From April 1, 2020, Russians had their social pensions, as well as state pensions, indexed by 6.1%. The amount of indexation is determined annually by the forecast index for the growth of the cost of living for the previous year. In 2020, social pensions increased by 2%, and in 2018 by 2.9%.

The head of the Ministry of Labor Anton Kotyakov said that in 2020 indexation will affect almost 4 million pensioners, of whom about 3.3 million people receive social pensions.

Laughter, not retirement. Why can a working pensioner be deprived of social benefits? More details

Increase in social pensions from April 1, 2020

Social pensions increase annually from April 1 in accordance with the provisions of Article 25 of Law No. 166-FZ of December 15, 2001 “On State Pension Provision in the Russian Federation.” The increase is made by the same percentage for all social pension recipients. This coefficient is approved by the Government of the Russian Federation, taking into account the growth rate of the living wage of a pensioner over the past year.

That is, in 2020, social pensions should be increased by the same percentage as the cost of living for pensioners increased in 2020 compared to 2018.

- will increase by 6.1% from April 1, 2020 . This is exactly how much the PMP amount increased in 2020.

- As a result of indexation by 6.1%, the average social pension by the end of 2020 will be 9925.35 rubles . For comparison: at the end of 2020, the average pension benefit is projected at RUB 9,266.

9925.35 rub. is the average amount of payment for all types of social security. What will be the size of the pension after indexation, depending on the category to which the pensioner belongs, is indicated in the table later in the article.

Indexation of social pensions

Social pension payments are received by vulnerable segments of the population, including disabled people and children left without the care of one or two parents. In this regard, the state is obliged to take care of increasing payments, especially since the majority of citizens receive only the required minimum. The increase in social pensions is included in the budget of the Pension Fund. Unfortunately, their indexation percentage is no different from other types of pensions. As mentioned above, it is 2.9%. If we take into account the average value of the social pension in the country, which is 8,726 rubles, the increase will be insignificant, a little more than 200 rubles. For many recipients of social pensions, it will be imperceptible.

If we study the issue of increasing social pensions in more detail, it becomes clear that the average increase will be for:

- Disabled children – 378 rubles.

- Disabled children - 382 rubles.

- Children who have lost their parents - 125 rubles.

Payments will also increase for people who are dependent on incapacitated relatives. The percentage increase will also be 2.9. Citizens who have been assigned a certain disability group, in addition to an increase in social pension, can count on indexation of their daily allowance. The amount of this payment is small, but it is also a measure of state support from the state. The pensioner has the right to receive it in kind or in cash. In this case, indexation is carried out annually. The cash equivalent allows for a slight improvement in the financial situation of disabled people.

Who will have their pensions increased from April 1?

According to Art. 25 of Law No. 166-FZ, indexation from April 1, 2020 by 6.1% will affect social pensions , namely ensuring:

- For old age disabled citizens:

- women who have reached 65 years of age and men who have reached 70 (taking into account the increase in the retirement age from 2020), who do not have enough length of service or pension points required to apply for an old-age insurance pension;

- small peoples of the North aged 50 and 55 (women and men, respectively);

- For disability:

- disabled children;

- disabled people since childhood;

- disabled people of groups 1, 2 and 3;

- In case of loss of a breadwinner:

- children under 18 years of age or full-time students under 23 years of age who have lost one or both parents or a single mother;

- children under 18 years of age or full-time students under 23 whose parents are unknown.

Photo pixabay.com

Simultaneously with the indexation of the social pension, from April 1, 2020, state pension payments for the following citizens:

- WWII participants;

- awarded with the badge “Resident of besieged Leningrad”;

- flight test personnel;

- military personnel who served under conscription, as well as members of their families;

- victims of man-made or radiation disasters, as well as members of their families.

Military pensioners who receive various types of supplements to their pension, calculated from the amount of the social old-age pension, will also receive an increase . This applies to allowances for dependents, for group 1 disability, upon reaching 80 years of age, for disability due to military injury, additional payments to WWII participants and combat veterans. The amount of such additional payments to military pensioners from April 1, 2020 will be determined taking into account the indexed value of the old-age social pension.

Who is assigned the social pension and how is it recalculated?

Article No. 4 of the pension law defines the full list of citizens who are entitled to receive one or another type of payment. In addition to the persons described above, their number also includes the category of disabled people.

