Rosselkhozbank is a successful credit and financial organization that has been on the Russian market for about 20 years. Initially, the bank was created on the personal initiative of the President of the Russian Federation. The main goal was to serve and support the Russian agro-industrial sector.

Today Rosselkhozbank is one of the top ten companies specializing in providing financial services to all categories of citizens. Separately, we can highlight favorable offers for people of retirement age. Every Russian pensioner can open a deposit on favorable terms and thereby increase their accumulated savings.

General information about the pension deposit of Rosselkhozbank

The bank was formed in 2000 to provide assistance to the agricultural sector and agricultural territories of Russia.

Since then, it has been included in the list of systemically important financial institutions in the country. Deposits at Rosselkhozbank are presented for pensioners with a special line of programs with high rates and loyal processing conditions. In order to register a pension deposit at Rosselkhozbank in 2020, you will have to present to the manager at the branch a certificate or a special document from the Pension Fund on the assignment of an insurance pension. In some cases, it is allowed to open a deposit if there is a document on lifelong maintenance payments (relevant for judges).

You can conclude a deposit agreement without certificates and certificates. Now deposits in Rosselkhozbank have become more accessible to citizens who have reached retirement age. You can get by only with a passport even if there are less than 2 months left before the age limit.

It is important to remember an important fact that at Rosselkhozbank, deposits for pensioners today participate in the RF CER. This means that all savings of individuals, including deposits for pensioners, in the amount of up to 1.4 million rubles, including interest, are reliably protected and guaranteed for payment by the government.

Pensioners at Rosselkhozbank have access to an extensive range of banking products: relatively cheap loans, various plastic cards, deposits for individuals.

This may be a pensioner’s ID or other official paper from the Pension Fund of the Russian Federation, indicating the assignment or establishment of an insurance pension to a citizen.

Pensioners who have confirmed their status can open a special deposit.

In some situations, it is possible to open a pension deposit upon presentation by the client of a documented court decision assigning him a lifelong maintenance, paid monthly. Now you don’t have to present a pensioner’s ID, limiting yourself to providing a certificate from the Pension Fund.

A depositor who has already reached retirement age may not be provided with any paper at all certifying the regular accrual of a pension. As you know, men in the Russian Federation receive pensioner status at the age of 60, and women at the age of 55. It is not significant for the bank if the client still has a maximum of two months left before reaching these age marks.

Rosselkhozbank offers elderly people an interesting product - issuing a pension card, which allows them to regularly receive interest income accrued on the account balance. This is an interesting opportunity to earn additional income for an ordinary Russian pensioner.

Rosselkhozbank| Deposits of individuals 2020. Interest

Rosselkhozbank offers a very profitable line of deposits for individuals for 2020, interest is up to 8.45% per annum in rubles. Traditionally, the bank has a very large number of different programs. All deposit products of Rosselkhozbank can be divided into the following categories: with additional contributions and expense transactions, with capitalization and monthly withdrawal of interest, an investment program with increased rates, a promotional line, special preferential programs for pensioners, deposits in foreign currency, deposit products in within the package.

On average, the opening amount is small - from 500 to 50,000 rubles. The deposit term can be chosen in a different range - from short-term (31 days) to long-term (up to four years). The bank is quite stable and reliable, and enjoys well-deserved popularity among the Russian population. By the way, all deposits in Rosselkhozbank are insured by the state for a deposit amount of up to 1.4 million rubles (the bank has been a participant in the state deposit insurance system since March 14, 2005). Therefore, you can “sleep peacefully” - nothing threatens your savings.

It should be noted that in some programs, the terms of the agreement provide for surcharges to the rate when opening a deposit remotely.

Rosselkhozbank - what are the deposits for pensioners today?

In 2020, clients are offered a choice between 10 different investment options. At the same time, 2 types of deposits were created and prepared specifically for pensioners, which is confirmed by both their name and opening conditions. Potential investors will have to choose between:

- Pension income;

- Pension plus.

