In March 2020, merged : Stalfond and Future. As a result, the process of registering the “Personal Account” of NPF “Stalfond” for viewing one’s pension savings has been modified.

Log in to your personal account of NPF "Future"

Please note that persons who were already clients of this pension fund at the time of the merger of organizations do not need to renew their agreement with them or sign new agreements with NPF Future. All previously concluded contracts are valid and have not been subject to changes.

In order to find out your savings in NPF “Stalfond”, you need to log in to your “Personal Account”. This can be done on the official website of the pension fund at one of the addresses: futurenpf.ru or www.stalfond.ru.

Additional information: only persons who have previously registered on the portal and are current clients of the pension fund can log in.

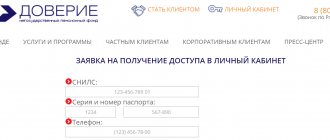

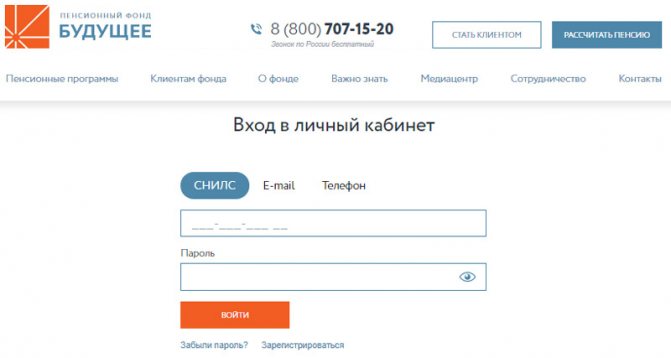

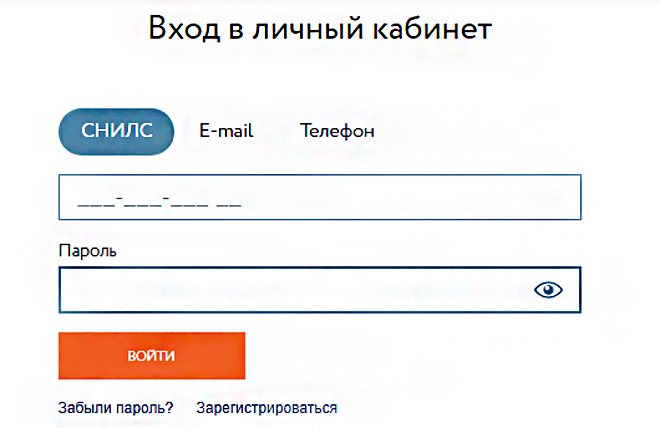

To enter your “Personal Account” on the official website of NPF “Stalfond” you need to click on the bright orange clickable link, which is located in the upper right corner. After clicking on the link, a form for entering personal data opens. You can access your “Personal Account” on the “Stalfond.ru” portal using one of three methods:

- by entering SNILS data;

- by email address;

- by phone number.

Next, you will need to enter the password that was given during registration and click on the “Login” button. The client of NPF "Stalfond" will be taken to his "Personal Account" on the official website of the portal.

About the fund

“Stalfond” is a fairly large organization, and this increases the level of citizens’ trust in it. The structure sets itself the task of improving service for clients and maintaining the position of one of the leaders in its segment.

Initially, the organization was called “Sheksna-Hephaestus” and was known as the “metallurgists’ fund.” This is due to the development of pension programs for industrial enterprises of Severstal, with which the work of this structure began. But after 5 years, branches began to open in different regions of the country, and 40 thousand people became clients of the fund.

The name “Stalfond” appeared in 2004; a special competition was even held to select the name. At the same time, pension reform took place, and new opportunities opened up for organizations in this area. This concerns, first of all. provision of OPS services.

During 2007-2014, Stalfond managed to increase the number of contracts for compulsory pension insurance by more than 33 times to 1.002 million. The volume of pension savings increased to 34.8 billion rubles, i.e. 86 times. The foundation has been repeatedly awarded prestigious awards, including international ones, and high ratings.

What kind of profitability can you expect?

The organization adheres to a fairly conservative investment strategy. It is based on maintaining a rational level of risks and obtaining the maximum possible profit. The fund's return in 2009 and 2012 was 45.81%. This allowed us to exceed the inflation rate by 10%. In the current period, the value of the indicator for OPS is 7.54%, and for NGOs - 11.71%, according to the Central Bank.

