Pension deposit in Russian Standard Bank

This deposit is an excellent tool for preserving the personal savings of investors from the impact of inflation, as well as their further increase. The offer for the Pension deposit has become new in the list of possible products of Russian Standard Bank.

It will be possible to open it only if you have a pension certificate. Its validity period is 6 or 12 months - at the choice of the depositor. The lower threshold for opening an account is 10,000 rubles. The interest rate varies from 6.5% to 6.75% - depending on the amount of money deposited and the duration of the deposit.

Interest on the deposit is paid every month and transferred to the bank card account specified when drawing up the agreement. Also, for the convenience of pensioner clients, the deposit has automatic renewal - extension of the validity period - and the possibility of making additional contributions.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

When a deposit is made at a bank branch, interest on it is paid to the card specified in the agreement. When opening a deposit through the online service, interest will be transferred to the account from which the deposit was opened.

Rustam Tariko found a buyer for NPF Russian Standard

The Russian Standard Fund is part of the pension savings guarantee system and formally belongs to the owner of the vodka holding of the same name, Rustam Tariko. As RBC previously wrote, at the end of 2020, Tariko lost operational control over his non-state pension fund, and the fund itself actually ended up as collateral from Mikail Shishkhanov’s BIN group for a previously issued loan. According to the law on pension funds, NPFs do not have the right to pledge the property they own, but can use their shares as collateral. A financier familiar with the progress of negotiations on the sale of NPF Russian Standard previously said that in this case the fund’s shares were not pledged. “Most likely, there was a gentleman’s agreement between Tariko and Shishkhanov,” he said.

A source close to the BIN group told RBC that the Russian Standard fund was not collateral for Tariko’s loans. “But the BIN group had a priority right to acquire the fund, so they checked the status of the fund. Later, the group decided not to buy the NPF, and another buyer was found for the Tariko fund,” says the source.

Read on RBC Pro

Cheap strategy: how the famous discounter Lidl conquered Europe “Robbery in broad daylight”: how the demands of MBA students have changed - Bloomberg How businessmen in Russia are personally liable for the debts of the companies they control Lamoda CEO Jeri Kalmis - RBC Pro: “There is no more traditional trade”

“Shishkhanov could gain control of the NPF in exchange for an old debt,” says the financier. He recalls that last year fugitive banker Anatoly Motylev laid claim to the fund’s assets. As the Vedomosti newspaper wrote, Tariko’s structures received a loan from Russian Credit, in exchange for which the pension fund had to buy mortgage-backed securities issued by Motylev’s structures. The deal was terminated at the request of the regulator at the moment when the Central Bank blocked the operations that managed the assets of NPF Russian Standard. Tariko had to urgently look for money to pay off the debt to Russian Credit, Binbank helped out, a Vedomosti source claims. In exchange, the businessman had to mortgage the NPF Russian Standard.

Rustam Tariko put up for sale his financial structures - NPF "Russian Standard" and Management Company "Russian Standard" - in the fall of 2020. In November 2020, BCS gained control of Russian Standard Management Company. “As part of the deal to purchase Russian Standard Management Company, Rustam Tariko and I agreed on a partnership in the field of sales of investment products that we will jointly develop. The partnership will allow us to use the experience of BCS in creating investment products and the bank’s sales opportunities,” said the head and founder of BCS Oleg Mikhasenko in an interview with RBC.

Programs for investors

In addition to the above-mentioned deposit, there are other programs for investors. Russian Standard Bank also offers its clients the following programs:

"Maximum Income"

Issued for 3, 6, 12 or 24 months (depending on the client’s choice). Interest on the deposit is 6–6.75%, and is paid at the end of the agreement. The minimum down payment is 30,000 rubles.

"Comfortable"

It involves both self-registration through an online service and opening through a bank branch. The registration period is 3, 6 and 12 months. It is possible to deposit and withdraw funds (in the second case, up to a minimum amount that must remain on the deposit account). The interest rate varies from 5.5% to 6.25%. Interest is paid at the end of the term. The minimum opening amount is also 30,000 rubles.

"Rentier"

It is possible to open both remotely and in the branch. It is permissible to make additional contributions. The yield is 6.25–6.5%, the deposit period is 6 or 12 months. Interest is paid every month or quarter (at the depositor's choice). Initial payment – from 30,000 rubles.

"Replenishable"

The deposit opening period is 6 or 12 months, the minimum initial deposit is 30,000 rubles. It is possible to top up your account. Interest rate – up to 7.5% (depending on the amount of the contribution and the investment period). Interest is paid at the end of the term.

There is capitalization of interest on the “Rentier” deposit - they are added to the principal amount of the deposit, and in the future interest is also accrued on them.

