The legislative framework

The determination of persons who may qualify for a military pension and the calculation of payments is regulated by:

- Federal Law No. 4468-1 dated February 12, 1993;

- Government Decree No. 941 of September 22, 1993

Reference! Retired military personnel receive benefits from the budget of the Ministry of Defense, and not from the Russian Pension Fund.

Employees of law enforcement agencies and equivalent persons who:

- served more than 20 years;

- have a combined total experience of 25 years, of which at least 12.5 years are in law enforcement agencies.

The size of the military pension is tied to income in the army and depends on many components:

- the rank in which the serviceman retired;

- length of service;

- participation in hostilities:

- presence of disability.

Rice. 1. Military pensioner

Article 49 of Federal Law No. 4468-1 determined the procedure for indexing the pay of retired military personnel, on the basis of which the pension should increase following the growth in the income of active military personnel, and the reduction factor should increase annually by 2%.

However, in 2012, on the basis of Federal Law No. 306, this procedure was changed, and the indexation of payments to retired military personnel was frozen for the next 6 years.

The moratorium on increasing allowances was lifted on the basis of Government Resolution No. 1598 of December 21, 2017.

Payments to military pensioners upon reaching 60 years of age

Military pensions are a special thing. They differ from civilians not only in their source of funding, but also in their age category. Military personnel retire much earlier than civilians. This is legally defined as follows:

Military pensioners are citizens who receive a pension from the Ministry of Defense. This pension is awarded either for length of service or as a result of disability received during service.

Since, as mentioned earlier, military personnel retire earlier than civilians, many take jobs. In this regard, since 2008 they can receive two types of pensions: “military” and “civilian”.

However, in order to receive such pensions, it is necessary to understand the nature of the military pension: social or labor. The composition of a military pension includes salary, rank and length of service. Based on this, the military pension is a labor pension.

What you need to keep in mind to receive such a second pension.

First, the retirement age of 60 and 55 years must be reached for men and women respectively. Further, there must be a minimum length of service for which a retirement pension is awarded. Moreover, this experience should not be included in the military. And of course, the presence of the latest innovation – a minimum number of pension points. In 2017 they amounted to 9.

What else is needed to receive a pension upon reaching 60 years of age? Standard set of documents: application for a pension, passport and SNILS. In addition, you will also need a certificate of assignment of a military pension and documents that confirm civil work experience.

That seems to be all.

Yes, one more thing. A military pensioner can remain working after reaching 60 years of age. In this case, each year his pension will be recalculated based on the accumulated pension points for the past year.

And lastly, in the event of death, his disabled relatives can receive a civil pension, who are assigned a survivor's pension from the Ministry of Defense.

Author of the publication

offline 2 years

Will military pensions increase from October 1, 2020?

This is not the first time the question of abolishing indexation has been raised. The security forces' hopes for an increase in payments in October 2020 did not materialize, but the government promised to return the bonuses in 2020.

The proposal to index payments in October 2020 was also withdrawn from consideration, as the deadlines for increasing the salaries of active military personnel were shifted.

Initially, it was planned to increase the allowances of military personnel in October 2020. But the redistribution of budget funds made it possible to do this in January of this year. Since pensions are directly tied to the salaries of military personnel, it was decided to index payments in this category also at the beginning of the year.

The program was scheduled to begin in April 2018, but after much debate the deadline was pushed back to February.

However, by order of Russian President V.V. Putin, the increase in military pensions in 2020 was postponed to January to synchronize payments, for which the corresponding funds were allocated at the end of 2020. Details in the video:

As a result, the increase in pension accruals for former military personnel amounted to 4%. To ensure the Presidential Decree regarding the provision of military personnel and pensioners, 38.6 billion rubles were allocated.

Since indexation was carried out at the beginning of the year, there will be no second increase in military pensions in 2020. Pensioners should not count on certain changes in October, since the government announced a program providing for an annual increase in payments by 4% for 3 years, and the limits for the current year have already been selected.

What to expect for pensioners

Taking into account the fact that, due to sanctions and the global crisis, the country finds itself in a difficult economic situation, most analysts are inclined to believe that the formula for calculating pension payments will be revised, and the payments themselves will change significantly - it is not known in which direction.

In principle, cutting pensions for military personnel would be a rational solution to the pension issue, since many officers, after “retiring”, continue to serve their homeland. That is, payments to at least working pensioners should decrease.

If the amendments are adopted, the majority of the military may express dissatisfaction with the current situation and claim a violation of their social and civil rights. Among other things, the authority of the Russian army will be irrevocably undermined, and the military profession may lose its attractiveness.

We will find out closer to February 2020, during the next indexation of pension payments, whether the state will take such a risky step or try to find funds to fulfill its debt obligations to pensioners. Next year they will amount to more than four percent, which, unfortunately, will not cover the losses caused by inflation.