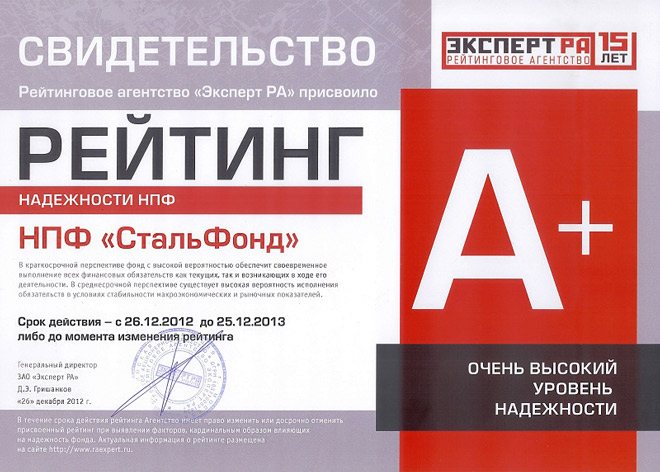

Reliability of the fund by year, according to the Expert RA agency, which evaluates NPFs using special methods.

- 2015: A, stands for “very high level of reliability.” Forecast: “stable” – there is a high probability of maintaining the current level.

- 2016: A, “High level of reliability.” The forecast changes: “developing”, i.e. In the future, the assessment is likely to change in a positive or negative direction, as well as maintaining the current one. Assigned the status “Under supervision”.

- 2017, August: ruBB-, “moderately low financial stability.” The fund depends on negative situations in the economy. Forecast: “stable”.

- 2017, August: withdrawn at the request of the foundation.

In 2020, it does not participate in the Expert RA reliability rating.

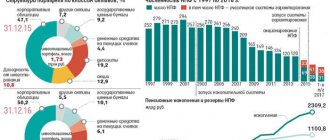

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| -25,35 | 26,89 | 12,39 | 0,91 | 7,15 | 8,23 | 1,47 | 5,58 | 4,08 | 3,88 |

Accumulated profitability 2013-2017 - 20.7.

Investing citizens' pension savings allows the fund to receive a certain income, which increases the amount of funds in each client's account. In 2014, the percentage of profitability of NPF “Future” was small - only 1.47%. Compared to the profitability of the Pension Fund of Russia, the indicator was lower by 1.21%.

In 2020, the yield was already 5.58%, in 2016 it decreased again - 3.87%, in 2017 - the figure stopped at 1.85%. This picture may indicate the futility of investments. However, this is not entirely true, since the annual profitability figures could potentially change significantly, and therefore grow.

Official website

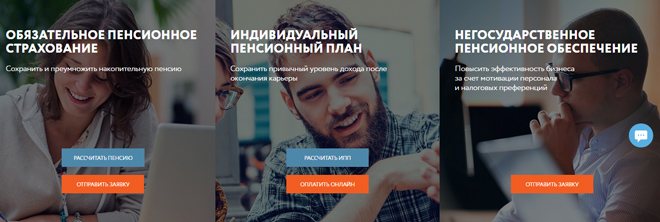

The official website of NPF "Stalfond" futurenpf.ru provides access to information about the work of the fund, areas of activity, cooperation with partners. Here you can:

- Calculate pension according to compulsory pension insurance;

- Submit a request for information;

- Choose an individual pension plan;

- and necessary documents;

- Learn about the procedure for inheriting funds.

On the official website of OJSC NPF Stalfond there are complete conditions for registering an individual pension plan. Moreover, clients of the fund can fill out an online application for the development of such a plan by specialists. In this case, all the capabilities and needs of the citizen will be taken into account.

What does the fund promise to pensioners?

Like any other NPF, “FUTURE” strives to attract as many clients as possible, therefore it declares the reliability of investment instruments, the reliability of deposits and high profitability. Whether this is really so, we will consider on the basis of specific indicators, which, in accordance with the law, are open information and are subject to disclosure (periodic publication).

Reliability and profitability rating

The main indicators on the activities of non-state pension funds are checked and published on its official website by the regulator, the Bank of Russia. One of these indicators is the profitability of placing funds from pension reserves minus remuneration to management companies, a specialized depository and a fund.

According to the information posted by the Central Bank, it is clear that in 2018 the efficiency of placing funds in this fund went into the negative. The return on savings management became negative and amounted to -13.35%. This is one of the worst indicators among all non-state pension funds; according to it, “FUTURE” takes 6th position from the bottom of the list.

During the first half of 2020, the fund’s investment activities were also unsuccessful. According to the interim information provided, the loss in placing citizens' savings amounted to 7.43%, i.e. The fund again turned into a major minus.