First of all, these are the following citizens:

- Northern peoples, provided that men reach 60 years of age and women reach 55 years of age and have not yet worked enough to receive an insurance pension;

- Citizens who received the status of a disabled child (and disabled children), as well as disabled people of groups 1-3;

- A single parent or children who have not yet turned 18 years of age, and their parents have died (subject to full-time study at any educational institution until they reach 23 years of age).

The size of the social pension at the current moment in 2020 is 5283.84 rubles.

Table of fixed payments for disability insurance pension in 2020

| Category of pension recipients | Fixed payments taking into account increases, rubles per month | |||

| Number of dependents | No | 1 | 2 | 3 |

| Disabled people of group I | 11 372,5 | 13 267,92 | 15 163,34 | 17 058,76 |

| Disabled people of group II | 5 686,25 | 7 581,67 | 9 477,09 | 11 372,51 |

| Disabled people of group III | 2 843,13 | 4 738,55 | 6 633,97 | 8 529,39 |

| Citizens living in the Far North and equivalent areas | The fixed payment to the disability insurance pension and increases to it are increased by the corresponding regional coefficient | |||

| Citizens who have insurance experience of at least 25/20 years for men/women and have worked in the Far North for at least ... calendar years | ||||

| Disabled group I, 15 years old | 17 058,75 | 19 901,88 | 22 745,01 | 25 588,14 |

| Disabled group II, 15 years old | 8 529,38 | 11 372,51 | 14 215,64 | 17 058,77 |

| Disabled group III, 15 years old | 4 264,7 | 7 107,83 | 9 950,96 | 12 794,09 |

| Group I disabled people, 20 years old | 14 784,25 | 17 248,30 | 19 712,35 | 22 176,40 |

| Disabled group II, 20 years old | 7 392,13 | 9 856,18 | 12 320,23 | 14 784,28 |

| Disabled group III, 20 years old | 3 696,07 | 6 160,12 | 8 624,17 | 11 088,22 |

As noted by the Ministry of Labor, increasing pensions from April 1 will cost the country approximately 1 billion rubles per month, which will amount to 10 billion by the end of the year. Not only the above-mentioned citizens will feel the increase, it will also affect other special groups:

- Military personnel taking part in the Second World War;

- Citizens who received the Leningrad siege award;

- People affected by various kinds of man-made disasters (Chernobyl, etc.);

- Cosmonauts and test pilots.

Payments will be increased to military families left without a breadwinner and disabled military personnel. Citizens who have received awards for services to the country will receive the most. Experts say that although the increase is insignificant and less than inflation, the adopted indexation coefficient fully complies with legal standards. This means that no laws are broken.

The size of the social pension in 2020

The amount of social pension in the period from January 1 to March 31, 2020 will be the same as in 2019. Payments will be indexed only from April 1 (they will increase by 6.1%). The table of social pension amounts depending on the type of assigned security is presented below:

| Type of security | Pensioner category | Payment amount, in rub. | |

| until 31.03.2020 | from 01.04.2020 | ||

| By old age | Small peoples of the North | 5283,85 | 5606,17 |

| Disabled citizens over 65/70 years of age | |||

| By disability | Disabled children | 12681,09 | 13454,64 |

| Disabled people from childhood, 1st group | |||

| Disabled people of 1st group | 10567,73 | 11212,36 | |

| Disabled people since childhood, 2 groups | |||

| Disabled people 2nd group | 5283,85 | 5606,17 | |

| Disabled people of 3 groups | 4491,30 | 4765,27 | |

| For the loss of a breadwinner | Lost one parent | 5283,85 | 5606,17 |

| Those who have lost a single mother, both parents, and those whose parents are unknown | 10567,73 | 11212,36 | |

The total financial support of a pensioner cannot be less than the minimum subsistence level established in the region of his residence (see the table of the minimum pension for the constituent entities of the Russian Federation for 2020). If the assigned payment is lower than the regional PMP, the pensioner can apply for an additional payment up to the “minimum wage”.

How much will state pension benefits increase?

State welfare payments will also increase in 2020. They will also be increased from April 1, since according to the law their amount is set as a percentage of the old-age social pension. From April 1, 2020, the calculation of these payments will be made taking into account the indexed old age security - 5606.17 rubles .

For example, for military personnel, the state disability pension received due to military injury, from April 1, 2020, will be:

- 16,818.51 rubles - for 1st disability group (since the payment is calculated as 300% of the old-age insurance pension);

- 14015.43 rubles - for disability group 2 (250% respectively);

- 9810.80 rub. — for disability group 3 (175%).