Both of these options have a lot of similar features, but some important nuances and provisions make them unique. Therefore, in order to choose one of the offers, you should familiarize yourself in advance with the interest rate, withdrawal procedure and existing restrictions. At the same time, it is necessary to focus on your own desires and needs and ensure that the decision made is fully consistent with the existing goals.

How to apply

New clients of a credit institution must come to the office with a passport to conclude an agreement. A pension certificate will be needed for those who are entitled to a pension not due to age, but for other reasons.

Operators of Rosselkhozbank will tell you about the current conditions for deposits and advise which one is suitable in your situation. It makes sense to open a pension plus only for crediting a pension. If you plan to save money, choose other deposits with a higher interest rate.

Existing clients of the Russian Agricultural Bank can open a deposit online. To do this, you need to go to your personal account, select a suitable deposit, agree to its terms and transfer the desired amount to your account.

Deposit percentage

The “Pension Plus” deposit in RosselkhozBank in 2020 brings a good income to citizens who trust and open an account. Calculating interest today is not difficult with the built-in calculator on the bank’s website. You just need to click on the yellow “Calculate return on deposits” button.

To find out what percentage you can get, select the currency (ruble) in the calculator. Next, indicate the amount you would like to invest. Then enter the due date. Move the slider to the right for the desired number of months.

395 days is approximately a little over 13 months, and 750 is about 24. Scroll down the page to see all the offers for the various programs. Find the product you need from the list. The table will indicate the rate, the possible maximum amount for storage, when interest is paid, as well as income at the end of the contract.

For example, for 100 thousand rubles. for a period of 395 days or 13 months you can get 7622 rubles 41 kopecks.

Conditions and rates for Rosselkhozbank deposits in 2020

The table below provides basic information on deposits offered by Rosselkhozbank in 2020 for retired Russian depositors. Some of these programs allow opening an account in foreign currency, but we will talk about this later in the article. Now let's look at the main characteristics for ruble deposits, their minimum validity period and maximum interest.

| Contribution | Conditions | |||||

| Required down payment, rub. | Minimum period, days | Maximum interest at the end of the deposit period | Replenishment | Partial withdrawal | Capitalization | |

| "Income pension" | 500 | 90 | 7% | No | No | No |

| "Pension income" | 500 | 395 | 5,6% | Yes | No | Yes |

| "Pension plus" | 500 | 395 | 5,5% | Yes | Yes | Yes |

| "Profitable" | 3000 | 31 | 6,5% | No | No | Yes |

| "Secure Future" | 50000 | 180 | 6,75% | No | No | No |

| "Investment" | 50000 | 180 | 7,1% | No | No | No |

| "Amur tiger" | 50000 | 395 | 5,6% | No | No | No |

| "Replenishable" | 3000 | 91 | 5,6% | Yes | No | Yes |

| "Save for a dream" | 3000 | 730 | 5,55% | Yes | No | Yes |

| "Comfortable" | 10000 | 91 | 5,2% | Yes | Yes | Yes |

| "Savings account" | 1 | 1 | 5,0% | Yes | Yes | No |

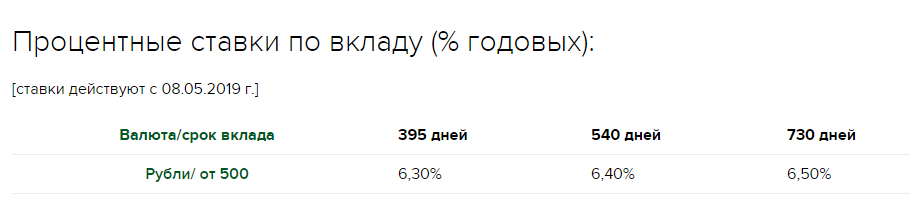

Pension income

Moving on to the study of current deposits, the first step is to consider in detail “Pension income”. For this type of investment, the financial institution offers:

- profit of 7.1% per annum;

- 3 types of agreement terms – 395, 540, 730 days;

- a minimum amount of 500 rubles;

- monthly payments;

- the client has the right to choose an account for receiving interest between a transfer using the details specified by him and crediting to a savings account;

- the maximum amount of savings does not exceed 2 million;

- replenishment is allowed, withdrawals are not allowed;

- in case of early closure, charges are made at the rate of 0.01% per annum;

- automatic renewal of the contract, unless the owner of the money has stated otherwise, occurs without changing the conditions.

