Retirement age

Retirement in the country depends on the following factors:

- seniority;

- job title;

- gender identity.

As in the Russian Federation, women pensioners in Kazakhstan retire earlier than men.

In accordance with the Law “On Retirement Age”, citizens with a certain length of service are entitled to receive benefits. The higher it is, the more substantial the payout.

In order to receive a pension based on length of service, a person undertakes to work for a certain amount of time. The minimum for men and women will vary. Women must work for the state for 20 years. It is possible for men to receive a well-deserved retirement only after 25 years of continuous service.

Today, the retirement age for women is 58 years, for men – 63 years.

Plan to raise the retirement age in Kazakhstan

Until 2027, it is planned to gradually increase the retirement age for women. Starting in 2020, the release schedule will gradually shift and increase by 6 months.

In 2027, women will also retire at 63.

You can find out about the retirement age and pension amount in the CIS countries on our website.

Return to contents

Calculation of pensions in Kazakhstan

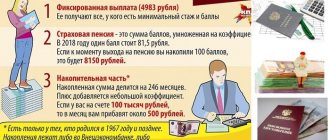

Pension calculations in the Republic of Kazakhstan include 3 components:

- Solidarity (labor);

- Basic;

- Accumulation part.

Labor or solidarity payment is due to those working before 1998, with a minimum work experience of 6 months. The amount of the pension directly depends on the number of working years available. To obtain the maximum volume, the following work experience is required:

- Women - 20 years old;

- Men are 25 years old.

The longer the length of service, the higher the payment, and accordingly, the shorter the length of service, the lower the amount.

Basic payment , after increase in July 2020 – 14466 tenge. For all citizens, its indicator was the same, regardless of length of service and salary. The basic rate is a guaranteed social benefit.

With the innovations adopted on July 1, 2020, the calculation of the amount of the basic pension will depend on two components - length of service and contributions. Persons who have participated in the pension system for up to 10 years will be limited to a social rate of 50% of the monthly minimum. For each year above this figure, the payout ratio will increase by 2%. Existing official employment for more than 35 years guarantees a pension in the maximum amount of the subsistence level.

Accumulation system

JSC UAPF since 2014 is the only totalizer of all pension contributions. Upon retirement, citizens have the right to withdraw their accumulated pension contributions. You must contact the branch and sign a receipt agreement. The payment can be one-time, monthly or annually. A one-time payment is limited to a maximum of 250 MCI.

The numerical coefficient that underlies the calculation of pensions and other government payments changes annually. The pension consists of the sums of the labor pension and the basic pension payment.

You can make voluntary contributions to the UAPF fund to increase your pension contributions.

The pension payment for citizens with more experience than necessary increases by 1% for each year. The amount of the labor pension is 60% of the average monthly salary for any three years from 01/01/1995. There are lower and higher limits (for 2020):

- Minimum – 31245 tenge;

- Maximum – 104374 tenge.

The average monthly salary is calculated as follows: the total profit for 3 years is divided by the number of months (36). Only permanent work experience (continuous work for three years) is taken into account.

In addition to payments, mandatory length of service is taken into account:

- For women – 20 years;

- For men – 25 years.

If there is a shortage of the required number of working years, a calculation is made - the available years worked are divided by the number of required ones.

Pension calculator

Sample:

- First you need to calculate the CTC (employment coefficient). The official length of service by law is 25 years for men and 20 for women. We translate into months - 25*12, and 20*12, respectively - it turns out 300 and 240 months, respectively. KTS=existing work experience/300 for men and 240 for women.

- We calculate PZ - % of wages. For example, the length of service for 1998 will be 25 years or less (men) and 20 years or less (women), then the PZ is automatically equal to 0.6. If the length of service exceeds these figures, 0.1 is added to the salary of 0.6 for each year. The highest threshold of PP is 0.75.

- KSMD – average monthly income for any 36 months of continuous work. KSMD=PZ*average monthly profit for any 3 years. If the KSMD is below the minimum pension threshold, then 31,245 is taken into account; if the average monthly figure is more than 93,029 tenge, the amount is taken to be 104,374 tenge.

- The pension is calculated using the formula – KSMD*CTS.

- Plus the basic part is added to the labor pension.

Average pension

The average pension benefit for 2020 – 60167 tenge. Total – joint and basic (12802 tenge) payment.

