The state is obliged to take care of its citizens at any age, especially when they are still or no longer able to earn their own living. If parents most often take care of small children who are unable to provide for themselves, then there is often no one to take care of the elderly. Therefore, a whole system of calculation, accrual and payment of various types and types of pensions was developed, which will allow older people to live with dignity, because the state compensates them for the lost opportunity to receive income on their own.

There are different types and types of security that can be assigned under different circumstances, which can be difficult for an ordinary person to understand. Many people in their declining years wonder how an insurance pension differs from a social pension, what they essentially represent, and what payments are best to choose in each specific case. This is exactly what we will talk about in our current article.

Place of insurance in the total payment

The pension reform that began in 2002 is still ongoing, and only by 2020 did it finally take on visible shape. According to them, pension provision for citizens in Russia will depend on the year of birth of the form of accumulation of labor resources.

Accordingly, there are two forms:

- For citizens born up to 1966 inclusive. Labor savings for payment after old age for this category of Russians are made up of components: the base, the insurance part of the labor pension (ICLP), and the savings reserve.

- For Russian citizens born after 01/01/1967. The formula in this category is: fixed base payment + STPP + savings funds.

It looks the same, but the results are different. In the first case, the insurance part of the labor pension is the lion's share of future security. It consists of direct work experience and accrued benefits. The funded component is fully available to the older generation by law in a very limited, symbolic quantity and only for those whose official employers made contributions under this article in 2002-2004.

In the second case, the pension fund plays an equally important role, but it is calculated more loyally, allowing you to receive a pension fund in accordance with your real work and salary, and not “like everyone else.” In addition, in some cases, an additional savings share can double or even triple the total payment, depending on how the owner manages it wisely.

State pensions

State pension provision is divided into 5 types:

- For years of service. This payment is received by military personnel, pilots and astronauts, as well as federal officials. This pension is sometimes called military or service pension.

- Due to old age. Appointed if a citizen has suffered from a radiation or man-made disaster (a striking example is the accident at the Chernobyl nuclear power plant).

- Due to disability. Entitled to military personnel and astronauts who have become disabled, persons who have lost their ability to work due to disasters, and war invalids.

- For the loss of a breadwinner. This type of support is intended for dependents of deceased military personnel, astronauts, as well as citizens who died as a result of the disasters mentioned above.

- Social. This is a payment that citizens who are not entitled to another type of pension can count on. Social pensions are assigned on three grounds: upon reaching age, in the event of the death of the breadwinner, or due to disability. They are assigned if a person has the right to one of the mentioned types of payments, but he does not have sufficient insurance experience and/or points. There is a condition - the person’s permanent place of residence must be in Russia.

Formation of the SFTP component

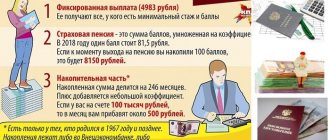

By 2020, the pension fund of every future retiree will consist of three components:

- basic - a fixed amount at the time of payment, growing every year in accordance with inflation according to the decrees of the President, is due to everyone initially;

- actual - what is included in the insurance part of the pension in the form of guaranteed remuneration for long-term work and only for work, is due only to citizens going on vacation, having many years of work experience;

- deposit - this is the nature of the accumulative part, which is formed from the share of regular deductions from the place of work or independent deposits and grows annually, like any bank deposit.

For 2020, for people of the older generation, who, according to current laws, can take out old-age leave in the next 3 (women) and 8 (men) years, the MF consists of:

- deductions that their employers made from official salaries before 2002;

- points awarded for work experience after the specified time.

This gap is associated with the beginning of that very reform in 2002, after which everything began to be considered in an updated manner.

For younger people, the insurance part of the pension is calculated only in the form of points.

What are points? — The government decided that the new method of forming the state pension proposed by knowledgeable people is most suitable for Russia, and the method is based on the transfer of received contributions into assessments or the Individual Pension Ratio (IPC). The higher the salary, the greater the deductions, the higher the IPC each year.

If by the time of retirement age the sum of points reaches the required limit, the citizen is assigned a full-fledged state pension, and the coefficient will not be able to reach the required level if one does not work officially for the required number of years. Thus, the combination of time worked with a white salary and the amount of earnings is what the insurance part of a pension is for a Russian pensioner.

What are insurance and social pensions?

To compensate for wages or other cash income lost due to disability (reaching retirement age or obtaining the status of “disabled”), a citizen is paid an insurance pension , accumulated through employer contributions . The amount of such a benefit is formed directly from the pension itself and the additional fixed part attached to it.

In the case of a social pension, funds are transferred to all Russian citizens from the state budget , regardless of length of work.

What is the government doing with the PPTP?

In simple terms, the insurance part of a labor pension is state insurance that guarantees any worker financial support according to his work after the onset of disability. In accordance with the categories of recipients, SCTP participates in savings in 2 ways.

In the first case (in relation to citizens born before 01/01/67), everything happens as for any insurance:

- By default, contributions received from a person insured by the state remain in his personal account and await the specified time. Savings are indexed annually depending on the overall economy.

- When day X arrives, the entire amount will be finally calculated and verified.

- The result obtained will be divided by the accepted average time the insured person spent on state pension support.

In parallel, the IPC points accumulated after 2002 will be applied to the result and a basic fixed payment will be added. All together this will constitute the full content directly from the state.

In the second case (citizens born after 01/01/67):

- Each year the employee is assigned the number of points earned depending on the contributions made.

- Before the payer switches to state old-age benefits, all collected IPCs are multiplied with the cash equivalent of 1 point valid for the current year.

- The insured amount received is enhanced by a fixed share of social benefits, which is due to everyone.