Summing up

To get acquainted with all the beneficial offers on deposits for pensioners, just visit the official website. Having studied all the offers on deposits for pensioners at Rosselkhozbank, you can understand that the bonuses here today are the most profitable. If you need more accurate interest rates, you can use a calculator. The calculation on it is very simple. Once it becomes clear what percentage is being earned on a particular investment, you can make an informed choice.

How to register pension deposits at Rosselkhozbank in 2019

To take advantage of profitable deposit services, you should show the branch manager your pensioner ID and, of course, your passport. The “Pension Plus” deposit of Rosselkhozbank in 2020 or “Pension Income” can be concluded in favor of a third party. At the same time, his presence in the department is optional; the main thing for a pensioner is to know the name of the person in whose name such a “gift” is issued.

There are several options available to clients for making a deposit with RSHB:

- At a bank branch.

- Through ATMs.

- Remotely, through the Internet banking service.

The last two methods significantly save time, but are available to existing clients who have managed to open a card, current account or use a loan at the institution.

New clients must contact any office of RSHB JSC with a general civil passport, sign an application for opening a deposit account, and then top it up.

Profitability calculator

If you want to roughly calculate how much profit a deposit will bring, then use our calculator. You don’t have to provide any personal information here, just the duration and size of the contributions. But these are only rough estimates. For more accurate figures, you should contact the Russian Agricultural Bank and draw up a deposit agreement.

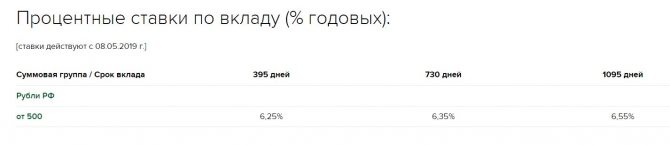

Pension plus

The deposit from the Russian Agricultural Bank is currently a profitable pension investment. The demand for a deposit is based on charges and the requirements for opening an account. Among the main conditions are:

- The deposit is opened upon presentation of an official ID or a special certificate from the Pension Fund regarding the transfer to the pension account.

- The general age for women is 55 years or more, and for men 60 years or older. An age group with a two-month period before the onset of these years is allowed.

- The deposit can be opened for a relative if he is a minor.

- The minimum investment is 500 rubles.

- Profitable capitalization of the process is carried out once a month.

- There is a replenishment from one ruble.

- The permissible maximum amount is 10 million rubles.

- Expenses can be made while maintaining the established rate and fully maintaining the pre-designated balance; it does not decrease.

- The amount of the balance that does not decrease is 500 rubles.

- If early termination is necessary, charges correspond to the rate of the “Demand” account.

- The deposit is subject to prolongation. It is carried out for the same time and on the same rules under which the deposit was opened.

The second type of deposits in Rosselkhozbank with interest in 207 for pensioners involves slightly different conditions. According to the main provisions of the agreement concluded between the financial institution and the depositor:

- The minimum amount on the account is 500 rubles;

- when opening a deposit with interest for 395 days, the rate will be 6.8%;

- when concluding an agreement for 730 days – 7%;

- profit is credited monthly to the deposit itself (capitalization);

- Deposits and withdrawals are allowed, provided the account is maintained within the permitted limits;

- the maximum permissible amount is 10 million;

- in case of early closure, interest is paid at the “demand deposit” rate, which is 0.01% per annum;

- The contract extension occurs automatically, preserving the current terms and conditions.

In a word, the main positive difference of this type is the ability to withdraw money, and the negative difference is lower interest rates.

