- home

- Reference

- Funded pension

The funded part of the pension has not been formed since 2014 due to its so-called “freezing” and, judging by the new pension reform announced by the Ministry of Finance, it will never be formed according to the old principles.

However, some citizens have already accumulated decent sums, control over which will subsequently help them receive an increase in their pension benefits . In this regard, we will consider the general principles of the formation of funded pensions and possible ways to control their placement.

What is a funded pension?

The funded pension is regulated by a separate federal law, which, among other things, establishes its definition.

So, it looks like this:

- cash payment;

- provided to citizens once a calendar month;

- aiming to compensate them for financial losses due to termination of employment due to the age established by law;

- consisting of the pension savings of a working citizen;

- formed on a separate personal account of the insured person.

Reference! The size of the funded pension, by law, depends solely on the amount of funds that were transferred by the citizen himself or his employer within the framework of the funded part.

Accordingly, the money that has already been accumulated by a citizen and is managed by a state or non-state pension fund constitutes his pension savings. A citizen’s control over their placement and investment allows him to increase the total amount, and therefore increase the increase in his pension at the expense of his own savings in the future.

Until 2014, the composition of insurance payments to the Pension Fund of the Russian Federation (22%) in different years included a certain part (recently 6% for those who chose this method of formation), which was not directed to the insurance (in fact, payments to current pensioners), and to the storage part. These funds constituted the future funded pension.

Nowadays, savings are not replenished , but those already made still belong to citizens, are managed by one or another organization and, if successfully invested, generate investment income.

Who is a member of the State Pension Fund?

Citizens who have not signed agreements on transferring pensions to a non-state institution can rest assured that their savings are in the Pension Fund. You can always go to the personal account of the pension fund and find out the status of your pension.

When the pension reform began, there were cases when representatives of the Pension Fund of Russia visited apartments and asked to conclude agreements with them. As it turns out later, Foundation employees do not go around and force anyone to sign papers. People who signed the agreements transferred their savings to non-governmental organizations. In their case, there is no need to fear that the funds will be lost or burned. In the event of bankruptcy of a frequent institution dealing with pensions, the entire base and savings are automatically transferred to the Pension Fund.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

If a non-state fund changes its name, transfers will also not be affected. The only question that remains is, what is the new name of the non-state pension fund? There are several ways to find out this information.

Where can I place my funded pension?

Citizens retain the right to manage existing funds; they have the right to independently decide where to place their accumulated money.

In a global sense, insured persons have 2 options:

- Transfer the right to manage funds to the State Pension Fund of the Russian Federation.

- Place savings in the hands of a non-state pension fund.

The choice of a specific fund also completely depends on the decision of the person himself, based on the parameters of interest to him (the level of profitability and reliability, the founder of the fund, the number of participants, etc.). At the same time, management funds can be changed; the legislator only set a limit on the number of such changes. You can contact the Pension Fund of Russia with an application to change the NPF no more than once a year.

Important! When changing NPFs more often than once every 5 years, the insured person risks losing not only the funds accumulated as a result of investment, but also part of the principal amount if the profitability of the fund’s activities was negative. If the management company changes no more than once every 5 years, the state guarantees the safety of the principal amount of savings, as well as all investment income, if any.

Interest rates for pensioners in Sberbank of Russia

Interest rates set by Sberbank may fluctuate. Unlike the conditions for other individuals, the rate for deposits of pensioners does not depend on the amount of the cash deposit. At the same time, very favorable rates are offered for a monetary amount of 1 thousand rubles, or 100 dollars if a pensioner wants to open a deposit in foreign currency.

It should be noted that the highest profit will be on investments opened using the Sberbank-Online system. Through the Internet, in addition to making a deposit, you can also deposit funds, top up your balance, or withdraw certain amounts from your account.

What to do if you don’t know where the funds are located

It is no secret to many that accumulative pension insurance agreements could be “offered” to citizens for signing in a bank, store, insurance company, etc. A citizen might not even know in which management fund his funds are located.

Since 2020, the procedure for selecting a non-state pension fund or transferring from one fund to another has been changed . From now on, the insured person can apply to the Pension Fund only in person (including electronically). Therefore, such semi-legal schemes have since been suppressed by the legislator.

Since a similar scheme could have been applied previously, it is important to carry out regular periodic monitoring of the placement of such funds, including the management organization and the result of its investment activities.

And for this it is necessary to obtain the relevant information using one of the tools offered by the state. It is worth mentioning right away that it is not difficult to obtain such information; it must be provided to the citizen upon his request.

Deposits in Sberbank for pensioners in 2020

This year, pensioners are offered several new bank products to place their funds. First of all, this applies to savings certificates, which bring the highest profits to citizens who have opened a pension deposit with Sberbank.

These securities have maximum government guarantees, and their acquisition can be a very profitable undertaking. And Sberbank’s pension savings accounts “Pension”, “Save” and “Replenish” can also become a big advantage.

