The legislative framework

Upon reaching a certain age, a citizen loses the ability to carry out work activities that ensure his living.

When retiring for a well-deserved retirement in old age, each citizen is calculated a pension designed to cover the costs of decent living.

All questions regarding the categories of citizens to whom benefits are intended, the calculation and provision of old-age pensions, as well as other nuances, are fixed in the current legislation:

- Federal Law No. 166 - determines the provisions on the assignment of pension benefits for all segments of the population;

- Federal Law No. 400 is one of the latest amendments, characterized by a description of insurance benefits;

- Federal Law No. 424 - determines the procedure for funded and old-age insurance pensions;

- Federal Law No. 385 is a law designed to make a final adjustment to all issues.

When entering a well-deserved retirement due to old age, a pension is calculated for each citizen

What periods are taken into account?

There are certain conditions for assigning an old-age insurance pension:

- The time when a citizen carried out labor activities on the territory of Russia, for which the employer accrued insurance payments to the Pension Fund of the Russian Federation as prescribed by law.

- Other activities during which pension contributions were calculated (entrepreneurship, civil contracts, private practice, etc.).

- The citizen’s working time outside of Russia, but subject to the same insurance payments from the Pension Fund.

- Voluntary payment of Pension Fund contributions for yourself or another person.

Socially significant non-insurance periods included in the insurance period

Some periods of time that are not accompanied by insurance payments are counted as production:

- serving in the army and other equivalent services;

- temporary disability with receipt of social insurance benefits;

- care for children by one of the parents after they reach the age of one and a half years (entirely no more than 6 years);

- unemployed period with registration at the Employment Center, community service, relocation for the purpose of subsequent employment in the direction of the Employment Center;

- unjustified detention with subsequent serving of a sentence;

- removal from work after such unjustified criminal prosecution;

- home care if there is a disabled person of group I, a disabled child, an 80-year-old pensioner;

- living with a military spouse during his contract service in a place where there is no opportunity to find a job (no more than 5 years);

- living abroad with a spouse sent to diplomatic, trade and other missions, international organizations, etc., approved by the Government;

- participation in operational-search activities.

Accrual procedure

The procedure for calculating the funded benefit has remained unchanged (it is calculated exclusively for people born in 1967 and younger). The reforms affected exclusively the miscalculation when calculating the insurance share.

Its calculation occurs according to a certain formula that determines the final payment amount.

The most significant amendments to the regulation of this issue were introduced in two thousand and fifteen. From that moment on, the total benefit for people who legally went on vacation was divided into an insurance share (the main part of payments) and a funded one.

The estimated old-age benefit is calculated by transferring all funds to the Pension Fund (for official employment) into equivalent points.

Then, this calculation is made by summing up the accumulated points and counting according to a certain formula.

This accrual procedure was introduced in order to achieve greater stability for pensioners given the poor economic situation in the country and the constant rise in inflation.

Upon reaching retirement age, labor compensation is calculated based on the value of points for the current year and at the time of making contributions to the Pension Fund. If, after calculation, the pension turns out to be less than the regional subsistence level, the state provides financial compensation to cover this difference.

In addition, the state government authorities carry out regular annual indexation, as a result of which old-age benefits are revised in favor of an increase.

Pensioners who have been working since two thousand and fifteen can count on additional pension supplements. However, its maximum value will be only three pension points, which is equivalent to 244.47 rubles.

The amount of 1 point for 2020 was 81.49 rubles.

In addition, an increase in benefits also occurs for citizens receiving an insurance pension for the disabled group and old age (a mandatory condition is the deduction of funds from each salary to the Pension Fund).

Who is entitled to benefits?

The age category upon reaching which the opportunity to receive a pension can be provided is clearly stated in legislative documents at the state level.

In Russia, you can retire to a well-deserved retirement with a guaranteed benefit after reaching the following ages:

- Men – 65 years old;

- Women - 60 years old.

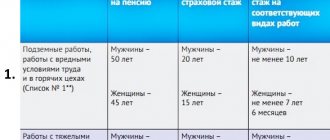

However, the legislation provides for some factors, under the influence of which it is possible to retire into old age at an earlier age:

- Certain professional activities;

- The birth of five or more children;

- Special conditions under which labor activity was carried out;

- Location of production in certain territories specified in federal legislation.

You can accurately determine whether a professional activity belongs to preferential categories by contacting your local Pension Fund. In addition, the structure’s employees will provide assistance in calculating the coefficient and determine the number of points accumulated over the working years.

In order for the pension payment to be accrued in full, you will need to have a certain amount of insurance coverage when taking your required vacation.

