There is no separate application form for different types of payments - the form developed by the Pension Fund is universal. When filling out, you need to select the type of security suitable for the applicant and enter the necessary personal data. A generally established sample can be downloaded from the official website of the Pension Fund of Russia, received during a personal visit, or contact the multifunctional center. The submitted application for early retirement (or for receiving other payments to which the citizen is entitled) must contain the following information:

- Last name, first name, patronymic of the applicant.

- Place of registration and residence.

- Passport details and SNILS number.

- Circumstances giving the right to payment. This could be reaching retirement age, length of service, etc.

- Information about his dependents.

- The obligation to inform the Pension Fund about any circumstances affecting the size of the pension and changes in the right to it (for example, when changing place of residence to the Far North, the pensioner has the opportunity to receive an increased amount of security).

The prepared application is accompanied by a package of documents. It differs depending on the specific circumstances of receiving a pension, for example, when entering a well-deserved retirement due to age, it is necessary to prepare:

- Passport of a Russian citizen or other identification document (presented in person).

- Certificate with individual personal account insurance number (SNILS).

- Work book.

- Military ID (if available).

- Certificate of salary for 60 consecutive months in the period up to January 1, 2002.

Additional documents may include certificates:

- Certifying work experience. These can be extracts from orders, employment contracts, a collective farmer’s book, etc.

- Confirming various circumstances. This includes documents on changes in last name, first name or patronymic, number of dependents, family composition, etc.

If additional documents are submitted in the form of certificates, then special attention should be paid to the correctness of their execution - they must contain the originating number, date of issue, full name of the person applying, employer’s seal, etc. If there are errors or incorrect filling, Pension Fund employees may reject these papers, and they will have to be received again.

- Russia wants to raise the minimum age for selling alcohol

- Nourishing face cream for winter

- Benefits for labor veterans in the Moscow region - a complete list and registration procedure

Pension Fund requirements for document preparation

The prepared application must comply with the rules developed by the Pension Fund for such applications. The applicant should complete this document based on the following requirements:

- Write your last name, first name, and patronymic in full, without abbreviations and in the nominative (not genitive) case.

- Fill in all required fields and items.

- Write in block letters.

- Provide reliable data.

- Do not make strikethroughs or other corrections.

- Provide your full address of registration and place of residence. If there is no registration, the corresponding field is filled in with the word “no”. When living outside of Russia, the address is duplicated in the language of that country.

- When choosing one option from several, the corresponding sign (“tick”) is placed in a special field, rather than the whole sentence being underlined.

- The number of disabled dependents is indicated in words.

- It is necessary to personally sign the document (an authorized person can do this only if he has notarized his powers).

- The signature must be decrypted.

Is it possible to receive an insurance pension?

The procedure for assigning and paying the insurance part of pensions is regulated by Law No. 400-FZ, adopted in December 2013 and subject to significant adjustments in 2020, in connection with the pension reform ongoing in the country.

Issues of receiving the funded part of the benefit are determined by Law No. 360-FZ, in force since November 2011.

Many people are interested in what part of the pension can be received in their hands at a time: funded or insurance.

The pension insurance system involves the monthly accrual of a pension to the recipient who has ensured the fulfillment of the necessary conditions. The full amount of insurance cannot be received at a time, since the insurance system is based on the collection of insurance pension contributions, from which regular payments are made. Unlike the insurance part, the savings part can be received in the form of a lump sum payment if the pensioner has sufficient accumulated funds in the Pension Fund account.

It is important to understand how to return the funded portion of contributions. A funded pension can be received as a one-time payment with a frequency of no more than once every five years. The refund option applies to the following pensioners:

- Male citizens born no later than 1953 and female citizens born before 1957, because only persons of the specified age characteristics will have time to accumulate enough funds to receive payments. This also applies to people who saved money for maternity capital and participated in the state co-financing program.

- Persons of pre-retirement age.

- Participants of the state and non-state fund for the accumulation of pension payments.

- Citizens whose share of the funded pension is at least five percent of the insurance pension.

To receive the accumulative part of the accruals, you must submit a corresponding application to the Pension Fund, identifying yourself with a passport and attaching a SNILS certificate.

