- home

- Reference

- Pension for women

Termination of work and retirement in our country is often seen as an opportunity to live for oneself, take care of family and grandchildren. Pension legislation has undergone changes in terms of increasing the age of the right to stop working and receive funds from the state.

In this regard, wide categories of future pensioners are interested in who has the right to receive an early pension, as well as who has retained the right to go on vacation at a previously established date. In this article, we will consider one of such cases, where women have a long insurance period.

A little about early retirement

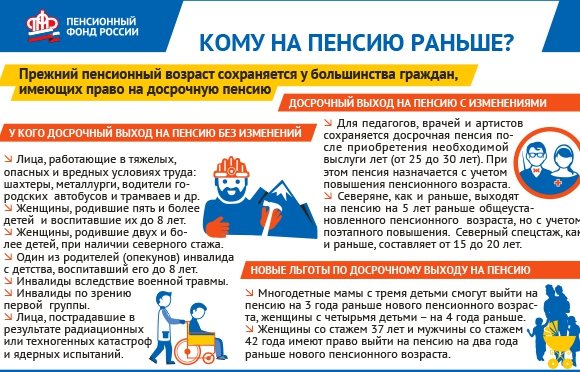

A citizen is entitled to a preferential pension until the general age for retirement established by law. This measure of support for certain categories of Russians was provided for before the start of the pension “reform”, but in its light it was somewhat expanded.

The legislator retained previously established benefits, and the law was supplemented with new opportunities for early receipt of state benefits.

Exit conditions

The benefit in question may be related to factors such as:

- working conditions of a citizen during a certain period of work;

- the employee’s length of service, the duration of his work;

- employment opportunity;

- number of children born and raised.

Important! In addition, in some cases, the number of accumulated pension points is taken into account. The minimum amount required to assign an insurance pension is established.

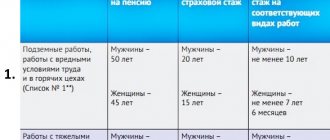

Thus, the law establishes the following categories of beneficiaries:

- Persons employed in jobs with hazardous working conditions (such experience must be at least 10 and 7.5 years for men and women, respectively).

- Workers with difficult working conditions, including those employed in underground work.

- Women who have a long history of working on self-propelled, road, and loading equipment.

- Women workers in the textile industry, if their working conditions showed signs of intensity and severity.

- Some railway and transportation workers.

- Persons with work experience in the forestry sector, geological exploration, navy, and civil aviation.

- Drivers of public route transport.

- Teachers, doctors and artists.

- Firefighters and rescuers.

- Employees of the criminal correctional system.

These categories were provided for in legislation earlier. All of them retained their right to early assignment of pension benefits upon reaching the previously established age and meeting other mandatory conditions.

The list has been supplemented with the following as new categories:

- persons with long work experience;

- mothers of many children;

- persons registered as unemployed and unable to find employment.

The specific procedure for pension bonuses in the New Year

Pensioners with more than 30 years of experience will receive a pension of 500 rubles starting from the new year 2020. For people who have a work experience of more or less than the specified figure, or who work additionally, a special calculation algorithm will be used, according to which bonuses will be made.

For social pensioners, pension recalculation is planned to take place in April. This recalculation will be carried out for 4 million citizens of the country. Social pensioners are beneficiaries and those who have not earned the necessary experience. For them, pensions will increase by 4.1%. In August, they will add a little to the pension of working pensioners - this amount will be about 245 rubles. in general, the level of pensions, compared to 2017, will be higher for everyone, which has already been confirmed at the state level.

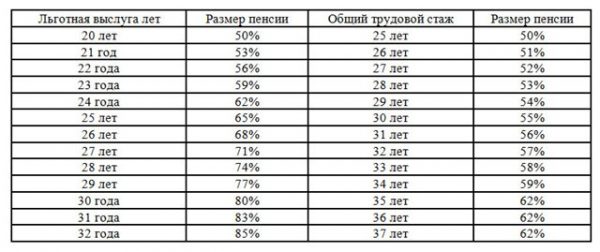

Pension amount depending on length of service

The pension increase is planned due to the fact that the inflation rate increased in 2020. If pensioners with more than 30 years of work experience receive a pension of 500 rubles from the new year 2020, they will hardly feel this, but their standard of living will not become worse. Pension supplements will be calculated automatically after recalculation is carried out at the state level.