The final figure of all additions will be a state-guaranteed labor benefit. These calculations should not be used for military pensioners, who have a separate system for assigning age-related state benefits.

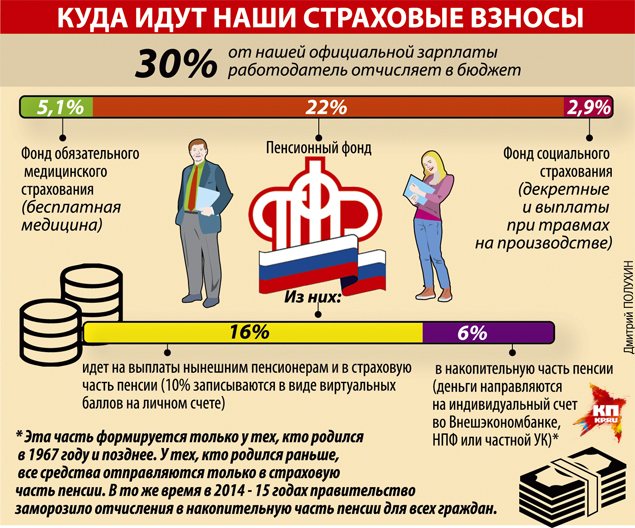

How are contributions to compulsory pension insurance calculated?

Accounting for contributions to compulsory pension insurance in Russia is carried out using a special number - SNILS. It is assigned to each citizen and through it all paid contributions are recorded. Based on the information in this account, the payment due is calculated.

The rules for paying contributions differ for employers and self-employed (IP). In the first case, there is an obligation to pay tax for your employees by the 15th day of the month following the billing month. Individual entrepreneurs make contributions based on the results of the whole year and make until June 30 of the next year.

Thus, pension provision under compulsory pension insurance represents financial support for citizens upon the occurrence of certain events and their fulfillment of established requirements. Payments are made from funds accumulated by the Pension Fund through payments from all insured persons.

Video on the topic of the article

What and how much does it cost?

All necessary limits and maximum coefficients are still at the formation stage. They will take their final value by 2025. And the values tied to inflation growth will be constantly indexed.

Current indicators for 2020:

- the minimum age for receiving state pension provision is 55/60 women/men;

- minimum work experience 9 years;

- minimum IPC – 13.8;

- cost of 1 IPC point – 81.5;

- fixed mandatory share - 4982.9 rubles;

- The average period of support is 228 months.

After 2024, the minimum work experience and IPC will become 15 years and 30 points, respectively, increasing by 1 year and the rate of 2.4 annually.

The procedure for calculating insurance (work experience)

To calculate the insurance pension, you can use the following formula:

IPC (individual coefficient in the Pension Fund) x SPK (the cost of one day of the coefficient at the time of pension assignment).

Based on the above, it becomes clear that the higher the pension coefficient, the larger the pension, but the average salary and insurance length for the entire period of work are of no small importance here.

Recalculation of insurance pensions in the Russian Federation is carried out twice a year:

- February 1 after calculating prices on the consumer market for the past year and establishing the value of the coefficient;

- April 1 after determining the coefficient for the specified date.

Also, the number of pension points is affected by the cumulative part of the pension: if a citizen refuses it, at the end of the year he will be awarded 10 points, but if not, -6.25 points.

How to get accurate information

Those who work full-time in an official workplace can independently find out the amount currently available in state pension accounts through the Pension Fund of Russia. Data is available in two ways:

- a personal visit to the local PF office, where it is enough to make a request to an employee;

- via the Internet through registered accounts on the websites of the State Service and the Pension Fund of the Russian Federation.

In the second case, the service is provided literally the same minute the request is received. By the way, the information or lack thereof can also be checked by citizens who have not worked.

As for the funded half, this is a completely separate topic and an autonomous component of the future state pension, which has many other nuances. Its main difference is unlimited investment limits, the opportunity to receive the entire deposit at a time and/or pass it on to relatives by inheritance. With the skillful distribution of this share, the younger generation in the future will be able to count on a truly decent post-work life.

The same thing that makes up state pension insurance, an emergency reserve that the state uses only for its intended purpose, without risks and additional markups.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - fill out the form below or call right now: +7 (ext. 692) (Moscow) +7 (ext. 610) (St. Petersburg) +8 (ext. 926) (Russia) It's fast and free!

What is the amount of fixed pension supplements?

The amount of such additional payments is regularly indexed. So, at the beginning of 2015, pensioners were paid about 4,000 rubles, in 2020 - almost 4,400 rubles, and from February 1, 2020 to the present day, 4,558.93 kopecks are transferred. monthly.

The law also provides for the transfer of increased fixed payments for a certain group of persons:

- Group 1 disabled people and citizens over 80 years of age;

- Persons with at least 15 years of work experience in the Far North;

- Citizens who have dependent disabled close relatives;

- Pensioners, if the size of their social pensions is less than the minimum subsistence level established in the region.

End of payments

The old-age insurance pension is assigned for life. The only reason for stopping the accrual of funds is the death of its holder. In other cases, a temporary suspension is possible. It applies to all social charges.

If after the expiration of the suspension period the reason is not eliminated, the funds cease to be paid.

- failure to receive a pension for six months—stopping payments for six months;

- refusal to undergo a mandatory medical and social examination to confirm disability - for 3 months;

- expiration of a foreigner’s residence permit in the Russian Federation (residence permit), if he was accrued a pension from the budget of the Pension Fund of the Russian Federation - for six months;

- submission of documents for moving for permanent residence to another country - for six months.

Payments are restored upon written request of the designer or his representative. It must be submitted to the regional Pension Fund office.

Disability and survivor's pensions are temporary. The benefit ceases to accrue when the dependent reaches the age of majority or when the disabled status is lost.