As official statistics show, the average pension in the country for non-working pensioners is about 15,500 rubles, but in fact many pensioners receive less than 10,000 rubles. Of course, such payments significantly reduce the standard of living of people after retirement, because this pension is several times lower than the wages received earlier.

However, you can achieve a higher pension on your own, although this should be taken care of in advance, long before retirement age arrives. There are many ways to increase future pension payments, and some of them are suitable for those who are already retired and receive low payments.

Work experience must be confirmed

Probably, everyone has long been accustomed to the fact that the employer himself makes the necessary contributions to the tax office and the Pension Fund, so very few people check all these actions. And it is for this reason that many people today cannot retire even at the right time, since employers do not always honestly make contributions to the Pension Fund.

For this reason, the Pension Fund does not always have complete data on a person’s work experience, which creates many problems. And this applies not only to those who are near retirement age or are applying for a pension, but also to those who are already receiving pension payments.

Too many people have insufficient work history records, especially those who worked in the 1990s. Even with official employment in those days and when receiving a legal white salary, information about work could simply be lost or hidden by unscrupulous employers, which significantly reduces the level of pension received today. For this reason, everyone who worked in the 90s should remember all their places of work and terms of employment, then request certificates about this and submit them to the Pension Fund.

It is important to remember that the work experience developed before January 1, 2002 has a very significant impact on the amount of pension payments due to the length of service coefficient. For example, if before 2002 a man worked for 25 years and a woman for 20 years, then their coefficient will be 0.55, but for each year above this norm another 0.01 will be added to the total coefficient, which is very significantly reflected in in the amount of monthly pension payments.

What is a professional foster family?

The concept of “professional” in relation to the term “foster family” is not contained in the current Russian legislation.

There is a whole section in the main legislative act concerning marriage and family relations - the Family Code of the Russian Federation. An entire chapter – 21 of the code – is devoted to the problem of foster families.

The concept of “professional” differs from the concept of “amateur”, so to speak, in relation to the activities of raising a person, according to the only criterion - the remuneration of fulfilling the duties of a parent.

In other words, the adoptive parent receives a reward for accepting the child. Enjoys a number of benefits guaranteed by the state for performing this socially significant work.

For many people who have not been able or do not want to realize themselves in the field of hired labor in production or the civil service, foster parents are a job and the main way to earn income.

Working as foster parents is encouraged in the form of payment established for performing the function of a parent, benefits, and a special procedure for calculating insurance/work experience, which is important when calculating a pension.

Notify the Pension Fund about the birth of children

This applies not only to those who are already receiving pensions and whose children are already adults, but also to young women who are just starting their families. The birth of a first child adds 2.7 pension points to a woman. For the second child, another 5.4 will be added to the total points. And if a third child is born, another 8.1 points will be added. Today, 1 pension point is 81 rubles 49 kopecks. Therefore, the birth of three children increases a woman’s pension by 1,230 rubles.

In order to receive the additional pension points due for born children, it is necessary to submit the children’s birth certificates to the Pension Fund to confirm the full insurance period.

What are there

The pension legislation provides for some payments, in addition to the basic pension, that a pensioner can receive. Payments are provided from the funded part of the pension, for length of service and some others.

From the savings part

In 2020, the funded component of the pension can be formed by citizens of the Russian Federation who were born no earlier than 1967. Pension savings are formed from a certain part of insurance contributions from the employer and from the personal amounts of citizens, which they independently deposit into their personal account. Each insured citizen has the right to withdraw these savings in a one-time payment in full or receive them in small installments along with the insurance pension.

A citizen can receive all his savings at once if the following conditions are met:

- reaching retirement age;

- loss of a breadwinner;

- receiving a disability pension.

When can you receive the funded part of your pension?

Report caring for a disabled relative

If you have been caring for a disabled relative, child or spouse for any period of time, this should also be reported to the Pension Fund, as such situations also increase the number of pension points.

Such periods of care are not indicated in a person’s work record, but must be included in the total length of service. Each year of caring for a disabled relative increases the number of pension points by 1.8. If care was provided for 10 years, then the amount of pension payments will be higher by almost one and a half thousand rubles.

It is also important to remember that if the pension of a disabled spouse is not enough to meet his needs, including the purchase of medicines and necessary things, as well as the provision of necessary food, he can be considered a dependent. In this case, you must contact the Pension Fund, bringing a certificate of the amount of the disabled spouse’s pension and the amount of your own pension payments, as well as providing evidence of regular expenses for the maintenance of the disabled spouse. After reviewing the documents, pension payments are usually increased by a very significant amount.

List of benefits that can be converted into money

In accordance with Federal Law No. 178, several subtypes of benefits can be monetized. In particular, regarding transport, obtaining medications and vouchers for sanatorium treatment.

There is also the possibility of monetizing benefits for utility bills. However, Russian pensioners approach this opportunity differently. The majority believes that this is another deception from the state, and the benefit is much less in terms of money than the benefit itself.

