ATTENTION! In accordance with the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”, the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation” does not apply from January 1, 2020, with the exception of the rules governing calculation of the size of labor pensions and those to be applied for the purpose of determining the size of insurance pensions to the extent that does not contradict the specified Federal Law.

See Old-age insurance pensions: concept, conditions of assignment, amount

The material below is no longer relevant!

What does an old-age insurance pension mean?

An old-age insurance pension is a cash benefit that is paid monthly to persons who have reached the appropriate retirement age. In essence, this type of social security is compensation for disability due to age.

In everyday life you can hear such wording as “labor pension”. Many believe that this concept is identical to that discussed in this article. However, it is not. Its formation largely depends on length of service, that is, the number of years worked. Since 2013, this form of pension provision is no longer used. It has been replaced by an insurance pension, the formation of which depends on the amount of insurance contributions to the Pension Fund paid by the employer for each employee. The higher they are, the more significant the payments will be.

Important! If a citizen is an individual entrepreneur, then he is obliged to pay insurance premiums for himself.

In addition, a similar principle for establishing payments is used when calculating the following types of benefits:

- Pensions for the loss of a breadwinner (if the latter had some insurance experience);

- Insurance (labor) disability pension (provided that the disabled person has officially worked for at least one day).

Conditions for assigning the insurance part

To qualify for payments, a citizen must meet a number of conditions, including:

- Reaching a certain retirement age.

Previously, for men it was 60 years old, and for women 55. However, as a result of the start of reforms, the retirement age in the Russian Federation is increasing. This is a long and gradual process. The reform will be completed in 2034, when women will retire at 63 and men at 65.

- Fact of contributions to the Pension Fund.

Every month, the employer transfers money for each employee to extra-budgetary funds (FSS, MHIF and Pension Fund). Insurance premiums make up a certain percentage of the employee's salary. Accordingly, the higher the salary, the larger amounts are transferred to the Pension Fund.

Important! The mere fact of working does not mean that the employee makes contributions to the pension fund. This applies, first of all, to workers who work unofficially. In addition, if an employee has a “gray” salary, this means that the transfer amounts are calculated only from the “white” salary. And this directly affects the size of future security.

- Availability of a certain amount of IPC.

IPC is an individual pension coefficient, expressed in pension points. They are calculated using a special formula that takes into account the amount of deductions for the calendar year. Also, a certain number of pension points are awarded for the periods:

- completing compulsory military service;

- being on maternity leave and caring for a child under the age of one and a half years;

- caring for disabled persons (disabled children and citizens over 80 years old).

To qualify for an old-age insurance pension, a citizen must have at least 16.2 pension points. This applies to the current year, 2020. However, during the pension reform, the Government decided to gradually increase the requirements for the number of pension points for the assignment of this type of social security . The number of points will increase by 2.4 annually, reaching a value of 30.

Each point has a value expressed in rubles. In 2020, 1 point costs 87.24 kopecks. This indicator is taken into account when calculating the insurance pension and directly affects its size.

- Having a minimum work experience.

To qualify for an old-age insurance pension, a citizen had to have at least 6 years of work experience. However, as with pension points, this value increases by 12 months each year. So, in 2024, the minimum length of service will be 15 years.

If a citizen does not meet the criteria set out above, then he cannot apply for an old-age insurance pension. Instead, after reaching the appropriate retirement age, he will be accrued a social pension, the amount of which, for obvious reasons, is significantly lower.

Persons entitled to an insurance pension. Types of insurance pensions

Page 1 of 6Next ⇒

Consultations

in the discipline "Social Security Law"«

for distance learning students

by specialty

"The Law and Organization of Social Security"

Lecturer of legal disciplines

Maksimova O.A.

The concept of an insurance pension.

Persons entitled to an insurance pension. Types of insurance pensions

Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”

Insurance pension is a monthly cash payment in order to compensate insured persons for wages and other payments and remunerations lost by them due to the onset of incapacity due to old age or disability, and to disabled family members of insured persons for wages and other payments and remunerations of the breadwinner lost in connection with death of these insured persons.

