History of NPF Kit Finance

The license for the non-state pension fund Kit Finance was issued in December 2007. For 10 years, the company in question has been carrying out pension provision activities. During its activity, this organization was one of the non-state funds that developed quite dynamically.

Keith Finance was an insurer of citizens in the field of compulsory pension insurance . In particular, he took part in a government program aimed at supporting the formation of savings for a future pension. In addition, the organization implemented programs to provide the population with pension payments.

The organization had corporate and private programs. Expert RA agency assigned this company an A++ rating. This indicates a high degree of reliability.

About the fund

The pension fund was part of the KIT Finance Bank structure. It also included a management, brokerage, leasing, and investment company. In addition to Russia, KIT Finance worked in Ukraine, Kazakhstan, and Estonia.

Money flowed into the bank from various sources:

- mortgage loans;

- investment;

- bond underwriting;

- sale of mutual funds to private individuals...

In fact, KIT Finance Bank represented a closed system, which included:

- divisions accumulating money;

- divisions that manage capital (and for different “baskets”).

The KIT Finance Bank pension fund provided an influx of cheap “long-term” money. Cheap because:

- there is no guaranteed payment to the account;

- all losses are also posted to customer accounts;

- profit is fixed once every 5 years;

- all costs are borne by investors.

The bank, according to the official version, became unprofitable as a result of speculation on the stock exchange. I also had to sacrifice the KIT Finance pension fund. As a result, the KIT Finance pension fund operated for 10 years: from 2007 to 2020.

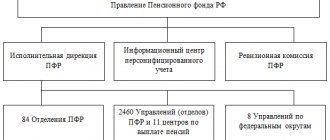

Then it became part of the NPF Gazfond Pension Savings (not to be confused with the NPF Gazfond), to which the following were also merged:

- CJSC NPF Promagrofond;

- CJSC NPF Heritage.

Information

| Full title | CJSC "KIT Finance NPF" | |

| License number | 408/2 | |

| head office | St. Petersburg, st. Marata, 69-71, lit. A. After the reorganization, you need to contact the address: Moscow, Sergeya Makeev Street, 13 | |

| Official site | www.kitnpf.ru, when opening the official website, a redirect to https://gazfond-pn.ru is triggered | |

| Contacts | Hotline* | |

| Founders | KIT Finance Pension Administrator LLC | |

| Shareholders | JSC Russian Railways LLC KIT Finance Pension Administrator | |

| Legal entity* | Pension savings | "TKB Investment Partners" Group IQG Asset Management "Agana" "Progressive Investment Ideas" |

| Pension reserves | "TKB Investment Partners" Group IQG Asset Management "Agana" "Progressive Investment Ideas" | |

| Depository | Specialized depository "INFINITUM" | |

| Managers Group IQG Asset Management "Agana" "Progressive Investment Ideas" | ||

| Branches and regional offices* | Any branches and departments: Bank "Russia" Gazprombank. The full list of offices can be downloaded from the link https://gazfond-pn.ru/about/requisites/ | |

| What services did you provide? | Mandatory pension insurance Non-state pension provision Individual plans |

Statistics

| Volume penny savings/reserves, thousand rubles* | 544970618,82762 / 20370088,26685 |

| Amount of pensions paid, thousand rubles* | 1245408,59151 |

| Number of clients* | 163604 |

| Profitability* | 9.99% minus all remunerations (Central Bank data for Q2 2019) |

| Reliability rating | A++ and AAA (according to the rating agency “RA Rating”) |

| Awards | Twice winner of the joint award in the field of finance “Financial Elite of Russia” Winner of the Rospotrebnadzor award “Consumer Rights and Quality of Service”. |

Terms and service *

| Foundation programs | Individual pension plans Savings pension |

| Conditions of entry | There are no requirements |

| Types of payments | Lifetime, fixed-term, to legal successors |

| User's personal account on the official website | https://lk.gazfond-pn.ru |

| Mobile app | https://gazfond-pn.ru/app/ |

* NPF "Gazfond Pension Savings"

How to enter into and formalize an agreement with the fund: application form

I recommend that you read the information at the link https://gazfond-pn.ru/ipp/ or immediately go to the contract conclusion page https://gazfond-pn.ru/ipp/new-contract/

The agreement can also be concluded at any representative office of the pension fund.

How to transfer pension

You will have to transfer your pension to the NPF Gazfond Pension Savings. This is done through any customer service office https://gazfond-pn.ru/about/requisites/.

At the same time, you need to terminate the agreement with the old NPF and submit an application to the GPRF.

How to find out your savings

The official website of the KIT Finance pension fund no longer exists. Track all savings in your personal account of the successor site.

Two alternatives:

- A written request to the legal successor for information (issued free of charge once a year).

- Checking savings through the State Services website.