A pension supplement in the amount of 500 rubles will be provided to non-working people of retirement age who have officially worked for more than 30 years. If the length of service is less than 30 years, the pension supplement will be lower. The decision to increase pensions has already been made at the state level and from the new year 2020 it will fully come into force, which will be felt by pensioners with relevant work experience. Accept order Send for revision.

What does the new law say about providing benefits?

The measure in question to support women during the implementation of pension innovations was introduced into the previous law on pensions. Changes to it were made by law dated October 3, 2018 No. 350-FZ as part of changes to the entire pension legislation as part of the so-called reform. This legal act provides for the following conditions when a woman can receive security on preferential terms:

- A woman’s work experience is 37 years or more (we are not talking about work activity, but specifically about insurance experience, which includes not only periods of work, but also time spent performing other socially useful activities).

- The onset of age 55 years.

- Availability of an individual pension coefficient of 30 or more (you can view it in your personal account on the official website of the Pension Fund of the Russian Federation or request information directly from this body).

Important! Even if all the mentioned conditions are met, a woman will be able to go on a well-deserved rest no earlier than 2 years before she could qualify for a pension on a general basis.

Early pension with 37 years of service for a woman

In Russia, there is a new condition for women’s early retirement in old age - long work experience.

The decision to introduce this benefit was made during the discussion of the law on raising the retirement age for Russians, as one of the measures to mitigate such an unpopular decision. For early retirement, according to the new law, women must have at least 37 years of insurance experience .

Initially, this standard for women was 3 years longer (40 years). But later it was adjusted to the current values (37) by an amendment to the bill on pension changes proposed by Vladimir Putin.

It is important to note that the rules for calculating 37 years of service, which gives women the right to become pensioners early, differ from the rules for calculating the insurance period. Not all periods of activity will be included in the early period, but only those that are directly related to the citizen’s work.

Having 37 years of official work for women does not give them the right to retire immediately. The date of registration of pension payments will be determined taking into account the following important conditions:

- According to the new law, long-term work allows them to reduce the retirement age by 2 years relative to the standard established for them. Since the retirement age will gradually increase from 2020 to 2023, the age for early payments for women will change annually (see table by year of birth).

- The retirement age for the female population can be reduced to a maximum of 55 years (that is, to the standard under the old legislation). This means that women who were supposed to receive pension payments in the first two years of the reform will not be able to fully take advantage of the new benefit. For them the reduction will be less than 24 months .

What is included in a woman’s length of service for early exit?

The right to the support measure in question for women arises if, in total, the following periods amount to at least 37 years:

- carrying out labor activities under an employment contract with an individual or legal entity, individual entrepreneur (subject to official employment);

- the period of carrying out entrepreneurial activities without forming a legal entity (if there is official registration with the tax authority);

- the time of performance of work or provision of services under civil contracts, if the customer, in accordance with the law, transferred insurance premiums to the Pension Fund of the Russian Federation;

- the time when the woman received benefits due to temporary disability;

- being on parental leave for up to 1.5 years. On this basis, only leave in respect of 4 children is taken into account for length of service. The period of care for 1.5-year-old children exceeding 6 years is not taken into account.

- periods when a woman was registered as unemployed at the employment center and received appropriate benefits;

- performing paid public works;

- the time required to move to a new place of work, if it is carried out in the direction of the employment service;

- work as a judge;

- the time of serving a criminal sentence by a person who was unjustifiably convicted and subsequently rehabilitated, as well as the removal of a woman from office for the period of unjustified criminal prosecution;

- work with operational intelligence agencies on a contractual basis;

- living with a diplomat spouse abroad or a military spouse in an area where the woman reasonably did not have the opportunity to officially work;

- care for a disabled child, group 1 disabled person or an elderly person over 80 years old (if officially registered in accordance with regulatory documents).

What will not apply to work experience?

The most obvious period that will not be counted in the calculation for assigning security on a preferential basis is that the woman did not work and was not registered as unemployed. In addition, the following time periods can be identified that cannot constitute an insurance period:

- being on parental leave for up to 1.5 years for 5 and subsequent children (since the maximum such period is 6 years);

- maternity leave for up to 3 years (although by law the woman retains her job for this period and can even receive appropriate benefits at the employer’s discretion);

- care for a 1.5-year-old child if the child’s father was on official leave (which is not prohibited under current legislation).

Reference! The required length of service does not include periods when a woman performed a labor function, but the employer did not transmit the necessary information to the Pension Fund of the Russian Federation and did not pay insurance premiums for it (this usually happens with unofficial employment).