Persons entitled to an insurance pension

1. Citizens of the Russian Federation who are insured in accordance with the Federal Law “On Compulsory Pension Insurance in the Russian Federation” have the right to an insurance pension, subject to Federal Law No. 167 of December 15, 2001, if they comply with the conditions provided for by this Federal Law.

Insured persons are persons who are covered by compulsory pension insurance. Insured persons are citizens of the Russian Federation, foreign citizens or stateless persons permanently or temporarily residing on the territory of the Russian Federation, as well as foreign citizens or stateless persons:

a) working under an employment contract;

b) those who independently provide themselves with work (individual entrepreneurs, lawyers, arbitration managers, notaries engaged in private practice, and other persons engaged in private practice and who are not individual entrepreneurs);

c) who are members of peasant (farm) enterprises;

d) working outside the territory of the Russian Federation in case of payment of insurance premiums;

e) who are members of family (tribal) communities of small peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors;

f) clergy;

g) other categories of citizens who have compulsory pension insurance relations

Types of insurance pensions

1) old age insurance pension;

2) disability insurance pension;

3) insurance pension in case of loss of a breadwinner.

Insurance pension structure

From 2020, the old-age insurance pension will consist of a fixed payment (today a fixed base amount) and the sum of all points earned , multiplied by the cost of one point. There will be no funded part of the pension. It is allocated as an independent type of pension. The funded pension will be established by both the Pension Fund of Russia and non-state pension funds, depending on where the SPN was formed.

Insurance pension (SP) = FI + IPC x SPK, where

FV - fixed payment - is a guaranteed amount that the state sets for an insurance pension in a fixed amount. As of January 1, 2020, it will be 3,935 rubles. The size of the fixed payment will increase annually by an index approved by the Government of the Russian Federation. This index cannot be lower than the inflation rate for the previous year;

IPC is an individual pension coefficient equal to the sum of all annual coefficients of a citizen. The annual individual pension coefficient is a parameter that evaluates each calendar year of a citizen’s labor activity, starting from January 1, 2020, taking into account deductions of insurance contributions to the Pension Fund of Russia;

SPK is the cost of 1 individual pension coefficient, or 1 point in the year the pension was assigned. This cost will be set by the state twice a year: on February 1 and April 1. At the same time, the annual increase in the value of the pension point cannot be less than the consumer price growth index for the past year. The cost of 1 point as of 01/01/2015 will be 64 rubles. 10 kopecks.

Taking into account the indexation of the fixed payment and the cost of 1 point, the size of the insurance pension will increase annually.

There are four key factors on which the size of the future pension will depend:

— the amount of official (“white”) wages;

— options for pension provision, which each citizen chooses to form only an insurance pension or an insurance and funded pension.

- duration of insurance period.

- retirement age (immediately upon acquiring the right to it or at a later period).

Pension formula

Right to choose a pension

Persons entitled to simultaneously receive insurance pensions of various types, in accordance with Federal Law No. 400, are assigned one pension of their choice.

In cases provided for by Federal Law No. 166-FZ of December 15, 2001 “On State Pension Security in the Russian Federation”, it is permitted to simultaneously receive a state pension pension established in accordance with the said Federal Law and an insurance pension in accordance with Federal Law No. 400. The assignment and payment of an insurance pension are made regardless of the assignment of a funded pension in accordance with the Federal Law “On Funded Pension”. An application for an insurance pension can be made at any time after the right to an insurance pension arises, without any time limit.

Deductions from pensions

In cases provided for by the legislation of the Russian Federation, territorial bodies of the Pension Fund make deductions from pensions

In accordance with Federal Law No. 400-FZ dated December 28, 2013 “On Insurance Pensions,” deductions from pensions are made on the basis of:

· executive documents;

· decisions of bodies providing pension provision on the recovery of pension amounts overpaid to a pensioner in connection with a violation of the obligation to immediately notify the body providing pension provision of the occurrence of circumstances entailing a change in the amount of the pension or termination of its payment, including a change living place;

· court decisions on the recovery of pension amounts due to abuse by a pensioner established in court.