Minimum pension

For 2020 – 45711, including the base part.

Maximum pension

The highest rate of this payment is 75% of 46 MCI. The MCI coefficient changes annually, this year it was 2269 tenge.

Early retirement

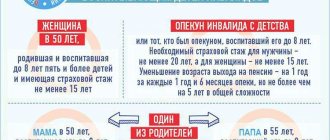

Early retirement is relevant for the following categories of citizens of the Republic:

- Kazakhstanis who were born in the period from 08.29.49 to 07.05.63, who have lived in environmental risk zones for at least 5 years and whose health has been compromised due to testing at the Semipalatinsk test site.

- Males whose age by 01/01/98 was 50 years old and whose work experience was 25 years.

- Females whose age by 01/01/98 was 45 years old and whose work experience was 20 years.

A mother of many children can also retire early. By the age of 53, a mother with many children needs to have time to give birth or take care of more than 5 children and raise them until the age of eight.

Pension system of the Republic of Kazakhstan

Return to contents

Calculation of work experience

When assigning an old-age pension, the following types of activities are taken into account:

- Service in the Ministry of Internal Affairs.

- Military service.

- Business activities.

- Caring for a disabled parent.

- Caring for a disabled child.

- A non-working mother caring for her small child.

- Caring for any other disabled relative of group 1, as well as groups 2 and 3.

- Caring for any unrelated person who has received a disability pension.

The period of joint life of spouses serving in the Ministry of Internal Affairs and living in areas where there was no possibility of their employment is also taken into account. The same applies to all military personnel, except conscripts. Length of service is also taken into account.

And studying at the institute is also taken into account.

Average pension in the Commonwealth countries and Georgia

Return to contents

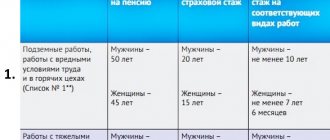

Preferential calculation of length of service

To apply for an old-age pension when calculating preferential length of service, the following is taken into account:

- military service for the period of hostilities;

- participation in the Second World War;

- work in infectious diseases institutions;

- participation in mining events;

- service in the police or military in the regions adjacent to the Semipalatinsk test site;

- work on water transport.

Return to contents

Types of pension payments

The main types of pension contributions are presented in the table.

| Type of pension | Description |

| Basic | All Kazakh pensioners receive it, regardless of their length of service and deductions. The size of the basic pension today is 15.2 thousand tenge/30 calendar days. |

| Solidarity pension in Kazakhstan | Paid to those Kazakhs and representatives of other nationalities whose work experience before 1998 was 6 months. |

| Cumulative | This is a new type of pension, which Kazakhstanis began to receive in 2014. Payments of savings occur either once or every year or month. In the first case, the maximum amount should not exceed 249 MCI. |

Return to contents

News about pension increases

The rise is carried out in 3 smooth steps:

- As of July 1, 2020, the labor pension increased by 11% (of which 9% in January), the basic pension by 13% (of which 7% in January);

- The second stage begins on January 1, 2020, with the plan to increase the basic pension to 16%;

- The next step will come into force on July 1, 2018. It will directly affect the basic pension payment. The payment amount will be based on the years worked before 1998. and mandatory pension contributions.

It is planned to gradually increase the percentage of mandatory pension contributions - which will directly affect pensions. The employer will be required to pay 5%. These contributions cannot be withdrawn from the fund; they will be paid along with the pension (as opposed to the 10% mandatory contributions). The size of pensions and benefits in Kazakhstan will be doubled, watch the video for more details:

How pension payments are calculated

The size of pensions in Kazakhstan is gradually increasing. A recalculation of the amount awaits those who receive a basic pension.

Increasing labor pensions in Kazakhstan

You can find out the approximate size of the minimum pension calculated using the new formula using an online calculator.

Read on our website: average pension in European countries.

Return to contents

Calculation of basic pension

Today, the size of basic pension payments is 50% of the monthly minimum. After the increase, its percentage will vary from 53 to 100% of the PM.

Social benefits will be accrued on the basis of work experience that was developed before 01/01/98. Also, the calculation will take into account the period of receipt of pension contributions to the funded part of the PS after 1998.

