the retirement age, but also parliamentarians who filed a lawsuit to consider the feasibility of the adopted law. According to the Constitution, changes that are made to legislation in violation of human interests and rights are considered illegal. The reform brought the following changes:

- increasing the pension amount by an average of 1000 rubles every year until the established limit is reached;

— in 2020, the retirement age will increase by six months;

— establishing benefits for citizens of pre-retirement age who will be able to work in production “until the very last”;

— some benefits have been preserved for citizens whose work is recognized as harmful and those who serve in law enforcement agencies.

Why is the retirement age raised?

The purpose of raising the retirement age is to reduce the deficit of funds in the Pension Fund for pension payments, as well as to increase the level of state pensions.

To receive an insurance pension, you also need to have at least 15 years of work experience according to the new rules. A future pensioner can have an extremely small impact on the size of the insurance pension - this is passive income in old age: you can receive stable income in retirement, but not much. The peculiarity of the insurance pension is that it is formed in points, and every year the state decides how much the point will cost. The cost may vary depending on the number of working citizens and pensioners in the country. Since the formula for calculating points is difficult to understand even for seasoned economists, the Pension Fund of the Russian Federation has created an online calculator to calculate pensions.

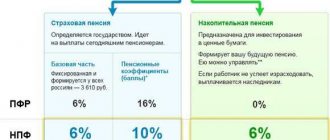

A funded pension was invented to enable future retirees to increase their pension savings. The fact is that the contributions that the employer makes to the insurance part of the pension (16% of the employee’s salary) go to the needs of current pensioners. And contributions to the funded part (6% of salary) should, in theory, be accumulated in a citizen’s pension account and used only when he reaches retirement age.

Depending on the choice of each person, these contributions go either to non-state pension funds or to the state Vnesheconombank, which manage pension investments of citizens, investing them in shares, deposits, government and corporate bonds, etc. Since 2014, contributions to the funded part have been frozen. Therefore, for now, all contributions go to the insurance part of the pension, that is, they are spent on paying pensions to today’s pensioners. Accumulative pension accounts are replenished only from investment income from previously transferred pension savings. In addition, if you wish, you can register an individual pension plan with a non-state pension fund and independently transfer part of your income to form a non-state pension.

Pension under voluntary (non-state) pension provision. Along with the state system of compulsory pension insurance in Russia, there is non-state voluntary pension insurance, within which Russians have the opportunity to form another pension. To receive such a pension, the future pensioner must enter into an agreement with a non-state pension fund (NPF) and make personal contributions for a certain time.

The Ministry of Finance and the Central Bank propose to eliminate the mandatory funded part of the pension

Kommersant has learned the details of the joint proposals of the Ministry of Finance and the Bank of Russia to “modernize the pension system” of the Russian Federation - the so-called Concept of Individual Pension Capital. Its main provisions: liquidation of the current savings system, preservation of the mandatory payment rate to the Pension Fund at 22%, benefits and guarantees for additional savings payments to NPFs in the amount of 0% to 6% with a voluntary choice of rate. How the pension system in Russia has changed - in the material of Kommersant.

History of the Russian pension system

November 20, 1990

The law “On State Pensions in the RSFSR” was adopted. On December 22 of the same year, the Pension Fund of Russia (PFR) was created. The mechanism for financing and paying pensions assumed the receipt of compulsory insurance contributions from employers and citizens. It was possible to calculate a pension from earnings for any five years of continuous service; “non-insurance periods” were also included in the length of service.

Pension rubles will become money

September 16, 1992

A presidential decree “On non-state pension funds” was signed, which allowed enterprises, groups of citizens and public associations to establish non-state pension funds.

In May 1995

The government adopted the Concept of reform of the pension system. Pensions began to consist of three parts: basic (living wage), labor (work experience and earnings) and non-state (savings in non-state funds).

In December 1995

The State Duma adopted the law “On individual accounting in the state pension insurance system”, developed by the Pension Fund. The size of pensions began to depend on the amount of contributions made by citizens during their working experience.

In May 1998

The government approved the pension reform program developed by the Ministry of Labor and Social Development. The program proposed the introduction of a mixed payment model: based on state pensions and insurance, as well as non-state insurance. Implementation was planned for 2000.

In March 2001

The National Council for Pension Reform under the President adopted a new pension reform program developed by the Ministry of Economy. The program supplemented the provisions of 1998 and retained the three components of the labor pension: basic, insurance and funded parts. The basic part is assigned by the government, the insurance part is formed up to 14% of tax payments paid by the employer within the framework of the unified social tax (UST) from the amounts of employees' wages, the funded part - 2-6% of the salary paid in the form of the unified social tax (UST).

At the same time, funds received for the formation of the insurance part of the pension are taken into account only in the form of “the rights of insured citizens” to receive a pension. Rights are accumulated and indexed by the state annually, based on inflation rates. The very funds that form these rights go to fulfill the current obligations of the Russian Pension Fund to pay pensions. The funded part of the pension is real money that is subject to investment on the stock market in the list of assets permitted by law.