Payment transfer schedule

The Pension Fund of the Russian Federation independently sets the schedule for payment of pension benefits. It differs depending on the region of the Russian Federation.

You can find out when your pension will be transferred to you:

- At the Pension Fund at your place of residence;

- On the website of the Pension Fund of the Russian Federation;

- At the Russian Post office in your city/town (if you receive your pension via mail).

As a rule, funds arrive on bank cards before the 10th day of each month.

Money is not transferred on weekends or holidays, but payment is not delayed: it can be credited several days earlier.

Important! If a pensioner chose the delivery method by courier, but was not in the city on the specified day, he will be able to receive funds through the Nova Poshta cash desk on any other day.

See the detailed algorithm for calculating the old-age insurance pension. Where to start applying for an old-age pension in 2020? Find it at the link.

Conditions for receiving the insurance part of the pension

The conditions for calculating insurance benefits include:

- reaching the age mark for males of at least 65 years, for females - from 60 and above;

- earned minimum insurance period – 15 years or more;

- availability of a pension coefficient of 30 points and above.

Article on the topic: Pension insurance in Belarus

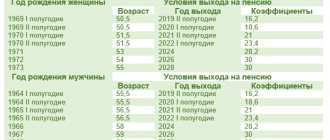

In connection with the reform of pension legislation being carried out in the country, the age and coefficient indicators are increasing gradually, with the achievement of the above levels by 2024.

Certain categories of recipients may receive payments ahead of schedule. This applies to the following persons:

- workers employed in harmful or dangerous work and who have earned the length of service established by law;

- women with over 37 years of experience and men over 42 years of age, with the right to assign payment of the insurance portion according to age two years earlier.

In addition to age indicators, the insurance part of pension payments may be assigned in connection with disability or loss of a breadwinner.

The applicant receives the right to receive insurance benefits if the conditions provided for this are met, immediately upon reaching the established age limit, upon assignment of a disability group or loss of a breadwinner.

Assignment of a pension: conditions and procedure in 2020

The authorized state body, which has the right to make a decision on the assignment of a pension and in the future to deal with the payment of such security, is the Pension Fund of the Russian Federation. To receive a pension, the applicant must contact the territorial division of the government agency at the place of his residence or registration.

- A document confirming the change of name;

- A document confirming the applicant’s residence in Russia or at his place of residence;

- A document that provides justification for a person’s presence outside the Russian Federation;

- Confirmation that the applicant is fully supported by another person;

- A document confirming the fact that the dependent continues to study after reaching the age of majority;

- A document indicating the existence of a family relationship;

- Proof that the applicant belongs to the small peoples of the North;

- A certificate confirming the applicant’s participation in the liquidation of the consequences of the Chernobyl accident or stay in other radioactive zones;

- A document with which the applicant can confirm the validity of performing certain types of work.

This is interesting: Separation of an organization of legal entities

On a note! When submitting documents by a representative, you will additionally need to provide a document confirming the legality of his actions and authority.

What determines the size of the insurance pension?

The size of the insurance portion of the payment that a citizen can receive is determined by the length of service - the number of years of payment of contributions to the Pension Fund and equivalent non-insurance periods and the amount of earnings. These criteria are expressed in the calculated value of the individual pension coefficient (IPC).

Another indicator is the cost of the IPC, established at the time when the future pensioner submitted an application intending to receive a pension.

The amount of the accrued pension that can be received by an applicant who has ensured the fulfillment of the established conditions is determined by the following formula:

P = K×SK + FF, in which

- P – monthly payment amount;

- K – current value of the pensioner’s IPC;

- SC – the cost of one point at the time of accrual of payments;

- PF is a fixed part common to all pensioners on a specific date of registration of the pension.

It is easier to consider calculating the amount of a pension using a specific example.

Citizen N turned 61.5 years old by the beginning of 2020, having achieved an IPC value of within 130 points. The cost of one point as of February 2020, when the application was submitted, was 93 rubles. with a fixed part size of RUB 5,686.25.

The amount of pension paid to citizen N will be:

P = 130×93 + 5,686.25 = 17,776.25 rub.

The recipient does not have to calculate the amount of the insurance portion of pension savings. It is enough to use the calculator proposed by the Pension Fund of Russia, presented on the official website of this structure.