Thus, the coming year 2020 may bring many surprises not only to ordinary Russian citizens, but also to military personnel; it remains to remember that work on future changes is already underway and the government will try to resolve the pension issue so that everyone is satisfied. In the meantime, we can only believe and wait that the new charges will not affect the standard of living of Russians, both military and civilian.

Who received pension increases in 2018 and by how much?

Since the amount of pension benefits depends on the rank in which the serviceman retired, the amount of indexation in monetary terms will be different.

Approximate calculations of actual payments, depending on rank, are given in the table.

Table 1. Approximate amount of payments

| Rank | Pension amount before increase, rub. | Amount of payments in 2020, rub. | Increase, rub. |

| Private under contract | 32 700 | 34 000 | 1 300 |

| Lieutenant | 63 600 | 66 100 | 2 500 |

| Lieutenant colonel | 85 300 | 88 700 | 3 400 |

| Platoon commander | 63 600 | 66 100 | 2 500 |

| Company commander | 79 800 | 83 000 | 3 200 |

| Battalion Commander | 85 300 | 88 700 | 3 400 |

Important! The calculated data in the table is given for reference.

The actual amount of payments also depends on other factors that influence the estimated amount of accruals.

It’s easy to calculate how much your allowance should have increased on your own. To do this, it is necessary to multiply the amount of payments in 2017 by 1.04, which will give an idea of the real amount of the increase in military pensions in 2020.

The principle of calculating military pensions

Fortunately, or maybe vice versa, military pensions were left behind the scenes of the pension system reform. Legislatively, they are still controlled by the Law of the Russian Federation No. 4468-I of 02.12.93. Which, in general, did not prevent Federal Law No. 400 of 12.28.13, which came into force on 01.01.15, from having a certain impact on the military.

As is known, several years earlier, Article 2 of the Federal Law No. 309 dated November 8, 2011 introduced amendments to the Law of the Russian Federation No. 4468-I, providing for the introduction of adjustment (lowering) coefficients for long-service pensions.

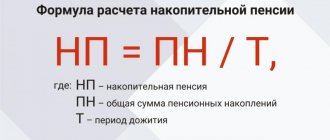

From 01/01/12 and to this day, the pension of military personnel is calculated using the formula:

SDD *PC, where

SDD is the total monetary allowance of a military man in service, equal to the sum of wages by position, by rank and an increase for length of service. PC - correction factor in the year of registration of the pension for length of service.

In January 2012, the PC was 54%. Since then, in accordance with Part 2 of Article 43 of Law No. 4468-I, the PC has been increased 4 times: in January and October 2013 and 2014. As of October 2014, the PC was 62.12% and has not changed further.

What pension increases affected the military in 2020?

In addition to the targeted indexation of military pensions, some pensioners in this category were also affected by other changes that are regulated by acts affecting the increase in payments to civilian pensioners.

From April 1, 2020, social payments were increased by 2.9%. This increase was given to retired military personnel who became disabled during service or as a result of grass received during service. The amount of the supplement in this case depends on the group and category of disability.

Table 2. Amount of disability supplement

| Category | Amount of allowance, rub. | ||

| III group | Group II | Group I | |

| War trauma | 9 065,43 | 12 950,61 | 15 540,73 |

| General diseases, work injuries | 7 770,37 | 10 360,49 | 12 950,61 |

| Disabled WWII | 7 770,37 | 10 360,49 | 12 950,61 |

| With the sign “Resident of besieged Leningrad” | 5 180,24 | 7 770,37 | 10 360,49 |

Material on the topic: How to apply for disability benefits.

In addition, traditionally, veterans of the Great Patriotic War received one-time payments in the amount of 10,000 rubles on Victory Day.

The amount of one-time benefits for military personnel who were discharged due to unsuitability as a result of a military injury was also increased. Despite the fact that the corresponding Government Resolution No. 238 was signed in March 2020, payments can be received by military personnel who were written off as a result of injury, starting in January of this year, in the amount of:

- RUB 2,562,112.32 – military personnel who served under a contract;

- RUB 1,281,056.16 – conscripts for military service, as well as reservists, the civilian population during training camps.