Attention! The profitability indicator is objective based on its calculation for the calendar year. Therefore, the figures given for the 1st half of 2020 are largely for reference purposes and demonstrate the dynamics

It will be possible to estimate the profitability for 2020 after the Central Bank publishes data for the calendar year.

There are no official ratings of the reliability of a particular fund in Russia, therefore this indicator can only be assessed by ratings of independent agencies established on the basis of various indicators of their performance.

Unfortunately, the only major rating agency in the country, RA Expert, due to the refusal of the fund itself, does not evaluate its performance indicators. The last rating of the NPF was assigned in 2020, according to the national scale - ruBB- with a stable outlook.

Personal account on the official website

A personal account on the Internet resource of NPF “FUTURE” opens up a standard list of opportunities for the owner:

- familiarization with the accumulated amount;

- studying the results of deduction management;

- correction of personal data if they change;

- calculation of the potential size of a funded pension, etc.

How to create a personal account and how to use it

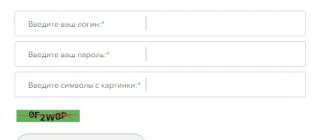

The personal account of the insured person is created on the official website. To do this you need to follow a few simple steps:

- In the upper right corner, click “Personal Account”.

- On the login page to your personal account, select “Register”.

- In the window that loads, enter the necessary data (full name, passport number and series, SNILS, email address and phone number).

- Agree to the processing of the submitted data.

- Enter the so-called captcha, referred to here as the “verification code”.

- Click the “register” button.

After sending the data, the user will receive a password to log into the system.

Important! Only its clients can register a personal account on the official website of NPF “FUTURE”. Accordingly, this can be done by a person who has entered into an agreement with this organization, and the citizen’s data has already been processed by the company along with consent to the processing of personal data

Pension plans

According to the plan, upon the occurrence of appropriate grounds, the NPF client receives a non-state pension plus income from the investment of funds that he contributed in the form of contributions.

Important! Additional income is a social tax deduction - 13% of the amount of contributions for the year. This rule applies to amounts within 120 thousand rubles.

When making contributions, the frequency can be any. The first payment is from 1 thousand rubles. This approach allows you to effectively manage savings and provide additional protection in retirement age. There are various ways to deposit funds, from enterprise accounting and Sberbank branches to online services.

Helpful information! You can become a client of the NPF at any time. To do this, it is enough to transfer the pension savings collected in the account until the end of 2020 to a non-state fund. The funded pension will be paid from this amount.

The fund's clients are given the opportunity to increase their pension. The employer transfers to the Pension Fund 22% in excess of the salary, of which 6% are savings until the specified date, 16% are deductions towards the insurance pension, formed in points.

How to view your pension savings

Pension savings mean the accumulated financial resources of working persons, from which the amount of the general labor pension is calculated depending on the length of service. Any resident of Russia can check their annual accrual amount. Below is a description of how to find out the amount of savings, where and what documents will be needed for this. Every Russian has the legal right to receive insurance and pension pensions after completing their work experience.

Thus, the combined group took third position among the leading players. The nuances of the organization’s activities and its achievements will be discussed below.

Hello, friends! All working people make contributions to a pension fund, but few people know how much money has been accumulated for a carefree and comfortable life after retirement. Let's figure out how to find out your pension savings and in what ways this can be done. No less interesting is the information in which fund the savings are made.

NPF rating

Earlier, RA “Expert” confirmed the rating of “Stalfond”, assessing its reliability at the “A+” level. This is a high figure, and the forecast for it was stable. After the reorganization, the rating was withdrawn. The fund received an 'AA' rating from the National Rating Agency in 2011, but this was withdrawn after the end of the contract period.

Contact Information

All clients who have entered into contracts with NPF "Stalfond" are currently serviced by the "Future" fund.

Important! All agreements remain valid and there is no need to re-issue them.

In Moscow, the fund's representative office is located on Tsvetnoy Boulevard. D.2, checkpoint D. You can contact the unified information service by phone: 8-800-707-15-20, the call is free from anywhere in Russia. Customer requests are accepted at:

Offices and branches operate in other cities of the country. You can find your nearest representative office on the official website of NPF "Stalfond".

Self-registration on the portal

If a new client needs to log into the “Personal Account” on the official website of the non-state pension fund “Stalfond”, he will need to go through a simple and standard registration procedure. To do this, you also need to go to the page for authorization on the portal (the “Personal Account” button of NPF “Stalfond” in the upper right corner) and click on the link: “Register” (at the bottom of the page).