When deducting from a pension according to executive documents, the citizen must retain 50% of the pension amount. This restriction does not apply when collecting alimony for minor children, compensation for harm caused to health, compensation for harm to persons who suffered damage as a result of the death of the breadwinner, and compensation for damage caused by a crime. In these cases, the amount of deductions can reach 70%. Deductions based on decisions of bodies providing pensions are made in an amount not exceeding 20% of the established pension

Decisions of the territorial body of the Pension Fund on the recovery of pension amounts overpaid to a pensioner can be appealed by the pensioner to a higher pension body and (or) to court.

Important! In the event of termination of payment of a pension before full repayment of the debt on overpaid amounts of the specified pension, withheld on the basis of decisions of the bodies providing pension provision, the remaining debt is collected in court.

Determining the payment order

Funded pension

Federal Law of December 28, 2013 N 424-FZ “On funded pensions”

A funded pension is a monthly lifetime payment of pension savings formed from insurance contributions from employers and income from their investment.

A funded pension can be formed for citizens born in 1967 and younger if a choice has already been made or will be made in its favor by the end of 2020.

For citizens born in 1966 and older, the formation of pension savings can only occur through voluntary contributions within the framework of the State Co-financing Program for Pension Savings, as well as through the allocation of maternal (family) capital funds to a funded pension. If a citizen works, insurance contributions for compulsory pension insurance are directed only to the formation of an insurance pension.

Pension savings are also available for men born in 1953-1966 and women born in 1957-1966, in whose favor in the period from 2002 to 2004. inclusive of paid insurance contributions for a funded pension. Since 2005, these deductions have been discontinued due to changes in legislation.

The size of the funded pension is calculated based on the expected payment period - 19 years (228 months). To calculate the monthly payment amount, the total amount of pension savings accounted for in the special part of the individual personal account of the insured person, as of the day from which the payment is assigned, must be divided by 228 months.

The amount of the funded pension will be higher if you apply for a pension after acquiring the right to the specified pension. For example, if you apply for a pension three years later, the amount of pension savings will be divided into 192 months.

In 2014 and 2020, every citizen born in 1967 and younger can choose a pension option for themselves: to direct the entire amount of the employer’s insurance contributions to finance only the insurance pension or to distribute this amount to finance funded and insurance pensions.

When choosing a pension option, you should take into account that the insurance pension is guaranteed to be increased by the state through annual indexation at a level not lower than inflation. The funds of the funded part of the pension are invested in the financial market by a non-state pension fund or management company chosen by the citizen.

The profitability of pension savings depends on the results of their investment, that is, there may be a loss from their investment. In this case, only the amount of insurance premiums paid is guaranteed for payment. Pension savings are not protected from inflation. The pension option in the compulsory pension insurance system affects the calculation of annual pension points. When forming only an insurance pension, the maximum number of annual pension points is 10, since all insurance contributions are directed towards the formation of an insurance pension. When choosing to form both an insurance and funded pension, the maximum number of annual pension points is 6.25, since 27.5% of insurance contributions are directed to the formation of pension savings.

It is important to note that even in this case, all previously formed pension savings of citizens are preserved: they continue to be invested and will be paid in full when citizens become eligible to retire and apply for it.

Federal Law dated December 15, 2001 N 166-FZ (as amended on July 21, 2014)

“On state pension provision in the Russian Federation”

State pension pension is a monthly state cash payment to citizens in order to compensate them for earnings (income) lost due to termination of federal public service, upon reaching length of service, upon retirement due to old age (disability), in order to compensate for lost earnings for citizens from the number of cosmonauts or from among flight test personnel, connections with retirement for length of service; or for the purpose of compensation for damage caused to the health of citizens during military service, as a result of radiation or man-made disasters, in the event of disability or loss of a breadwinner, upon reaching the legal age; or disabled citizens in order to provide them with a means of subsistence.