With ten years of work experience, the pension in Kazakhstan will be 54% of the monthly salary. For every 12 months over ten years of experience, 2% will be added.

The basic pension is calculated based on the total length of service.

Return to contents

Calculation of joint pension

The calculation of the joint pension is carried out on the basis of 2 indicators: length of service and average monthly income.

Amount of joint pension in Kazakhstan

You can calculate the second indicator for 36 months of work by dividing the total income for all 3 years by 36.

The size of the joint pension is calculated at 59% of the average monthly profit of a citizen of the Republic of Kazakhstan for any 36 months from 01/01/95.

In accordance with the new calculation of pensions in Kazakhstan, every 12 months. length of service, pension payments will be recalculated and increased by 1%. You should know how much it will be in the end: the average pension in the Republic will be 74%.

Return to contents

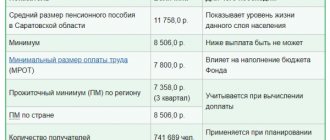

Minimum and average size

In accordance with the law on pension provision, an indirect minimum of joint pension payments was determined. It's called the "minimum wage". This is the lower guaranteed limit for Kazakhstanis who have the required work experience.

The minimum pension today is 38,636 tenge. Considering that pensions in Kazakhstan are now calculated according to a new scheme, after summing up all the coefficients, the average pension amount is 85 thousand tenge. The maximum pension after indexation is 117 thousand tenge.

Moreover, according to the new calculation of pensions, both basic and joint payments will be taken into account.

For those Kazakhstanis who are already on a well-deserved retirement, in 2020, in accordance with the new procedure for calculating pensions, the increase in the basic benefit will be made automatically. No special certificates are required to be submitted to the state pension payment center.

Return to contents

WE CALCULATE YOUR PENSION

1 535

How to calculate your future pension? If at the time of retirement a person does not have enough work experience, then what will be the amount? What will determine the size of the basic pension, and who will receive the additional 5 percent? At the numerous requests of our readers, we asked the deputy head of the department for control and social protection of the population, Manshuk Lepesova, to answer these and other questions regarding pension provision.

— Tell us, what is a pension in Kazakhstan? — A pension is a set of pension payments from an authorized organization, the Unified Accumulative Pension Fund, or a voluntary accumulative pension fund. The calculation of pensions, their size and payment procedure is regulated by the Law of the Republic of Kazakhstan No. 105 of June 21, 2013 “On pension provision in the Republic of Kazakhstan”. All citizens of the Republic of Kazakhstan, as well as foreigners and stateless persons permanently residing in the territory of Kazakhstan, have the right to pension provision. Kazakhstan has a mixed pension system, which consists of a solidary (labor) pension system, a funded system and a basic pension. On June 18, 2014, No. 841, the Decree of the President of the Republic of Kazakhstan “On the Concept of further modernization of the pension system of the Republic of Kazakhstan until 2030” was signed. The concept was developed in pursuance of the instructions of the Head of State, voiced in an address to the people of Kazakhstan on pension reform issues dated June 7, 2013. The main goal of the Concept is to ensure adequate pension payments. The concept provides for the development of a three-tier pension system, which will include:

1) A basic pension provided by the state and aimed at reducing poverty and stimulating citizen participation in the pension system. Currently, the basic pension is assigned in the same amount to all citizens who have reached retirement age, regardless of length of service and salary. In contrast to the current procedure for assigning a basic pension, it is planned to assign a basic pension depending on the length of participation in the system and when citizens reach the generally established retirement age. Thus, according to these changes, from July 1, 2017, the basic pension will be assigned only when citizens reach the generally established retirement age and depending on the length of participation in the pension system. If citizens have less than 10 years of experience in the system, they will be provided with a social pension equal to 50% of the subsistence minimum; for each year over 10 years, its size will increase by 2%, and with 35 or more years of experience, it will be equal to the subsistence minimum. . This will solve the problem of three generations of participants in the pension system. The first generation includes established retirees who receive a minimum pension, have a long work history, but did not provide information on income due to their absence at the time of retirement, as well as due to legislative restrictions. From July 1, 2017, this category of pensioners will undergo a one-time recalculation of the basic pension, taking into account the length of participation in both the joint and funded pension systems. The second generation is people who reach retirement age before 2043 and have an incomplete record of participation in both the joint and funded pension systems. They will be assigned a basic pension depending on: 1) their work experience accumulated as of January 1, 1998; 2) the period of payment of pension contributions to the funded pension system after 1998. The third generation is people who will retire after 2043 and receive a basic pension depending on the amount of savings. A basic pension will be assigned in the event that their pension amounts received from other components of the pension system are lower than the established socially acceptable level of pensions.

