Who are considered government employees?

A civil servant is a person who works in civil authorities, for example the following structures:

- Office of the President;

- Local government bodies;

- Prosecutor's Office;

- Court;

- Ministry;

- Various government corporations.

A distinctive feature of a civil servant is the fact that he receives wages from the country’s budget.

Are employees of the Russian Pension Fund Administration civil servants?

Employees of the Russian Pension Fund Administration are not government employees.

In accordance with Article 10 of the Federal Law of May 27, 2003 N 58-FZ “On the Civil Service System of the Russian Federation”, a civil servant is a citizen who carries out professional official activities in a civil service position and receives a salary (remuneration, allowance) from funds corresponding budget.

You will learn everything about civil servants 2020 if you read the material at the link.

Article 8 of the Federal Law of July 27, 2004 N 79-FZ “On the State Civil Service of the Russian Federation” determines that positions of the federal state civil service are established by federal law or by decree of the President of the Russian Federation.

Currently, the list of relevant civil service positions is established by Decree of the President of the Russian Federation dated December 31, 2005 N 1574 “On the Register of Positions of the Federal State Civil Service.”

In the relevant register, positions provided for employees of the Pension Fund of the Russian Federation are not indicated as state civilian ones.

Moreover, according to Article 8 of the Federal Law of December 25, 2008 N 273-FZ “On Combating Corruption”, when listing persons who are required to provide information on income, the positions of the Pension Fund of the Russian Federation are directly opposed to the positions of the state civil service.

Considering these facts, we can conclude that employees of the Pension Fund of the Russian Federation do not belong to state civil servants.

Note:

Despite the fact that the employees of the Pension Fund are not government employees, they, like the state. employees are subject to anti-corruption legislation restrictions and prohibitions, violation of which may lead to the dismissal of the employee.

Details in the System materials:

Regulatory framework: Article 8 of the Federal Law of July 27, 2004 N 79-FZ “On the State Civil Service of the Russian Federation”.

Article 8. Civil service positions

Positions of the federal state civil service are established by federal law or a decree of the President of the Russian Federation, positions of the state civil service of the constituent entities of the Russian Federation - by laws or other regulatory legal acts of the constituent entities of the Russian Federation, taking into account the provisions of this Federal Law in order to ensure the execution of the powers of a state body or a person holding a public position .

- Regulatory framework: Article 8 of the Federal Law of December 25, 2008 N 273-FZ “On Combating Corruption.”

Article 8. Submission of information on income, property and property-related obligations

1. Information about your income, property and property-related obligations, as well as information about the income, property and property-related obligations of your spouse and minor children must be submitted to the representative of the employer (employer):

1) citizens applying for positions in the state or municipal service included in the lists established by regulatory legal acts of the Russian Federation;

1.1) citizens applying to fill positions of members of the Board of Directors of the Central Bank of the Russian Federation, positions in the Central Bank of the Russian Federation included in the list approved by the Board of Directors of the Central Bank of the Russian Federation;

2) citizens applying for positions included in the lists established by regulatory legal acts of the Russian Federation in state corporations, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, and other organizations created by the Russian Federation on the basis of federal laws;

3) citizens applying to fill certain positions included in the lists established by federal government bodies, on the basis of an employment contract in organizations created to carry out the tasks assigned to federal government bodies;

3.1) citizens applying for positions of heads of state (municipal) institutions;

4) persons filling positions specified in paragraphs 1 - 3.1 of this part.

2. The procedure for submitting information on income, property and property-related liabilities specified in Part 1 of this article is established by federal laws, other regulatory legal acts of the Russian Federation and regulations of the Central Bank of the Russian Federation.