Pensioners are an interesting category of citizens who can afford to work and receive a pension. This arrangement helps you live in abundance, help your children and grandchildren, and also make small savings. Why not put these savings at interest? As you know, money must work.

RSHB thinks about people of retirement age and invites them to use the “Pension Plus” or “Pension Income” program. It is easy to open one of the deposits at any bank branch by presenting a pension certificate or a certificate from the Pension Fund. The retirement age by law is 55 for women and 60 for men, with the exception of certain categories of citizens. You can also open a deposit for a minor child.

A deposit can only be opened at bank offices, subject to the condition of replenishing the deposit with a minimum amount.

Deposits for pensioners from Rosselkhozbank

Today Rosselkhozbank is practically the largest Russian bank serving the country's middle class population. It has a number of products that will be beneficial to individuals, and for pensioners it can also offer special deposits, loans and other programs on favorable terms.

Today there are new offers to Rosselkhozbank clients on deposits, and old programs are also in effect on acceptable terms. For individuals of retirement age, the bank can offer one of the special programs for this category of citizens, but whether the pensioner wants to take advantage of this offer or choose another deposit on general terms is his own business.

Rosselkhozbank offers the following types of deposits to pensioners on standard or preferential terms (everything will depend on the chosen offer):

- Pension income.

- Pension plus.

- European.

- Profitable.

- Investment.

- Amur tiger.

- Refillable.

- Save up for your dream.

- Comfortable.

- Poste restante.

The conditions of Rosselkhozbank deposits will differ in interest rates, first of all, which is most important to people, but also in additional opportunities - extension, replenishment, partial withdrawal, early closure, etc. A pensioner will be able to choose the most profitable deposit only after examining in detail all the conditions of banking products (interest, opportunities).

Pension income

Rosselkhozbank will open “Pension income” only to pensioners - women over 55 years old, men over 60 years old, with a pension certificate or a certificate from the Pension Fund of the Russian Federation. The deposit is opened exclusively in rubles and has the following conditions:

- Minimum investment – 500 rubles.

- The maximum amount of funds stored is 2 million.

- A pensioner can open an account for any period of time - 395, 540, 730 days.

- Replenishment is optional at any time and for any amount.

- Interest is added monthly to the deposit or transferred to the card - all at the request of the pensioner.

- A person receiving a disability pension or any other state pension can also open it if there is a corresponding certificate from the Pension Fund of the Russian Federation, so even in the name of a minor child a deposit can be opened with Rosselkhozbank under this program.

- The interest rate does not depend on the size of the funds stored or the validity period and is stable at 5.9%.

- The deposit account is automatically renewed under the same conditions upon expiration of its validity, if the pensioner does not wish to close it or change the conditions.

Pension plus

Pension Plus has almost the same conditions for pensioners as Pension Income, but it also has differences:

- The maximum contribution is 10 million.

- The deposit has a minimum balance of 500 rubles. and if it is observed, the pensioner can use expense transactions without reducing the rate.

The interest rate is also 5.9% and all the conditions of the previous deposit are met here. If the client wishes to close the deposit account earlier than the established time, then the rate for the remaining period will be recalculated at the “Demand” rate; this rule applies to all Rosselkhozbank deposits, unless otherwise specified.

European

This is a new offer from Rosselkhozbank, available to all individuals and pensioners on equal terms. Rosselkhozbank offers not only ruble deposits, as was the case with those described above, but also foreign currency deposits. The European one is exactly like this, and it can be opened exclusively in euros. The deposit has the following conditions:

- Opened only in the name of the depositor.

- Opening is carried out for 2 or 3 years.

- The minimum investment is 1000 euros.

- You can transfer money non-cash remotely, or open it at a bank and pay at the cashier.

- You are allowed to invest an unlimited amount of funds.

- You cannot top up your deposit.

- There is no automatic renewal.

- Interest is credited to the account at the end of the validity period.