Step-by-step instructions: how to find out where the funded part of the pension is located

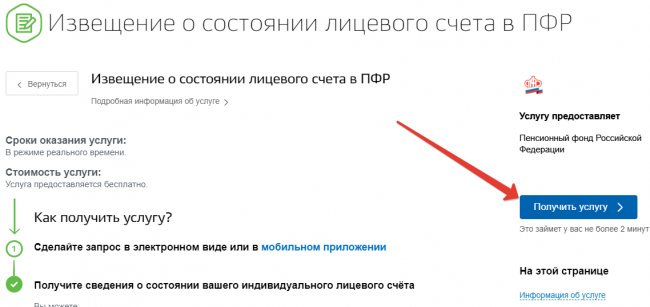

As of 2020, an insured citizen has several ways to obtain information about his pension savings , in particular, the location of the funds. They are available to every person and can be chosen by them on the basis of greatest convenience.

To the Pension Fund

For a long time now, the Russian Pension Fund has not sent citizens notifications about the status of their individual pension account. However, the law provides for the right of every citizen to apply for the provision of this information to the authority.

Attention! The provision of this service is free for citizens, and the number of requests is not limited.

What you need to check your savings funds at the Pension Fund:

- Form an application to provide information about the status of the individual personal account of the insured person. Its form is approved by the Pension Fund and must be used when submitting applications. But theoretically, the Pension Fund does not have the right to refuse to provide information even if the application is drawn up in free form but contains all the necessary information. The application form can be downloaded on the Internet or obtained from the territorial office of the Pension Fund.

- Submit an application to any division of the Pension Fund of Russia that works with clients. The request can be sent by mail or during a personal visit to the authority.

- Receive the requested information. The method of receipt is chosen by the applicant in the request: personal receipt of the response from the body to which the request was submitted, or registered mail.

The citizen receives a complete statement, which also contains the chosen method of placement of the funded part: in the PRF or NPF, as well as the name of the fund when choosing the method of placement in a private organization.

The necessary information is indicated in block 4 of the statement. It indicates who is the citizen’s insurer for pension savings, and from what date. The statement also contains information about the amount of savings and the result of their investment by the fund.

At work

It will not be possible to obtain information in this way for 2 reasons:

- from 2020, there will be no contributions to the funded part of the pension;

- the employer in any case transfers insurance contributions to the Pension Fund account and does not have information about the insurer of its employees.

In the bank

Any branch of Sberbank is ready to provide citizens with the same extract. Once a year, a citizen can receive it through Sberbank free of charge.

To do this you need:

- Prepare your passport and SNILS.

- Visit any Sberbank branch.

- Present the documents to the bank employee.

- Create a request using it.

- Get the necessary information.

Information is provided to the citizen immediately; an additional visit is not required to obtain it.

What are these deductions and where can they be?

The funded part is one of the types of pensions, which is formed from contributions from employers, profits from investment and personal contributions from the account owner.

With the adoption of Federal Law No. 424 “On funded pensions” in 2013, citizens could themselves determine the procedure for forming their future security. Before the adoption of the law, 22% of contributions from a citizen’s employer went to the formation of an insurance pension. Since 2013, these contributions have been divided into two parts:

- 16% went to the formation of the basic pension;

- the remaining 6% went to the formation of the savings part.

Citizens could decide for themselves whether to leave the entire part of the contribution for the formation of an insurance pension, or to divide it into insurance and funded. In addition, they had the right to invest savings in NPFs, PFR partner banks, or leave them in the Pension Fund (what are the pros and cons of transferring the funded part of the pension to NPFs?).

The reform carried out ended in complete confusion for many citizens. Some still don’t know what happens to their savings part and where it is currently stored.

REFERENCE! Since 2014, the law on the funded part has not been in effect, as the government decided to “freeze” the funded pension. This means that all 22% of the employer's contributions again go to the insurance pension account.

What parts a pension consists of, what a funded pension and the insurance part of a pension are, and how they differ from each other are described here.

Is it possible to find out online without leaving home using SNILS

Using just one insurance certificate, you can obtain information about pension savings only in a citizen’s personal account in a non-state pension fund . But for this we need to know it, and this is what we need to find out.

Therefore, the only way left to obtain information without leaving home is to use your personal account on the Pension Fund website or on the government services portal. In both cases, you must have a verified account. Information can be sent to a citizen either in the form of an electronic document or by post.

Thus, you can obtain information about the insurer regarding the funded pension on the government services portal, in the citizen’s personal account on the Pension Fund website, during a personal visit to this body, sending a written request to it, as well as through any branch of Sberbank PJSC.

Deposit for pensioners “Pension Plus”

The terms of the Pension Plus account at Sberbank are simple and clear.

According to this program, a pensioner is issued a “Social” card, to which pension funds are credited. The pensioner can dispose of this money absolutely freely. The main feature of this program is that profit is accrued at an interest rate of 3.5% per year, which is added to the main part of the investment. In addition, annual interest is capitalized at 3.7% annually. The pensioner receives profit from the amount that has been in his account for more than 90 days.

As an alternative to a pension contribution, you can apply for a pension card - “Maestro-social”. It also provides for accrual of 3.5% per annum with the possibility of capitalization. But the majority still prefer to use the usual savings books. But it’s easier for young pensioners to get a card so that they don’t have to go to the bank office to withdraw funds every time.

It is also permissible to open both a card and a pension deposit. They can be interconnected, which is convenient when transferring interest on a deposit quarterly.

In addition, if you need a dosed use of funds from a pension deposit in the case when the size of the pension payment is quite significant, software products are configured in such a way that a fixed amount is transferred from the deposit to the card every month.