3. Information on income, property and property-related liabilities presented in accordance with Part 1 of this article is classified as restricted information. Information on income, property and liabilities of a property nature, submitted by a citizen in accordance with Part 1 of this article, in the event that this citizen does not enter the state or municipal service, work in the Central Bank of the Russian Federation, a state corporation, the Pension Fund of the Russian Federation, the Social Fund Insurance of the Russian Federation, the Federal Compulsory Medical Insurance Fund, another organization created by the Russian Federation on the basis of federal law, employment in an organization created to carry out the tasks assigned to federal government bodies, for the position of head of a state (municipal) institution in the future cannot be used and must be destroyed. Information on income, property and liabilities of a property nature, presented in accordance with Part 1 of this article, classified in accordance with federal law as information constituting a state secret, is subject to protection in accordance with the legislation of the Russian Federation on state secrets.

4. It is not permitted to use information on income, property and property-related liabilities submitted by a citizen, employee or employee in accordance with Part 1 of this article, to establish or determine his solvency and the solvency of his spouse and minor children, for collection in direct or indirect form of donations (contributions) to the funds of public associations or religious or other organizations, as well as in favor of individuals.

5. Persons guilty of disclosing information about income, property and property-related obligations represented by a citizen, employee or worker in accordance with Part 1 of this article, or using this information for purposes not provided for by federal laws, are liable in accordance with legislation of the Russian Federation.

6. Information on income, property and liabilities of a property nature, submitted by the persons specified in paragraph 4 of part 1 of this article, is posted on the Internet information and telecommunications network on the official websites of federal government bodies, government bodies of constituent entities of the Russian Federation, local government bodies, the Central Bank of the Russian Federation, state corporations, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, and other organizations created by the Russian Federation on the basis of federal laws, and are provided for publication to the media in the manner determined by the regulatory legal acts of the Russian Federation Federation, regulations of the Central Bank of the Russian Federation.

7. Verification of the accuracy and completeness of information on income, property and property-related liabilities submitted in accordance with Part 1 of this article, with the exception of information submitted by citizens applying for positions of heads of state (municipal) institutions, and persons filling these positions , is carried out by decision of a representative of the employer (manager) or a person to whom such powers are granted by the representative of the employer (manager), in the manner established by the President of the Russian Federation, independently or by sending a request to the federal executive authorities authorized to carry out operational investigative activities, about the data they have on the income, property and property-related obligations of the citizen or person specified in Part 1 of this article, the spouse and minor children of this citizen or person.

7.1. Verification of the accuracy and completeness of information on income, property and property-related liabilities submitted by citizens applying for positions of heads of state (municipal) institutions, and by persons filling these positions, is carried out by decision of the founder or a person to whom such powers are granted by the founder, in in the manner established by regulatory legal acts of the Russian Federation. Powers to send requests to the prosecutor's office of the Russian Federation, other federal state bodies, state bodies of constituent entities of the Russian Federation, territorial bodies of federal executive authorities, local government bodies, public associations and other organizations in order to verify the accuracy and completeness of information on income, property and the property obligations of these persons are determined by the President of the Russian Federation.

8. Failure by a citizen to submit when entering a state or municipal service, to work in the Central Bank of the Russian Federation, a state corporation, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, or another organization created by the Russian Federation on the basis of federal law , to work in an organization created to fulfill the tasks assigned to federal government bodies, for the position of head of a state (municipal) institution, the representative of the employer (employer) information about his income, about property and property-related obligations, as well as about income, about property and obligations of a property nature of their spouse and minor children, or the submission of knowingly false or incomplete information is grounds for refusal to admit the specified citizen to the state or municipal service, to work in the Central Bank of the Russian Federation, a state corporation, the Pension Fund of the Russian Federation, the Social Fund insurance of the Russian Federation, the Federal Compulsory Medical Insurance Fund, another organization created by the Russian Federation on the basis of federal law, to work in an organization created to carry out the tasks assigned to federal government bodies, to the position of head of a state (municipal) institution.

9. Failure by a citizen or person specified in part 1 of this article to fulfill the obligations provided for in part 1 of this article is an offense entailing his release from the position he is filling, his dismissal from state or municipal service, from work in the Central Bank of the Russian Federation, a state corporation , the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, another organization created by the Russian Federation on the basis of federal law, dismissal from work in an organization created to fulfill the tasks assigned to federal government bodies, as well as in the state (municipal) institution.