Using a European deposit from Rosselkhozbank, a pensioner or other investor can receive a good income. The interest rate will depend on the term and method of opening:

| Opening a deposit in excess of 1000 euros | 730 days | 1095 days |

| At the Rosselkhozbank branch | 0,10% | 0,30% |

| Remotely through your personal account | 0,15% | 0,35% |

Of all similar offers from other banks, European wins in terms of accrued interest; other banking organizations offer only 0.01% per annum on deposits in euros.

Profitable

If there are any profitable offers for individuals on deposits in addition to special programs, then the first place after them is occupied by the “Profitable” deposit. It is very easy to open and use, and has a number of advantages compared to other offers from Rosselkhozbank. Its conditions are as follows:

- Deposits are allowed to be opened in rubles or dollars.

- The minimum amount to open is 3,000 rubles or 50 dollars.

- There is no maximum limit.

- Validity periods vary - from 1 month to 4 years.

- Replenishment is not provided.

- It is allowed to open a deposit for a third party.

- Auto-renewal is allowed several times.

- Interest is credited to the account monthly or at the end of the term; it can be added to the deposit or sent to the card.

Interest rates on the Income Deposit vary greatly depending on many parameters and all information is given in the tables.

If a bank client wishes to receive interest at the end of the deposit period, the rate will be as follows.

Interest rate depending on the validity period (for remote opening/through the Rosselkhozbank office).

| From 3000 rub. | $50 – $15,000 | $15,000-$25,000 | Over $25,000 | |

| 31 days | 6,05%/6,0% | 0,10%/0,05% | 0,15%/0,10% | 0,20%/0,15% |

| 91 days | 6,10%/6,05% | 0,50%/0,45% | 0,55%/0,50% | 0,60%/0,55% |

| 180 days | 6,15%/6,10% | 1,10%/1,05% | 1,15%/1,10% | 1,20%/1,15% |

| 270 days | 6,20%/6,15% | 1,10%/1,05% | 1,15%/1,10% | 1,20%/1,15% |

| 395 – 455 days | 6,35%/6,30% | 1,90%/1,85% | 1,95%/1,90% | 2,00%/1,95% |

| 540 days | 6,50%/6,45% | 2,05%/2,0% | 2,10%/2,05% | 2,15%/2,10% |

| 730 days | 6,70%/6,65% | 2,15%/2,10% | 2,20%/2,15% | 2,25%/2,20% |

| 910 – 1460 days | 6,70%/6,65% | 2,35%/2,30% | 2,40%/2,35% | 2,45%/2,40% |

If the pensioner wishes the interest to be capitalized monthly, then the deposit rates will change slightly:

| From 3000 rub. | $50 – $15,000 | $15,000-$25,000 | Over $25,000 | |

| 31 days | 6,05%/6,0% | 0,10%/0,05% | 0,15%/0,10% | 0,20%/0,15% |

| 91 days | 6,05%/6,0% | 0,50%/0,45% | 0,55%/0,50% | 0,60%/0,55% |

| 180 days | 6,05%/6,0% | 1,10%/1,05% | 1,15%/1,10% | 1,20%/1,15% |

| 270 days | 6,10%/6,05% | 1,10%/1,05% | 1,15%/1,10% | 1,20%/1,15% |

| 395 – 455 days | 6,15%/6,10% | 1,85%/1,80% | 1,90%/1,85% | 1,95%/1,90% |

| 540 days | 6,20%/6,15% | 2,0%/1,95% | 2,05%/2,0% | 2,10%/2,05% |

| 730 days | 6,30%/6,25% | 2,10%/2,05% | 2,15%/2,10% | 2,20%/2,15% |

| 910 days | 6,20%/6,15% | 2,25%/2,20% | 2,30%/2,25% | 2,35%/2,30% |

| 1095 days | 6,10%/6,05% | 2,25%/2,20% | 2,30%/2,25% | 2,35%/2,30% |

| 1460 days | 5,95%/5,9% | 2,25%/2,20% | 2,30%/2,25% | 2,35%/2,30% |

Investment

This is a rather unusual offer from Rosselkhozbank, and it differs from other deposits. To open a deposit, a depositor must purchase shares from investment funds managed by RSHB Asset Management LLC. A deposit account from a bank has additional conditions:

- The deposit amount is equal to the amount of shares.