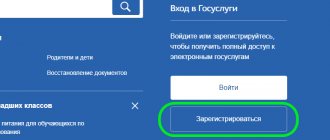

How to register in your personal account

Before you log into your RSB personal account for the first time, you must enter into an agreement with the bank. The service is provided to customers who have issued any product - card, loan, deposit.

You can register in the system by following 4 steps:

- Open the RSB website and click the “ Internet Bank ” button at the top of the main page.

- Follow the “ Get access ” link.

- Select the registration method and fill out the requested information.

- Wait for an SMS with data to access the service.

Registration is carried out using contract or plastic data. your login and password via SMS to the number specified as the contact number.

Login to your RSB personal account

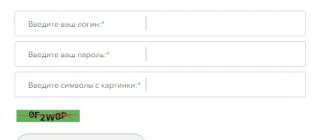

The client will need a login and password to access the remote service. Logging in is carried out using 3 steps:

- Open the RSB website in any browser.

- Click on the green “ Internet Banking ” button located next to the main menu.

- Enter your account information

- Click on the “ Login ” button and confirm authorization.

If the client does not remember the login or password, then he can restore the account data himself using the “ Restore access ” link. The client will have to go through the registration procedure in the system again, indicating the details of a valid card or agreement. You can also reset your password if you know your account login.

Important!

The system does not allow you to recover your old password. It is stored encrypted and cannot be sent to the client. But it provides the opportunity to reset it and install a new one.

How do you manage your online banking accounts?

To access your accounts, you need to log into your personal account of the RSB Internet bank online.

At the top there is a horizontal menu, the tabs of which correspond to specific services.

The funds available on your cards (own funds, credit funds) and accounts (current account, savings account) are displayed in the Cards and accounts tab.

Carrying out a financial transaction (payments, replenishing accounts, money transfers, managing loans and deposits, connecting additional functions) through Internet banking is carried out in three steps:

- filing an application;

- transaction confirmation;

- receiving information about successful registration of the application.

When submitting an application , you must fill in all the empty fields on the page, for example, recipient details, transfer amount, parameters of the loan or deposit being opened, etc. The type of application and the requested data vary depending on the selected operation. Clicking the "Next" button will take you to the next step.

To confirm the operation, a personal code is sent to your phone number, which must be entered in the appropriate window. Before clicking the "Confirm" button, make sure that all entered parameters are correct.

The personal code confirms the completion of only one current operation. It is valid for 30 minutes from the moment the request is sent.

If the code was entered incorrectly, code No. 2 is sent to the phone number. However, if three incorrect attempts are made, this function is blocked. If the “Login by one-time password” service is activated, then access to your personal account is also blocked. To restore, you must contact the Bank's support service and go through the identification procedure.

After confirmation, a message appears indicating the successful registration of your application and information about the completed transaction.

Mobile bank

Russian Standard clients - both individuals and businessmen - have access to a mobile bank. It allows you to carry out basic operations with accounts and cards using a smartphone or tablet. The mobile application connects with online banking and uses the same login data. It is available for any devices based on the latest iOS and Android versions.

Using the application, you can monitor the status of your accounts, make payments and transfers, set limits and carry out other operations. It also has a built-in online chat for communicating with the bank's support team. A separate application has been developed for mobile acquiring - it will help the smartphone interact with the mPOS terminal.

Internet banking functionality

Russian Standard develops its own Internet banking systems for individuals and legal entities. They are available to everyone who has issued a card at this bank, opened a current account or connected acquiring. Remote service services in RSB have all the necessary functionality for managing bank products.

For legal entities

Internet banking for legal entities in Russian Standard is divided into several parts:

- Correqts corporate is a classic Internet client for managing current accounts. Allows you to make payments, request statements, exchange documents with banks and perform other operations on the account

- OMS account - connected for clients who have registered for trade acquiring. Allows you to view information about payments and statistics on terminals, as well as configure the service

- MPOS and Alipay account - provided to those who have activated mobile acquiring or accepted payments through the Chinese payment system Alipay. The main functionality is the same as the previous office

- ECOMM and MIGS accounts are available to those who have connected Internet acquiring in Russian Standard. They also allow you to manage service settings and track payments received through the payment form

For individuals

For individuals, Russian Standard offers Internet banking RSB-Online. With it you can:

- Monitor the status of accounts and cards in RSB

- Pay taxes, communications, internet, housing and communal services and other expenses

- Transfer money between accounts and cards

- View statements and statistics on transactions

- Pay off debts on loans and credit cards

- Keep track of accumulated bonuses and special offers from partners

- Manage card settings and limits