Answer from Nosopharynx The Pension Fund of the Russian Federation is an independent financial and credit institution and was created for the purpose of state financial management of pension provision in the Russian Federation. This is not a government body and Pension Fund employees are not government employees. If you answer this question, then, yes, an employee of the Pension Fund of Russia is a public sector employee. BUT the PFR budget is not included in other budgets. Approved by independent law. Accordingly, Pension Fund employees are not included in the general group of “public sector employees” for whom the government declares an increase in salary. “Expenditures not provided for by the budget of the Pension Fund of the Russian Federation for the corresponding year are carried out only after amendments are made to the said budget in the manner prescribed by federal law. “So, until changes were made to the law that approved the financing of the Pension Fund for the current year, it would be wrong to expect an increase. The only hope is for the distribution of savings from the salary fund. fees. The approach is typical for our state. Tax officials were in the same situation at one time.

Raising the retirement age for civil servants in 2020

Despite their seemingly privileged position in society, civil servants are people like everyone else. Therefore, they were also affected by the issue of raising the retirement age.

In agreement with higher authorities, the official can extend the service life to 70 years.

A gradual increase occurs in periods every six months. In 2020, the retirement age of civil servants will be:

- 62 years for men.

- 57 years for women.

Over time, these figures will become equal to the general criteria for Russia. The gradual increase in the retirement age will last until 2028 for men and 2034 for women.

Are pension fund employees civil servants?

Last Thursday, the State Duma adopted in the first reading the bill “On the management of state pension provision (insurance) funds in the Russian Federation,” which significantly changes the organization of the pension system in the country. Let us note that the government’s draft, which received 235 votes, passed “with difficulty” - only 14 votes were lost to the alternative bill of Yabloko deputy Sergei Ivanenko. which provided for a significantly different status than the government proposed for the Russian Pension Fund (PFR).

As a result, the chairman of the Pension Fund, Mikhail Zurabov, was forced to promise that the adopted draft would necessarily include some provisions from the alternative - concerning the status of the organization to which the main “pension” functions are transferred, and whose work has more than once caused many justified complaints.

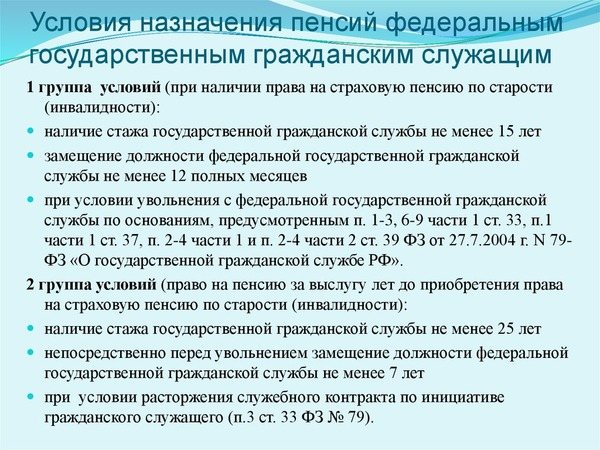

Requirements for citizens applying for a long-service pension

To become a recipient of a long-service pension benefit, an official must have worked for at least a certain period of time by 2020.

According to the new law, starting from 2020, the service pension for civil servants begins upon reaching 17 years of service. Of these, at least 10 must be given to service for the state.

If a civil servant meets the specified conditions, then he is assigned an additional payment for length of service. Achieving the threshold of required length of service does not give the right to early retirement, however, the length of “extra service” can greatly affect the size of the future pension benefit.

Increased length of service

There is no provision for an increase in length of service for pension eligibility from 20 to 30 years in 2020. However, from January 1, 2020, a law has been in force providing for a gradual increase in the minimum working experience in government agencies.