- The deposit is opened on the day the shares are purchased.

- Rosselkhozbank pays interest upon expiration of the agreement.

- The minimum investment is 50,000 rubles or $1,000, and the maximum amount is not limited.

- Opens for 180 and 365 days.

- The deposit cannot be renewed automatically.

Interest rates for this banking product will be as follows:

| Sum | Bid (%) | |

| 180 days | 365 days | |

| Rubles | ||

| More than 50,000 | 7,10% | 7,30% |

| Dollars | ||

| 1 000 – 25 000 | 1,60% | 2,40%/2,50% |

| More than 25,000 | 1,70% | |

Amur tiger

For pensioners who initially have a considerable amount of money, this product from Rosselkhozbank represents a good opportunity for additional income. The terms of the ruble deposit are very good:

- The minimum contribution is 50,000.

- The maximum amount is unlimited.

- Opens only to the depositor.

- Validity period: 395, 540, 730 days.

- Interest is credited to the card monthly.

- Additional funds cannot be deposited.

- Automatic renewal is possible.

The interest depends only on the duration of the contract and is presented in the table:

| Amount/Term | 395 days | 540 days | 730 days |

| More than 50,000 | 6,15% | 6,20% | 6,30% |

Refillable

For people, this deposit is quite beneficial in that Rosselkhozbank gives the opportunity to additionally deposit funds throughout the entire period of the deposit, which helps reduce income and does not immediately hit the wallet. A person can save a small part from his pension and make a profit on it. The general terms and conditions of the product are:

- A deposit account is opened for a minimum of 3,000 rubles or 50 dollars, the same amounts are the minimum for additional top-ups.

- The maximum investment is 10,000,000 rubles or $300,000.

- Interest is capitalized monthly or sent to the card.

- Automatic renewal is possible no more than 3 times (up to 91 days) and 2 times (all other time frames).

Interest on the Replenishable Deposit is presented in the table.

| Amount/Validity (days) | 91 | 180 | 270 | 395 | 455 | 540 | 730 | 910 | 1095 |

| Rubles | |||||||||

| 3 000 – 700 000 | 5,75% | 5,65% | 5,35% | 5,10% | 5,00% | 4,95% | 4,80% | 4,80% | 4,70% |

| 700 000 – 10 000 000 | 5,80% | 5,70% | 5,40% | 5,15% | 5,05% | 5,0% | 4,85% | 4,85% | 4,75% |

| Dollars | |||||||||

| 50 – 5 000 | 0,25% | 0,85% | 0,85% | 1,60% | 1,60% | 1,70% | 1,80% | 1,95% | 1,95% |

| 5 000 – 15 000 | 0,30% | 0,90% | 0,90% | 1,65% | 1,65% | 1,75% | 1,85% | 2,0% | 2,0% |

| 15 000 – 25 000 | 0,35% | 0,95% | 0,95% | 1,70% | 1,70% | 1,80% | 1,90% | 2,05% | 2,05% |

| 25 000 – 300 000 | 0,40% | 1,0% | 1,0% | 1,75% | 1,75% | 1,85% | 1,95% | 2,10% | 2,10% |

If you open a deposit account remotely, the interest rate for any parameter will be 0.05% higher, which brings more income to existing clients of Rosselkhozbank.

Save up for your dream

This is a rather advantageous offer from Rosselkhozbank, allowing a pensioner to gradually raise money for a specific purpose if the initial investment was small. The conditions are:

- 3000 rubles or 100 dollars are the minimum amounts for opening and replenishing an account.

- You can invest a maximum of 10 million rubles. or 300 thousand dollars.