The amounts of government payments for other types of security listed in Art. 15, 16, 17 and 17.2 of Law No. 166-FZ. This applies to WWII participants, blockade survivors, Chernobyl survivors, flight test personnel, and so on.

Revelations from the Pension Fund: Seven ways to increase your pension

Indexation of insurance pensions for non-working pensioners is provided at the level of 6.3%, and social pensions – at the level of 2.6%. The average annual old-age insurance pension for non-working pensioners in 2021 will be 17,443 rubles. In total, funds in the amount of 7 trillion 800 billion rubles are planned to finance the payment of insurance pensions next year. The figure is large, no one argues, but where are the average pensions of 25 thousand rubles promised by Strategy 2020?

“Now we are hearing more promises coming from the same Ministry of Labor and the Ministry of Finance,” notes economist Alexey Lapushkin. – These and similar organizations have been carrying out pension reform for 18 years now, and we see the result with the naked eye in our lives. Or maybe we should change those who promise before we change anything? I have argued, I maintain and will fight to the last drop that the existing economic policy pursued by the systemic liberals from our government has suffered complete bankruptcy. And in the current situation with falling oil prices and self-isolation measures, it is simply incompatible with the life of the state.

The Ministry of Economic Development predicts a 3.9% drop in GDP for this year. And this is an even improved forecast. One might ask a rhetorical question: is the patient more likely to be alive than dead? But the First Russian TV channel is about facts. But the facts are that the health of the Pension Fund depends on the normal functioning of the economy. And here it is not surprising that the Pension Fund’s budget deficit in 2021 will break a five-year record.

If GDP falls by 3.5% in 2020, the income of the Pension Fund will fall even more, says political scientist, deputy chairman of VTsIOM Joseph Diskin. – And expenses will only increase due to the indexation of pensions, which is provided for by the amendment to the Constitution, and the growth in the number of pensioners.

That is, the situation is clear. And the answer to the question is obvious: can pensions, in principle, be increased?

“In this situation, for pensions to start growing sharply, one single miraculous event must happen,” says economist Anton Lyubich optimistically. – Our economy must grow sharply and at the same time the number of employed must increase sharply. This is an absolutely fantastic scenario. Under these conditions, there are no objective prerequisites for the growth of pensions in the system that we currently have.

It is obvious that the system needs to be changed. Money for payments to pensioners, of whom there are more and more, needs to be taken somewhere. But where? Many experts interviewed by First Russian agreed that we need to start, paradoxically, with the liquidation of the Pension Fund, which in essence is not a fund - just the name.

The first thing that needs to be done is to liquidate the Pension Fund, says economist Alexey Lapushkin. – The state should pay pensions to citizens directly. Current technologies more than allow this, because the Pension Fund is luxurious. In the center of every subject of the Russian Federation, the two most luxurious buildings are Mezhregiongaz and the Pension Fund.

Economist Mikhail Delyagin also agrees that the Pension Fund needs to be liquidated.

“We need to liquidate the Pension Fund as a center of theft - the Accounts Chamber proved this to us,” says the expert. – But even if we abstract from Kudrin’s research, the Pension Fund is an absolutely meaningless bureaucratic superstructure.

Economist Mikhail Delyagin agrees that the Pension Fund needs to be liquidated and the normal pension system – the Soviet one – restored. Photo: Sofya Sandurskaya / AGN “Moscow”

There is no money in the Pension Fund; the stabilization fund, which was intended to pay pensioners, no longer exists. But there is a National Welfare Fund, which currently contains about 11 trillion rubles.

“Previously, a stabilization fund was formed, which was intended to stabilize the pension system,” recalls economist Anton Lyubich. “Then this money was removed from being tied to the pension and thrown into the National Welfare Fund. Part of this money needs to be returned to the pension system and, at the expense of it, pensions for working pensioners can be increased - then it will be possible to increase the size of the pension to the notorious 20-25 thousand rubles per month.

Supporters of the opposite point of view will say: you can’t waste money. But what does it mean to “eat up”? Pensioners or their grandchildren will spend the money, thereby stimulating the economy. In professional language this is called “consumer demand”; it triggers the entire mechanism, without which the huge economic machine will not spin. But money from the National Welfare Fund and the liquidation of the Pension Fund alone will not solve the problem. How to decide? Here opinions differ. Mikhail Delyagin – for a return to the classical solidarity-distribution model.