2) The second component of the pension system will be a pension from the new conditional savings system, which is formed from 5 percent contributions by employers in favor of their employees. For each participant in the system, an individual pension account is opened in the UAPF, on which the amount of transferred contributions or pension savings is recorded. They are conditional and are not the property of the system participant. The pension amount is determined as pension savings divided by the life expectancy ratio. A pension is assigned when citizens reach the generally established retirement age and have at least 5 years of experience in the system. It is paid for life and is not inherited.

3) The third component will be pensions from the current funded pension system. They are formed from 10 percent mandatory contributions from the employees themselves. At the same time, the amount of pension payments received will depend on the participation and regular deductions of citizens’ contributions, as well as on the level of profitability of pension savings. For persons employed in hazardous working conditions, from January 1, 2014, in addition to the mandatory pension contributions of employees, mandatory professional pension contributions (OPPV) in the amount of 5% of the wage fund were introduced. Moreover, employers deduct OPPV only for those types of production that are classified as hazardous, and only to those persons who are employed in them. The list of types of hazardous industries and the list of professions of workers employed in them is approved by the Government of the Republic of Kazakhstan and will be periodically revised taking into account changes in working conditions. In addition to all this, joint pension payments are maintained for both established pensioners and citizens with at least 6 months of work experience as of January 1, 1998. The assignment and payment of solidarity pensions will be carried out in accordance with current legislation, along with basic, conditionally funded and funded pensions. — At what age can a person count on a pension? — Currently, men retire at 63 years old, women at 58 years old. Women who have given birth to five or more children can count on retirement at age 53. From 01/01/2018, the age of women will increase by 6 months annually for ten years, and from 01/01/2027, pension payments will be made to women upon reaching 63 years of age. Currently, men receive a full pension from the solidarity system if they have 25 years of work experience, and women - at least 20 years before January 1, 1998. — How is the old-age pension calculated (calculated) in Kazakhstan? — Pensions are calculated in full from the Center at the rate of 60% of average monthly income. To calculate income for calculating a pension, you need to divide the total amount of income for any 3 years (36 months) of work in a row, regardless of breaks in work since January 1, 1995, by thirty-six. Income for calculating pension payments from the Center cannot exceed the 41st monthly calculation index, the amount of which is currently 1,852 tenge. (41 x 1,852 = 75,932 tenge). Income for calculating the pension amount has been accepted since 1995, tenge in Kazakhstan since November 1993. The amount of average monthly income for the period from January 1, 1998 is established according to the income from which mandatory pension contributions were made to savings pension funds in the manner determined by the central executive body in the field of social protection of the population. The amount of pension payments for each full year worked before January 1, 1998, in excess of the required length of service, increases by 1 percent, but not more than 75% of the income taken into account for calculating the pension. The maximum amount of pension payments cannot exceed 75% of 41 times the monthly calculation index (56,949 tenge). — Please give an example of calculating a pension. — Let’s say a man was born on July 1, 1951, upon reaching 63 years old, applied for an old-age pension, works, total work experience as of January 1, 1998 is 28 years, average monthly income for the period from 2011 to 2013 is 87,000 tenge. To calculate the income of 87,000 tenge, we take into account the limitation of the 41st monthly calculation indicator and get 75,932 tenge (41 x 1,852 = 75,932). We multiply by 63% of the average monthly income for 25 years (this is added to 60% by 3% for each year of excess work experience). As a result, the man will receive a pension in the amount of 47,838 tenge, to which the basic pension will be added. — What is the size of the basic, minimum and maximum pension in Kazakhstan in 2014? — According to the Law “On the Republican Budget for 2014-2016”, from April 1, 2014, the following pension amounts have been established in Kazakhstan: . basic pension - 10,450 tenge; . minimum pension - 21,736 tenge; . maximum pension - 56,949 tenge. — Who is paid the minimum pension? — The minimum pension is assigned if there is sufficient length of service, but there is no or insufficient income to calculate the pension. — Let’s say a person has reached retirement age, he has some work experience, but before retirement he didn’t work anywhere for five years. Or, on the contrary, a person has some experience, but there was a long break in work and only a year or two before retirement he got a job. How is the old age pension calculated in this case? What will determine the size of the pension in this case? Give an example. — The size of the pension depends on length of service and salary. The amount of the old-age pension in the absence of the required work experience is calculated as a share of the full pension in proportion to the existing work experience as of January 1, 1998. For example: a woman has 10 years of work experience as of January 1, 1998, no income, pension amount is 10,868 tenge, that is, 21,736 x 120: 240 = 10,868 tenge (21,736 tenge is the amount of the minimum pension, 10 years - 120 months , 20 years = 240 months). A woman with the same length of service, but with an average monthly income of 70 thousand tenge, has a pension of 21,000 tenge, that is, 42,000 x 120: 240 = 21,000 tenge (42,000 = 60% of 70,000 tenge, full pension). — Who gets a pension on preferential terms in Kazakhstan? — The following are entitled to a preferential pension in Kazakhstan: . women who have reached the age of 53, who have given birth (adopted) five or more children and raised them up to the age of eight; . citizens who lived in zones of extreme and maximum radiation risk during the period from August 29, 1949 to July 5, 1963 for at least 5 years are entitled to pension payments: - men - upon reaching 50 years of age with a total work experience of at least 25 years as of 01/01/1998; - women - upon reaching 45 years of age with a total experience of at least 20 years as of 01/01/1998. — What is included in the length of service for calculating an old-age pension? — When calculating the length of service for assigning a pension from the Center, the following are taken into account: . work under employment contracts, paid by individuals and legal entities; . military service; . service in law enforcement agencies; . public service; . entrepreneurial activity; . the time a non-working mother cares for young children, but no more than until each child reaches the age of 3 years, within 12 years in total; . training in higher and secondary specialized educational institutions, in colleges, schools and courses for personnel training, advanced training and retraining, in graduate school, doctoral studies and clinical residency, as well as in full-time higher and secondary religious educational institutions on the territory of the Republic of Kazakhstan and beyond it outside, etc.