Only the years of official employment during which calculations were made to the Pension Fund of the Russian Federation are taken into account.

In addition, the insurance period during absence from work is also taken into account, but only in the following situations:

- Vacation period;

- Time to care for a child with a certain disability group;

- The period of care for a disabled person of the first group;

- Absence related to caring for a citizen aged eighty or more.

The total work experience also includes periods when a person is paid unemployment benefits.

Legislative basis for calculating seniority

Citizens of the Russian Federation calculate their length of service according to the Federal Law “On Labor Pensions in the Russian Federation” No. 173, which entered into force on January 1, 2002.

Currently, the law does not contain the concept of “work experience”; since December 31, 2001, it has been replaced by

clarified term

“insurance period” , that is, the period during which a working citizen made contributions from his salary to the Pension Fund of the Russian Federation, and other legally justified periods added to them.

However, the phrase “seniority” is often used synonymously. The insurance period is the duration of periods of work and other activities during which insurance contributions were paid to the Pension Fund of the Russian Federation.

What parts does the pension consist of?

The latest adopted reforms affecting the area of old-age pension payments.

The accumulated benefits were divided into:

- Insurance share;

- Cumulative share.

The formation of the labor pension was made from the two above-mentioned shares. However, recent adjustments have led to the equalization of labor and insurance pension payments.

Since the adoption of the law, all employees in the Russian Federation who have a certain period of insurance payments in the Pension Fund are provided with payment precisely according to insurance savings.

At the decision of the pensioner, part of the funded pension can be paid as an independent payment.

The insurance share is also divided into several parts:

- A fixed rate is an increase to each insurance pension upon reaching a certain age. For the current year, its size fluctuates at the level of 4805 rubles. If pensioners have preferential benefits, they receive a fixed rate in an increased amount;

- The variable part is the same old-age insurance pension. This amount is calculated individually, and the amount depends on the pensioner’s length of service, salary for the position held and insurance premiums paid.

Part of the funded pension can be paid as an independent payment

Fixed part of pension

The provision of increased state benefits for old age is provided for by the legislation of the Russian Federation.

Accrual occurs when taking into account the factors indicated in the table.

| People who are entitled to the fixed portion of the old age pension | Number of citizens in custody | PV size (rub.) |

| Having not reached the age of eighty and not having been assigned a disability group. | — | 4558 |

| 1 | 6 078 | |

| 2 | 7 598 | |

| 3 or more | 9 117 | |

| Having reached the age of eighty, or having been assigned the first disability group. | — | 9 117 |

| 1 | 10 637 | |

| 2 | 12 157 | |

| 3 or more | 13676 | |

| Those under the age of eighty, without a disability group, who have worked in the Far North for at least fifteen years, and with at least twenty years of insurance experience for women and twenty-five men. | — | 6 838 |

| 1 | 9 117 | |

| 2 | 11 397 | |

| 3 or more | 13 676 | |

| Those who have reached the age of eighty, or with the first group of disability, have been working in the territories of the Far North for at least fifteen years, and have an insurance record of at least twenty years for women and twenty-five years for men. | — | 13 676 |

| 1 | 15 956 | |

| 2 | 18 235 | |

| 3 or more | 20 515 | |

| Those under the age of eighty, without a disability group, who have worked in the Far North for at least twenty years, and have an insurance record of at least twenty years for women and twenty-five men. | — | 5 926 |

| 1 | 7 902 | |

| 2 | 9877 | |

| 3 or more | 11 853 | |

| Those who have reached the age of eighty, or with the first group of disability, have been working in the territories of the Far North for at least twenty years, and have an insurance record of at least twenty years for women and twenty-five years for men. | — | 13 676 |

| 1 | 13 828 | |

| 2 | 15 804 | |

| 3 or more | 17 779 | |

| Citizens who have worked in agriculture for at least thirty years, are not burdened with labor, with mandatory pension insurance, living in rural areas. | — | 4 918 |

| 1 | 6 230 | |

| 2 | 7 542 | |

| 3 or more | 8853 |

The last category of citizens was added to the list of beneficiaries for whom the bonus is calculated only in the latest amendments.

Its effect does not apply when citizens move to urban areas.

What is IPC?

In addition to dividing the pension into two shares, recent amendments to the legislation have also brought an individual pension coefficient, also called a pension point.

This indicator is used when calculating old-age pension payments.

The higher the IPC indicator, the larger the amount of payments a citizen is entitled to.

The components of the IPC are the sum of the APC (annual pension coefficients), which are points awarded by summing up annual transfers from the official salary to the Pension Fund.

In case of unofficial employment, no transfers to the Pension Fund are made.

How to calculate your old age pension yourself?