How to terminate an agreement with a non-state pension fund

NPF "KIT Finance" "dissolved" in the new fund. Therefore, you can interrupt cooperation through your personal account on the official website of the NPF “Gazfond Pension Savings”.

At the same time, an agreement is concluded with the new pension fund, and an application is also submitted to the State Pension Fund of the Russian Federation.

Personal income tax refund

I advise everyone not to refuse the opportunity to return part of the money. Although this requires:

- communication with the tax inspector;

- Providing a declaration, copies of documents, SNILS and a certificate of transfers is in your power to reduce planned losses.

According to the law, you can exercise the right to return personal income tax for 3 years.

I send documents through the tax website. Pros, besides saving time:

- downloading new forms;

- I read news about changes in tax legislation;

- submitting reports;

- I use consultation.

Early retirement

If the agreement with the KIT Finance pension fund has not been renegotiated with the legal successor, the investor receives savings upon the arrival of the period specified in the agreement (“Retirement regardless of age”). Unfortunately, in other cases you will have to wait until retirement age.

Payment of fees

The payment schedule is specified in the agreement (the first payment is within 5 days from the date of signing the agreement, then monthly). The transfer is carried out using the details of the legal successor of NPF “KIT Finance” https://gazfond-pn.ru/about/requisites/.

How to make a payment:

- On the official website, by clicking the “Make payment” menu button, you are invited to make transfers through your personal account.

- Online banking (check with the bank operator for the minimum payment amount and commission).

- Payment at a bank cash desk or terminal.

- Deductions from salary (an application to the accounting department at the place of work is required).

Reorganization

The company in question ceased operations due to reorganization. Keith Finance was merged with NPF Gazfond. This procedure was carried out in 2020.

All obligations that were assigned to Kit Finance passed to the Gas Fund unchanged. Citizens did not need to draw up new agreements, since the translation was carried out automatically.

Currently, Kit Finance clients use the programs and services provided by Gazfond.

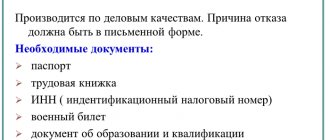

How to terminate a contract

Termination takes place in accordance with the legislation of the Russian Federation, so no difficulties or problems should arise. In order to terminate the contract, you must contact the fund branch with the following package of documents:

- Russian passport;

- agreement with the fund;

- SNILS;

- a new contract with another company;

- an extract with the details of another non-state pension fund to which you wish to make contributions.

If you have collaborated with the fund for four years, then the amount you have accumulated does not expire. If the cooperation lasted less than three years, then 80% of all savings are returned. If it’s three full years, then the entire amount of savings will be returned, but no income will follow.

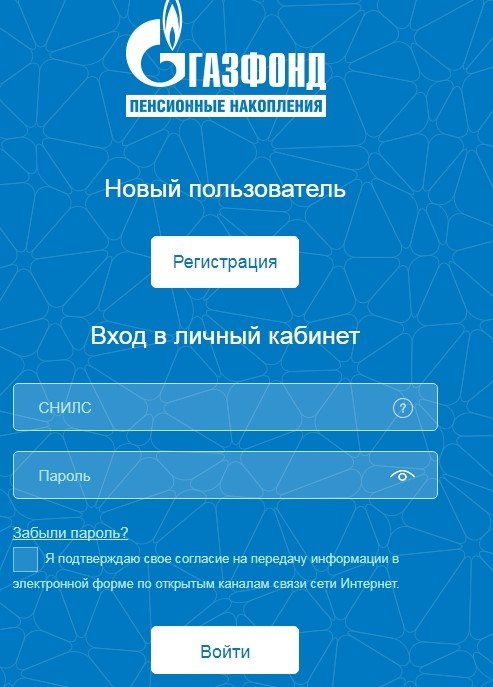

What website do clients of NPF KIT Finance use now?

While the organization in question carried out its activities, the official website was used, which belonged directly to the Kit Finance Foundation.

Today, clients can use the capabilities of the Gazfond portal, including the “personal account” option.

Important! Kit Finance now does not exist as a separate NPF, since a merger with Gazfond took place in 2020. For this reason, citizens can use their personal account only on the Gazfond website.

Customer Reviews

In addition to the high rating, it is worth keeping in mind customer reviews that relate to the fund and its work differently. Part states complete satisfaction with the activities of KIT Finance, noting that the annual income covers the inflation rate. In addition, the advantages are the convenient service of your personal account, responsiveness of the staff, etc.

Negative reviews relate to some mistakes made by fund employees when servicing clients and the timing of money transfers. Some people are not satisfied with the profitability of the organization.

The presence of negative reviews does not affect the overall positive picture of the NPF, which proves its reliability every year. To confirm this, we can cite figures: the number of people insured under the compulsory pension insurance program has exceeded the 2 million mark.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Is it possible to create a personal account?