Natalia URAZGALIEVA

Payments to military and police

The increase in pensions in the country will also affect former military personnel and employees of the Ministry of Internal Affairs.

Before the pension reform, benefits for former military personnel were paid from the age of 45. This is also the case today. Pensions in Kazakhstan for military and former employees of the Ministry of Internal Affairs will be calculated in accordance with:

- length of service;

- disability;

- having mixed experience.

The amount of benefits for this category of citizens is gradually increasing from 2020.

Providing military housing in Kazakhstan

In 2020, the year worked will be assessed separately. This is due to the introduction of the GPC - the annual pension coefficient.

In addition to the basic benefit, former military and police officers can count on additional funds. The amount of the pension supplement is indicated in the tablet.

| Category | Supplement amount |

| WWII participants under 80 years of age | 31% |

| WWII participants over 80 years old | 41% |

| Disabled people over 80 years old | 100% |

| Non-working persons of retirement age with dependents | 33–100% |

The total indexation volume in 2020 was 7–8%.

Return to contents

Indexation of other payments

In accordance with the law of the Republic of Kazakhstan “On social benefits for disability, loss of a breadwinner and age in the Republic of Kazakhstan”, benefits for the loss of a breadwinner in the country are assigned and paid to disabled members of his family.

First of all, this concerns children with disabilities of groups 1, 2 and 3.

Survivor's benefits are provided for the entire period during which a family member of an untimely deceased person is considered incapacitated.

A person applying for benefits must present a photocopy of any document that confirms a family relationship with the deceased:

- Marriage certificates.

- Document establishing paternity (maternity).

- Identity cards.

More detailed information can be obtained by contacting the state pension payment center. It will also be possible to clarify whether payments will increase in the near future.

Another point where you can get reliable information is the Department of Control and Social Protection of the Population. You must apply strictly at your place of stay.

Return to contents

Social payments

Social benefits from the State Social Insurance Fund increase every year.

Video material about social payments in Kazakhstan:

Survivor's pension

Family members have the right to receive social benefits in the event of the loss of a breadwinner.