LiveInternetLiveInternet

Monday, October 16, 2020 07:18 + in the quote book “It is impossible to love the state on one pension”

Narodnoe

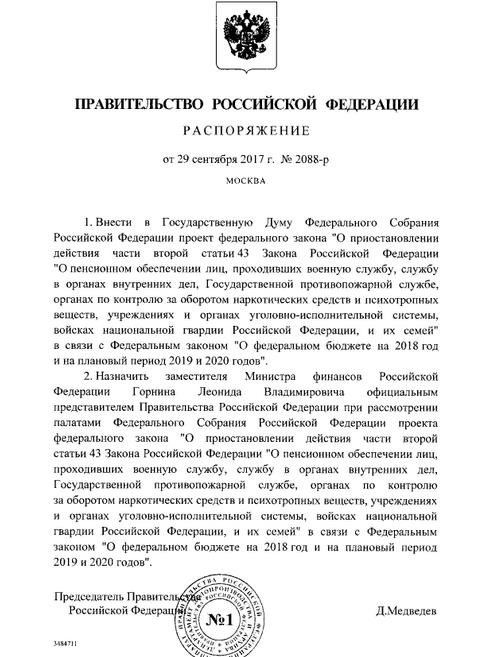

According to media reports, on September 2, 2017, the chairman of the Duma Defense Committee, retired Colonel General Vladimir Anatolyevich Shamanov, at a meeting with military service veterans at the Volsky Higher Military School of Logistics, assured military service veterans that At the upcoming winter session of the State Duma 2017-2018, he intends to achieve the abolition of the reduction factor of 0.54 (currently 0.7223) for military pensions. The news of this instantly spread across the Internet. Many even believed in what Shamanov said, Shamanov would do…. After all, who else to trust then, if not the Hero of Russia, a military officer! However, as it turned out, in our time you can’t even trust yourself...

Let's see what the second part of Article 43 with the subtitle “Monetary allowance for calculating pensions” says.

Part two: The specified monetary allowance is taken into account when calculating the pension from January 1, 2012 in the amount of 54 percent and, starting from January 1, 2013, increases annually by 2 percent until it reaches 100 percent of its amount.

Taking into account the level of inflation (consumer prices) by the federal law on the federal budget for the next financial year and planning period, the specified annual increase may be established for the next financial year in an amount exceeding 2 percent. (Part two was introduced by Federal Law dated November 8, 2011 N 309-FZ) And part two says that every year from January 1, 2013, according to this part, military pensioners were added at least 2 points to the castration coefficient of 0.54.

Let's remember the history of increases in military pension from comrade Ed: 01/1/2012. — 0.54 January 1, 2013 — 0.56 10/1/2013 — 0.5805 01/1/2014 — 0.6005 October 1, 2014 — 0.6212 01/1/2015 - there was no indexing. 10/1/2015 — 0.6678 02/1/2016 — 0.6945 01/1/2017 — 5000 rub. (one-time cash payment, instead of indexation for the 2nd half of 2020) 02/1/2017. — 0.7223 Therefore, Bill No. 274628-7 is going to suspend the 2-point increase in military pensions for three years. As Comrade Ed wrote: “from January 1, 2018.

- nevermind." However, Bill No. 274628-7 has not yet been adopted, look, Shamanov and K* will remember military pensioners and kill this Bill No. 274628-7... Let's see what kind of money our local government wants to save on military pensioners by suspending the legal supplement for military pensioners from January 1, 2020 by 2 points.

The average military pension in 2020 with a castration coefficient of “0.7223” is equal to 24,456

rubles.

If, according to the law, the castration coefficient became “0.7423” from January 1, 2018, then the average pension would increase to 25,133

rubles.

The difference is 677

rubles.

Military pensioners, according to data from the same State Duma in 2018, are 2,639,000

people, multiply by 677 rubles and get:

1,786,603,000

rubles are needed for one month of increase.

Now we multiply by 12 months = 21,439,236,000

- the savings of the Russian state on its retired servants in 2018.

The amount, let’s say, is not very unaffordable, if you take into account, for example, according to the deputy chairman of the Central Bank Vasily Pozdyshev, “The Central Bank estimated the recovery of Otkritie and B&N Bank at 800-820 billion rubles.”

Eight hundred billion Karl is not a pity for the moneylenders!

However, there is no need to be upset, the inflation rate in 2020 is expected to be 3.2%. The native government remembered (forgot since 2013) about inflation, and from January 1, 2020, state employees and public sector employees will (should) lose a penny in the amount of a 4% increase in salaries. And this means that the military will also receive this penny for the DD. Consequently, the military pensions will also be broken. But the Defense Committee also considers it necessary to redistribute cash allocations to bring the indexation of the “military pension” from 4% to 5.2% from January 1, 2020 (taking into account the beginning of the financial year)... That’s the concern. Although bills neither suspending nor increasing salaries for public sector employees have yet to be adopted. Therefore, where is our popcorn, we stock up on it and wait for the results. By the way, fellow military pensioners who work, your pension may not increase this time, because the state does not compensate for inflation for working pensioners. In past years (since 2013) the supplement went to all military pensions, but those supplements were for “0.54” and that’s different. And compensation for inflation did not apply to civil servants, including the military, for five years. Now it will most likely not affect working military pensioners.... Be healthy, live richly! Note:

Law of the Russian Federation

of February 12, 1993 N 4468-1

“On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families" Article 43

.