“We need to restore a normal pension system – the Soviet pension system,” the economist is sure. – Practice has shown that the most effective and beneficial system for society is the solidary distribution system, and everything else is “carrots” that are shown to people in order to rob them.

The Pension Fund advises citizens not to rush into retirement. Photo: Akimov Igor / Shutterstock.com

Anton Lyubich has different views. He believes that we need to end the solidarity-distribution system and move on to a funded system. But not the one that existed and disappeared in 2014 along with the freezing of funds, but another one – tied to the individual accounts of citizens.

It is important that the money in the pension account belongs to the citizen by right of ownership, it is his personal individual account and no one besides him can withdraw this money from the individual account, says Anton Lyubich. – So that these are not points, not units of account, but real rubles. And when you are offered an account with points that can be recalculated into an arbitrary number of rubles by government decree - well, who will play such thimbles in the 21st century?

As for the scores, all the experts are unanimous: this is a stillborn child, like much of what the financial and economic authorities have done over the past quarter century. But no one is planning to cancel the points yet; instead, they are distributing advice to citizens on how to independently increase their pension. The Pension Fund website talks about seven ways. This is a white salary, official work, official income, length of service, monitoring the state of your pension account, participation in voluntary pension programs... And one more point sounds like this: “Don’t rush to retire.”

“Every extra year worked after retirement age increases the size of the future pension,” says the recommendations of the Russian Pension Fund. – If after reaching retirement age you postpone retirement, it will be assigned in an increased amount. For example, if you apply for an insurance pension five years after the right to it arises, the amount of payment will be approximately 40% more.”

For experts, the last ambiguous point only evokes a skeptical smile.

“I am skeptical about this,” economist Anton Lyubich shares his doubts. “There are no guarantees that in five years these obligations will be fulfilled on a scale of “40% more.” They will simply replay the conditions again - that’s all. Our people, frankly, are already accustomed to such deception on the part of the state.

Well, one more piece of advice would be useful, the eighth: “Don’t rely on a state pension, but save money yourself.” A bank deposit, an individual investment account, a brokerage account, a three-liter jar is better.” Of course, this advice is addressed to those who have something to save.

Will there be an increase in subsequent years?

Annual increases in social and state pensions will continue in the future. The explanatory note to the draft law on the Pension Fund budget for 2020 contains preliminary data on indexation in 2021 and 2022. According to forecasts of the Ministry of Economic Development, changes will occur according to the following scheme:

- In 2021, indexation will be carried out by 0.7% due to an increase in the cost of living of a pensioner to 9,067 rubles.

- In 2022, they plan to index by 3.4% , since according to forecasts the PMP will increase to 9,374 rubles.

As new data becomes available, forecasts will be adjusted. Therefore, it is likely that when forming the budget for 2021, other indexation percentages will be included.

5 043

Indexation of pensions for guardians in July 2020

According to the Pension Fund of the Russian Federation, starting from July 1, 2020, pensioners who are guardians or trustees of minor children will begin to receive an indexed insurance pension. This became possible thanks to the adopted amendment to the federal law on compulsory pension insurance.

“Previously, pensioners who were guardians received a remuneration of about 3-4 thousand rubles, but because of this they fell into the category of working pensioners. In this regard, their pensions were not indexed, - this is how State Duma deputy Sergei Neverov explained the need to amend the legislation. “Now the indexation of pensions is being restored for retired guardians who receive “salaries” for their work as guardians.”

According to preliminary estimates of the Pension Fund of the Russian Federation, 45.8 thousand foster parents - pensioners will receive increased payments as a result of the approved changes.

Comments (17)

Showing 17 of 17

- Andrey 10/09/2019 at 08:44

Here they write in the table that the social pension is 4491 rubles. for group 3. Why am I only paid 2,038 rubles extra?answer

- admin 09.10.2019 at 09:07

Hello Andrei. The social pension for disabled people of group 3 is really more than 4 thousand rubles. And the 2 thousand you are writing about are most likely EDV for disability group 3.

answer

- Konstantin 03/22/2020 at 08:04

Barely disabled 3 gr 2.228 rub.

answer

For disabled people 3 gr. minimum pension, because they can work. I have 3 gr. indefinitely, but there are epilepsy attacks. And where should I go, and who will take it? I’ve been unemployed for five years, no one cares how I live on this pension. 50-60% goes to pay for something + on medications. So what remains? Buy inexpensive groceries or some clothes or shoes. There should be additional payments for children and for my husband, but I myself cannot collect all the documents. And why collect them? After all, according to their requests to the Pension Fund, the Civil Registry Office, etc. All documents will be provided quickly.