Thus, the pension of judges (as well as other public sector employees) in 2020 will be increased in stages: an annual increase of six months to 65 years for men and 60 years for women.

Increasing the length of service to 25 years, which gives the right to a pension, is provided for by a new law, which may come into effect as early as January 1, 2020.

Expert opinion

Mikhailov Ivan Leonidovich

Legal consultant with 10 years of experience. Specialization: criminal law. Member of the Bar Association.

The law provides for payments in the amount of 65% of salary for 25 years of service, and beyond this period an addition of 3%, but not more than 95%.

Currently, after 20 years of military service, a serviceman has the right to a pension equal to half of his salary, depending on his existing salary, military rank, position, bonus for the period of service and other indexations. For each year of service after 20 years, a serviceman receives a bonus of 6.3%, but not more than 85%.

What periods are counted towards the pension period?

The length of service for an official includes periods of holding any positions related to work for the government at any level. The list of such positions is enshrined in Presidential Decree No. 1574.

The following periods will also be counted towards the official’s length of service:

- Time spent acquiring the knowledge and skills necessary for the job.

- If a person worked for the government of the USSR, then this time must also be taken into account.

- The period of military service upon conscription.

This also takes into account the service life of a device that was abolished or reformed for some reason.

Are employees of the Russian Pension Fund Administration civil servants?

Employees of the Russian Pension Fund Administration are not government employees.

In accordance with Article 10 of the Federal Law of May 27, 2003 N 58-FZ “On the Civil Service System of the Russian Federation”, a civil servant is a citizen who carries out professional official activities in a civil service position and receives a salary (remuneration, allowance) from funds corresponding budget.

You will learn everything about civil servants 2020 if you read the material at the link.

Article 8 of the Federal Law of July 27, 2004 N 79-FZ “On the State Civil Service of the Russian Federation” determines that positions of the federal state civil service are established by federal law or by decree of the President of the Russian Federation.

Currently, the list of relevant civil service positions is established by Decree of the President of the Russian Federation dated December 31, 2005 N 1574 “On the Register of Positions of the Federal State Civil Service.”

In the relevant register, positions provided for employees of the Pension Fund of the Russian Federation are not indicated as state civilian ones.

Moreover, according to Article 8 of the Federal Law of December 25, 2008 N 273-FZ “On Combating Corruption”, when listing persons who are required to provide information on income, the positions of the Pension Fund of the Russian Federation are directly opposed to the positions of the state civil service.

Considering these facts, we can conclude that employees of the Pension Fund of the Russian Federation do not belong to state civil servants.

Note:

Despite the fact that the employees of the Pension Fund are not government employees, they, like the state. employees are subject to anti-corruption legislation restrictions and prohibitions, violation of which may lead to the dismissal of the employee.

Details in the System materials:

Regulatory framework: Article 8 of the Federal Law of July 27, 2004 N 79-FZ “On the State Civil Service of the Russian Federation”.

Article 8. Civil service positions

Positions of the federal state civil service are established by federal law or a decree of the President of the Russian Federation, positions of the state civil service of the constituent entities of the Russian Federation - by laws or other regulatory legal acts of the constituent entities of the Russian Federation, taking into account the provisions of this Federal Law in order to ensure the execution of the powers of a state body or a person holding a public position .

- Regulatory framework: Article 8 of the Federal Law of December 25, 2008 N 273-FZ “On Combating Corruption.”

Article 8. Submission of information on income, property and property-related obligations

1. Information about your income, property and property-related obligations, as well as information about the income, property and property-related obligations of your spouse and minor children must be submitted to the representative of the employer (employer):

1) citizens applying for positions in the state or municipal service included in the lists established by regulatory legal acts of the Russian Federation;

1.1) citizens applying to fill positions of members of the Board of Directors of the Central Bank of the Russian Federation, positions in the Central Bank of the Russian Federation included in the list approved by the Board of Directors of the Central Bank of the Russian Federation;

2) citizens applying for positions included in the lists established by regulatory legal acts of the Russian Federation in state corporations, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, and other organizations created by the Russian Federation on the basis of federal laws;

3) citizens applying to fill certain positions included in the lists established by federal government bodies, on the basis of an employment contract in organizations created to carry out the tasks assigned to federal government bodies;

3.1) citizens applying for positions of heads of state (municipal) institutions;

4) persons filling positions specified in paragraphs 1 - 3.1 of this part.