In order to register in your personal account, you will need to log into the official NPF portal and enter your SNILS number. Next, the citizen carefully studies the provisions of the policy related to data processing. If everything stated is clear and the person agrees, you need to check the box. Next, press the “Next step” button.

You will be required to enter your mobile phone number. This is necessary in order to gain access to your personal account. An SMS with a code is sent to your mobile phone. Please note that after the first login you will need to change your password.

Only those citizens who have entered into an agreement with a non-governmental organization can go through the registration process. If, after entering the SNILS number, the database displays information about the absence of data about the person, you will need to contact the NPF branch and check the information.

To enter your personal account you need to use a password and SNILS. If a citizen has lost their password, they will need to use the “Forgot Password” tab. Then the system requests consent to process the data. The citizen enters the SNILS number and clicks “Next” to continue the procedure.

The advantages of using this service are that the services are provided online so that the citizen can quickly interact with the fund. A person can find out about the savings in the account, analyze the increase in the amount of funds, deposit money into the account, change information about himself.

Terms of the contract

There are two ways to draw up a contract, from which everyone can choose the most convenient for themselves:

- Through the Internet. To do this, you need to go to the website in a special section and start filling out the application yourself. To do this, you need to indicate your SNILS number and some other personal data. Then you just need to wait until the operator contacts you and explains the further course of action. After this, an agreement will be sent to your email address, which must be signed. The already signed agreement will be sent to the fund itself to complete the service. You can use a pre-made electronic signature.

- Visit a branch of the fund. They are located throughout Russia, the client can easily visit them in person. To leave an application for concluding an agreement there, you must have your passport, registration and SNILS with you.

Increasing pensions for disabled people of group 3 in 2020

As of 01/01/2020, the amount of the fixed payment to the disability insurance pension of groups I and II is 5,334.19 rubles. per month.

The fixed payment to the disability insurance pension of group III is 2,667.10 rubles. (50% of RUB 5,334.19).

People with a disability group need social benefits, and increasing pensions for group 3 disabled people in 2020 is very important for them, because they need funds to buy medicine, go to rehabilitation centers and medical care. According to statistics, only 20% of people with disabilities are able to provide themselves with the required standard of living by earning money on their own.

Children with disabilities do not have enough money to provide the necessary standard of living.

This year, pension benefits for people with health problems were indexed by 4.5%. In 2020, there will be an increase in pensions for group 3 disabled people by 4.4%.

Disability group 3 is given to people who have health problems, but can lead the same lifestyle as healthy citizens and engage in light work.

Citizens with disability group 3 are provided with the following benefits:

- 50% discount on payment for housing and communal services (in some regions of Russia this discount can reach 100%): electricity, water supply, major repairs, heating and waste removal;

- for disabled people living in private housing construction, a 50% discount is provided on the purchase of gas, coal, firewood and other types of fuel;

- exemption from payment of property tax for individuals;

- free use of medical services;

- annual free sanatorium-resort treatment, if it helps improve health; in the presence of certain diseases, a separate room is provided;

- free receipt of equipment that increases the level of independence and mobility of a person with disabilities;

- All medications purchased by people with disabilities as prescribed by a doctor are given a 50% discount.

The third disability group is assigned to the following categories of citizens:

- people who require social security;

- citizens who have lost their ability to work due to injuries or any diseases;

- persons who are unable to lead a full life due to health problems.

If this is not officially confirmed, then the pension will not be assigned.

The pension benefit for citizens with group 3 disabilities consists of four parts:

- Social benefit. Appointed in the absence of work experience to citizens living in Russia.

- Insurance benefit. Appointed with existing work experience of any length. Having a job and the cause of disability do not affect the receipt of such a pension.

- Federal benefit. It is prescribed to military personnel, WWII participants and citizens affected by radiation and man-made disasters and astronauts.

- Additional preferential benefits.

The amount of permanent supplement to the insurance pension benefit, taking into account the increase, will be:

- citizens with disability group 3 who do not have dependents – 2,667.10 rubles;

- disabled people of group 3 with 1 dependent – 4,445.16 rubles;

- disabled people of group 3 with 2 dependents – 6,223.22 rubles;

- disabled people of the 3rd group with 3 dependents – 8,001.28 rubles.

Expert opinion

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Social pension benefits for disabled people of group 3 are assigned in the absence of any work experience. In 2020, its size was 4279.14 rubles, in 2020 after indexation on April 1 - 4454.78 rubles. The pension will be increased for all disabled people, regardless of when they received the group.

More on the topic Pension Fund Saransk official website personal account

The pension of disabled people of the third group is much less than the benefit for citizens with disabilities of the first and second groups, who receive 9,000 rubles. This is due to the fact that they can work and provide themselves with the required standard of living.

If citizens with disabilities want to know about all the payments they are entitled to, then they need to call the Pension Fund at least once every 90 days and find out about the changes. They will be able to find out whether there will be an increase in pensions for group 3 disabled people.