Federal laws provide a specific formula by which the coefficient can be calculated for any citizen, which is taken as the basis when calculating the amount of benefits.

To calculate the coefficient for the entire year, use the following formula:

The above calculation of annual points consists of three indicators:

- GPK - annual pension coefficient;

- SSP – the amount of insurance pension contributions collected from the employee’s total profit for one year;

- SSM - the amount of insurance fees in the amount of sixteen percent of the maximum salary subject to insurance contributions, which is annually established by the RF Government;

- 10 – used to make the calculation of pension points simpler. In addition, the number ten is the maximum allowed number of points accumulated over the year.

Pension points in the amount of 10 will be awarded exclusively from two thousand and twenty-one. Also, such a coefficient will be provided to those who do not participate in the formation of funded pension payments.

State authorities have provided for a gradual increase in the coefficient since the adoption of the law (2015) for subsequent years, which is shown in the table below.

| Year of granting old-age pension | The maximum IPC indicator when forming a funded pension | The maximum IPC without the formation of a funded pension |

| 2015 | 4.621 | 7.39 |

| 2016 | 4.89 | 7.83 |

| 2017 | 5.16 | 8.26 |

| 2018 | 5.43 | 8.7 |

| 2019 | 5.71 | 9.13 |

| 2020 | 5.98 | 9.57 |

| 2021 onwards | 6.25 | 10 |

As an example, if the coefficient calculated in 2020 is 9.7, then the payment is calculated only at the maximum coefficient of 8.26.

The IPC is derived by summing the GPC for all officially employed years when transfers were made to the Pension Fund.

Accordingly, the higher the employee’s official salary, the higher the individual pension coefficient.

It follows from this that the larger the IPC, the larger the size of the pension intended for him.

where GPC2015 is the number of pension points earned by a citizen in 2020, GPC2016 - in 2016, etc.

The higher the employee’s official salary, the higher the individual pension coefficient

Example of calculating individual coefficients

Before you start calculating the amount of pension payments, you need to understand that twenty-two percent of the funds are deducted from the employee’s official salary to the Pension Fund.

Which are intended for:

- Sixteen percent is transferred to create the employee’s insurance pension. At the request of the employee: ten percent is charged to the insurance part, and six percent to the savings part;

- Six percent goes to the Pension Fund account. It is from them that a fixed rate of insurance pension is paid to pensioners.

Calculation of the Civil Procedure Code with an accrual of 10% of the official salary

Melnichenko A.G. received salary the fee in two thousand and sixteen was 40,000 rubles per month. At the request of the employee, the employer paid ten percent for the insurance pension and six percent for the funded share of the pension.

The calculation of the number of contributions paid to the insurance share will be:

40,000 rubles x 12 months x 10% = 76,800 rubles.

For 2020, the maximum salary subject to payment in the Pension Fund was 796,000 rubles. The maximum annual payment per worker was 127,360 rubles.

The amount of pension payments will be:

Calculation of the Civil Procedure Code with the accrual of ten percent of the official salary

Calculation of the Civil Procedure Code with accrual of 16% of the official salary

Let's consider the same Melnichenko A.G. with the same level of official salary for the year two thousand and sixteen.

If the employer pays sixteen percent of the annual salary, the following contribution amount can be calculated:

40,000 x 12 months x 16% = 76,800 rubles

From this you can calculate the 2020 coefficients for Melnichenko A.G. according to the following formula:

When transferring exclusively insurance pensions, the coefficient is much higher, which implies many times larger accruals of old-age pensions.

Example of old age pension calculation

Benefits can be calculated using the new formula:

SPS = FV × PC1 + IPK × SPK × PC2

Melnichenko A.G. reached retirement age in 2020. In the process of two thousand and fifteen, his pension entitlement was converted into equivalent points. By summing up all points earned, the size of the insurance pension was 91.6 points.

- Fixed payment – 5000 rubles (presumably);

- The pension point amount is 81.49 (for 2018).

Therefore, it is calculated using the formula:

ATP = FV x IPK x SPK

5,000 rubles + 91.6 x 81.49 rubles = 12,464 rubles – the amount of Melnichenko A.G.’s insurance pension.

Pension formula

The old-age pension for men born in 1953 and younger and for women born in 1957 and younger includes two parts (Part 2, Article 5, Part 1, 23, Article 14 of Law No. 173-FZ):

P (labor pension) = SC (insurance part) + NC (funded part)

Each of them is calculated according to its own rules.