2. The procedure for submitting information on income, property and property-related liabilities specified in Part 1 of this article is established by federal laws, other regulatory legal acts of the Russian Federation and regulations of the Central Bank of the Russian Federation.

3. Information on income, property and property-related liabilities presented in accordance with Part 1 of this article is classified as restricted information. Information on income, property and liabilities of a property nature, submitted by a citizen in accordance with Part 1 of this article, in the event that this citizen does not enter the state or municipal service, work in the Central Bank of the Russian Federation, a state corporation, the Pension Fund of the Russian Federation, the Social Fund Insurance of the Russian Federation, the Federal Compulsory Medical Insurance Fund, another organization created by the Russian Federation on the basis of federal law, employment in an organization created to carry out the tasks assigned to federal government bodies, for the position of head of a state (municipal) institution in the future cannot be used and must be destroyed. Information on income, property and liabilities of a property nature, presented in accordance with Part 1 of this article, classified in accordance with federal law as information constituting a state secret, is subject to protection in accordance with the legislation of the Russian Federation on state secrets.

4. It is not permitted to use information on income, property and property-related liabilities submitted by a citizen, employee or employee in accordance with Part 1 of this article, to establish or determine his solvency and the solvency of his spouse and minor children, for collection in direct or indirect form of donations (contributions) to the funds of public associations or religious or other organizations, as well as in favor of individuals.

5. Persons guilty of disclosing information about income, property and property-related obligations represented by a citizen, employee or worker in accordance with Part 1 of this article, or using this information for purposes not provided for by federal laws, are liable in accordance with legislation of the Russian Federation.

6. Information on income, property and liabilities of a property nature, submitted by the persons specified in paragraph 4 of part 1 of this article, is posted on the Internet information and telecommunications network on the official websites of federal government bodies, government bodies of constituent entities of the Russian Federation, local government bodies, the Central Bank of the Russian Federation, state corporations, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, and other organizations created by the Russian Federation on the basis of federal laws, and are provided for publication to the media in the manner determined by the regulatory legal acts of the Russian Federation Federation, regulations of the Central Bank of the Russian Federation.

7. Verification of the accuracy and completeness of information on income, property and property-related liabilities submitted in accordance with Part 1 of this article, with the exception of information submitted by citizens applying for positions of heads of state (municipal) institutions, and persons filling these positions , is carried out by decision of a representative of the employer (manager) or a person to whom such powers are granted by the representative of the employer (manager), in the manner established by the President of the Russian Federation, independently or by sending a request to the federal executive authorities authorized to carry out operational investigative activities, about the data they have on the income, property and property-related obligations of the citizen or person specified in Part 1 of this article, the spouse and minor children of this citizen or person.

7.1. Verification of the accuracy and completeness of information on income, property and property-related liabilities submitted by citizens applying for positions of heads of state (municipal) institutions, and by persons filling these positions, is carried out by decision of the founder or a person to whom such powers are granted by the founder, in in the manner established by regulatory legal acts of the Russian Federation. Powers to send requests to the prosecutor's office of the Russian Federation, other federal state bodies, state bodies of constituent entities of the Russian Federation, territorial bodies of federal executive authorities, local government bodies, public associations and other organizations in order to verify the accuracy and completeness of information on income, property and the property obligations of these persons are determined by the President of the Russian Federation.

