Modern regulations and orders allow citizens to actively participate in shaping their future and ensuring it, namely, influencing pension accruals.

The Russian Pension Fund receives considerable insurance contributions into the account from employers, which are supposed to be paid from wages towards a future pension. The funds accumulate, becoming the basis of the pension, but according to the law (Federal Law No. 56 “On additional insurance contributions for funded pensions and state support for the formation of pension savings”) citizens have the right to supplement it with insurance contributions, which will lead to an increase in pension.

Basic Concepts

Insurance contributions for a funded pension are insurance contributions made by the citizen himself towards a future labor pension to his individual account. The combination of insurance funds and accumulated funds constitute the basis for the formation of one of the reliable forms of ensuring payments.

The combined pension that results from this consists of budgetary calculations and market (from the employer) and payments against various risks.

Also, the insurance part of the pension is a guaranteed payment from the state for acquiring pension status in the following categories:

- by old age;

- on disability;

- upon loss of a breadwinner.

Its size depends on the annual indexation, the number of residents of the country, the social status and economic situation in the country, especially the ratio of workers and the number of pensioners to the volume of the state budget.

Insurance premiums are intended to guarantee payments of pension funds by the state , to ensure an increase in the funded part by citizens and to provide coverage for risks in the future.

Voluntary payments – what are they and what are they for?

Additional insurance premiums (ADI) are considered individual compensation payments that are paid out of the insured person’s own funds.

They are calculated and transferred by the employer, and are also paid by the insured citizen himself under certain conditions established at the legislative level in Federal Law No. 56.

The employee can pay an additional contribution independently or through the employer , who makes expenses out of wages. For the latter method, you need to contact the accounting department with a corresponding application, indicating in it the amount of costs or the insurance interest rate. The money will be transferred from your monthly salary to an individual account in the pension fund. The application is stored in the accounting department until the employee refuses the service.

ATTENTION! The personal funds of the insured citizen who is a participant in the co-financing program will be sent to him independently or also through the employer.

The money will be used to form pension savings and will be credited to the state financing fund.

What is KBC?

KBK is a specialized digital code that is intended for grouping state budget items. According to the legislation, it is determined by the groups of income, expenses and their sources of financing, as well as the budget deficit of the Russian Federation.

Today, contributions from the employer are aimed at increasing the pension capital of their employee and are included in the social package when applying for a job as an additional bonus.

For the employer, the calculations bring a positive effect - he does not pay insurance premiums of more than 12 thousand rubles per employee, the amounts are already included in the expense item and taken into account for taxation.

The employer transfers funds to the Pension Fund in a separate payment , which indicates that an order has been formalized in the relationship.

Additional insurance premium rate in 2017

The amount of the additional insurance premium rate may change based on the results of a special assessment of working conditions (SOUT). If it is not carried out, then insurance premiums for the additional tariff in 2020 should remain at the same level - 6 or 9%. Carrying out such activities may make it possible to reduce the rate to 0% in accordance with the scale given in paragraph 3 of Art. 428 Tax Code of the Russian Federation. It all depends on what class of working conditions will be identified.

So, if a special assessment showed that working conditions correspond to the “Optimal” or “Acceptable” class, the additional tariff will be equal to 0%. If conditions are recognized as harmful by subclass, the rate will take values from 2 to 7%. Hazardous working conditions mean the tariff will be 8%.

It should be noted that special assessments must be carried out at enterprises without fail when organizing safety precautions. Ignoring such measures may result in the company being administratively punished.

You can learn about how a special assessment is organized from the article “How is a special assessment of working conditions carried out (nuances)?”

In what cases are payments transferred?

Insurance payments are transferred to the Pension Fund, summing up the results of each month, but no later than the fifteenth day. BCC is paid by the employer in the following cases:

- transfers for compulsory pension insurance (KBK is equal to 182 1 0200 160);

- for temporary disability and maternity leave (KBK is 182 1 0200 160);

- medical insurance for employees (KBK – 182 1 02 02101 08 1011 160);

- social insurance for employee injuries (KBK - 393 1 0200 160).

Additional insurance contribution for funded pension

Additional insurance contribution for funded pension

- an individual compensation payment paid at the expense of the insured person’s own funds, calculated, withheld and transferred by the employer or paid by the insured person independently under the conditions and in the manner established by the Federal Law “On additional insurance contributions for funded pensions and state support for the formation of pension savings.”

The procedure for entering into legal relations for compulsory pension insurance in order to pay additional insurance contributions for a funded pension.

In order to enter into legal relations for compulsory pension insurance in order to pay additional insurance contributions for a funded pension, it is necessary to submit to the Pension Fund of the Russian Federation an application for voluntary entry into legal relations for compulsory pension insurance for the purpose of paying additional insurance contributions for a funded pension (hereinafter referred to as the application).

The application must indicate:

1) insurance number of the citizen’s individual personal account;

2) last name, first name, patronymic of the citizen;

3) place of residence of the citizen.