Pay

The state pension for long service is paid monthly. The pensioner has the right to choose, at his own discretion, the organization that will deliver the pension, as well as the method of receiving it (at home, at the cash desk of the delivery organization or to his own bank account). In addition, a trusted person can receive a pension for a pensioner.

Conditions of appointment

The conditions for granting a state old-age pension vary depending on the status of citizens exposed to radiation and the nature of the work they performed, on the time, place and duration of residence in territories exposed to radiation contamination, on establishing the causal relationship of developed diseases and disabilities with the consequences of Chernobyl disasters or with the consequences of other radiation or man-made disasters.

In addition, common to all categories will be the presence of at least 5 years of insurance experience.

| Category of pension recipients | Retirement age and conditions for granting pensions |

| Participants in the liquidation of the consequences of the Chernobyl disaster in 1986-1987. Citizens evacuated from the exclusion zone Citizens who became disabled as a result of the Chernobyl disaster | Upon reaching 50 and 45 years of age (men and women, respectively) With at least 5 years of work experience |

| Participants in the liquidation of the consequences of the Chernobyl disaster in 1988-1990. Citizens who received or suffered radiation sickness and other diseases associated with radiation exposure as a result of the Chernobyl disaster or work to eliminate the consequences of the said disaster Citizens engaged in the operation of the Chernobyl nuclear power plant and work in the exclusion zone Citizens who became disabled as a result of the Chernobyl disaster | Upon reaching 55 and 50 years of age (men and women, respectively) With at least 5 years of work experience |

| Citizens resettled from the resettlement zone Citizens permanently residing in the resettlement zone before their resettlement to other areas Citizens employed in work in the resettlement zone (not residing in this zone) | The generally established old age retirement age is reduced by 3* years and an additional six months for each full year of residence or work in the resettlement zone, but not more than 7 years in total. With at least 5 years of work experience |

| Citizens permanently residing in a residence zone with the right to resettlement Citizens who voluntarily left for a new place of residence from a residence zone with the right to resettlement | The generally established old age pension age is reduced by 2 years and an additional 1 year for every 3 years of residence or work in the specified zone, but not more than 5 years in total, if you have at least 5 years of work experience |

| Citizens permanently residing in a residential area with preferential socio-economic status | The generally established old age pension age is reduced by 1* year and an additional 1 year for every 4 years of residence or work in the specified zone, but not more than 3 years in total, if you have a work experience of at least 5 years |

| Citizens who became disabled as a result of other (non-Chernobyl) radiation or man-made disasters | The conditions for granting an old-age pension are established in the manner prescribed by regulations governing the pension provision of these citizens. |

Consultations

in the discipline "Social Security Law"«

for distance learning students

by specialty

"The Law and Organization of Social Security"

Lecturer of legal disciplines

Maksimova O.A.

The concept of an insurance pension.

Persons entitled to an insurance pension. Types of insurance pensions

Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”

Insurance pension is a monthly cash payment in order to compensate insured persons for wages and other payments and remunerations lost by them due to the onset of incapacity due to old age or disability, and to disabled family members of insured persons for wages and other payments and remunerations of the breadwinner lost in connection with death of these insured persons.

1Next ⇒

Recommended pages:

How is the amount of the old-age insurance pension determined?

The amount of old-age security is strictly individual and depends on the characteristics, duration and nature of the pensioner’s previous work activity. In addition, various allowances are added to the amount of the payment, for example, “northern coefficients” if a citizen has worked for a long time in the Far North.

Also, additional coefficients (called bonuses) take place in the case when a pensioner continues to work after reaching the appropriate age, that is, simply put, he retires later.

Calculation procedure

The formula for calculating the insurance pension consists of the following components:

SP = IPC x SPK + FV.

Explanation of the formula:

SP – insurance pension.

IPC is the sum of pension points.

SPK – the value of pension points.

FV – fixed payment.

The calculation is carried out automatically by the pension fund based on information about the applicant’s insurance experience.