To successfully register your “Personal Account” on the website of NPF “Stalfond”, you will need to enter the following personal data:

- Full name (if there is no middle name, then you need to check the box “No middle name”).

- Series and passport number.

- SNILS number.

- E-mail address.

- Phone number.

Please note that by default there will be a checkbox confirming consent to the processing of personal data. It should not be removed, otherwise the registration process will not be able to complete.

If the client wishes to receive notifications about fund news in the form of SMS messages to the phone or letters to the specified e-mail, then you need to check the appropriate box.

To protect against spam and confirm that it is a real person and not a bot who is registering, the system will ask you to enter . As a rule, it consists of numbers and Latin letters.

More on the topic Pension Fund Severodvinsk official website personal account

Expert opinion Elena Smirnova Pension lawyer, ready to answer your questions. Ask me a question If the person registering “Personal Account” on the official website of the pension fund “Stalfond” is not a citizen of the Russian Federation, the form also provides a special column for this case. You just need to check the box and continue entering data.

The final stage of registering the “Personal Account” of JSC NPF “Stalfond” is to click the “register” button. After that, the new user will receive a letter to the specified email address containing a password to enter the portal.

An individual can register on the Nalog.ru website either using an account in the State Services system or by filling out an electronic form on the official website of the Federal Tax Service.

Personal Area

To register a personal account, you will need to pass authorization. To do this, you need to enter your passport and SNILS details, as well as contact information. After registration, the fund's clients have access to:

- Information about the account status (provided within a few seconds);

- Free consultations for employees of the organization;

- Intuitive interface;

- Interest rate data.

By providing the required information, the client agrees to the processing of his personal data.

Non-state Pension Fund "Stalfond" and "Future"

When there was no hope left for the state in the matter of pension accruals, the state pension fund was replaced by organized ranks of non-state pension funds. One of them is Stalfond.

NPF "Stalfond" dates back to 1996. True, now by typing the word "Stalfond" into a search engine, you will be redirected to the website of NPF "Future", don't worry, this is not a hoax or other tricks, it's just in 2020.

Stalfond merged with NPF “Welfare OPS” and became “Future”. The result turned out to be quite confident and successful, since as of April 2020.

this fund is one of the three largest pension funds; this rating is based on data from the Bank of Russia.

At the same time, it is worth remembering the origins of Stalfond; its development began with a narrow profile focus; the programs were prepared only for Severstal employees. Over the seven years of its existence from 2007 to 2014.

The steel fund has grown so much that it has increased its financial performance by 86 times. These qualities of the enterprise contributed to the receipt of prestigious awards, not only in the domestic but also in the international market.

All this allows the fund, even in a new form, to win the trust of citizens.

How to get to your personal account Stalfond/Future

Despite the unification of Stalfond and its new name, this does not change anything for citizens who entered into an agreement.

There is no need to sign any new documents and with the old data you can register your personal account on the website of the NPF “Future”, which has now become Stalfond.

Or log in using old data if you have already registered your account - the company website: https://futurenpf.ru

Login to the account is possible in three options, you should indicate:

- SNILS.

- Or email.

- Or phone number and password.

If you have forgotten your password, technical support can remind you of it.

How to register on the official website

Please note that it is not necessary to check all the boxes provided in the form, for example, if you are not interested in information from the fund, do not check the box to receive newsletters

How to check your pension savings in Stalfond/Future

By registering a personal account, you can always be aware of the status of your hard-earned savings, and you will also know the investment rates with which the fund works. Directly in your personal account there is a specialized “pension savings” tab, which will allow you to keep everything under control.

You can obtain data on savings in three ways:

- online - you have this information directly in your account and you can immediately see it with your own eyes;

- by email - if you wish, you can order an extract to the e-mail specified during registration;

- by mail - if you need a practically official document, you can request an extract, which will be sent to you by mail to your post office. Perhaps this document may be required by the Pension Fund when calculating a pension.

Electronic versions of the information will become available almost within a couple of minutes, but the postal item will have to wait and the time depends on the Russian Post.

Reviews about the fund

Reviews about the work of NPF "Stalfond" are quite contradictory. You can often find stories about fraudulent methods of concluding contracts.

It happens that agents introduce themselves as employees of the Pension Fund and do not clearly explain to people the conditions for transferring funds to the fund. However, such costs are more likely associated with the lack of competence and integrity of the agents themselves.

In general, the fund fulfills its obligations and pays all amounts on time. This is confirmed by many years of successful work in this market and not the last positions of “Stalfond”.

( 6 ratings, average: 3.33 out of 5)