8. Failure by a citizen to submit when entering a state or municipal service, to work in the Central Bank of the Russian Federation, a state corporation, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, or another organization created by the Russian Federation on the basis of federal law , to work in an organization created to fulfill the tasks assigned to federal government bodies, for the position of head of a state (municipal) institution, the representative of the employer (employer) information about his income, about property and property-related obligations, as well as about income, about property and obligations of a property nature of their spouse and minor children, or the submission of knowingly false or incomplete information is grounds for refusal to admit the specified citizen to the state or municipal service, to work in the Central Bank of the Russian Federation, a state corporation, the Pension Fund of the Russian Federation, the Social Fund insurance of the Russian Federation, the Federal Compulsory Medical Insurance Fund, another organization created by the Russian Federation on the basis of federal law, to work in an organization created to carry out the tasks assigned to federal government bodies, to the position of head of a state (municipal) institution.

9. Failure by a citizen or person specified in part 1 of this article to fulfill the obligations provided for in part 1 of this article is an offense entailing his release from the position he is filling, his dismissal from state or municipal service, from work in the Central Bank of the Russian Federation, a state corporation , the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, another organization created by the Russian Federation on the basis of federal law, dismissal from work in an organization created to fulfill the tasks assigned to federal government bodies, as well as in the state (municipal) institution.

Calculation of pension benefits for civil government employees:

The position held by the official does not matter in the calculations. The accrual algorithms are the same for both ordinary employees of the mayor’s office and for employees of the presidential staff. These rules are established by Federal Law No. 166.

Encouraging longevity

The state values employees who are responsible for their work.

For long-term work, an official can expect the following types of incentives:

- one-time cash incentives (bonuses);

- valuable gift;

- certificate of honor;

- honorary title.

Attention! But there is a special reward that awaits a civil servant upon retirement. Upon termination of employment, an official will receive a payment equal to ten times his official salary. This type of incentive is prescribed in clause 8 of Art. 21 FZ-119.

Availability of the right to social benefits

The size of your future pension may be affected by your right to receive social benefits. This is the part of the pension benefit that is guaranteed to every person regardless of their length of service. The amount of such payment directly depends on the number of accumulated points.

Also, a civil servant with an established disability group can count on certain social benefits. The presence of a salary paid from the budget does not in any way affect the guaranteed financial assistance to a person with persistent health problems.

Old age payments

Every official, having reached a certain age, is entitled to a standard old-age pension. A person who, in addition to long-term civil service, has work experience in private organizations not associated with the state, can count on such payments.

Having crossed the 80-year mark, a pensioner can count on certain benefits from the state. And one of them is a twofold increase in the fixed part of the pension benefit.

Formula for calculations

The payment due to an official for length of service cannot be assigned while he continues his work activity.

However, upon reaching a specified age, an official can retire and become a recipient of a pension. In this case, he will be assigned a pension benefit.

Its size is calculated using a special formula:

| Designation | Decoding | Note |

| GP | State benefit | Pensions of civil servants are paid from the federal budget |

| ZS | average salary | Based on the last year (12 months) |

| P.O. | Total pension provision | Consists of the following parts:

|

| B.C. | Development of experience | Official length of service beyond length of service |

The total amount of the assigned benefit, taking into account all required additional payments and allowances, should not be more than 75% of the salary (average salary).

Features of pensions for civil servants

Civil servants have the right to receive 2 pensions at the same time:

- for length of service in accordance with Federal Law No. 166 “On State Pension Provision”;

- share of old-age insurance coverage in accordance with the Federal Law “On Insurance Pensions”.

Now only those who have worked not 15 years, but 20 years (increasing gradually) can receive the first pension.

The retirement age for them has also increased: for men it is now 65 years, and for women 63 years.

To receive the first type of pension, several conditions must be met:

- reaching above the stated age;

- continuous work experience of at least one year before retirement;

- dismissal only by agreement between the parties, for example, when changing the terms of the contract, liquidation or layoff.