The application form and instructions for filling it out are approved by the Pension Fund of the Russian Federation.

The application can be submitted to the territorial body of the Pension Fund of the Russian Federation personally by a citizen, through his employer or through the MFC.

The employer who has received the application, within a period not exceeding 3 working days from the date of receipt of the application, sends it personally or through the MFC to the territorial body of the Pension Fund of the Russian Federation at the place of registration as an insurer for compulsory pension insurance.

Employers whose number of employees during the previous reporting period was 25 or more insured persons submit received applications to the territorial body of the Pension Fund of the Russian Federation in the form of electronic documents signed with an electronic signature.

The territorial body of the Pension Fund of the Russian Federation, which received the application, no later than 10 working days from the date of receipt of the application sends the citizen a notification of receipt of the application, the results of its consideration and the date of entry into legal relations for compulsory pension insurance in order to pay additional insurance contributions for a funded pension.

If a citizen submits an application in the form of an electronic document, notification of receipt of the application is sent to the citizen in the form of an electronic document.

If the application does not contain the necessary data and (or) the necessary information is not provided, the territorial body of the Pension Fund of the Russian Federation provides the appropriate explanations to the citizen who submitted the application.

Procedure for paying additional insurance contribution for funded pension.

In accordance with the law, a citizen can pay DSA for a funded pension independently or entrust their payment to his employer by deduction from his salary.

The procedure for independently paying an additional insurance contribution for a funded pension.

Payment of an additional insurance premium for a funded pension can be made by the insured person independently, by transferring funds to the budget of the Pension Fund of the Russian Federation through a credit institution.

When independently paying additional insurance contributions for a funded pension, the insured person, no later than 20 working days from the end of the quarter in which such payment was made, has the right to submit to the territorial body of the Pension Fund of the Russian Federation a copy of a document confirming the payment of additional insurance contributions for a funded pension, or send such a document in the form of an electronic document using information and telecommunication networks, access to which is not limited to a certain circle of persons, including the State Services portal.

The procedure for calculating and withholding additional insurance contributions for a funded pension by the employer.

Additional insurance contributions for the funded pension are calculated monthly by the employer separately for each insured person.

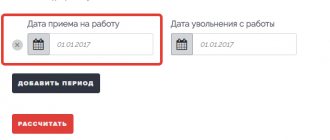

An employer who has received an application for the payment of additional insurance contributions for a funded pension or for a change in the amount of the additional insurance contribution to be paid for a funded pension shall calculate, withhold and transfer additional insurance contributions for a funded pension starting from the 1st day of the month following the month the employer received the corresponding statements.

The termination or resumption of payment of additional insurance contributions for a funded pension is also carried out from the 1st day of the month following the month of filing the relevant application.

In what size?

Contributions are paid to the following authorities:

- to the pension fund (future pension);

- to the medical fund (free medical services);

- to the social insurance fund (life and health insurance of employees).

Contributions to the Pension Fund depend on the size of the salary received by the citizen.

IMPORTANT! The employer pays a pension even when applying for a job under a fixed-term, part-time, open-ended or civil contract.

Additional contributions are usually paid in the amount of 22 percent ; the transfer must contain the KBK code for the correct direction of transfers.

On our website you can also find out the following information about the funded part of the pension:

- What is a lump sum payment?

- What happens to savings after death?

- How to find out the size?

- Where is the best place to store it?

- When can you withdraw before retirement?

- How can working and military pensioners receive a funded pension?

- To whom can it be paid?

In what cases are additional insurance premiums charged?

Currently, the scope of calculating insurance premiums is regulated by Chapter 34 of the Tax Code of the Russian Federation, introduced on January 1, 2020, entitled “Insurance Premiums”. Its essence and content are identical to the content of the law of July 24, 2009 No. 212-FZ, which was in force until that moment. Nevertheless, it is advisable to once again consider the subtleties of applying existing standards.

Additional contributions, in accordance with the law, are calculated on the income of employees who have the right to retire early. Such cases are defined by the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

Corresponding additional tariffs for pension insurance have been adopted for those persons who work in hazardous conditions, in hot workshops, and in underground work. The tariff here is 9%.

A lower rate - 6% - is provided for a number of citizens, depending on working conditions, gender, age, place of work and a combination of these conditions. For example, the reason for assigning the specified rate may be work in difficult conditions, as part of locomotive crews, the activities of passenger transport drivers in cities, logging workers, rescuers, teachers, etc.

More details about the categories of persons who are included in this group can be found in the article “Who is entitled to an early old-age pension (nuances)” .

Co-financing

This type of program allows you to increase funds in the form of pensions and savings from the state. This is done within the limits and in proportion to the citizen’s investment. The range can be within 2,000 – 12,000 rubles. Otherwise, the state will not increase invested savings.

The program assumes joining before 2014. But at the moment there is a possibility of the law being adopted in 2020. Its effect still applies to pensioners who have already received their first payment. The duration of the offer is for the next 10 years.