answer

Why have I been disabled since childhood, group 2, but receive a pension as a disabled person of group 2?

answer

Who calculated these pensions anyway? Have they tried to live on this money themselves? I am disabled 3 degrees. indefinitely. I receive medicines and a pension of 7600. Of these, rent + communications + electricity + water = 3500-4000. And the rest is for food and clothes. They don’t hire me, and I can’t do much. We practically cannot buy anything, only inexpensive products. And if you bought clothes or shoes, you will be hungry! This is my opinion, I’ve been living this way for several years and I can’t change anything. Maybe I don’t know something.

answer

I am retired, 50 years of work experience, a 3rd group disabled person and a labor veteran. I only receive 1,900 rubles towards my pension. Why so few?

answer

Hello. My name is Maxim, I have been disabled since childhood (cerebral palsy), I live in the Krasnoyarsk Territory. I read on one of the sites that from February 1 the pension will be increased by 3%, but nothing has increased. Now I read that Putin gave a decree to raise pensions by 7% from April. Please tell me whether I can hope for a promotion or not? And, if so, where to go to clarify increases?

answer

admin 02/18/2020 at 10:28

Hello, Maxim. From February 1, there was indeed an increase, but it was not the pension that was increased, but the monthly cash payment for disability (EDV). The amount of EDV was actually increased by 3%.

From April 1, 2020, social old-age pensions will be increased (for those who do not have insurance coverage). They will tentatively be increased by 7%, but the exact index will only be approved in March, closer to the indexation date. The promotion will happen automatically; you don’t need to apply anywhere.

answer

Hello. The question is: is the increased pension only for April or until the end of 2020?

answer

- admin 04/07/2020 at 15:32

Hello. In this amount, the pension will be paid until the next indexation date, that is, until April 2021.

answer

Hello. I am 71 years old, I am disabled, group 2. From April 1, they promised to index the social pension by 6.1. The pension for April was transferred on March 27, and there was no compensation.

answer

I am a Chernobyl survivor, a liquidator in 1987. From the age of 50 I receive 250% of social benefits + EDV + additional allowance. nutrition. I live in Sevastopol. In April, the amount for social benefits amounted to 14,015 rubles, EDV - 2,782 rubles. Question: Are the calculations done correctly by the Pension Fund?

answer

What social pensions have been increased since April 1? I have group 2 disability, and my pension came the same as usual. Are certain categories of social pensions being increased?

answer

For disabled people of group 3, the pension is 4765.27. Is it the same or higher in areas of the Far North and equivalent areas? Arkhangelsk.

answer

- admin 05/05/2020 at 11:27

Hello. If a regional coefficient is established at the place of residence, then it is also applied to the amount of the pension. For example, in the Arkhangelsk region it increases by 1.2 or 1.4 (depending on place of residence).

answer

Terribly small social pensions. Dear deputies, or whoever counts these pensions, I beg you, immediately increase social pensions by 5 thousand. This is also incredibly little, but when paying for housing and communal services, buying the necessary medicines, there is still very little left! It just so happened in life that someone (and there are many of us) became disabled. Who is guilty? But at least support them with a more or less decent social pension. And the size of current social pensions are simply humiliation! We also want to smile, to live more or less positively, and not to survive, which is what we are doing now! Medicines are expensive despite the discount. And the current social pensions are cat tears, a mockery of us. We are people too, can you imagine? Amendments to the constitution are ready that should work without amendments anyway. It would be better if the amendments included a significant increase in social pensions, then everyone would vote for it! We need a tangible increase in social pensions - not to the subsistence level with additional payments, but to the minimum wage. Do you agree? Sorry, it's boiling, screaming...

answer

Share your opinionCancel reply

Read other news on this topic

- 5 624 24.10.2019

Indexation of pensions in 2020

In 2020, pensions will be indexed from January 1 by an amount exceeding the forecast inflation level - by 6.6%.

- 2 813 27.01.2020

EDV in 2020, latest news

The amount of EDV that the Pension Fund pays to federal beneficiaries will increase from February 1, 2020.

- 1 488 24.01.2020

Pensions in February 2020

All federal payments and benefits will increase by 3% from February 1, 2020.