A person can receive a pension at an earlier age, but then the work experience in the civil service must be at least 25 years, and a continuous period of 7 years. In the event of liquidation of a state body or reduction, it is possible to obtain security without working for a year.

Government officials have the right to count on insurance coverage after 15 years of employment, which includes length of service in the public service. It is paid only if you have the required number of points and reach the age limit.

The insurance payments include the following periods:

- all activities during which contributions to compulsory pension insurance were paid;

- civil service period;

- other terms specified in Article 12 of the Federal Law “On Insurance Pensions”.

The insurance payment is made based on the number of pension points, which are multiplied by the cost of one IPC. Government officials receive the amount without a fixed rate.

Expert opinion

Alekseev Dmitry Yurievich

Lawyer with 6 years of experience. Specialization: civil law. Member of the Bar Association.

If a person continues to work after receiving support, then he is entitled to a recalculation, since he continues to pay contributions to the Russian Pension Fund.

In this case, the share of insurance coverage is subject to recalculation based on the points received, which were not previously taken into account when calculating the payment. Recalculation is carried out automatically annually in August without submitting a corresponding application.

New in pension provision for federal government employees

There was also an increase in the age at which civil servants can retire: 60 years for women and 65 years for men, i.e. You need to work 5 years longer. Of course, this is beneficial for the state and saves the budget.

But there are also positive aspects for those receiving this support:

- fixed payments;

- increase in payments for government employees by 6%.

Pensions for prosecutors

Regarding pensions for prosecutors in 2020, the latest news indicates an increase in indexation for these employees. The State Duma has received a bill on the need to increase pension benefits for employees of the Investigative Committee and the Prosecutor's Office who are entitled to this.

The essence of the document: since the pension benefits of former employees of these structures have not increased since 2020, it was decided to increase it by 6% from January 1, 2020.

Thus, by 2020, a total increase in pensions for prosecutors is expected by 12%. The initiative received support from higher authorities.

Judges' pensions

The pensions of judges in 2020 will also be subject to indexation.

In 2020, by increasing wages by 30% percent, according to Deputy Minister of Labor and Social Protection A. Pudov, in the future the amount of this payment will increase by 5-7 thousand rubles.

Monthly payments to Themis employees directly depend on the insurance period, like other Russian citizens. The pension is paid to them on a general basis. However, the payments themselves will increase.

Indexation of additional payments to pensions for civil servants in St. Petersburg 2020

These payments will be provided at the expense of the city and local budgets of municipalities. The indexation coefficient was approved at 1.04.

Today we’ll talk about who can count on an increase in their pension and what changes civil servants should prepare for, starting on January 1, 2020. Pensions for long service are due to all state and municipal employees who have reached the appropriate age in combination with a certain work experience.

State civil servants include persons vested with administrative, administrative and managerial functions, as well as employees of executive bodies of state power. Deputies of the Legislative Assembly of St. Petersburg and the Leningrad Region **** are considered state civil servants and are subject to provisions on increasing the retirement age. In 2019, federal government employees will receive a pay raise. This was officially announced late last year. Indexation will be done for the first time in a long time.

Calculation of pension payments to teachers

The work of citizens in the field of education is not without stress and tension. Therefore, the legislation of the Russian Federation has provided for the possibility of teachers taking a well-deserved rest based on their length of service.

The calculation can be done using the following formula:

FV + SB x St = PV, where:

- PV is a payment fixed by the state;

- SB - the number of points earned during the working period;

- St - cost per point.

By substituting the necessary data into the formula, you can calculate the amount of your pension yourself.

Example

Samsonova I.P. She has been working as a literature teacher for 26 years, and she plans to retire in February 2020. Over the years of work, she has accumulated 98 pension points.

The accrual calculation will look like this:

Expert opinion

Mikhailov Ivan Leonidovich

Legal consultant with 10 years of experience. Specialization: criminal law. Member of the Bar Association.

When calculating output, all leaves taken by the teacher are taken into account, including maternity leave, if it was granted before October 6, 1992.