The procedure for obtaining the insurance part

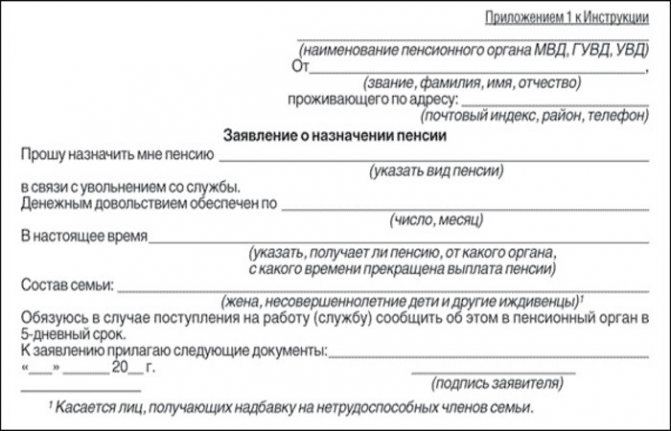

If there are appropriate conditions that give the right to an insurance pension, a citizen should contact the territorial division of the Pension Fund of the Russian Federation at his place of residence with documents confirming the right to this payment (work book, certificates of earnings, etc.). The applicant has the right to submit an application through the State Services portal, however, after its consideration, he is obliged to provide the original documents to the Pension Fund. Sample application:

After the pension fund makes a decision to assign payments, the money should be expected in the next calendar month.

A pensioner can receive his payments:

- at home;

- at the post office;

- to a bank card.

Fixed payment to the insurance pension

Fixed benefit (FB) is a mandatory part of the insurance pension, which is added to it after calculating points. If a citizen was unable to meet the necessary criteria for receiving it, then he can only count on the amount of this payment without taking into account pension points.

Its size varies and depends on many factors.

For example, the amount of the basic fixed payment in 2020 is 5334 rubles 19 kopecks. However, under certain conditions it becomes higher. Thus, citizens over 80 years old receive 10,668 rubles 38 kopecks, and those who have a dependent receive 7,112 rubles 25 kopecks .

Attention! The PV amounts are subject to annual upward adjustments.

Who is assigned a social pension?

In 2020, the size of social pensions increased by 566 rubles (last year by 182 rubles). The annual indexation of the social pension directly depends on the established minimum subsistence level (in 2020 it was increased by 6.1%). Unemployed persons and citizens who have not provided themselves with the necessary work experience can count on this pension.

When assigning a social pension to a citizen, the pensioner’s age and length of service are not taken into account. Even a citizen who has never worked, for example, for health reasons, children under 18 years of age, those who have lost their breadwinner, orphans, and the disabled, can receive social support from the state.

Insurance part upon early retirement

Certain categories of citizens may qualify for early retirement. This applies mainly to persons working in special working conditions. These include, among others:

- medical workers;

- teaching staff;

- workers in environmentally unfavorable and hazardous industries.

Also, some citizens may retire earlier than due not due to difficult working conditions, but due to special circumstances. These include, for example:

- persons carrying out labor activities in territories belonging to the Far North with at least 15 years of experience;

- parents of disabled children;

- disabled combatants.

It is calculated using a similar method as the regular old-age insurance benefit and its amount is also based on wages and, as a consequence, the amount of contributions to the Pension Fund.

The old-age insurance pension is the most important measure of material support that senior citizens of working age have the right to count on. Its peculiarity is that its size is largely influenced by the amount of contributions to the Pension Fund, which means that if an employee receives a high salary, then in old age he can count on a high pension. If the length of service is not enough, then the state will only pay social benefits, the amount of which barely allows to satisfy the basic needs of a person.

Let's understand the concept

A labor or insurance pension is a monthly payment, the amount of which is determined depending on contributions to the Pension Fund for the period of working activity. The insurance period is the main condition for assigning payment.

Appointed in cases where a person loses the opportunity to earn money on his own. Loss of ability to work is possible in the event of reaching retirement age, receiving the status of a disabled person, and so on. In some cases, the generally established period for going on vacation may be reduced.