All possible options that will help increase the length of service required to assign a pension

In practice, it also turns out differently - it all depends on the amount of CG. If the pensioner agrees to transfer benefits for utilities into compensation, then he pays the full cost of utilities, and then submits an application to the Pension Fund. Part of the funds is transferred to him along with his pension.

Civil servants

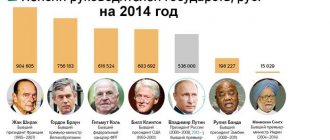

Civil servants have the highest pensions in the country, since they directly depend on the salary paid during the period of work. In addition, when calculating pensions for officials, not only the amount of salary is always taken into account, but also all types of allowances and bonuses paid.

As a result, after working for the Government for 16.5 years, you can receive a pension in the amount of 45% of your previous salary. And if you work for 26.5 years, the pension will be 75% of the salary.

Of course, State Duma deputies have the highest pensions. In just 3 years of meetings, they provide themselves with a pension in the amount of 50% of their salary. Judges, prosecutors, FSB and Ministry of Internal Affairs employees also have high pensions. The size of their pensions ranges from 50,000 to 130,000 rubles.

Processing cash payments

You can refuse social services (recruitment) for a year. The pensioner refuses all types of government assistance in whole or in part. To refuse, you must submit an application to the Pension Fund. You will need the following documents:

- passport, copies of passport;

- statement;

- a certificate confirming the right to social services from the state.

If necessary, the Pension Fund may request other documents. The application is drawn up at the Pension Fund department. It contains your full name, registration address, and the waiver of benefits.

An application to waive services for the next year must be submitted before October 1 of the current year. This is due to the fact that the compensation payment will be next year. If you submit documents later, there will be no compensation next year. The statement will come into force in a year.

Who will get a pension increase?

Who will have their pension increased from January 1, 2021 and by how much is one of the most popular queries on the Internet. It is already known that, as always happens at the beginning of the year, pensions for non-working pensioners will be indexed. Indexation will be carried out above the inflation rate.

Also, according to a special schedule, pensions for military pensioners and veterans of law enforcement agencies will be indexed. Pensions for this category of citizens have already been increased by three percent since October 2020.

But pensions for working pensioners will still not be indexed (indexation of pensions for this category of citizens has been suspended since 2020). Such pensioners will begin to receive an increased pension, taking into account missed indexations, only after completing their working career.

It should be noted that the State Duma has repeatedly raised the issue of resuming the indexation of pensions for working pensioners, but so far no money has been provided for such payments in the budget.

Endowment insurance

Savings insurance cannot be fully attributed to the mechanisms for forming a pension. Rather, it is a mechanism for financially protecting your future.

The mechanism of accumulative insurance is as follows: you make a certain payment to the insurance company monthly (or annually) for several years. This money has a guaranteed return, for example 4%, and during the entire period of accumulation you are covered by insurance for a large amount in case of disability, illness or death. Thus, endowment insurance is a two-in-one financial product: life insurance and savings.

Few people usually think about insurance, but if, for example, you have a high level of income and you are the only breadwinner in a large family, then thinking about this type of financial protection is a certain level of your responsibility to your family.

Moreover, in this case, the money does not disappear anywhere, but is invested with a conservative return.

Previously, this type of insurance was common only abroad, but now it is gaining popularity in the Russian Federation. Programs and their profitability can be viewed from major insurance companies.

How much will pensions increase in 2021–2024?

Earlier, the Ministry of Labor announced an expected increase in pensions for the period from 2021 to 2023. It is planned to increase the old-age insurance payment in 2021 by 6.3% (on average to 17,432 rubles per month). This figure is more than two thousand rubles higher than in the first quarter of 2020.

In 2022, pensions will increase approximately by 5.9%, in 2023 - by 5.6%. Thus, pensions should increase annually by about a thousand rubles per month. If a pensioner receives a minimum pension, for example, 10 thousand rubles per month, then from January 1, 2021, the increase will be approximately 600 rubles.

Those retiring in 2021–2023 can count on the following indexation increases to the fixed insurance payment:

in 2021 - by 6044.48 rubles;

in 2022 - by 6401.1 rubles;

in 2023 - by 6,759.56 rubles.

The planned size of indexations exceeds expected inflation, but if inflation indicators change upward, pensions will increase by more significant amounts.

Method for non-working pensioners

Option one for non-working pensioners: apply to the Pension Fund of the Russian Federation for recalculation of pensions on the basis of clause 8 of Art. Federal Law No. 400 of December 28, 2013. According to it, a pensioner has the right to choose the method by which his work experience is counted: according to the new legislation (Federal Law No. 400), or according to what was in force before Federal Law No. 400 came into force, that is until 01/01/15

The huge advantage of this method is that during recalculation you do not lose anything - if the “new pension” turns out to be lower than the “old” one, then you will receive the “old pension”. This option is best suited for those who are just about to apply for an old-age pension.