The provisions of the program were enshrined in November-December 2001 by the laws “On Compulsory Pension Insurance” and “On Labor Pensions”. In 2002, the Pension Fund began implementing the reform.

Not life, but pension

In June 2003, an electronic system for informing about pension accounts was presented, and the State Duma adopted the law “On investing funds to finance the funded part of a labor pension.” On July 1, the Pension Fund began sending out notifications about savings. Future pensioners have the right to choose a management company to manage this part of the pension. Since January 1, 2004, non-state pension funds also received the right to manage accumulative pension funds.

Since October 1, 2008

A program for state co-financing of the funded part of a pension was launched, which provided citizens with the opportunity to increase their future pension by dividing contributions between the state and the citizen.

From January 1, 2010

valorization of pensions began - recalculation of the size of pensions for those who started working before 2002. In general, the pension increased by 10% plus 1% for each year of work experience until 1991.

In 2013

Funded pension funds were frozen in the Pension Fund budget until non-state pension funds (NPFs) and management companies (including VEB) were audited. The volume of frozen funded pension funds of Russians in 2013 amounted to 323.2 billion rubles—in total, at that time, NPFs had more than 2 trillion rubles at their disposal. Since then, the moratorium has been extended annually.

By the end of 2020, citizens younger than 1967 had to decide whether they want to form a funded portion of their insurance premiums, or whether all funds should go only to the insurance model. 5.2 million citizens asked to transfer them from one non-state pension fund to another, and another 5.2 million people withdrew their money from state control to non-state pension funds and opted for the funded part of their pension.

Modern pension system

On January 1, 2020, new pension legislation came into force. The labor pension is transformed into two types of pensions: insurance and funded. Insurance contributions amount to 22% of the employee’s annual earnings; in 2020, the maximum wage fund from which insurance contributions to the compulsory pension insurance system are paid is 796 thousand rubles. Of this, 6% of the tariff can go to the formation of pension savings, and 16% - to the formation of an insurance pension, and perhaps, at the choice of the citizen, all 22% can go to the formation of an insurance pension.

The calculation of the insurance part is now carried out in pension points, which will depend on the amount of salary, length of service and retirement age. To qualify for an old-age insurance pension, you must have 30 or more pension points, but this norm will come into full force in 2025.

The requirements for the minimum length of service to qualify for an old-age pension have also changed. From the current 5 years it has grown to 15 years. However, as in the case of pension points, a transition period is provided: in 2020, the required minimum length of service was 6 years and will gradually increase over 10 years - 1 year each year.

Who pays for the Pension Fund budget deficit?

The budget of the Russian Pension Fund for 2020 was formed with a deficit of 175 billion rubles: revenues are projected at 7.529 trillion rubles, and expenses will amount to 7.704 trillion rubles. (9.8% of GDP), of which 6,539.1 billion rubles are intended for the payment of pensions and benefits.

The pension fund is preparing to double

In addition to pensions, maternity capital is paid from the Pension Fund of Russia (304 billion rubles), and social programs are also being implemented related to the development of the material and technical base of social service institutions and the provision of targeted assistance to pensioners (1 trillion rubles).

The budget deficit can be covered from two sources: the National Welfare Fund (NWF) and the Reserve Fund, formed in 2008 after the division of the Stabilization Fund. In 2012–2014, it was tacitly determined that the Reserve Fund is a highly liquid, essentially cash reserve of the federal budget, and the National Welfare Fund is an investment fund that is provided on a repayable basis.

How much do pensioners receive?

It is predicted that during 2020 the number of pensioners receiving pensions from the Pension Fund will increase from 42.7 million to 43.2 million people. In accordance with PFR forecasts, the average old-age insurance pension in 2020 will be 13,132 rubles, and the social pension - 8,562 rubles.

The majority of pensioners (39 million people) receive an insurance pension, over 3.5 million people receive a state pension, and about 3.1 million pensioners are recipients of a social pension.

Work never leaves retirees

Simultaneously with the increase in the number of pensioners, the number of those who continue to work is also growing. If in 2005 there were 22.4% of such people, then in 2014 - 34.9%.

The insurance pension is paid upon reaching retirement age (women - 55 years, men - 60 years) if they have the required insurance period and a minimum amount of pension points. Social old-age pension can be received by citizens who have reached a certain age (women - 60 years, men - 65 years), but do not have sufficient work experience and the right to a labor pension, as well as representatives of indigenous peoples of the North.

In addition, a social pension may be paid on the basis of disability or loss of a survivor. State pension benefits are paid to compensate for earnings lost due to termination of federal government service.

How pensions are indexed

All types of pensions paid by the Pension Fund are annually indexed in accordance with the level of inflation. For example, in 2020, the insurance pension was indexed by 11.4%, and the social pension by 10.3%.

No money - nothing to count

In February 2020, insurance pensions were indexed by 4%, and on April 1, social pensions were indexed by the same amount. Meanwhile, the inflation rate in 2020 was 8.9%, and in April, the head of the Ministry of Economy, Alexey Ulyukaev, stated that inflation at the end of 2016 would be 6.5% (in January, the UN predicted inflation at 10.5%). It was assumed that pre-indexation would be carried out in the fall, but in March Dmitry Medvedev said that full indexation of pensions would be restored only in 2020, noting that the increase in payments depends on the situation in the economy. As one of the options, the White House is considering the possibility of a one-time payment of an “additional pension” in the summer of 2020 without changing the scope of pension rights.