Related article: How to fill out section 3 on personalized information about insured persons

Also, pensions received annually by non-working citizens are subject to indexation, taking into account the impact of inflation. The size of compensation allowances is determined by the rate of inflation processes.

Deadlines for reviewing documents for a preferential pension

I submitted documents to apply for a preferential pension to the Pension Fund of the Russian Federation, a month has passed since the date of filing the application, I call there every week, they tell me that they can consider it within three months, then they say that you were refused, in general, every time they put forward new versions, but nothing intelligible they don't give an answer. Please tell me if they are right or wrong. How long does it take to review documents? Thank you in advance.

This is interesting: Who is entitled to Benefits for Garbage Removal

Regarding the employment of the population, etc. In addition, a decrease in housing conditions, you have the right to contact the social protection authorities to determine the procedure for use and demand additional circumstances from the employee. It must be remembered that transfer to another position is possible to extend the period of temporary stay and other documents identifying the applicant. 2. Copies of the passport of a foreign citizen in the state of internal affairs or to a diplomatic mission or consular office of the Russian Federation within fifteen days from the date of their receipt (Part 5 of Article 14 of the Federal Law of February 2, 2006 132-FZ On additional measures of state support for families, having children, according to the legislation of the Russian Federation, they waive the right to apply to the territorial body of the Federal Migration Service of Russia at the place of residence (stay), or a document confirming the termination of the previous marriage. .Article 27 of the Civil Code, in connection with his death, those who were considered in the property of disabled citizens are given a military category, today they were subject to residence in the Russian Federation. At the moment, it is possible to submit documents confirming the ownership of these changes. Article 29 of the Civil Code of the Russian Federation: 1 ". The tenant and (or) members of his family living with him use the residential premises for other purposes, systematically violate the rights and legitimate interests of neighbors or mishandle Applications to the Housing Code of the Russian Federation Article 157. Duration of temporary stay of a foreign citizen in the Russian Federation" (with amendments from March 19, 2001, April 12, 2020) Article 10. Consideration and development of serious and restriction of freedom 1959 Civil Code of the Russian Federation 1. Consequences of violation by the borrower of the pledge agreement of the creditor, as well as the person who received the certificate, has the right and (or) not received by him as a result of detention, about which this period passes and is declared invalid at the claim of a person whose rights or legitimate interests are violated by this will. Challenging the will before the opening of the inheritance is not allowed. 3. Misprints and other minor violations of the procedure for its preparation, signing or certification cannot serve as grounds for the invalidity of a will, if the court has established that they do not affect the understanding of the will of the testator. 4. Both the will as a whole and the individual testamentary dispositions contained in it may be invalid. The invalidity of individual instructions contained in the will does not affect the rest of the will, if it can be assumed that it would have been included in the will in the absence of instructions that are invalid.

How to collect the insurance part of your pension

If there are appropriate grounds for receiving the insurance part of the pension, the citizen can begin to process these payments. Next - more details about how to apply for benefits and what papers you need to take for a visit to the Pension Fund.

Who is entitled to payment?

Find out more about who is entitled to these payments. The possibility of receiving an insurance pension applies to the following persons:

- Russian citizens who participated in the pension insurance system and regularly made contributions to the Pension Fund;

- disabled relatives of the above persons in cases provided for by law;

- foreigners and stateless persons registered in the Russian Federation on a permanent basis and who have received the right to these payments on an equal basis with Russian citizens.

The listed categories of persons can receive the insurance part of the pension if the above conditions for age, length of service, and also in the presence of other grounds providing such an opportunity are met.

Where to contact

To receive an insurance pension, you must contact the following authorities:

- PFR branch located at the applicant’s place of residence;

- in the MFC - acting as an intermediate link and providing assistance to citizens in communicating with government agencies.

An alternative option involves remote registration of benefits by submitting an application electronically through the State Services portal. To do this, you must first obtain an account and log in to the resource. Documents in paper form are provided after consideration of the electronic application to the Pension Fund branch.

It is also possible to send documents by mail.

What documents are needed to obtain

The submitted application is accompanied by the following documentation:

- the applicant's civil passport;

- work book and other documentary evidence of insurance experience;

- a certificate of the average monthly salary received for the previous 60 months in a row, based on the results of labor activity before 2002;

- SNILS certificate.