We calculate the insurance part of the pension

To calculate the insurance part (IP), we use the formula (Parts 1, 2, Article 14 of Law No. 173-FZ):

SCH (insurance part) = PC (pension capital) / (T (expected period of payment of the old-age labor pension - 228 months) + B (fixed size of the insurance part of the old-age labor pension))

Note. From April 1, 2013, the fixed amount of the insurance part of the old-age labor pension, taking into account indexation, for old-age pensioners under the age of 80 without dependents is RUB 3,610.31. (Part 6 of Article 17 of Law N 173-FZ; Decrees of the Government of the Russian Federation dated 03/27/2013 N 264, dated 01/23/2013 N 26, dated 03/27/2012 N 237, dated 01/25/2012 N 4, dated 01/26/2011 N 21, dated March 18, 2010 N 167).

Determining the amount of pension capital is influenced by whether you worked before January 1, 2002 or not. Situation 1. You did not work until January 1, 2002. Then everything is simple (Part 1, Article 14, Article 29.1 of Law No. 173-FZ):

PC (pension capital) = The total amount of insurance contributions to the CP (insurance part) transferred for you by the employer, from January 1, 2002 to the date of pension. It is indicated in the extract from your ILS for each year since 2002.

Situation 2. You worked until January 1, 2002. Then we make the calculation according to the formula (Part 1, Article 29.1 of Law No. 173-FZ):

PC (pension capital) = PC1 (converted part of the estimated pension capital for the period January 1, 2002) + SV (valorization amount) + PC2 (total amount of insurance contributions to the CP (insurance part) transferred for you by the employer, from January 1, 2002 d. By the date of assignment of the pension. It is indicated in the extract from your personal insurance record for each year starting from 2002)

The converted part of the estimated pension capital for the period before January 1, 2002 (PC1) is calculated using the formula (Clause 1, 7, Article 30 of Law No. 173-FZ):

PC1 (converted part of the estimated pension capital for the period before January 1, 2002) = RP (estimated pension amount), but not less than 660 rubles. – 450 rub. (basic part of the old-age labor pension as of January 1, 2002) x T (the expected period of payment of the old-age labor pension is 228 months)

At the same time, you can choose a more profitable option for you to calculate the estimated pension amount (RP) (Clause 2 of Article 30 of Law No. 173-FZ).

Option 1. Without taking into account individual periods that were taken into account in the total length of service according to the rules in force before January 1, 2002. For example, without taking into account the time of full-time study in educational institutions of vocational education, child care (Clause 3 of Article 30 of Law No. 173-FZ).

Then the estimated pension amount is determined as follows:

RP (calculated pension amount) = SK (experience coefficient) x K (ratio coefficient ZR (average monthly earnings of the insured person for 2000 - 2001 according to the ILS or for any 60 months (5 years) in a row until 2002 according to data from the employer's certificate) to the salary (average monthly salary in the country for the same period), but not more than 1.2) x SWP (average salary in the country for the period from July 1 to September 30, 2001 - 1671 rubles)

Note. The seniority coefficient depending on the length of total work experience as of January 1, 2002: - for women - 0.55 with a total work experience of 20 years as of January 1, 2002, plus 0.01 for each full year of total work experience over 20 years, but not more than 0.2; - for men - 0.55 with a total work experience of 25 years as of January 1, 2002, plus 0.01 for each year of total work experience over 25 years, but not more than 0.2. Thus, the maximum length of service coefficient for women and men is 0.75 (0.55 + 0.2). Service after January 1, 2002 is not taken into account when calculating the length of service coefficient.

Option 2. Taking into account all periods that were included in the total length of service before January 1, 2002 (for example, including periods of full-time study in educational institutions of vocational education, child care) (Clause 4 of Article 30 of Law N 173-FZ ).

In this case, the estimated pension amount is determined as follows:

RP (calculated pension amount), but not more than 555.96 rubles. = ZR (average monthly earnings of the insured person for 2000 – 2001 according to the ILS data or for any 60 months (5 years) in a row until 2002 according to the employer’s certificate) x SC (experience coefficient)

Note. The length of service coefficient is determined in the same way as when calculating the estimated pension amount under option 1.

If, when determining the estimated pension amount for the chosen option, it turned out that the total length of service as of January 1, 2002 was less than 20 years for women and 25 years for men, then the converted part of the estimated pension capital for the period before January 1, 2002 is first calculated for the full length of service according to the selected option (that is, using a length of service coefficient of 0.55), and then reduce it in proportion to the existing length of service (Clause 1, Article 30 of Law No. 173-FZ):

PC1 (converted part of the settlement capital for the period before January 1, 2002) with incomplete service = PC1 (converted part of the settlement capital for the period before January 1, 2002) with full service / (or) 240 months (20 years x 2 months ) – for women; (or) 300 months (25 years x 12 months) – for men) x Number of full months of total work experience available as of January 1, 2002

Please note that when determining the estimated pension amount, option 2 will be more profitable for you if:

- your average monthly salary before 01/01/2002, taken into account when calculating the RP, was no more than 1200 rubles;

- due to the periods excluded from the total work experience under option 1, as of January 1, 2002, you have a full total work experience (that is, at least 20 years for women and at least 25 years for men);

- the total duration of the periods excluded under option 1 was more than 5 years and 6 months (for example, you studied at the institute for 5 years and looked after your child for 3 years).