Raising the retirement age

The issue of raising the retirement age has been repeatedly discussed both among experts and among government officials. Statements about the need for reforms were especially frequent from representatives of the government's economic bloc.

Alexey Ulyukaev: the retirement age can be increased to 63 years for men and women

Former Finance Minister Alexei Kudrin, who heads the board of the Center for Strategic Research, stated that he considers raising the retirement age inevitable. “I am sure that the retirement age will be raised, the question is some kind of model of how this will be done. We all have no doubts. The question is when - in a year, in three or in five, but it will happen in any case,” he asserted. Minister of Economic Development Alexey Ulyukaev shares a similar point of view: in March 2020, he proposed announcing an increase in the retirement age from the end of 2020, since this decision is “bad, but inevitable.” Mr. Ulyukaev called the optimal option a gradual increase in the retirement age for men and women to 63 years.

However, in December 2020, Russian President Vladimir Putin stated that raising the retirement age, which may occur in the future, will not affect current pensioners in any way. “I resist raising the retirement age in every possible way. The time has not yet come, but not only experts, but also practitioners say that this is necessary. Someday we will have to do this,” the president said. Previously, Mr. Putin said that the increase in the retirement age should be “delayed” and not “sharp.”

Despite the fact that the question of raising the retirement age for all Russians remains open, certain categories of citizens will experience the new rules in the near future. From January 1, 2017, the retirement age of officials will begin to increase. Every year, the retirement age will increase by six months and will eventually reach 65 years for men and 63 years for women. The total number of such pensioners in Russia is about 70 thousand people.

Who manages pension funds abroad?

IN THE USA

pension funds are administered by the Social Security Administration. It was a department of the Department of Health and Human Services until 1995, when it became the independent federal agency (non-profit organization) that it still is. It has 65 thousand employees and 11 branches throughout the country. Pension money constitutes a trust fund (one of several) within the US federal budget.

In Germany

Pension funds are managed by the Federal Pension Fund and regional (land) pension funds. They have the status of government bodies. Pension money is an integral part of the federal budget, although it is accounted for separately. Moreover, the federal budget subsidizes pension costs if there is not enough money collected from earmarked tax (analogous to our unified social tax) to pay pensions. This is how Germany differs from the USA. The amount of subsidies has fluctuated in recent years within 20% of pension payments.

In Great Britain

Pension funds are managed by the Pensions Service within the Department of Work and Pensions. Pension money is part of the federal budget, although it is accounted for separately.

In Canada

pension funds are managed by the Ministry of Human Resource Development. It deals with pension payments. The tax authorities are responsible for collecting pension taxes. At the first level of the pension system (minimum pensions), payments are made from general federal budget revenues. Labor pensions (second level) are paid from a separate trust fund, which is part of the federal budget.

Evgeny Fedunenko, Alexander Zhuravlev, Dmitry Shelkovnikov

Methods for assessing the effectiveness of the pension system

The effectiveness of the pension system is assessed in the following areas:

— indicators of pension provision parameters (retirement age, prevalence of early retirement, system of tariffs for insurance contributions, effective rate of insurance contributions, rules for indexation and formation of pension rights, requirements for the minimum insurance period);

— indicators for assessing the standard of living of pensioners (replacement rate, dynamics of the average pension);

— demographic indicators for assessing the pension system (ratio of dependents and employed, life expectancy, probability of surviving until retirement);

— economic indicators of the impact of the pension system on the economy based on the scenario approach (expenses for pension payments in GDP, pension savings);

— financial balance of the pension system (budget deficit, interbudgetary transfers, budget sustainability indicators).

Main characteristics of the Russian pension system

The pension system of the Russian Federation - its concept, structure, features require serious additional consideration due to the fact that due to a lack of budgetary funds and the general aging of the Russian population, its radical reform is planned. Now, a citizen’s future pension is formed using three types of contributions:

- provision of a basic pension by the state;

- formation of the funded part of the pension by the employer through monthly contributions;

- additional insurance - is formed through additional voluntary contributions by citizens, which allows you to increase its size.

Important!

The pension system of the Russian Federation has a multi-stage nature, which allows it to ensure its long-term stable existence, but is now experiencing a crisis due to low labor productivity and a decrease in tax revenues.

The modern pension system in the Russian Federation is divided into two types of pension provision:

- Compulsory pension insurance - it is provided for old age or disability, in the event of the loss of a breadwinner, and the main source of payments are mandatory contributions, which are regularly paid from wages;

- Voluntary pension insurance, when an employee independently enters into an agreement with the fund and regularly deposits a set amount into the account of this organization, which in the future allows him to increase the size of his pension.

The pension system in the Russian Federation includes a central office, as well as regional and city branches that deal with issues of processing payments locally, as well as processing social benefits for disability and other social benefits.