- Replenishment is allowed at any time.

- Interest is capitalized monthly.

Interest rates are fixed for the entire period of the agreement:

| Sum | 730 days |

| From 3,000 rub. | 4,90% |

| From 100 dollars | 2,0% |

Comfortable

This Rosselkhozbank deposit account can bring a person a good profit, but it is only necessary to take into account some of its features:

- 10,000 rubles or 150 dollars is the minimum amount to open.

- The maximum you can deposit is up to 10 million rubles. or 300 thousand dollars.

- It is allowed to top up in amounts over 5,000 rubles and 100 dollars.

- The pensioner must choose the size of the minimum balance independently.

- Interest is capitalized monthly.

For ruble deposits the rates are as follows:

| Sum | Validity period (days) | |

| 91 – 455 days | 540 – 1095 days | |

| 10 – 700 thousand | 4,25% | 4,15% |

| More than 700 thousand | 4,30% | 4,20% |

For a foreign currency deposit the numbers are different:

| Sum | Validity period (days) | ||||

| 91 | 180 — 270 | 395 – 540 | 730 | 910 – 1095 | |

| 150 – 5,000 dollars. | 0,01% | 0,20% | 0,65% | 0,75% | 0,95% |

| $5,000 – $15,000 | 0,05% | 0,25% | 0,70% | 0,80% | 1% |

| $15,000 – $25,000 | 0,10% | 0,30% | 0,75% | 0,85% | 1,05% |

| Over $25,000 | 0,15% | 0,35% | 0,80% | 0,90% | 1,10% |

When opening ruble and foreign currency accounts remotely, the rate will be 0.05% higher.

Poste restante

This is a practically unprofitable deposit account, on which the rate will be equal to 0.01% for any currency and amount. No funds are placed on such a deposit, but the interest on early closure of other deposit accounts is recalculated at this rate. This deposit can be replenished and withdrawn, but there is no profit from it.

Video

Additional opportunities for older investors

At RSHB JSC, pensioners can take advantage of additional tools for using deposits:

- Open a power of attorney in the name of a third party

As mentioned above, even during registration you can request to make a deposit for a relative or child, but the pensioner has this right for the entire duration of the deposit. The document can be drawn up either at the RSHB branch or at a notary.

- Leave a testamentary disposition

The agreement is concluded for the branch of the bank in favor of one or more individuals. This will allow a person to pass on the contribution to inheritance. The signed document does not limit the pensioner’s right to manage his money in the account. If desired, a testamentary disposition can easily be canceled or supplemented with several more accounts opened in the department.

What deposits can pensioners open at Rosselkhozbank

Rosselkhozbank offers a wide range of deposit programs for the population. A pensioner has the opportunity to open any of the bank deposits on a general basis. Two deposits have special conditions: “Pension income” and “Pension plus”. The deposits are similar.

Deposit with replenishment function and no partial withdrawals. It is possible to make a deposit in rubles.

Deposit characteristics:

- The minimum for opening a deposit is 500 rubles, the maximum is 2 million.

- There are 3 deposit terms: 395, 540 and 730 days.

- Contributions to the deposit can be made during its entire validity period.

- The minimum contribution amount is 1 ruble.

- The extension of the deposit occurs automatically, under the same conditions that will apply during the extension at the bank.

- Interest is paid every month or at the end of the deposit period at the request of the client. Interest can be capitalized by adding it to the total amount of money invested, or transferred to a separate account.

- If you wish to terminate the contract early, interest is paid according to the rules of the “On Demand” deposit in ruble currency.

- The deposit can be opened in the name of a minor.

Conditions of the “Pension Income” deposit

This type of deposit is partially similar to “Pension income”. The minimum amount, replenishment conditions, auto-renewal, early termination, the ability to open a deposit in the name of a child under the same conditions as the Pension Income program.

The maximum deposit amount is 10 million rubles. Interest is added monthly to the deposit amount. “Pension plus” can be issued for 395, 730 and 1095 days. Partial withdrawals are possible provided the minimum balance is maintained. Otherwise, interest on the deposit is lost.