In other cases, apparently, it will be more profitable to calculate the RP using option 1. But to make sure of this, it is better to calculate the RP for both options.

The amount of valorization (SV) is determined as a percentage of the converted part of the estimated pension capital for the period before January 1, 2002. The amount of valorization for everyone who has experience before January 1, 2002 is 10% of PC1. And for those who have experience before January 1, 1991, 1% is added for each full year of such experience (Article 30.1 of Law N 173-FZ).

We calculate the funded part of the pension

the funded part (PF) of the pension as follows (Part 23, Article 14 of Law No. 173-FZ):

NP (funded part) = PN (pension savings - the total amount of insurance contributions for the funded part of the pension transferred for you by the employer (it is indicated in a special part of the extract from your personal insurance plan from January 1, 2002), as well as income from investing these funds) / T (the expected period for payment of the funded part of the old-age labor pension is 228 months)

Extra points

In addition, federal legislation awards an additional number of points from 1.8 to 5.4 points for certain stages of life when insurance premiums were not charged:

| Life circumstances | Allotted number of additional points (per year) |

| Time spent serving in the army. | 1.8 |

| Lack of care for a newborn up to the age of 1.5 years. | |

| Term for caring for people with disabilities (as well as children with disabilities), or pensioners over eighty years of age. | |

| When caring for a second child. | 3.6 |

| When caring for a third or more children (total period no more than six years). | 5.4 |

| Maternity leave for twins, etc. | Odds do not add up |

Assignment of insurance experience

The amount of daily benefits in case of illness or injury of the employee himself, when caring for a sick child (other family member) will be:

- 60% of average daily earnings with work experience from 6 months to 5 years;

- 80% of average daily earnings with 5 to 8 years of experience;

- 100% of average daily earnings with 8 years of experience or more.

Maternity benefits for more than 6 months of service are calculated based on 100% of average daily earnings.

The Social Insurance Fund benefit in connection with an accident at work or an occupational disease is calculated based on 100% of average earnings, regardless of length of service.

Premium odds

Government authorities do their best to encourage citizens who have reached retirement age to retire as late as possible.

This is taken into account when calculating the old-age pension in the form of an additional coefficient, which is provided to those pensioners who continue to work with the required pension.

The bonus coefficients provided for by federal legislation when calculating old-age pensions are shown in the table below.

| Number of months | IPC increase coefficient | PV increase factor |

| Less than 12 | 1 | — |

| 24 | 1.07 | 1.056 |

| 36 | 1.15 | 1.12 |

| 48 | 1.24 | 1.19 |

| 60 | 1.34 | 1.27 |

| 72 | 1.45 | 1.36 |

| 84 | 1.74 | 1.58 |

| 96 | 1.9 | 1.73 |

| 108 | 2.09 | 1.9 |

| 120 or more | 2.32 | 2.11 |

How to apply for an old-age pension?

To receive government benefits, you will need to visit the local Pension Fund, where you need to provide all the necessary documents.

To apply for a pension benefit, you will need the following package of documentation:

- Completed application;

- Copy of the passport;

- A copy of the work book confirming official employment;

- Conclusions obtained from companies where the candidate for payment worked;

- Photocopy of the insurance certificate issued by the Pension Fund;

- Extract from payroll records for the last five years;

- When changing your name, you will need official certificates confirming this;

- Photocopy of military ID;

- Certificate for citizens supported by the candidate;

- A document confirming registration or place of residence;

- Photocopies of certificates of disability, or the presence of relatives requiring regular care;

- Conclusions that confirm the presence of periods of life when the citizen did not work, but has the right to include them in his work experience;

- Bank details (Sberbank), to which the old-age pension will be received every month.

When providing photocopies of documents for the first time, you will need to take the originals with you.

Confirmation of insurance experience

The insurance period is confirmed as follows:

- work under an employment contract, state or municipal service - a work book or, for example, an employment contract or a certificate issued by a previous employer

- military service - military ID.

Part-time workers must bring a copy of their work book, certified at the place of their main job, to confirm their insurance experience.

That is, the main document for calculating the insurance period is the work book.