All news

Methods for increasing pension payments

At the moment, there is an opinion among citizens that only the “chosen few” survive to retire. However, this is a misconception, because more than 70% of all citizens of the country still retire. Therefore, in order not to put up with a small pension, it is better to take care of it in advance and try to exaggerate it.

“I’m unlikely to live to see retirement” is a phrase that can often be heard among the population. However, this is absolutely not true, because most citizens live in retirement for decades. This is precisely the reason to try to increase it before you start using it. How to survive as much benefit as possible from all possible methods? It's worth looking into it in more detail.

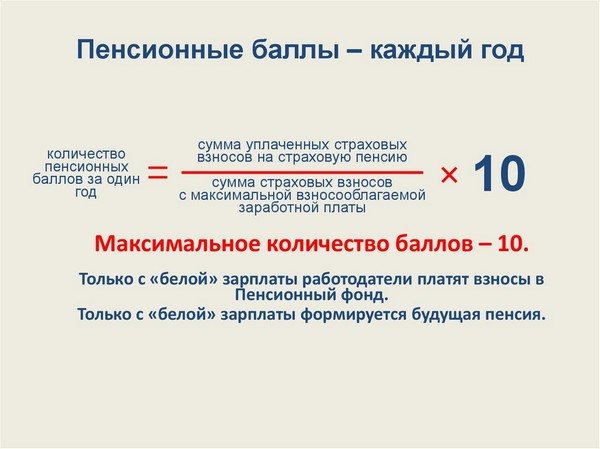

The amount of wages. At the moment, this item is one of the main methods of increasing pension payments among people who decide to do so. The essence of this method is to receive certain points that are awarded according to the salary you have. The maximum number of points is 10, but you can only get them if your monthly salary is equal to or exceeds 65 thousand. It is not easy to get these points, because the required indicator is twice the average salary in the country. However, you shouldn’t get upset and cross out this method: those whose salary is equal to or exceeds 33 thousand will be awarded 5 points.

Important ! If the salary is less than this indicator, it is calculated individually. For example, a person receiving 25 thousand will receive approximately 4 points (65:25=2.7; 2.7x10=4.2).

Calculation of pension points

These points are awarded annually and then multiplied by the “labor coefficient”, the indicator of which changes every year. This method is only good if you have the opportunity to work enough to get at least 10 points - this amount is necessary to participate in this method of state co-financing.

White wages . At the moment, every employed citizen of the Russian Federation pays 30% of his salary to the state, thereby providing himself with free medicine, training for the younger generation and pensions for the elderly. However, many are the owners of “black wages” - earned money that appears completely out of nowhere. People believe that this money is also taken into account when calculating pensions, but they are wrong.

Important ! If the size of your white salary is equal to the minimum in the country, then you will receive the minimum payments. This is due to the desire to create equal conditions for everyone. After all, in essence, if you pay the minimum tax, you leave pensioners without bread, which they have been so hard to earn their entire lives.

The pension is calculated only from the “white” salary

Seniority. Be that as it may, the time served for the benefit of the country will always be important. At the moment, the minimum period required to receive a labor pension is 15 years. If this period has not been worked out, then the person will have to receive a different pension, almost half the previous one. In addition, for people who have worked for more than 15 years, more and more points are added every year to increase their pension. However, at the moment the government is open to the question of increasing the retirement age, and therefore the length of service may change.

Accumulation part . This method applies only to those who receive a pension from 2020. For them, all pension payments, divided into parts, can be divided into two categories - funded and insurance. And if the second was discussed in the first three methods of increasing pensions, then the first is worth talking about in more detail. In addition, if insurance payments include all payments that later went towards the same pensions for others, then funded ones are absolutely personal for each person who decides to use them. However, at the moment, due to the crisis in the country, this method of increasing pensions has become impossible.

Taking care of yourself as you age . No one but yourself can take proper care of you in your old age. That is why it is necessary to start looking for methods of saving money, which can become a great help in old age.

Important ! A small part of your salary, which regularly replenishes a savings account in a bank, after a certain period of time can turn into a round sum, which will come in handy when there is no source of income.

Passive income and your own savings will, of course, help in old age

In addition, there are many ways to earn passive income. It can be anything: renting out an apartment, room, plot. The main thing is that this allows you to have income independent from the state, which can be spent on personal needs.

By the way ! If you are a pensioner, you can increase your pension by working somewhere while receiving it. In this case, your pension will increase faster than that of other non-working retired citizens. Moreover, you will also have additional income through official employment.