Monetary allowance for calculating pensions Part one: Pensions assigned to persons specified in Article 1 of this Law and their families are calculated from the monetary allowance of military personnel, ordinary and commanding personnel of internal affairs bodies, the State Fire Service, drug control agencies and psychotropic substances, persons serving in institutions and bodies of the penal system. To calculate their pensions, they take into account in the manner determined by the Government of the Russian Federation, salary for a military position or official salary, salary for a military rank or salary for a special rank (without taking into account the increase in salaries for service in remote, high-mountainous areas and in other special conditions) and monthly an allowance or percentage increase for length of service (length of service), including payments in connection with the indexation of salary. (as amended by Federal Laws dated November 28, 1995 N 186-FZ, dated July 21, 1998 N 117-FZ, dated June 30, 2002 N 78-FZ, dated July 25, 2002 N 116-FZ, dated June 30, 2003 N 86-FZ , dated 12/01/2007 N 311-ФЗ, dated 11/08/2011 N 309-ФЗ) Part two: The specified monetary allowance is taken into account when calculating pensions from January 1, 2012 in the amount of 54 percent and starting from January 1, 2013 it increases annually by 2 percent until it reaches 100 percent of its size. Taking into account the level of inflation (consumer prices) by the federal law on the federal budget for the next financial year and planning period, the specified annual increase may be established for the next financial year in an amount exceeding 2 percent. (Part two was introduced by Federal Law No. 309-FZ of November 8, 2011) The provisions of Part Two of Article 43 do not apply to judges of the Military Collegium of the Supreme Court of the Russian Federation and military courts, prosecutors (including military personnel of the military prosecutor’s office) and employees of the Investigative Committee of the Russian Federation (including military investigative bodies of the Investigative Committee of the Russian Federation), pensioners from among these persons and members of their families (Federal Law of November 8, 2011 N 309-FZ). Previously I wrote about pensions:

Military pensions in 2020: castration coefficient 0.54 (0.72) will not be canceled Military pensions in 2020: money may be enough for 4%, or 5.2% Military pensions in 2020: no money

PySy

- However, not everything is like that pessimistic like me. Here’s another opinion: Finally, the military will increase their pay, and military pensions will be abolished at 0.54...??? Thank you comrades for your help in writing this note.

| Categories: | Army |

Tags:

Russia military pensions pensions for military pensioners

Cited 6 times Liked by: 11 users

Like share

0

Like

- 11

I liked the post - Quoted

- 0

Saved

- Add to quote book

- 0

Save to links

Liked11

0

Increase in mixed pensions

Pensioners who, in addition to military service, have civilian work experience, can apply for an insurance pension under the following conditions:

- The minimum insurance period in the civil service is 9 years.

- Registered in the pension insurance system and has a minimum number of accrued pension points - 13.8.

- Reached the generally accepted retirement age.

It should be taken into account that in accordance with the ongoing pension reform, the retirement age and the number of required points will increase annually.

More details about the second pension in the video:

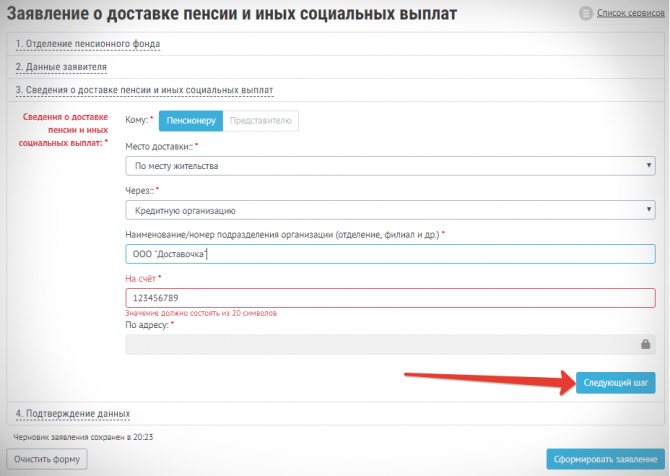

To receive a second social benefit, a retired military personnel can:

- Apply for an old-age pension at the territorial department of the Pension Fund of the Russian Federation at your place of residence.

- Officially get a job and receive a salary, in addition to pension payments.

In the first case, the pensioner can count on indexation of the social part of the accruals.

For working military pensioners, an annual increase in payments is provided due to an increase in pension points. The latest increase to 235 rubles. was produced automatically from August 1, 2020.

Possible changes

In the current realities, only those military personnel who have successfully served for twenty or more years can count on pension payments. This payment is official, established by the state at the legislative level. But everywhere there are reservations and exceptions. We couldn’t do without them here either.

If you read the law carefully, it says that this payment can also be received by people who have served in the army for twelve or more years, have a work experience of twenty-five years, but who were dismissed from their place of service due to health problems, until they reach military retirement age - forty-five years.