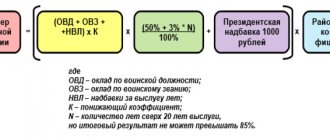

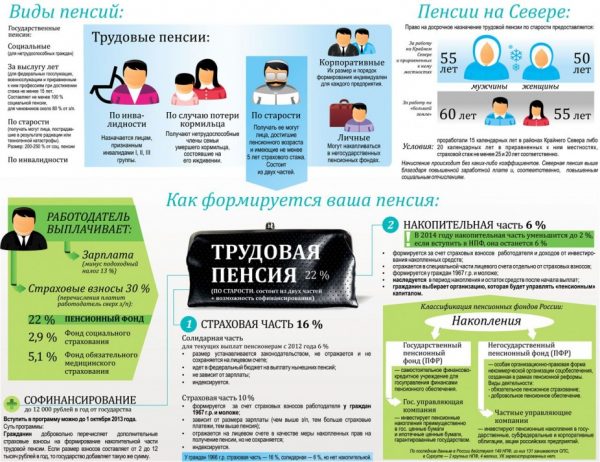

What algorithm will be used to credit allowances?

A person’s work experience is an indicator of what kind of pension he can receive in old age. Since a person who officially works is withdrawn a certain amount into the pension fund every month, a funded pension is formed due to this. The more a person worked, the more contributions were sent to the Pension Fund, and a decent amount of savings is a guarantee of a good pension in old age.

For a woman to retire, she needs to have 30 years of work experience; for a man, this figure is 5 years more. If we talk about people who have already gone on legal vacation and are receiving a pension, then from the New Year they will receive an increase. If we are talking about pensioners whose work experience is 30 years, then the state promises them to add 500 rubles to the standard payment.

This bonus will be accrued to the following categories of pensioners:

- elderly people who no longer work live only on pensions;

- persons with work experience not lower than the above;

- all people with 30 years of service, regardless of the year they retired.

It should also be noted that working pensioners will also be affected by the recalculation of pensions, but indexation in this case will be carried out on a slightly different principle. If we talk about the average increase in the New Year for all pensioners, it will be about 400 rubles. The pensioner will receive more or less, depending on. How much work experience does he have and what complexity of work has he performed throughout his life.

Table of early retirement by year according to the new legislation

Once the general retirement age for women is set at 60 years, it will not be difficult to calculate the time for a possible preferential pension if you have 37 years of experience. From 2020 to 2028 there is a transition period when this age increases gradually. At what age will women retire according to the new law? The table shows the years when a woman can exercise the right to early receipt of state support:

| Woman's year of birth | Possible year of retirement (not earlier) |

| 1964 | 2019 |

| 1965 | 2020 |

| 1966 | 2022 |

| 1967 | 2024 |

| 1968 | 2026 |

Women of subsequent birth years can simply subtract 24 months from the generally established date.

Thus, if there is a long period of work or other socially significant activity, a woman has the right to complete it 2 years earlier than the total period. However, this will require compliance with a number of conditions, such as the size of the pension coefficient and reaching a certain age.

Is military service included in the 42 years of service?

Note that to calculate the insurance period, a limited number of periods are taken into account - only those for which insurance premiums were transferred to the Pension Fund (see above). The question arises, why military service is not included in the 42 years of insurance coverage in 2019?

The main basis for early retirement when the bill was adopted was the presence of extensive work experience. Thus, the Russian government wants to soften the adopted standards for retirement for those citizens who began their career early and have a long career in their work record. Therefore, military service and other military activities equivalent to it cannot be credited to a citizen when establishing 42 years for early retirement, as well as other periods listed above.

However, during 2020, a transitional provision is in force, allowing men who have reached the age of 60 to retire not at 61, but six months earlier. The same rule will apply until the end of 2020, when it will be possible to apply for a pension not at 62 years old, but at 61 years and 6 months.

| Year of reaching age 60 (men) | Year of birth | The right to a pension arises | |

| aged | per year | ||

| 2019 | 1959 (1st half of the year) | 60 years 6 months | 2019 (II half of the year) |

| 1959 (2nd half of the year) | 60 years 6 months | 2020 (I half of the year) | |

| 2020 | 1960 (1st half of the year) | 61 years 6 months | 2021 (2nd half of the year) |

| 1960 (2nd half of the year) | 61 years 6 months | 2022(I half of the year) | |

This norm is enshrined in paragraph 3 of Article 10 of Law 350-FZ. Accordingly, during these periods, citizens will have the right to apply for a pension earlier than the age assumed in the draft law.