The pension is assigned:

- Persons under 18 years of age (children, brothers and sisters - if they do not have parents);

- Persons over 18 years of age if they have a disability that appeared before they turned 18;

- Persons studying full-time at any secondary or higher educational institution (up to 23 years old);

- Relatives of the deceased who are raising his child/children (up to 3 years old);

- Guardians (per child for each lost parent).

The survivor's pension is calculated from the number of disabled citizens living in the family:

| Number of disabled family members | Amount (tenge) |

| 1 | 21 035 |

| 2 | 36 444 |

| 3 | 45 250 |

| 4 | 47 940 |

| 5 | 49 652 |

| 6 or more | 51 609 |

The amounts depend on the subsistence level (subsistence level). For family members of military personnel, the amount of payments increases by 0.25 monthly wages for each member.

Disability pension 1st group

Disabled children (from 16 to 18 years old), disabled since childhood, disabled people with general illness receive a benefit in the amount of 1.78 monthly wages. Military personnel, special services workers:

- 1.78 PM – for disability received outside of working hours;

- 2.74 PM - for disability received in the performance of official duties.

Conscripts - 2.11 PM. In addition, disabled people of group 1 have the right to receive a Special State Benefit:

- 1.49 MCI – disabled people with general illness, disabled children (16-18 years old);

- 0.96 MCI – disabled children (under 16 years old).

The amount directly depends on the PM coefficient, which increases every year.

Possibility of benefit transfer

A person who wants to move to Russia or any other country has the right to withdraw his pension savings. The main criterion is the correct registration of permanent residence.

Today, a pension agreement is being developed between the member countries of the Eurasian Union. In accordance with it, the transfer of a monthly pension payment is possible when changing citizenship within the union. Return to contents

Agreement between the CIS countries

The issue of pensions for migrants from one country to another is regulated by the Agreement, which was signed in 1992.

The following principles of this agreement are highlighted:

- funds are paid in accordance with the legislation of the country in which the pensioners live;

- the costs of payments fall on the shoulders of the home state;

- benefits are assigned only at the place of residence.

Work experience includes all years of work recorded in the territory of any of the CIS countries that signed the agreement.

Labor migration and social security of citizens in the EAEU

Return to contents

How to transfer benefits

In order to transfer your savings to the territory of the Russian state, you will need to prepare a list of certificates in advance. The next steps are as follows:

- It is legal to cross the border of the Russian Federation.

- Register with the territorial Federal Migration Service.

- Apply for a residence permit.

- Notify the Pension Fund of the Republic of Kazakhstan about the change of place of residence.

- Withdraw from the pension register in your home country.

- Send a list of documents related to work experience to the Russian pension fund.

Transfer of benefits to migrants is carried out only after employees of the special commission have examined the pension file of the applicant and confirmed the accuracy of all documents provided.

Payments are transferred to the card of one of the Russian banks. But money can also be transferred to a pensioner by mail. The procedure is provided for by Russian law.

Changes in the minimum subsistence level in Kazakhstan

Return to contents

Registration of benefits

The following documents are required to apply for a pension:

- residence permit;

- identification document;

- work book, which records the work experience;

- a certificate from the Pension Fund of the Republic of Kazakhstan confirming that the migrant does not receive any payments;

- certificate from the place of residence in the Russian Federation;

- a document fixing the amount of contributions from the insurance fund.

If a migrant or refugee needs a pension, then a certificate confirming his status will need to be attached to the main list of documents.

Read on our website: receiving a pension with a residence permit in Russia.

In accordance with the Agreement adopted in 1992, legalization of certificates for submission to the Russian pension fund is not necessary.

Return to contents

What amount is paid

Recalculation of payments is carried out on the conditions presented in the table.

| Type of benefit | Conditions |

| Due to old age. | The applicant must be over 58 years of age. Work experience – from 15 years. The pension coefficient must be 30 points. |

| Due to disability. | To carry out the recalculation, the applicant will need to go through the MSEC again. Disability is confirmed on the territory of the Russian Federation. |

| For the loss of a breadwinner. | The first step is to confirm the death of the breadwinner. Then all documents proving the fact of relationship are presented. |

| According to length of service. | It is necessary to provide proof of work in hazardous work. |

Regardless of the grounds, the pension includes insurance and fixed payment.

Return to contents