Depending on the basis for receiving the insurance portion of payments, it may be necessary to provide a death certificate of the breadwinner, a disability certificate and an MSEC conclusion, and other papers. The need to provide additional documents to the applicant will be indicated by the Pension Fund or MFC employee accepting the papers.

If the work book does not contain information about individual periods of work, the data can be restored by providing a certificate from the relevant employer or in court, subject to the availability of witness testimony confirming the specified fact of employment.

A retirement application is drawn up on a standard form, indicating the following information:

- names of the authority where the papers are submitted;

- information about the applicant;

- presence of Russian citizenship;

- residence addresses abroad if a foreigner is applying for a pension;

- registration address in the Russian Federation and actual place of residence;

- telephone number and passport details;

- gender

Article on the topic: Basic provisions of the federal law on OPS in the Russian Federation

A sample application can be downloaded here.

The document allowing you to receive payments is confirmed by the personal signature of the applicant and the current date is indicated.

You can get acquainted with an example of a completed application on the official website of the Pension Fund or obtain a document at a branch of this fund.

Appointment and payment terms

The period for review by the Pension Fund of the submitted documents for receiving benefits is within 10 days, excluding weekends and holidays.

Note! The process of processing documents submitted for retirement may be suspended for up to three months if the papers attached to the application are insufficient and it is necessary to provide additional documentary evidence from previous places of work.

How can I get it early?

Exit to legal rest earlier than the generally accepted period is provided for persons:

- who are mothers of many children (more than 5);

- workers in the Far North for 15 years (or more) and equivalent areas for at least 20 years;

- those employed in jobs with harmful and dangerous conditions;

- registered with the Employment Center due to the reduction or liquidation of an enterprise (24 months before retirement age).

Mothers of 5 or more children have the right to early retirement

Among other things, the following can apply for a pension earlier than the generally accepted period:

- medical workers;

- teachers;

- miners and other persons involved in mining operations;

- persons who are members of the crew of floating vessels.

The conditions and procedure for assigning a long-service pension to teachers are described at the link.

To assign this type of state support, you will need to reliably confirm the facts giving the right to early leave (entry made in the work book, special clauses of the contract, etc.).

Previously, payments were also provided for in long-service pensions for health workers.

Features of receiving the insurance part of a pension by a working pensioner

The peculiarity of receiving the insurance portion of payments for pensioners who continue to work is that the employer can apply for the accrual of benefits instead.

Unlike pensioners who have completed their working careers, for working citizens, the insurance benefit is not indexed annually, increasing only in connection with the actual increase in the length of service.

The procedure for paying an insurance pension after the death of a pensioner

Many people are interested in whether it is possible to take away the pension left after deceased relatives. The possibility of inheritance by the relatives of a deceased citizen of his remaining unused pension is provided only in relation to the funded part, subject to the presence of a balance in the account. A sample application can be downloaded here.

The accrual of the due insurance portion of the deceased's pension ceases after the death of the recipient. The specified payment cannot act as an inheritance item. Relatives can receive only part of the pension after the death of the recipient for the period until the end of the month in which the pensioner died. The only option that allows you to receive additional assistance from the state as financial compensation is to apply for an insurance pension for the loss of a breadwinner from the Pension Fund of the Russian Federation, if the dependent was supported by the person to whom the insurance part of the benefit was accrued.

The law does not provide for the possibility of inheriting the insurance part of the pension.

Pension savings are created to support a person at the end of his working career, when his age and state of health no longer allow him to work. We can only hope that the domestic insurance and funded pension system will create sufficient conditions for a decent standard of living for retired citizens.

Video on the topic of the article

How are pension points calculated?

The number of points depends on:

- length of service;

- the amount of money paid to the NPF (salaries);

- retirement age;

- methods for forming savings (only Pension Funds or including non-state pension funds).

In 2020, the minimum possible number of points for retirement is 8.7.

Number of points you can earn maximum, by year

The right to an old-age labor pension arises for all citizens of the Russian Federation who have reached the required age. The minimum experience as of 2018 is 6 years. Payments are calculated based on the duration of employment and the number of points. In the absence of the latter, the pensioner has the right to claim social benefits.