There are also several features here.

The following conditions must be met:

- availability of rights to insurance coverage in accordance with Federal Law;

- failure to apply for a similar type of pension.

Formation

Accumulations can be called all accruals of funds that are recorded on a citizen’s individual personal account.

There are probably several ways of forming here:

- at the expense of the insurance payment to the savings account. This can be either mandatory payments that are paid by the employer, or payments that are paid independently by the citizen or through the employer;

- participation in co-financing of a future state pension;

- directing funds from the family certificate towards the formation of the mother's funded pension.

In accordance with Federal Law No. 410 of December 28, 2013, there are several possibilities for transferring from one non-state fund to another within a certain time frame and only after submitting a specific application in the established form:

- after 5 years, a standard transfer application must be completed;

- Before the 5-year period, an application for early transfer is written.

The first one has an informed choice and investment. That is, this is already a reasoned position. In the latter case, this is a method with a possible loss from investment. This fact is documented.

We suggest you familiarize yourself with: Calculation of the amount of insurance premium OSAGO coefficients

Calculation of reduced contributions to compulsory pension insurance when the maximum base is exceeded

EXAMPLE

Payments in the amount of 1,200,000 rubles were made to the employee for January-March 2020. For April 2020, the specified employee was accrued another 200,000 rubles. That is, the amount of payments in favor of the employee, determined by the cumulative total from the beginning of the billing (reporting) period, in April 2020 exceeded the maximum base value for calculating insurance premiums for compulsory health insurance by:

(1,200,000 + 200,000) - 1,292,000 = 108,000 rubles.

200,000 - 108,000 = 92,000 rubles - the amount of payments for April 2020, which is included in the maximum base for calculating insurance premiums for compulsory health insurance.

In this case, at the usual rates of insurance premiums, part of the payments for April 2020, not exceeding the minimum wage, is levied, i.e. 12,130 rubles.

Part of the monthly payments in excess of the minimum wage, which does not exceed the maximum base for calculating insurance premiums for compulsory health insurance, in the amount of 92,000 - 12,130 = 79,870 rubles, is subject to insurance premiums for compulsory health insurance at a rate of 10%.

The part of payments that exceeds, from the beginning of the billing (reporting) period, the maximum value of the base for calculating insurance premiums for compulsory health insurance, in the amount of 108,000 rubles, is subject to insurance premiums for compulsory health insurance at a rate of 10%.

Calculation of contributions to compulsory pension insurance for April 2020:

- 12 130 × 22% = 2668,60

- 79 870 × 10% = 7987,00

- 2668.60 + 7,987.00 = 10,665.60 rub.

Part-time

In practice, cases are not excluded when an employee is part-time for a month both in work with harmful, difficult and dangerous working conditions indicated in the table, and in other positions. Then the accountant calculates contributions using the formula:

Amount of contributions to the Pension Fund = [Amount of payments and remunerations accrued per month (including bonus) / Number of days actually worked in the relevant types of work with harmful, difficult and dangerous working conditions] * Additional tariff

This formula is also relevant if during the month the employee was partially employed in work with harmful, difficult and dangerous working conditions, to which different rates of additional contributions apply. For example, part of the time he worked in the jobs listed in paragraph 1 of the table, and then was employed in the jobs listed in paragraphs 2–17 of the table. Similar explanations are given in the letter of the Ministry of Labor of Russia dated April 23, 2013 No. 17-3/10/2-2309.

Additional payments

Payments can be made from the citizen’s own savings. This allows you to increase your pension savings in the future. The employer has the right to accrue payments as part of the increase in security for its own employees.

In addition to this positive feature, which includes a social package with additional security, there are other positive aspects:

- exemption from payment of insurance coverage in the amount of contribution per employee;

- tax reduction due to increased salary costs.

See what you need

additional insurance contributions to the Pension Fund for hazardous working conditions

.

Who is entitled to an increase in pension after 80 years of age? Find it at the link.

How to pay

To pay, you must independently contact the authorized body at the place of registration with an application for payment of additional insurance premiums. An application of the established form can also be submitted through the employer. In this case, the final authority sends the application within three days to the authorized body.

It contains the following details:

- last name, first name and patronymic;

- place of registration and residence;

- individual personal account number;

- other information.

No later than 10 days, the territorial authorized body sends the applicant a notice of consideration and the date of entry into this relationship. If a person wishes to pay additional payments through the employer, then this is indicated in the established form.

The amount of additional contributions is also indicated here.

Additional payments may be made not only by persons participating in compulsory health insurance, but also by citizens who are not subject to insurance. Even if they did not carry out any activities and did not serve.

We invite you to read: Whose insurance company pays damages in an accident to the victim?

Paid contributions are reflected in the citizen’s individual account. You can view your savings in the annual statement of the Pension Fund, as well as by requesting information through your personal account of the State Services or the Pension Fund of Russia.