Conditions of the “Pension Plus” deposit

Opening an account will not cause any difficulties, since the main actions that the future investor has to perform do not contain anything special and almost completely coincide with what needs to be done when drawing up similar agreements in other banks. But there is still one important difference today.

Otherwise, nothing unusual or unexpected will happen. With the package collected, you will have to visit the nearest branch and write an application for opening. After that, all you have to do is deposit the initial amount and wait to receive a profit. The percentage you can claim was indicated above.

It is important to note that it is necessary to read the agreement being concluded very carefully, since the procedure and quality of receiving banking services depends on it. Don’t be shy to ask questions and clarify unclear nuances, because the job of managers is precisely to help clients.

Other contributions

In addition to targeted deposits for pensioners, older people in 2021 can take advantage of other deposits for individuals. Rosselkhozbank has many programs implemented on favorable terms.

- The “Profitable” deposit provides a rate of up to 5.6% per year even when opened for an amount of 3,000 rubles or more. You can place funds online through a mobile application or your personal account on the organization’s website. Profit, at the request of the client, can be transferred to his account monthly, or capitalized. When opening a deposit of 50,000 rubles or more, the client is issued a card with a favorable tariff plan.

- The “Reliable Future” deposit is one of the most profitable. The interest rate ranges from 5.8 to 6.2%. The minimum contribution should not be less than 50,000 rubles. There are no restrictions on the maximum amount. The contract period is from 180 to 395 days.

- The “investment” deposit is made for a period of 395 to 730 days. The minimum contribution is 50,000 rubles or 1,000 dollars. The program does not provide for any expenditure or replenishment of funds. Otherwise, the agreement with the bank will be terminated, and the profit will be calculated at a minimum rate of 0.01%. The interest rate is 6.4%.

- The “Save for a Dream” deposit is placed at 4.75%. The minimum amount for opening a deposit is 3,000 rubles. The contract period is up to 730 days, depending on the client’s wishes. Interest is capitalized every month.

Results

Rosselkhozbank has programs on various conditions, among which you can find something suitable. An elderly person can use both a deposit for pensioners and a deposit for individuals. After studying the conditions, you will be able to choose the program that is more profitable or more suitable.

Deposit "Pension Plus" Rosselkhozbank: conditions

RSBH has developed special conditions that attract many investors:

- Currency – Russian ruble.

- The down payment can be from 500 rubles inclusive.

- It is possible to top up your deposit from 1 ruble. This can be done at any time, regardless of the amount and period.

- The deposit can be opened for 395 and 730 days.

- Accordingly, the annual percentage will be 6.8 or 7%.

- The maximum amount subject to annual calculation is 10 million rubles.

- Income is accrued monthly.

- There is capitalization.

- Payment of % at the request of the client.

- Possibility to withdraw money from the account up to a minimum threshold of 500 rubles.

- There is auto-renewal. The deposit is extended under the same conditions.

- In case of early termination of the contract (withdrawal), the bank recalculates income at a reduced rate on demand.

- There is no rate increase.

- There is insurance on the deposit.

How can a pensioner choose a deposit?

The income for these programs is almost the same. When choosing a deposit, you should pay attention to other conditions. If you plan to withdraw interest every month, you should choose “Pension income”. If it is necessary to make a partial withdrawal from the deposit, use “Pension Plus”.

Let's consider the income for each deposit with an investment of 500 thousand rubles for 395 days.

| Name of contribution | Pension plus | Pension income |

| Profitability, rubles | 34 857,21 | 35 144,90 |

| % | 6,25 | 6,3 |

With the same investment for the same period, the return will be different. The calculation for the “Pension Plus” deposit is indicated with the condition of monthly capitalization of interest.

If there is no need to replenish and withdraw money, you need to pay attention to other deposits from the RSHB deposit line with higher rates, for example, the “Profitable” deposit.